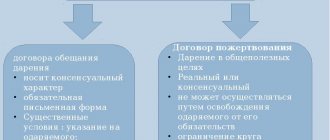

In one of the previous publications of the section, or rather, in the article on the types of deed of gift, we already listed the main features of concluding a consensual agreement, which is also called a contract of promise of gift.

Today, blog author and practicing lawyer Oleg Ustinov will talk in more detail about all the nuances of drawing up this type of agreement, as well as the most common mistakes that can lead to such a transaction being declared invalid.

Contract of promise of gift: features, characteristics

A promise of gift is a transaction in which there are two parties - the donor and the recipient. It is supported by an appropriate agreement, where the owner of the gift undertakes to transfer the property to the second party upon the occurrence of a specific date or event: wedding, receipt of a diploma, etc.

Unlike an ordinary (real) deed of gift, the contract of promise of gift (hereinafter referred to as the DOD) is consensual in nature and begins to be executed only from the date specified in it.

DOD is characterized by several conditions:

- Gratuitous. The owner who gives the value has no right to demand money or services from the donee. Donation is a completely free transaction.

- Postponement of execution. In a real contract, the date of execution coincides with the moment of transfer of the gift. In consensual execution begins with a delay.

- Voluntariness. The transaction is concluded on a voluntary basis: no one has the right to force the owner to give up the property in favor of another person.

- Possibility of refusal of execution of the DOD by the donor.

Features of DOD are regulated by Ch. 32 of the Civil Code of the Russian Federation. Let's look at all the details in detail.

Contract form

According to Art. 574 of the Civil Code of the Russian Federation, the DOD is concluded exclusively in writing. An oral promise of donation has no legal force. This rule applies to any gifts.

For example, if in a real car donation agreement it is enough to simply hand over the keys and title documents, and then make changes to the title, then with a consensual (promise) donation of a car, everything is done only in writing.

The obligatory written form is explained simply: if in a real DD the wording “I give free of charge” is used, then in a consensual one it is used “I undertake to give”. To prevent the donor from repudiating his obligations in the future, everything must be documented on paper.

Is it possible to execute a contract after the death of the donor?

A deed of gift containing a condition of donation after the death of the donor is considered void (Clause 3 of Article 572 of the Civil Code of the Russian Federation). Instead, according to the law, a will is drawn up.

But there is Art. 581 of the Civil Code of the Russian Federation, which determines legal succession under the DOD. If the donor who promised to transfer the gift dies before the date specified in the contract, his obligations to the donee pass to the heirs. They must fulfill the terms of the contract.

An exception is the content of a clause in the DOD, according to which, upon the death of the owner, it is canceled: in this case, the heirs do not bear obligations to the donee.

If the donee dies before the donor, without having received the gift, the rights to it do not pass to the legal successors. But the contract may specify other conditions.

Complete the survey and a lawyer will share a plan of action for a gift agreement in your case for free.

Legislator's position in 2021

Based on the information contained in paragraph 2 of Article 572 of the Civil Code of the Russian Federation, a consensual gift agreement is an agreement concluded between the donor and the donee, according to the content of which one party (the donor) promises to transfer a certain thing free of charge in the future into the ownership of the second party (the donee). , property rights or obligations.

It is worth noting that specifying the deadlines for the execution of such an agreement is not a prerequisite, although establishing an exact date will eliminate a lot of disputes that may arise between the parties to the agreement.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

According to paragraph 2 of Article 574 of the Civil Code of the Russian Federation, in order to conclude a consensual agreement, the agreement must be drawn up in simple written form. This need is, first of all, dictated by the possibility of protecting the rights of the donee. In addition, a written contract of promise of gift acts as evidence of the will of the donor in his intention to transfer certain property benefits in favor of the donee. If such a transaction is concluded orally, it will be declared invalid.

In addition to the mandatory written form, the legislator in 2021 established a number of other essential conditions that must be met when drawing up the agreement in question.

So, for example, in the content of the signed document, the donor and the donee (or their legal representatives) are obliged to specify the object acting as a gift, indicating that the donor wants to transfer this particular item into the ownership of the donee in the future.

