Score 76. AB

If it is necessary to calculate and withhold alimony amounts collected from employees, account 76 is also used. The final balance for these entries can be of a debit or credit nature, depending on the specified conditions. Debit records any debt owed to the company.

The loan collects information on the debts of the enterprise itself to third parties. Therefore the account belongs to . 76 account in the balance sheet can be taken into account both in the active part and in the passive part. To do this, its expanded balance is analyzed. Debit balances constitute the asset item “Debit Accounts”.

The credit balance increases the liability of the balance sheet under the item “Accounts payable”. Analytical accounting is maintained separately for transactions.

Postings to account 76 form the final balance for each fact of mutual settlements with debtors and creditors.

On account 76, subaccounts have many meanings, the most used among them are: 76.

Account characteristics/description:

Question about filling out lines 1230 and 1260 of the balance sheet. Can we show VAT accrued on advances received, reflected in Dt account 76-AB, and reflect other current assets in line 1260? What regulatory documents establish the rules for reflecting such VAT? We make decryptions for banks to creditors and other accounts receivable and payable, if we show the accounts payable to the bank minus VAT, will this be correct, because if the buyer refuses the order, then we will be obliged to return the entire amount of the advance to him, and not minus VAT?

Come on. 1 day of playing with the awl will bring a fresh stream of hatred towards the flat-decks and their fans. And it will give at least some variety. You can play for an hour.

From the above provisions of Law N 402-FZ it follows that Recommendations for audit organizations, individual auditors, auditors on conducting an audit of the annual financial statements of organizations for 2012 (appendix to the letter of the Ministry of Finance of Russia dated 01/09/2013 N 07-02-18/01) and Recommendation An organization can apply R-29/2013-KpR, but is not obliged to.

According to paragraph 38 of PBU 4/99, the articles of the financial statements prepared for the reporting year must be confirmed by the results of the inventory of assets and liabilities. In the debt inventory sheet, all amounts appear including VAT.

An advance is often confused with a deposit. Both the advance and the deposit have one function - advance payment for a product or service, partial or full.

At the same time, according to Part 1 of Art. 30 of Law N 402-FZ, until regulators approve the federal and industry standards provided for by this Law, the rules for maintaining accounting records and preparing financial statements approved by the Ministry of Finance of Russia before the date of entry into force of Law N 402-FZ (until 01/01/2013).

Subaccount 76.1 includes all expenses associated with personal and property types of insurance. This includes a voluntary form of insurance for employees, in addition to mandatory types - medical and social.

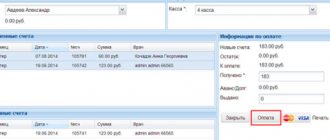

Almost any company is faced with a situation where it is both a debtor and a creditor. To keep records more correctly in 1C Accounting, it is recommended to offset or adjust the debt. To do this, you should use the document of the same name in the program. It must be filled out as follows:

- In the 1C Accounting menu section with operations that record all sales, there is a corresponding subsection. You must select the desired document, and to open the form to fill out, use the button to create a new document. The transaction type must be set off of previously paid advances.

- In the field with the operation parameters, you should determine which option to use: if you need to offset the advance received from the buyer, then you should specify that the offset is made from the buyer. If operations are performed with a supplier, then a different value is set.

- In order to offset an advance received from a buyer, it should be indicated that the offset is made against his debt to the organization (this also applies to the debts of third parties when carrying out an offset operation with them). To perform similar actions with a supplier or a third party, it is necessary to indicate that the advance payment is offset against the company’s debt to the relevant counterparty.

- Be sure to indicate the buyer or supplier (depending on the situation). The choice of organization is made from the appropriate directory, where all the necessary information must be present.

- When carrying out the described operation in front of a third party in 1C Accounting 8.3, the counterparty should be selected in the appropriate field, depending on whether he is a debtor or a creditor.

- In the case of offset of obligations in foreign currency, it is also necessary to reflect this fact in the form, indicating the name of the currency in the appropriate field.

