Definition of the concept of “inheritance”, “inherited mass”, “inherited property”

Within the meaning of Section V. of the Civil Code of the Russian Federation (“Inheritance Law”), the concepts of “inheritance”, “hereditary property” and “inherited estate” are identical.

Article 1112 of the Civil Code of the Russian Federation defines the object of the inheritance legal relationship, i.e. the composition of property transferred by inheritance from the testator to other persons (heirs).

In inheritance law, property is understood as broadly as possible - as a complex consisting of an asset (things, property rights) and a liability (property obligations) that belonged to the testator on the day the inheritance was opened. In other words, the inheritance represents the unity of rights (assets) and debts (liabilities) belonging to the testator on the day the inheritance was opened. In particular, the inheritance may include an enterprise as a property complex, which includes things, property rights and obligations.

Inheritance is property that passes by inheritance from the deceased (testator) to the heirs. May include property rights, other real rights, exclusive rights to the results of intellectual activity, as well as obligations encumbering these rights, with the exception of those inextricably linked with the personality of the deceased (Big Legal Dictionary. - M.: Infra-M. A. Ya. Sukharev, V. E. Krutskikh, A. Ya. Sukhareva. 2003.).

Inheritance (Latin patrimonium, bona heredita-ria; successio; hereditas; English inheritance, heirdom) - property rights and obligations that pass after the death of the owner (testator) to another person (heir) in the order of inheritance. Inheritance in the material sense is also called inheritance mass. To acquire an inheritance, the heir must accept it. Acceptance of an inheritance under conditions or with reservations is not allowed in the Russian Federation (Encyclopedia of Law. 2015).

The procedure for forming the hereditary mass

As mentioned above, you can only inherit all property, that is, get an apartment, but refusing to pay taxes on it is unacceptable.

There are two options for resolving situations:

- Receipt of all assets and liabilities of the deceased. That is, not only those rights, the receipt of which will be beneficial to the heir;

- Refusal of all inheritance. No one obliges you to accept an inheritance. The heir has the right to refuse to participate in the division of property, both in favor of another heir, and without specifying the relevant persons.

It is important to know that the refusal is irreversible, that is, it will no longer be possible to restore your rights to the inheritance.

The procedure for forming an inheritance mass is strictly defined and consists of including or excluding property from the general list.

Read also: How to inherit under a will

The procedure for including an inheritance in the estate can proceed as follows:

- If a will serves as justification, then a list of objects is already written in it, indicating all the necessary characteristics;

- In the absence of a will, a list of property is drawn up in the form of an appendix (inventory) in the presence of two witnesses, as well as heirs, indicating a list of inheritance, documents confirming the deceased’s ownership of objects, descriptions of objects of inheritance, and an indication of the approximate cost.

The said document is signed by the heirs, a notary, and also witnesses. If you disagree about the amount of property included in the inheritance, you can appeal the notary’s decision in court. After the court has established the fact that any property belonged to the deceased, it will also be included in the general list of the inheritance estate.

Exclusion of property from the inheritance mass is also possible on the basis of a trial, following which the court will make a decision to remove any object from the list. Any of the heirs can make such a statement to the justice authorities, if there is significant evidence of the illegality of including the property in the total estate.

As an example, we can cite a widow’s statement of disagreement with the inclusion of a jointly owned residential building in the general list of inheritance, since, according to the current legislation, the share should go to her.

What is included in the inheritance?

In accordance with paragraph 14 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated May 29, 2012 No. 9 “On judicial practice in inheritance cases,” the inheritance includes the property belonging to the testator on the day the inheritance was opened, in particular:

- things, including money and securities (Article 128 of the Civil Code of the Russian Federation);

- property rights (including rights arising from contracts concluded by the testator, unless otherwise provided by law or contract; exclusive rights to the results of intellectual activity or to means of individualization; rights to receive sums of money awarded to the testator, but not received by him);

- property obligations, including debts within the value of the inherited property transferred to the heirs (clause 1 of Article 1175 of the Civil Code of the Russian Federation).

In accordance with Art. 128 of the Civil Code of the Russian Federation, objects of civil rights include things, including cash and documentary securities, other property, including non-cash funds, uncertificated securities, property rights; results of work and provision of services; protected results of intellectual activity and means of individualization equivalent to them (intellectual property); intangible benefits.

As can be seen from the definition of Art. 128 of the Civil Code of the Russian Federation, such objects of civil rights as non-cash funds and uncertificated securities belong to other property and, accordingly, can also be inherited.

Based on Art. 129 of the Civil Code of the Russian Federation, objects of civil rights can be freely alienated or transferred from one person to another in the order of universal succession (inheritance, reorganization of a legal entity) or in another way, if they are not limited in circulation.

The law may introduce restrictions on the negotiability of objects of civil rights; in particular, it may provide for types of objects of civil rights that can belong only to certain participants in the turnover or transactions with which are permitted with a special permit.

What property can be included in the inheritance mass?

Inheritance of the property of the deceased is carried out in accordance with the current civil legislation of the Russian Federation.

Debt obligations include promissory notes, issued loans, and the obligation to make payments under the agreement.

Hereditary succession arises upon the death of a citizen, involving the transfer of various items of heritage to a potential new owner and includes:

- real estate (house, apartment, garage, non-residential building, land plot);

- movable property (transport, furniture, equipment, jewelry);

- cash, deposit account, securities and so on.

To add any form of property to the estate, the future owner will need to provide the notary with documentary evidence of the testator's right to own and dispose of this property.

The estate of inheritance may include other personal belongings of the testator.

Recommended reading: Where is a will kept until death?

If for some reason the property was not privatized or the registration procedure was not completed, it is allowed to complete the process in person or resolve the issue through the court. Properly carried out registration allows you to attach the property to the inheritance mass.

If anything unclear arises, it is recommended to seek legal advice.

What is not included in the inheritance?

Paragraph 3 of Article 1112 of the Civil Code of the Russian Federation states that such intangible benefits as:

- life and health,

- personal dignity,

- personal integrity,

- honor and good name,

- business reputation,

- privacy,

- inviolability of home,

- personal and family secrets,

- freedom of movement,

- freedom to choose place of stay and residence,

- citizen's name,

- authorship,

- other intangible benefits.

The intangible benefits listed in Article 150 of the Civil Code of the Russian Federation are inalienable and non-transferable in any way.

The rights and obligations that are inextricably linked with the personality of the testator are not included in the inheritance

- right to alimony,

- the right to compensation for harm caused to the life or health of a citizen,

- rights and obligations, the transfer of which by inheritance is not permitted by the Civil Code or other laws.

According to paragraph 15 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated May 29, 2012 No. 9 “On judicial practice in inheritance cases,” the inheritance also does not include “rights and obligations arising from contracts:

- free use (Article 701 of the Civil Code of the Russian Federation),

- instructions (clause 1 of Article 977 of the Civil Code of the Russian Federation),

- commission (part one of Article 1002 of the Civil Code of the Russian Federation),

- agency agreement (Article 1010 of the Civil Code of the Russian Federation).”

