Travel by private car

When traveling on a business trip for using a personal car for business purposes, the employee is entitled to compensation provided for in Article 188 of the Labor Code of the Russian Federation. The organization determines the amount of such compensation independently.

An employee who was on a business trip in personal transport - a car or a motorcycle - must submit a memo to the accounting department. This is the requirement of paragraph 7 of the regulation approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749.

However, this resolution does not specify the contents of the memo. The official document only says that the actual duration of the trip must be recorded in the note.

Do not overload the note with unnecessary information. After all, this is not the document that confirms the use of the car.

At the same time, a memo is needed to calculate daily allowances and confirm relevant expenses. This means that it must contain the details required for the primary document (Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ). These include the name and date of the document, the name of the organization, the content of the business transaction, the value of the physical measurement - the number of days of travel, the signature of the employee. We also recommend that you provide information that is usually contained in any travel document: time and place of departure and arrival.

Upon returning from a business trip, the employee submits a memo to the employer. He attaches supporting documents to it confirming the use of personal transport to travel to and from the place of business trip. For example, waybills, invoices, receipts, cash receipts, etc. This is stated in paragraph 7 of the regulations approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749.

Compensation of expenses

The employee is compensated:

- payment for fuel and lubricants, repairs;

- daily allowance;

- other expenses.

The accounting department is responsible for calculating expenses. It also determines the validity of the employee’s personal expenses for using the car for work purposes. The amount of compensation is ultimately determined by the employer.

How to confirm?

Expenses can be confirmed by any documents. The main thing is that the costs correspond to the purposes of the trip.

Receipts, checks and other payment information can be used as documents.

Personal car: personal income tax and insurance premiums

Compensation for the use of an employee’s personal car is not subject to:

– Personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation);

– contributions for compulsory pension (social, medical) insurance (subparagraph “and” paragraph 2, part 1, article 9 of the Law of July 24, 2009 No. 212-FZ);

– contributions for insurance against accidents and occupational diseases (paragraph 10, subparagraph 2, paragraph 1, article 20.2 of the Law of July 24, 1998 No. 125-FZ).

For more information about this, see How to take into account when taxing the costs of paying compensation for the use of an employee’s personal car.

Situation: is it necessary to withhold personal income tax from compensation to an employee for the cost of parking a personal car on a business trip?

Answer: yes, it is necessary if such payment is formalized as reimbursement of travel expenses.

Amounts for reimbursement of travel expenses are exempt from personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation). Such expenses include daily allowances, travel and baggage costs, airport service fees, commission fees, expenses for renting residential premises, payment for communication services, obtaining and registering a service passport, obtaining visas, as well as costs associated with exchanging cash. . Such a list is established by paragraph 3 of Article 217 of the Tax Code.

Compensation for the cost of parking an employee’s personal car is not mentioned here. Therefore, it is not included in travel expenses. This means that personal income tax must be withheld from such compensation.

Similar clarifications are given in the letter of the Ministry of Finance of Russia dated April 25, 2013 No. 03-04-06/14428.

Advice: there is a way not to withhold personal income tax from compensation for the cost of parking a business trip employee’s personal car. It is as follows.

All types of compensation payments established by Russian legislation and related, in particular, to the performance of work duties by an employee (clause 3 of Article 217 of the Tax Code of the Russian Federation) are exempt from personal income tax.

If an employer uses an employee’s personal property (including a car), then he is obliged to:

- pay him compensation for the use of personal property (car);

- reimburse the costs associated with such use.

This is established by Article 188 of the Labor Code.

The cost of parking can be considered an expense associated with the use of an employee's personal vehicle for business purposes. Consequently, compensation for parking costs is recognized as a payment established by law and related to the employee’s performance of work duties. And, accordingly, it is not subject to personal income tax.

Thus, personal income tax on compensation for the cost of parking for an employee who goes on a business trip in a personal car may not be withheld. But in order to avoid claims from regulatory agencies, arrange such compensation not as travel expenses, but as reimbursement for costs associated with the use of the employee’s personal car.

This approach is confirmed by the Russian Ministry of Finance in letter dated December 1, 2011 No. 03-04-06/6-328.

Reimbursement of travel expenses

Remember! In accordance with Article 168 of the Labor Code and paragraph 11 of Government Decree No. 749, the following expenses are subject to reimbursement to an employee who was sent on a business trip:

- travel of the employee to the place of business trip and back;

- rental housing expenses;

- daily allowance;

- other expenses incurred by the employee and which the employer agrees to reimburse.

