INN: what is it and what is it for?

A taxpayer identification number (TIN) is a unique number that is assigned to all individuals and legal entities of the Russian Federation for the purpose of registering them as tax payers. TIN of individuals consists of 12 digits:

XX – code of the subject of the Russian Federation (region) XX – code of the tax inspectorate (IFTS) XXXXXXX – taxpayer number XX – check number.

By law, you do NOT have the right to receive any income in Russia without having a TIN (for example, salary, benefits, income from business, sale or rental of property), so having a TIN is very important for any citizen. You will be asked for your TIN in many life situations.

It is now quite easy to obtain, find out, and restore a TIN. In particular, you can obtain a TIN at the MFC. Below we will tell you how to do this.

| Tired of reading? Save time, ask a lawyer a question for FREE: |

Why does an individual need a TIN?

Of course, the identification number is not needed by the individual, but by the regulatory authorities. Most often, it may be required when applying for a job, since the employer transmits information to the tax office.

However, unlike legal entities and individual entrepreneurs, who cannot operate without a taxpayer ID, an individual is not required to have one. It would be more correct to say that an individual most likely has a taxpayer ID at the tax authority, but the person may not know it.

The employer does not formally have the right to demand a TIN, but may ask to provide it.

The child may also need an identification number, since the child may be the owner and must pay taxes. Of course, his parents do this for him, but, nevertheless, it will be necessary to obtain a tax registration certificate.

Methods for obtaining a TIN

The organization that assigns TIN to individuals and legal entities is the Federal Tax Service (FTS). To initially obtain or restore a lost TIN certificate, you can

- contact any tax authority serving individuals, fill out an application on form No. 2-2-Accounting and after 5 days receive a TIN certificate;

- fill out an application on the Federal Tax Service website using a special service and send it to the selected tax authority;

- send a completed application for obtaining a TIN by mail to any tax authority along with a certified copy of a document identifying the applicant and his place of registration;

- obtain a TIN certificate from the “My Documents” MFC.

Please note: this service is not provided in all MFCs. We recommend that you first check by phone that it is indeed possible to obtain a TIN at the MFC of your choice.

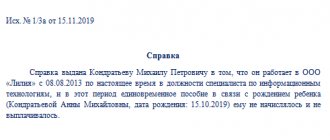

This is what the TIN certificate looks like (click on the image to enlarge it):

TIN stamp in the passport

Most recently, from October 30, 2021, the Federal Tax Service approved an official order that states that special marks in the passport are indicated with a citizen identification number.

This stamp will be placed on a special page of the passport. The individual code of the individual, date and signature are written directly on the stamp.

This option is very convenient, because it eliminates the possibility of loss or damage to a separate TIN certificate. As a result, the code is stamped in the citizen’s passport and is always with him. There is no need to carry a separate document with you that indicates that a person has been assigned his code.

In order to put a stamp with an individual taxpayer number in your passport, you need to contact the tax service department that deals with the issue of servicing individuals.

The stamp itself is placed in black or blue and is located in the upper parts of the 18th or 19th page of the passport, if there is free space. If it is missing, then the stamp is placed on the same pages, only at the bottom of the document.

The code numbers are handwritten in the specially designated fields on the stamp. The date of application of the stamp is also indicated and the signature of the tax inspector who dealt with this issue is applied.

In order to put a stamp, you do not need any documents other than the passport itself. The mark is placed on the basis of data obtained from the official register database of the Federal Tax Service on the TIN.

If your information is not in the database, that is, you do not have an individual taxpayer number, the inspector will ask you to go through the procedure of obtaining a TIN certificate. After registration, information about the TIN is entered into the database, and you also receive the desired stamp in your passport with your unique code.

But still, there is one hitch, because the stamp in the passport does not have the same functions as a separate document. When applying for an individual electronic signature, you will still need to present the certificate. At the moment, this is the only difference between the mark in the passport and the original document. But still, in other cases, having a stamp is more convenient and practical.

Obtaining a TIN through the MFC

If your MFC “My Documents” provides it, there are no problems getting it (in other words, getting a TIN). You can find the phone number and address of your MFC through the directory on our website.

The procedure is extremely simple:

- We will check by phone whether it is possible to obtain a TIN at your MFC and their opening hours.