Norms of the Civil Code of the Russian Federation that do not allow inheritance of rights and obligations

A number of rights and obligations of the testator arising from an agreement or other transaction do not pass to his heirs, that is, they cease with the death of the testator. For example, the testator was given a power of attorney to complete a transaction. In the event of the death of the testator, his heirs do not acquire the right to perform the actions specified in this power of attorney. The following provisions of the Civil Code of the Russian Federation do not allow inheritance of rights and obligations:

- the power of attorney is terminated due to the death of the citizen who issued the power of attorney, the death of the citizen to whom the power of attorney was issued (clause 1 of Article 188 of the Civil Code of the Russian Federation);

- the obligation is terminated by the death of the debtor if the performance cannot be carried out without the personal participation of the debtor or the obligation is otherwise inextricably linked with the personality of the debtor. An obligation is terminated by the death of the creditor if the performance is intended personally for the creditor or the obligation is otherwise inextricably linked with the personality of the creditor (Article 418 of the Civil Code of the Russian Federation);

- The rights of the donee, who is promised a gift under a gift agreement, do not pass to his heirs (legal successors), unless otherwise provided by the gift agreement. At the same time, the obligations of the donor who promised the donation pass to his heirs (legal successors), unless otherwise provided by the donation agreement (Article 581 of the Civil Code of the Russian Federation);

- in the event of the death of one of the annuity recipients, his share in the right to receive annuity passes to the surviving annuity recipients, unless otherwise provided by the life annuity agreement, and in the event of the death of the last annuity recipient, the obligation to pay the annuity is terminated (clause 2 of Article 596 of the Civil Code of the Russian Federation);

- the agreement for gratuitous use is terminated in the event of the death of the citizen-borrower, unless otherwise provided by the agreement (Article 701 of the Civil Code of the Russian Federation);

- the agency agreement is terminated due to the death of the principal or attorney, recognition of one of them as incompetent, partially capable or missing (Article 977 of the Civil Code of the Russian Federation);

- the commission agreement is terminated due to the death of the commission agent, recognition of him as incompetent, partially capable or missing (Article 1002 of the Civil Code of the Russian Federation);

- the agency agreement is terminated due to the death of the agent, recognition of him as incompetent, partially capable or missing (Article 1010 of the Civil Code of the Russian Federation);

- a property trust management agreement is terminated due to the death of a citizen who is a trustee, recognition of him as incapacitated, partially incapacitated or missing, as well as recognition of an individual entrepreneur as insolvent (bankrupt) (Article 1024 of the Civil Code of the Russian Federation);

- in the event of the death of the copyright holder, his rights and obligations under the commercial concession agreement pass to the heir, provided that he is registered or registers as an individual entrepreneur within six months from the date of opening of the inheritance. Otherwise, the contract is terminated (Article 1038 of the Civil Code of the Russian Federation);

- the right to receive a testamentary refusal is valid for three years from the date of opening of the inheritance and does not pass to other persons (clause 4 of Article 1137 of the Civil Code of the Russian Federation);

- the right to accept an inheritance in the order of hereditary transmission is not included in the inheritance opened after the death of such an heir (clause 1 of Article 1156 of the Civil Code of the Russian Federation);

- state awards that were awarded to the testator and which are subject to the legislation on state awards of the Russian Federation are not included in the inheritance. The transfer of these awards after the death of the recipient to other persons is carried out in the manner established by the legislation on state awards of the Russian Federation (Article 1185 of the Civil Code of the Russian Federation);

Provisions of other laws that do not allow inheritance of rights and obligations

Examples of other legal provisions that prohibit inheritance of certain types of property (both rights and obligations) are the following.

- the obligation to pay a tax and (or) fee terminates with the death of an individual - the taxpayer or with the declaration of his death in the manner established by the civil procedural legislation of the Russian Federation (clause 3 of clause 3 of Article 44 of the Tax Code of the Russian Federation). At the same time, the debt of a deceased person or a person declared dead for transport tax, land tax and personal income tax is repaid by the heirs within the limits of the value of the inherited property;

- wages not received by the day of the employee’s death are issued to members of his family or to a person who was dependent on the deceased on the day of his death. Payment of wages is made no later than a week from the date of submission of the relevant documents to the employer (Article 141 of the Labor Code of the Russian Federation);

- payment of alimony collected in court is terminated by the death of the person receiving alimony or the person obligated to pay alimony (clause 2 of Article 120 of the RF IC);

- the social rental contract for residential premises is terminated due to the loss (destruction) of the residential premises, with the death of the tenant who lived alone (clause 5 of Article 83 of the Housing Code of the Russian Federation);

- subsoil plots cannot be the subject of inheritance (Article 1.2 of the Law of the Russian Federation of February 21, 1992 N 2395-1 “On Subsoil”);

- accrued amounts of funded pension due to the insured person in the current month and remaining not received due to his death in the specified month are not included in the inheritance and are paid to those members of his family who belong to the persons specified in Part 2 of Article 10 of the Federal Law " On insurance pensions” and lived together with this insured person on the day of his death, if the application for the unreceived amounts of the specified pension followed no later than six months from the date of death of the insured person. When several family members apply for the specified amounts of funded pension, the amounts of funded pension due to them are divided equally between them (clause 3 of Article 13 of the Federal Law of December 28, 2013 N 424-FZ (as amended on March 7, 2018) “On Funded Pension”) ;

- sale, donation and inheritance of combat short-barreled hand-held award weapons are not allowed (Article 20.1 of the Federal Law of December 13, 1996 N 150-FZ (as amended on March 7, 2018) “On Weapons”). At the same time, donation and inheritance of civilian weapons registered with the federal executive body authorized in the field of arms trafficking, or its territorial body, are carried out in the manner determined by the legislation of the Russian Federation, if the heir or the person in whose favor the donation is made, licenses for the purchase of civilian weapons (Article 20 of Law No. 150-FZ “On Weapons”).

Actions with inheritance mass

Inherited property can be added to, reduced, accepted or renounced.

If the testator does not have documents on the right of ownership, or the papers were filled out with errors, then the property cannot be included in the total estate.

If there are disagreements with the composition of the inherited property, potential heirs must, within six months from the moment the notary office opens the inheritance case, send a claim to the district judicial authority.

There are different types of property that are subject to inheritance:

- membership in economic and consumer cooperatives;

- organization or production;

- ownership of a farm participant;

- items of limited circulation;

- territorial allotments;

- unpaid funds that are the main source of livelihood of the testator;

- state awards, orders and so on.

The succession of rights from these categories is carried out according to a special procedure prescribed by Chapter 65 of the current Civil Legislation.

The deceased’s existing production (firm, company) is accepted along with current expenses and debts. It is impossible to make only profit or lead an organization without paying off debt obligations.

