On September 1, 2021, amendments and additions were made to the Civil Code of the Russian Federation regarding cases of inheritance of property. New developments in inheritance legislation will make it possible to change the procedure and basic conditions for the entry into property rights of relatives or close people of the deceased.

With the help of the adopted amendments, the regulatory framework will be significantly improved, each stage of the inheritance procedure is clearly regulated.

From 2021, pre-retirees have a mandatory share in the inheritance

In December 2021, the Federal Law on a mandatory share of inheritance for citizens of pre-retirement age was adopted. He introduced an additional rule into the 3rd part of the Civil Code of the Russian Federation in order to eliminate possible negative situations of pre-retirement age and inheritance.

The essence of the new guarantee for pre-retirees

Here's what else you need to understand about pre-retirees and inheritance. The generally established retirement age has been increased since 2021. Accordingly, the age at which these heirs acquire the right to an obligatory share will also increase. In particular, this may include:

Important! The inheritance agreement may contain a clause regarding the executor. After the death of the testator, the executor has a number of obligations of both a property and non-property nature, which the testator will secure in this inheritance agreement.

On June 1, 2021, the federal law of July 19, 2020 No. 217-FZ “On Amendments to Article 256 of Part One and Part Three of the Civil Code of the Russian Federation” comes into force; in essence, these are amendments to the Civil Code of the Russian Federation in sections about inheritance.

About innovations

Each of the spouses at any time and even after the death of the other spouse has the right to cancel the joint will and dispose of the property at its own discretion. When performing these actions and in the event that the spouses are alive, the notary is obliged to notify the second spouse in writing.

- an extract from the Unified State Register of Real Estate as the main document of title indicating ownership of the apartment;

- certificate from the housing cooperative confirming payment of shares for housing;

- information on the market, inventory or cadastral price (at the choice of the successor under the will) of the object of inheritance;

- certificate of payment of property tax (if the apartment was inherited or gifted to the deceased).

Amendments coming in 2019

Another series of changes awaits Russian citizens next year. Thus, legal spouses will be able to jointly draw up a will. Moreover, they will have the right to bequeath not only jointly acquired property, but also the personal property of each spouse, and to determine shares for each of the heirs. A joint will can be revoked after the death of one of the spouses.

In 2021, an alternative to a will will appear, represented by an inheritance agreement. In it, the testator will be able to specify the conditions that the recipient of the inheritance must fulfill. For example, organizing a funeral or caring for a cat or dog. If the heir is not satisfied with the conditions and does not want to fulfill them, then the contract is terminated by a court decision.

Inheritance by will

As stated in Article 1131 of the Civil Code, a will after the death of the author is annulled by a court decision. The claim can be initiated by relatives of the deceased who do not agree with his will regarding inheritance, or by other persons claiming the inheritance.

Inheritance of land

After the death of the testator, the heirs, in order to accept the inheritance, provide a certain list of papers indicating their rights. It is of an individual nature; the composition of the documents must first be clarified with a notary, because their number and specificity depend on the subject of inheritance.

The definition of gardening and vegetable gardening for the form of partnership is of great importance. Owners of garden plots have the right not only to grow crops on their plots, but also to build permanent buildings suitable for housing.

And the founders of vegetable garden partnerships have the right to build only economic buildings on their plot. Law No. 217 finally gave a clear definition to such buildings.

Outbuildings include greenhouses, bathhouses, gazebos, and temporary huts. According to the law, a house suitable for habitation is considered to be a house that has a foundation and complies with all construction rules and regulations.

This division will greatly simplify the payment of taxes for each type of partnership.

Inheritance procedure through a notary

The procedure for registering the property of a deceased person with a notary consists of several stages:

- All heirs are required to write an application addressed to a notary. It must contain information about the deceased, a list of inherited property and justification of the applicant’s right to inherit.

- In addition to the mandatory package of documentation indicated above, successors must provide papers on the inherited property. They may vary depending on the type of property: cadastral passport for land, technical passport for residential premises, savings book or bank statement, etc.

- Next, you should begin to evaluate the inherited property. This will require the services of an appraiser. The procedure is necessary to determine the amount of the state duty. Each heir pays it. The exception is for persons registered with the deceased at the same address. Citizens who own property jointly with the deceased will also not pay the state tax. The duty is 0.3% of the value of the property for heirs of the 1st and 2nd stages and 0.6% for other successors.

- After the period specified by law, the notary will give all successors certificates confirming the right of inheritance.

The new law on summer cottages will come into force on January 1, 2021

Expert opinion

Romanov Igor Severinovich

Lawyer with 7 years of experience. Specialization: civil law. Extensive experience in developing legal documentation.

According to the new law on dacha farming, which will come into force in 2021, at least 7 founders can create a garden or vegetable partnership. But there are citizens who want to run their own households.