- We go to the selected MFC with an ID card and make an appointment with a specialist by taking an electronic queue coupon through the terminal.

- With the help of a specialist, fill out an application in form No. 2-2-Accounting.

- After 7-10 days you can get a TIN certificate here. The period for providing the Federal Tax Service service is 5 working days, to this period is added the time required to transfer documents between the MFC and the Federal Tax Service.

How long does it take to obtain a TIN at the MFC?

As soon as you give the completed application to the employee and he checks all the information, you will be given a receipt containing contacts for feedback.

You can track the readiness of the TIN at the MFC according to the following principle; according to the law of the Russian Federation, the production time should not exceed 5 working days, however, please note that it may take an additional 1-2 days to send the finished tax form to the multifunctional center, after which you can receive document in hand.

How to find out your TIN?

If you have forgotten or lost your TIN, you can find it:

- online. Using the service of the Federal Tax Service. You will need your passport or other identification document details;

- when contacting the tax office in person. Select the inspection that is convenient for you and make an appointment online.

Is it necessary to change the TIN when changing your last name?

The TIN is assigned to the citizen once and for all. Changing your last name does not entail a change in the number itself, but it makes sense to obtain a new TIN certificate so that it is issued in your new last name. This step is not required, but it may make it easier for you to communicate with various organizations, such as your employers.

According to the information on the Federal Tax Service website, a new TIN certificate is issued free of charge when the last name is changed.

It is possible to change the TIN certificate when changing your last name through the MFC if your MFC provides the service of issuing a TIN.

The issuance of a new certificate is carried out on the basis of an application in the same form No. 2-2-Accounting. The procedure is similar to obtaining a TIN upon initial registration with the tax authority. The application can be filled out manually during a personal visit to the Federal Tax Service, or filled out and sent through the Federal Tax Service website or by mail. If your MFC provides the service of issuing TIN, you can do everything through this MFC.

How to find out the TIN via the Internet using a passport

You can find out the TIN of an individual using a passport via the Internet using the service on the Federal Tax Service website: service.nalog.ru/inn.do Since the taxpayer’s identifier is not considered confidential information, you can find out both yours and someone else’s.

The same service is provided by the government services portal: gosuslugi.ru This applies not only to the ability to find out the TIN via the Internet using a passport. On the government services portal, you can also make an appointment with the tax office or send an application to obtain a certificate of registration. And an electronic signature will provide access to the full list of government services available on the portal.

Restoring TIN in case of loss or damage

If some trouble occurred with your TIN certificate, as a result of which it was damaged or lost, you can order and receive a duplicate of the certificate. At the same time, the TIN number itself, which is stored in the Federal Tax Service database, will remain the same.

When you receive a certificate again to replace a lost or damaged one, you must pay a state fee of 300 rubles. and attach the payment receipt to the application.

An application in form No. 2-2-Accounting must be sent to the Federal Tax Service at the place of your registration in person, through a legal representative or by mail. The procedure for obtaining a duplicate TIN certificate is described in the information on the Federal Tax Service website.

If your MFC provides the service of issuing TIN, you can submit an application to the Federal Tax Service through this MFC. The required documents are an identity card and a receipt for payment of the state duty.

What is an individual taxpayer number?

In the state taxpayer accounting system, every citizen of the Russian Federation has a personal identification number, which is a digital code. It is issued when a person first applies to the state tax service. After registration, Russians receive a uniform certificate.

All adult citizens of the Russian Federation are required to have a TIN, and it can also be assigned to young children if, for a number of circumstances, they become payers of mandatory taxes.

According to current legislation, Russians are required to pay a certain tax on their income (work, profits from various types of activities, etc.). The TIN allows you to quickly process any information about the taxpayer, benefits and tax deductions; moreover, its owner, having provided the certificate, has the right not to indicate personal data.

Payer number is a 12-digit number in which the first two digits indicate the region where the certificate was issued. The last 2 are the control number of the person (individual). Please note that a unique number is assigned to citizens from the moment of birth. This is necessary so that you can distinguish between people with the same initials and surnames. If an individual changes personal data for a number of reasons, the TIN number will still remain with him until the end of his life. If a person dies, his number is transferred to the archive for storage.

