What it is?

Transformation is a special type of reorganization, which is a change in the organizational and legal form of a company, while another legal entity is created, and the old one ceases its activities, the constituent documents and charter are changed, but all rights and obligations are retained after the procedure.

A significant difference from other types of reorganization, that is, merger, separation, accession, is that one legal entity begins to participate in the procedure and, as a result, one company is also formed .

The process has some features:

- From an economic point of view, the transformed organization is one and the same company, which has only changed its management structure and legal status, and no changes have occurred in other areas of the company’s life.

- From a macroeconomic point of view, such a reorganization is a neutral action in relation to capital, since there is no division or merger of the authorized capital of several companies. This nuance is the most significant difference. In other cases, assets and liabilities are either combined into one fund or divided among several organizations.

- From a legal point of view, during the transformation, a completely new enterprise is created, which is a complete successor to the obligations and rights of its predecessor. The book value of the property does not change.

There are two types of transformation:

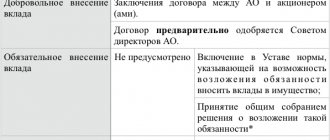

- Voluntary . Carried out only on the initiative of the company owners. For example, the procedure can be carried out if the owners or founders come to the conclusion that the enterprise will operate most effectively in a different legal form. Most often, for this reason, an LLC is transformed into a joint stock company.

- Mandatory . It is carried out upon the occurrence of certain circumstances defined by law. There are several such cases: participants in a non-profit organization intend to conduct business, and it is transformed into a partnership or society;

- the number of participants in an LLC or CJSC exceeds 50 people, and it is necessary to reorganize the enterprise into an OJSC or cooperative.

Reorganization does not include a change in the type of joint stock company, for example, a transition from an OJSC to a CJSC. This action is recorded as a name change.

Types of reorganization of a legal entity in the form of transformation

Voluntary. Carried out only on the initiative of the company owners. For example, the procedure can be carried out if the owners or founders come to the conclusion that the enterprise will operate most effectively in a different legal form. Most often, for this reason, an LLC is transformed into a joint stock company.

Mandatory. It is carried out upon the occurrence of certain circumstances provided for by law. There are several such cases:

- participants of a non-profit organization intend to conduct business activities, while it is being transformed into a partnership or society;

- the number of LLC participants exceeded 50 people, and it is necessary to reorganize the enterprise into a joint-stock company or a production cooperative (Article 59 of the LLC Law).

Reorganization does not include a change in the type of joint stock company, for example, a transition from a PJSC to a JSC. This action is recorded as a name change.

Regulation by law

The most important documents regulating the procedure are:

- Civil Code of the Russian Federation. The main types of reorganization, definitions, and features are established by Article 57 of the Civil Code of the Russian Federation.

- Federal Law No. 129-FZ of August 8, 2001 “On state registration of legal entities and individual entrepreneurs.” The procedure, necessary documents, nuances are indicated in Chapter V.

Other regulations establish some restrictions on the choice of legal form into which an existing enterprise can be transformed:

- LLC - into a partnership, a company of another type, a cooperative;

- private institution - to a foundation, non-profit organization, society;

- production cooperative - into a partnership, society;

- CJSC and OJSC - into LLC, non-profit partnership, cooperative.

When determining a new form, it is worth taking into account the requirements established by law for the amount of capital, the number of founders, etc.:

- A company cannot have one legal entity as its founder, which also has a single owner.

- The founder of a partnership must be registered as an individual entrepreneur if he is an individual.

- Minimum size of the capital: LLCs and CJSCs owe more than 10 thousand rubles;

- For OJSC this amount is equal to 100 thousand rubles.

- for partnerships - 2 or more;

Reorganization of a legal entity in the form of transformation: legal requirements

The most important documents regulating the procedure are:

- Civil Code of the Russian Federation. The main types of reorganization, definitions, and features are established by Article 57 of the Civil Code of the Russian Federation;

- Federal Law No. 129-FZ “On state registration of legal entities and individual entrepreneurs.” The procedure, necessary documents, nuances are indicated in Chapter V;

- Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies”;

- Order of the Ministry of Finance of the Russian Federation dated May 20, 2003 N 44n “On approval of the Guidelines for the preparation of financial statements when reorganizing organizations”;

- Order of the Federal Financial Markets Service of Russia dated 07/09/2013 N 13-57/пз-н “On approval of the Requirements for the form of a document confirming the assignment of a state registration number or identification number to the issue of shares subject to placement during reorganization in the event that a legal entity created through reorganization is a joint stock company”, etc.