Acceptance of an inheritance within a period of six months from the date of death of the testator is formalized by a notary. To do this, future owners must themselves come to the notary firm located closest to the inherited property and submit an application about their desire to acquire inheritance rights. The following documents must be attached:

- the applicant's identity card;

- grounds for ownership of property by the testator;

- confirmation of the status of the successor (marriage certificate, birth certificate, change of surname, will);

- death certificate of the person;

- receipt of payment of state duty.

Entering into inheritance rights is not mandatory. If a potential successor does not want to become the owner of the inheritance, a written refusal must be drawn up. Absolute refusal or in someone else's favor is allowed.

We recommend reading: Register of inheritance cases of the unified notary information system

In relation to the legal aspects of inheritance proceedings, the heir can receive either everything he is entitled to or nothing. For example, if the testator left a private house and apartment to the successor, then you cannot choose one thing: the successor must accept all the benefits of the deceased.

When the now deceased makes a will concerning the distribution of the inheritance in part, then the part that is not indicated within the last will of the testator is subject to inclusion in the estate of the legal heirs.

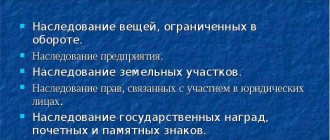

Features of inheritance of certain types of property

Chapter 65 of the Civil Code of the Russian Federation is devoted to the peculiarities of inheritance of certain types of property, which includes the following articles:

- Inheritance of rights related to participation in business partnerships and societies, production cooperatives (Article 1176 of the Civil Code of the Russian Federation)

- Inheritance of rights related to participation in a consumer cooperative (Article 1177 of the Civil Code of the Russian Federation)

- Inheritance of an enterprise (Article 1178 of the Civil Code of the Russian Federation)

- Inheritance of property of a member of a peasant (farm) enterprise (Article 1179 of the Civil Code of the Russian Federation)

- Inheritance of things with limited negotiability (Article 1180 of the Civil Code of the Russian Federation)

- Inheritance of land plots (Article 1181 of the Civil Code of the Russian Federation)

- Features of the division of a land plot (Article 1182 of the Civil Code of the Russian Federation)

- Inheritance of unpaid amounts provided to a citizen as a means of subsistence (Article 1183 of the Civil Code of the Russian Federation)

- Inheritance of property provided to the testator by the state or municipality on preferential terms (Article 1184 of the Civil Code of the Russian Federation)

- Inheritance of state awards, honorary and memorable signs (Article 1185 of the Civil Code of the Russian Federation)

1) Compensation for harm

The right to compensation for harm caused to the life or health of the victim is not included in the inheritance; the inheritance includes claims for the collection of amounts actually accrued as compensation for damages, but not paid to him during his lifetime.

The Plenum of the Supreme Court of the Russian Federation in Resolution No. 1 of January 26, 2010 “On the application by courts of civil legislation regulating relations under obligations resulting from harm to the life or health of a citizen” indicated the following:

“Since, by virtue of Part 2 of Art. 1112 of the Civil Code of the Russian Federation, the right to compensation for harm caused to the life or health of the victim is not included in the inheritance; his heirs have the right to file independent claims in court or enter into the process in the manner of procedural succession (Article 44 of the Civil Procedure Code of the Russian Federation) only for claims for actual recovery accrued to the victim as compensation for harm, but amounts not paid to him during his lifetime.”

The inheritance includes monetary compensation for moral damage awarded to the rehabilitated person, but not received by him during his lifetime

His heirs have the right to demand compensation for property damage caused to the rehabilitated person in the event of his death.

Considering that the right to compensation for moral damage in monetary terms is inextricably linked with the personality of the rehabilitated person, in accordance with Article 1112 of the Civil Code of the Russian Federation, it is not part of the inheritance and cannot be transferred by inheritance. Therefore, in the event of the death of the rehabilitated person before the resolution of the claim filed by him in court for compensation for moral damage, the proceedings in the case are subject to termination on the basis of paragraph seven of Article 220 of the Code of Civil Procedure of the Russian Federation.

Courts must keep in mind that monetary compensation for moral damage awarded to a rehabilitated person, but not received by him during his lifetime, is included in the inheritance (clause 24 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated November 29, 2011 N 17 (as amended on April 2, 2013) “On practice of application by courts of the norms of Chapter 18 of the Criminal Procedure Code of the Russian Federation, regulating rehabilitation in criminal proceedings”).

2) Rights and obligations from the transactions of the testator

The obligations of the seller under the purchase and sale agreement pass to his heirs

Based on Articles 58, 1110 and 1112 of the Civil Code of the Russian Federation, the seller’s obligations under the sales contract are transferred to his universal legal successors. Therefore, the buyer of real estate has the right to file a claim for state registration of the transfer of ownership (Article 551 of the Civil Code of the Russian Federation) to the heirs or other universal legal successors of the seller (clause 62 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 10, Plenum of the Supreme Arbitration Court of the Russian Federation No. 22 of April 29, 2010 (in ed. dated June 23, 2015) “On some issues arising in judicial practice when resolving disputes related to the protection of property rights and other property rights”).

Inclusion in the estate of an apartment that the testator did not have time to privatize

By inheritance, not only already existing rights and obligations are transferred, but in cases provided for by law, also rights that the testator did not have time to legally formalize during his lifetime, but took the necessary measures to obtain them. Thus, in paragraph 8 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of August 24, 1993 No. 8 “On some issues of application by courts of the Law of the Russian Federation “On the privatization of housing stock”” the following is stated:

“If a citizen who submitted an application for privatization and the necessary documents for this died before the execution of an agreement for the transfer of residential premises into ownership or before the state registration of property rights, then in the event of a dispute regarding the inclusion of this residential premises or part of it in the inheritance estate, it is necessary to have in view that this circumstance in itself cannot serve as a basis for refusing to satisfy the heir’s claim if the testator, having expressed his will during his lifetime to privatize the occupied residential premises, did not withdraw his application, since for reasons beyond his control he was deprived of the opportunity to comply with all rules for processing documents for privatization, which he could not be denied.”

Inclusion of residential premises in the estate in the case where the testator filed an application for privatization, but died before the agreement was executed

The inclusion of residential premises in the estate at the request of the heir is permitted in the case where a citizen (testator), who wanted to privatize the residential premises, submitted an application for privatization and all the documents necessary for this, did not withdraw it, but died before the execution of the contract for the transfer of residential premises to property (before state registration of property rights).

The mere desire of a citizen to privatize residential premises occupied under a social tenancy agreement, in the absence of mandatory actions on his part (application during his lifetime personally or through a representative with a corresponding application and the necessary documents to the authorized body) by virtue of the provisions of Art. 2, 7, 8 of the Law of the Russian Federation “On the privatization of housing stock in the Russian Federation” and the explanations on their application contained in paragraph 8 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated August 24, 1993 No. 8, cannot serve as a legal basis for the inclusion of residential premises after death of a citizen into the inheritance estate and recognition of the heir's right of ownership of this residential premises (clause 10 of the Review of Judicial Practice of the Supreme Court of the Russian Federation No. 1 (2017), approved by the Presidium of the Supreme Court of the Russian Federation on February 16, 2017) (as amended on April 26 .2017)

Real estate that the testator managed to dispose of but died before the state registration of the transaction is not included in the inheritance.