- Data about the debt of the organization and its counterparties is entered automatically after clicking on the button to fill out the form. As a result, the table should contain data on the agreement, documents confirming the execution of settlements, as well as on the amounts of mutual debt. Next, you should adjust the data so that only information remains about the amount of debt and advances that will be offset against each other.

- After completing all actions, the document must be processed and the editing process completed. As a result, the amount of debt should decrease by the amount of advance payments.

Rebus Company

But we looked at only one side of the coin - when our company acts as a seller of its own products.

But in order to produce these products, the enterprise buys everything necessary for production (materials, equipment, etc.) and in this case itself acts as an ordinary buyer and pays VAT upon purchase, which the sellers added to the price of their goods. And this is where the “most interesting” part comes in.

Since VAT must flow into the pocket of the state from the buyer through the pocket of the seller, then when our enterprise acts as a buyer, the state returns to it the amount of VAT that it transferred to the seller.

In order not to get confused in complex calculations, the state introduced the following procedure: 1) first, each enterprise calculates the amount of VAT that it must pay to the state directly - that is, the amount from transactions in which our enterprise acted as a seller.

This part of the VAT is reflected in the liability side of the balance sheet.

Advances issued and received: procedure for registering accounting entries

How should these lines be filled out? Is there a strictly defined algorithm for passing an audit?

On this issue, we adhere to the following position: In the case under consideration, the organization did not make mistakes when reflecting in the balance sheet debts for advances issued and received. Therefore, no corrections to the balance sheet are required.

Justification for the position: In accordance with Part 1 of Art. 14 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting” (hereinafter referred to as Law N 402-FZ), annual accounting (financial) statements generally consist of a balance sheet, a statement of financial results and appendices thereto. The mentioned annexes include: - statement of changes in capital; — cash flow statement; — report on the intended use of funds (clause

2 orders of the Ministry of Finance of Russia dated July 2, 2010 N 66n “On the forms of financial statements of organizations”, hereinafter referred to as Order N 66n); - others

What is the procedure for using subaccounts 76-AB and 76-VA to account for VAT amounts on advances received and issued?

3 Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n, clause.

3 Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n). Received (issued) advances (prepayments) are reflected in accounts payable (receivable). In the balance sheet they are reflected minus the amount of VAT payable (paid) to the budget (from the seller) and minus the VAT accepted for deduction (VAT subject to deduction) from the buyer (Appendix to the Letter of the Ministry of Finance of Russia dated 01/09/2013 N 07-02- 18/01, Letter of the Ministry of Finance of Russia dated 04/12/2013 N 07-01-06/12203, Interpretation T-16/2013-KPT “VAT on advances issued and received” (organization-developer: OJSC MCC EuroChem, Fund NRBU "BMC", meeting date: 08/09/2013) (hereinafter - Interpretation T-16/2013-KpT)). VAT amounts as part of receipts from buyers

We recommend reading: M Zhukova d 35 bailiffs Moscow

Passive balance: decoding lines

Actually, what’s the point of this post - I hope that the local double basses will be able to get some information on the above-mentioned issues. At the office asking all this on the forum, as I see it, is pointless, and it can lead to RO, you never know, well, their forest. At the same time, none of the current rules for maintaining accounting records and preparing financial statements approved by the Ministry of Finance of Russia (Part 2 of Article 21, Part 1 of Article 30 of Law N 402-FZ) specifies the procedure for reflecting debt on advances issued and received in the given recommendations. not installed.

If an organization decides to use VAT deduction from an advance issued, then after the provision of the service and the closing of this advance, it will be obliged to restore this VAT to the budget.

It should only be added that this report makes sense to use only after the balance sheet in 1C has been completely reconciled. After all, this technique is based on his data.

ToTo Design School

If it is necessary to calculate and withhold alimony amounts collected from employees, account 76 is also used. The final balance for these entries can be of a debit or credit nature, depending on the specified conditions. Debit records any debt owed to the company.

