In what cases is a notification letter written?

Chapter 11 of Federal Law-229 provides for the obligation of the employer or persons paying wages to the debtor under a writ of execution to withhold part of the funds to pay off the debt. The basis for this is a writ of execution or a court order, which can be transferred to an organization (IP) either by the collector (recipient of alimony) or by the bailiff.

Return of the claim with a covering letter

It is possible that an organization has received a writ of execution against an employee who has already resigned. In this case, it is necessary to return the writ of execution to the bailiffs, attaching a cover letter in any form.

It must contain information about the basis for the debtor’s dismissal (with reference to the order), information about the amounts of deductions and the collection period.

The letter is signed by the chief accountant and general director of the organization; if there is a seal of the organization, its imprint is affixed. It is best to record such (if there is one), and also keep documentary evidence of the return (a list of attachments if the document was sent by registered mail).

The procedure for dismissing an employee against whom penalties were imposed under a writ of execution is quite complex and requires maximum care and professionalism of the accountant and the organization’s personnel. We hope that the detailed description will help you not to encounter difficulties and make mistakes when working.

Employers who make deductions from an employee’s income on the basis of a writ of execution, upon satisfaction of the claims, are obliged to return the documents to the claimant in the prescribed manner. In this article we will look at how to return a writ of execution to bailiffs, whether it is necessary to return the document in the event of an employee’s dismissal, and what deadlines are provided for returning the writ of execution.

How to inform bailiffs about a dismissed employee

Notice of dismissal of an employee is a document of arbitrary content. However, practice has developed unified forms, which are provided for the convenience of performers on the FSSP website. The notice must contain:

- name of the legal entity or individual employer;

- address and details of the notifying person;

- name and ID number on the basis of which deductions were made;

- the amount of existing debt under obligations;

- information about amounts withheld at the time of dismissal;

- number of the dismissal order and its grounds;

- signature of the manager and chief. accountant;

- date and seal of the company.

In addition to the specified mandatory information, the letter to the bailiffs may contain other information known to the employer. For example: about the debtor’s place of residence, his contact information, where he plans to work, the locality to which the debtor has moved.

If the original IL was kept in the accounting department of the organization, it is returned to the claimant or, if impossible, to the bailiff, for subsequent return to the recipient of payments.

Accounting statements, copies of documents submitted to the FSSP and notifications are transferred to the archive in case of inspections by fiscal authorities.

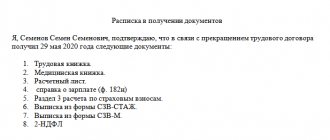

To write a letter, you can use an example notification:

Features of dismissal of a debtor

When an employment contract with a debtor is terminated, from whose wages funds were withheld according to a court order, the employer is obliged to notify the bailiffs of the dismissal. There is no legally approved form for such a letter.

An enterprise can use a company letterhead; the following information is entered into the document in free form:

- the very fact of termination of the agreement;

- date of dismissal;

- reason according to the Labor Code of the Russian Federation.

If management has additional information about the dismissed person, it must be indicated on the form.

A copy of the order to dismiss the debtor from office is attached to the letter to the bailiffs.

For reference! The employer is given 3 days from the date of drawing up the dismissal order to complete and submit the notice to the bailiffs. Violation of deadlines leads to fines.

Employer's procedure

The procedure for handling a writ of execution when dismissing an employee includes 4 stages:

- Notifying the bailiff or recoverer of receipt of the document for collection. This is not a requirement, but if a notification of receipt form is included, it is best to fill it out.

- Registration in the journal of incoming documents. A prerequisite for resolving possible disputes with bailiffs or collectors.

- Storage of the document for debt collection throughout the entire period of the employment relationship with the debtor. For this purpose, a responsible person (accountant) is appointed who is in charge of the IDs for all debtor employees. The originals of the IL are stored in a safe. They are documents of strict accountability.