Property in respect of which the testator has expressed his will regarding its legal fate, that is, has disposed of it, is not included in the inheritance. So, for example, when considering a case on a claim for recognition of a gift agreement and registered property rights as invalid, recognition of property rights by inheritance, the court indicated the following:

“Since the donor Korotich A.M. personally participated in the conclusion of the gift agreement and the execution of a power of attorney for the registration of this agreement, thereby expressing her will to conclude and state registration of this transaction, the application for registration was submitted by power of attorney during the life of the donor and was not revoked by it, then the fact of the death of the donor in itself in the process of state registration of rights is not a basis for invalidating a gift agreement and the donee’s ownership of the disputed property registered on its basis” (Decision of the Supreme Court of the Russian Federation dated July 19, 2011 N 24-B11-2).

Interest on the use of the loan amount is payable by the borrower's heirs from the moment the inheritance is opened

Unlike interest for late fulfillment of a monetary obligation, interest for the use of the loan amount is payable by the borrower's heirs from the moment the inheritance is opened.

The obligations arising from the loan agreement do not cease with the death of the debtor and are included in the inheritance.

Within the meaning of these explanations, the obligation to pay interest for the use of funds is included in the inheritance, these interests continue to accrue even after the opening of the inheritance, and the interest provided for in Art. 395 of the Civil Code of the Russian Federation, which is a measure of liability for failure to fulfill a monetary obligation, are not accrued for the time required to accept an inheritance (clause 10 of the “Review of the judicial practice of the Supreme Court of the Russian Federation No. 2 (2018)”, approved by the Presidium of the Supreme Court of the Russian Federation on July 4, 2018) .

The heir of the debtor who accepts the inheritance becomes a debtor to the creditor within the limits of the value of the inheritance transferred to him. Collection of credit debt is possible from a guarantor within the limits of the value of the inherited property

“Question 1: Is it possible to collect a credit debt in the event of the death of a debtor from a guarantor (who, under an agreement with a credit institution, is jointly and severally liable with the debtor in the event of non-fulfillment or improper fulfillment of his obligation to repay the loan, and is also responsible for any new debtor), if Are there heirs of the debtor and inherited property? What if there is no inherited property?

Answer: ...The heir of the debtor, subject to his acceptance of the inheritance, becomes a debtor to the creditor to the extent of the value of the inherited property transferred to him. In the absence or insufficiency of inherited property, the loan obligation is terminated by the impossibility of fulfillment, respectively, in full or in the missing part of the inherited property (clause 1 of Article 416 of the Civil Code of the Russian Federation).

.. The guarantee terminates to the extent that the obligation secured by it terminates, and the guarantor must be liable to the creditor within the limits of the value of the inherited property.

Thus, in the event of the death of the debtor and in the presence of heirs and inherited property, collection of credit debt is possible from the guarantor within the limits of the value of the inherited property (if in the agreement of the guarantor with the credit organization the guarantor agreed to the creditor to be responsible for the new debtor) (question 1 of the Review of Legislation and Judicial practice of the Supreme Court of the Russian Federation for the first quarter of 2008", approved by the Resolution of the Presidium of the Supreme Court of the Russian Federation dated May 28, 2008) (as amended on October 10, 2012).

Bankruptcy of the estate

This publication continues the study of the construction of bankruptcy of a deceased citizen, new to domestic law (hereinafter referred to as bankruptcy of an inheritance, bankruptcy of an inherited estate).[1]

Russian inheritance law traditionally uses a system of liability of heirs for the debts of the testator within the limits of the value of the inheritance (pro viribus hereditatis). The creditor of the testator becomes the creditor of the heir who accepted the inheritance. The value of the inheritance is determined at the time of its opening. The inheritance mass merges with the heir's property: the bailiff, who enforces the claims of the testator's creditor, is authorized to foreclose both on the inherited property and on other property of the heir; The heir's personal creditors have the right to satisfy their claims at the expense of the inherited property. The limit of liability is established ipso jure and does not require the heir to draw up an inventory of all inherited property known to him under the threat of full liability for dishonest behavior. The placement of an inheritance under the regime of administration for the purpose of paying off the debts of the inheritance and the subsequent distribution of the net balance is unknown to Russian inheritance law.

During the Soviet period, when, due to economic and political principles, a citizen did not have a large amount of property, especially located in different states, and could not be enmeshed in debt, this simple mechanism was sufficient. The developers of the Civil Code of the Russian Federation in 2002 chose to maintain the existing model, somewhat strengthening the position of the testator's creditor: the liability of co-heirs became joint and several, the imperative challenge of creditors under the threat of loss of rights was abolished, and individual creditors (Article 1174 of the Civil Code of the Russian Federation) received priority.

Over the years of work in new economic conditions, a number of shortcomings of the model have emerged.[2]

1.1. “Incentivizing” heirs to conceal inherited property. The judicial practice of collecting the testator's debts from heirs is based on a dispute considered in 1951 by the Supreme Court of the USSR regarding the collection of debt from the widow of citizen Koikhman, who did not hand over accountable money to the company's cash desk. Then the Supreme Court of the USSR came to the conclusion that the burden of proving the composition of the inheritance lies with the creditor. The Supreme Court of the Russian Federation also proceeds from the assignment of proof of the composition and value of the inheritance to the creditor, pointing to the relief of the burden through judicial assistance (determination of the Supreme Court of the Russian Federation of May 10, 2016 N 5-KG16-60, determination of the Supreme Court of the Russian Federation of June 28, 2016 No. 18-KG16 -58, determination of the RF Armed Forces dated April 18, 2021 No. 18-KG17-3).

1.2. The emergence of the problem of a confluence of creditors, previously considered exotic. In order to calculate the limit of liability, the court considering the claim of the testator's creditor against the heir establishes the total amount of the testator's debts and reduces the asset of the inheritance by the amount of other known claims of creditors (determination of the Supreme Court of the Russian Federation of June 9, 2015 No. 89-KG15-3).[3] The question of the relationship between the identification of another debt of the testator and the already completed judicial act remains open.[4]

1.3. Property alienated by the testator during his lifetime is inaccessible to the testator's creditors. The heir is liable to the extent of the value of the estate. Thus, property donated to the chosen successor, received by him under an annuity agreement or as an insurance payment under a combined personal insurance agreement, as well as property aimed at repaying a debt by the testator to one of the creditors, is not taken into account when calculating the value of the inheritance. In egregious cases, bypassed creditors still have the opportunity to seek to challenge the transaction under clause 4 of Art. 1 or according to Art. 10 of the Civil Code of the Russian Federation[5].

