Cases often arise when, by agreement between enterprises, an employee is sent to another, third-party employer to perform work for the latter or for the purpose of exchanging experience. As a result, once an invitation has been received, all associated expenses (travel there and back, accommodation, food) are reimbursed by the inviting person. As a rule, this situation is possible when assigned to foreign business trips, there is an urgent need to perform qualified or high-tech work.

How is a business trip arranged at the expense of the host party?

All transactions related to the business activities of the company must be reflected in documents - primary documentation forms, which are then stored by an accounting employee. A business trip is precisely one of these events, and therefore it must be properly formalized.

When an enterprise sends an employee on a business trip, the following mandatory documents are drawn up:

- official assignment (on a unified form T-10a);

- travel certificate (on the unified form T-10);

- order of the head of the company or his order to send an employee on a business trip (in form T-9 or T-9a).

Although labor legislation obliges employees' managers to pay them for travel expenses, there are no specific guidelines regarding methods and procedures for financing business trips.

Due to the fact that the methods for compensating an employee’s travel expenses are not defined by law, both the direct employer and the organization to which the employee went to perform any duties can reimburse the expenses. To provide the employee with guarantees of payment for his work, before the trip he signs an agreement with the employer, which will indicate which company will have to pay the money and what specific costs will be reimbursed.

The manager's order to send a subordinate on a trip must contain information about the source of funding for the trip. In the case of payment for the trip at the expense of the enterprise to which the employee will go, it is stated that the business trip is at the expense of the receiving party.

If they feed

The company must pay a per diem when the host pays for meals. Despite the fact that someone pays for the employee’s food, this cannot serve as a basis for refusing to pay the daily allowance.

A business trip is a trip by an employee by order of the employer to carry out an official assignment outside the place of permanent work.

Judges have repeatedly spoken out on this issue. For example, the Supreme Court drew attention to the fact that employers do not pay daily allowances for specific purposes, and this payment covers the employee’s personal expenses during a business trip (decision dated March 4, 2005 No. GKPI05-147).

Therefore, it is impossible to replace the daily allowance with payment for food and other services. They must be paid before the business trip in the amount established by the company’s internal local regulations. We draw the attention of readers that this approach must be used not only for business trips around Russia, but also for business trips abroad.

Read also

07.11.2018

How is a business trip paid for at the expense of the host party?

Before sending employees on a business trip, the company must include a clause determining the amount of payment for travel in local regulations and the collective agreement.

The employee must receive payment for travel expenses on time and in full when he provides the host company with documentation of expenses, including payment documents for housing (rental agreement or receipts for payment of a hotel room), train or plane ticket. If the contract stipulates payment of any other expenses during your stay on a business trip, you will need to collect more paperwork.

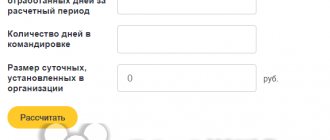

According to the approved rules, an employee cannot claim daily payments in an amount greater than 700 rubles per day . However, if we are talking about a trip abroad, the daily allowance increases significantly - up to 2.5 thousand rubles per day .

Per diem – payment for all days, without exception, spent by an employee on a business trip, taking into account weekends, holidays, periods of travel and forced stops.

Even if the host party undertakes to pay for the business trip, the employee’s employer still pays him some amounts. The receiving enterprise will pay the cost of travel to the destination and for the rental of residential premises, and the employee’s supervisor will pay:

- salary for the entire period of stay on a business trip in the amount of the average monthly salary;

- compensation of daily expenses for all days of travel, including compensation of expenses incurred with the permission of the employer (for paperwork, for mobile communication services).

While an employee of an enterprise is on a business trip, he cannot be fired, deprived of his position or workplace. The position is retained for the time spent en route to the destination and back.

We organize business trips in a new way

Company executives (2 people) are going on a business trip to China. The plane tickets were ordered online and paid for with one executive's credit card (that is, he bought tickets for everyone). How to do all this? How and when to reimburse the expenses of the manager who bought the ticket?