Limitations on the choice of legal form

Other regulations establish some restrictions on the choice of legal form into which an existing enterprise can be transformed:

- LLC - into a partnership, a company of another type, a cooperative;

- private institution - to a foundation, non-profit organization, society;

- production cooperative - into a partnership, society;

- PJSC and NJSC - into LLC, non-profit partnership, cooperative.

When determining a new form, it is worth taking into account the requirements established by law for the amount of capital, the number of founders, etc.:

- A company cannot have one legal entity as its founder, which also has a single owner.

- The founder of a partnership must be registered as an individual entrepreneur if he is an individual.

- Minimum capital size: LLCs and non-profit joint-stock companies must have at least 10 thousand rubles;

- for PJSC this amount is 100 thousand rubles.

- for partnerships - 2 or more;

Unlike other forms of reorganization , reorganization in the form of transformation can be carried out independently without the consent of authorized government bodies.

For example, in accordance with Art. 27 of the Federal Law “On Protection of Competition”, reorganization of a company in the form of a merger is carried out with the prior consent of the antimonopoly authority. Reorganized business entities must obtain such consent if the companies’ balance sheet is more than 7 billion rubles or the total revenue of the reorganized companies is more than 10 billion rubles. And also such requirements are imposed on financial organizations, control over which is exercised by authorized bodies.

Step-by-step registration instructions

The procedure occurs in several stages in a certain order. Actions of the founders:

- Making a decision on reorganization . At the general meeting of all owners of the enterprise, the following issues are discussed: conditions of transformation;

- exchange of shares of participants or contributions to the authorized capital of a future enterprise;

- the charter of the new organization is agreed upon.

- receive creditors' claims for repayment of obligations, draw up a register of counterparties, amounts payable, etc.;

draw up and sign reconciliation reports with partners;

Based on this data, the founders draw up and approve the transfer deed. The absence of a document is the reason for refusal of state registration of the reorganization. The act states:

- general information about the enterprise;

- income statement;

- gear balance;

- explanations.

After all these documents are completed, they are submitted for state registration.

- deregister with the tax office, the statistics body, and extra-budgetary funds;

You can find out more detailed information about the stages of the procedure in the following video:

A few words about the phenomenon of reorganization in the form of transformation

The existence of companies is always accompanied by continuous development and changes in terms of the vector and strategy of their activities. Such phenomena provoke amendments to the structural and organizational areas of work of organizations. Changes in the legal form, owners and similar aspects of activity require appropriate registration, the procedure for which is regulated by the legislation of the Russian Federation.

Reorganization in the form of transformation is one type of such changes. Its essence lies in the fact that when implementing reorganization procedures, a company legally changes its organizational and legal form with the creation of a fundamentally new legal entity. Naturally, the company that existed before is abolished and officially ceases to operate. The results of this procedure are:

Company reorganization

- Changing the constituent documentation of the organization and its Charter

- Opening a new legal entity while maintaining the rights and obligations of the old one

Transformative procedures of a reorganization nature have one significant difference from transformations in the form of a merger of several organizations, the allocation of their shares or affiliation. To be more precise, we are talking about the participants in this process. During the reorganization in the form of transformation, in fact, only one legal entity is involved.

At first it begins the procedure, being abolished over time and appearing again, but in the form of a completely different company. Other forms of transformation always involve several legal entities, since they cannot be carried out otherwise within the framework of the laws of the Russian Federation.

Less significant, but also significant, features of the company’s transformation are:

- An official change in the general concept of the organization, the structure of its management and legal status, while completely preserving everyday life as such. That is, personnel, approaches to work, vector of activity and similar nuances remain unchanged, but official information about the company changes.

- Immutability of fixed assets of a legal entity. Regarding the capital, the transformations of a legal entity are neutral in nature, since neither its distribution, nor amalgamation, nor addition occurs. Reorganization of funds with changes in them is extremely rare in the transformative form of reorganization.

- Interchangeability of a liquidated and emerging legal entity. Perhaps there is no need to explain the complete continuity of rights and obligations between the two companies during the transformation.

In the jurisprudence of the Russian Federation, there are two types of transformation procedures aimed at reorganizing enterprises:

Organization transformation

- Voluntary transformation is a procedure carried out solely at the will of the owners of the organization. There can be many reasons for its implementation. Most often, reorganization in the form of transformation is resorted to when it is necessary to change the organizational and legal type of a company in order to increase the efficiency of its functioning.

- Mandatory transformation is a procedure carried out in the presence of certain factors that are defined by law and oblige the owners to implement the reorganization. For example, mandatory conversion may be required if the number of participants in an LLC exceeds 50 people. In this case, it is important to change the form of the enterprise to an OJSC or a cooperative association.