1.4. Competition between the heir's personal creditors and the testator's creditors. The testator's creditors do not have advantages over the heir's personal creditors when satisfying claims at the expense of inherited property. The belated creditor of the testator still has the opportunity to seek redistribution of the execution performed in the bankruptcy case of the heir.

1.5. Attribution to the heir of financial risks arising during the deadlines for acceptance of inheritance and registration of inheritance rights. If, for example, the testator’s shares fall in price shortly after the opening of the inheritance, the heir, despite his lack of ability to manage securities, will be liable for the testator’s debts based on the pre-crisis value of the property (paragraph 61 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated May 29, 2012 No. No. 9).

1.6. Termination of bankruptcy proceedings in the event of the death of an individual entrepreneur who is a debtor. Succession and continuation of the procedure for the first time in Russian law was formulated by the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 4, 2013 in case No. 17530/12.

II.

On October 1, 2015, simultaneously with the emergence of bankruptcy of citizens in Russia, Art. 223.1 of the Bankruptcy Law (currently this article is in force as amended by Federal Law No. 391-FZ of December 29, 2015), allowing bankruptcy of an inheritance.

Comparative law reveals a variety of approaches in this area: from detailed regulation of the insolvency of inheritance (Germany, England) to the absence of a bankruptcy regime for a testator who was not an entrepreneur (Italy)[6].

The possibility of initiating a case of insolvency of a citizen after his death makes it possible to effectively solve some of the previously identified problems. Bankruptcy of an estate is based on the principle of liability by inheritance (cum viribus hereditatis). The property of the deceased is separated from the personal property of the heirs and the claims of their personal creditors. The search for an inheritance by a financial manager is more effective than the assistance of the court, especially in cases of foreign, in particular, English assets.[7] The testator's creditors receive proportional satisfaction (taking into account general and special hereditary seniority) through the sale of the inheritance, that is, due to what the creditor had the right to count on if the testator were alive. Additionally, it becomes possible to challenge transactions made by the testator during his lifetime on bankruptcy grounds. In addition, the heirs, without refusing to accept the inheritance, have the right, by initiating bankruptcy proceedings against the testator, to protect their personal property from foreclosure on the debts of the inheritance.

Judicial practice and doctrine perceived the new institution very warily. Let's look at some issues that have caused mixed understanding.

2.1. The heirs have registered rights to all or part of the inherited property. Is it still possible for the estate to become bankrupt?

The thesis that after registration of rights to inherited property (or even after acceptance) the inheritance ceases to exist separately and, as a consequence, the possibility of its bankruptcy is lost, in our opinion, contradicts the idea of the insolvency of the inherited mass.[8] The right of the testator's creditor to separate the inheritance from the property of the heirs should not depend on the efficiency of the latter and the onset of deadlines for the fulfillment of the testator's obligations. Otherwise, the benefits of separation exist for the most part based on the goodwill of the heirs (a certificate of the right to inheritance, if the circle of called heirs is indisputable, can be issued before the expiration of the six-month period (clause 2 of Article 1163 of the Civil Code)). On the contrary, all the property of the testator distributed among the heirs, its increments (interest on deposits, dividends on shares, rent, royalties), objects received in exchange for those alienated or unjust enrichment (money proceeds from the sale; amounts saved by the heirs as a result of paying off their own debts due to inheritance) are subject to inclusion in the bankruptcy estate. The financial manager has the right to claim property from the heirs who accepted the inheritance, despite the fact that they remain the owners of the estate.[9] The justified desire of the creditor to receive the debt in full should not be countered by the argument about the difficulty of collecting property. If we take into account the experience of German colleagues, then the creditor’s right to initiate bankruptcy of the inheritance ceases not from the moment of acceptance of the inheritance or its distribution among co-heirs (§ 316 (2) InsO), but with the expiration of a two-year period from the date of acceptance of the inheritance (§ 319 InsO), which is an indicator of the undesirability of separation after a long time.

2.2. The creditor has a court decision denying the claim due to reaching the limit of the heir's liability. Can such a creditor be a petitioner in an estate bankruptcy case?

The creditor's claim regarding the insufficiency of property is qualified by the plenum of the RF Armed Forces as terminated due to the impossibility of fulfillment (paragraph 4, clause 60 of the Resolution of the Plenum of the RF Armed Forces dated May 29, 2012 No. 9). However, in bankruptcy, this clarification should not be applied, in our opinion. Competition is available both when the inheritance is scarce, and in the case of one creditor being ahead of another. The task of repaying the testator's debts in full is carried out by redistributing previously performed execution, bringing unscrupulous heirs to personal liability, and finding property alienated before the opening of the inheritance to the detriment of the interests of creditors. Thus, a judicial act dismissing a claim against the heir in connection with reaching the limit of liability, while confirming the existence of the testator’s debt, should provide the right to initiate bankruptcy of the estate. Similar reasoning applies to an application for inclusion of a deceased citizen in the register of creditors.

2.3. Can an heir be held vicariously liable for actions in managing the inheritance that preceded the initiation of bankruptcy proceedings?

Let's say that the heir repaid the debt of one creditor of the testator, knowing about the presence of other creditors and the insufficiency of the inheritance. Let us assume that the repayment was made more than six months before the initiation of bankruptcy proceedings, and the satisfied creditor knew nothing and should not have known about the insolvency of the inheritance[10]. The heir, taking the place of the testator, has the right to pay creditors in any order, since the procedure for liquidating an inheritance is unknown to Russian inheritance law. However, in our opinion, subsequent separation means applying the standard of conduct of a conscientious and reasonable manager to the previous actions of the heir. By comparison, the German model applies the attorney standard (§1978 (1) BGB) to the behavior of the heir in the event of a subsequent bankruptcy of the estate. Thus, in the above example, the financial manager has the right to hold the heir personally liable. The situation is more complicated in a situation of unintentional harm to the interests of creditors. For example, the heir, in pursuit of high interest, transferred the testator's deposit to a bank whose license was subsequently revoked; the heir is inactive and does not initiate bankruptcy of the inheritance for a long time (Russian law does not impose such an obligation on him), allowing the debt to the testator's creditors to grow. In our opinion, the basis for imposing personal liability is the gross negligence of the heir. In relation to the behavior of a trustee of an inheritance (Articles 1135, 1173 of the Civil Code of the Russian Federation), who is also responsible to the estate and worked for a fee, the standard of behavior should be higher.

Does a creditor of the testator have the right to initiate bankruptcy of the heir rather than the estate?

