An employee returns to work on the day he returns from a business trip: is it necessary to pay per diem?

Rostrud experts explained how the day an employee returns from a business trip is paid if he goes to work on that day.

The agency notes that if an employee returns to work on the day of his return from a business trip, he must be paid wages. The employer is also obliged to pay the employee daily allowance for this day.

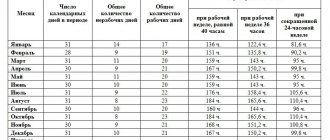

Rostrud explains that daily allowances are reimbursed to the employee for each day he is on a business trip, including weekends and non-working holidays, as well as days en route, including during a forced stopover.

The day of departure on a business trip is the date of departure of a train, plane, bus or other vehicle from the place of permanent work of the business traveler, and the day of arrival from a business trip is the date of arrival of the specified vehicle at the place of permanent work.

When a vehicle is sent before 24 hours inclusive, the day of departure for a business trip is considered the current day, and from 00 hours and later - the next day. If a station, pier or airport is located outside a populated area, the time required to travel to the station, pier or airport is taken into account.

The day of the employee’s arrival at his place of permanent work is determined in a similar manner.

The issue of an employee’s attendance at work on the day of departure on a business trip and on the day of arrival from a business trip is resolved by agreement with the employer.

Rostrud provides such explanations on its website, answering questions from workers and employers.

BUKHPROSVET

When an employee is sent on a business trip, he is guaranteed to retain his job, average earnings, as well as reimbursement of expenses associated with the business trip. Earnings are retained for all days of work according to the schedule established by the sending organization. During a business trip, an employee working part-time retains the average salary from the employer who sent him on a business trip.

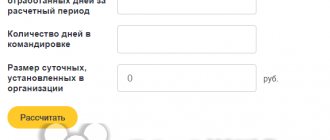

The actual length of stay on a business trip is determined by travel documents. If the employee travels by official or personal transport, the actual length of stay at the place of business trip is indicated in the memo. The note should be accompanied by a waybill, route sheet, invoices, receipts, cash receipts and other documents confirming the transport route.

Upon returning from a business trip, the employee is obliged, within 3 working days, to submit to the employer an advance report on the amounts spent in connection with the business trip and make a final payment for the cash advance issued to him before leaving for the business trip for travel expenses. Documents on the rental of accommodation, actual travel expenses and other expenses associated with the business trip are attached to the advance report.

What should I do if my departure date falls on a weekend?

Often there is a need to be present at a temporary workplace on Monday morning. That is, the posted employee will have to leave in advance: on Saturday or Sunday. How do I pay for a business trip on a day off?

Payment for days off on a business trip can be made in two ways:

- Double payment.

- Single payment if the employee has expressed in writing a desire to take time off for that day.

In this case, daily allowances are paid strictly for the number of days that the trip lasted.

The previous version of the Resolution specified the maximum period during which an employee could be on official absence - 40 days.

After these days, if necessary, one business trip was closed and a new one was immediately opened by order. There are no such restrictions in current legislation: the duration of the business trip is determined by the organization.

In addition to the first case, when the road takes up a day off, it also happens that an employee is forced to spend the weekend away without returning home .

Are these days payable? The situation is similar here, only one nuance differs: whether or not the employee performed his official duties on those days.

If an employee was involved in this on a day off (and there is an order about this), then double payment or time off and single payment occurs. If the employee did not work that day, then such day is not subject to payment.

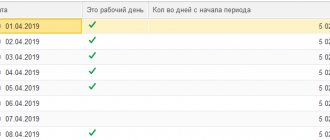

Filling out a time sheet

Even if an employee is on a business trip, the HR department is required to mark him on the report card.

How does this happen?

The days that fall on such absence are marked with one of two types of designations:

- letter – “K”; numeric – “06”;

If the trip falls on a weekend or holiday, then it is illegal to put one of these designations, since work on weekends on a business trip is paid at double the rate. In this case, the designation “РВ” or “03” is given. This is on the one hand.

On the other hand, you can put two marks on the report card at once to reflect that the employee is on a business trip on weekends and holidays . This will be more appropriate for the correct calculation of charges. Payment for business trips on weekends and holidays is made in the same order.

In addition, putting two marks at once is a guarantee that all payments will be received in the established amounts and the employee will retain all his rights during his absence from his main workplace.

Payment

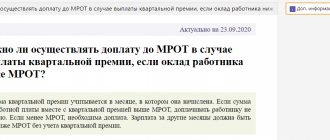

During a business trip, an employee does not receive a salary, but an average salary. It includes a variety of bonuses and allowances, so the rate for an employee on a business trip may be even higher than his regular salary.

