How to issue a deed of gift for a child or incapacitated person?

- First, a gift agreement is signed by both parties.

- Then it is registered with the Federal Registration Service.

- You can have the document certified by a notary; this, of course, is not necessary, but it is advisable. This is a useful service; if documents are lost, you can always count on a copy.

Provide the necessary documents:

- consent of all family members, and necessarily notarized, if, of course, this property is jointly acquired;

- a document proving your ownership of it;

- certificate about the number of registered people in the apartment;

- appraisal paper from the BTI;

- for a minor, as well as an incapacitated citizen, the written consent of a guardian will be required;

- if the apartment has several owners, their consent will also be required;

- passports of 2 parties;

- a gift agreement, which must be signed by both parties;

- cadastral passport received from the BTI;

- the authorized representative will need a completed agreement in accordance with all the rules;

The Federal Reserve System often requires additional documents; these will also need to be provided in full. You will also need to pay a fixed state fee. duty. The size and details will be communicated and issued immediately on the spot.

The registrar will take all the documents you have prepared, of course, except for passports. In return, you will be given a receipt in the prescribed form. They will definitely set a time when you need to come up with a completed contract.

Registration process

Includes 2 design options, optional:

- independent;

- through a notary.

In option 1, you will have to fill out the document yourself with the following information:

- information about the subject of the donation;

- data of 2 parties;

- name of the required object;

- document on legal ownership;

- signatures;

- exact parameters and data of the object.

Documents are prepared at the Registration Chamber. When the registrar receives them, you will need to draw up a statement signed on both sides.

Then the registrar will take all the documents and issue in return (within 10 calendar days):

- copies of the finished contract;

- certificate of your right to property.

If you want to save your time and use (prudently) the services of a notary, then just prepare the necessary documents for him and pay him, although the services are not cheap. He will quickly and sensibly draw up an agreement, and you just sign it. And after some time, the recipient will receive a completed certificate.

According to our legislation, the registration procedure is required to be carried out by the Federal Registration Service.

To carry out this procedure we will need:

- a document with the true assessed value of the property;

- a certificate indicating the number of registered people in the apartment;

- 2 passports: donee, donor;

- cadastral passport (take from BTI);

- documents about your existing property rights;

- technical passport of housing;

- agreement on drawing up a deed of gift;

- gift agreement;

- extract from the house register, etc.

This is the main package of documents, but it may change and be added a little. Much depends on the design conditions. When the deed of gift is ready, you immediately need to re-register the apartment in your name. It is better to clarify the list of documents in the Registration Chamber (reference window) or the MFC.

We invite you to familiarize yourself with: The amount of payments for guardianship of an elderly person

It looks like this:

- Subject of the agreement - the name is indicated (for example, a three-room apartment). The technical data of the object is also entered here.

- Parties to the agreement enter the details of both passports and place of registration. If the donee is a minor, instead of passport data, entries from the birth certificate are made.

- No encumbrances - your apartment must be free from unfounded and justified property claims of other persons; written evidence of this is needed.

- Registration - when there are registered people in the apartment, it is necessary to indicate the deadline for their eviction and check-out.

- Title document - you need to start with the words “This living space now belongs to (full name) based on the data...”

Below are the exact details of the documents:

- original certificate of inheritance;

- agreement for joint participation in shared construction;

- a document indicating the right to your property.

Responsibility and rights of both parties - write the phrase: “Rights and responsibilities are not at all provided for in this agreement, but are established in accordance with the current legislation of the Russian Federation.”

But often this paragraph also includes:

- termination of this agreement - note under what circumstances and how this transaction can be canceled;

- signatures of 2 parties - legal representatives, signed in person when submitting documents.

The gift agreement is considered legal and valid only after state registration. When a transaction is formalized by a notary, this agreement is immediately drawn up and signed.

Then it must be certified and registered at will:

- MFC;

- Registration Chamber.

There are situations where notarization is not required, since the agreement is submitted for registration immediately, in the case of:

- the apartment has one owner;

- joint property of both spouses.

Only the closest relatives should be exempt from paying taxes: fathers, mothers, children, grandchildren, grandmothers, grandfathers, etc. When donating to all other relatives, other persons will have to pay 13% of the total cost.

Costs will depend on the option chosen:

- If the documents were certified by a notary, then you will need to pay: services from about 8 thousand rubles. % of the transaction and up to 10–13 thousand rubles. for carrying out technical work.

- Self-registration will cost 3 thousand rubles.

A competent lawyer can draw up an agreement in less than an hour, but this, of course, is provided that he has all the documents he needs. The transaction then goes through the required registration.

The timing will depend on the workload of employees, the choice of registration service, etc. But on average it will not exceed 10–15 days. If you do this yourself, then with the collection of all the necessary data it will take about a month.

The law protects the rights of children - this is stated in Articles 26, 28 of the Civil Code of the Russian Federation. As well as incapacitated citizens - this is Article 29 of the Civil Code of the Russian Federation.

The following may accept property from them:

- one of their parents;

- guardian.

But giving someone else’s property, even on their behalf, is strictly prohibited at the legislative level. Minors can also enter into an agreement, but only after 14 years of age. But this only requires the unanimous consent of legal representatives.

