Author of the article: Anastasia Ivanova Last modified: January 2021 22682

Refusal of donation and cancellation of donation are not so common in legal practice, but still specialists have to deal with a similar procedure. A deed of gift is a gratuitous transaction that cannot be terminated unilaterally. For this document, inheritance law provides for a number of special rules. It is possible to return the donated property before its actual transfer to the donee takes place. However, to do this, the transaction must be consensual in nature.

Expert commentary

Shadrin Alexey

Lawyer

If an oral agreement has occurred between the donor and the donee, then the rights to transfer property in the future do not arise, and the object of the donation simply passes from the donor to the donee, as a result the transaction is considered completed.

A donation executed in accordance with all the rules of the Civil Code of the Russian Federation cannot be canceled, but there are certain situations in which it is possible to cancel the transaction and return the donated property, but it is not easy to do. What nuances are involved in refusing a donation and canceling a transaction, as well as what its participants will have to face, will be discussed below.

Cancellation of a gift agreement

It is possible to refuse a gift or cancel a transaction only in a number of cases provided for by law. The donor can specify the terms of termination in the contract independently, or the cancellation will be carried out in accordance with Articles No. 577-578 of the Civil Code of the Russian Federation.

You can cancel a deed of gift if:

- The donor's financial situation or well-being has changed so much that the transfer of property as a gift will cause him significant damage.

- The donee made an attempt on the life and health of the donor or his family. He caused bodily harm to the above citizens. If the donor has died, then his successors can terminate the contract.

- The recipient, after receiving a gift of property that was valuable to the donor, treated it carelessly, which led to its damage or loss. In this case, the donor can terminate the transaction through the court. However, he will need to provide evidence that the donated property is truly valuable.

- The property was donated to a legal entity that became bankrupt. In this case, the bankruptcy trustee has the right to demand termination of the contract.

Important! After the deed of gift is cancelled, the donated property must be returned to the donor unchanged.

It is also necessary to take into account that the donee does not have the right to demand compensation after cancellation of the deed of gift. The donor, upon termination of the gift agreement by the donee, may demand that the latter reimburse the expenses incurred by going to court.

Features of termination of a deed of gift for real estate, land

Cancellation of a deed of gift for a property has its own nuances that you need to be aware of. So, if there has not yet been state registration, the transaction can be canceled - it comes into force only after registration.

If registration has already been completed, and both parties agree to cancel the donation, then an agreement is drawn up, which also must undergo state registration. If one of the parties or an interested third party does not agree with the gift agreement, the decision to cancel it will be made in court.

At the same time, the grounds for challenging a deed of gift for an apartment, a house, any premises and a plot of land are the same as for other objects of donation.

Refusal of donated property

Sometimes the donee does not want to accept the property given to him as a gift.

How to terminate the deal? Based on Article No. 573 of the Civil Code of the Russian Federation, the recipient may refuse the gift until the deed of gift comes into force and the actual transfer of property occurs. However, he may have to compensate the donor for damages caused by his refusal. If the transaction was formalized, then its termination should be registered in the state register.

Expert commentary

Kolesnikova Anna

Lawyer

It should be noted that partial acceptance of property, as well as incomplete rejection of it, is impossible.

If a written gift agreement was concluded, then it should be renounced by writing a written refusal.

Consequences of failure

The recipient's refusal of the gift has a number of legal consequences . Some of them are obvious, since their occurrence is sought by the giver.

If the refusal is properly formalized, then under Part 1 of Art. 573 of the Civil Code of the Russian Federation, the gift transaction is considered terminated . Accordingly, the expected legal consequence in the form of the donee’s emergence of ownership of a thing, a property right, or his release from an obligation does not occur .

Important

According to Part 3 of Art. 573 of the Civil Code of the Russian Federation, the donor has the right to demand from the beneficiary compensation for real damage caused by refusal to accept the gift.

The donor's right to compensation is a condition for the written execution of the deed of gift. If the donee did not sign the gift agreement or otherwise did not give prior written consent to accept the gift, then his refusal cannot become the basis for compensation for damage.

