When going on a business trip, an employee incurs expenses in the interests of the employer, therefore, these expenses are subject to compensation. In addition to travel, housing, negotiation costs, and other business expenses, daily allowances are also reimbursed. Per diem refers to additional costs associated with an employee’s accommodation outside his usual conditions. We will discuss below how to correctly calculate and issue daily allowances, how to confirm them for inclusion in the expense report, and what role daily allowance limits play in these calculations.

Question: For the upcoming business trip of employees, the organization plans to purchase tour packages to the city of residence. The tour package includes hotel accommodation on a full board basis and air tickets. Is it possible to take into account daily allowance in the amount of 700 rubles for the purposes of calculating income tax? for each day of a business trip and the cost of purchasing a tour package? View answer

Business trip and daily allowance standards

The term “daily allowance” is given in Art. 168 of the Labor Code of the Russian Federation, which establishes legal standards for reimbursement of travel allowances to employees. Daily allowances are mentioned in Art. 217 of the Tax Code of the Russian Federation, clause 3, as one of the compensation payments not subject to personal income tax.

Question: The Inspectorate demanded that an updated calculation of insurance premiums be submitted, including the daily allowance paid to posted workers. What is the liability if this requirement is not met? View answer

Limits have been established for tax purposes: expenses within the country - 700 rubles. per day, and for foreign business trips – 2500 rubles. per day. The lower limit of daily allowance is stated in government decree No. 729 dated 02/10/2002 and is 100 rubles. per day in Russia. The document concerns employees of state budgetary institutions, however, commercial structures should also be guided by this lower limit in payments - a deterioration in the position of an employee of a private company, compared to a government agency, may provoke an inspection by Rostrud or a lawsuit against a commercial company.

Question: How to reflect in the accounting records of an organization that uses the simplified tax system (the object of taxation “income reduced by the amount of expenses”), the payment of daily allowance (including excess) if the employee is sent on a business trip in the territory of the Russian Federation? Do I need to withhold personal income tax and charge insurance premiums from daily allowances? The business trip is related to the management of the organization. According to the collective agreement, the daily allowance paid in connection with a business trip within the territory of the Russian Federation is 900 rubles. in a day. To pay the daily allowance, the employee was given a cash advance from the organization’s cash desk in the amount of 2,700 rubles. Upon returning from a business trip, the employee submits an advance report, which is approved by the manager. According to the advance report, the amount of daily allowance for three days of a business trip corresponds to the advance payment issued. Other travel expenses, as well as the procedure for conducting and documenting cash transactions are not considered in the consultation. View answer

For employees of government agencies going abroad, daily allowances are calculated according to the norms of Resolution No. 812 of December 26, 2005 and are calculated in foreign currency.

Important! The basic general principles and requirements for calculating daily allowances are set out in government document No. 749 dated 13/10/2008.

The company must develop and adopt a local RA for business trips or take into account all the nuances of the procedure and amount of reimbursement of daily expenses to an employee in the collective agreement. A state institution or municipal institution must be guided by the regulations of the authorities at the appropriate level.

Question: For work performed on a rotational basis, instead of daily allowance, a shift bonus is paid for each day on shift. If an employee is absent, is he accrued a shift bonus for that day? View answer

In the LNA, the daily allowance can be specified in any amount, but if it exceeds the maximum norms, the difference is subject to personal income tax. In excess of the established limits, daily allowances and insurance contributions are subject to (Article 422-2 of the Tax Code of the Russian Federation). Contributions “for injuries” are considered in connection with daily allowances according to the rules of Federal Law-125 of July 24, 1998, Art. 20.2-2. Contributions are not subject to all amounts provided for by the employer's LNA.

In practice, when establishing daily allowance standards, employers often take as a basis the maximum limits specified in the Tax Code of the Russian Federation regarding personal income tax in order to minimize the difference between accounting and tax accounting, the number of accounting errors and problems with the tax authorities.

The employer may not take one-day business trips around Russia into account when calculating daily allowance. At the same time, it is quite possible to register something like this in the LNA and compensate the employee for even one day.

Note that the issue of withholding personal income tax from the amount of such a one-day payment is controversial:

- The Ministry of Finance believes that it is illegal to tax income, for example, food expenses in the range of 700 and 2500 rubles, respectively (Letter of the Ministry of Finance of Russia No. 03-04-07/6189 dated 01/03/13).