Personnel registration of all necessary documentation for official trips of this kind is carried out in a general manner, taking into account a number of features.

A service note is a document confirming the fact of stay and time of stay of a business traveler at the destination.

Details Category: Selections from magazines for an accountant Published: 07/29/2015 00:00 Source: Glavbukh magazine Let's start with the differences between a contract (civil law) and an employment contract.

Arranging a business trip at your own expense

The law does not provide for the possibility of sending an employee on a business trip at his own expense; however, employers often break the law and compensate the employee’s expenses after his return from the trip.

As in the general case, the employer must issue an order, draw up a job assignment and issue a travel certificate (if such documents are provided for by the company’s internal regulations). Before the trip, the employee does not contact the accounting department to receive money to pay the average monthly salary, daily allowance and compensation for his future expenses. All payments will be made upon return.

Common mistakes

Error: An employee who was on a business trip abroad did not spend all the money given to him and returned part of the funds to the employer in rubles.

Comment: Reimbursement for travel expenses abroad for work is paid in the foreign currency of the country where the employee is sent. If there is money left, the employee returns it to the company’s cash desk, also in foreign currency.

Error: The employer sent the employee on a business trip at the expense of the host party, without offering to draw up an agreement to pay for the costs that the employee would incur during the trip.

Comment: As a guarantee, the employee must be provided with an agreement on payment for the trip by the host party for signature.

Sample of a business trip agreement between the sending and receiving parties

The employee is not given cash as an advance, so he bears all expenses himself. At the same time, he will not be paid the average monthly salary, daily allowance, or other types of expenses.

In addition, it should be noted that the main purpose of a business trip is to complete a production assignment.

But at the end of the trip, he can submit an advance report, according to which his expenses for travel, accommodation in a hotel or rented apartment are compensated, subject to an agreement with the employer. In addition, he must present the results of the work performed. : Business trip.

Attention: If a trip is planned outside the territory of the Russian Federation (regardless of whether the destination state belongs to the far or near abroad), then the daily allowance is paid:

- during your stay within the Federation - in accordance with the generally established procedure;

- from the moment of crossing the border abroad - in the order and amounts specifically determined for trips abroad. In such cases, the employee is provided with an advance payment in foreign currency.

For short-term (one-day) trips within the country, daily allowances are not paid.

When a one-day business trip is planned abroad, the daily allowance is paid in the amount of 50% of the cost norm (personal income tax is not assessed for amounts below 1,250 rubles). What you should know if you are planning a business trip at the expense of the host party - personal income tax and insurance contributions are not deducted from daily allowances if their limits are met. According to paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, the daily allowance limit is 700 rubles.

Registration of a business trip at the expense of the receiving party

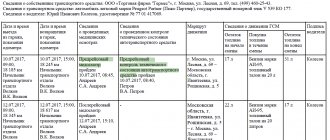

Data on the employee are given in the table: Month Earnings for the month, rub. Number of days worked per month July 2000 14 August 1000 10 September 7000 14 October 6500 15 November 3000 14 December 7500 14 January 8000 18 February 4000 10 March 5000 14 April 6000 14 May 7000 14 June 3000 9 In addition, the employee had 14 days vacation and 7 days of sick leave.

July and August I worked part-time. After which he was fired, and hired in September. Received 2000 rubles in vacation pay. The business trip lasted from July 17 to July 25, that is, 9 days, but during this time there were 2 days off, during which the employee was not involved in work.

That is, there were 7 working days. The amount of days worked is counted for 10 months, since the first two were worked as a part-time employee with subsequent dismissal. If an employee were hired without dismissal, the days would be counted for 12 months.

14+15+14+14+18+10+14+14+14+9-14 (vacation)-7 (sick leave)=115 days.

Daily allowance for a business trip at the expense of the host party

Registration of a business trip at the expense of the host party To arrange a business trip at the expense of the host party, first of all, you need the following documents:

- agreement between companies;

- travel order.