Part 3 Art. 573 of the Civil Code of the Russian Federation specifies that the donor can only claim compensation for “real” damage caused to his property interests by the grantor.

According to Art. 15 of the Civil Code of the Russian Federation, real damage is the costs that the donor is forced to incur to restore his violated right or in connection with the loss or damage to property. For example, a donor may claim compensation for investments in preparing a gift for donation and its delivery.

Real damage must be distinguished from lost profits. The cumulative effect of Art. 573 and art. 15 of the Civil Code of the Russian Federation means that the donor will not be able to compensate at the expense of the legator :

- his salary or the average daily earnings of an individual entrepreneur for the time when he was not working and was bringing a gift to the donor;

- the cost of a gift that was destroyed or lost in transit;

- the profit that he could receive by using the gift in business or by renting it out.

Example

T. declared to the court that the suspension of state registration was illegal. He indicated that the territorial body of the Federal Service for State Registration, Cadastre and Cartography did not properly formalize the “agreement on termination of donation” of the apartment. He explained that an agreement was concluded between him and the donor K., which was subsequently registered, for which a certificate of state registration of rights was issued dated March 12, 2015. T. indicated that he was not aware of the legal consequences of the transaction. Later he learned that he needed to pay tax on the gift, but he did not have such opportunities. He invited K. to draw up an agreement to cancel the donation, to which he agreed. They filed an application for state registration of this agreement. A controversial notice of suspension of state registration was received from the territorial office of Rosreestr. It states that refusal of an already accepted gift is impossible. The only way out is to conclude a new deal, according to which T. alienates the apartment to its former owner K.

T. considered that the position of the registration authority violated his rights: additional obligations would arise under the new agreement.

The court considered T.'s claims to be unfounded. Referred to:

- Art. 573 of the Civil Code of the Russian Federation, according to which the recipient has the right to refuse a gift only before accepting it;

- Art. 13 Federal Law No. 122, by virtue of which, within the registration procedure, an examination of the submitted documents is carried out and the legality of the agreement is checked, as well as a check for the absence of contradictions between the declared rights and previously registered ones;

- Art. 19 Federal Law No. 122, according to which state registration is suspended by an authorized person if there are doubts regarding the legality of its grounds.

The court found that T. and K. signed an agreement to terminate the donation and submitted the relevant documentation for state registration to the Rosreestr department. The latter sent T. and K. a notice to suspend state registration for a month.

According to Art. 254 of the Code of Civil Procedure of the Russian Federation, a person can challenge a decision of an authority if he believes that his rights have been infringed. According to the explanations of paragraph 28 of the PP of the Supreme Court of the Russian Federation (Resolution of the Plenum of the Supreme Court of the Russian Federation), as well as based on the provisions of Art. 258 of the Code of Civil Procedure of the Russian Federation (Civil Procedure Code of the Russian Federation), the judge satisfies the applicant’s demands if it is proven that the decision violates the interests of the applicant and is contrary to the law. For the suspension of state registration to be declared illegal, there must be a coincidence of these two circumstances.

The court found that the registration authority acted within the framework of its powers and in accordance with Federal Law No. 122. State registration was suspended legally, since there were no grounds for registering the fact of termination of the transaction:

- the donation agreement was executed by accepting T.’s apartment as a gift;

- the parties complied with the requirements for the form and content of the deed of gift (Article 572, Article 574 of the Civil Code of the Russian Federation);

- The agreement has passed state registration and has not been challenged in court.

An agreement to terminate the deed of gift, signed by the participants after the actual acceptance of the gift by the beneficiary, cannot be the basis for registering the transfer of ownership of the real estate back to the donor. The court refused to satisfy the stated demands.

Gift deed: In what cases is it not valid?

The deed of gift will be considered illegitimate if:

- Legislative standards were not observed when concluding the contract;

- the purposes of the transaction are contrary to the law;

- the deed of gift is concluded only “for show” and does not imply the transfer of property from the donor to the donee;

- the transaction is a sham. That is, if a gift deed is concluded in exchange for another document, for example, confirming a purchase and sale. Since when receiving a gift of property from people with whom the recipient is closely related, he does not need to pay a state duty, some citizens, trying to take advantage of this advantage, enter into a gift agreement instead of the necessary sale and purchase.