If these citizens use the services together with the founders of the partnership, this means public services - garbage removal, lighting of the territory, security of the site, then they must pay all fees equally with everyone else. For refusal to pay contributions, the meeting of the partnership has the legal right to resolve this issue in court.

According to the new law of 2021, it will become much easier to obtain registration

Deputies of the Federal Assembly, when adopting Law No. 217, significantly simplified this procedure. From January 1, 2021, the founders of garden partnerships that have a building on their site that is suitable for citizens to live in and that complies with the norms and rules of the Housing Code of the Russian Federation can easily register their residence.

To do this, you only need to have a state register of land.

The law provides for two types of inheritance: by will and by law.

In a will, property is transferred in accordance with the will of the deceased. If the deceased did not leave a will, then inheritance occurs according to law.

There is a sequence according to which the relatives of the testator can claim the inheritance. There are eight inheritance queues in total.

New rules of inheritance: law in favor of the rich

For the first time since the late 90s, significant changes have been made to the regulation of marriage, family and inheritance relations. The State Duma adopted a law on joint wills and inheritance agreements. However, it seems that these changes are needed only by rich people who transfer property to other persons .

For a long time, the regulation of marriage, family and inheritance relations in our country has not changed. But time passes, people need new legal mechanisms that require a universal approach to paperwork.

Marriage agreements are prescribed by law, but Russians have not yet begun to enter into them en masse. Although every year the number of such agreements, according to the Federal Notary Chamber, increases by one and a half times. Last year, for example, notaries were contacted more than 87 thousand times to draw up a marriage contract. This document is slowly taking root in Russian realities: spouses began to understand that concluding such an agreement is one of the ways to protect the family from the debts of one of the spouses, and not a “signal” that the family is being created for mercantile purposes.

In July, the State Duma adopted a law that introduces the institution of a joint will and establishes the procedure for concluding an inheritance agreement. From June 1, 2021, changes to the Civil Code of the Russian Federation regarding the regulation of inheritance of joint property of spouses will come into force. A joint will will allow spouses to divide (or not divide) joint property. It will also be possible to include the property of each of them in the document. It will be possible to name any person as an heir, determine the shares of the heirs, and disinherit any heir by law.

However, there are exceptions. Firstly, minors or disabled dependent persons will have mandatory shares in the inheritance. Secondly, “unworthy” heirs—those who themselves tried to become one of the heirs illegally or tried to illegally include other people in the will—will not be able to receive property.

The joint will will need to be certified by a notary. It will become invalid upon divorce. Also, each spouse will be able to unilaterally cancel such a will - in this case, it will lose force for both. If this happens during the life of the other spouse, the notary will have to send the latter a notice of this fact. In such a situation, an unscrupulous spouse can take all actions to ensure that the notice does not reach the addressee. And here the law will not protect the second spouse: the husband and wife can reach certain agreements, but one of them can potentially revoke the joint will without the other knowing about it.

Also, an ambiguous situation may arise when one of the spouses revokes a joint will after the death of the other. The law in this case also does not protect the interests of the deceased spouse and his will during life, but, on the contrary, legitimizes any actions of the surviving spouse.

An inheritance agreement will even have an advantage over a joint will if both of these documents were concluded. According to the law, a will loses legal force if there is an agreement, but not everyone knows about this. This also leaves a loophole for unscrupulous spouses. An inheritance agreement may be concluded on less favorable terms for one of the spouses, who will think that the joint will is valid simultaneously with the inheritance agreement.

The inheritance agreement will be concluded between testators and heirs. In addition to the distribution of assets, it will specify the procedure for transferring rights to the property of the spouses. It will also be possible to assign property and non-property responsibilities to the heirs. They will be able to receive the inheritance after fulfilling these duties.

It will be possible to change the inheritance agreement only during the lifetime of the parties who entered into it - by agreement between them or on the basis of a court decision. Accordingly, the rights and obligations from such an agreement cannot be transferred to other persons (these rights and obligations are inalienable). In this case, spouses can conclude an inheritance agreement not only among themselves, but also separately with other people.

When certifying a joint will and inheritance agreement, the notary is obliged by default to video record the process of signing documents. However, both spouses may oppose this when concluding a joint will or the parties when concluding an inheritance agreement. By July 1, 2021, all notaries must be equipped with technical means for video recording. Not everyone is ready for this now.

There is also a question regarding the wording of the law in a situation where one of the spouses opposes video recording when concluding a joint will. If we interpret the provisions of the law literally, both spouses must disagree with video recording, and not one of the two. In addition, from the content of the law it is not entirely clear what to do if both spouses are against video recording of a joint will or the parties to the inheritance agreement are against video recording. In this situation, should the notary refuse the notarization or continue working without video recording? If the working option is the second, then disputes may arise in the future - it is not clear how to record the refusal of video recording.

