Home / Family law / Benefits and benefits

Back

Published: 07/15/2018

Reading time: 8 min

0

402

To apply for child care benefits for children up to 1.5 years old, you need to collect a certain set of documents. Its composition depends on whether the parent is officially employed or not.

- General information

- Instructions for applying for child care benefits for children up to 1.5 years old

- List of documents for obtaining benefits for employed citizens

- List of documents for the unemployed

What are the types of child benefits?

The list of financial assistance at birth and for the maintenance of a child in the Russian Federation is quite extensive, the list of documents for receiving child benefits is almost the same. Help is allocated to both the mother and the child. Here is the complete list:

- on PB&R - pregnancy and childbirth;

- PB&R supplement for registration no later than 12 weeks;

- at birth;

- child care up to one and a half years, then up to three;

- if the father serves in the army by conscription;

- for children under one and a half and three years old according to the “need criterion”;

- per child up to 18 low-income families;

- regional child benefits;

- new “coronavirus” benefits.

The essence of the law on state benefits for citizens with children

The first year and a half of maternity leave is financially supported by the state to a significant extent. But what to do when the child is 1.5 years old?

When the child reaches one and a half years old, until January 1, 2021, compensation from your organization in the amount of 50 rubles was due. every month. To date, the state has abolished monthly compensation payments in the amount of 50 rubles for child care, which are paid from one and a half to three years. But the citizens to whom these payments were assigned will continue to receive this benefit.

In addition to payments established by federal regulations, there are also payments, the decision on the accrual of which is made at the local and regional level. Please inquire about their availability when applying for benefits. Such payments can be of a different nature - additional one-time payments, maternity capital, and additional monthly benefits.

In 2021, the list of subsidies was replenished with new benefits - these are Putin’s payments for 1 and 2 children. Also, the family now receives one-time financial support immediately after the birth of the baby.

List of documents for the birth of a child

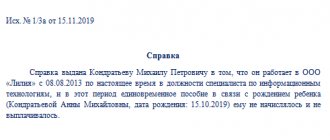

From 01.02.2021 its amount is 18,004 rubles 12 kopecks. The money is paid once to one of the parents - the one who works. If parents do not work or are full-time students, the subsidy is paid by the Social Insurance Fund. What certificates are included in the list of documents required to establish benefits:

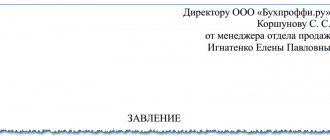

- statement;

- birth certificate:

- confirmation from the second parent’s work that he does not receive payment.

Additionally, if required:

- divorce certificate;

- a certified statement of the last place of work for the Social Insurance Fund.

IMPORTANT!

The papers must be collected and submitted no later than six months from the date of birth. Appointed within 10 days from the date of submission of documents, paid within the same 10 days by the employer and no later than the 26th of the next month by the Social Insurance Fund.

Documents for non-working parents

If a child's parents are temporarily unemployed, this does not mean that they cannot receive government benefits. To do this, you will need to prepare a certain list of documentation.

One-time payments

The right to receive lump sum payments is granted to the father or mother of a born child. Unemployed people wishing to receive benefits must submit paperwork to their local Social Security Administration.

The main list of documentation is:

- A completed application with a request for payment, which is formed in free form;

- Birth certificate;

- A certificate stating that the second parent did not receive a similar payment;

- Marriage certificate;

- An extract from the work book, which contains information about the last place of work. It must be certified by a notary.

To receive the payment, parents must submit the necessary documents within six months from the date of birth of the child.

Payments are calculated within thirty days from the date of application.

Monthly benefits for children under one and a half and three years of age

For parents who are not engaged in official work, the following list of documentation must be provided to the Department of Social Protection of the Population:

- A completed application with a request for payment, which is formed in free form;

- Child's birth certificate (original and photocopy);

- Applicant's passport (with photocopies of all pages containing data).

The above documents are basic and will be required when applying for absolutely any benefit.

To apply for benefits for a child up to one and a half years old, you need to additionally collect the following documents:

- An extract from the Employment Center containing information that the applicant did not receive payment in other places;

- A photocopy of the order of dismissal from the last place of work;

- An extract from the work book containing information about the last official place of work;

- Certificate of income containing data on average earnings (if you have official work experience, and if not, a certificate of income).