The loan collects information on the debts of the enterprise itself to third parties. Therefore, the account belongs to active-passive.76 the account in the balance sheet can be taken into account in both the active and passive parts.

To do this, its expanded balance is analyzed. Debit balances constitute the asset item “Debit Accounts”. The credit balance increases the balance sheet liability under the item “Accounts payable.” Analytical accounting is maintained separately for transactions.

Postings to account 76 form the final balance for each fact of mutual settlements with debtors and creditors. On account 76, subaccounts have many meanings, the most used among them are: 76.

How to reflect VAT on advances in the balance sheet

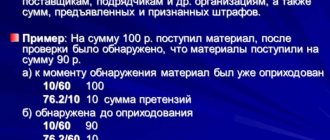

According to the rules of the Tax Code, an organization on OSNO that is not exempt from VAT, when receiving an advance on account of upcoming deliveries of products, works, services upon receipt of them, must calculate VAT (clause 2, clause 1, Article 167 of the Tax Code). Let's do this: VAT payable = 141,600 / 118 * 18 = 21,600 rubles.

At the moment when the clothes are sewn and shipped, Moda LLC needs to charge VAT again - already on the cost of the shipped products: VAT payable = 141,600 / 118 * 18 = 21,600 rubles. And VAT accrued earlier on the advance payment is accepted for deduction (clause 1, clause 1 and clause 14 of Article 167, clause 8 of Article 171 and clause 6 of Article 172 of the Tax Code).

A deduction is made if, after receiving an advance payment, the terms of the contract are changed or terminated and the corresponding amounts of advance payments are returned (clause 5 of Article 171 of the Tax Code). But in our example, we have only received an advance. How to reflect its receipt and the accrual of VAT on advances received in accounting?

To do this, they usually use one of the subaccounts to account 76:

Postings for advances issued and advances received

The required entry is included in the document automatically with the “Advance payment” event. We post the document and see that our VAT amount goes to the debit of account 68.02, reducing the total amount of VAT payable, and to credit 76.AB, closing settlements for this counterparty. Federal and industry standards are mandatory for use, unless otherwise established by these standards (Part 2 of Article 21 of Law No. 402-FZ).

An advance payment is an advance payment to the supplier against future deliveries, work performed or services performed. Transferring an advance payment to a supplier does not mean receiving economic benefits, since the supplier may, for various reasons, fail to fulfill its obligations under the contract: fail to ship goods, fail to provide a service. In this case, the advance payment is returned to the buyer’s account if it was transferred through a bank, or to the cashier if received in cash. The buyer does not have the right to accept VAT as a deduction if all of the above conditions are not met. Acceptance of VAT deduction is not an obligation, but a right of the purchasing organization.

Drawing up a balance sheet is essentially transferring the balances of the accounting accounts to the lines provided for them. Therefore, to correctly draw up a balance sheet, you need not only to keep accounting records correctly and in full, but also to know which accounting accounts are reflected in which line of the balance sheet. With its help, they collect insurance information, make claims against contracts, take into account deposited wages, and conduct settlements with employees, confirming them with executive documents.

Firstly, doing a financial analysis of economic activity on the basis of accounting data in the conditions of Ukraine and Russia is not a rewarding task. The results of such an analysis may be of interest only to auditors, and it is not clear for what purpose. For potential investors, such an analysis does not show the real picture of the enterprise. For the manager and owners, this is often a very good letter. As stated in Part 7 of Art. 21 of Law N 402-FZ, recommendations in the field of accounting are adopted in order to correctly apply federal and industry standards, reduce the costs of organizing accounting, as well as disseminate best practices in organizing and maintaining accounting, the results of research and development in the field of accounting. Unlike standards, recommendations in the field of accounting are applied on a voluntary basis (Part 8 of Article 21 of Law No. 402-FZ).

Account 76 av

Receipt of goods from suppliers with invoices has been established. 2. Shipments to customers with invoices have been initiated. 3. Advance invoices have been made for the buyers' prepayments. We begin to study Operations - Closing the period - VAT Accounting Assistant.

