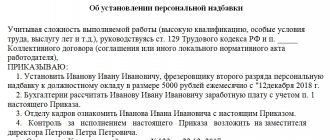

What is it and who is it for?

A bonus for length of service or experience is an incentive payment that is awarded to citizens working in the public sector and entitled to such a payment.

It is calculated based on the employee’s official salary, and its size depends on how long he has been working as a particular specialist. Payments are guaranteed by the current legislation of the Russian Federation and are regulated by the following documents:

- Law “On State Civil Service”;

- Labor Code of the Russian Federation, in particular Chapter 21 and Article 317;

- Federal Law No. 306-FZ concerning financial allowances and certain payments to military personnel.

According to regulations, monetary “benefits” are provided for the following categories of citizens:

- persons working in non-profit organizations financed from the state budget;

- civil servants;

- military personnel, employees of the Ministry of Internal Affairs and courts;

- teachers (this category includes teachers, researchers, preschool teachers);

- doctors and nurses;

- persons working in the fire service;

- cultural workers (this category includes theater actors, directors and artists, librarians, museum workers).

How is it calculated

Additional payments depend on the time period during which the employee performed work duties.

Even if during this time he managed to quit his job several times and get a new job, this does not cancel the required financial support. The additional payment is calculated as a percentage of the official salary that was received for this period of time. In addition to the salary, the size of the payment depends on a number of conditions. These include regional coefficients, determined on a territorial basis. They are installed separately in each subject of the Russian Federation.

In addition, the amount of additional payments also implies a bonus, if this is provided for by the Labor Code of the Russian Federation, as well as regional and federal legislation. Therefore, to calculate the amount of additional money paid, pay attention to these parameters; you should remember the need to pay income tax.

Amount of surcharges

Persons covered by this benefit receive a bonus, the amount of which is determined by length of service:

- 5% – from 1 year to 3 years;

- 10% – over 3 years;

- 20% – from 10 years;

- 30% (maximum!) – 20 years or more.

It is important to note here that for a number of positions, a separate calculation scale is used. Thus, employees of the Ministry of Internal Affairs receive additional payments:

- 10% of salary for work experience from 2 to 5 years;

- 15% – 5-10 years;

- 20% – 10-15 years;

- 25% – from 15 to 20 years;

- 30% – from 20 to 25 years;

- 40% (possible maximum!) – service life has reached 25 years.

Civilian government employees also have a slightly different procedure for receiving additional payment:

- 10% – from 1 year of experience to 5 years;

- 15% – from 5 to 10 years;

- 20% – from 10 to 15 years;

- 30% (maximum!) – over 15 years.

When calculating the bonus, accounting takes into account only the official salary of the person. This means that any bonuses, allowances, etc. will not be taken into account.

How to get additional payment for work experience in a budget institution in 2021?

Reading time: 3 minutes(s) The bonus for work experience in a budgetary institution is a special additional payment to the salary that is paid to certain categories of workers in the Russian Federation. The main factor that influences it is the duration of work in a government agency. Let's look at the allowance in more detail.

Who is entitled to a bonus for work experience in a budgetary institution?

A wage supplement related to the development of a certain length of service in budgetary institutions is paid to the following categories of employees:

- citizens who work in institutions financed from the state budget (including municipal organizations);

- teachers;

- medical workers;

- employees of cultural institutions;

- rescuers and firefighters.

In addition to the above categories of workers working under an employment contract, an allowance is also provided for those serving in public service. True, in this case its size is determined by other regulations (including departmental documents). You can count on receiving it:

- federal civil servants (employees of the Ministry of Internal Affairs, the Federal Penitentiary Service, the prosecutor's office);

- military personnel (both the Ministry of Defense and other departments where military service is provided);

- government civil servants (for example, employees of the tax inspectorate or bailiff service);

- state civil servants of the constituent entities of the Russian Federation;

- municipal employees.

Who is paid by?

Additional funds are paid to employees who have the required length of service from the payroll of the organization in which they work. The situation is similar with civil servants - they receive a bonus from the wage fund of their department.

What does the premium depend on and how is it calculated?

The amount of the surcharge is determined based on the salary of the employee or civil servant. In fact, it represents a certain percentage of it.

For employees who carry out their activities on the basis of an employment contract, the additional payment will be as follows (as a percentage of salary):

- 5% for experience from one to three years;

- 10% for work for more than three years;

- 20% for ten to twenty years of experience;

- 20% for work for twenty years or more.

In the Ministry of Internal Affairs and the Federal Service of National Guard Troops, surcharges are different. Here is what additional payment is due for length of service (as a percentage of salary):

- 10% for length of service from two to five years;

- 15% for service from five to ten years;

- 20% for ten to fifteen years of service;

- 25% - from fifteen to twenty years;

- 30% - from twenty to twenty-five years;

- 40% for service of twenty-five years or more.

The amount of the allowance for state civil servants is calculated in their own way. Here's what they can claim (as a percentage of salary):

- 10% for length of service from one to five years;

- 15% for work experience from five to ten years;

- 20% for work for ten to fifteen years;

- 30% for fifteen years of experience or more.

Rules similar to the rules provided for state civil servants (including employees of a constituent entity of the federation) also apply to municipal employees.

It should be noted that for each specified category of workers there is a certain “ceiling”, above which the premium does not rise. If an employee has accumulated length of service that exceeds this limit, his bonus will no longer be increased - it will remain at the same, maximum permissible level. This rule was introduced in order to avoid unnecessary expenditure of budget funds.

What documents are needed to receive additional payment?

The employer determines the additional payment independently. He does not need to provide any documents for this - it is enough to work in a position that gives the right to an increase in wages for the time established by law or departmental regulations.