It should be borne in mind that the amount of daily allowance is set by each employer independently. As for government institutions, the amount of daily allowance is strictly defined.

In this case, one should proceed from the requirements of paragraph 3 of Article 217 of the Tax Code, according to which compensation amounts of 700 rubles are not subject to income tax if the employee was sent on a business trip within the territory of Russia. For a business trip abroad, the amount is 2,500 rubles. All amounts that exceed these values are subject to tax.

Upon returning from a business trip, the employee provides an advance report to the employer’s accounting department. Its form No. AO-1 was approved by Decree of the State Statistics Committee of the Russian Federation No. 55 of August 1, 2001.

Personal car: income tax

When calculating income tax, compensation for the use of a personal car can be taken into account only within the limits established by Decree of the Government of the Russian Federation of February 8, 2002 No. 92 (letter of the Federal Tax Service of Russia dated May 21, 2010 No. ШС-37-3/2199). These rules are also intended for calculating a single tax when simplifying the difference between income and expenses. At the same time, according to the regulatory agencies, the standards established by the Government of the Russian Federation already include depreciation of the car, as well as reimbursement of costs for routine repairs, maintenance and the purchase of fuels and lubricants (letter of the Ministry of Finance of Russia dated September 15, 2005 No. 03-03-04/ 2/63, dated May 16, 2005 No. 03-03-01-02/140 and the Ministry of Taxes of Russia dated June 2, 2004 No. 04-2-06/419).

Therefore, no additional payments are made to an employee who uses a personal car for business trips (letters from the Ministry of Finance of Russia dated September 15, 2005 No. 03-03-04/2/63, dated May 16, 2005 No. 03-03-01- 02/140 and the Ministry of Taxes of Russia dated June 2, 2004 No. 04-2-06/419).

Advice: during the business trip, enter into a rental agreement with the employee for his personal car. Taxable profit can be reduced by the entire amount of the rental payment, and if supporting documents are available, by all costs associated with operating the car (subclause 2, clause 1, article 253, subclause 10, clause 1, article 264 of the Tax Code of the Russian Federation). If an organization does not enter into a rental agreement, then it can use the following arguments to justify reimbursement of expenses for the use of a personal car during a business trip.

Article 188 of the Labor Code of the Russian Federation deals with two payments in favor of the employee. The first is compensation for wear and tear of a personal car, and the second is reimbursement of expenses associated with its use (purchase of fuel, maintenance, etc.). In the letter of the Ministry of Finance of Russia dated November 2, 2004 No. 03-05-01-04/72, these payments are also considered separately.

Thus, when sending an employee on a business trip in a personal car, in addition to compensation, the organization must reimburse him for the costs of purchasing gasoline, paid parking, etc. (Article 168 of the Labor Code of the Russian Federation). These costs can be classified as material expenses, as well as travel expenses to and from the business trip. Such costs can be taken into account when taxing profits (subclause 2, clause 1, article 253, subclause 12, clause 1, article 264 of the Tax Code of the Russian Federation). The basis for reimbursement of expenses will be waybills, gas station receipts, etc. That is, the same documents used by employees sent on a business trip in a company car to confirm their expenses.

However, the tax inspectorate is unlikely to agree with this interpretation of the legislation. When checking, the inspector will be guided by letters of the Ministry of Finance of Russia dated September 15, 2005 No. 03-03-04/2/63 and the Ministry of Taxes of Russia dated June 2, 2004 No. 04-2-06/419. Therefore, most likely, he recognizes as unlawful the simultaneous reduction of the tax base by both the amount of compensation for the use of a personal car and the amount of reimbursement for travel expenses. In such conditions, the organization must make the final decision on settlements with the employee independently. Moreover, if this decision contradicts the requirements of the Russian Ministry of Finance, the organization will have to defend its position in court.

What does the law say?

The procedure for business trips, including employee transport, is regulated by the Labor Code of the Russian Federation and by-laws.

In ch. 24 of the Labor Code of the Russian Federation provides a definition of a business trip, outlines guarantees for the employee and the procedure for reimbursement of amounts spent in various conditions of business trips.

The specifics of sending employees on business trips are established by the Regulations put into effect by Decree of the Government of the Russian Federation No. 749 of July 29, 2008.