The agreement of the receiving party to bear the costs associated with the arrival of an employee of another company is stated in the agreement between the enterprises. The corresponding clause may look like this - the customer company under this agreement compensates the executing company for the following costs:

- Travel costs for representatives of the contractor to and from the place of performance.

From this article you will learn:

- how a business trip is processed at the expense of the receiving party;

- what documents will be needed to register a business trip at the expense of the receiving party;

- Is it necessary to pay daily allowance to an employee if the business trip is paid for by the host party.

A business trip at the expense of the host party assumes that all expenses associated with the transfer and accommodation of the seconded employee are borne by the company to which he is sent to perform an official assignment.

In this case, the specialist’s direct employer enters into a corresponding agreement with another company, which spells out all the nuances associated with financing the trip - this document is subsequently used by the enterprise’s accounting department when accounting for expenses.

How to arrange a business trip? To arrange a business trip at the expense of the host party, it is necessary to draw up two basic documents - an order to send an employee on a business trip and the aforementioned collective agreement. At the same time, the employee retains certain obligations:

- During the entire period of his stay, he retains his workplace;

- Daily expenses are reimbursed for each day of travel on a business trip. This also includes those amounts that were spent only with the permission of the manager: obtaining a passport for a foreign country, telephone communications, purchasing a visa, and the like.

The contract must provide the most accurate information possible. It describes basic travel expenses and specifies which business should reimburse them.

Business trip at the expense of the host party

Earnings for the year are also calculated without the first two months: 7000 + 6500 + 3000 + 7500 + 8000 + 4000 + 5000 + 6000 + 7000 + 3000-2000 (vacation pay) = 57,000 rubles. Amount of travel allowances: 57,000 (earnings for 10 months)/115 (days worked for 10 months)*7 (duration of business trip) = 3,470 rubles.

In the case where daily payments are significantly less than the average monthly earnings, you can make an additional payment provided for by a collective or labor agreement or a regulatory act of the enterprise. The daily allowance for a business trip in Russia should not exceed 500 rubles, and abroad – 2,500 rubles.

Important

Housing and transportation on a business trip Housing expenses are reimbursed in the amount of no more than 550 rubles per day if the employee provides documents confirming payment for housing. If there are no documents, they pay 12 rubles per day.

Business trip at the expense of the host party

The contract must be drawn up by two companies at the expense of the other party, after which all expenses for the employee’s business trip are transferred to the receiving company. Payment of daily allowances during a business trip As mentioned above, the receiving party has nothing to do with daily allowances.

- Analyze the number of days worked in one year.

Source: https://vipkonsalt.ru/obrazets-dogovora-na-komandirovku-mezhdu-otpravlyayushhej-i-prinimayushhej-storonoj/

Answers to common questions about how a business trip is arranged at the expense of the host party

Question No. 1: How to reflect in the accounting report the absence of an employee who was sent on a business trip?

Answer: The HR department employee must mark the days he is on a business trip as working days with the mark “K”.

Question No. 2: How to compensate for the expenses of an employee who was sent on a business trip abroad at the expense of the receiving party?

Answer: All employee expenses must be reimbursed in foreign currency, the same applies to advance payments.

Rate the quality of the article. Your opinion is important to us:

The concept of host and inviting party (new mandatory document for foreign workers)

Before finding out what the adoption of bill No. 150363-7 will mean for Russian companies and foreign workers, you should understand two concepts:

- The receiving party

is a legal entity or individual (a citizen of Russia or a foreigner residing in the Russian Federation on a permanent basis - with a residence permit), with whom a foreign citizen who has arrived from abroad actually resides. - Inviting party

- a legal or natural person, government bodies, international organizations and other authorized persons who have the legal right to apply for an invitation to visa foreigners to the Russian Federation (visa-free foreign nationals do not have an inviting party).

The inviting and receiving party of a foreigner may be the same person. But these concepts should not be confused.