The introduction of new institutions of inheritance law - a joint will and an inheritance agreement - will unify the work of notaries in this area. But the adopted law has a number of shortcomings that can manifest themselves in practice and give rise to controversial situations. We can definitely say that the list of notarial acts services will increase, the income of notaries will increase, since each notarial act has its own tariff.

This is interesting: Inheritance of a mortgaged apartment 2021

It seems that the changes to the law were adopted solely to please wealthy people who, due to certain circumstances, transfer their property to other people and are not protected from a legal point of view, since all agreements are oral. In such a situation, formally, after the death of the “owner”, the property is inherited by law to the wrong people. Current legislative changes will allow this to be avoided. Now the ultimate beneficiaries of property, using legal mechanisms, will be able to ensure the protection of their interests.

In support of this argument, I would like to draw your attention to the fact that the law mentions the concept of “hereditary fund”, which appeared in Russia on January 1, 2021. I believe that it is unlikely that many Russians can afford to form an inheritance fund. Among the population with average incomes and below, that is, the majority of people in our country, these legal instruments will clearly not be popular. Most simply do not have valuable property to inherit.

The opinion of the author may not coincide with the opinion of the editors

Joint will of spouses

- There is no need to divide the property of one of the spouses among other heirs in the event of his death.

- The size of shares in the right of common property can be determined immediately when drawing up the document, and therefore the rule on equal rights to property of spouses can be changed.

- After the death of one of the spouses, it will not be possible to revoke the will at the request of the other party.

- The ability to display in the document the will of both spouses at once, and each one separately.

New law from June 1, 2021

Another change in the legislation is the emergence of the opportunity for a citizen to dispose of property by agreement with the heirs by drawing up an inheritance agreement . This document differs from a will in that it is a bilateral transaction and it may contain conditions, only upon fulfillment of which the inheritance can pass to the legal successor.

Issues and problems related to inheritance of property always cause a lot of controversy and litigation. In practice, there are many examples when the testator’s acquired property goes not to the person with whom he lived for many years, but to a completely different person who happened to be nearby in the last minutes.

And, on the contrary, if the will of the testator was to leave the property to a specific person who was there in the most difficult times, provided assistance, supported, the will was disputed by relatives who did not help during their lifetime. Upon death, they receive most or all of the inheritance.

This process is especially difficult in the segment of any type of business, when you have to wait six months before you have the right to change or adjust anything in a company that has been left without management. The new law on inheritance is designed to simplify the work procedure of notaries and ensure control over the execution of the last will of the testator.

What other changes in legislation are planned?

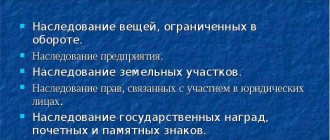

The new legislation on inheritance is expected to be further refined and additional clauses will be added, for example, such as:

- introduction of a single tariff for notary services for registration of inheritance;

- preparation and issuance by employees of notary offices of a special certificate of inheritance rights, which will indicate not one, but several successors at once.

The resolution with amendments and additions should be issued on June 1, 2019.

The adoption of this bill will enable testators to enter into an inheritance or joint agreement.

Inheritance contract

In this document, the testator will be able to stipulate special conditions that the successor will be obliged to fulfill after receiving the inheritance, for example, to care for the deceased’s pets, preserve and increase his collection, etc.

Features of the inheritance agreement:

- can be concluded with both an individual and a legal entity;

- the testator has the right to indicate in the will the person who will control the actions of the successor. If the condition set by the deceased is not met, the heir is deprived of the property bequeathed to him in court;

- an inheritance agreement, like a foundation, helps the successor to enter into inheritance rights immediately after the death of the testator, and not after 6 months, as in other cases;

- an agreement can be concluded even with a minor with the consent of his parents or guardians;

- if the list of property to be inherited contains real estate, the agreement must be notarized and officially registered;

- if the testator has elderly parents, children or disabled people as dependents, they retain the right to an obligatory share in the distribution of the inheritance;

- If someone’s rights were violated during the preparation of an inheritance agreement, they can be challenged in court both during the life of the testator and after his death.

It happens that a citizen draws up both a will and an inheritance agreement, then the property is distributed according to the latter document, since it takes precedence over the will.

Expert opinion

Irina Vasilyeva

Civil law expert

If the testator suddenly changes his mind, he can subsequently draw up a new will, where a separate clause will stipulate that the inheritance agreement drawn up earlier is now invalid.

Joint agreement

A joint agreement is drawn up by a married couple.

