Regulatory acts

The following list of documents regulates bonuses for length of service in various budget areas: from the central government and the military, to workers in the educational and medical industries.

Labor Code of the Russian Federation (Articles: 21, 135, 143 and others).

Also, this type of incentive bonuses is regulated by many regulations:

- by resolution of the Council of Ministers (No. 638);

- by order of the Ministry of Health of the Russian Federation (No. 377);

- Decree of the Government of the Russian Federation (No. 583);

- by decree of the President of the Russian Federation (No. 1532);

- federal law (No. 73-F3), etc.

Definition of the term and legal regulation

Article 135 of the Labor Code of the Russian Federation, which regulates the procedure for remuneration, establishes recommendations for ensuring a uniform procedure in the formation of wages for public sector employees. Decree of the President of the Russian Federation No. 1152, as amended on January 16, 2017, determines the procedure for calculating length of service to establish compensatory payments for length of service for state and municipal employees.

The amount and procedure for payments are regulated by their own regulations in each field of activity, but the unifying indicator is length of service. What is this – a parameter of quantity or quality of service? The indicator combines the impeccable performance of official duties, takes into account the period of exposure to extreme conditions, the arithmetic calculation begins immediately from the moment of registration for the corresponding position and ends with the moment of termination of the relationship. When resuming after a break, regardless of the duration, it continues to be calculated on a cumulative basis.

In accordance with acts of law enforcement agencies and civil regulations, in addition to the actual performance of duties during the period of service, the following is included:

- time of treatment and rehabilitation after injury or occupational disease;

- being in captivity or on the list of missing persons;

- appointment to an elected position;

- illegal dismissal with subsequent reinstatement by court decision;

- training in the direction of management personnel for a period not exceeding five years.

Separately, the time spent in hot spots, places of accidents and disasters as liquidators, the period of service in the Far North and equivalent territories are taken into account.

In accordance with Law No. 306-FZ of November 7, 2011, length of service is considered according to certain parameters for military personnel:

- pilots, parachutists and workers testing ejection devices – 1:2;

- crew members of combat ships and oceanographic expeditions - 1: 1.5.

Additional payment for length of service, taking into account the special procedure for calculating length of service, is an obligation at the level of local, regional and federal budgets, under government control. Commercial organizations, when forming a remuneration mechanism, can indicate in local documents an increase for length of service, but this is only a right, and not an obligation, unlike state employees.

What determines the size of the allowance?

Therefore, you should not hope that your colleague’s salary will be the same as yours, because the bonus itself depends on many factors, which will be discussed below.

This premium is always calculated as a percentage and depends on a number of factors, which we list below:

- type of employment (military, Ministry of Internal Affairs, educational and medical institutions, etc.);

- seniority;

- length of service in a specific position;

- the salary you received previously and what you are receiving now;

- regional and district allowances (depending on the specific area);

- allowances depending on the institution (set individually for a particular industry);

- depending on the conditions specified in the labor and collective agreement;

- depending on the specified payments in the regulations on incentives (bonuses) in a particular organization;

- percentage by years of service:

- length of service up to three years – 10% of salary;

- length of service from three to five years – 20% of salary;

- service for more than five years – 30% of salary;

In the military sphere, the percentage of bonuses for years of service differs slightly from the civilian one:

- from two to five years – 10%;

- from five to ten years – 15%;

- from ten to fifteen years – 20%;

- from fifteen to twenty years – 25%;

- from twenty to twenty-five years – 30%;

- from twenty-five years and older – 40%.

The following allowances exist for civil government employees:

- from two to five years – 10%;

- from five to ten years – 15%;

- from ten to fifteen years – 20%;

- from fifteen years and more – 30%.

If a particular employee has access to state secrets , the premium can range from five percent (minimum) to seventy-five percent (maximum).

If a particular official is responsible for protecting state secrets, then he may receive an additional 20 percent bonus.

What other bonuses and benefits are available to teachers?

The provision of various benefits and payments to teaching staff is regulated by the Federal Law “On Education” and regional laws. In particular, teachers are entitled to a shortened working week (from 18 to 36 hours depending on the category), increased leave (from 42 to 56 calendar days per year, in the Far North - up to 80 days), as well as early retirement. In addition, once per ten years of continuous teaching activity, teachers can request a long additional leave of up to a year (unpaid, unless provided for by the collective agreement).