Important : according to existing legislation, not only Russians, but also foreign citizens temporarily residing in the Russian Federation must have a unique taxpayer number. This is necessary to obtain an official work permit (patent) when registering.

Not all citizens know in what cases a tax payer’s certificate may be required. As a rule, it is received upon reaching adulthood or at the beginning of working life. The tax office can automatically assign a digital code to an individual if it is necessary to maintain appropriate records in relation to him.

Important: no one can force citizens of the Russian Federation to compulsorily issue a TIN, since this process is voluntary, however, it should be remembered that when applying for employment in government agencies, the presence of a TIN is a mandatory condition.

The certificate itself is an official document made on a standard size sheet of paper. It contains the following data:

See also: Horsepower tax in 2015

- Full name of the individual taxpayer;

- birth data of a citizen of the Russian Federation;

- unique digital code;

- the exact date of registration of the payer with the inspectorate;

- information about the tax authority.

It is mandatory to put a stamp on the taxpayer’s certificate, as well as the signature and data of a Federal Tax Service employee. If Russians need to get a new document due to a change in personal data, they can do it for free. If the certificate is lost or damaged, you will need to pay a fee to restore it.

Get a TIN in Moscow or St. Petersburg

According to information received through the official telephone line of the Moscow government website, all public service centers in Moscow provide the service of issuing a TIN, both primary and repeat.

Required documents - in the case of the initial receipt of the TIN, only an identity card and confirmation of registration, in the case of re-issuing a duplicate certificate, also a receipt for payment of the state fee of 300 rubles.

Additional information can be obtained by calling:

8(495)777-77-77 Moscow

8(800)550-50-30 Moscow region

According to the St. Petersburg hotline, the service for issuing a TIN is NOT PROVIDED at the MFC of St. Petersburg. You can only obtain a certificate directly from the tax office - in person, through a legal representative or by mail.

Where can I get a TIN?

According to Federal Law No. 243 of 2021, Russian citizens can obtain a certificate with a payer identification number at any branch of the Federal Tax Service. However, you can register only at your place of registration. You can also order a unique number through the State Services portal on the Internet by sending an application by mail, or by personally appearing with a package of necessary documents at the nearest branch of the multifunctional center.

Important : if there is a need to send documentation by mail, all copies must be notarized. If a citizen of the Russian Federation does not have a residence permit at the time of receiving the TIN, a payer’s certificate can be issued at the place of his temporary stay or the location of his property.

Internet

The Internet allows you to send an application for an individual taxpayer number at any time, while saving time waiting in queues. To do this, you need to visit the official website of the Federal Tax Service or the State Services portal. In the first case, you will need to enter your email and password. When applying for a TIN through State Services, you need to confirm your identity. To do this, the passport details, registration and contacts of the applicant are indicated in the personal account.

See also: How to find out your transport tax debt

If they have a so-called enhanced electronic signature, citizens can use special software that allows them to prepare a request in encrypted form, after which it must be sent to the tax service. You can receive the certificate in electronic form, which will be certified by a qualified signature of the Federal Tax Service. The TIN can also be sent by registered mail.

MFC

Today, the most convenient way to obtain a taxpayer certificate is to contact multifunctional centers at your place of residence. In this case, the applicant can visit the nearest branch in person, and also entrust this to his authorized representative. MFCs work much longer than tax service branches, so you can come there after the end of the working day.

The applicant needs to apply with documents at any window, and all procedures for obtaining a TIN will be performed by one operator. If necessary, a specialist will provide assistance in filling out the application. When the payer’s certificate is ready, the applicant will receive a message, after which he will need to appear at the same MFC and receive his number. When applying to a proxy, you must provide notarized copies of documents.

Federal Tax Service

Citizens of the Russian Federation can personally apply to the Federal Tax Service at their place of residence to obtain a Taxpayer Identification Number (TIN). In the client department, specialists will be able to provide detailed information on all questions of interest and necessary documents. As for the application, it can be filled out electronically and downloaded, as well as entering the necessary data by hand. In the latter case, it is worth checking once again to ensure that there are no errors or omissions in the document.

During a personal visit to the tax office, it is allowed to submit copies of documents not certified by a notary. In this case, Federal Tax Service employees verify the data and then return the originals. The date of receipt of the certificate can also be obtained from tax service specialists. It can be issued personally to the applicant himself or an official representative, or sent by registered mail to the specified address.