It is worth noting that consensual deed of gift refers to unilaterally binding transactions, as a result of which the donor has the obligation to transfer the object established by the agreement in the future .

At the same time, we remind you that the donee party, in this case, does not have any obligations other than the following:

- The obligation to use the subject of the transaction only for its intended purpose (in accordance with paragraph 3 of Article 582 of the Civil Code of the Russian Federation) when concluding a donation agreement;

- the obligation to carefully use a gift that has great non-property value for the giving party (according to paragraph 2 of Article 578 of the Civil Code of the Russian Federation).

The parties who have decided to enter into a promise of gift agreement, in accordance with the provisions described in Article 157 of the Civil Code of the Russian Federation, can include in its content suspensive and disqualifying conditions (at their own discretion and agreement), which represent a list of various circumstances that serve as grounds for determining the moment of gift transfer.

Also, when concluding such transactions, until the terms of the agreement are fulfilled (prior to the transfer of the object of donation into the ownership of the donee), the parties have the right to refuse to participate in the transaction. The recipient party may express its refusal to accept the gift (in accordance with the provisions of Article 573 of the Civil Code of the Russian Federation), fully compensating for all losses that were caused by the refusal of the gift, and the giving party has the right to refuse to provide the object of the transaction if its transfer to the recipient may lead to a decrease in his standard of living (based on the information established in Article 577 of the Civil Code).

In addition, it is necessary to learn to distinguish between a preliminary gift agreement and a consensual one. Thus, in contrast to a preliminary transaction, a contract of promise of a gift at the time of its conclusion forms the right of the donee to demand performance of the contract from the donor. At the same time, a preliminary agreement allows you to require only the completion of a prepared donation transaction.

But first things first…

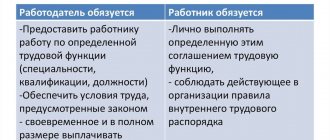

Rights and obligations of the parties under the contract of promise of donation in the future

The DOD is unilaterally binding, and the obligations arise on the donor. After a specific event or date specified in the contract, he undertakes to transfer the property in favor of the second party.

The recipient has more rights: he can refuse it at any time before the transfer of the gift. If the date has arrived, but the donor does not fulfill the terms of the ADD, the other party has the right to reclaim the property by agreeing with the owner or going to court.

Important! The DOD comes into force from the moment of signing, unless other conditions are specified. Execution is carried out from the date determined by the parties and indicated in the document.

When does the gift restriction apply and what does the donor need to do to complete the transaction correctly?

How to properly draw up a preliminary gift agreement and why is it needed?

When is it possible to refuse to fulfill a contract of promise of gift?

According to Art. 573 of the Civil Code of the Russian Federation, the recipient of a gift has the right to refuse it at any time before delivery. If the agreement is drawn up in writing, the refusal is drawn up in a similar form.

For the donor, the possibility of refusal is provided for in Art. 577 of the Civil Code of the Russian Federation for several reasons:

- after registration of the DOD, the property, financial or family situation of the owner has changed for the worse, and the execution of the donation will only worsen it;

- the recipient of the gift commits an attempt on the life and health of the donor or his close relatives;

- poor treatment by the new owner of a gift that is of non-property value to the donor, if there is a threat of irretrievable loss.

It is important to take into account that when refusing the DOD, the donee undertakes to compensate the donor for the damage caused by him. If the donor refuses to perform, the donee has no right to demand compensation for losses.

Are you tired of reading? We’ll tell you over the phone and answer your questions.

What can be given under a promise of gift agreement?

According to the DOD, you can donate any movable and immovable property:

- cars and other vehicles;

- money;

- shares in LLC;

- right to claim debt;

- shares, other securities;

- debt obligations (from the donee to the donor);

- real estate: houses, land, apartments, commercial premises, etc.;

- bank deposits.

Note! Houses are donated only with the land plots on which they are located. Alienation separately is unacceptable. If a person plans to donate a share in the authorized capital of an LLC, one must take into account the provisions of the company’s charter: in some cases, the consent of the remaining owners may be required.

