Grounds for re-registration of property

Before we talk about re-registration of property, let us establish what ownership means. Civil legislation defines this as the right to use, as well as own and dispose of property. Thus, a person can do whatever he wants with his property - sell, donate, exchange, or even destroy, of course, if this does not cause damage to surrounding people and nature. Section 2 of the Civil Code (hereinafter referred to as the Civil Code of the Russian Federation) is devoted to this right.

Based on the provisions of the mentioned law, re-registration of ownership is nothing more than the transfer to another person of the right to dispose, own, use real estate or other property.

You may be interested in: what are the features of registering ownership of an apartment.

Sometimes it is enough to simply transfer the item to the new owner, and sometimes it is necessary to additionally draw up a written agreement. The latter is relevant for the transfer of ownership of an apartment. Based on the Civil Code of the Russian Federation, the Housing Code, laws regulating property relations, as well as the practice of lawyers, there are five ways to transfer an apartment to another person:

- Purchase and sale - the owner transfers the apartment to another person for a fee (Articles 549 - 558 of the Civil Code of the Russian Federation).

- Donation is a gratuitous transfer of property (Articles 572 – 582).

- Rent - a person undertakes obligations for the care and maintenance of the owner of the apartment or pays a certain amount during the period established by the agreement, and as a result receives it into ownership after the expiration of a certain time or the death of the owner (Articles 589 - 605).

- Exchange - in such a transaction, owners exchange property among themselves (Articles 567 - 571).

- Will - with this method, the apartment is transferred to the new owner after the death of the former owner and inheritance on the basis of a written order certified by a notary or a person specified in the law (Articles 1110 to 1175 of the Civil Code).

Registration deadlines

The duration of registration of ownership of an apartment depends on the type of transaction concluded and the method of submitting documents. The timing is approximately as follows:

- 1 day - if the application is sent electronically;

- 3 days - if a contract of sale, gift, etc. certified by a notary;

- 5 days - if ownership has arisen by a court decision or mortgage documents have been submitted;

- 7 days - if documents are submitted to the Rosreestr division;

- 9 days - if the papers are submitted to the MFC.

In all the above cases, not calendar days are meant, but working days.

Re-registration procedure

Documents required for re-registration of an apartment:

- Passport;

- a document confirming the emergence of ownership rights (DCT, rent agreement, etc.);

- consent of the spouse, confirmed by a notary.

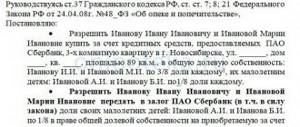

To re-register, you need to submit these documents to Rosreestr and write a corresponding application. Order of the Ministry of Economic Development of Russia dated November 26, 2015 No. 883 established that the collected package can be sent by Russian Post, through a representative, the online portal of State Services or the website of Rosreestr, MFC, or submitted in person to the branch of the registration authority. The applicant also needs to pay a state fee - 2,000 rubles.

After submitting the application, within 12 days the specialist will make a decision on registration or refusal (for example, due to an error in the execution of the contract), which can be appealed in court.

Thus, to re-register an apartment, it is necessary not only to draw up a written agreement, but also to prepare a package of documents and register the acquired property. Below we will look step by step at re-registering an apartment in different ways.

There is nothing complicated in the instructions provided, however, certain knowledge is required so that all actions and executed documents have legal force.

About privatization

To begin with, we should consider the situation in which the re-registration of an apartment occurs during privatization. Only citizens registered in a particular territory can participate in the process. You will need to submit a package of documents to the administration of the locality or to the MFC.

All re-registration of ownership of an apartment can be divided into several stages:

- Showing initiative. Someone from the family proposes to privatize the property. Residents either give their consent to the process or refuse to participate in writing.

- Contact the BTI. Engineers will inspect the apartment and mark the redevelopment and all non-residential objects located on the territory.

- Collection of documents. The most difficult thing imaginable. You will need a lot of paperwork, so it is recommended to start the process of preparing for privatization with the preparation of documents.

- Applying to the administration with an application for privatization. Attached to it is the previously collected package of papers.

- Verification of documents by the administration.

- Signing of the privatization agreement. The presence of all potential property owners is required.

- Registration of an apartment in Rosreestr. This is where the process ends. Owners are issued real estate certificates and a new cadastral passport.

Nothing else is needed. What documents are required to re-register an apartment in this case? Their list is not that long.

Purchase and sale

You can sell an apartment to absolutely any person or organization. To find a buyer, you can place an ad online or contact a real estate agent. Next, we presented instructions for independently conducting a transaction for a private apartment.

Step 1. Appraisal of the apartment.

Since the apartment lease transaction is of a paid nature, it is necessary to realistically assess its value. When selling, you can rely on the results of a cadastral valuation, but they do not always satisfy the owners or buyers of real estate. Therefore, it is worth contacting specialists to conduct an independent assessment of the apartment and determine its market value specifically for the period of sale.

Don't agree with the cadastral value of your property? Fill out the form to the right and our highly qualified attorney will tell you how to challenge the results of a government assessment.

Step 2. Prepare documents.