It may include not only common property, but also valuable personal belongings of each spouse. It specifies the shares transferred to the heirs. The document must be certified by a notary, and video recording is allowed during its conclusion in order to prevent forgery and deception. Only spouses who are legally capable and in a legal union can enter into a joint agreement. If the marriage is dissolved before one spouse dies, the will is considered invalid. After the death of one of the testators, it is no longer possible to change anything in the agreement.

All amendments to the law are being introduced to simplify the procedure for obtaining an inheritance and reduce the number of controversial situations leading to litigation. It is important that these changes and additions work not only on paper, but also in real life.

Dear readers, the information in the article may be out of date, take advantage of a free consultation by calling: Moscow +7

, St. Petersburg

+7 (812) 425-62-38

, Regions

8800-350-97-52

Basic principles of inheritance distribution

After the opening of the inheritance, the inheritance is distributed either by law or by will.

In law

If a will has not been drawn up, then according to the law there are 7 main stages. Close relatives and family members have priority rights. The clarity of the transfer of rights from one queue to another and their composition are shown in the picture diagram.

In addition to these main lines, there are additional branches of the right of representation, when the heir by law dies at the same time or before the testator, and his share is inherited in turn.

By will

In the case of a will drawn up and certified by a notary, the deceased can bequeath all property to any of his relatives or strangers. But part of the property is a mandatory share if there are applicants for it. The following are entitled to the obligatory share:

- disabled elderly parents;

- minor unemployed children;

- disabled dependents who have lived with the testator for at least one year.

Attention! In the Civil Code, disabled people of groups 1-3 are considered dependents. Unemployed relatives do not fall into this category.

Options for joining

The right of inheritance is the transfer of the property of the deceased, his duties and rights to the heirs.

The inheritance can be cars and other vehicles, securities, real estate, household appliances, jewelry and much more. And besides this, the inheritance also includes loans and debts of the deceased.

Entering into inheritance is a legal process that is carried out according to the established procedure and laws.

The legislation of the Russian Federation indicates that there are two options for entry:

- According to the will.

- In law.

In law

For this option of entering into an inheritance, the testator’s will is not required. According to the will, the property passes to the recipients in order of priority. What is this line of heirs and how can it be distinguished?

The queue for acquiring rights to inheritance looks like this:

- The closest ones are children, spouses, parents, grandchildren.

- Brothers/sisters, grandparents.

- Uncles/aunts.

- Cousins/sisters, first cousins.

- Cousin grandchildren.

- In the absence of relatives, the property passes to citizenship.

Also, there are heirs who, in any case, do not have the right to receive an inheritance:

- Parents who are deprived of their rights to their child.

- Those who committed a crime or only took aim at the testator, or legal heirs.

Entry into inheritance according to the new rules

The innovations in the law on wills are reduced to a simplified registration procedure, which came into force in September 2021. A new concept “Inherited Fund” (NF) has appeared.

The changes affected parts 1-3 of the Civil Code of the Russian Federation. Creating a fund eliminates the six-month waiting period.

Unfortunately, today not all legal sources of information adequately explain its purpose and main functions. The result is confusion and substitution of legally significant concepts.

According to the new law on wills, any citizen can create his own NF, with the help of which the deceased’s business, his property, and various types of savings will be managed.

- It is created by the testator at the time of drawing up the expression of will, in which he describes in detail who will be at the head of the organization and manage its activities after death.

- The creator himself approves the Charter.

- Managers are appointed, the role of each person in the organization is outlined, with a detailed description of how to dispose of the property.

- Methods of replenishment and volumes of assets are indicated.

- The validity period of the Fund is established. The execution of the will of the deceased is controlled by the administrators.

Important! All instructions are mandatory. Correction is possible only through the courts, and in very rare cases.

Expert opinion

Romanov Igor Severinovich

Lawyer with 7 years of experience. Specialization: civil law. Extensive experience in developing legal documentation.

The Foundation, having the status of an organization, also becomes a co-heir with management rights. The rights to the received material assets are claimed:

- creditors of the deceased;

- relatives specified in the will and members of the obligatory share.

This approach preserves assets and the ability to continue the family business if close relatives are unable or refuse.

Place, time and timing of opening of inheritance in 2018

Based on the amendments made to the legislation, the period when entering into an inheritance must take place will be shortened; changes from 2021 will fix the reduction in terms in the case of creating an inheritance agreement or fund.

An inheritance agreement is a document according to which the successor, after the death of the testator, is obliged to accept the inheritance. The agreement is drawn up by a notary for an individual or legal entity.

The deadline for entering into inheritance according to the law in 2021 may be several days after the death of the testator. Which is very important when the deceased owned his own business, which he wants to pass on to his heirs. The procedure for accepting the property of a deceased person follows general requirements.

Another innovation is the possibility of spouses writing a joint will. In June of this year, the State Duma came up with a new law - an apartment can be inherited by successors under such a document if the following conditions are met:

- if the spouses were legally married;

- At the time the will is written, both makers must have legal capacity.