Teachers are paid a salary bonus for their category, which is assigned based on the results of certification. Honored teachers of the Russian Federation receive an additional payment for their title in the amount of at least 15% of their salary. Upon retirement, they can receive the title “Veteran of Labor” and the benefits and monthly payments that come with it.

Teachers have the right to additional professional education in their field of teaching (at least once every three years). Teachers in need are provided with residential premises out of turn within the framework of a social rental agreement. Teachers working in rural areas are compensated for the costs of living quarters, heating and lighting.

Also, regional legal acts may establish benefits for transportation for teachers, additional payments for conducting the Unified State Examination and the Unified State Examination, checking notebooks, working with an extended day group, extracurricular activities, etc. For young specialists, “lifting allowances” (one-time allowance) may be provided. in some regions they are provided with social housing or benefits when applying for a mortgage. Teachers who are transferred to the village also receive various benefits and allowances.

Who is entitled to a seniority bonus?

Every public sector employee has the right to receive a seniority bonus.

True, this type of premium is calculated individually based on the factors that we listed above. Such allowances are also available to employees not only of the budget and government sectors, but also of the military, employees of the Ministry of Internal Affairs, as well as those who are officially employed. In the latter case, this type of allowance is usually smaller in percentage terms, because the salaries of employees in private areas are often higher than those of employees in public sectors.

Read more: Indexation of pensions for working pensioners in 2019

Examples of calculating allowances

Example 1

This person also receives a 25% bonus for working in the village: 3278 x 1.25 = 4097.5

We calculate the fee for hours worked: (4097.5x22)/18=5008.1

Additional payment for class management – 20%: 4097.5x0.2=819.5

Additional payment for checking notebooks (22 hours) – 15%: (4097.5x0.15)x22/18=751.2

Based on teaching experience, another 20% of the net salary is accrued, 3,278%20 = 655 rubles. 6,578 + 655 = 7,233 rubles - a full salary.

Example 2

The salary based on his position is 3,589 rubles. This man has been working in the educational sector for 7 years (20% bonus).

According to this formula, 1.255 is an increasing coefficient for the category of his qualifications. 1.08 – for the title. 0.25 – bonus for working in the village. 0.15 – salary increase coefficient for the specifics of the work.

Based on all of the above, his salary will be equal to 6810.3 rubles. We calculate the bonus based on length of service: 3589%20=717 rubles. 6810+717=7527 rubles.

Example 3

A woman works as a teacher in preschool education. Has an allowance for working in rural areas. This teacher also has the highest qualification category. Her bet is 1.5.

The salary for her position is 3,589 rubles.

Based on the formulas described above, we have the following 3589×1.255×1.25 = 5630 rubles.

1.255 is an increasing coefficient due to the teacher having the highest category. 1.25 – allowance for work in rural areas. We add the profit for the hours actually worked, we have 8,445 rubles - a full salary.

3589%20=717 rubles – long service bonus. 8445+717=9162 rubles, full salary.

Example 4

The employee is engaged in educational work in a special correctional orphanage. Rate – 1. Previously, this person had rank 10 in the ETS. Worked in the field of educational institutions for 3 years (10%).

Salary based on position – 3,278 rubles.

Rate + specifics of work 3278x(1+0.2+0.2) = 4589 rub.

0.2 – bonus for working in an orphanage. 0.2 – bonus for working in a special institution.

4589%10=458.9 – bonus for teaching experience. 4589+458=5047.9 rubles final salary.

Example 5

A person works as a teacher of his native language in one of the republics of the Russian Federation. He teaches first through fourth grades at a comprehensive boarding school.

His teaching load is 24 hours a week. Qualification: first category. This employee is assigned a class, and accordingly he has a bonus for class management. Twenty-four hours a week are spent checking notebooks. The teacher has 2 years of teaching experience (10%).

Net salary – 3,589 rubles.

Then 3589×1.168×1.15 = 4820.7.

Where 1.168 is an increase in salary for the first category. 1.15 additional payment for the specifics of the work.

We calculate the bonus for the hours actually worked (4820.7×24 hours)/20 hours. = 5784.8.

This person receives 15% for class management (4820.7 × 0.15 = 723.1 rubles).

We calculate the extra charge for checking notebooks (4820.7×0.15)x24h./20h. = 867.7 rub.