- The Supreme Arbitration Court of the Russian Federation believes that daily allowances are not the employee’s income and should be compensated to him without personal income tax (Resolution of the Presidium of the Supreme Arbitration Court No. 4357/12 of 09/11/12).

- Federal Tax Service of the Russian Federation, guided by Art. 122, 123 of the Tax Code of the Russian Federation, may charge the employee, in addition to tax, a fine and penalties for the “extra” paid day.

The choice of what to do is left to the taxpayer.

If an employee goes abroad, he must be compensated for a one-day trip in the amount of 50% of the daily payment amount established by the company (Post. 749, clause 20). When calculating income tax or “simplified” tax, daily allowance expenses are taken to reduce the base in full (Article 264-1-12, 346.16-1-13 of the Tax Code of the Russian Federation). If the LNA establishes the calculation of daily allowances for foreign business trips in foreign currency, when calculating the tax base, a recalculation is made at the rate on the date of recognition of the expense (Article 272-10 of the Tax Code of the Russian Federation), i.e. approval of the advance report (clause 7, paragraph 5 of the same article).

When leaving on a business trip, the employee’s daily allowance is advanced: it is calculated in advance and issued. The planned number of business trip days is taken by the accountant from the organization’s order. Upon return, the daily allowance is recalculated depending on the actual duration of the business trip and either additional payment is made to the employee, or they are put on mutual settlements with the subsequent deduction of the overpaid amount.

Days are counted according to the calendar, from the day of departure until arrival at the place of permanent work, including weekends and holidays. The day is taken up to 0 o'clock, i.e. from zero hours it is considered that a new business trip day has begun. For each day, a full payment is issued, without proportional calculations by hour.

If a citizen returns from a business trip on the same day and is simultaneously sent on another business trip, he must receive the daily allowance twice. If an employee travels abroad, he is paid a “Russian” daily allowance until the day he crosses the border with Russia, after which the “foreign” standards established by the company are applied, and upon return they do the same. The moment of crossing can be tracked in the international passport or, if we are talking about the CIS, where crossing the border does not require such marks, using travel documents.

Local NAs may specify different daily allowances for different countries visited by the business traveler. If a business trip involves traveling to several foreign countries, the daily allowance is calculated based on the end of the day and the country visited.

Attention! An employee who, according to the terms of the employment contract, constantly performs his duties on the road or has a traveling nature of work, is not recognized as a business traveler and is not paid daily allowances.

What exactly is the difference?

Let's start with the fact that compensation for food expenses is the actual reimbursement by the employer of the money that was spent by the employee on the purchase of one or another food industry product for personal needs. From the point of view of labor legislation, the employer will be obliged to reimburse funds in this regard only if a corresponding agreement was previously concluded between him and the employee, and in writing. They could have agreed verbally, but we will not consider this case now. Daily allowances are payments separate from wages, which in theory should compensate the employee for all the inconveniences associated with his actual residence during a business trip in another city or country. The company is obliged, in accordance with the requirements of the Labor Code of the Russian Federation, to provide the employee with the opportunity to rent housing or book a hotel room, as well as provide those funds (daily allowance) that the employee can spend on personal needs if necessary. As we can see, the legislation does not say anything specifically about nutrition. Consequently, we conclude that the management does not have an obligation as such to “buy food” for the employee, because he is already paid the nth amount of money to cover similar costs, which cannot be said about rental housing, which is a separate expense item. In our example, the director decided to “cheat” by not paying daily allowances, but by compensating for food expenses. A priori, in this case, the company's management spends less money. For this, by the way, a posted worker can sue his employer. So, directors, keep this in mind, because the stingy pays twice.

Examples of daily allowance calculation

Across Russia

Manager Martynova went on a business trip on July 1 at 10:00 a.m. and returned on July 15 at 7:15 p.m. The company she represents has set the daily allowance at 1,000 rubles per day.

Calculation:

- Martynova was on a business trip for 15 days.

- 15 * 1000 = 15,000 rub. Daily allowance accrued.

- 700 * 15 = 10,500 rub. Amount not subject to personal income tax.