This is interesting: Inheritance of sex-linked diseases 2021

Legislative amendments concerning the inheritance agreement and joint will were signed by President V.V. Putin, but will gain legal force from June 1, 2021.

Important! Thus, if the terms of the will provide for the creation of an inheritance fund or if an inheritance agreement is drawn up, then the successors must declare their rights within 3 days. If a regular will was drawn up, then the legislators left a 6-month period for opening the inheritance and beginning its registration.

Citizens can declare their rights of inheritance at the notary office located at the place of residence of the deceased. There are several ways to do this:

- seek advice from lawyers and deal with the registration of property yourself;

- send to the lawyer by registered mail all documents required to enter into inheritance rights;

- carry out the procedure through an authorized person to whom a power of attorney must be issued.

Operating principle

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your specific problem, please contact the online consultant form on the right.

The testator decided and outlined all organizational issues with the NF during his lifetime. After his death, the notary is obliged:

- within three days, submit an application to the Ministry of Justice to open an NF, providing a will as confirmation;

- according to Art. 1154 of the Civil Code of the Russian Federation, issue all documents of the NF that confirm its legal status within the period specified by law.

According to the new law on wills, the NF must ensure the growth of the estate by applying effective management. Profits from activities are distributed according to the will. The circle of persons was approved by the testator, among whom there may be relatives of any level of relationship, organizations, and employees of the company.

By the way! If the will specifies an unaddressed charity, then the board of trustees independently decides who to pay the money to.

Rights and obligations of heirs

The beneficiary claiming the property acquires rights and obligations. The basic principles are as follows:

- there is no opportunity to repay your debt at the expense of the Fund;

- existing rights are not inherited or alienated;

- receives funding according to the terms of the expression of will;

- complete openness about the activities of the NF;

- challenging management only in court;

- lack of rights to sole management;

- has the right to vote in the election of a manager;

- control over the implementation of significant transactions is allowed.

The experience of hereditary funds was adopted from foreign experience. If the testator during his lifetime does not give instructions to open an NF, then all business assets are frozen for six months in accordance with existing legislation. During this time, there is a high probability of losing everything.

Before the President signed the law, business representatives organized Funds abroad, withdrawing assets. Now business remains in Russia, jobs are created and the opportunity to develop our own economy.

It is still unknown how the law will show itself in Russian realities. What’s new in inheritance is no longer needed by ordinary Russians, but by business representatives, since they manage the main assets.

There are unresolved tax issues and how to prevent double payments.

Inheritance contract

As a norm of law, an inheritance agreement is an alternative to a will and will come into force in June 2021. It can be concluded with individuals and legal entities.

The contract specifies the conditions that must be met after entering into inheritance rights. This could be caring for cats and dogs, erecting a monument and other tasks.

They are also mandatory.

You should know! If someone's rights were violated when drawing up an inheritance agreement, then it is disputed in court even during the life of the testator. And after his death by a person whose rights were violated. Mandatory shares are preserved both in the will and in the inheritance agreement, which has priority over the will.

What is the essence of the new law?

The inheritance bill regulates the procedure by which real estate is transferred from a deceased citizen to his relatives or other people named in the testator's will.

According to the new legislation, the heir has the right to abandon property in favor of a third party, and this person can be any person, even if he is not a relative or close acquaintance of the testator. This rule of law is noted in Article 1158 of the Civil Code of the Russian Federation.

Previously, a person who refused an inheritance could not decide to whom to transfer it and the property was distributed among the next heirs. The only requirement for a third party, limiting his entry into inheritance rights, is the following - previously he should not have been deprived of property rights by the testator due to unworthiness of his lifestyle or behavior.

In order not to rewrite the will every time the composition of the property changes, when drawing it up, you need to use the following phrase - “all the property that will belong to me at the time of death.”

A testator can leave the same piece of property, for example, an apartment, to several successors. If the will does not indicate the share of each of them, the property is divided equally among all heirs.

Who will be affected by the new law?

As you can see, the changes affect the interests of people who decide to formalize a will properly and redraw the order of inheritance. The new law on inheritance in Russia in 2021 allows you to freely dispose of your wealth.

A document certified by a notary allows you to transfer the right to own property to anyone. But there is also a mandatory share that will be claimed by:

- Minor children (in the absence of official employment).

- Elderly parents of retirement age/

- Disabled dependents (they must live with the author of the will for at least a year).

New opportunities for heirs and testators

One of the key tools in the updated legislation is a joint will. Previously, such a concept did not exist in domestic law.

This type of will allows spouses to agree in advance on the fate of their property by documenting their intentions. The number of court proceedings will be reduced - this is the main advantage of the new Inheritance Law 2021.

