The collection of alimony payments in the event of divorce between spouses can be either voluntary or forced if the alimony payer refuses his obligations. If there are no disagreements regarding the collection of these payments, and a peace agreement is drawn up, then alimony is paid without a writ of execution. In this situation, payments are withheld at the request of the employee to the accounting department.

The procedure for transferring funds for child support by court decision

The calculation of alimony established in accordance with a court decision has a certain procedure.

First of all, the accounting department must be provided with a writ of execution, which is issued only in court. In some cases, the document that serves as the basis for the transfer of alimony from the income portion of the alimony payer may be a court order, as well as a resolution of the bailiff (if the judicial authorities oblige to pay alimony forcibly).

After documents are received by the accounting department, their compliance with the requirements established for registration must first be checked. If there is an error, inaccuracy or unreadability of the lines, then such documents cannot be the basis for collecting alimony, and the accounting department should not accept them.

Accounting should calculate alimony only on the basis of the original document.

If the original document is lost, then a duplicate of it is issued by the court in accordance with the established procedure. If the document is executed correctly, the organization must immediately begin to execute it. First of all, the employee must familiarize himself with the writ of execution for signature. Then the accountant must determine from which employee payments to withhold alimony.

Based on the general rule, alimony is collected both from official income from the main type of activity and for work performed part-time.

Thus, alimony is withheld from all income, which includes bonuses, allowances, compensation for working conditions, etc. However, the maximum amount of collection should not exceed 50% of total income and 70% in the case of alimony arrears.

Nuances for entrepreneurs and administration

According to Article 109 of the Family Code of the Russian Federation: “The administration of the organization at the place of work of a person obliged to pay alimony on the basis of a notarized agreement on the payment of alimony or on the basis of a writ of execution is obliged to withhold monthly alimony from the wages and (or) other income of the person obliged to pay alimony, and pay or transfer it at the expense of the person obligated to pay alimony to the person receiving alimony no later than three days from the date of payment of wages and (or) other income to the person obligated to pay alimony.”

Thus, when an enterprise receives an order to withhold alimony from wages, the administration is obliged to obey. Otherwise – a fine and administrative or criminal liability.

The algorithm for storing a writ of execution at an enterprise consists of the following points:

- The head of the organization appoints an accounting employee responsible for the document. The worker is responsible for processing, protecting and storing the sheet.

- The order is issued against signature and stored in a safe or a special room intended for documents of high importance. Storage parameters are specified in more detail in the document flow regulations signed by the Ministry of Finance in 1983.

- The document is registered in the journal of accounting and executive documents. The format is approved by the company/enterprise.

- In case of loss of the executive order, the responsible employee bears the penalty. The fine is up to 2.5 thousand rubles. Malicious or deliberate failure to comply with court orders by employees of an organization entails:

- a fine of up to 200 thousand rubles or seizure of wages (or other sources of income) for one and a half years;

- lack of the right to work in specific positions or work in a specific field for five years;

- correctional labor lasting 480 hours;

- forced labor for 2 years;

- arrest for up to six months or imprisonment for up to 2 years.

If the writ of execution has been lost, you should apply to the court for a duplicate. By the way, when the culprit is the claimant, there are no problems and a duplicate is issued without unnecessary “bureaucratic red tape.”

From what date will money be paid for a child?

The deadline for the payment of funds intended for the maintenance of a minor child is established by Art. 109 RF IC. The employer must transfer alimony within 3 days from the date of payment of wages.

This applies to payments made on the basis of a court decision. If an agreement is reached between the parents without a trial, then they set the deadlines themselves.

Often, an accounting employee faces certain difficulties. First of all, this is due to the fact that wage payments are made to employees twice a month. In this case, the question arises from what exact amount to withhold alimony as ordered by a judicial authority.

In this situation, it is necessary to follow the norms of the current law. Withholding of alimony should be carried out from the amount that closes the current month. But in this case, all income that was earned by the parent is taken into account.

Withholding alimony from wages without a writ of execution

Is it possible for accounting staff to withhold alimony from an employee’s salary without a writ of execution, and what needs to be done for this? This is precisely the question that concerns many fathers who, despite the divorce, want to voluntarily help their minor child.

Unfortunately, in the workplace, some of them are faced with the fact that accounting employees categorically withhold alimony from the salary of such an employee without a writ of execution, even after receiving a corresponding application from him.

In fact, such actions are illegal. In accordance with the norms of family law, a writ of execution is only one of the grounds for paying child support. In addition, the law allows for voluntary payment of funds.

Accordingly, a personal statement from the alimony payer is quite enough to transfer alimony from his salary even without a writ of execution.

Expert opinion

Marina Bespalaya

In 2011 she graduated from the University of Internal Affairs with a degree in jurisprudence. In 2013, master's degree course, specialty "law". In 2010-2011, a course at Portland State University (USA) at the Faculty of Criminal Law and Criminology. Since 2011 - practicing lawyer.

On the other hand, the parent can make money transfers to the child themselves. To do this, it is better to contact the bank and make an official payment. The purpose of the payment is alimony for a specific month in the name of the child. Even if you have a writ of execution in your hands, you will have to avoid personally transferring money to the baby’s guardian.

What to write in the application

In an application for the transfer of alimony from an employee’s salary without providing a writ of execution, the following information must be reflected:

- Full name of the payer and recipient of alimony.

- The beginning of the transfer of funds and their regularity (in this case, as a rule, a monthly transfer of alimony is established).

- Amount of payment (percentage of salary received or fixed amount).

- Details by which funds will be transferred.

- The date when the alimony payer filed the application.

- Applicant's signature.