The debtor of the testator's creditor from the moment of opening of the inheritance is the heir who accepted the inheritance. Preservation of the inheritance in a separate state under Russian law does not limit the claim of the testator's creditor to the composition of the inheritance mass. Arguing consistently, the creditor of the testator has the right to pursue any assets of the heir in enforcement proceedings and even initiate the personal bankruptcy of the latter (enter into an existing bankruptcy case). At the same time, the creditor of the testator has the right to initiate bankruptcy proceedings against the estate, which precludes further recovery from the heir. Does Art. 223.1 of the Bankruptcy Law, does the creditor have a choice between the bankruptcy of the heir and the bankruptcy of the inheritance, or is the creditor of the testator limited to the possibility of bankruptcy of the inheritance? German bankruptcy law allows the bankruptcy of an heir who has not limited his liability for the debts of the testator (§ 331 (1) InsO).[11] In our opinion, the creditor also has the right to choose under the Russian model. This option encourages heirs who receive property gratuitously to settle accounts with the testator’s creditors, and if the insolvency of the inheritance is revealed, to promptly initiate bankruptcy proceedings of the inheritance on their own initiative.

Of course, the creditor of the testator does not have the right to claim double satisfaction (at the expense of the separated insolvent estate and at the expense of the heir’s personal property). Bankruptcy of the inheritance can be initiated by any of the testator's creditors if the amount of debt is sufficient, or by any heir who has accepted the inheritance. As already mentioned, the consequence of initiating bankruptcy proceedings against an inheritance is the exclusion of further recovery from the heir. Someone alone decides for everyone. However, what about the “success” that creditors have developed in relation to heirs (initiated enforcement proceedings, imposed arrests, initiated bankruptcies)? The German approach offers a “retreat” to the bankruptcy of an inheritance, except in cases where the heirs bear punitive unlimited liability for actions related to concealment or distortion of the state of the inheritance (§§ 2005, 2013 BGB). In a bankruptcy case of an heir, creditors receive the inheritance that was not received in the bankruptcy case. Russian inheritance law does not know the construction of unlimited liability of the heir for the debts of the testator. At the same time, the discussion about creditors preserving their claims as a sanction for the inaction of the heirs can be fruitful.[12]

III.

Due to the laconic and somewhat hasty text of Art. 223.1, a number of wordings of the law require judicial interpretation.

3.1. Legatees (Article 1137 of the Civil Code), who are creditors of the heirs within the limits of the net value of the inheritance, did not come to the attention of the legislator. If judicial practice does not resort to a broad interpretation of the term “bankruptcy creditor” for the purposes of bankruptcy of an inheritance, then these persons will have to wait for the completion of the procedure and the distribution of the net balance among the heirs. The law enforcer has the opportunity to build on the wording of paragraph. 3 clause 48 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of October 13, 2015 No. 45 on the creditors of the heir, obligations to whom arose in connection with the inheritance.

3.2. The law does not separately regulate the situation of co-heirs, which most often occurs in practice. Apparently, the court, when making a decision on a case of bankruptcy of an inheritance initiated on the basis of an application from one of the heirs, will take into account the position of the other heirs.

3.3. The law does not mention such a common situation when there is no notarial inheritance file. For example, the heir continues to live in the apartment of the testator, who is enmeshed in debt, thereby accepting the inheritance (clause 2 of Article 1153 of the Civil Code). It is likely that the bankruptcy court, even in the absence of an inheritance case, is competent to initiate and consider a case of bankruptcy of the inheritance. The circle of heirs who accepted the inheritance, and therefore the circle of persons participating in the case of bankruptcy of the inheritance, will be determined by the court independently, without the assistance of a notary. In itself, the expression of the heir’s will to participate in the bankruptcy case, in our opinion, qualifies as an action aimed at determining the fate of the inherited mass, i.e. acceptance of inheritance. And if there is an inheritance file, information about the heirs who accepted the inheritance through actual actions may not be included in the materials of the notary file.

3.4. Paragraph 1 clause 4 art. 223.1 of the Bankruptcy Law connects the possibility of the heir exercising the rights and obligations of the testator (debtor) in a bankruptcy case with the expiration of the period for accepting the inheritance. The legislator proceeded from the fact that before the expiration of the period for accepting the inheritance, the circle of successors of the testator is not completely clear. Since one of the heirs, as a general rule, should not decide for all the others, concluding a settlement agreement before the expiration of the period for accepting the inheritance is prohibited. At the same time, a case of bankruptcy of an inheritance can be initiated before the expiration of the period for acceptance of the inheritance (for example, the creditor has an unfulfilled court decision made against the testator; a moratorium on the accrual of sanctioned interest provided for in paragraph 61 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated May 29, 2012 . No. 9, does not prevent the creditor from filing a bankruptcy petition). The law does not provide for the suspension of bankruptcy of an inheritance until the circle of heirs is determined; on the contrary, according to paragraph 9 of Art. 223.1 proceedings may be completed before the expiration of the period for accepting the inheritance. Thus, in our opinion, para. 1 clause 4 art. 223.1 needs a teleological reduction. The heir, immediately after accepting the inheritance, has the right to ask the court to grant the rights and obligations of the testator (debtor) in the initiated bankruptcy case of the estate. The heir who accepted the inheritance has the right, if there are signs of insolvency of the inheritance, to apply for bankruptcy of the inheritance, without waiting for the final determination of the circle of heirs.

3.5. The debtor no longer needs housing and the land on which it is located. Therefore, even the testator’s only residential premises, which previously enjoyed immunity, may be included in the bankruptcy estate on the basis of a judicial act. However, for the heirs, the housing included in the inheritance may also be the only one. The testator mother, who has accumulated consumer loans, lives in the same apartment with her daughter. Within the meaning of paragraph 7 of Art. 223.1 of the Bankruptcy Law, the court does not include in the bankruptcy estate the property of the testator, which during the life of the testator would enjoy immunity in two cases that differ in the moment of resolution of the issue and the circle of heirs enjoying protection. Before the expiration of the period for acceptance of the inheritance - when compulsory heirs live in the specified residential premises (Article 1149 of the Civil Code of the Russian Federation), regardless of their acceptance or non-acceptance of the inheritance, and for compulsory heirs this housing is also the only one. After the expiration of the period for acceptance - when the heirs for whom the living space is the only one live in the specified premises. Perhaps in both cases the legislator had in mind the same persons: at first they were called to inheritance and eventually accepted it. The circle of compulsory heirs is formed by close relatives of the testator who are unable to work. The obligatory share in the inheritance is inferior to the claim of the testator's creditor. Thus, from the standpoint of humanitarian values, it is more correct to extend the immunity and preserve housing for the obligatory heirs who lived together with the testator. However, such an interpretation does not directly follow from the text of the law. There is no sign of cohabitation with the testator at the time of opening of the inheritance. The second group is called “heirs”; it includes any heirs, not just mandatory ones. Should the court, after the expiration of the period for acceptance of the inheritance, make a decision on the inclusion of housing in the bankruptcy estate, when the testator lived alone, and after the opening of the inheritance, an able-bodied descendant who had no other housing moved into the apartment (or when the testator lived together with an able-bodied descendant, as was the case in dispute between A.E. Nikolaeva and the financial manager of the inheritance estate[13])? It is difficult to say which interpretation is more consistent with the policy of law. In the case of a literal interpretation, the result will depend on the speed with which the court resolves the dispute (before or after the expiration of the period for accepting the inheritance). The next problem of interpretation is related to the fact that a disabled child or an elderly spouse is often left not property, but a testamentary refusal in the form of the right of lifelong residence. Acceptance of a testamentary refusal is taken into account towards the obligatory share (clause 3 of Article 1149 of the Civil Code). It is hardly worth including the only home in the bankruptcy estate on the formal basis that the person entitled to the obligatory share did not become an heir, preferring a legacy. And the last issue that I would like to consider is related to the fragmentation of property rights to housing when property is inherited by several persons. Co-heirs, as a general rule, become shared owners of the inherited property. What to do when housing is not the only one for one of the co-heirs? It appears that in this case the immunity does not extend to the relevant share in the property right.