To apply for benefits for a child under three years of age, you will need to additionally collect the following papers:

- Employment history;

- An extract from the Employment Center confirming the non-receipt of this payment in other places.

Applications for monthly benefits for those not working are here.

A sample application for monthly benefits for officially employed people can be found here.

Registration of child benefits for child care up to 1.5

If the previous subsidy was paid once, then this child benefit is monthly. It is received by the one who cares for the baby - this is not only the mother, but also the father, grandparents. The full list of documents up to one and a half years is as follows:

- a statement written in free form;

- birth certificates of all children in the family;

- the other parent confirms with a certificate from work that he does not receive this subsidy;

- if the caregiver has changed jobs over the last two years, he provides a salary certificate from the previous employer (to calculate the amount of payment).

The payment amount will be 40% of average income. Its minimum size is 4,852 rubles, and 3,375.77 rubles. for non-working people. RUB 6,751 54 kopecks parents will receive for caring for their second and subsequent children. The Pension Fund website contains explanations about what documents are needed for child benefits from 1.5 to 3 years and how to fill out the application correctly.

How to receive payment?

The same rule for everyone - you can apply for benefits at any time, but no later than six months after the child’s 1.5th birthday (Clause 2.1, Article 12 No. 255-FZ). Funds due for payment before submitting the application will be transferred in a single amount.

Documents common to all:

- an application for a guaranteed state benefit, drawn up at the place of application;

- documents confirming the birth and citizenship of the baby;

- documents to initialize the identity and citizenship of the benefit recipient;

- certificates from the place of work (service) or from the social security authority (for a non-working) second parent (relative) stating that he did not apply for this benefit;

- personal account details or address (if received via mail) for transferring funds.

In all cases, 10 days, no more, are given to consider the application, after which payments are calculated.

Working parents

Additionally provide:

- for combined jobs - a certificate from another job stating that monthly benefits are not accrued there.

The collected documents are transferred to the employer’s accounting department, where employees will calculate the amount of benefits and transfer money to the account monthly.

REFERENCE! Since 2011, a pilot project has been implemented in some regions where payments and transfers of money are handled directly by the Social Insurance Fund. In this case, the package of documents is still sent to the employer.

The start of receiving payments is from the first day of maternity leave. At the age of 1.5 years, child benefits stop automatically.

Money is credited to the account on the payday accepted by the enterprise.

Unemployed

The following must be attached to the main documents:

- birth/adoption certificates of previous children;

- a copy of the work book indicating the last workplace;

- certificate from the labor exchange confirming non-assignment of unemployment benefits.

The citizen takes the documents to the social security authority at the place of residence.

What is more profitable to receive unemployment benefits or child benefits?

It is difficult to answer the question unambiguously: unemployment benefits range from 1,500 to 8,000 rubles, depending on the conditions of dismissal.

Child benefit can also vary from four and a kopeck to twenty-seven thousand. Therefore, the applicant must decide for himself in each specific case what is more profitable for him.

Since in fact these persons do not have leave under the BiR, monthly state support is due from the day of birth until the child is 1.5 years old.

Transfer to the account or postal address is made no later than the 26th day of each month.

For students

Additional documents:

- about the birth of a previous child (if any);

- a certificate from a university (technical school, etc.) about the status of a full-time student.

Documents are submitted to social security at the place of residence.

The first and last days of receiving benefits depend on:

- when using leave under the BiR - from the date of care leave to 1 year 6 months;

- no leave was issued - from the day of birth to 1 year 6 months.

Enrollment date - no later than the 26th day of the month following the month of application, and beyond.

For military personnel

Attached to the main package:

- information about the birth of previous children (if any);

- an extract from the commander’s order granting maternity leave.

The package is transferred to the financial support authority (accounting department) of its part.

The period for receiving payments, as for employees, is from the first day of leave to care for the baby until he turns 1.5 years old.

Funds are transferred on the day established for the issuance of allowances.

