Free legal consultation!

8 Hotline in the Russian Federation

8 Moscow and Moscow. region

8 St. Petersburg and Len. region

- home

- Donation

Current legislation provides for the opportunity to dispose of one’s property in the event of death. To transfer money, real estate, or movable property to a relative/stranger, you can draw up a gift transaction or a will. In this article we will talk about whether it is possible to transfer something into ownership and then change the decision.

The donor has the right to cancel the decision to make a gift. This right is guaranteed to him by law, Art. 577 Civil Code. Cancellation of the donation procedure is possible only if there are compelling reasons and confirmation of the grounds.

Is it possible to re-register a deed of gift and how to write it to another person

Many citizens are worried about whether it will be possible to rewrite the deed of gift to another person. The text of the contract can be replaced only after the previous transaction is canceled or invalidated and the property is returned to the previous owner. Get free legal advice on this issue right now on our website.

On a note!

If the parties to the agreement are not relatives, the recipient will have to pay a state fee of 13%.

About the opportunity

First of all, this is a transaction that is clearly regulated by civil law.

The Civil Code describes it this way.

A donation is an agreement between one party, who is the donor, to transfer from his immediate property free of charge as a gift to the donee any thing.

In this case, each party must agree to the gift. Further, the procedure begins to acquire all sorts of features and nuances, which we will talk about.

Is it possible to challenge? When drawing up an agreement, few people think about the fact that it is permissible to challenge the procedure. The parties to the contract see only the desired result achieved in the near future, but not the process of achieving it. This is very in vain.

In fact, if we look at judicial practice, challenges occur quite often.

But is it legal?

Read our article about how a donated apartment is divided between spouses after a divorce.

How to cancel a deed of gift in order to complete a new transaction

People will be able to donate property only if the previous decision is reversed. This can be done if the grounds for cancellation are among the legitimate reasons.

Cancellation can only occur for the following reasons:

- The recipient does not need the property; he does not want to register ownership of the object.

- The owner of the property changed his mind and wanted to personally cancel the order for an apartment or other object. This is a refusal to comply.

- Recognize the deed of gift as invalid.

Attention!

You can cancel the apartment owner’s decision by declaring the document invalid. To do this, a statement of claim is filed in court.

Preparation of a package of documents

It is in connection with the above-mentioned presence of certain difficulties that the collection of documents should be entrusted to a specialist.

Often, not far from the registration authorities there are offices of organizations specializing in drawing up contracts for the alienation of property rights and registering the transfer of rights, including the registration of a deed of gift for a share in an apartment.

Depending on the complexity of the work and the volume of services provided (simply draw up an agreement or accompany the transaction until receiving a certificate of ownership), the cost ranges from 2,000 rubles to 15,000 rubles.

By hiring a highly specialized lawyer or realtor for these purposes, you guarantee yourself the desired result in the shortest possible time.

Refusal of the gift

The recipient may not give his or her consent to the registration procedure. You need to understand that the received property will need to be owned and managed, and this entails certain obligations. The reason for refusal may be due to the need to maintain the object, preserve it and restore it, pay taxes and utility bills on it. This is not always included in the plans of the recipient.

Whatever the reason, it is better to make a decision before signing the papers. This will help avoid litigation.

Refusal to execute

When planning to re-register a contract for another person, the donor wonders whether it is possible to re-register the deed of gift. It is possible if you cancel the previous order. You can do this at your own request only if there are compelling reasons specified in Art. 557 Civil Code and 558 Civil Code.

Reasons for refusal:

- Decreased quality of life. It can be caused by deterioration of health, decrease in material wealth.

- The donor's misconception regarding the property and behavior of the recipient.

- Causing bodily injury, harm to health and life to the donor himself, his family members.

- There is a risk of losing a thing, an object that has significant property value. Taking care of the gift is one of the requirements of the Civil Code. If the norm is not met, then the violation may be accompanied by a rewrite of the contract.

- The person being gifted died before the current owner. The condition must be stated in the contract.

- The donor is a legal entity, and the deed of gift becomes the reason for the failure to fulfill his duties.

Attention!

Life and health should not suffer as a result of fulfilling obligations under the gift agreement. If there is such a risk, then refusal to perform is provided. And in this case, the recipient cannot claim compensation for the loss.

Transfer procedure

Transfer has specific features from a legal point of view. Is it possible to re-donate an apartment received by a person under a deed of gift? How can this be done? Let's consider the options for registering a gift in more detail.

- Drawing up a new deed of gift.

- Have the deed of gift certified by a notary (this is a mandatory point when preparing documents).

- Passing state registration of rights.

It is necessary to contact the municipal office of Rosreestr, or the MFC at the location of the object.

Submission of documents is carried out by sending a registered package by mail with a receipt notification, or through the Internet - the official website, or the State Services portal.