Donation agreement with a suspensive condition

- the property must be privatized or registered in another way;

- in case of donation of a share, the consent of all co-owners is not required;

- in case of joint ownership, the consent of the remaining co-owners is mandatory;

- If there is a building on the land plot, then donating a separate plot or a separate house is prohibited.

Civil Code.

Unlike suspensive conditions, according to which some event must occur, after which the object will be transferred to the new owner, annulling conditions indicate that if some event occurs, the gift agreement loses its force. The fulfillment of the cancellation condition is possible before the new owner assumes his rights; they are prescribed in the agreement on the promise of donation.

The essential terms of the deed of gift are a mandatory component of every contract. In the first paragraph of Art. 432 of the Civil Code of the Russian Federation establishes the rules governing the parameters for drawing up these nuances. They contain the main stipulated requirements of the agreement that must be fulfilled. Only if they are implemented is it allowed to draw up an act of acceptance - delivery.

How to draw up a contract of promise of donation of real estate: step-by-step instructions

The procedure for registering a deed of gift consists of several stages:

- Agreeing on terms and conditions with the donee.

- Notarization of the DOD, if required by law or the parties apply to the notary at their own request.

- Drawing up and signing an agreement, if the parties do not contact a notary and do everything themselves.

- The beginning of the execution of the DOD is the date from which the donee has the right to transfer the property to himself.

- Registration of property rights and obtaining a new extract from the Unified State Register of Real Estate.

Let's consider all the stages in detail.

Step 1: agreeing on the terms of the deal

Despite the fact that the contract of promise of gift is unilaterally binding, it is necessary to obtain the consent of the donee: he can refuse the transaction at any time.

A preliminary verbal agreement is sufficient: tell what property you would like to donate, when you plan to register the ADD, etc.

Step 2: visit a notary

Notarization of the DOD of real estate is required if a share is being donated and there are several other owners. Their consent is not required - everyone has the right to dispose of the shares at their own discretion, except in cases of sale.

A notary's signature will be required if the owner is a minor or person with limited legal capacity.

Documentation

What documents are provided to the notary:

| Name | Where to get |

| Passports of the parties | Department of Internal Affairs of the Ministry of Internal Affairs |

| Extract from the Unified State Register or certificate of ownership of the donated apartment | MFC |

| Technical certificate |

Notary prices

According to Art. 333.24 of the Tax Code of the Russian Federation, when visiting a notary for mandatory certification, a fee of 0.5% of the contract amount is paid, but not less than 300 and not more than 20,000 rubles. The payment is calculated based on the cadastral value of the property.

Calculation example:

An apartment is donated, the cadastral value is 3,000,000 rubles.

3,000,000 x 0.5% = 15,000 rubles. – this is how much you need to pay the notary for the certificate.

Note! If, in addition to certification, the notary is required to draw up a deed of gift, this is paid separately. Tariffs for technical work are set by regional notary chambers.

Step 3: drawing up a contract

The parties can draw up a deed of gift independently if contacting a notary is not required.

Contents of the contract of promise of gift

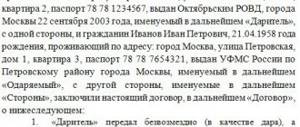

The deed of gift must contain complete information about the transaction:

- Full name, date of birth, passport details, registration addresses of the parties;

- information about real estate: address, area, floor, details of title documents;

- the date or circumstances from which the execution of the DOD begins;

- information about the spouse’s consent to the transaction (if required);

- signatures of the owner and recipient of the gift.

Sample contract of promise to donate an apartment in the future:

Consultation on document preparation

Step 4: Arrival of date or circumstances

When the date specified in the DOD arrives, the donee needs to collect documents to register ownership, agreeing on a visit to the registrar with the donor.

Step 5: Registration of ownership

To register, both parties must come to the MFC or Rosreestr to submit documents. Joint presence is required.

If one of the citizens cannot visit a government agency, you can issue a notarized power of attorney for another person who will go in his place.

Important! When contacting a notary, you can order a free service of sending documents for registration, and then you will not have to visit the MFC yourself.

Documentation

For the MFC or Rosreestr, the same documents are provided as for a notary. Additionally, you will need DOD - it is transferred to complete registration actions.

State duty

For registration of property ownership, citizens pay 2,000 rubles, organizations - 22,000 rubles.