We invite you to read: Who has the right to privatize an apartment: participation of minors, is it possible to participate a second time

The law protects the rights of children - Article 37 of the Civil Code of the Russian Federation. Incapacitated citizens can take part in a transaction, but only with the written consent of their guardians (Article 29 of the Civil Code of the Russian Federation).

Deadline for donation

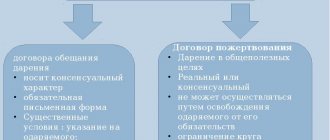

In addition to the mandatory (essential) terms of the contract, there are additional conditions . They may not be included in the document without affecting the recognition of its legality.

The timing of the transfer of the gift is subject to additional conditions. If it is specified in the contract, then the donation must be made within this time. In other cases, a date is determined when the gift must be transferred.

An agreement in which the period for transferring the gift is not specified is considered real . This means that the donation must be made immediately after the document is signed. An agreement made orally is also considered real, since the promise of a gift in the future is unacceptable.

Is it possible to limit the validity period of a deed of gift?

A donation is a gratuitous transaction, as a result of which the rights to real estate or another object are transferred from one owner to another. There are two parties involved in the transaction:

- donor – owner of property;

- donee – the one who receives the gift.

The rules for drawing up and the relationship between the donor and the donee are regulated by the Civil Code of the Russian Federation. The agreement is drawn up in writing and, if necessary, certified by a notary. The mere presence of a deed of gift does not make the donee the owner of an apartment and other objects; the ownership transferred to him under the agreement must be registered with Rosreestr.

How long is the validity period of the deed of gift? If the new owner has taken ownership, the agreement has an unlimited duration. Unlike a lease, property is not given for temporary use; the object can only be taken back by a court decision if the new owner forced the previous owner to sign a deed of gift, threatening his life and health.

However, it is possible to delay the transfer of the gift. To do this, a promise of gift agreement is drawn up, which indicates a specific date upon which the property will be transferred to the new owner, or the following conditions:

- suspensive - the gift is transferred only when a certain condition occurs;

- cancelable - the gift is transferred unless an event occurs that cancels the transaction.

Conditions suspensive and dispensable must be probable. In other words, it may come, or it may not. For example, an apartment is given to newlyweds when they have a child, or given to a student if he graduates from university without C grades. In this case, the birth of a child will be a suspensive condition, and a C in the diploma will be a dispensable one.

Sometimes the promise of a gift agreement does not indicate specific terms. In this case, the donee has the right to demand the transfer of property at any time, and the donor is obliged to fulfill the requirement within seven days.

Is it possible to conclude a gift agreement for the future?

Civil legislation provides for the possibility of drawing up a deed of gift in which the gift will be made in the future. In the text of the deed of gift, the donor undertakes to transfer free of charge specific property (value, right, exemption from property obligations) to a specific person.

A promised deed of gift is a consensual contract. It must be drawn up in writing; oral form is considered void. The text of an agreement with a promise to donate property to another person must necessarily contain a date before which the property must be transferred to the donee.

Alternatively, the parties can specify a condition precedent, the occurrence of which leads to the execution of the contract. Clause 1 of Art.

157 “Transactions made under a condition” of the Civil Code of the Russian Federation provides that a transaction, which also includes a donation, can be made under a suspensive condition. In this case, the contract must be executed when the condition specified in the text of the agreement is met.

By default, if the donor dies before the contract is executed, the obligation to donate the property is transferred to his heirs. If the donee dies before the transfer of the gift, then his heirs do not inherit such a right, unless otherwise provided by the provisions of the contract.

How to specify the effective date of a gift

There is no need to indicate the effective date of the agreement, since the agreement comes into force from the moment it is signed and begins to operate.

If the parties have chosen a specific date as a condition for the execution of the gift agreement, it is simply given in the text. For example, the donor indicates that before 01/01/2023 he undertakes to donate to a specific person (passport details of the individual) specific property, which must be accurately described.

If there are title documents for the property, then they must also be indicated in the text of the agreement. The exact deadline for the execution of the contract is determined only by the wishes of the parties.

If the parties have specified the occurrence of any event as a condition for the transfer of property, it must be specifically described in the text of the agreement. For example, the donor may indicate that he will transfer specific property to the recipient when he marries.

Additionally, the donor can specify a date before which the condition must be met. For example, in the text you can indicate that property is transferred as a gift if the donee marries before 01/01/2023.

As a suspensive condition, you can specify the birth of children of the donee, graduation from a university, obtaining a driver’s license, etc.

Expert opinion

Romanov Igor Severinovich

Lawyer with 7 years of experience. Specialization: civil law. Extensive experience in developing legal documentation.

A suspensive condition cannot be mandatory, nor can it be immoral or illegal. The suspensive condition must be a legal fact, that is, it can be actually confirmed.

Also, it cannot be fantastic or unrealizable. For example, it is impossible to indicate that property will be donated if an elixir of eternal youth is invented, etc.

d.

The inevitability of the occurrence of a condition is also inappropriate. Indicating that the condition for the execution of the contract is the coming of the next week is legally meaningless. In such cases, it is more correct to simply indicate the date of execution of the contract.