The tool that appears will distribute everything in its place. The death of spouses will not lead to conflict between their relatives, and the courts will not be overloaded with lawsuits. It should be remembered that the joint paper does not affect the mandatory share, so the interests of young children, the elderly and dependents will not be infringed.

Inheritance contract

Another tool that appeared thanks to the edition approved in June. Now the applicant can agree with the testator on counter actions for the transfer of property. The parties sign the document, notarize it and enjoy life.

Foreign experience served as the basis for the creation of inheritance funds relating to business assets. When opening such a fund, an entrepreneur freezes all assets for six months. The heir receives certain rights and obligations:

- lack of possibility of alienation;

- prohibition of sole management;

- financing;

- openness of activity;

- voting for the manager;

- control of serious transactions.

As you can see, the new Law on Inheritance in Russia 2021 expands the boundaries of possibilities for ordinary citizens and, in some cases, simplifies doing business. The existence of inheritance funds in the Russian Federation will slow down the outflow of capital abroad, since company owners will receive an important tool.

True, there is a risk of losing all assets during the six-month freeze. Perhaps legislators will make amendments and eliminate this shortcoming.

The legislation of the Russian Federation on inheritance has undergone some changes in recent years, provoked by modern legal realities. The inheritance procedure is a complex process, so each stage must be clearly regulated at the legislative level.

What will the law on inheritance of the Russian Federation be like in 2021, what has been adopted new in this area in recent years and what changes can be expected in the future?

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Legacy fund

The testator has the right to draw up the charter of the organization, appoint people responsible for conducting business, and the method of distribution of profits. The will specifies the list of heirs who will receive income from this fund, as well as the amounts due to them.

Previously, such a procedure was possible only abroad, and many large entrepreneurs specifically transferred their business and money abroad to take advantage of this opportunity. In addition, previously it was possible to officially enter into inheritance rights only 6 months after the death of the testator, which greatly interfered with the work of large companies that were left without an owner for a long period of time.

When registering an inheritance fund, these deadlines change. Within three days after the death of the testator, the notary must write an application to the Ministry of Justice regarding the opening of an inheritance fund, presenting the client’s will to confirm his authority.

Immediately after this, the business and assets of the deceased are transferred to the management of the people who were noted in the will as the managers of this fund.

Thus, after the death of the owner, the property is not squandered, but is collected in a fund and distributed as the testator wanted. This rule of law was created mainly for rich people with large businesses.

However, small, individual entrepreneurs can also exercise their right to create an inheritance fund.

What regulates

The hierarchy of legal acts of the Russian Federation is headed by the Constitution. The most important document of the state does not directly relate to the inheritance procedure, but it establishes the basic rights of citizens associated, among other things, with this process.

The procedure for accepting an inheritance is directly considered by the Civil Code of the Russian Federation, and issues of taxation, fees, duties and benefits are regulated by the Tax Code of Russia.

The actions of notaries during the procedure for registering an inheritance are provided for by the law “Fundamentals of the legislation of the Russian Federation on notaries.”

Expert opinion

Romanov Igor Severinovich

Lawyer with 7 years of experience. Specialization: civil law. Extensive experience in developing legal documentation.

More highly specialized issues that are not considered by civil law are additionally regulated by decisions of the Supreme Court of the Russian Federation.

What does the inheritance law say?

Required documents

Within 6 months. After the death of the testator, the heirs must collect and submit the following documents to the notary:

| When inheriting by law |

|

| When inheriting by will |

|

Depending on life situations, the following types of documents may be required:

- refusal of other heirs to inherit;

- extract from the house register;

- cadastral plan for the land, technical passport for the apartment;

- savings book (information about bank accounts);

- report on the market value of real estate, movable property, shares, non-property rights, shares;

- extract from the register of shareholders, etc.

To take ownership of real estate you will need:

- title documents for real estate (house, apartment, land);

- certificate of registration of the testator's right in the registry office (if available);

- those. passport and certificate Form No. 2 from the BTI;

- land cadastral passport;

- documents on the inventory, market or cadastral value of the property.

Sample certificate from BTI

To inherit a car, the notary will need to submit:

- PTS:

- vehicle registration certificate;

- report on the market price of a vehicle.

How to register

The process of registering an inheritance can be divided into the following stages:

- Acceptance of inheritance. Can be done in several ways:

- By application to a notary. According to the new rules of “Inheritance Without Borders,” a citizen has the right to independently contact a notary of his choice. The notary checks information about the availability of a record of opening a notary business and other notaries through the Unified Information System for Notaries in Russia. In the absence of such a record, he starts an inheritance case. This procedure eliminates duplication of inheritance cases, and if there is already an open case, any notary will direct other heirs to the desired notary office.