However, in this case there is one small nuance. If a citizen previously worked in another organization, then moved to his current place of work and only there received the necessary experience for the bonus, he may need to inform the employer about the availability of the necessary work. However, in most cases this is not required - the personnel department, together with the accounting department, independently calculates the length of service required for additional payment, based on the information contained in the employee’s work book.

You can learn more about the intricacies of calculating length of service for certain categories of workers and what privileges they are entitled to by watching this video:

Some categories of employees in the Russian Federation have the right to receive a salary increase after they have worked in their position for a certain amount of time. These include those who work in budgetary institutions (including municipal ones), as well as civil servants of all types. The bonus is calculated as a percentage of the employee's salary. It should be noted that for different categories of workers the calculation rules and the amount of the bonus are also different. You don’t need to do anything to receive it - the employer will make the calculation himself.

Did this article help you? We would be grateful for your rating:

3 0

Features of calculating length of service for additional payment

The length of service for granting a long service bonus is calculated on the basis of the work book or special statements and orders that reflect the person’s length of service in this specific position.

The presence of length of service is determined by the personnel service, which, upon reaching the length of service specified in the regulatory documents, issues an appropriate order for the accounting department. When calculating length of service for additional payment, time at the main place of work is taken into account, while length of service gained while working part-time is not taken into account.

It is worth remembering that for some categories of military personnel, length of service is considered somewhat differently - a month of work can be taken as either one and a half or two months of service. For example, a month of work is counted as two for aviation workers whose tasks include testing catapults and conducting research related to parachute jumping. If a person is engaged in parachute jumping and is part of the crew of combat ships or is a participant in oceanographic expeditions, then the month of his work is equal to 1.5 in calculations.

In addition, the length of service that gives the right to payment includes not only the time when the person actually worked, but also the following periods:

- Holiday to care for the child;

According to a medical report, the period of child care can be up to 6 years. If he has stage 1 diabetes mellitus and is insulin dependent, the period increases to 16 years. - when a person did not actually work, but a place was reserved for him.

Some nuances of accounting for experience are also available for social workers. They take into account the time spent working in state and municipal institutions and organizations, regardless of the type of subordination. There is only one condition - salary calculations must be carried out in accordance with the terms of payment for the corresponding category of employees.

Accrual of funds

The bonus is accrued from the next month after the right to receive it arises. For example, the work book indicates that A. A. Ivanov has been working as a teacher since September 16, 2014 and has no breaks in work. Thus, on September 16, 2021, his experience reached 3 years and he is entitled to a 10% bonus, but it will be accrued starting in October.

It is worth noting that the presence of an additional payment for length of service does not mean that individuals are not entitled to receive other additional payments. For example, civil and military government employees receive other additional payments for the group of positions they hold. In this case, the amounts of additional payments are simply summed up.

Length of service for employees of the Ministry of Internal Affairs and military personnel

After working for two years, employees are entitled to an additional payment to their monetary remuneration.

Its size cannot exceed 40%. Such monetary incentives are possible if the labor activity in the Ministry of Internal Affairs lasts more than 25 years. In other cases, it is graduated, starting from 10% (2-5 years), adding 5% every 5 years. Exception: 25 years of experience: increase – 10%. Read about the long service bonus for military personnel.

In the video, the length of service of employees of the Ministry of Internal Affairs:

Allowances in the Far North

A number of bonuses are guaranteed to workers in the Far North.

Today, there are two main categories: 1. Depending on the area in which the person works

. At the beginning of his or her work experience, the employee is given a minimum bonus of 10%. Every six months it increases by another 10% and stops growing, reaching the maximum established for a given area (there are only 4):

- 100% – Chukotka Autonomous Okrug, Kamchatka, islands of the Arctic Ocean;

- 80% - some areas of the Khabarovsk Territory, the Sakha Republic, the northern regions of the Komi Republic;

- 50% – Amur, Arkhangelsk and Sakhalin regions, the Republics of Karelia and Buryatia, Primorsky Territory;

- 50% – Irkutsk region, Komi Republic, southern regions of the Far East.

2. Depending on how old the person is

. Employees under 30 years of age have the right to an accelerated procedure for calculating bonuses. If they work in areas of the first and second groups, then they are entitled to an initial bonus of 20%. The size of the premium increases with the same frequency of 6 months, but by 20% until it reaches the maximum level.

You can learn more about the specifics of calculating and calculating bonuses for work in the Far North, taking into account length of service, from the video below:

Allowance in commercial organizations

Such organizations do not pay employees bonuses for length of service.

Nevertheless, if desired, the company’s management has every right to assign additional payments to the most “faithful” employees. In this case, the procedure for calculating them and the amount must be specified in the employment or collective agreement, as well as in a number of regulatory documents of the organization. Having sufficient work experience allows a number of people to receive an additional payment to the basic salary in the amount of 5% to 30%. A person working in the Far North can receive a bonus for length of service of up to 100% of the salary. You can clarify all questions regarding additional payments in the accounting department of the institution where you work.

Results

- The long-service pension for teaching staff refers to a specialized supplement to insurance payments. Refers to early and stimulating.

- Payments are provided subject to 25 years of work experience, compliance with the position held and full-time employment.

- To apply for additional payment, you will need a general package of documents and a specialized certificate confirming periods of professional activity.

- The pension is calculated by the Pension Fund from the moment of application. Payments are made monthly and indefinitely.

- The amount of security directly depends on wages and contributions to the Pension Fund. The determining factor is length of service. In case of refusal of payments after 25 years of service, the points and the amount of additional payment increase. The total amount cannot be less than 40% of monthly earnings and more than 75%.