When buying an apartment with a registered child, the new owner takes on a big risk. Since he will not be able to discharge him without providing similar housing.

These documents are collected directly by the owner. The future owner should carefully study all the documents, and pay special attention to the USRN extract.

The buyer will only need a passport and the consent of the spouse.

Step 3. Draw up a policy statement.

This agreement is drawn up in simple written form, but in compliance with certain requirements. He contains:

- details of the seller, buyer;

- information about the apartment: address, location in the house, area, number of rooms;

- transaction price;

- payment method (cash, non-cash);

- payment method (one-time payment, installments);

- conditions for re-registration of ownership (after payment of the entire amount, after the first installment);

- rights, obligations of the parties to the contract;

- liability for breach of contract;

- additional conditions.

It is also necessary to draw up a transfer deed, which will be an annex to the agreement.

For the agreement, you will additionally need the buyer’s passport and the consent of the spouse (if he has one).

You can draw up this agreement yourself; notarized confirmation is not required, except in cases where one of the parties to the transaction is a minor child, incapacitated, the documents will be sent by mail, or when a share in the apartment is being sold.

Step 4. Register ownership.

Nuances of real estate transition

Each of the above methods of transferring real estate involves certain legal subtleties. For example, when concluding a purchase and sale agreement, citizens will have to pay notary services and state fees. Most often, real estate transactions are concluded between strangers, but sometimes the buyer is a relative. For example, a father can sell an apartment to his son at a symbolic price. If the seller has owned the property for less than 5 years, he will have to pay tax when selling it.

Much more often, relatives enter into deeds of gift. Such agreements have a number of advantages over other transactions:

- If a gift agreement is concluded between relatives, then no tax is paid on the transfer of property. We are talking about persons who are closely related, for example, spouses, grandparents and grandchildren, parents and children, brothers and sisters. The category of close relatives also includes adopted children. All other persons will be required to pay a fee upon receipt of the gift.

- After signing the agreement, the property instantly becomes the property of the donee. Let us remind you that when drawing up a will, the apartment is transferred to the recipient only after the death of the owner.

- The gift is transferred free of charge, which makes this deal the best option for relatives.

- The minimum number of documents will allow you to avoid paperwork.

An exchange agreement involves the exchange of real estate between the parties to the transaction. More often, citizens exchange housing of equal value, which avoids additional payments and compensation. This method allows you to avoid paying income tax. If the exchange is unequal, and one participant in the transaction pays the other a certain amount, then payment of a duty cannot be avoided.

Having received an apartment by inheritance, a citizen will not have to pay income tax. In the current legislation of the Russian Federation, inheritance does not relate to income. However, the heir will have to pay for notary services. The amount of the fee depends on the cost of housing.

Donation

You can transfer an apartment under a gift agreement to any persons, in particular, those who are not relatives. The deed of gift is gratuitous, so a real estate appraisal is not required; you can start immediately by preparing the necessary papers.

Step 1. Prepare documents.

To draw up a deed of gift, you will need the same list of papers as for the DCT.

Step 2. Draw up a deed of gift.

This act of will must be drawn up only in writing. There are no special requirements for the structure. But the deed of gift must contain:

- details of the parties;

- information about the apartment;

- rights, obligations of the donor and the donee;

- liability for breach of contract.

The need for notarization arises in the same situations as with DCT.

Step 3. Rewrite the apartment.

How to save money when transferring an apartment

To reduce your taxes and avoid difficult situations, listen to the following tips:

- Regardless of the type of transaction being concluded, it is recommended that the contract be certified by a notary. Notarization is a guarantee of the legal purity of the transaction and the absence of problems in the future.

- You should not purchase an apartment with registered persons. To discharge an adult able-bodied citizen, you will have to spend not only time, but also money. Such actions are carried out only through the courts.

- If you have doubts about the seller’s honesty, it is better to order an extract from the Unified State Register of Real Estate. This document will contain information about the seller, as well as information about encumbrances.

- Concluding an annuity agreement can be dangerous not only for the recipient, but also for the payer. If an elderly person has relatives, they will subsequently be able to challenge the agreement in court.

- It is advisable for the heir to study the text of the open will in advance. You need to check the recipient's first and last name for typos. If an error is made in the heir's data, the will will be declared invalid.

Rent

The legislation allows for the transfer of ownership under a rent agreement for a fee or free of charge. In the first option, the agreement specifies a condition for the periodic transfer of funds to the owner during his life (lifetime annuity) or indefinitely (permanent). And in the second there is a condition on the provision of services and the fulfillment of certain obligations - lifelong maintenance with dependents.

Does the rent recipient continue to live in the re-registered apartment? Write to our legal adviser by filling out the form on the right, and he will definitely help you solve the problem.

If the agreement contains a condition for payment, then the rules of the monetary contract apply to it, and if the transfer of property is free, the gift agreement applies. However, annuity is not one of these contracts.

You may be interested in the apartment rental agreement and its features.

Step 1. Prepare documents.

The package of documents for an annuity agreement does not differ from the DCP.

Step 2. Draw up an agreement.