IMPORTANT! For delay of benefits on the part of the employer, he faces criminal liability (Article 145.1 of the Criminal Code of the Russian Federation), as well as the accrual of penalties (Article 236 of the Labor Code of the Russian Federation).

Conscript's spouse

To the above mandatory documents are added:

- a certificate from dad's military unit stating that he is serving.

In this case, the documents are sent to the social security authority at the place of residence of the newborn.

The money is due from the day of birth if the father is serving at that time. If the baby was born before the father became a conscript, the money is due from the first day of the parent’s service. The last payment is due in 3 years or until the end of service - whichever event occurs earlier (Article 12.6 No. 81-FZ).

Money is credited as for everyone who applied to social security - until the 26th of each month.

Payments for children up to 14, 16 and 18

Minors under 18 years of age also have the right to receive cash assistance. True, it is intended for low-income families. Categories from the following list have the right to apply for it and provide documents for child benefits to social protection under 18 years of age:

- unemployed single mothers;

- large families with an average per capita income below the minimum wage in the region;

- guardians/trustees.

The child subsidy is calculated and paid by regional social protection authorities. You need to contact the MFC, collecting certificates in accordance with the list of documents for child benefits up to 16 years of age:

- statement;

- birth certificate of a minor, after 14 - passport;

- parents' passports;

- certificates: about cohabitation, parents’ income for the quarter, family composition;

- about full-time study at the educational institution.

The list of documents for child benefits under 18 years of age, which are provided annually, is similar.

Papers for processing payments for children from low-income families

A low-income family is one whose income per member is less than the subsistence minimum (Article 7 of Federal Law No. 178 of July 17, 1999 “On State Social Assistance”).

IMPORTANT!

This subsidy is regional, paid from the local budget, and is established taking into account the subsistence levels established for the relevant socio-demographic groups of the population.

For example, in the Kemerovo region, the Law of the Kemerovo Region No. 75-OZ dated November 18, 2004 established the amount of material support: for children from two-parent families - 340 rubles, from single-parent families and children of single mothers - 620 rubles.

The list of documents varies depending on the region. Required:

- income documents for the last 3 months;

- birth certificates of all young children;

- work records of all able-bodied family members;

- certificate of registration with the employment center (for the unemployed);

- certificates of disability (if available).

To clarify the size and procedure for receiving them, contact your local social security office. Typically, documents for benefits up to 7 years, up to 1.5 and others for minors are similar to those provided for payments at birth, but it is necessary to provide certificates of income and work activity.

How to get a Putin subsidy for up to 3 years

Let's talk about what certificates are needed to apply for child benefits under 3 years of age - these are special children's benefits approved by decree of the President of the Russian Federation. Issued to families using the criterion of need. This means that the average income of each member of a family applying for a subsidy is no higher than the regional subsistence level multiplied by 2. The size of the payment is also set by the regions - this is the children’s subsistence level of a particular territory. It will be paid until the child is three years old. In the first case, the subsidy is issued at the local Health Insurance Fund and paid to the budget. On the second day, the application is submitted to the Pension Fund, since the funds are paid from maternity capital. This subsidy does not apply to the third and subsequent ones. A list of documents for payments up to 3 years has been approved; it must be submitted annually:

- statement;

- birth certificate;

- confirmation of Russian citizenship;

- information about all income of each family member;

- a certificate from the military registration and enlistment office about the father's conscription;

- account details.

The Order of the Ministry of Labor and Social Protection of the Russian Federation dated December 29, 2017 No. 889n speaks in detail about the list of documents for benefits up to 3 years, the procedure for their provision and the implementation of this payment.

For benefits for children of military personnel

In a situation where the husband of a woman carrying a child performs military conscription service, she can arrange payments for the child by submitting a certain list of papers.

Such documents are:

- A completed application requesting benefits;

- Marriage certificate (photocopy and original);

- An extract from the antenatal clinic indicating registration for pregnancy;

- A certificate from the military registration and enlistment office confirming that the spouse has completed conscription service.

Wives of military personnel can receive this benefit, regardless of whether other payments were issued or not.

To receive an additional payment you will need to submit the following list of documents:

- A completed application requesting benefits;

- Child's birth certificate (photocopy and original);

- Certificate from the military unit in which the spouse is undergoing conscription service.