3589%10=358.9 rubles – bonus for teaching experience. And that’s 5784.8 + 723.1 + 867.7 + 358.9 = 7734.5 – the final salary with all allowances.

What documents are needed for registration?

Starting from the first working day, the assignment to work is indicated in the work book.

Then, with each working day, the length of service increases. Depending on the number of years worked in the public sector, you receive a corresponding bonus; we wrote above about what percentage and for how many years you can receive.

Based on the above, all the documents necessary for calculating your length of service are already present in the accounting department or at your place of work. This means that all the necessary calculations will be carried out by accountants themselves.

When is it profitable to use a bonus payment system? All detailed information on this issue is here.

Do you think you deserve higher pay? Then quickly write a memo to your boss. You will find a sample in this article.

How is this allowance recorded in accounting?

It is calculated from the net salary and is treated as a regular additional payment for length of service in accounting calculations.

To summarize, it must be emphasized that allowances for public sector employees are very individual and depend on various factors. This means that your salary will differ from the salary of a colleague or an employee you know, and this is not surprising. True, it is important to remember that length of service depends on when official employment is indicated in the work book and in the corresponding contract.

Or on the website. It's fast and free!

In accordance with the educational reform, the provisions of which came into force in 2008, remuneration for teachers is made according to a new scheme, which takes into account the qualification category, work experience, level of education and the presence of a registered degree. In the article, we will look at the features of remuneration for employees of educational institutions, and will also look at how to calculate bonuses for teachers for category, length of service, and experience.

What additional payment for experience are due to teachers?

Additional pay for experience for teachers in public schools is calculated as a percentage of the official salary. The growth pattern for the premium is as follows:

- for more than 1 year of experience - 10%,

- for more than 5 years of experience - 15%,

- for more than 10 years of experience - 20%,

- for more than 15 years of experience - 30%.

Thus, to reach the maximum additional payment, 15 years of work at the school are required.

After this, the bonus remains at 30% for all subsequent years of work. Let us remind you that upon reaching 25 years of experience, a teacher can retire at any age.

Despite the fact that the above-listed system of additional payments for length of service for teachers is prescribed in federal legislation for state employees of Russia, the regulations on remuneration and bonuses in the school itself must also contain a mention of additional payments.

New teacher remuneration system (NSOT)

On August 5, 2008, the Government of the Russian Federation issued Resolution No. 583, according to which a new procedure for remuneration of employees of budgetary institutions was approved.

- employees of federal budgetary institutions and government agencies;

- civilian personnel of military units;

- employees of federal executive authorities;

- other public sector employees whose work was previously paid according to the Unified Tariff Schedule.

The provisions of Resolution No. 583 apply, inter alia, to the procedure for calculating and remunerating workers in the education sector - teachers of all levels and specializations, methodologists, laboratory assistants, management and administrative personnel of schools and educational institutions, as well as employees of educational institutions for preschool children.

Instead of the previously used Unified Tariff Schedule, from December 1, 2008, a new wage system (NSOT) is used to calculate teacher salaries, according to which:

- for a teacher, a salary is established in the amount approved by regional executive authorities, but not less than the amount previously in force under the Unified Tariff Rate;

- The teacher has the right to receive bonuses accrued for the qualification category, work experience, level of education and registration degree (if any).

Read more: How to convert academic hours to astronomical hours

Categories

In the regulations on the remuneration of college employees there is a section “Types and amounts of incentive payment coefficients for employees of the institution,” which states that teaching employees receive additional payments (incentive payments) from 10 to 30% for teaching work experience. The college's accounting department makes additional payments only to teachers, educators and industrial training masters, that is, to those employees who have the right to receive an early pension. In this regard, a controversial question arose between the personnel department and the accounting department: do the deputy director for scientific work, social teacher, additional education teacher, trainer-teacher, methodologist and sports instructor belong to teaching staff if they do not have the right to early retirement?

In accordance with Art. 8 of the Labor Code of the Russian Federation, employers, with the exception of employers - individuals who are not individual entrepreneurs, adopt local regulations containing labor law norms (LLA), within their competence in accordance with labor legislation and other normative legal acts containing labor law norms, collective agreements and agreements.

LNA norms that worsen the situation of workers in comparison with established labor legislation and other regulatory legal acts containing labor law norms, collective agreements, agreements, as well as LNA adopted without observing the procedure for taking into account the opinions of the representative body of workers[1], are not subject to application. In such cases, labor legislation and other regulatory legal acts containing labor law norms, collective agreements, and agreements are applied.