3.6. The determination on the completion of the sale of a citizen’s property cannot be revised. Does this provision mean that dissatisfied creditors have no means of protection in the event of subsequent discovery of property that belonged to the testator? In our opinion, the testator's creditors are granted a direct claim against the heir within the value of the identified property.

3.7. In bankruptcy cases of living persons, capitalization of amounts paid to compensate for damage to life or health is not carried out (Clause 4 of Article 213.27 of the Bankruptcy Law). After completion of bankruptcy, the debtor will continue to fulfill his tort obligations using new income. It is reasonable that in a bankruptcy case the inheritance should be capitalized in favor of the victim.

[1] For other publications on the topic, see: Ostanina E.A. Bankruptcy of the inherited estate: analysis of changes in legislation // Inheritance law. 2015. No. 4. P. 33 - 38. She is the same. Bankruptcy of an inherited estate: in search of a balance between the interests of creditors and heirs // Judge. 2021. N 6. P. 58 - 61. E. Petrov. Responsibility of heirs for inheritance debts. On Sat. Current issues of inheritance law. Ed. P.V. Krasheninnikova. M. Statute. 2021. P.63-65. It's him. Liability of heirs for the debts of the testator and bankruptcy of the inheritance. https://zakon.ru/blog/2017/10/06/otvetstvennost_naslednikov_po_dolgam_nasledodatelya_i_bankrotstvo_nasledstva. Komissarova E.G., Permyakov A.V. Evolution of creditor rights in relations with heirs who accepted the inheritance // Bulletin of Perm University. Legal sciences. 2021. N 2. P. 185 - 192. Kazantseva A.E. On the compliance of the provisions on the bankruptcy of a deceased citizen with civil legislation // Notary. 2021. N 3. P. 8 – 10; Shishmareva T.P. Problems of insolvency of separate property masses // Business Law. Application "Law and Business". 2021. No. 3. P. 50 - 54. Povarov Yu.S. Peculiarities of consideration of a case of bankruptcy of a citizen in the event of his death // Bulletin of Civil Procedure. 2021. N 5. P. 255 - 272. Kirillova E.A. Institute of bankruptcy of an inherited estate in Russian civil law: problems of practice // Notary. 2021. N 2. P. 23 - 28. Suvorov E.D. Features of the implementation of the principle of equality of creditors of the testator in the bankruptcy of the estate // Laws of Russia: experience, analysis, practice. 2021. N 10. P. 52 - 60.

[2] The standard is the maximum possible immutability of the position of the creditor in the event of the death of the debtor in an obligation that knows succession. To some extent, we are just representatives of the property masses.

[3] In cases where debt collection took place during the life of the testator and the deceased debtor is replaced by an heir, the Supreme Court of the Russian Federation demonstrates a more loyal approach to the creditor: only repaid debts are subject to deduction when determining the limit of liability (determination of the Supreme Court of the Russian Federation of January 30, 2021 No. 50-KG17-24).

[4] In our opinion, the judicial act that has taken place cannot be canceled for the purpose of recalculating the debt. Otherwise, the revision may be repeated again and again. The situation with the fate of subsequent claims is more complicated. Existing judicial practice in disputes regarding debt collection from heirs does not allow previously established requirements to be ignored. Thus, late creditors should be left with the possibility of initiating bankruptcy of the inheritance on the basis of a judicial act, in the reasoning part of which the existence of a debt is stated, but the claim is denied due to reaching the limit of liability (see more about this below).

[5] Proposal of Suvorov E.D. the possibility of challenging the preferential satisfaction made by the testator in the case of bankruptcy of the heir was made in one of the most interesting and at the same time controversial publications on the bankruptcy of inheritance (see sn. 1), as far as we know, was not supported by practice. Challenging a gift agreement made by the testator in favor of the heir does not lead to an increase in the bankruptcy estate of the heir. The limit of liability to the testator's creditors increases, but competition with the heir's personal creditors remains.

[6] See, for example, Braun/Bauch, Fiorini, Honert, Tschentscher. German Insolvency Code. 2021. P.815-835, 839, 843-845. In the future, we will use German experience to clarify Russian rules.

[7] See, Dicey, Morris 15 ed. V.2. P.1407.

[8] This line of reasoning is acceptable in relation to legal systems, where in the case of acceptance of an inheritance with a clause limiting liability, a procedure is initiated for compiling an inventory of inherited property and subsequent proportional satisfaction of the creditors of the inheritance at the expense of the inheritance mass, and not within the limits of its value at the time of opening of the inheritance ( liquidation of an inheritance carried out under the control of a notary or court is essentially an analogue of bankruptcy). Even in relation to legal systems where there is full liability of heirs for the debts of the testator imperatively or at the choice of the heir (classical Roman law, Russian pre-revolutionary law, simple acceptance of inheritance in France, Italy, Spain), the irrevocability of the mixing of property masses is assessed critically, since it can harm creditors testator (competition with personal creditors). Thus, in Russia, where there is a system of limited liability for the debts of the testator, which does not require the heir to fix the composition of the inheritance, the ban on bankruptcy of the inheritance after its acceptance, registration of inheritance rights or division is not justified in any way. If the inherited property cannot be separated in kind (it is lost, consumed, alienated, mixed), the bankruptcy estate is collected at the expense of substitutes and claims arising from the heir’s responsibility to the estate.

[9] Separation does not require any court decision to cancel the acceptance of the inheritance, and is a consequence of declaring the inheritance insolvent. The financial manager does not need to cancel entries in various registers about the registered rights of heirs (it is enough to notify the registrar about the transfer of powers of disposal). The decision to declare a deceased citizen bankrupt, documents confirming the presence of property in the bankruptcy estate, and an agreement on the alienation of property by the financial manager are the basis for recording the rights of the acquirers.

[10] If there are bankruptcy or general civil grounds, there may simultaneously be a right to challenge transactions involving the alienation of the inherited estate in favor of third parties.