Family support due to coronavirus

Children under 3

During the spread of the COVID-19 virus, new types of child benefits have appeared. Families entitled to maternity capital will receive five thousand, regardless of whether the family used it or not. Paid from April to June in 2021. To receive it, the owner of maternity capital, after authorization on the State Services or Pension Fund portal, fills out an application. No additional documents are needed except a power of attorney if the application is submitted by a representative (spouse).

Low-income people with children from 3 to 7 years old

Due to financial problems faced by families as a result of a long period of self-isolation, the payment of subsidies to children under 7 years of age has been moved a month earlier - to June 2021. It will be received by low-income parents with income below the regional subsistence level. There is no established list of documents for benefits from 3 to 7 years. It is enough to fill out an application on the State Services portal or the MFC. The payment amount is 1/2 of the region’s subsistence level. There is also no need to attach an additional list of documents for child benefits from 3 to 7 years old - all information is checked against state databases.

IMPORTANT!

The Ministry of Labor is preparing a resolution to change the amount of benefits. Now it is 50% of the subsistence level in the region. On average it is 5,500 rubles. They plan to increase the amount to the subsistence level. After this, large families will receive from 11,000 to 12,000 rubles. The changes are expected to come into force in 2021.

A detailed description of the service - what certificates are needed to apply for child benefits under 7 years old, a list of necessary information - can be found on this State Services page. There is also an opportunity to submit an application here.

Unemployed parents

Many parents found themselves unemployed during the coronavirus crisis. If you applied to the employment service on March 1 and you have minor children, you should receive increased unemployment benefits. Its size will increase by 3,000 rubles, paid for each child - Decree of the Government of the Russian Federation No. 485 of 04/12/2020. Fill out the following list of documents on the “Work in Russia” portal to apply for child benefits from 3 to 7 years old, if the mother does not work:

- statement;

- summary.

All children from 3 to 16

In accordance with measures approved by the president to support families with children aged 3-16 (if they turn 16 before July 1), they are entitled to a one-time payment of 10,000 rubles for each child. The support applies to everyone, regardless of income level. The PFR website contains information about what documents are needed to receive benefits from 3 to 16 years in the pension fund and an information support page.

To receive it, you must submit an application before October 1, 2021 on the State Services website. After filling out the applicant’s personal data, it is necessary to enter information about the minor and a list of bank details; no documents are anymore required to issue 10,000 per child. Payments will begin on June 1.

Payments from 3 to 7 years

For low-income families (with an income less than the regional subsistence level), a payment has been established for children from 3 years of age to 7 years of age inclusive (Decree of the President of the Russian Federation No. 199 of March 20, 2020). The subsidy is paid if the amount of income of all family members before taxes for April 2019 - March 2021 per family member per month does not exceed the subsistence level per capita as of the second quarter of 2021. Each minor from 3 to 7 years inclusive is entitled to a monthly payment in the amount of half the subsistence minimum for children.

The payment is made by the region, therefore, what documents are needed to apply for child benefits from 3 to 7 years in 2021, check on the State Services portal or in social security. The State Services website provides a list for each region; in most cases, when submitting an electronic application, they only require you to attach bank details for the transfer.

IMPORTANT!

This special feature concerns documents for obtaining child benefits from 3 to 7 years old, if the mother (or another family member) does not work: a certificate of registration with the employment center must be attached. In case of failure to register, please attach a copy of your work record book.

How to apply for regional child benefits

Some regions provide their own subsidies to parents. The list of recipients includes large or low-income families. Regional authorities provide additional assistance to parents (adoptive parents) of disabled children. Responsible departments post lists of documents for monthly child benefits on their websites. The list of papers is usually standard:

- child's birth certificate;

- registration document (family composition);

- parents' passports;

- confirmation of the right to payment (certificate of income, determination of disability, certificate of a large family, etc.).

Payments to special categories of the population

Social benefits for children are paid to certain categories of recipients, including:

- families with disabled children;

- the poor;

- large families;

- single mothers;

- on the occasion of the loss of a breadwinner.

