All families that are soon preparing to have large families are interested in the question of what benefits and privileges are provided to them by the state. And this is not surprising, because the more children there are in a family, the higher the costs of upbringing, education, food and accommodation in general become. And in order to normalize the demographic situation in the country, the government is developing special programs for large families in order to somehow make their life easier.

What is a large family?

Presidential Decree No. 431 of 05/05/1992 says that, depending on national and cultural aspects, authorities in different regions themselves name the types of families that are considered large families. The decree regulates the main points regarding the provision of assistance to families with a large number of children.

In 2021, privileges can be received by parents of many children, or by a person raising three minor children on their own. Some regions increase the age of benefits - up to 23 years.

IMPORTANT! Sometimes circumstances arise when a family cannot adopt or adopt a child; they only have the power to formalize guardianship. Even if the parents are mentors of three minor children, the family cannot claim privileges, since they will not be included in the category of having many children.

A large family is a unit of society that contains all jointly born (or adopted) children or children left over from former unions. If the mother and father were deprived of parental rights, or they deviate from raising children or sent them to an orphanage, they also cannot be considered as having many children and use privileges.

What do you give at the birth of 4 children?

Parents who have a 4th child already have the status of a large family. The latter is assigned at the birth of the third child and is associated with the provision of additional benefits. The birth of a fourth child does not provide any additional status.

In general, all payments of this type can be divided into federal and regional. The difference lies in the source of funding for these programs. Thus, most of the benefits that are paid at the birth of children, including the fourth baby, are federal.

These include:

- A one-time payment upon the birth of a child. In 2021, its size is 18,143 rubles.

- Payment for early registration with a gynecologist at the antenatal clinic. The amount of money is 675 rubles 15 kopecks.

- Cash payment for pregnancy and childbirth. The amount of this benefit may vary as it depends on your pre-pregnancy employment and income level.

- Care allowance for up to one and a half years. Its size can also vary and directly depends on the woman’s salary.

Reference! Federal payments are subject to periodic annual indexation.

In addition, in a number of regions of the country there may be other programs for financial incentives for women who have given birth to a fourth child. For example, in Moscow there is a program of financial assistance to young families.

So, if at the time of birth the mother was under 30 years old, then for the third and subsequent babies she is entitled to a cash payment ten times the minimum subsistence level established by the city authorities of the capital.

Amount due

The amount of maternity capital is subject to annual indexation. In 2021 it was 3.7%. If part of the money has already been spent, then the remaining funds are indexed. Currently the MSC is:

- For the 1st child – 483,882 rubles.

- For the 2nd and subsequent children - 693,432 rubles.

If the mother applied for maternity capital for the first baby born after the beginning of 2021, then for the birth of the second child an additional payment in the amount of 155,550 rubles is due.

If there is a mortgage loan, a family can receive an amount of up to 450,000 rubles from the state. for its repayment. The exact amount of the subsidy is determined by the outstanding balance. To receive money, you just need to write an application to the bank that issued the loan. This measure was introduced in 2021 and applies to families where a third or subsequent child was born. For now, the program is limited to the end of 2026.

Benefits and benefits if there are 4 children in a family

Benefits and preferences for families with four children are usually established by regional authorities independently. Among the federal benefits, especially noteworthy are those that were announced by V.V. Putin in his address to the Federal Assembly.

Thus, it has been established that upon the birth of a third and subsequent child, families can count on state assistance in paying off a mortgage loan. The amount of state support in this case will be 450 thousand rubles.

In addition, families that do not have a sufficient level of income equivalent to the subsistence minimum for one person in the family can count on receiving a monthly benefit amounting to an amount equal to the subsistence minimum in the region.

However, it should be noted that these payments are made at the expense of maternity capital, so if the family has previously used this form of state support, then the benefit in question will not be provided.

The main volume of benefits for families with many children is established by local regional authorities. Among them, the following should be highlighted, which residents of most regions are entitled to:

- compensation for housing and communal services;

- preferential medical coverage;

- benefits for admission to preschool institutions;

- compensation for travel on municipal public transport;

- exemption of families from part of the tax burden (only within the competence of regional authorities);

- provision of discounted vouchers to health camps and sanatoriums;

- free meals in preschool and secondary education institutions.

To clarify the full list of benefits provided to a large family, you must contact your local social security authority for advice.