Documents required to complete the registration procedure:

- applications from the parties to the donation regarding registration;

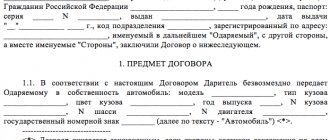

- passports of citizens of the Russian Federation (both parties);

- receipt of payment of state duty in the required amount;

- documents of law for the object of donation (direct deed of gift - gift agreement);

- a document that confirms ownership (this is a certificate, an extract);

- a certificate from the place of registration about registered persons in the property being donated (houses, apartments) or a unified housing document (UZhD). This certificate is obtained from the Management Company (MCC). If a transaction is made through the MFC, this document may not be required.

Advice ! Data such as receipts for payment of state duties (receipt of payments) are in a common database, so their provision is not necessary. To avoid troubles, you should save it until the registration process is completed.

Basic Rules

When going through the procedure of registering a gift or transfer, as in any transaction, there are details and features that should be taken into account. For example, such aspects:

- The deed of gift can be canceled within a period of up to three years from the date of registration. It is necessary to prove that the transaction was carried out under pressure or due to a fraudulent offense by one party;

- in the case where the recipient is unable to personally be present during the procedure for drawing up the contract, he can be replaced by an authorized person who acts under a notarized power of attorney;

- As a result of the transaction, the parties have a written document (the original deed of gift). A third copy of the deed of gift is required for the Rosreestr body;

- when transferring property to an incapacitated or minor person, the legal representative or guardian gives his approval for the transaction;

- If the donor is married, then the notarized consent of the spouse is required.

If it is necessary to transfer part of a house or apartment that is in common ownership, an officially written agreement of all owners is required.

Sometimes it is possible for Rosreestr to refuse the transfer of rights, which can be explained by two reasons - there were errors when drawing up the gift agreement or, perhaps, some necessary documents were not provided.

What does the cancellation of a deed of gift entail?

It is impossible to remake a gift agreement for another person without canceling the previous agreement. An action can be taken if there are grounds for cancellation. This operation entails the need to return the donated object in its original form. Profit from the gift does not need to be returned.

You will also not have to give away property that the recipient managed to sell, donate, exchange, or destroy. But, if it is proven that there was a deliberate alienation or destruction of the object, then its value will be required to be returned.

On a note!

Profits for the use of an object that will eventually have to be returned to the donor do not need to be returned.

Legal grounds

There are certain rules in the legislation that allow the donor to demand the return of his gift during his lifetime if the recipient has already become the full owner.

According to Article 578 of the Civil Code of the Russian Federation, the following are recognized as legal grounds for canceling a deed of gift:

- the new owner of the house deliberately attempted to kill the former owner or his relatives, as well as in the event of causing any injuries;

- improper handling of the gift by the recipient, which can lead to disastrous consequences, for example, the final loss of the object;

- death of the donee, as a result of which, if a certain condition is indicated in the deed of gift, the donor has the right to demand the return of the house to personal property;

- when a transaction is made by an individual entrepreneur or an organization in circumvention of the bankruptcy law.

It is possible to cancel a written agreement if, over time after the transaction, the financial situation or health status of the former owner has changed significantly, which will cause a decrease in the standard of living. This fact should be supported by appropriate evidence. It is possible to demand recognition of a deed of gift for a house as an invalid document if the donor signed the document in an alcoholic or drug-induced state or if the recipient used means of blackmail, threats, various types of pressure, etc. against him.

Invalidation of an order

Art. 170 of the Civil Code determines the possibilities for declaring a gift invalid.

The reason for declaring a deed of gift invalid may be related to covering up other types of orders or concealing income. An example of the first situation - there is a purchase and sale of real estate, and everything is presented as a gift. The second example is that there are debts, and the transaction helps hide income.

Attention!

In Art. 171 determines that a contract can also be declared invalid due to the incapacity of the parties. This is under 14 years of age, mental disorders.

Current questions and answers

- Question:

If a law firm formalizes a donation, and only then files for bankruptcy, can the deed of gift be challenged.

Answer:

Yes, the transaction can be challenged to prevent deliberate concealment of things, concealing property from creditors. Basis – Art. 578 Civil Code.- Question:

Is there a state duty when re-issuing a deed of gift?

Answer:

Yes, the donor who decides to change the side of the contract is required to pay a state fee in the amount of 1000 rubles.- Question:

If I sell the donated apartment immediately, will there be a duty?

Answer:

The deadline for resolving the problem, in which you will have to pay 13% tax on the cost of the apartment, expires after three years. If you sell before this period, there will be a tax of 13%.

- home

- Donation

Article rating:

(no votes)

Share with friends:

Related publications

- Donation

Deed of gift for a house and land in 2021

- Donation

Cancellation of deed of gift for an apartment

- Donation

Cancellation of deed of gift for a house in 2021

- Donation

Gift or inheritance: which is better?

Popular material

Statute of limitations

A deed of gift can be appealed, both at the time of its conclusion and many years later .

What is the statute of limitations? In judicial practice, there are cases when the period for challenging was close to ten years .

However, the legislator strongly recommends finding errors and challenging the agreement no later than three years after the conclusion of the transaction. Otherwise, property donated earlier may simply be lost.

Deed of gift for an apartment: how to challenge it?