Where can I pick up the completed form?

If the application was submitted to the tax authorities at the place of registration, the final TIN is received there in person or by proxy (if you have a passport).

If the application for a TIN was submitted to the MFC, the final TIN certificate is also collected from the same MFC in person or by proxy (required with a passport).

For submitting an application via the Internet, a completed certificate is received (if you have a personal digital signature) electronically by e-mail or on the government services website or by mail. In the absence of an electronic signature, a completed TIN certificate is obtained from the Federal Tax Service at the place of registration of the applicant.

Where to go to obtain and replace a certificate

There are several ways to submit the required documents. Every citizen of the country already has a taxpayer number from his birth, but to document it, you must follow one of the algorithms:

- You can go to the Federal Tax Service

at your place of registration or registration. Take all the necessary documents with you; tax service employees will help you fill out the application. In case of personal application, photocopies of documents are not required. Federal Tax Service employees will examine the package of papers, and after that they will return everything back, keeping only the application and the document confirming payment of the duty, if any. - The second way is to send an application by mail

. It will need to be accompanied by copies of all papers from the list, their authenticity must be certified by a notary. When you send a letter, make sure that it is registered and has a notice. Check your department with the service; knowing the required inspection, finding out its address on the Internet is not a problem, but you will need to send a letter to it. - You can apply for registration through the Federal Tax Service online service

. In this case, you do not need to attach documents, but their originals will need to be taken to the service department you marked when you go to receive your certificate. You can do without documents if you have an electronic signature. - You can obtain a TIN certificate through the MFC

. The procedure for submitting documents is similar to submitting through the Federal Tax Service. Come to the multifunctional center with a package of papers upon appointment or take a queue ticket. You are invited to the required window, employees help with writing an application, if everything is correct, they register the application.

The TIN certificate will be ready 5-6 days after registration of your application.

List of documents

A pleasant bonus for those applying for their first TIN will be the absence of any financial payment for receiving it. You just need to prepare the papers and use one of the methods for submitting them. You will need:

- Identity card, a Russian passport

. For some categories of citizens, registration is possible using a military personnel ID card, refugee ID card, etc. ;

If another person is registering the TIN for you, then a notarized power of attorney is required.

- Application

form for obtaining a TIN; - Information about place of residence

. This data is contained either in your passport, or you can bring a document confirming temporary registration.

Replacement of TIN in case of loss or change of full name

If you have lost your certificate, you can get it again at the Federal Tax Service offices. You must bring with you the above documents, in addition to them, a free form application for replacing the TIN and a paid state fee in the amount of 300 rubles. You can use the service to pay the fee.

For citizens who receive a new certificate due to changes in personal data, in addition to the main package of documents, they must bring with them confirmation of the change in full name. As a rule, this service is used by women after marriage. In this case, you must have a marriage certificate with you. The procedure for replacing the TIN certificate under these circumstances is free.

What documents are needed

In order for a tax institution to assign a TIN to a citizen, it is first necessary to prepare the necessary papers. What documents are needed for the TIN are listed below.

- Application completed in accordance with the approved form.

- A copy of the general civil passport document.

- A document confirming registration at the address of residence, if registration is temporary.

- A resident of a foreign country attaches a translation of his national passport document to the set of documents for the TIN.

- A birth certificate, if a TIN is required for a minor.

Having collected the required papers, you can begin writing your application. Download the form on our website below, and we’ll take a closer look at how to fill out an application for a TIN.

- The form consists of three pages, each of which must be printed on a separate sheet.

- Each sheet begins with the full name of the TIN recipient.

- The text is written with a pen or filled out electronically.

- Each cell contains a separate printed letter or number.

- If the TIN applicant does not have a middle name, the number 1 is entered in the first cell of this field.

- When entering a contact phone number, the numbers are written without dashes or spaces.

- If an application for a TIN is submitted by a man, a 1 is entered in the “Gender” box, a woman is identified by the number 2.

- When the recipient of the taxpayer code independently fills out the application, in the section guaranteeing the authenticity of the data, he must put the number 5 and indicate his last name, first name, and patronymic.