In addition, in a number of regions of the country there are so-called “regional capitals”, which are programs created by analogy with maternity capital, but financed from local budgets and having a smaller size. The conditions for receiving government support for such programs vary.

For example, in the Ulyanovsk region there is a “Family” program, within the framework of which, upon the birth of a second child, families are issued a certificate for 50 thousand rubles. When the third and subsequent children appear, this amount increases to 100 thousand rubles.

Payments to large families: who is entitled to what?

A family with 3 or more children is recognized as having many children. Foster children and adopted children are also part of the family. In some regions the age is limited to 14 years. Usually the number of children under age is taken into account.

How to obtain the status of a large family

- At the birth of a third child, regional authorities pay the family monthly assistance. In 2021 it is equal to 11 thousand 850 rubles.

- At the birth of 3 children, regional maternity capital is paid in the amount of 100 thousand rubles.

- Payments are provided for adoptive parents and foster parents.

May 03, 2021 semeiadvo 778

Share this post

- Related Posts

- Relocation of emergency housing Samara 2021 comments

- Toilets and sinks can I repay with 344 kosgu

- Amendments to the Criminal Code of the Russian Federation in 2021 latest news on Article 228 Part 2 changes Russian newspaper

- How much do Donskoy towns in the Tula region pay for the Chernobyl zone?

Types of payments for the fourth child in 2021

All payments for the 4th child, which will be made in 2021, are divided into two categories: one-time and regular (monthly).

One-time subsidies

Families in which a fourth child was born can count on the following types of financial assistance:

- allowance for visiting an antenatal clinic in the early stages of pregnancy - 655.48 rubles;

- child birth benefit - 17,479.72 rubles;

- maternity benefit - the amount is determined by average earnings;

- allowance for the adoption of a child over 7 years old or a disabled person - 133,559.35 rubles.

Monthly benefits

This group includes the following payments:

- for child care up to 1.5 years, up to 3 years, from 3 to 7 years;

- benefits for children under 18 years of age.

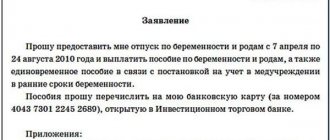

An application for payment of child care benefits is sent to the employer if the child’s parents are officially employed. In other cases, you must contact the territorial department of social protection of the population or the MFC, where all collected documentation is provided.

This can be done by visiting the authority in person, as well as sending the necessary documents by mail or through the State Services portal.

Benefit for a child up to one and a half years old

In 2021, the minimum compensation amount will be 6,284.65 rubles. If the mother worked before maternity leave, then the amount of the benefit corresponds to 40% of her average monthly salary for the two years preceding the filing of the application.

Child benefit under 3 years of age

It is regional in nature. The size is determined by the cost of living established in the region of residence. To assign compensation, you must contact your local social protection department with an application and a package of documents.

Child benefit from 3 to 7 years old

A decree introducing a new type of payment was signed by the President of the Russian Federation in 2020. The amount of assistance is 50% of the subsistence level for children in force in the territory of a particular subject of the Federation.

If the family is recognized as low-income, that is, the income of both parents does not exceed the minimum monthly wage, then the payment amount is doubled.

Benefit for a child under 18 years of age

Monthly assistance is provided only to those who need it. In particular, we are talking about low-income families.

The calculation is made as follows:

- the incomes of the father and mother are summed up;

- the amount received is compared with the cost of living in the region.

Putin's benefits for the poor

Low-income is usually defined as a family whose income over the last three months is less than the subsistence minimum.

Low-income people are entitled to the following benefits:

- One-time payment. Timed to coincide with certain life situations (for example, the birth of a child).

- Regular payments. Accrued once a month.

Regional benefits

Regional payments for 4 children in 2021 are made in 69 constituent entities of the Russian Federation. In some regions of the country, citizens cannot take advantage of this privilege. This is due to the fact that the budgetary capabilities of local authorities are very limited.

A general overview of the funds available to large families

To obtain the status of a low-income family, it is enough to sum up the salaries of the father and mother and divide by the number of family members. If the income for each person is less than the regional monthly minimum, a large family can receive not only a monthly allowance, but also financial assistance for the birth of their next child. Its size is determined by local authorities and in some regions reaches a very decent amount; according to rough estimates, the average payment in Russia for a fourth child is more than 100 thousand rubles.

