Use of personal transport within the limits of the law

Russian legislation does not prohibit the administration from engaging drivers with their own personal cars to perform work functions. Moreover, in Art. 188 of the Labor Code of the Russian Federation states that for the use of personal property, including a vehicle, a worker is entitled to compensation.

At the same time, government decree No. 92 of 02/08/2002 determined the threshold norms of compensation that are tax-free. They depend on the engine size and are:

- 1500 rubles when the engine capacity exceeds 2000 cc. cm.;

- 1200 rubles if the engine has a volume of up to 2000 cc. cm.;

- 600 rubles, if motorcycles are used as work transport.

It is important to note that the law imposes restrictions solely on the payment of a fixed part of compensation. Associated other costs (fuel, technical inspection, various types of repairs and diagnostics) are not included in this limitation and are regulated by the hiring company independently.

In order to avoid misunderstandings with inspection structures, it is advisable to develop and approve a separate local document for the enterprise, which will regulate the issues of accounting for the real costs of maintaining and operating employees’ personal transport. But the main thing here is to properly establish primary accounting of the work performed. And then the accounting department will be able to easily allocate expenses to the relevant accounting items. The employee will receive full compensation for his expenses.

Remember, the legislator allowed the use of personal vehicles for work purposes and receiving compensation for this from the administration. The main thing is to formalize such relationships correctly, establish accounting and clearly state what exactly such payments are due for.

Summarize

If we look at the problem from the other side, we need to choose whether we want to draw up documentation, ensure the availability of qualified personnel and write off fuel and lubricants? Or is it more important for us to make the system as simple as possible.

If, according to the law, we can do without issuing waybills, medical examinations and responsible persons, and this is possible if we do not carry out transportation work for money and do not actually need drivers, then we can transfer the company car to the employee in the form of a “piece of metal” .

To do this, we must develop an appropriate provision where we assign responsibility and responsibilities for maintaining the vehicle to the employee. An order to transfer the car to him and a power of attorney on the basis of which he will drive the official transport provided to him.

True, we will have to come to terms with the fact that we will not be able to take fuel and lubricants into account.

How to register an employee's car

Primary question. After all, without documentation, the company will not be able to allocate and account for the costs of maintaining an employee’s personal transport used for business purposes.

The legislator has provided several legal ways to register a personal car used for company purposes. Here are the following design methods:

| Way | A comment |

| Through an employment contract | This indicates the norm that the worker will fulfill the obligations assigned to him with his car and is written into the body of the employment agreement. It will be necessary to determine not only the fact of use of personal property, but also the basic conditions for payment of compensation for such actions. Alternatively, the company has a separate local document, which is referenced in the employment contract. |

| By concluding a civil agreement | In many companies, employment and civil law contracts are equalized. In practice, they have different natures, conditions, and legal weight. If you go this route, you will need to describe in detail the rights and obligations of the parties, as well as the conditions for payment of compensation for the operation of the vehicle. Don't forget payments for fuel, repairs, and maintenance. |

| Through a loan | The mechanism is simple. The car owner transfers his car to the loan company. Transport is placed on the balance sheet of the enterprise for its full provision. Local documents assign the car to its owner, who will continue to operate it. However, such a mechanism does not provide for direct compensation. Loan payments only. |

| Using a rental agreement | Everything is also simple here. An employee enters into a rental agreement for his car with the company. Can be rented together with him, as service personnel. At the same time, he is hired to work in the same organization. The car is placed on the balance sheet of the enterprise and is fully covered (refueling, technical inspection, repairs, depreciation). The owner receives wages and benefits under the lease agreement. |

Remember, depending on the chosen method of registering a personal car used for work purposes, the conditions of its operation and the amount of payment due to the employee will further depend.

Now it’s important to understand why we use transport

There are two options: for your own needs and for profit.

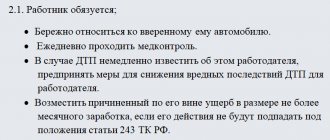

If we enter into transportation contracts, deliver people or goods, then this is a “profit making” option, and here the organization of labor protection in the company is no different from an ordinary motor transport enterprise. Namely, an employee is appointed responsible for road safety and responsible for releasing cars onto the line (duty mechanics). These people must have appropriate qualifications.

If we use cars exclusively for our own needs, then we need to understand who the employee driving the vehicle is.

Here, too, two options are possible. Driver and regular employee.

Since nothing prevents the driver from being called a manager in the staffing table, everything depends on the definition of his labor function. An employee who comes to work to transport someone or something performs the functionality of a driver.

The driver is required to pass (In accordance with Article 23 of the Federal Law “On Road Traffic Safety” No. 196-FZ):

- Mandatory medical examination of candidates for vehicle drivers;

- Mandatory preliminary, periodic (at least once every two years) medical examinations;

- Pre-trip and post-trip medical examinations.