Step 6: obtaining an extract from the Unified State Register of Real Estate

10 days after the application, the new owner needs to come to the registrar and receive an extract from the Unified State Register.

Donation agreement with suspensive condition sample

Conditions precedent imply that the concluded contract comes into force upon the occurrence of certain circumstances. No one knows for sure when they will occur. Such nuances are a kind of motivation for the recipient of the gift to carry out actions.

Donation with a suspensive condition

This article is devoted to the legal characteristics of the contract of donation. Gift is one of the oldest instruments of civil law. It requires not only an obligatory written form, but also set forth in the express intention to commit a donation in the future. Donation is one of the oldest civil law contracts. Already in Roman law 5th - 1st centuries. BC e. it was recognized as one of the grounds for the emergence of property rights, according to which “one party, the donor, provides the other party, the donee, with any valuables at the expense of his property.

- enter passport details and details of both parties;

- control the accuracy of the information provided;

- provide all the necessary information;

- secure the document with the signatures of both parties;

- notarize the document.

A person has the right to dispose of his property at his own discretion, including donating it. In order for the donation of real estate to be official, it is necessary to draw up an appropriate agreement. The donation agreement for a residential building is a mandatory document on the basis of which the property of one person is transferred into the ownership of another.

Procedure for filling out a gift agreement

To fill out such an agreement, you must first indicate the data of both parties to the agreement. In addition, it is necessary to indicate information about the property being transferred, in particular the address, residential and non-residential area, availability of a land plot and state registration number. The donor must also provide documents confirming his ownership rights to the transferred property. The parties need to decide who exactly will pay for registration services and indicate their decision in the document.

- a bilateral transaction on the gratuitous transfer of property rights to real estate. The legal owner of a residential building (donor) has the right, at his own discretion, to transfer ownership of a residential building to another person (donee) at any time. The donee can be either a relative of the donor or a person who has no family ties with the donor. In addition, several persons may act on both the donor’s and the recipient’s side.

Cancellation of a contract of promise of gift

DD can be marked on the grounds specified in Art. 578 of the Civil Code of the Russian Federation in court.

The following persons have the right to go to court:

- Givers: the recipient treats the gift poorly; committed a crime against the health or life of the former owner.

- Heirs of the donor who died due to the fault of the donee.

- Creditors of the donor, if he executed the DOD less than six months before applying to the arbitration court to begin bankruptcy proceedings related to business activities.

Important! The donee has the right to cancel the transaction before accepting the gift. There is no need to go to court. A similar rule is established for the donor if the recipient dies before him.

Additional grounds for challenge

You can also file a claim in court if there are other circumstances: the conclusion of the DOD under the influence of a misconception regarding the nature of the transaction; signing a deed of gift under the influence of blackmail, threats, violence on the part of the donee.

The above circumstances will have to be proven in court. As evidence, you can use any audio and video recordings, witness statements, photographic materials, correspondence via SMS or on social networks.

Legal advice: when faced with such a situation, file a motion to call witnesses along with the statement of claim. This may slightly shorten the processing time.

Elena Plokhuta

Lawyer, website author (Civil law, 7 years of experience)

The concept and aspects of giving in 2021

Based on the description contained in Article 572 of the Civil Code of the Russian Federation, a gift is usually called a gratuitous unconditional transaction, according to which the donor transfers certain property benefits, obligations or rights into the ownership of the donee, or promises to transfer this subject of the transaction in the future.

At the same time, in 2021, based on the principles of civil law, most subjects of civil law, who are not prohibited at the legislative level, can still act as parties to a transaction.

Thus, the role of a donor can be any legally capable person who has the right of ownership of an object or the rights acting as a gift and consent to the alienation of this object from its other owners. Regarding the donee, these persons do not have to be legally capable, and instead of incapacitated citizens, their legal representative (usually relatives or trustees) can participate in the transaction on their behalf.

Lawyer's Note

Based on the information established in paragraph 2 of Article 26 of the Civil Code of the Russian Federation, those with limited legal capacity, as well as minor citizens of the Russian Federation, can participate in gift transactions only in cases where they (the transactions) do not provide for the mandatory registration of the agreement or its certification by a notary.