Other ancillary payments

The government paid special attention to helping large families even before the onset of distress during the spread of the global pandemic. The statuses of a large family and a low-income family in many cases coincide - raising children is not cheap, expenses for a small child in many cases coincide with expenses for an adult.

The time for consideration of the application is approximately one month. It happens that when families with four children first submit an application for assistance, they refuse to accept it due to a lack of documents. In this case, you can repeat the application on another day or contact higher authorities.

It is also possible to increase the funded part of the pension of a mother with many children using capital funds. To do this, the following documents must be available: passport, SNILS and an application for disposal of money from the payment or part thereof.

Right of use

- Free delivery of linen for newborns.

- Children under six years of age are given free medicines and vitamins with a doctor’s prescription, benefits for medical care and first priority with doctors in public clinics.

- A child from a large family is admitted to kindergarten first of all. It is also possible to return 20 - 70% of the cash payment for the garden.

- Receiving a monthly allowance until the child reaches 1.5 years of age to care for him, received only by his mother. The size of the payment depends on the woman’s average income over the last two years.

- Advantages when enrolling in school.

- Schoolchildren can travel on city and suburban railway transport for free (with the exception of minibuses and taxis). One parent is also entitled to free or discounted travel.

- The right not to pay for sets of textbooks, if such are available at the school.

- The child eats free of charge in the school cafeteria. This benefit applies to students of technical schools and higher educational institutions.

- School students are provided with free clothes for every day and a suit for sports throughout all years of study.

You might be interested ==> Amendment to 2 2 8 20

Read more about what specific assistance and in what volumes families with children in our region can count on in the joint special project of the Bashinform news agency and the Ministry of Family, Labor and Social Protection of the Population of the Republic.

In Bashkiria, absolutely all families into which a child was born can count on support from the state, regardless of their material well-being and the number of children. At the same time, some categories of citizens - large families, low-income people, single mothers and parents of disabled children - have additional financial privileges.

How to get it: paid to one of the parents at the place of work. If you do not work, take the documents to the branch of the Republican Center for Social Support of the Population at your place of residence, the nearest MFC office, or apply for benefits through the State Services portal. IMPORTANT POINT. You need to bring only those documents that the social service cannot request from government agencies on its own. The link opposite these documents in the far right row says “no”. This applies to all other links too.

The main directions of the state’s social policy for a long time have been supporting vulnerable segments of the population and stimulating the birth rate in order to improve the demographic situation in the country. And providing assistance to large families solves both of these problems at once. In most regions, parents with many children are considered to be those raising at least three children who have not yet reached adulthood. It goes without saying that when a fourth child appears in a family, the law also provides for incentive payments and benefits, in addition to generally accepted child benefits. We suggest you figure out what benefits (payments) families are entitled to at the birth of their fourth child in 2021.

Maternity benefits

The list of maternity payments for the birth of a fourth child includes:

- Lump-sum maternity benefit (B&C). Available for women only.

- Monthly child care allowance. It takes the form of a monthly payment. Both the mother and the father can apply for benefits.

Based on Art. 255 TC, the holiday for the BiR is 140 days. In case of multiple pregnancy or complicated childbirth, the period increases.

Care leave, according to Art. 256 TK, provided for children up to 3 years old. Until this moment, the employee has the right to be absent from the place of work under the conditions of maintaining his position. If the employee wishes, the period may end earlier.

Reference! Care allowance is provided only until the child is 1.5 years old.

The deadline for applying for payments, according to Art. 17.2 of Law No. 81-FZ and Art. 12 of Law No. 255-FZ, - no later than 6 months from the end of maternity leave or from the day the child turns 1.5 years old.

Payments to employed people

The amount of maternity benefits for working persons directly depends on wages. The calculation is made taking into account Art. 11 and art. 11.2 of Law No. 255-FZ.

The compensation amounts will be as follows:

- 100% of average earnings - the amount of the B&R benefit;

- 40% of an employee’s average salary – monthly child care allowance for up to 1.5 years.

Funds for payments are transferred from the Social Insurance Fund, however, a request for their accrual should be submitted to the employer. The personnel service or accounting department will need to present a certificate of incapacity for work issued at the antenatal clinic.