The employee’s salary is established by the employment contract in accordance with the current employer’s remuneration systems.

Remuneration systems (including tariffs) for employees of state and municipal institutions are established by collective agreements, agreements or LNA in accordance with federal laws and other regulatory legal acts of the Russian Federation[2].

According to the section “Qualification characteristics of positions of educational workers” of the Unified Qualification Directory of Positions of Managers, Specialists and Employees[3], the positions of pedagogical workers include : teacher, instructor (except for teachers classified as faculty members of universities), teacher-organizer, social educator , teacher-defectologist, teacher-speech therapist (speech therapist), educational psychologist, teacher (including senior), tutor (with the exception of tutors engaged in the field of higher and additional vocational education), teacher-librarian (the title of the position is used in educational institutions implementing educational programs of primary general, basic general, secondary (complete) general education), senior counselor, additional education teacher (including senior), music director, accompanist, head of physical education, physical education instructor, methodologist (including senior), instructor-methodologist ( including the senior), labor instructor, teacher-organizer of the basics of life safety, trainer-teacher (including the senior), master of industrial training.

The Government of the Russian Federation has approved a different list of positions, work in which is counted towards length of service, giving the right to early assignment of an old-age pension to persons engaged in teaching activities[4].

The length of continuous teaching work experience, which gives the right to a long vacation , includes the time spent working in established positions and under the conditions provided for in the List of Positions, work in which is counted towards the length of continuous teaching work experience[5]. This List provides for two groups of positions:

1) positions in which work is counted towards the length of continuous teaching activity, regardless of the volume of teaching work: professor, associate professor, senior teacher, teacher, assistant, teacher, teacher-defectologist, teacher-speech therapist, teacher-organizer (basics of life safety, pre-conscription training ), teacher of additional education, head of physical education, master of industrial training, senior trainer-teacher, trainer-teacher, accompanist, music director, educator;

2) positions in which the time of work is counted towards the length of continuous teaching activity, provided that the teaching staff performs teaching work in the following volume in each academic year in the positions specified in the first group:

- at least 150 hours - in institutions of higher professional education and corresponding additional professional education (advanced training) of specialists;

- at least 240 hours - in institutions of primary and secondary vocational education and relevant additional education;

- at least 6 hours a week - in general education and other educational institutions.

These positions include: rector, director, head of an educational institution, head of an educational institution; vice-rector, deputy director, deputy head of an educational institution, deputy head of an educational institution, whose activities are related to the educational process; director, head of a branch of an educational institution; head of a branch of an educational institution; head master; educational facility manager; dean, deputy dean of the faculty; head, deputy head of the department, doctoral studies, postgraduate studies, department, sector; head, deputy head of an office, laboratory, department, educational and consulting center, speech therapy center, boarding school at a general education institution; scientific secretary of the academic council; manager (manager) of production practice; Methodist; instructor-methodologist; senior methodologist

As can be seen, the regulatory documents listed above indicate various positions related to teaching. And when using this or that document, it is necessary to know the purpose of its publication and scope of application.

Thus, the decision of the college accounting department on non-payment of incentive payments to persons whose positions do not provide grounds for early retirement and is absent from the Federal Law of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation” (as amended on December 3, 2011) and Decree of the Government of the Russian Federation dated October 29, 2002 No. 781, is not entirely consistent and lawful, since this Federal Law establishes the grounds for the emergence and procedure for exercising the right of citizens of the Russian Federation to labor pensions.

But the regulations on the remuneration of workers determine the procedure for forming the wage fund for workers at the expense of the federal budget and other sources not prohibited by the legislation of the Russian Federation, establishing the size of official salaries, wage rates for professional qualification groups and qualification levels, as well as payments of compensation and stimulating nature.

Incentive payments include payments aimed at stimulating an employee to perform quality work, as well as rewards for work performed.

The list of types of incentive payments in federal budgetary, autonomous, government institutions and an explanation of the procedure for their establishment were approved by Order of the Ministry of Health and Social Development of Russia dated December 29, 2007 No. 818 (as amended on December 29, 2007).

Budgetary institutions determine specific types of incentive payments independently (within the wage fund) in collective agreements and other local regulations.