In addition, today the legislator still prohibits individual entities from participating in gift transactions, the list of which is established in Article 575 of the Civil Code of the Russian Federation. Thus, in 2021, minors and incapacitated citizens cannot participate in the role of donor. The same rule applies to their legal representatives.

ARTICLE RECOMMENDED FOR YOU:

Agreement on donation of land between relatives - sample 2021. for MFC

Regarding the donee, the legislator prohibits workers and employees of medical, state, social, budgetary and municipal organizations from acting in their role if the donation is related to their professional activities (for example, doctors cannot accept gifts from their patients and their relatives), according to 2- 3 paragraphs 575 of the Civil Code of the Russian Federation.

Another prohibition can be found by studying paragraph 4 of Article 575 of the Civil Code of the Russian Federation, which establishes a ban on gift transactions between commercial organizations if the actual value of the gift exceeds the threshold for a gift of small value. This norm is determined by the need to suppress economic abuse in private organizations.

Arbitrage practice

Most often, the courts refuse to satisfy the claims, but there are also cases in which the plaintiffs managed to get the donation canceled and the contract declared invalid:

- Decision No. 2-6177/2014 2-6177/2014~M-5866/2014 M-5866/2014 dated September 19, 2014 in case No. 2-6177/2014;

- Decision No. M-1752/2013 2-70/14 2-1548/2013 2-70/2014(2-1548/2013;)~M-1752/2013 2-70/2014 dated January 20, 2014;

- Decision No. 2-679/13 2-679/2013 2-679/2013~M-736/2013 M-736/2013 dated July 16, 2013

As a result of the proceedings, the contracts were declared invalid by the courts. Registration entries in the Unified State Register were cancelled, and property rights were returned to the donors.

Lawyer's answers to frequently asked questions

Is it possible to draw up a contract of promise to donate an apartment with a mortgage?

Any transactions with mortgaged property before the debt is repaid without the consent of the lender are prohibited. Try to get permission from the bank. An alternative option is to issue a deed of gift, the execution of which will begin after the mortgage debt is closed.

I took out a loan secured by real estate, now I want to give it to my son. Can I draw up a contract of promise to donate a collateralized apartment?

No, alienation of mortgaged housing without the consent of the bank is prohibited. He can challenge the deal in court, and the judge will most likely take his side.

Is it necessary to draw up a deed of transfer and acceptance when donating real estate?

Not necessary, but if necessary, you can draw it up, indicating all the details: what is the condition of the housing, are there any defects, etc.

Is it possible to draw up a contract of promise of gift to a legal entity?

Yes, with the exception of donations between commercial organizations - this is prohibited by clause 4, clause 1 of Art. 575 of the Civil Code of the Russian Federation.

Is it possible to give money for a wedding under a promise agreement, and how to do it?

The contract is drawn up in writing, the amount is indicated, because a document without a description of the item (gift) is invalid. Draw up a deed of gift, give the second copy to the recipient and wait until the wedding, and then hand over the bills.

Donation agreement for a residential building

4.1. The Donor guarantees that before signing this agreement, the Real Estate has not been sold to anyone, not donated, not pledged, not encumbered with the rights of third parties, is not in dispute and is not under arrest (ban).

Donation agreement for a residential building

3.1. This agreement contains the entire agreement between the parties with respect to the subject matter hereof and supersedes and invalidates all other obligations or proposals that may have been accepted or made by the parties, whether oral or written, prior to the execution of this agreement.

Conditions precedent are those on the occurrence of which the execution or non-execution of a transaction depends. It should be noted that such circumstances are characterized by uncertainty of occurrence, i.e. When concluding a gift agreement, the parties do not know whether they will occur or not in the future. Example A mother decides to give her daughter a car, but on the condition that she completes her studies at a university (higher educational institution). Such conditions when promising a gift contribute to a certain behavior of the person, but do not oblige him to the donor. Additionally, therefore, when donating under a condition, the actions of the donee cannot be considered as some kind of obligation arising from the contract that must be fulfilled. Taking into account this circumstance, it should also be noted that neither suspensive nor disqualifying conditions should be illegal or of an immoral nature.