After receiving the application, the funds are transferred to the employee’s card within 10 days. Or on the next day of payment of wages to other employees.

Benefits for non-workers

Unemployed women do not have the right to benefits under the BiR. The exception is cases where the expectant mother was fired on the basis of the complete liquidation of the enterprise or individual entrepreneur. In this case, she receives 300 rubles.

Based on Art. 6 of Law No. 81-FZ there is a rule - the reduction must be carried out no later than a year before the onset of pregnancy. During the same period, the woman is obliged to register her unemployed status and register with the employment service.

An unemployed woman has the right to payment when registering before the 12th week of pregnancy, only if she is entitled to benefits under the BiR. According to Art. 9 of Law No. 81-FZ, these amounts are interrelated.

A care allowance for up to 1.5 years for a non-working woman is assigned regardless of employment.

As Art. 13 of Law No. 81-FZ, for payment to be calculated, dismissal must take place during the period:

- pregnancy;

- holidays according to the BiR;

- maternity leave.

In these cases, the amount of benefits is calculated on the basis of Art. 15 of Law No. 81-FZ. The amount will be commensurate with 40% of the woman’s average earnings for the last year preceding the date of dismissal.

If the mother of the fourth child is a housewife who is not registered with the employment center and was not fired due to the liquidation of the organization, then the amount of care pay will be minimal. The monthly benefit will be 6,752 rubles.

Maternity payments for the birth of 4 children for non-working women are issued through social protection authorities. You will need to have a certificate of incapacity with you. If the mother was fired due to the liquidation of the enterprise, then an extract from the work book and a certificate from the employment center declaring the woman unemployed should be prepared.

For individual entrepreneurs and military personnel

An individual entrepreneur can receive maternity benefits in full if he has timely transferred insurance contributions to the Social Insurance Fund. You should also submit an application for payment here.

Also, labor and care allowances for up to 1.5 years are provided to military personnel and full-time students of universities, technical schools, and vocational schools. In the first case, the mother will need to contact the commander at her place of duty. Students must submit a request to the dean's office of the educational institution.

What can you spend it on?

The payment is targeted. Spending funds under the state program is allowed only for certain purposes:

- improving living conditions (building a house, buying an apartment, a house, reconstructing a living space with an increase in area);

- payment of the first or next installment on a mortgage (housing) loan;

- payment for educational services for children;

- monthly allowance for a child under 3 years of age (for low-income families);

- to increase the funded part of the mother’s pension;

- payment for goods and services that help a child with a disability adapt to society.

Svetlana Anokhina

Social lawyer

Ask a Question

In most cases, you can use state support 3 years after the birth of a child (for more details, see the article “What can you use maternity capital for”). But if money is needed to pay the down payment on a mortgage loan, then the funds can be used immediately. The Pension Fund of the Russian Federation will also approve an application for disposal of certificate funds if maternal capital is used to pay for educational services for children or goods and services for a child with a disability.

Benefits for the birth of 4 children

In 2021, to apply for benefits for 4 children, the mother must submit the necessary package of documents to her employer.

If the mother does not have an official place of employment, then the collected documentation is sent to the social protection authority.

Procedure for applying for benefits:

- Collect the required package of papers.

- Make an application in the prescribed form.

- Send the collected documentation to the employer or social security authority.

- Wait for the commission's decision.

If the commission’s decision is positive, the family will receive funds in accordance with the established rules.

If a family is denied benefits, the notification sent will indicate the reason why this decision was made.

To apply for benefits, you must collect the following package of documents:

- an application drawn up according to the established template;

- parents' passports;

- confirmation of registration;

- children's birth certificates;

- a certificate from the employment center confirming the fact that the mother is not registered;

- family income certificate;

- a certificate confirming the fact that the family does not receive benefits.

It is important to understand that only people with Russian citizenship and registration in the country are entitled to receive benefits.

Tax

Financial assistance that mothers are entitled to when their fourth child is born is not taxed.

If a family is low-income, which is documented, then it is exempt from paying transport tax.

To apply for tax benefits, you must personally contact the Multifunctional Center or social protection authorities.

Transport

A transport benefit usually means free travel on intracity transport. In this case, the age of the child does not matter, since no restrictions are set.