- the donor is incapacitated, and accordingly he cannot fully dispose of personal property.

- the donor is in an unstable psycho-emotional state, which means he cannot be held responsible for his actions.

- the deed of gift was concluded fraudulently. For example, if the donor thought that he was not entering into a gift transaction, but a purchase and sale agreement.

- the deed of gift was concluded under fear of one’s life or as a result of mental or physical violence.

All of the above situations lead to the recognition of the gift deed as invalid. In some cases, the transaction is illegitimate in itself, but in others, its invalidity will need to be proven in court.

Lawyer's answers to frequently asked questions

Is it possible to relinquish an apartment through the court?

Yes, if the ownership has already been registered, and the donee wants to return the housing to the donor who does not agree with this.

Can the donor refuse to fulfill the contract of promise of gift?

Yes, based on Art. 577 of the Civil Code of the Russian Federation, if after drawing up the deed of gift the financial situation of the donor has changed, and the transfer of the gift will entail a significant deterioration in his standard of living.

Does the recipient need to explain the reasons for the refusal to the donor?

No, a citizen has the right to refuse a gift without giving reasons.

Can a minor recipient refuse to make a gift?

Maybe, but with the consent of the parents.

Is it possible to refuse a gift through the court upon the death of the donor? Who will be responsible?

Yes. According to Art. 581 of the Civil Code of the Russian Federation, the obligations of the donor under the contract of promise of gift are transferred to the heirs. They are the defendants.

Refusal of residential real estate: Procedure for refusal of donation

There are situations when the recipient cannot accept such an expensive gift as residential real estate. The reasons for refusal can be different: from a lack of funds to pay the state duty when donating an apartment to the inability to come and receive the rights to housing transferred by the donor. The recipient is not required to notify anyone of the reasons for refusing the gift. However, in order to terminate the transaction, the donee must abandon the residential property before the gift deed is registered. That is, the refusal must be made before the change of ownership rights to the property. Immediately after the registration procedure, the donee can dispose of the apartment legally, as he becomes its full owner.

Refusal of a gift must be made in writing. In order to cancel a gift deed, you must have the consent of both parties to the transaction. If its participants have claims against each other, they are resolved through the courts.

Expert commentary

Gorbunova Olga

Lawyer

If the deed of gift was certified by a notary office, then in order to cancel it, you should contact the same office with a request to cancel the transaction.

If the property rights were transferred from the donor to the donee, and the updated data was entered into the Rosreestr database, then the agreement can be canceled only in court in cases regulated by law.

How can an apartment donor protect himself from possible eviction?

It so happens that a will inspires much more confidence in people than a gift - although both options allow you to transfer property to a loved one free of charge.

It is clear that few are willing to part with their home during their lifetime by signing a deed of gift.

But a will would be good for everyone if it did not have one serious drawback: it does not protect against the so-called. obligatory heirs who, by law, can receive a guaranteed share in the inheritance, despite the will of the testator.

So in this regard, donation is more reliable, since real estate can be transferred to a specific person even before the inheritance opens and division begins.

But in order to get the maximum benefit from a gift, and not harm, you need to carefully consider its design. I will illustrate this with an example from court practice.

The elderly woman's only joy in life was her grandson. She had a very strained relationship with her own son (the father of her grandson) (having received a disability, he began to abuse strong drinks).

And when, due to a tragic accident, the mother passed away, the grandmother took the boy in with her, raised him and, as they say, doted on him.

Worried about her grandson, she really wanted her apartment to go only to him - and turned to a notary to draw up a will.

But he immediately warned that since his son has a disability, he can legally claim a mandatory share in the inheritance (Article 1149 of the Civil Code of the Russian Federation). Therefore, even if there is a will in favor of a grandson, there is no 100% guarantee that the apartment will completely pass to him.