- By actually accepting the property of the deceased. As a rule, this method is applicable if the heirs are not familiar with the legal procedure for entering into an inheritance, but in fact accept it, for example, they take the things of the deceased, pay utilities for housing that belonged to the testator, etc. In this case, citizens who have not formalized the inheritance must will file a claim with the courts. It is possible to avoid the proceedings if there are no other heirs, or if citizens who have already entered into the inheritance agree to restore the deadline for entry for the heir who missed the registration of the property.

- Collection of certificates and documents (the list will be indicated by the notary).

- Opening an inheritance case and issuing a certificate of inheritance.

Order of priority

The order of inheritance is systematized by law according to the degree of relationship with the deceased. The basic rule is this: the right to inherit arises for each subsequent line only if there are no heirs from the previous one.

Lines of heirs:

| First of all | This includes: children, surviving spouse, parents. |

| Second | Siblings, grandmothers, sisters and grandfathers. |

| Third | Aunts and uncles of the deceased. |

| Fourth | Great-grandparents. |

| Fifth | Cousins: grandparents, grandchildren and great-grandchildren. |

| Sixth | Aunts and nephews (cousins). |

| Seventh | The deceased's stepmother, stepson, stepdaughter and stepfather. |

If there are no heirs of all the listed orders, then the property can be inherited by the disabled dependents of the deceased, and in their absence - by the state (escheat property)

Payment of taxes

The tax legislation of the Russian Federation does not provide for the levy of tax on inheritance received.

Only after registration of the inheritance can the heir fully use the received property at his own discretion. What documents are needed to register a house by inheritance can be found in our article.

However, when entering into an inheritance, citizens in 2021 will need to pay the so-called notary fee, the amount of which varies for certain categories of heirs:

| Close relatives | It is set at 0.3% of the value of the property they inherit. In this case, the amount of the duty cannot exceed 100 thousand rubles . |

| Other relatives | 0.6% of the property value. The maximum amount of state duty in this case will be 1 million rubles . |

The collection of the above tariffs is provided for by the Tax Code of the Russian Federation and is carried out for the registration of an inheritance and the issuance of a certificate (both by law and by will).

A citizen who has entered into an inheritance and registered the transfer of rights to it in Rosreestr becomes its full owner and from that moment begins to bear the burden of maintaining his property, which includes, among other things, payment of taxes and other obligatory payments (citizen property tax, transport tax, tax on the sale of real estate, etc.).

Drawing up a certificate

A certificate of inheritance is an official document issued by a notary at the request of the heir and confirming his rights to the inherited property.

The legislation does not define the period when the applicant must receive the specified certificate. The state gives him the right to do this at any time after the deadline for issuing this document (Article 1163 of the Civil Code of the Russian Federation).

Sample certificate:

Image of the coat of arms of the Russian Federation

Certificate

on the right to inheritance by law

City G-k, Krasnodar region, Russia

September sixth two thousand seventeen

I, full name, notary of the city of Krasnodar Territory, certify that on the basis of Art. 1142 of the Civil Code of the Russian Federation, the heir to the property specified in this certificate, gr. The full name of the deceased “___” __________ _____ is:

daughter – full name, “___” __________ ______ year of birth, living at the address: ______________________________________________ (passport series ______, No. ______ issued ____________________________ “___”_________ ________).

The inheritance for which this certificate has been issued consists of:

non-residential premises (garage) number six, located at the address: ____________________________, owned by the testator on the basis of a gift agreement registered with the Office of Rosreestr for the Krasnodar Territory “____” _____________ _____, about which entry No. __________________________ was made in the Unified State Register.

The specified garage is located in GSK No. and consists of one non-residential premises with a total area of 30 sq. m. m, which is confirmed by the site plan drawn up by the Municipal Unitary Enterprise BTI of the city of G-k for No. __________. Garage cadastral number: _______________________ Inventory assessment of the garage is 105,000 (One hundred and five thousand) rubles.

Ownership of the garage is subject to registration with the Rosreestr Office for the Krasnodar Territory.

This certificate confirms the emergence of ownership rights to the above-mentioned inherited property.

Notary's official seal

No. ____________ inheritance case

Registered in the register under No. ____________________

Notary: Full name

Purpose

The legislation is designed to streamline the process of receiving property by heirs, provide for possible options for accepting property and provide maximum assistance in resolving disputes that arise between successors.

The provisions of the laws protect the rights and interests of heirs, establish the necessary list of documents for receiving an inheritance, determine the actions of officials in the inheritance process and the size of shares due to various categories of persons.

You can find out how to draw up an agreement on the division of property here.

Documentation

In order to enter into an inheritance, first of all, you should collect all the necessary documents.

You need to provide the following documents:

- Original and copy of death certificate.

- An extract from the house register showing everyone who was registered in the house before the death of the testator.

- Documents that can confirm a family relationship - marriage certificate, birth certificate, etc.