Housing and communal services

Even if a family has been officially recognized as having many children, it is not exempt from the need to pay for housing and communal services. However, parents are entitled to the following benefits:

- Providing a discount of 30% to 50%. It is important to understand that each situation is considered individually, and the region in which the large family lives will also be taken into account.

- Relief from the state when paying for utility bills.

- Discount on waste removal service.

- Providing funds to pay for telephone services.

Education

Benefits in the field of education:

- free textbooks;

- extraordinary admission to kindergarten;

- compensation for the purchase of school uniforms (carried out annually);

- free meals in the school canteen;

- 100% discount for keeping a child in kindergarten;

- issuing vouchers to sanatoriums and children's camps.

Treatment

If we talk about benefits for families in the field of medicine, we can highlight:

- free medication provision for minors (with a prescription issued by the attending physician);

- free examination by a qualified specialist.

Land for many children

A large family can obtain ownership of a plot of land to build a house or run a personal subsidiary plot.

To register a plot of land as your own, you must submit a corresponding application to the local administration.

If a family is not recognized as in need of housing, it will be denied a plot of land.

A large family has the right to refuse a plot of land and receive funds. However, it is important to consider that the amount can only be used for the following purposes:

- Payment for purchased housing.

- Participation in shared construction.

- Down payment on a mortgage.

- Payment of an existing loan that was taken out to purchase a home.

Pension and labor benefits for large families in 2021

By going to work and drawing up an employment contract, a mother or father of many children can receive the following benefits:

- Early retirement of the mother under the following conditions:

- work experience from 15 years;

- age 56 years, if there are 4 children in the family;

- age 57 years, if there are 3 children in the family.

- Unpaid additional leave for two weeks, which, if desired, can be combined with the main one. An important condition is at least 3 minor children in the family.

- If there are 40 working hours in a week, you can get one auxiliary paid day off.

- 3a for each newborn - receiving additional pension points on leave to care for a child up to 1.5 years old. These points increase the size of the basic pension (every working year is assessed by pension points, on which the pension in the future depends). The sum of periods of maternity leave should not exceed six years.

Providing employment support for the population - home or temporary vacancies are considered.

In order for social support for large families to be realized and labor benefits to begin to be paid, it is necessary to write an appeal, providing the following documents:

- passport or other identification document of father, mother and children;

- a statement with information confirming the number of people in the family from the passport office;

- a salary certificate for each parent from the tax service;

- TIN for children;

- photographs of all adults and children over 6 years old.

How to get a subsidy for a large family to build a house or buy an apartment

In 2021, a special program for state subsidization of mortgage loans began to operate. Families with many children can take part in preferential mortgage lending at a rate of 6 percent. To obtain this advantage, the following factors are necessary:

- birth of the 3rd, 4th, etc. child after January 1, 2021, but not later than December 31, 2022;

- purchasing an apartment or house on the primary real estate market;

- 20% initial payment (more is possible) from your own money.

In April 2021, a law was adopted on the unlimited subsidization of mortgage loans under this program.

Features of demographic policy

The birth rate in our country is lower than the death rate. This means that there is a gradual natural population decline - several hundred thousand people a year. Although this is not so noticeable in general numbers, since the influx of migrants is taken into account. And this despite the active government policy in increasing the birth rate.

Today there are many state, regional and regional programs to support not only large families, but also parents with 1-2 children. They affect almost all areas of human life - work, finance, education, recreation, etc. It is quite difficult to list them all, and they also vary from region to region. But the main list is worth going through.

Tax discounts: what is due to large low-income families in 2021

To save money for parents with many children, Russia provides tax deductions - money on which income tax is not charged.

Tax deductions are divided into:

- social, i.e. one-time sums of money received back from the tax service;

- basic - means for every minor.

Conditions under which tax deductions are provided:

- child's age - up to 18 years;

- adult child in full-time education.

To take advantage of the benefit, parents of many children must provide their boss with:

- circulation on paper;

- child's birth certificate;

- certificate 2 forms of personal income tax.

What payments are due to large families in 2021 in Russia related to housing and land.

Parents with a large number of children can become the owner of a land area of up to 15 acres. The right to land presupposes the use of the plot for gardening, or the construction of a house or dacha. In their particular region, parents with large families can seek a piece of land of at least 6 acres.