The grandmother was not happy with this option, so she decided to give her apartment to her grandson during her lifetime. Then the apartment, having ceased to be her property, could no longer go to her heirs - incl. and mandatory.

No sooner said than done. The grandmother signed a gift agreement with her grandson, including, for reliability, a clause stating that she retains the right to live in the apartment for life.

The transaction was registered with Rosreestr - and the grandson became the full owner of his grandmother’s apartment.

Only a few years later, what is so feared when giving a gift happened: it turned out that the grandson was mired in debt and was forced to sell his grandmother’s apartment.

The woman failed to invalidate the purchase and sale agreement, since no violations were committed during its conclusion. The court recognized the buyer's right to the apartment - and now the grandmother was under threat of eviction.

If the new owner wants to vacate the apartment, it will not be difficult for him to evict the grandmother. According to the law, family members of the former owner lose the right to housing along with him (Part 2 of Article 292 of the Civil Code of the Russian Federation). So all he has to do is file a claim in court, and grandma will remain on the street.

The clause in the agreement that she retains the right to lifelong use of the housing, alas, does not apply to the new owner. After all, the gift agreement and all the obligations associated with it were concluded with the grandson. And the buyer of the apartment has nothing to do with this transaction - and, accordingly, should not provide housing to the grandmother.

The law does not allow the gift of housing with the condition that the recipient cannot subsequently sell it or dispose of it in any other way. But you can protect yourself from possible eviction.

Along with the gift agreement, you need to conclude another one - an agreement for the gratuitous use of housing for a long period. Under such a transaction, the obligations of the previous owner are transferred to the new owner (by virtue of direct instructions in the law - Article 700 of the Civil Code of the Russian Federation).

Then the buyer would have to provide housing for the grandmother, since the obligation of the grandson would pass to him.

The main thing is to conclude a contract for free use for a certain period (for example, 30-40 years), since the owner can cancel an open-ended contract at any time by warning the tenant a month in advance.

But terminating a contract early, which specifies a specific period of validity, is very problematic. Therefore, before giving an apartment to a loved one, think a hundred times.

Even if you are 100% confident in your decision, it would still be a good idea to sign another important agreement - for the free use of housing. At the moment, this is the maximum possible protection for the donor.

Donation of residential real estate: Invalidity of the transaction

In some cases, a gift deed may be considered illegitimate. Not every citizen can give their property, just as not every citizen can accept it. The legislation clearly states the list of persons who cannot be donors and recipients:

- Citizens under the age of eighteen or persons with psycho-emotional disabilities cannot donate real estate. Also, their guardians do not have the right to conduct the transaction on their behalf.

- Medical workers and social workers cannot accept gifts in the form of residential real estate. services and other persons of similar professions from their students, patients and their relatives.

- Officials in the civil service cannot receive real estate as a gift for the performance of their duties.

- Legal entities cannot enter into a gift agreement with each other.

Expert commentary

Kireev Maxim

Lawyer

If the above-described persons are participants in a transaction involving the donation of real estate, the transaction will be considered illegitimate and canceled.

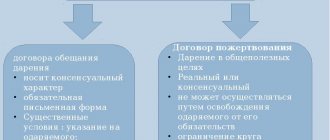

Form of gift agreement

The article of the same name is devoted to the issue under consideration - Art. 574 of the Civil Code of the Russian Federation). Gift deeds also fall under the general requirements for transactions (Articles 158-165) and contracts.

Important

A “manual” donation can occur in a non-documentary form if its subject is movable property. Restrictions on oral donation based on the value of the gift, Part 1, Art. 574 was not provided for.

The conclusion of a gift can be verbally evidenced by the transfer of a gift or title documentation for it, or the delivery of symbolic accessories (for example, keys).

According to Art. 574 donation of movable property should be documented if:

- its price exceeds 3 thousand rubles. and the donor is a legal entity;

- the gift will be transferred in the future (consensual transaction).

The donation of real estate and (vehicles) is formalized in writing . Otherwise, the donee would not be able to prove the legality of ownership of the property to the registering authority. Such deeds of gift must be a single document signed by each party.