There is also a useful summary report in 1C, see. Reports - Analysis of VAT accounting If payment and shipment (receipt) are in the same period, then everything is taken into account very simply: all my documents “Receipts of goods” in the invoice received have a checkbox “Reflect the VAT deduction in the purchase book by the date of receipt.”

Those. here we immediately make entries for VAT refund (68.02 Thus, the document creating the purchase book and sales book are almost empty. And all sorts of advances and other evil spirits got there, which makes the life of an accountant bright and eventful. The problem is that if you spit and don’t understand with advances, then all this will come out anyway.

Therefore, we are looking for algorithms for checking advances.

Account 76.AB - VAT on advances and prepayments

And it can also be understood - invoice documents and regular invoices are handed over with the delivery of goods, usually in boxes. If, after all, there is such a financial system. for an advance payment from the supplier, then it must be handled in Purchases - Invoices received - Invoice for advance payment . 4. If there were schf. for an advance from the supplier, then after the full cycle the balance is on the account. 60 of our supplier is empty and, accordingly, the balance of 76.VA for our supplier is empty. 5. If there is a balance left in the prepayment to the supplier at 60.2, then there should also be a balance at 76.VA, in the ratio (60.2*0.18/1.18=76VA).

That's all, miracles don't happen. Everything is very simple! And by the way, having calmly spent 1 day getting to grips with the meaning of VAT charges and another 1-2 days sorting out mutual settlements with suppliers and customers, as well as re-processing documents + re-closing months 30 times, I had noticeable confidence (turning into euphoria ) that we did VAT correctly.

We reclose sequentially January, February, March through “close month”. In the same place, see the formation of a book of purchases and sales; by the way, the creation of these documents must be controlled manually, since it has been noted that they may not be created automatically.

We prepare a VAT return for the 1st quarter. It appears in Reports - Regulated reports - list (VAT Declaration) . There is a sequence for filling out the Sections - see the icon on the right? .

Further errors: 1. If OKTMO is not automatically substituted in Section 1, then we stupidly re-select “tax authority” on the Title page.

76av in the balance sheet as it closes

, making postings: Dt 62 Kt 51 - refund of advance payment. Dt 68 Kt 76 - acceptance of VAT on advances received for deduction.

• Reflects VAT for deduction in the purchase ledger. • Fills out line 120 of section 3 of the VAT return. Option for selling previously paid goods and materials • The seller accepts VAT on the advance received for deduction (clause

8 tbsp. 171 of the Tax Code of the Russian Federation), making entries: Dt 62 Kt 90 - proceeds from sales received. Dt 90 Kt 68 - VAT is charged on sales. Dt 68 Kt 76 - VAT on advances received is deducted. • Shows the VAT deduction for advances received in the purchase book with the invoice number that was issued by the seller upon receipt of the advance.

• Fills out a declaration in which he enters a deduction in line 170 of section 3. Tax authorities believe that VAT is charged on the advance payment received in any case, even if the periods of receiving the advance payment and the sale coincide (letter of the Federal Tax Service of Russia No. ED-4-3/11684).

We recommend reading: Order on the monthly sales plan

In addition, according to sub. 3 p.

Economics: indicators of financial stability of an enterprise

Of course, it is impossible to talk about all the nuances of calculating VAT on advances in one article, so if you want to fully master this and other topics related to VAT calculation, I recommend you our video course “VAT: from concept to declaration”! We share practical experience and help bring order to your database. The course is structured according to the “theory + practice in 1C” scheme. Detailed information about the course is available at the link VAT: from concept to declaration. The company chooses options for paying dividends at a general meeting or at the board of directors. The law does not provide for or oblige companies to pay dividends on securities, even if they have net profit.

Well, in general, if you ever introduce Aviks “for testing” into the design bureau, then it will be in this format, “Clan Half-Bumps”. I even suspect that the blitz was started for the sake of this test) will they give it for free for the sake of six hours of play? What do you think?