Among other things, the legislator also considered other benefits related to the provision of housing:

housing subsidy for the construction of your own house (you can also pay off debt or interest on housing purchased with your own money);

under a rental agreement - free housing from social authorities; provision of an apartment owned by the state.

Help! An apartment that is given to large families as their own or for rent must be equipped with a sewerage system, electricity, heating and water supply.

Regional authorities have the right to provide a family with 3 or more children with a preferential loan, subsidy or interest-free loan. These benefits can be spent on building a residential building and purchasing construction materials.

What measures of social support are provided for large families

Families with many children have a number of auxiliary privileges in different types of services:

- 3 classes in clubs and sections in budgetary institutions of additional education at preferential prices.

- Exemption of children who are in school from paying for travel on city, suburban and intra-district transport.

- Immediate registration of the child in kindergarten.

- Obtaining new housing while demolishing the old one. The area of the new apartment or house will be equivalent to the previous one.

- By Decree of the President of the Russian Federation dated 05.05.1992 No. 431, large families can apply for free material assistance or loans without interest for the development of farms or gardens o-garden farming.

- A mother or father with many children has the right to get a new profession and change their specialty due to the lack of specific specialists in the field.

- Some regions exempt large families from land taxes and property taxes.

- Certain subjects of the Russian Federation present awards, New Year gifts, etc. to large families.

Help! To extend the status of a large family, when the eldest child turns 18 years old, it is necessary to provide the competent authorities with a student’s certificate, thereby proving his innocence cost-effectiveness in terms of money.

What privileges can a large family receive in Moscow?

The capital of the Russian Federation provides the following benefits:

- Parents: exemption from kindergarten fees;

- free travel on public transport;

- free car parking for up to 365 days;

- exemption from transport tax;

- once a month - free visit to museums, zoos, etc.;

- preferential prices for tickets to the Bolshoi Theater;

- obtaining a garden plot out of turn;

- free holidays in Moscow bathhouses;

- the right to subsidies for the construction of housing and its purchase;

- additional supplement to the pension of a mother with ten children;

- the right to short-term use of social housing (children must be 5).

- free lunch or discount on it;

- morning meals in primary schools are free of charge;

- admission to kindergarten without waiting in line;

Help! Free medicines in the capital can be obtained for minor children.

On the territory of Moscow and in many regions of the Russian Federation there are numerous social organizations, rehabilitation centers, shelters and organs that provide assistance from a psychologist and various teachers. for children from large families.

Procedure for applying for benefits

Before applying for regional benefits, a large family must contact the local social security authority to clarify the support programs available in the region.

After this, you need to take care of collecting documents confirming your right to receive benefits. Their list may vary from region to region, however, as a rule, all of them require the following papers:

- the applicant’s passport (copy, including the page indicating registration);

- birth certificates of children, marriage (divorce);

- certificate of family composition;

- certificate of family income.

As a rule, the regulations of local social security authorities establish a thirty-day period for considering an application for financial assistance.

Terms of service

According to legal regulations, to obtain a certificate you must:

- the mother has Russian citizenship, the stateless father can also receive a payment if the woman is denied it;

- birth must occur after January 2007;

- payment is provided once.

Important! The applicant does not have to reside in the country, but he must have a legal connection with the baby (established relationship or adoption).

If the parents were previously deprived of parental rights or received a cancellation of adoption, the payment is made to the children. At the same time, it is divided in equal parts between minor brothers and sisters.

Required documents

To become a certificate holder, you will need to document your right to receive it. The application must be supported by the following evidence:

- mother's civil passport;

- SNILS;

- children's birth certificates;

- documents confirming Russian citizenship for children;

- adoption certificate.

If the parents are deprived of their rights in relation to some children, then maternity capital can be obtained only for those of them in respect of whom parental rights have not been lost.

Receipt procedure

Within 5 working days after the birth of the baby, an electronic certificate form is sent to the mother’s personal account on the Pension Fund of Russia or State Services resource. The same period for consideration of the application is also provided for cases when parents personally apply to a government agency. Over the next day, the applicant is notified of the decision made. If it is positive, then you can go to the Pension Fund to get the document.

Other innovations

After the decision is made, an electronic document is generated, the data of which is recorded in the information system of the Pension Fund and sent to the mother’s personal account on the Pension Fund website or the State Services portal.