In addition to the average salary, during a business trip the employer is obliged to pay the employee a daily allowance.

The minimum amounts for these payments are provided - 700 rubles per day for business trips in Russia and 2,500 rubles per day for business trips abroad.

Such amounts are not subject to personal income tax, so employers are not recommended to accept larger daily allowances for employees.

However, at his own discretion, the employer has the right to increase the amount of daily allowance, but in this case the amounts will be subject to personal income tax in full.

Salary on a business trip is mandatory. How to apply for a business trip extension? Information here.

What documents are required for a business trip using personal transport? Details in this article.

Reimbursement

Based on labor legislation, the employer is obliged to reimburse the employee for expenses associated with renting housing during a business trip, travel to and from the destination, as well as other types of expenses.

For delays in transit, the employee also has the right to demand payment - double the amount if it occurred on a weekend, and at the regular rate - for delays on weekdays.

In order to confirm the existence of expenses, the employee must provide the employer with checks, receipts and other documents from the trip.

Business trip on a weekend - features

Current legislation establishes that a business trip is a trip by a company employee to an area determined by the company’s management to achieve the goals and objectives set for him.

Depending on them, the duration of a business trip can take a fairly significant period of time.

It may include weekends and holidays. Please note: in most cases, weekend travel dates fall at the beginning or end of a business trip. The legislation establishes that these days must be agreed upon with the management of the company and formalized accordingly.

An employee goes on a day off

In practice, a situation often occurs when an employee on a business trip must begin completing the task assigned to him by management at the beginning of the week.

Therefore, in order to be at the destination on time, he must go on a trip on a day off. The legal requirements are such that management must give permission for this, and the employee must agree to start work on a day off.

To do this, these days must be reflected in the order for the business trip so that the employee takes advantage of the existing guarantee - appropriate payment or a day of rest. The employee must provide his consent to go on a business trip on a day off in writing.

Attention: the business trip order must accurately record the days that fall on weekends, and, if necessary, the hours. This must be done so that the employee can correctly pay for travel expenses, payroll, etc.

For example, in order to be on time at the destination on Monday, an employee needs to fly out of his city at 23-30 on Sunday. To be at the airport by this time, the employee must leave home at 22-00.

In order for an employee sent on a business trip to have their salary calculated correctly for two hours of work on Sunday, it is necessary to record that this person is going on a business trip on Sunday at 22-00.

Important: if you do not do this, but simply indicate that the business trip begins on Sunday, the employee will have to pay for the entire day.

Do not forget that the company employee chooses the type of compensation for working on weekends independently. He can request either double payment for this period or the provision of any day of rest for him.

It is important to remember that daily allowances on weekends are paid in full. They should not be recalculated taking into account the time worked.

Attention: the situation may turn out to be such that an employee goes on a business trip without permission on a day off. Then the administration can pay him for this day in a single amount as a simple working day.

Day off during a business trip

A business trip may cover a long period of time, which includes weekends. For example, an employee went on a business trip to Central Asia and returned the following Tuesday. During his business trip, he has days off.

In this case, payment is made only if the employee performs the official tasks assigned to him on the specified weekends.

Just as in the previous case, the involvement of an employee in work must be provided for by order of the manager. Also, the administration must agree with the employee, obtaining his consent.

Attention: if the documents confirming the trip do not indicate that the employee must perform his duties on a day off, then there is no need to pay for them.

In this case, only daily allowances for business trips in 2021 must be paid. Their size must be fixed in the internal documents of the organization.

For the purpose of calculating income tax, the daily allowance should not exceed 700 rubles if traveling within Russia, and 2,500 rubles if traveling outside the country.

Attention: in addition, when traveling on a business trip, travel expenses for travel, accommodation and other allowable expenses must be compensated.

Returns on the day off

If the day an employee returns from a business trip falls on a weekend or holiday, then such a day must be taken into account in the same way as departure on a weekend.

Thus, if an order was issued in advance, according to which work on a day off should be carried out only for the hours actually worked during which the trip occurred, then payment should be made only for them. If there was no such order, then you will have to pay in full for the whole day.

Attention: the procedure for paying for days off must be determined in advance and carried out on the basis of a previously issued order.

What if an employee himself wants to leave early on a day off?

The law stipulates that the employee and the administration must agree on the start and end days of a business trip. After this, they must be secured by issuing a travel order in T-9 format.

However, a situation may arise when an employee, on his own initiative, wants to go on a business trip on a day off in order to start work in a new place on Monday.

Attention: the law establishes that the day of the start of the trip will be considered the day indicated in travel documents, receipts for housing, etc. Therefore, you cannot simply ignore this. But in order not to pay for these days as work on a day off, in the report card they are o instead of “RV”.