Allowance for a disabled child

Financial support for families with a disabled child is provided for by Decree of the Government of the Russian Federation No. 61 dated January 29, 2020. It stipulates social payments for disabled children when the child is transferred to a family for upbringing. The amount of payments is 18,004 rubles 12 kopecks, and for the adoption of a disabled child - 137,566 rubles 14 kopecks.

For Muscovites, Decree of the Capital Government No. 1753-PP provides for the payment of child benefits up to 18 and 23 years of age. In accordance with this act, the amount of benefits for caring for a disabled child under 23 years old is 12,672 rubles per month. The same amount of disability benefits for a child under 18 years of age is paid to non-working parents who are disabled people of groups I-II.

Child benefits for low-income families

From July 1, 2021, it will be possible to receive a low-income benefit for a child from 3 to 7 years old; for this, the income per family member must be less than the subsistence level. The assignment of benefits for children from low-income families will be made based on applications that can be submitted through the State Services portal, the MFC or the social protection authority. Payments for a child from a low-income family will be accrued from January 1, 2021, if by this date he is already 3 years old, or from the date of birth, if the child was born after January 1, 2021. The benefit amount is half of the subsistence level in the constituent entity of the Russian Federation established for children.

In the capital, social assistance to low-income families with children is provided according to Moscow Government Decree No. 1753-PP in the form of monthly payments per child:

- up to 3 years in the amount of 10,560 rubles;

- from 3 to 18 years old in the amount of 4224 rubles.

Benefits for large families

Large families require government support, because often parents do not have sufficient income to support a large number of children. In Moscow, you can apply for benefits for a family with 3 or more children if there are appropriate grounds. Monthly benefits for 3 children in Russia ease the financial burden on the budget of a large family.

Social assistance is provided to large families in accordance with Moscow Government Decree 1753-PP. The amount of monthly payments to large families is:

- for compensation of expenses due to the increase in the cost of living for families with 3-4 children - 1268 rubles, with 5 or more children - 1584 rubles;

- for the purchase of children's goods for a family with 5 or more children - 1901 rubles;

- families with 10 or more children – 1,584 rubles;

- a mother of many children who has given birth to 10 or more children and receives a pension – 21,120 rubles;

- to pay for housing and utilities for families with 3-4 children - 1103 rubles, with 5 or more children - 2205 rubles;

- For using a telephone, a family with 3 or more children is entitled to 264 rubles.

In addition, large Moscow families are also entitled to payments at the birth of the third child and subsequent children, timed to coincide with certain events. The amounts of such child benefits for large families:

- for a family with 10 or more children on International Family Day – 21,120 rubles annually;

- for a family with 10 or more children for Knowledge Day - 31,680 rubles annually;

- for the purchase of children's clothing for training - 10,560 rubles annually;

- parents awarded the Badge of Honor “Parental Glory of the City of Moscow” - 211,200 rubles at a time.

Child benefits for single mothers

Child benefits to single mothers are paid in accordance with current regulations. In Moscow, cash payments to single mothers for children are assigned in accordance with Decree of the Capital Government No. 1753-PP. The monthly child care benefit for a single mother (single father) is:

- for children under 3 years old 15,840 rubles;

- for children from 3 to 18 years old 6336 rubles.

Survivor's benefit for children

In Moscow, you can apply for a child survivor's benefit in accordance with City Government Decree No. 1753-PP. In the event of the loss of a breadwinner, a child is entitled to social benefits in the amount of 1,532 rubles per month; they are provided for disabled people from childhood to 23 years.

Common mistakes

It’s a mistake to try to apply for care benefits for a working parent if someone else is actually caring for you. It is impossible to receive 100% compensation and salary. But the one who has applied for the benefit has the right to work part-time with the appropriate earnings.

It is a mistake to think that a subsidy can be issued at any time after the birth of a baby. If you send a list of documents six months after birth, you will be refused.

The BIR benefit is paid to all women - this statement is also wrong. The payment is due only to working people. The exception is full-time students or expectant mothers who lost their jobs after the liquidation or bankruptcy of the organization.