- 15000 - 10500 = 4500 rub. Amount subject to personal income tax.

- 4500 * 13% = 585 rub. Calculation of personal income tax.

- 4500 - 585 = 3915 rub. Taxable amount minus tax.

- 3915 + 10500 = 14415 rub. Daily allowances to be issued to Martynova before the trip.

Abroad

The conditions are the same as in the previous example, but Martynova is sent abroad. The daily allowance for all trips abroad is fixed - 4,000 rubles per day. Let Martynova have already been given an advance payment earlier, but now it is necessary to calculate the actual amount. Martynova crossed the border on June 2, fulfilled an official assignment and returned to Russia on July 14, judging by the marks in the document when crossing the border.

Calculation:

- 1000 * 2 = 2000 rub. 700 * 2 = 1400 rub. 2000 - 1400 = 600 rubles. Calculation of daily allowance and taxable amount in Russia.

- 4000 * (15 - 2) = 52,000 rub. 2500 * 13 = 32500 rub. 52000 - 32500 = 19500 rub. Calculation of daily allowance and taxable amount for the foreign part of a business trip.

- 600 + 19500 = 20100 rub. 20100 * 13%= 2613 rub. Calculation of personal income tax on taxable amounts.

- (2000 + 52000) – 2613 = 51387 rub. Daily allowance for issue.

From the taxable amounts it is necessary to calculate and transfer the same contributions, except for the amounts “for injuries”.

What else can an employee count on?

Compensation for food costs is not the only thing an employee going on a business trip can ask for. Among the most popular needs are payment for mobile communications, compensation for Internet costs, purchase of additional warm clothing if we are talking about a trip to the Far North, additional money in case the booked hotel room has a number of inconveniences and he will have to rent other housing on his own . In other words, the requirements may be completely different. It is important for the employer to understand that he can refuse many of them, being right. In particular, additional expenses for mobile communications are the employee’s whim, the Internet is also a whim, additional clothing is a whim, etc. At the same time, the employer must provide the employee with exactly the kind of housing that will allow the employee to stay comfortably at the place of business trip, and also pay exactly the amount of daily allowance that is regulated by current legislation. In any case, no one can forbid the director from buying his dear subordinate a hat with earflaps made of arctic fox, so that he does not freeze while working in the Arctic Circle. The main thing is that all expenses are, if possible, agreed upon in advance. This will help solve the main problem of all business trips – who owes what to whom.

Documentation and accounting

Within three days after returning, the employee is required to report on travel expenses, including daily allowance, and draw up an advance report, on the basis of which the previously issued advance will be recalculated.

For daily allowances, these are mainly travel documents and border crossing marks. If an employee used a personal car for the trip, he can present a waybill and any other document proving the official nature of his absence from work.

Based on these documents, a note-calculation for daily allowance is drawn up, which indicates:

- Full name of the employee, his personnel number;

- details of the order for sending on a business trip;

- business trip period;

- legal norm of daily allowance;

- actual issuance of daily allowance per day.

The main element of this note is the calculation of the issue: according to the norm, in fact, and the calculation of the excess amount issued, taking into account the days of the business trip. Exceeding the standard is considered if the organization has adopted increased norms for issuing daily allowances compared to the maximum established ones.

Attention! The calculated daily allowance is entered into the advance report as a separate line.

The employee is "out of order"

Since we have already touched upon the topic of replacing daily allowances to compensate for the daily expenses of a posted employee, it would not be out of place to talk about what a director should do in a situation where an employee, for example, gets sick and therefore cannot perform his job duties. It is logical to assume that the daily allowance is paid to him when he is actually “in service” and does the work that is assigned to him. We want to make a reservation right away - this is a misconception. From the point of view of the Labor Code of the Russian Federation, daily allowances should be paid to an employee exactly in the amount of how many days the employee worked while outside the city of his permanent residence. Even if he fell ill on the first day of his arrival in another city or country and spent the entire period of the business trip “lying in bed,” the management is obliged to accrue him a daily allowance. Here again, the company's management may be tempted to negate the need for expenses from which they will have no return. It is worth noting that a similar approach to solving this issue is a punishable act that can result in a large fine.