An example of a letter to a bailiff about termination of an employment contract with an alimony worker

The notice of dismissal of the alimony provider is drawn up in any form, like the letter of dismissal of any debtor. The document is drawn up on the employer’s letterhead and contains:

- date of compilation;

- outgoing number (if available);

- Full name of the alimony provider;

- link to paragraph 1 of Art. 111 of the Code, paragraph 4.1 of Art. 98 of the law on enforcement proceedings;

- date and grounds for termination of the employment contract;

- the date on which salary deductions were made;

- debt and the reasons for its occurrence (if any);

- new place of work of the alimony worker (if known).

The document is signed by the head of the alimony payer’s former employer.

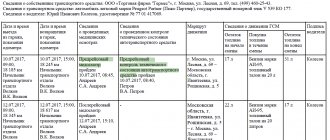

The attachment to the message is an IL with a mark that contains the following data:

- about the withheld amounts of funds;

- numbers of payment documents with which the funds were transferred to the alimony recipient;

- dates of transfer of alimony payments;

- balance of debt.

This mark is certified by the seal of the enterprise (if any) and the signature of an authorized person (see paragraph 10 of section II of the Memo for managers and accountants of the organization..., which is Appendix 1 to the Methodological Recommendations, approved by the Federal Bailiff Service on June 19, 2012).

By virtue of paragraph 1 of Art. 111 of the Code, the recipient of payments must also be notified of the dismissal of the alimony provider. It is allowed to issue one document sent to 2 addresses. An example of filling can be viewed at the link: Sample letter to bailiffs about the dismissal of an alimony worker.

Was the article useful? Subscribe to our channel RUSYURIST in Yandex.Zen!

An official notification to the bailiffs about the dismissal of the debtor is a mandatory document. What does it mean to comply with the deadlines for sending it and the order of its preparation.

Otherwise, those obligated to send notice of the debtor’s dismissal will face an administrative fine. Responsibility for such an offense is established by Art.

17.14 of the Code of the Russian Federation on Administrative Offences.

Not only debtors, but also their employers should pay attention to the information below. Both organizations and individual entrepreneurs and other individuals who have hired citizens against whom enforcement proceedings have been initiated.

Especially if such persons make deductions under a writ of execution or a resolution to foreclose on wages. If after studying this article you still have additional questions, ask them to the site’s on-duty lawyer.

Notification to bailiffs about the debtor's dismissal

What deadlines do you need to meet?

The notice period after dismissal may vary. Depends on the nature of the obligations for which the debt was collected. For general property obligations, no deadline has been established. In Part 4 of Art. 98 FZ-229 there is only an indication that the ID is subject to immediate return.

More precisely, the terms of return are established in relation to debtors from whom alimony is being collected. The return period for IL is established by Part 1 of Art. 111 of the Family Code - no later than 3 days from the date of dismissal.

Withholding under executive documents: general provisions

An executive document received by the organization in the name of an employee is the basis for collecting from the employee’s salary the amounts specified in the document.

An executive document can be: (click to expand)

- performance list;

- certificate issued by the labor dispute commission;

- act of regulatory authorities on the collection of credit debt and accrued interest;

- a judicial act issued in accordance with the Code of Administrative Offences;

- order of bailiffs;

- a notary's writ of execution on an agreement on out-of-court dispute resolution.

In accordance with the provisions of Federal Law 223, the employer is obliged to make deductions from the moment of receipt of the writ of execution.

In order to make penalties, the employee's consent is not required. The employer only needs to notify the employee in writing (the employee’s signature “Notified” on the writ of execution), after which the accountant has the right to withhold the amounts in the manner established by the writ of execution.

What to do in this situation

The practice follows the path when the former employer withholds alimony from income and notifies the bailiff about this. However, there is no legal justification for such actions.

The FSSP does not provide an official explanation regarding the current situation. The justification for the retention is a reference to Art. 109 RF IC and clause 3. Art. 98 FZ-229. However, when reading these articles, it turns out that we are talking about deductions from “salaries and other periodic payments.” Payments for temporary disability and the assignment of bonuses do not qualify as such, since they are not of a regular nature. By the time the payment is made, the employee is no longer working. The IL, which was the basis for the deduction, was returned to the bailiff or collector.

There is no explanation from the FSSP regarding the actions of the former employer. The only justification for the actions of the former employer is Letter No. 11-1/OOG-43 of the Ministry of Labor dated February 19, 2014; the drafters, in turn, refer to the List of types of income for which alimony is withheld.