As explanatory documents, Order No. 33n of the Ministry of Finance of the Russian Federation was introduced in 2021. Taxation issues are explained in Letter of the Ministry of Finance No. 03-03-06/2238 (Explanations of the Department of Tax and Customs Tariff Policy).

Travel by company car

When paying expenses for a business trip in a company car, the organization can reimburse the following costs:

- for the purchase of fuels and lubricants;

- related to the operation and maintenance of the car during a business trip (for example, the cost of parking, repairs along the way, etc.).

The procedure for traveling on a business trip on official transport is not regulated by current legislation. Therefore, the employer can prescribe special rules for such a situation in a local regulatory act issued in accordance with Article 8 of the Labor Code of the Russian Federation (for example, in the Regulations on Business Travel). The correctness of this approach is confirmed by Rostrud in a letter dated April 10, 2015 No. 831-6-1.

Decor

It is important for workers to know what documents are issued before traveling in 2021. There are various nuances of registration, for example, if an employee goes on a business trip in a personal car, then a memo and a waybill will be required. By law, some documents that were previously used when registering a business trip are no longer used. This is a travel certificate, official assignment, etc.

However, at some enterprises managers continue to use them, having issued the corresponding local acts.

When sending an employee on a business trip, the manager is obliged to issue an appropriate order. For this, there is a legally established form T-9 or T-9a, if we are talking about sending several employees. In addition, the enterprise may have a different form of order.

If an employee goes on a business trip using official or personal vehicles, the order contains the following information:

- Company name;

- date and number;

- information about the employee;

- information about the place of business trip;

- duration of the trip;

- target;

- details about vehicles.

The order must be signed by the immediate supervisor of the posted employee. Based on it, the accounting department carries out the necessary calculations and issues daily allowances to the person.

Supporting documents

All facts of economic life (including travel expenses) must be confirmed by primary documents (Article 9 of the Law of December 6, 2011 No. 402-FZ, Article 252 of the Tax Code of the Russian Federation). These include:

- cash and (or) sales receipts;

- gasoline coupons;

- slips (if gasoline was paid for with a fuel card);

- receipts issued at parking lots;

- auto repair shop bills, etc.

The employee must attach documents confirming travel expenses to the advance report.

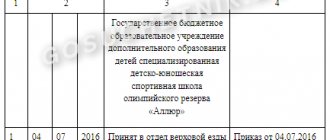

The mileage of the car during a business trip is confirmed by waybills. Prepare your waybills:

– either according to standardized forms;

– or according to forms developed by the organization independently and approved by the head of the organization.

This conclusion follows from Part 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

The following standardized forms are provided for waybills:

- No. 3 for a passenger car;

- No. 3 special for special vehicles;

- No. 4 for passenger taxi;

- No. 4-S or No. 4-P for a truck;

- No. 6 special for buses (except for route buses).

The listed forms of waybills were approved by Decree of the State Statistics Committee of Russia dated November 28, 1997 No. 78.

The issuance of waybills to drivers and their receipt by the accounting department should be reflected in the logbook for recording the movement of waybills (either according to an independently developed form, or according to Form No. 8, approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78).

Expenses

Almost all expenses of posted workers are subject to reimbursement by the employer (Article 168 of the Labor Code of the Russian Federation). Among these expenses are:

- per diem, which the employee spends on food and other needs;

- travel (spending on gasoline);

- rental of property;

- other expenses.

As for the amount of daily allowance, the law sets a maximum for employees of government agencies. Private organizations have the right to independently set the amount, but there are nuances. The maximum daily allowance, which is not subject to personal income tax, in 2019 is 700 rubles for trips within Russia and 2.5 thousand rubles for business trips abroad. Other travel allowances are also calculated based on the organization’s budget.

To receive an advance, the employee must write an application indicating the required amount. It is signed by the manager and then transferred to the accounting department. Money is transferred to a subordinate’s bank card or given in cash. After returning, the employee must hand over the remaining funds to the accounting department on the basis of the appropriate order.

After returning, the employee is required to draw up an advance report and attach the following documents to it:

- hotel receipts or other documents confirming accommodation expenses;

- receipts for payment of fuel and lubricants;

- waybill, service note, etc.

It is important to know that you do not need to report per diem. If the employee drove his own car, the employer is obliged to pay appropriate compensation. Its size is set by him independently, but the engine size of the car is often taken into account. If the volume is 2 thousand cubic meters. see, then at least 1,200 rubles are paid. When the engine volume is higher than this norm, then no less than 1,500 rubles are paid. An employer can also enter into a lease agreement with an employee.