Note! Reorganization in Russia is a global procedure that is required when there is a major change in the legal form of an organization. That is why, when changing the type of joint stock companies, reorganization procedures are not required; it is enough to change the name of the legal entity.

Required documents

The legislation establishes a list of documentation required for submission to the tax service. To register the transformation, the following documents of the liquidated enterprise must be submitted:

- Application on form P12001. The document must be signed by the applicant. Provided for each emerging company.

- A set of documents of the reorganized organization. It includes:

- TIN;

- charter;

- extract from the Unified State Register of Legal Entities;

- OGRN certificate.

statistics codes;

Originals or notarized copies are submitted to the Federal Tax Service. Documents are provided in two copies.

For a newly created company, the following information is needed:

- full and abbreviated name;

- activity codes;

- legal address;

- size of the authorized capital indicating the form of payment;

- details of the manager, name of his position;

- data of the chief accountant;

- data of the founders indicating their shares in the authorized capital;

- information about the bank in which the account will be opened;

- The contact person.

If these documents and information are available, the tax authorities register the reorganization of the enterprise.

Legislative framework of the issue

As noted earlier, the process of reorganization in the form of transformation is defined by several legislative acts of the Russian Federation. The main regulators of this procedure are:

- Civil Code (Civil Code of the Russian Federation). Article 57 of this act defines the basic types of reorganization procedures, gives them a definition and establishes the specifics of carrying them out.

- Federal Law No. 129-FZ of August 8, 2001 “On State Registration of Legal Entities and Individual Entrepreneurs.” This regulatory document clarifies the reorganization process, defining the specialized nuances of its implementation. For example, the Federal Law contains a list of required documents.

Letters, recommendations of the Ministry of Finance of the Russian Federation and similar acts also determine the features of the reorganization. Summarizing these provisions, it is necessary to highlight the possibility of change:

- OOO only into a partnership, a company of another form or a cooperative

- private institution to a foundation, non-profit organization or any society

- production cooperative into a partnership or company

- CJSC and OJSC in OOO, non-profit partnership or cooperative

Other types of transformations in terms of reorganization of legal entities are not allowed. This is important to consider before implementing such a procedure.

The legislation of the Russian Federation also determines other nuances of transformation procedures. Basically, they concern the procedure for determining the form of an enterprise organized from an old legal entity. It is important to consider the following:

Legislative acts

- It is impossible to carry out reorganization in such a way that as a result of its implementation a certain company will appear, among the founders of which there will be only one legal entity with a single owner.

- It is important that the participants of the reorganized partnerships be registered as an individual enterprise, if in fact they are ordinary individuals.

- The minimum amount of authorized capital appearing after the transformation of a legal entity is 10,000 rubles for LLC, CJSC and 100,000 rubles for OJSC.

- The names of commercial companies should make reference to the future vector of their work.

- In addition to the minimum authorized capital, for legal entities emerging after the transformation, the minimum number of founders (participants, partners) should be taken into account. In a production cooperative it is equal to 5 persons, in a partnership – 2, in a non-profit partnership – 2.

In other aspects, the legislative framework for reorganization in the form of transformation does not have any nuances. To carry out the procedure competently, it is enough to carefully study the noted article of the Civil Code of the Russian Federation and the entire Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs”. In addition, we should not forget the noted provisions in this paragraph of the article. All of them are extremely important and are presented in the easiest to understand form.

Does the TIN change?

From a legal point of view, during reorganization, the enterprise ceases to exist and a completely new company is created. In this regard, all company details are changing.

During the procedure, the taxpayer number of the converted company is removed from the register. In the future, this TIN will no longer be used. The newly created enterprise is assigned a different number .

If the legal form changes without reorganization, the TIN remains the same. For example, when an OJSC is transferred to a CJSC, no changes are made in the tax service register.

Other nuances

Conversion is a rather complex procedure. There are a few more nuances, knowledge of which will allow you to carry it out without violations:

- The liquidated enterprise must draw up final financial statements as of the date preceding the day the reorganization was recorded.

- The new organization must provide introductory reports. It is compiled by transferring indicators from the final one.

- If an enterprise used a special tax regime, then after reorganization it can apply the simplified tax system or UTII only if it submits an application to the tax authorities.

- Small organizations wishing to switch to the simplified tax system or UTII can submit a corresponding application within five days from the date of creation.

- The duration of the procedure is approximately 2-3 months .

- To implement this, you can use the services of specialized companies.