The parties can also indicate in the agreement a condition according to which the gift can be canceled if the fulfillment of the agreement leads to a significant drop in the donor’s standard of living. For example, the birth of children to the donor while executing the contract can significantly worsen his financial situation.

In this case, the parties can specify the condition that the gift will be canceled if the donor has a child.

ConsultantPlus has many ready-made solutions, including how to draw up a donation agreement for funds between individuals. If you don't have access to the system yet, sign up for a free trial online. You can also get the current K+ price list.

In what cases does the deed of gift cease to be valid?

There are several cases when a gift agreement is canceled and is no longer valid. In some situations, court intervention is required, for example:

- recognition of a document as invalid due to legal errors, for example, failure to respect the rights of third parties or minors;

- commission of a crime by the donee against the donor or his relatives, as well as his use of threats and blackmail to complete the transaction;

- careless handling of property that is of great value to the previous owner;

- recognition of the transaction as void due to its registration after the death of the donor.

In the case of a contract of promise of gift, the owner of the property can abandon his intentions. Life circumstances change, and giving an apartment as a gift can cause significant harm to the owner’s well-being. In this case, he has the right to write a refusal of the transaction.

Until March 1, 2013, the apartment donation agreement was subject to state registration. A deed of gift drawn up after this date is not registered. The right of ownership of property received as a gift is subject to state registration in Rosreestr.

We suggest you read: How to evict an unregistered person who is not the owner from an apartment?

Features of the gift agreement

A gift agreement is a document according to which one citizen voluntarily transfers his property or part or share to another. The agreement is bilateral, that is, it is signed by both parties - the donor and the donee.

The document has several distinctive features that are important to consider before signing it:

- Property is transferred as a gift, therefore neither the donee nor the donor can demand material compensation from each other.

- If the transaction is executed correctly (legally), it will be impossible to refute it in court.

- By signing the agreement, the donee indicates his consent to accept the donor’s property as a gift. This is an important condition of the deal. No one can force a citizen to accept a gift of property or part of it belonging to another person.

- Unlike a will, when a citizen enters into an inheritance six months after the death of the owner, under a gift agreement the donee becomes the owner of the property after the conclusion of the agreement. The contract comes into force and the donee immediately becomes its legal owner.

- When dividing property during a divorce, the donated apartment or part thereof remains the property of the spouse to whom it was given as a gift.

- When registering a deed of gift for a close relative, the 13% tax is not charged.

Who cannot be the recipient?

Article 575 of the Civil Code of the Russian Federation imposes a number of prohibitions on such a transaction. The recipient cannot be:

- people working: hospitals, schools, nursing homes, etc.;

- when the donor is a pupil of a children's or medical institution;

- persons under 14 years of age and their representatives;

- incapacitated citizens and their legal representatives;

- some categories of employees holding high state and even municipal positions, Bank employees;

- commercial organizations.

Features of donating a share in an apartment

Starting from 2021, in June, the conditions for donating a share have completely changed. There are situations when registration is possible only with a notary.

But sometimes it is possible to act independently when:

- The apartment has several owners;

- The common share is the property of one spouse or both spouses - which means they acquired it during marriage.

- A certain share is given to only one of the spouses - this is when they jointly buy an apartment and register it as joint ownership. Then, instead of donating, it is best to draw up an agreement, or even a marriage contract. One of the spouses must give the other half his share with the right of complete disposal.

Donating a share, of course, can be done independently in the following cases:

- the apartment has one owner;

- property acquired during marriage.

Deadline for registering the transfer of ownership by way of gift

Real estate donated to an individual or legal entity is subject to state registration . The donee needs to obtain a certificate of ownership of it - only after that he will be able to fully dispose of the property. Movable property subject to state registration must also be registered within the period specified for this type of property.

Registration of the transfer of ownership is carried out by the Federal Registration Service of Cadastre and Cartography. Documents are prepared within 10 working days from the date of their submission . You can submit a package of documents through the local branch of Rosreestr or a multifunctional center. a state fee must be paid in the amount specified in Art. 333.33 of the Tax Code of the Russian Federation (TC RF).

In accordance with Art. 2 of the Federal Law of July 21, 1997 N 122-FZ “On state registration of rights to real estate and transactions with it”, the date of state registration will be considered the date of making the corresponding entry in the state register.

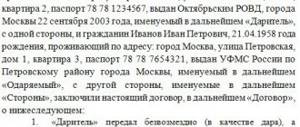

Example

In 2014, citizen Fedorov gave an apartment to his second cousin, citizen Ivanov. The gift agreement was drawn up in writing and signed by the parties to the transaction. A standard form was taken as the basis for drawing up the document, since notarization of the gift agreement is not necessary in this case. The agreement contained the data of the parties, a description of the gift (apartment) and the period during which it should be transferred. After receiving the apartment, Ivanov paid the state fee, the amount of which at that time was one thousand rubles, and submitted documents to register the transfer of ownership. After 10 working days, citizen Ivanov received a certificate of ownership, giving him the right to dispose of the received property.