The employer is obliged to reimburse travel expenses, that is, gasoline. If the business trip was carried out in a personal car, then compensation is the same as for a trip in an organization’s car. In order to write off fuel and lubricants, the employer will need receipts from gas stations. The calculation must be carried out in other documents, for example, in the waybill.

Help: if there were several employees on a business trip, then the waybill is issued only to the driver. It is he who is obliged to report on expenses for fuels and lubricants, maintenance, etc.

The employer has the right to extend the business trip. To do this, you must follow the following procedure:

- the employee agrees to extend the work trip;

- the employer issues an appropriate order;

- will transfer the advance amount to the employee.

Read more: Who pays for the examination of project documentation

The manager does not have the right to demand that a subordinate spend his own funds when extending a business trip. If employees do use them, they should receive a refund upon return.

Accounting

In accounting, reflect the receipt and write-off of consumed fuels and lubricants on subaccount 10-3 “Fuel” (Instructions for the chart of accounts).

Depending on the purpose of the business trip, record the purchase and write-off of consumed fuels and lubricants with the following entries:

Debit 10-3 Credit 71

– gasoline purchased on a business trip was capitalized (based on receipt documents);

Debit 20 (25, 26, 44...) Credit 10-3

– the cost of fuel consumed on a business trip is written off (based on the waybill).

Write off the remaining expenses by posting:

Debit 20 (25, 26, 44...) Credit 71

– expenses for operating and maintaining a company car on a business trip are written off.

An example of how expenses for travel on a business trip in a company car are reflected in accounting

General Director of Alpha LLC A.V. Lvov was on a business trip to Tver from January 17 to 19. The purpose of the business trip is negotiations with business partners. Lvov went on a business trip in a company car.

The advance report was approved on January 21. Attached are documents confirming travel expenses:

- gas station receipts for the purchase of gasoline - for a total amount of 1000 rubles. (VAT is not allocated);

- paid parking receipts – for a total amount of 150 rubles. (VAT is not allocated).

The cost of gasoline consumed during the business trip is 860 rubles.

Alpha's accountant made the following entries in the accounting records:

Debit 10-3 Credit 71 – 1000 rub. – gasoline purchased on a business trip was credited;

Debit 26 Credit 10-3 – 860 rub. – the cost of gasoline consumed on a business trip is written off;

Debit 26 Credit 71 – 150 rub. – payment for parking services is reflected.

How is payment made?

Calculation of payments is possible only taking into account the waybill, memo and submitted confirmation of expenses.

Payment can be made in cash or by crediting compensation to the employee’s card. It is possible to pay money to the employee before the start of the trip.

Taxation issues

Business trip expenses in excess of 1,500 rubles are included in the tax base.

If traveling by car is necessary for a business trip abroad, expenses over 2,500 rubles are subject to taxes.

Employee travel expenses must be reported on the annual return.

How is a business trip paid on weekends? Information here.

How to prepare an advance report for a business trip? Details in this article.

Company car: personal income tax and insurance premiums

Regardless of what taxation system the organization uses, compensation for documented expenses for travel on a business trip in a company car does not need to be paid:

- Personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation);

- contributions for compulsory pension (social, medical) insurance (clause 2, part 1, article 9 of the Law of July 24, 2009 No. 212-FZ);

- contributions for insurance against accidents and occupational diseases (clause 2, part 1, article 20.2 of the Law of July 24, 1998 No. 125-FZ).

The procedure for calculating other taxes depends on what taxation system the organization uses.

Nuances

Payments in a budget institution

In organizations financed from the budget, reimbursement for a business trip in your own car is carried out in accordance with the Procedure and conditions of business trips, reimbursement of expenses associated with the use of personal vehicles by civil servants to travel to the point of business and back.

Director's business trip

The director, like any employee of the company, can go on business trips in his own car.

The reason for paying the director compensation for his expenses should be a document issued by the company, as for an ordinary employee.

If there are several employees

If several people go on a business trip in the car of one of the employees, then the waybill is issued only for the driver.

Also, if only the driver pays for gasoline, other employees should not provide receipts from gas stations.

The basis for calculating the time spent on a trip is a memo issued by each subordinate. A note is a reporting document for subordinates who returned from a trip separately from the driver, earlier or later.