A typical mistake of many young parents is to assume that subsidies are provided by default, and after birth the money will immediately begin to flow into the account. In our state, all payments and benefits are of a declarative nature. Find out what list of child care documents will be required and submit the certificates along with the application to the relevant department or employer.

It’s a big mistake to stand in line at the MFC during the spread of the coronavirus to find out what documents are needed to apply for a child benefit from 3 to 7 years old in 2021 or other information. Lists of all data are on the State Services portal - look carefully.

Calculation of payments

The legislation established clear rules and restrictions based on which the amount of benefits:

- The benefit is calculated as 40% of average earnings for officially employed citizens; parents in military service; dismissed due to the liquidation of the enterprise during parental leave;

- The payment is transferred in a fixed amount to unemployed citizens and students,

In the first case, the amount of payment is calculated in the employer’s accounting department. For a general understanding, here are the calculation rules :

- The calculation period is two years before the birth of the child. When giving birth in 2021, the income for 2021 and 2021 is summed up. In total, we get 730 days.

- All periods of sick leave (including maternity leave), as well as the period of parental leave (if it fell during these years) are excluded from the period since there are no deductions from them to the Social Insurance Fund (clause 1, clause 1, article 422 of the Tax Code) RF);

- Next is the amount of the benefit: average daily income * 30.4 * 40%. This part will be transferred to the recipient's account every month.

If the average monthly result is less than the minimum wage, then the latter is taken for further calculation: Benefit = minimum wage (as of the date of vacation calculation) x 40%. If the minimum wage changes in the future, payments will not be recalculated.

The scheme for calculating monthly benefits in 2021 for military personnel and those dismissed during maternity leave is similar, only the average income is calculated not for 2 years, but for 12 months (paragraph 3 of Article 15 No. 81-FZ).

When twins/triplets are born or there are two children under the age of one and a half years, the benefit is accrued for each of them.

FOR YOUR INFORMATION. Childcare benefits for children under one and a half years old are not taxed. (clause 1. Article 217 of the Tax Code of the Russian Federation)

Is there a difference in the amount of payment for the first and second child?

The difference in benefit amount will depend on the situation. For working parents, the calculation algorithm is always the same for both the first and all subsequent children.

For them, the benefit amount may depend only on the decrease or increase in their income.

In the case of students and unemployed people, there will indeed be a difference: the allowance for the second and all subsequent children of the child is greater than for the first.

REFERENCE! From May 1, 2021, monthly government support is transferred only to the MIR card (Government Decree No. 419 of April 11, 2019).

On the Social Insurance Fund portal, on the “Benefits” tab, you can use a calculator to calculate the benefit yourself. All data is entered, the regional coefficient is selected and the calculation is ready.

Who doesn’t make sense to collect certificates and statements?

Nothing will be paid to those parents who left the Russian Federation for permanent residence in another country. It is useless to collect documents for persons whose children are kept in state institutions with full support. Persons deprived or limited in parental rights will not receive government assistance. This norm is contained in clause 4 of section I of order No. 1012n dated December 23, 2009.

Legal documents

- Order of the Ministry of Labor and Social Protection of the Russian Federation dated December 29, 2017 No. 889n

- Decree of the Government of the Russian Federation No. 485 of April 12, 2020

- order dated December 23, 2009 No. 1012n

Results

Types of child benefits are listed in Law No. 81-FZ. These include: a one-time allowance for the birth of a child, a monthly allowance for child care, an allowance for transferring a child to a foster family and others. What documents you need to contact your employer or social security agency to apply for child benefits are established in Order No. 1012n of the Ministry of Health and Social Development. The application for payment of benefits must be accompanied by a certificate from the registry office about the birth of the child, a certificate of his birth, a certificate of family composition, a certificate of non-receipt of benefits by the other spouse and other certificates, extracts and copies.

If the parents are deprived of parental rights or the child is fully supported by the state, the benefit is not paid and documents for its registration are not submitted.

Sources:

- Federal Law of May 19, 1995 N 81-FZ “On state benefits for citizens with children”

- Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”

- Decree of the Government of the Russian Federation of October 31, 1998 N 1274

- Federal Law of December 28, 2017 N 418-FZ “On monthly payments to families with children”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.