- Russian citizen passport.

- Required certificates and certificates.

If the inheritance is an apartment, additional documents are required:

- Title documents (original and copies).

- A copy of the financial personal account.

- A certificate from the Bureau of Technical Inventory, which describes the valuation of the property.

- A document confirming the absence of debts for utility services.

If the inheritance is a land plot, plus documents such as:

- Technical passport with the Bureau of Technical Inventory.

- A certificate from the BTI, which describes the valuation of the property.

- A document confirming the absence of debts for the plot.

- Certificate of market value and site plan.

If the inheritance is a car, additionally provided:

- Title documents for transport (original and copies).

- Valuation document for the car.

In case of inheritance of securities, the following documents are added:

- Documents confirming bank investments.

- An extract from the register of shareholders, and the name of the organization in full.

- Savings book.

- Certificate of market value of inherited securities.

As you can see, in addition to the main papers, for each type of inheritance an additional list of documents necessary to receive inherited property is attached.

Is the inheritance procedure mandatory?

Along with the inherited property, the heirs also receive a number of obligations.

This applies to both loans and debt obligations. And therefore, many are in no hurry to receive an inheritance. There are cases when expenses exceed property income.

There are several ways to refuse an inheritance.

In the first case, you need to take only two actions:

- Write a statement of refusal.

- The application must be submitted to a notary. You also need to have with you a passport and a document confirming the death of the person giving the inheritance. The right to inheritance is not restored after filing an application.

There is another technology . It consists in the fact that the recipient of the inheritance ignores the fact of transfer. It is important not to accept actual inheritance.

Even if a person is already using inherited property, he can refuse it. This can be done within six months.

The right to inherited property may be taken away from these persons:

- The person neglected his duty towards the one who gave the inheritance;

- A person with malicious intent falsified a fact and a document, exerted pressure on a non-dead person;

- If the parent who gave the inheritance was deprived of parental rights.

Check for a will

After you have collected all the documents, it is worth determining the existence of a will. To do this, you need to go to a notary. If you know his last name and first name, then you shouldn’t waste time and you can contact him right away. It is better to contact a specialist, because he will be the one who will be able to clarify all the nuances of your case.

The notary's office will tell you and clarify in detail all the nuances when entering into an inheritance, and the procedure for preparing important documents. At the notary, a person writes consent and confirmation of the acceptance of the property, or, if desired, a refusal of it. When accepting an inheritance, you cannot refuse the debt obligations associated with this inheritance.

When contacting a notary, you will need to pay a state fee, which for primary heirs will be 0.3%, and for other relatives - 0.6%. After all this, you can safely formalize the transfer of new ownership.

People with rights to inherited property

There is a certain queue for accepting inherited property. It is established by Articles 1142–1145 of the Civil Code of the Russian Federation. First of all, the closest people, relatives, children, spouses receive inherited property. Article 1116 of the Civil Code of the Russian Federation states that the list of those receiving an inheritance may include:

Relatives who have rights to inheritance are:

- Husbands (wives), children.

- The property can be accepted by the grandmother or grandfather on either side.

- Uncle or aunt, if they died along with the giver of the inheritance.

- Child of an uncle or aunt.

- Their children.

- Great-grandfather or great-grandmother.

- A cousin, grandson, brother or sister of a grandfather or grandmother.

- Great-great-great-grandson, uncle or aunt, nephew.

- A child of the inheritor who is not related by blood.

- A disabled person who was dependent on the person who gave the inheritance.

- State organization. It happens that there is no claimant to the inherited property. Then the property values go to the state or municipal property.

Rights of heirs to inheritance in 2018

The categories of persons who can count on the values of the deceased are determined by the Civil Code of the Russian Federation. The bill provides for two such categories:

- Heirs who are related to the deceased.

- Applicants without blood ties: persons who were financially supported by the testator for at least a year before his death. At the same time, the facts of material content and living together must be proven.

Writing a will 2018

The first category of heirs consists of 7 subgroups that acquire the alternate right to inherit the property of the deceased:

- Mother, father, children, husband or wife of the deceased;

- Brothers, sisters, grandmothers, grandfathers of the testator;

- Brothers and sisters of parents;

- Great-grandparents;

- Grandchildren and great-uncles, grandmothers;

- Great-grandchildren, nephews, cousins, aunts of the deceased;

- Stepsons, stepdaughters and stepfather, stepmother of the deceased.

Note! The list of heirs defined at the legislative level does not include a common-law husband, wife, or a child if he was later adopted by another citizen.

In the absence of any relatives of the deceased, all his property passes to the disposal of the state. Another reason why property may become state property is a refusal in writing from the successors or the omission of the period when it is necessary to enter into inheritance rights. Property that has passed into state use after the death of a citizen is called escheat.