Taking into account the above, we note that the positions of teaching staff include, among other things, social pedagogue, additional education teacher, trainer-teacher and methodologist. Consequently, there are no grounds for excluding these positions from the list for incentive payments.

[1] Article 372 of the Labor Code of the Russian Federation.

[2] Article 144 of the Labor Code of the Russian Federation.

[3] Approved by Order of the Ministry of Health and Social Development of Russia dated August 26, 2010 No. 761n (as amended on May 31, 2011).

[4] Resolution No. 781 of October 29, 2002 “On the lists of jobs, professions, positions, specialties and institutions, taking into account which an old-age labor pension is assigned early in accordance with Article 27 of the Federal Law “On Labor Pensions in the Russian Federation”, and on approval of the Rules for calculating periods of work giving the right to early assignment of an old-age labor pension in accordance with Article 27 of the Federal Law “On Labor Pensions in the Russian Federation” (as amended on May 26, 2009).

[5] Appendix to the Regulations on the procedure and conditions for granting long-term leave to teaching staff of educational institutions for a period of up to one year (approved by Order of the Ministry of Education of Russia dated December 7, 2000 No. 3570).

Allowances for teachers according to NSOT: for category, for length of service, for experience

The purpose of introducing NSET in the field of education is to stimulate teachers to constantly improve their own professional level and qualifications by providing incentive payments. In addition, NSET provides financial incentives to individuals who have many years of experience in the field of education and training.

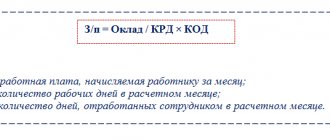

According to NSOT, monthly wages for teachers are calculated using the formula:

Salary for teachers = Salary + Compensation + Allowances,

where Salary is the salary amount established according to the qualification category; Compensation - the amount of additional payments accrued for the intensity of work (substitute work, combining positions, teaching children with disabilities, teaching activities in rural areas, etc.); Allowances are incentive payments accrued as an additional salary.

NSOT provides the following allowances for teachers:

- for the qualification category;

- for work experience in educational institutions;

- for education;

- for an academic degree.

Calculation of bonuses for teachers

The amount of the bonus (incentive payment) is determined by the formula:

Allowances = Salary * Coefficient,

where Salary is the salary amount established according to the qualification category; Coefficient – bonus coefficient approved by the regional executive authority in accordance with the type of incentive payment.

- Bonus for length of service (length of service ). A teacher’s right to receive a bonus is determined in accordance with the regulations of regional executive authorities. In general, the executive body approves the categories of bonus recipients depending on the period of work in educational institutions, after which it determines the amount of the bonus as a percentage of the salary.

- Bonus for qualifications . The current legislative acts have approved 3 qualification categories of teachers - highest, I and II categories. The amount of the bonus is set by regional authorities as a percentage of the salary for each category. A teacher without a category, as a rule, receives a minimum bonus or is deprived of the right to an incentive payment on this basis.

- Education supplement . Another basis for assigning an incentive payment is the level of education of the teacher. A separate bonus coefficient is established for teachers with a bachelor's, specialist, or master's degree.

- Supplement for an academic degree . This type of bonus is an additional way to motivate teachers with a candidate of science degree, associate professor, professor, academician of science.

We emphasize that the amount of bonuses and the procedure for assigning them are approved at the regional level. Thus, incentive payments in different regions of the Russian Federation may differ significantly from each other. Also, regional authorities can adjust the approach to determining recipients of a particular allowance. For example, a bonus for experience in the Oryol region is paid only to those teachers who do not have a qualification category. If an employee of an institution is qualified, then he is assigned a bonus for his qualification category, without the right to receive an incentive payment for length of service.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Components of a teacher's salary

The exact amount of the salary depends on the school where the teacher works, and the final amount is made up of four parts.

- The basic part itself is teaching the subject, checking notebooks, as well as additional clubs and activities.

- Stimulating part . Usually this component is regulated by the administration and governing council of the school. In this case, bonuses are added for competitions, high academic performance of students, as well as the use of new technologies, experience and advanced training.

- Compensating part . These are supplements for working with disabled students, that is, children with disabilities. This part also includes payment of utilities to teachers of rural schools.

- Awards . Their size and number are determined by the governing council of the educational institution.

Checking the redevelopment of an apartment: what residents should know

Read

Is it possible to store bicycles and strollers in the entrance - specifics of legislation

Read