The same norms apply to subordinates who travel in a company car.

The rules for using your car to arrive at your destination by one or more subordinates are fixed in a local document drawn up by the company’s management.

If repairs are required

If, during a business trip in a personal car, the car required maintenance or repair of breakdowns, the company reimburses the costs incurred in accordance with the agreement on the use of the vehicle for the needs of the company, concluded between the employee and the enterprise.

How to arrange a business trip during vacation? Read our article. How is night overtime paid? Find out here.

If an employee is involved in an accident

If the accident occurred due to the fault of an employee, then the organization does not reimburse him for the costs incurred or compensate for the costs of restoring the car. Those. payments to the injured party will be made by the employee's insurance company, and if the amount of insurance does not cover the damage, compensation to the injured party will be made by the subordinate himself.

In the event of an accident through no fault of the employee, the company compensates him for expenses incurred under an agreement on the use of the car for business needs.

Postings

The payment intended to a subordinate as compensation for the use of his car for the business needs of the company is made once a month and is reflected using the following entry:

Company car: income tax

Travel expenses on a business trip reduce taxable profit (subclause 12, clause 1, article 264 of the Tax Code of the Russian Federation).

For more information on how to take into account travel expenses when calculating income tax if an employee of an organization is sent on a business trip to purchase a fixed asset, see How to determine the initial cost of a fixed asset in tax accounting.

For more information on how to take into account when calculating income tax the costs of fuels and lubricants paid by an employee on a business trip (according to the norms or in the amount of actual expenses incurred), see How to reflect the purchase of fuels and lubricants for cash in tax accounting (OSNO).

During a business trip, an employee can buy fuel and lubricants for cash. If the cash receipt states “including VAT” and the tax amount is not allocated, then you will not be able to take advantage of the tax deduction (clause 1 of Article 172 of the Tax Code of the Russian Federation). It is also impossible to increase the cost of fuel and lubricants by the amount of VAT. VAT is not included in expenses that reduce taxable profit (Clause 1, Article 170 of the Tax Code of the Russian Federation). Therefore, for tax accounting, the amount of VAT must be allocated by calculation (at a rate of 18/118) and written off without reducing the tax base. In accounting, at the time of writing off fuel and lubricants, a permanent difference and a permanent tax liability will arise (clauses 4 and 7 of PBU 18/02).

For more information on tax accounting for fuel and lubricant expenses, see:

- How to reflect the purchase of fuels and lubricants for cash in tax accounting (OSNO);

- How to record the purchase of fuels and lubricants using fuel cards;

- How to record the purchase of fuel and lubricants using coupons.

An example of how expenses for the purchase of fuel and lubricants are reflected in accounting and taxation during a business trip in a company car. The organization applies a general taxation system

Manager of Alpha LLC A.S. Kondratiev went on a business trip to Vladimir in a Skoda Rapid company car. On May 18, the employee received an advance from the cash register for travel expenses in the amount of 3,000 rubles. On May 21, Kondratyev returned from a business trip and submitted an approved advance report to the accounting department.

Among other documents, gas station cash receipts are attached to the advance report, from which it follows that the employee purchased 60 liters of AI-95 gasoline for a total amount of 2,064 rubles. In the cash receipt, VAT is not highlighted in the price of gasoline and is not mentioned at all.

According to the itinerary:

- the remaining fuel in the tank when leaving on a business trip is 5 liters;

- the remaining fuel in the tank when returning from a business trip is 5 liters;

- During the business trip, the car's mileage was 700 km.

Thus, 60 liters (5 l + 60 l – 5 l) can be written off as expenses. The organization's accounting policy provides for the method of writing off inventories at the average unit cost. The Kondratiev purchase price for gasoline corresponds to the calculated average cost. The gasoline consumed by Kondratiev during the business trip was written off by the Alpha accountant at the purchase price.

Kondratyev’s expenses for the purchase of gasoline were reflected in the accounting records by the Alpha accountant using the following entries.

May 18:

Debit 71 Credit 50 – 3000 rub. – an advance was issued for travel expenses.

May 21st:

Debit 10-3 Credit 71 – 2064 rub. – gasoline purchased for cash is capitalized;

Debit 26 Credit 10-3 – 2064 rub. – the cost of consumed fuel is written off (based on the waybill).

In tax accounting, the accountant also writes off 2,064 rubles for expenses.