It is worth remembering that a voluntary agreement on the payment of alimony does not mean at all that the alimony payer has the right to reduce the amount of payments to those established at the legislative level. That is, the amount of child support assigned by the parent must be no less than:

- 25 percent of wages (after taxes and insurance contributions) per child.

- 33 percent of earnings for two children.

- 50 percent of wages (minus personal income tax) for 3 children.

Duration of the writ of execution for the collection of alimony

In cases related to alimony penalties, the writ of execution will be valid until the child reaches the age of majority, as well as for three years after the child reaches the age of majority.

In this case, the statute of limitations applies. Also, the alimony recipient has the right to revoke the writ of execution in the case where the parents have drawn up a different agreement on the payment of alimony.

However, over the next three years, you can transfer it again to the organization where the alimony payer works.

In the event of the death of the alimony payer or child, the writ of execution terminates on the basis of law.

Dear readers! To solve your problem right now, get a free consultation

— contact the on-duty lawyer in the online chat on the right or call:

+7

— Moscow and region.

+7

— St. Petersburg and region.

8

- Other regions of the Russian Federation

You will not need to waste your time and nerves

- an experienced lawyer will take care of solving all your problems!

Why do you need a writ of execution?

A writ of execution is issued for forced collection of alimony.

Based on the results of the application to the court, the applicant will receive one of the documents:

- Court order , which is issued within 5 days based on a written application. The order refers to executive documents.

- The court's decision . The document reflects the judge's verdict following the trial. On its basis, a writ of execution is issued containing the operative part of the decision.

To arrange alimony without a writ of execution, you need to contact a notary with your spouse and child, if the latter is over 10 years old, and draw up an agreement. After the notary has certified it, the document will acquire the force of a writ of execution. The amount of alimony in the agreement is established in relation to the law and cannot be less than stipulated in Art. 81 RF IC: for 1 child - a quarter of income; on 2 - a third; for 3 or more children - half the earnings.

Control over the execution of a court decision or order is entrusted to the Federal Bailiff Service. The organization's structural divisions are dispersed geographically. You should contact the branch located at the place of residence of the claimant. Within 5 days the bailiff begins enforcement proceedings.

The writ of execution is sent to the organization where the alimony provider is employed. The manager submits the document to the accounting department, after which payments begin to be made.

The responsible employee of the enterprise must not only monitor the timeliness and accuracy of deductions, but also carry out indexation of alimony.

If the obligations are assigned to an unemployed citizen or private entrepreneur, the responsibility for maintaining children will not be relieved. The bailiff explains the need to help the family, notify about a change of job, change in financial situation, so that the sudden cessation of payments is not regarded as evasion of obligations.

It will be easier for a father who is accustomed to personally keeping everything under control to avoid interaction with government agencies and pay child support upon application without a writ of execution.

What to do if the writ of execution for alimony is lost

There are often situations when an executive document is lost for various reasons. What to do in this situation, since it is issued only in one copy? Its re-issuance is decided only in court after the reasons for its loss have been established.

It is impossible to restore the writ of execution itself; the court issues a duplicate of it with a special mark. To restore it, you should take into account the nuance that it is necessary to apply for a duplicate of the document in the very court in which the original was issued.

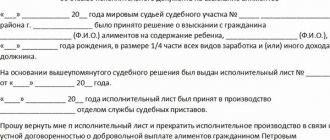

First of all, you will need to submit an application, which must contain the following information:

- information about the alimony recipient and alimony payer, their full name, as well as residential addresses;

- information about the civil case for which the writ of execution was issued;

- the essence of the court decision;

- information about the FSSP, as well as about the bailiff who was involved in enforcement proceedings;

- reasons and circumstances for the loss of the document;

- a request for the issuance of a duplicate of the lost writ of execution, in particular the sheet.

The document must contain the signature of the applicant. The application is then examined at a court hearing.

Restoring a duplicate is not subject to state duty.

Is it possible to withhold alimony through the accounting department at the request of an employee?

It is possible to transfer alimony through the accounting department upon application only if a voluntary agreement has been reached between the child’s parents and there is no court decision.

If there is a writ of execution or other court document, then this method of collecting alimony is not allowed. Child support is obligatory withheld only on the basis of any document.

If the issue is resolved peacefully, an agreement is drawn up and submitted to the accounting department.

The agreement must be notarized. Only in this case will it have executive force.

It is necessary that the application be correctly drawn up and executed, otherwise it will be declared invalid and will not be the basis for the collection of alimony.

How to pay under a voluntary agreement through the accounting department?

Rules for filling out an application and a sample form from the employee

There are no strict requirements for the content of the application. It is compiled freely and in writing.

The application must indicate the following information:

- the name of the organization in which the alimony payer is employed;

- personal data (full name, passport details, date of birth, including place of residence);

- amount of alimony;

- method of withholding funds (by mail, bank transfer or through a cash register);

- bank details of the alimony recipient;

- from what date the withholding must be carried out;

- signature and date of writing the application.

This statement is registered and stored in the accounting department as a strict reporting document.

What documents do I need to bring to work?

In the case of voluntary payment of alimony for accounting purposes, it is necessary to provide a statement and agreement, which must be certified by a notary. This procedure is necessary to give the document legal force.

Procedure for deducting funds from wages

Under a voluntary agreement, alimony is usually withheld in the form of a fixed amount, which is specified in the application and agreement.

The collection procedure itself consists of the following stages:

- the total income for the month is determined;

- personal income tax is withheld (13%);

- insurance payments are deducted to the Social Insurance Fund;

- From the remaining net income, the amount specified in the application is transferred to the account of the alimony recipient.

Responsibility for the timely calculation of alimony lies with the accounting department, as well as the management of the organization in which the alimony payer works.