[11] A way to limit liability is the separation of the estate by establishing the administration of a wealthy estate or the bankruptcy of an insolvent estate (§ 1975 BGB). A special case when liability is limited and the creditor cannot choose to bankrupt the heir is when the co-heirs retain the inheritance in an undivided state. However, in the Russian Civil Code there is no article similar to §2059 (1), according to which co-heirs, before dividing the inheritance, have the right to limit the collection of debts of the testator to the composition of the inherited property. On the German approach to limitation of liability and the “anomaly” of § 2059 GGU, see: Rheinstein. European Methods for the Liquidation of the Debts of Deceased Persons. Reprinted from The Iowa Law Review Vol. XX No. 2 Janury 1935. P. 431-475. Schmidt, Jan Peter, Transfer of Property on Death and Creditor Protection: The Meaning and Role of 'Universal Succession'. Nothing So Practical as a Good Theory: Festschrift for George L.Gretton, pp. 323-337, Andrew JM Steven, Ross Gilbert Anderson, and John MacLeod, eds., Avizandum, 2017; Max Planck Private Law Research Paper No. 18/3. P.323-336.

[12] See: Inheritance law: article-by-article commentary to articles 1110–1185, 1224 of the Civil Code of the Russian Federation [Electronic edition. Revision 1.0] / Rep. ed. E.Yu. Petrov. – M.: M-Logos, 2021. P.491-502. (The author of the commentary to Article 1175 is E. Petrov).

[13] Resolution of the Arbitration Court of the Ural District dated September 6, 2017 N F09-10866/16 in case N A07-22918/2015.

3) Tax debt

Transport tax debt can be recovered from the taxpayer's heir only in court in civil proceedings

Requirements of the tax authority to collect transport tax debt from the heir of a citizen-taxpayer are subject to consideration by the court in civil proceedings, since the transfer of this obligation to the heirs is not unconditional and requires compliance with the procedure established by civil legislation.

By virtue of clause 3 of Art. 44 of the Tax Code of the Russian Federation, the obligation to pay taxes and (or) fees terminates with the death of an individual - the taxpayer or with his declaration as deceased in the manner established by the civil procedural legislation of the Russian Federation. Debt for taxes specified in paragraph 3 of Art. 14 (transport tax) and art. 15 of the Tax Code of the Russian Federation, a deceased person or a person declared dead, is repaid by the heirs within the limits of the value of the inherited property in the manner established by the civil legislation of the Russian Federation for payment by the heirs of the testator's debts.

According to paragraph 1 of Art. 1175 of the Civil Code of the Russian Federation, the heirs who accepted the inheritance are jointly and severally liable for the debts of the testator. Each heir is liable for the debts of the testator within the limits of the value of the inherited property transferred to him.

From the above rules of law it follows that in order to impose on the heir of a deceased person the obligation to fulfill his tax obligations in the manner of universal succession, it is necessary to establish the existence of circumstances related to the inheritance of property. Such circumstances that are important for the correct resolution of the dispute include, in particular: the fact of opening an inheritance, the composition of the inheritance, the circle of heirs, the acceptance of the inherited property by the heirs, its value. This dispute, arising from civil legal relations, is subject to consideration in civil proceedings (extract from paragraph 13 of the “Review of Judicial Practice of the Supreme Court of the Russian Federation No. 5 (2017)”, approved by the Presidium of the Supreme Court of the Russian Federation on December 27, 2017).

The concept and meaning of inheritance and inheritance law. Sources of regulation.

Inheritance is the transfer of property and property rights and obligations of a deceased person (testator) to living persons (heirs) in the order of universal succession, unchanged as a single whole and at the same moment (Article 1110 of the Civil Code of the Russian Federation).

A feature of hereditary succession is its universality: all the rights of the deceased are transferred as a single whole, simultaneously and without the mediation of third parties. As a result of legal succession, an inheritance legal relationship arises. It has the following structure: objects, subjects, content (powers of heirs).

The meaning of inheritance is that it:

1) is the basis for the emergence of ownership rights to someone else’s property;

2) guarantees the protection of private property by the state, provided for in Art. 35 of the Constitution of the Russian Federation, since it contains legal guarantees for the lawful transfer of property rights from one person to another;

3) stimulates the practical activity of an individual in acquiring ownership of property, as it creates confidence in him that the acquired property will pass to close people after his death.

The concept of “inheritance law” is used in two senses - objective and subjective.

In an objective sense, inheritance law is a set of rules governing the process of transferring the rights and obligations of a deceased citizen to other persons. These norms form a subbranch of civil law.

In a subjective sense, inheritance law is the right of a person to be recognized as an inheritor and his rights to property after acceptance of the inheritance.

Stages of inheritance:

• opening of inheritance;

• protection of inheritance;

• expression by the heir of his attitude towards the opened inheritance - acceptance or refusal of it;

• entry into inheritance.

Sources of inheritance law. The main legal source regulating inheritance is the Civil Code of the Russian Federation (part three) - was adopted in November 2001. Other sources of inheritance law relate to various branches of law, i.e. are complex in nature. Let's list the main regulations:

• Constitution of the Russian Federation 1993

• Civil Code of the Russian Federation (part three);

• Federal Law of November 26, 2001 N 147-FZ “On the introduction into force of part three of the Civil Code of the Russian Federation”;

• Fundamentals of the legislation of the Russian Federation on notaries” (approved by the Supreme Court of the Russian Federation on February 11, 1993 N 4462-1) (as amended on July 19, 2009);

• Federal Law of December 31, 2005 N 201-FZ) “On Amendments to Chapter 25.3 of Part Two of the Tax Code of the Russian Federation and the Federal Law “On the Revocation of Certain Legislative Acts (Provisions of Legislative Acts) of the Russian Federation and Amendments to Certain Legislative Acts Russian Federation in connection with the abolition of the tax on property transferred by inheritance or gift”;

• Instructions on the procedure for certifying wills and powers of attorney by heads of prisons, approved by the USSR Ministry of Justice on May 14, 1974;

• Instructions on the procedure for performing notarial acts by heads of local administrations of settlements and municipal districts and specially authorized officials of local self-government of settlements and municipal districts (as amended by Orders of the Ministry of Justice of the Russian Federation dated 08/27/2008 N 182, dated 08/03/2009 N 241).

When resolving inheritance disputes, the following rules are used:

• Family Code of the Russian Federation (clause 1, article 36, clause 3, article 60);

• Civil Procedure Code of the Russian Federation;

• the first and second parts of the Civil Code of the Russian Federation (10 articles of the first and 13 articles of the second part).

Inheritance issues are also regulated by separate articles of various laws, as well as decisions of the plenums of the Supreme Court of the Russian Federation on the application of these laws. For example:

• laws on legal entities (limited liability companies, joint stock companies, non-profit organizations, agricultural cooperation, consumer cooperation, etc.);

• on copyright (protection of computer programs and databases, topology of integrated circuits);

• on the privatization of the housing stock.

Yuksha Y.A. Textbook "Civil Law"