In order to avoid misunderstandings and fines on the part of the FSSP, it is recommended to withhold alimony from dismissed debtors, although there is no direct indication of such actions in any law. The explanations of the Ministry of Labor are advisory in nature and reflect the subjective point of view of the lawyers of this government agency.

FAQ

I received a letter from the bailiffs that the court foreclosure on the loan was cancelled, can the bailiff subsequently resume proceedings again?

Check on the FSSP website for what reason the enforcement proceedings were completed or terminated. If you have not repaid this debt, then most likely it will be under Art. 46 part 1 clause 3. - return of the writ of execution to the claimant. If the claimant returns the sheet back to the bailiff, the proceedings will be restored.

Can the bank itself present a writ of execution to the accounting department of the organization where I work?

The claimant has the right to present a writ of execution to the bailiff, to the bank where the debtor's accounts are opened, or to the employer's accounting department if the debtor is an individual.

According to the writ of execution, 50% of the salary was withheld, but I did not know that the bank had filed a lawsuit. What can be done in such a situation?

If the amount of debt does not exceed 500 thousand rubles, then most likely the court issued a court order. It is necessary to go to court to cancel the court order and obtain an appropriate determination, which will be the basis for terminating the individual entrepreneur. But after the court order is canceled, the bank has the right to go to court to collect the debt. Your right to be present at this process and request a reduction in the penalty.

Deadlines for submitting a notice of dismissal of an alimony payer

The Russian Investigative Committee gives only 3 days to send a message to representatives of a commercial organization. As for the “executive” law, it states that notice of dismissal must be reported immediately.

This point needs to be given special attention, since being late can result in a fine for the company in the amount of 50,000 to 100,000 rubles. The chief accountant may also be fined from 15 to 20,000 rubles.

What to do with a writ of execution in accounting?

Sometimes it happens that the debtor has not been an employee of the organization for quite a long time, but the bailiff does not have the necessary information and still sends a writ of execution to the legal address of the former employer with a request to withdraw some part of the salary of the executor of the judgment. In this case, there is no need to worry, because the organization and its employees will not suffer any financial losses if they send a response to the bailiff’s request in a timely manner and return all received documents.

Subsequent proceedings with documents, a decision that the person does not work and the search for ways to collect the debt is already the job of the bailiffs. But you will greatly help the investigation if in your answer you also indicate information known to you about the current or last place of employment of the debtor known to you.

If an employee is still employed in this company, but for some reason does not receive wages, the executive officer should also be notified about this. An administrative penalty for failure to prepare a response may be a monetary fine.

How can you fire a debtor?

Currently, very often there are situations when a person who works at an enterprise is obliged to pay alimony debts or they will be collected from him through the court.

At the same time, the company’s administration can independently think through an action plan when dismissing such employees, since any types of violations threaten the company with the imposition of an administrative fine.

The procedure for dismissing an employee from his main place of work should be carried out in the following categories:

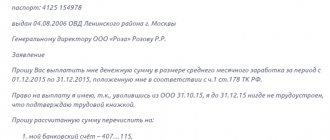

- At the personal request of the employee. In this case, the employee needs to fill out a special resignation letter, which is most often filled out in free form;

- By decision of the head of the company. This is usually used when an employee fails to fulfill his official duties, in the presence of a fine or disciplinary violation. In addition, this category may include liquidation of a company;

How does a package of documents get to the bailiffs and the bank?

Most often, the package of collected documents is delivered to the bailiff service and the bank by the debtor independently.

It should be noted that the debtor must have a second package of executed documents and notification of receipt of these documents by the bailiff service.

In the event that documents are issued by postal order, it is necessary to issue this by registered mail with mandatory notification and deadline. You can also create an inventory of attached documents.

It should be noted that the letter form that will be sent to the bailiffs can be found on the Internet.

01

Consultation with a lawyer on bailiffs is free, click

02

Free hotline (Moscow and regions of the Russian Federation)

8 800 350 14 85 03

We accept applications around the clock, a lawyer will call you back in 10 minutes

Prices for lawyer services for bailiffs