Download Sample application for TIN (.xls)

The TIN application must not contain any strikeouts or edits. If a mistake is made, you need to print out the form of the damaged sheet and fill it out again. You should also not use correction fluid.

The accuracy of the information is confirmed by the signature of the citizen who filled out the application for TIN. This may also be the taxpayer's authorized representative. In this case, in addition to the previously listed documents, a power of attorney will be required to carry out the procedure for obtaining a TIN.

How to submit an application?

Upon personal appearance of an individual:

- bring a passport or other identification document of a citizen, as well as a copy of it;

- if there is no mark in the document on temporary or permanent registration of residence of a citizen, the original certificate of registration;

- an application about the desire of an individual to register with the tax authority is filled out by him personally on the spot.

Copies of documents do not need to be certified, since their authenticity will be verified by the employee receiving the documents.

Through the Internet:

- send electronic copies of your passport or other document; registration certificates;

- Submit a carefully and thoroughly completed application form.

By regular mail:

- copies of documents are sent, which must be certified by a notary office;

- the application is completed on a computer (a sample can be found online), or written by hand only with a ballpoint pen, in blue or black;

- The documents must be sent by registered mail with a list of enclosed papers.

The completed certificate form can be ordered in person, or it will be sent by mail to the specified address.

Some departments of the Federal Tax Service do not send documents by mail. A citizen should clarify these nuances with his Federal Tax Service department.

You should be aware that an application submitted with errors or corrections will not be accepted by the tax service .

And inaccurately specified passport or child certificate information will lead to confusion in paying taxes.

How to get a duplicate TIN - read here.

Therefore, when filling out the application form, you should be extremely careful and not send a carelessly completed document by mail. Otherwise, the citizen may not receive the document, or it will have to be issued again.

An example of filling out an application for registration with the tax authority.

Waiting when contacting the Federal Tax Service directly

How long does it take and where is the TIN made? The second scenario is to contact the local tax service directly. This method of solving the problem is considered the most preferable. It allows you to register with the Federal Tax Service in the shortest possible time.

According to current legislation, a TIN must be issued within 5 days after a citizen submits an application in the established form. As a rule, there is no need to wait longer at the tax office for the paper being studied. This happens as a rare exception. For example, with a huge load on the tax authority. But as a rule, you won’t have to wait longer than a week.

Price and time for document processing

Another pressing issue, how much it costs to make a TIN, is no less interesting than the others discussed above. When a person applies for a code assignment for the first time, the procedure will be free. It will take 5 days for the tax institution to process the submitted materials, check the accuracy of the information, assign a code to the taxpayer and enter it into a single database. This time period starts counting from the moment the set of documents is submitted. Therefore, when submitting an application by mail, the deadline will be longer.

The same can be said about submitting an application through a “single window”. This is due to the fact that the legislation allocates an additional 2 days for the redirection of documents accepted at the MFC to the tax institution. The same additional period is given to the Federal Tax Service to transfer the finished certificate with the code to the MFC, where the applicant will pick it up.

Thus, the time frame for obtaining a TIN for an individual varies and depends on the method chosen by the applicant for submitting the package of required documents. The fastest, most effective and inexpensive option is to apply for a code online. In this case, the five-day period will begin to count from the moment the application form is submitted to the service.

Sometimes citizens change their last name. The unique code remains the same, but you should change the entry in the unified register and receive a new certificate. This procedure will also not cost the applicant anything.

It happens that citizens lose their certificate of assignment of a unique code. It should be understood that a unique code is assigned once in a lifetime. If the certificate is lost, you must contact the tax service with a request to issue a duplicate. To do this, confirmation of payment of the fee must be attached to the standard set of documents. The procedure will cost 300 rubles.

Restoring your TIN when moving

In this case, is it possible to apply at your place of residence? Is it possible and how to restore the TIN not at the place of registration, or rather temporary registration? Since the taxpayer code is assigned to a citizen once, the information is located in a single register, where every tax institution in the country has access, no matter where it is located.

If a citizen has moved to another locality, changing jobs, or for another reason, he does not need to change the code. The law does not oblige him to register with the local tax office. The employer must provide information about the new employee’s code to the tax office.

If the certificate was lost during the move, you should apply for a duplicate. You can obtain it at your place of temporary residence, regardless of where the certificate was issued. Registration of a duplicate is subject to state duty.