Briefly

- Daily allowances for seconded employees are calculated taking into account the maximum standards established by the Tax Code of the Russian Federation, 700 and 2500 rubles per day, respectively, for domestic and foreign trips.

- Any daily allowance can be registered in the LNA of a commercial company, but excess amounts are subject to personal income tax and contributions, except for contributions “for injuries.”

- According to income tax and under the non-profit system “income minus expenses”, daily allowances are taken completely into the tax base.

- A person sent on business for one day, without going abroad, may not receive daily allowance, unless otherwise stated in the LNA. Whether such a payment should be subject to personal income tax is a controversial issue - the tax service answers it positively, while the judicial authorities consider taxation illegal. The standard for daily one-day trips abroad is set at 50%, these amounts must be paid.

- The employee’s daily allowance must be advanced before the trip, and after providing him with an advance report and supporting documents, it must be recalculated to actual values.

- Settlements with the employee are adjusted towards additional payment or return of the excess funds issued. Expenses are recognized on the day the advance report is approved.

- Daily allowances for employees of the budgetary and municipal spheres are issued taking into account regulatory documents and acts of the relevant government structures.

conclusions

Based on the above, we inform you that “replacing” daily allowance payments with compensation for food expenses is an illegal act, which will inevitably be followed by a fine. Further, all compensatory payments must be reflected in tax and accounting records, which obliges the company's management to tax these amounts. Moreover, the employer has the right not to compensate for the food costs of his subordinates, because these expenses are not included in the number of mandatory payments, while he retains the opportunity to help his employee financially.

Thank you very much for your attention and see you again!

Simplified

The tax base of simplified organizations that pay a single tax on income will not be reduced by the daily allowance. When calculating the single tax, such organizations do not take into account any expenses at all (Clause 1, Article 346.18 of the Tax Code of the Russian Federation).

Organizations on a “simplified” basis with the object “income minus expenses” can take into account daily allowances as part of expenses that reduce the tax base (subclause 13, clause 1, article 346.16 of the Tax Code of the Russian Federation). Include them in expenses in the amount (both fixed and actual expenses) provided for by the collective agreement or local regulations of the organization: orders, regulations on wages, regulations on business trips, etc.

Personal income tax

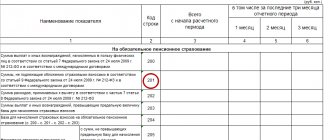

When calculating personal income tax, the amount of daily allowance is standardized. Thus, daily allowances are not subject to this tax within the following limits:

- 700 rubles per day of being on a business trip in Russia;

- 2500 rubles per day of being on a business trip abroad.

Withhold personal income tax from daily allowances paid in excess of the established norms (700 rubles and (or) 2500 rubles).

This procedure follows from paragraph 10 of paragraph 3 of Article 217 and Article 210 of the Tax Code of the Russian Federation.

Let’s say an organization paid an employee excess daily allowance. Then the employee has income for personal income tax purposes.

Income is recognized on the last day of the month in which the advance report is approved, after the employee returns from a business trip. Withhold personal income tax on the next payment of income to an employee - for example, salary. Transfer personal income tax no later than the first working day after payment of income to the employee (subsection 3, clause 1, article 223, clauses 4 and 6, article 226 of the Tax Code of the Russian Federation).

Let's talk separately about business trips abroad. There are two options.

Option No. 1 Daily allowances are issued in foreign currency

To determine whether the daily allowance is in excess or not, recalculate the amount paid into rubles at the Bank of Russia exchange rate. Do this on the last day of the month when the advance report is approved (clause 5 of Article 210, subclause 6 of clause 1 of Article 223 of the Tax Code of the Russian Federation).

If you have income, withhold personal income tax (letter of the Ministry of Finance of Russia dated January 21, 2016 No. 03-04-06/2002).

Option No. 2 Daily allowances are issued in rubles

To determine whether the daily allowance is excessive or not, the exchange rate at the end of the month is not important. Use the amount actually received by the employee.

If there is income, recognize it on the last day of the month when the advance report is approved. And when you next pay money to an employee, withhold personal income tax (letter of the Ministry of Finance of Russia dated 02/09/2016 No. 03-04-06/6531).

note

The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, the amount of daily allowance paid does not affect the calculation of the tax base.