Using taxi services on a business trip

If expenses for taxi travel are recorded in the above documents or are authorized by the employer, then the employee should attach to the advance report a receipt on a strict reporting form or a cash register receipt issued after the trip by the taxi driver. In the absence of these documents, reimbursement of costs for taxi services cannot be made. An electronic check sent by email by the carrier is not a supporting document.

Read more: What activities are meant by waste collection

The strict reporting form receipt must contain the following information:

- receipt details: series, number;

- name of the carrier, his TIN;

- fare amount;

- date of issue of the receipt;

- signature with a transcript of the person who issued the receipt.

Reimbursement for taxi services is included in the organization's expenses, by the amount of which its income tax base is reduced. A prerequisite is documentary evidence that the trip was made (a check or receipt for strict reporting) and confirmation that the trip was part of an activity aimed at making a profit. A business trip is an integral part of the activities of any organization, therefore the costs of its implementation are included in the expense item.

Good afternoon The employer sends 4 people for training on my vehicle along the Rostov-Taganrog route every day for 5 days. What documents do I need to register a business trip and reimburse expenses?

Natalya Gushchina Author

Registration of employees on a business trip begins with an Order to send the employee on a business trip. It indicates for what period the employee is going on a business trip, to what place and for what purposes. The accompanying document is an official assignment, which indicates in more detail the purpose of the business trip, the stages of interaction with counterparties, clients, potential buyers or other persons.

After completing the order and official assignment, an advance amount is paid, intended to be spent during the business trip. The advance covers daily expenses: accommodation, meals and related expenses (travel to the place). When the money is received, all documents are completed, the employee is given a travel certificate, and then in the personnel department, accounting department or the secretary he is given a stamp stating when he goes on a business trip (the date is indicated), where he is leaving from, and the signature of the person confirming the employee’s departure from places of work. The date on which the departure fields on the back of the travel certificate are filled in is considered the date when the employee is sent to the destination. After arriving at the place of business trip, he puts a mark of arrival in the accounting department, the secretary or another person with the stamp of the organization.

It happens that a seconded employee is sent to one place, but to solve some work problems he has to go to other organizations. In such cases, on the reverse side of the travel certificate it is necessary to reflect all the points where the employee arrives and from where he departs, so that there are no problems in justifying travel expenses.

The final stage of filling out the reverse side occurs when the employee returns to his organization. He marks his arrival at the organization in the personnel department, and at this point the reverse side of the travel certificate is considered completed. Within three working days after returning from a business trip, the employee must report and submit an advance report on all expenses incurred.

Travel conditions in your case are decided solely with your employer; in any case, keep receipts from gas stations and record fuel consumption for business trips.

With the adoption of amendments to the Labor Code of the Russian Federation and a number of by-laws, the list of documents required to register a business trip on a personal vehicle has been significantly reduced. The basis for sending an employee on a trip is an order from the employer in form T-9 or T-9A. Form T-9A is used when several employees are traveling on business.

simplified tax system

The tax base of simplified organizations that pay income tax is not reduced by travel expenses (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

Simplified organizations that pay a single tax on the difference between income and expenses can include documented travel expenses as expenses (subclause 13, clause 1, article 346.16 of the Tax Code of the Russian Federation). At the same time, expenses for fuels and lubricants of organizations using the simplified tax system are taken into account in the same manner as organizations using the general taxation system (subclause 12, clause 1, article 346.16 of the Tax Code of the Russian Federation). VAT amounts on travel expenses will also reduce the tax base for the single tax (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation).

For more information on tax accounting for fuel and lubricant expenses, see:

- How to reflect the purchase of fuels and lubricants for cash in tax accounting (special regime);

- How to record the purchase of fuels and lubricants using fuel cards;

- How to record the purchase of fuel and lubricants using coupons.

Features of the trip

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (Saint Petersburg)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

To compensate for the costs of fuels and lubricants, repairs, and depreciation of the car, it is necessary that a business trip in a personal car be agreed upon with the employer.

The ability to go on employer-compensated trips in a personal car may be specified in the employment contract or a separate agreement.

Organizations have the right to adopt local regulations regulating the procedure for compensating employees for travel expenses using personal transport. Relevant norms may also be provided for in a collective agreement.

The employee must keep receipts and receipts for spent fuel and lubricants and vehicle repairs. Confirmation of payment must also be provided if fuels and lubricants were purchased by bank transfer and using a bonus card.