In turn, legal entities are obliged to meet the requirements specified in the Law “On Road Traffic Safety”:

Article 20 of Federal Law No. 196-FZ:

Legal entities and individual entrepreneurs carrying out transportation by road and urban ground electric transport must:

comply with the rules for ensuring the safety of transportation of passengers and cargo by road and urban ground electric transport, approved by the federal executive body exercising the functions of developing state policy and legal regulation in the field of transport;

appoint a person responsible for ensuring road safety who has been certified for the right to engage in relevant activities in the manner established by the federal executive body exercising the functions of developing state policy and legal regulation in the field of transport;

ensure that employees comply with the professional and qualification requirements for transportation and established by the federal executive body exercising the functions of developing state policy and legal regulation in the field of transport, unless otherwise established by federal law;

ensure the availability of parking (parking space) for the parking of all vehicles belonging to them, as well as premises and equipment that allow for the maintenance and repair of these vehicles, or the conclusion of agreements with specialized organizations for the parking of these vehicles, for their maintenance and repair ;

organize and conduct pre-trip inspection of the technical condition of vehicles in the manner established by the federal executive body exercising the functions of developing state policy and legal regulation in the field of transport.

This requirement applies not only to companies that use company vehicles for profit, but also to those who use cars for their own needs. This opinion was expressed in the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 26, 2021 No. 26.

For legal entities and individual entrepreneurs carrying out transportation on the basis of contracts for the carriage of goods, passengers and luggage, as well as the movement of persons, except the driver, located in the vehicle (on it), and (or) material objects without concluding the specified contracts (transportation for their own needs), the obligations provided for persons operating vehicles apply (for example, Article 20 of the Federal Law of December 10, 1995 No. 196-FZ “On Road Safety”).

From the above it follows that if an employee carries only one loved one (driving a car does not change his work function), then formally he is not a driver and is not required to undergo medical examinations. There is also no need for a full-fledged transport operation service (or even worse, the transfer of all powers to a labor protection specialist).

It turns out that for a driver, the duty to drive a car can be a factor determining harmful working conditions. And managers are given a car as a bonus or an element of status.

Employment contract or additional agreement

The idea of using an employee’s personal transport for organizational purposes may arise simultaneously with employment, or in the future. The conditions and procedure for drawing up the primary document will directly depend on this. So, you will have to issue:

- Employment contract . When a citizen is hired to work with his own car, which will be used for official purposes. Here it is immediately advisable to indicate the conditions and amount of payment of compensation for operating a car for work purposes. They must be understandable and fully cover the costs incurred by the citizen.

- Additional agreement . It is practiced when the idea of hiring an employee’s transport for work purposes arose in the future, when he was already on staff. In this case, an additional agreement to the existing contract is simply signed. It becomes an integral part of it.

Remember, a properly signed and registered supplementary agreement becomes an integral part of the employment contract. Therefore, what is important here is not the form, but the content of the document signed by the parties.

Reimbursement of expenses when using a personal car

Among the costs of operating a vehicle, it is worth distinguishing between direct costs, without which the car simply will not move, and the remuneration that is due to the owner for the use of his property. All this must be included in the terms of the employment (civil) agreement. It is advisable to break these positions into two independent blocks.

So, during the period of using a personal car for work purposes, its owner can count on reimbursement of expenses for fuel, oil, spare parts in the event of a breakdown, scheduled repairs, repairs in the event of an accident, payment of insurance premiums, and other direct costs.

To confirm such expenses, the following documents may be required:

- waybills, other similar documents valid in the company;

- travel logs filled out by representatives of the employer and containing the travel route, time, purpose of the trip;

- personal reports of the employee, which contain a detailed description of each trip (when, where, for what purpose, on whose behalf);

- detailed calculation of the required amount of compensation based on the actual consumption of materials and fuel;

- The work or job description contains provisions on the traveling nature of the work. But in this case there must also be primary documents (receipts, checks, invoices).

Remember, in order to receive reimbursement for real costs in the process of operating your vehicle for the needs of the employer, you will need to collect all the primary documents confirming the costs, as well as documents indicating that the work was performed for a specific institution.

Using the car for your own needs by proxy

A power of attorney as such is not a mandatory document to confirm the right to drive a specific car. In order to confirm this right, it is enough to provide an MTPL insurance policy. Moreover, if the owner of the car is a company, its management can provide powers of attorney for its employees, allowing them to drive cars listed on the balance sheet.

However, this method of transferring a car for use to an employee creates the possibility of ambiguous situations arising from a legal point of view. For example, each business trip must be accompanied by a waybill and other documentation. In its absence, each driver can refer to the personal nature of the trip, and it will be very difficult to prove the opposite.

Considering all of the above factors, a power of attorney can be the most comfortable and easiest way to allow an employee to use a company vehicle outside of work hours. This is possible provided that management has a high degree of trust in this employee, as well as a sufficient level of responsibility for him, since by law the owner of the car will not be able to require a trusted person to provide repairs, depreciation and refueling.

The ideal situation is if the company car is driven by proxy by the founder or head of the enterprise. For example, your own vehicle was added to the company’s balance sheet, and subsequently a power of attorney was issued on its behalf in the name of the original owner.

Features of registering the use of an enterprise’s vehicle through a power of attorney include:

- A high degree of risk for the company associated with the lack of legally justified responsibility of the trusted employee for the safety and provision of the vehicle.