The rent must also be drawn up only in writing and must be certified by a notary. Otherwise, the agreement will not have legal force. It includes:

- data of the parties;

- information about the apartment;

- rights, duties, responsibilities;

- additional conditions.

Step 3. Rewrite the apartment.

Gift deed

Now it is clear how the re-registration of an apartment occurs after death. There is no other way. The only exceptions are annuity agreements and deeds of gift. As a rule, a gift agreement is most often encountered in practice. It allows you to transfer the ownership of the entire apartment or part of it to another person during the lifetime of the owner of the property.

If the deed of gift is drawn up for close relatives, you do not need to pay tax. Otherwise, the donee must pay 13% of the cadastral value of the property to the tax authorities.

As a rule, the procedure for registering a deed of gift is as follows:

- The owner turns to the notary with documents for real estate and a deed of gift.

- The notary either checks the literacy of the gift agreement, or independently draws it up according to the established rules.

- The owner of the apartment and the donee sign an agreement.

- The notary registers the transaction, and the new owner draws up documents for the property at the registration chamber.

It is interesting that the deed of gift can be revoked within 12 months if certain circumstances exist. Usually the procedure is possible if:

- the donee killed the former owner (then the heirs deal with the annulment of the deed of gift);

- the recipient of the property has committed a crime directed against the donor or his relatives;

- there is a threat of damage and loss of the apartment, which is of intangible value to the former owner;

- the property is of public value and the recipient may destroy or damage it.

In practice, such situations rarely occur. Therefore, a deed of gift is the most reliable re-registration. No one obliges the apartment owner to donate the entire property. He has the right to donate only a share. This nuance must be specified in the gift deed.

Exchange

In practice, apartment exchanges often occur within the same city, region or even country. It can be either without additional payment or with additional payment.

Step 1. Prepare documents.

For exchange, both parties to the transaction collect a package of documents for each subject of the contract, as in the case of purchase and sale.

Step 2. Draw up an agreement.

The peculiarity of this agreement is that the parties to the transaction act as a seller and a buyer at the same time. The agreement contains the same conditions as the above agreements. Notarization is not necessary; the contract can be certified at the request of the parties.

Step 3. Rewrite the apartment.

What documents are required to re-register an apartment?

To re-register real estate you will need the following papers:

- passports of persons participating in the transaction;

- cadastral extracts;

- permissions certified by a notary;

- title documentation for real estate;

- extract from the house register;

- cadastral extract;

- a document certifying the registration of ownership;

- real estate re-registration agreement.

This is a standard list of documents that will be needed to re-register an apartment as the property of another person. Additional paperwork may also be required depending on the nuances of the transaction.

Will

The peculiarity of a testamentary disposition is that it comes into force only after the death of the owner. It also has an advantage over inheritance by law.

Step 1. Prepare documents.

To draw up a will, it is enough for the owner of the apartment to provide a passport and title documents for the apartment.

Step 2. Make a will.

To draw up a will, you must contact a notary or other authorized person. For example, if a person is in a hospital, then the head physician can certify the “last will”.

When receiving an apartment under a will, the heir acts as follows:

- Collects documents.

To receive an inheritance you must provide:

- heir's passport;

- testator's passport;

- original will;

- certificate of ownership in the name of the testator;

- extract from the Unified State Register of Real Estate.

- Presents documents to the notary.

To re-register the apartment in his name, the heir needs to obtain a certificate of inheritance. To do this, the documents indicated above are transferred to the notary for examination.

- Pays the state fee.

After reviewing the documents, the heir receives a payment order to pay the state fee. For children, spouse and parents of the testator, the payment amount is 0.3% of the value of the inherited property, and for other categories - 0.6%.

- Receives a certificate.

Having paid the fee, the heir receives a certificate of the right to inheritance - the basis for re-registration of the apartment.

- Registers property rights.

You may also be interested in: how to challenge a will for an apartment.

Transaction price and taxes

Registration of ownership of an apartment is a paid procedure. The state fee is as follows:

- 2000 rub. - for private citizens;

- 22,000 rub. - for legal entities.

Some categories of citizens have payment benefits. The list of beneficiaries is given in the law. You can also save 30% of the state fee if you submit your application for registration electronically.

After the property has passed into the hands of a new owner, he has responsibilities for the maintenance and servicing of this object. Every month he will receive receipts for payment of housing and communal services and once a year - a paper from the Federal Tax Service with the amount of tax.

Registration for relatives without sale

The easiest way to transfer ownership between relatives is through a gift agreement or a will.

If the deed of gift is issued to a minor, the agreement is signed in the presence of a notary and representatives of the child.

Between spouses, the transfer of property rights occurs under an agreement of gift, sale or exchange. The choice depends on the stage of family relationships.

Read about the annuity agreement between relatives at this link.

List of required documents

The basic package of documents is always the same:

- Identity cards of the parties to the transaction.

- Certificate of ownership.

- A title document required for state registration (sale and purchase agreement, annuity, deed of gift, etc.).

- Consent of the spouses, certified by a notary (if the alienating party is married).

- Permission from the guardianship authorities if a minor or incapacitated person is involved in the transaction.