The written form of donation of movable property (Article 434 of the Civil Code of the Russian Federation) is considered to be complied with if there are several documents jointly confirming the fact of the conclusion of the transaction. an offer coming from the donor - a proposal to conclude a deed of gift and acceptance - the response consent of the donee.

Failure to comply with the requirements of the law regarding the written form of the deed of gift leads to its nullity (Article 162 of the Civil Code of the Russian Federation).

The transfer of ownership of real estate to the donee is registered in the Unified State Register of Rights to Real Estate and Transactions with It by the territorial bodies of Rosreestr (Articles 131, 574 of the Civil Code of the Russian Federation).

Additionally

The Civil Code of the Russian Federation and Federal Law (Federal Law) No. 122 On state registration of real estate have not established a period during which the donor and donee are required to apply for registration actions. However, the legal consequences stipulated by the deed of gift for real estate occur only after state registration (Article 164 of the Civil Code of the Russian Federation).

Donation of a vehicle can be made after its deregistration. The new owner of the car must register it with him within 10 days .

What to do if proprietary rights are already registered in Rosreestr

Is it possible to mark a gift deed after registering the donee’s property rights in Rosreestr? Yes, this procedure is possible.

To terminate a transaction, you must collect a package of documents consisting of:

- refusal statement;

- deed of gift;

- a conciliation document confirming the recipient’s refusal to accept the gift;

- passports of both parties to the transaction;

- powers of attorney, if one of the parties to the agreement sent his proxy in his place;

- extracts from the Unified State Register;

- a consent document for the refusal of all persons interested in the transaction;

- receipts for payment of state duty;

- papers for donated property.

The listed documents should be submitted to Rosreestr, where specialists will carry out the procedure for registering the refusal of the gift. It is also necessary to take into account the nuances of termination of the contract. For example, it is mandatory to obtain consent from the spouse of the recipient to renounce the donated property.

Is it possible for the recipient to refuse to accept the gift?

The recipient's refusal of the gift is possible on the basis of Art.

573 Civil Code of the Russian Federation. According to it, refusal is made at any time before the transfer of the gift. When a gift agreement (hereinafter referred to as DD) is drawn up in writing, the refusal is also drawn up on paper. If the transaction is made orally, a verbal refusal is sufficient. Most often, recipients refuse gifts in several situations:

- a contract of promise of gift has been drawn up, the gift has not yet been transferred;

- consent to receive the gift was given orally, but before delivery the person decided to cancel the transaction;

- the donor transfers a gift that does not belong to him by right of ownership.

Important! A donation is considered a bilateral transaction, but the refusal is formalized or given orally unilaterally. The donor or third parties have no right to influence the recipient. It is worth considering that when drawing up a deed of gift in writing, the owner of the gift has the right to demand from the other party compensation for damage caused by the refusal (clause 3 of Article 573 of the Civil Code of the Russian Federation).

Cancellation of a gift deed: What happens after the procedure

After the transaction is cancelled, the rights to the donated property are returned to the donor, and the gift itself is also transferred to him, in the form in which he transferred it to the donee. The recipient's proprietary rights, if received, are revoked. If the donor suffered any losses as a result of the refusal of the property donated by him, he can recover actual damages from the donee in accordance with Article No. 573 of the Civil Code of the Russian Federation. The conditions for compensation of costs must be specified in the deed of gift. Only actual damage is subject to compensation; the recipient does not compensate for lost profits.

How to refuse a donated share in an apartment

Expert opinion

Kovalev Konstantin Vladimirovich

Practicing lawyer with 6 years of experience. Specializes in criminal law. Recognized legal expert.

The procedure for giving up a share in an apartment is practically no different from giving up a donated entire apartment. The donee may refuse the share before its transfer.

This means that after the transfer of the right to a donated share in an apartment is registered in Rosreestr, it is almost impossible to refuse such a gift.

The renunciation of the share is made in writing . In this case, the document must contain a clear description of the item that the donee is refusing (what is the share or its size in the apartment, its location).