- Simplified legal regulations for transferring a car for use without additional documents and conditions.

- There is no strictly regulated period for using vehicles.

Payment of compensation for the use of a car

Let us immediately note that even when using a car on the basis of an employment contract, the compensation paid to the owner is not part of the salary. This is a separate type of payment. Up to a certain limit (set by the government of the Russian Federation) it is not taxed. Above this norm you will have to pay taxes.

It is necessary to distinguish between reimbursement of direct expenses and compensation for the use of the machine. Indeed, in this case, the car owner also saves the company on maintaining an additional driver. In other words, the company receives real savings even if it makes payments to an employee for using his car for work purposes.

Business trip by personal car (2020)

For example, a trading company's car was sent with a consignment to deliver it to retail stores. In this case, store directors must sign the waybill when the car arrives at them. This measure is an additional control function that allows you to check mileage, operating time, and it also confirms the production nature of the costs taken into account under this document.

Reimbursement of expenses

According to the current rules, a waybill must be issued for every vehicle leaving, even if it is a forklift and it operates within the warehouse. The name of the form must contain the type of vehicle. This means a car or a truck.

For example, if your car has a special license plate with certain designations, you must have with you a document that makes the use of such a sign legal. It is also worth considering additional elements of the vehicle, such as a trailer. For some trailers you will need an additional package of documents.

How to determine the amount of compensation

The calculation of the amount of compensation due to a worker for using a vehicle for work needs depends on the intensity of use of the vehicle.

Typically, if the machine is used daily, a fixed maximum compensation level is set. To set a smaller size, you can simply subtract the proportion of car use every day based on the results of the month.

Alternatively, some employers set a daily compensation level. This means that at the end of the month, the number of days the employee worked on his machine is displayed and the compensation due to him is calculated.

Remember, no one prohibits the employer from paying as compensation an amount exceeding the maximum allowable amount established by the government of the Russian Federation. But in this case, taxes will have to be calculated and withheld on the “remainder”.

What Documents Does a Driver Must Have with Him in 2021?

A driver's license is also called a license and certifies a person's ability to drive a vehicle. It contains basic information about the owner, the date of issue, the place where the license was issued, as well as the categories of vehicles that the owner of the document can drive.

This is interesting: Benefits for Children of War in the Perm Territory

What documents must a driver have with him in 2021?

The vehicle registration document should be kept in a safe and secure place. If the car is stolen, it will not be difficult to restore all other documents if you have a title on hand. In the car passport you can see the number, names and sequence of owners of the vehicle, which, in turn, allows you to track the history of the vehicle’s operation, the presence of dark spots and suspicious points.

Experts and lawyers have also long proposed to cancel this document. Although if you decide to sell a car with someone else’s help, then a power of attorney will, of course, be needed. Only a notary must draw up and certify it.

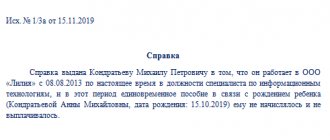

Registration of compensation for use and reimbursement of expenses

Compensation for the use of a private car is processed in the following order:

- An employment contract is concluded between a citizen and his employer, one of the sections of which stipulates the conditions for using personal transport for official needs.

- The employer issues an internal order for the company, which sets the limit on the amount of compensation, as well as the procedure for compensating the direct costs of the car owner.

- Each business trip is documented with a waybill or an entry in a special journal. The information must include the route of travel, the purpose of the trip, at whose command it is carried out, the start and end time.

- Each costly action (purchase of fuel, oil, visit to a service station) must be confirmed by a receipt, check, invoice. In the future, the originals of these documents must be submitted to the accounting department for payment of compensation. Accounting is required to check the consistency of expenses with other records that take into account the work carried out by the enterprise

- The employer has the right to refuse compensation payments to an employee if they were not made for official purposes or during non-working hours (with the exception of the purchase of fuel).

- All expenses are summed up for the month, previously issued advances are deducted and paid to the employee along with the remuneration due.

Remember, legal entities are prohibited from making financial payments for actions not confirmed by primary documents.

How to register the use of a company car for personal purposes? The following video is about this:

But most companies want to write off (account for) fuel and lubricants

And we have already said that the only tool for writing off fuel and lubricants is a waybill. It doesn’t matter whether it is drawn up according to a standard form or approved by an order of the enterprise, the waybill will be valid if it contains data on passing medical examinations, there is a note from the duty mechanic about the serviceability of the vehicle, the mileage and the amount of fuel in the tank are indicated.

If an employee comes to work in the morning and takes his assigned vehicle from the parking lot, then no problems arise. What if he uses official transport both on work and after work? How then to write off the gasoline spent over the weekend on a trip to the country?

Here, not only the enterprise is at risk, but also the employee himself, who may find a profit (the company actually compensated him for the cost of gasoline) on which personal income tax has not been paid.

Again, problems will arise in the event of an accident during non-working hours.

The solution is to transfer the vehicle for personal use each time, drawing up the appropriate act, and take it back in the morning, but due to the labor-intensive nature of this process, we will not even consider it.