Expenses for purchasing the liner

Providing an employee with a work book is the responsibility of the employer (Article 65 of the Labor Code of the Russian Federation). And this obligation extends to the insert as an integral part of the work book.

Forms of both documents are purchased by the employer for a fee from their manufacturer or distributor (clauses 2-5 of the Procedure approved by Order of the Ministry of Finance of the Russian Federation dated December 22, 2003 No. 117n) and are stored with him until issued to the employee.

Expert opinion

Volkov Georgy Tarasovich

Legal consultant with 10 years of experience. Specializes in the field of civil law. Member of the Bar Association.

When issuing a work book or insert, the employee must reimburse the employer for the cost of the corresponding form (clause 47 of the Rules approved by Resolution No. 225). Refunds can be made by:

- deduction of funds from wages;

- depositing cash into the cash register;

- cashless transfers.

The employee is not charged for the form in cases (Rules approved by Resolution No. 225).

- damage to the form is not his fault (clause 48);

- restoration of documents after emergency situations (clause 34).

Who's buying

Forms and applications are strict reporting documentation that records the worker’s service life. The employer is required to keep and maintain the forms. According to the rules, the employer is required to purchase the forms, the accounting department must store blank forms, and the HR department must issue them.

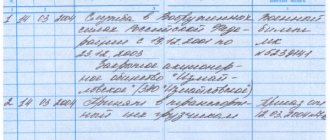

In the cash receipts book, which is maintained by the organization's accounting department, records are recorded with all operations related to the acquisition, expenditure of new forms and applications, where the series and number of each document are indicated, and a stamp is placed.

The personnel department or other department that processes the hiring and dismissal of an employee maintains a record book. It records the movement of work books and applications. If the employee is given the document again, the operation is recorded in the accounting book indicating all the required data.

Prospects for an insert for an electronic work record book

Until 2021, a work book, issued in the form of a paper document, was the only possible option for reflecting information about work and awards for it. Since 2021, it has become mandatory to accumulate data entered into the work book in electronic form in a database stored in the Pension Fund of Russia (Art.

66.1 of the Labor Code of the Russian Federation, Law “On Amendments...” dated December 16, 2019 No. 439-FZ).

The presence of an electronic database allows you to avoid entering information about your work activity into a paper document, since the necessary information can be obtained from it at any time and not only in paper form, but also in electronic form. However, the paper work book continues to be relevant because:

- It remains a source of information about work that took place up to 2021. The information base records only data characterizing it as of January 1, 2020 (clause 1.7 of Appendix No. 2 to the Resolution of the Board of the Pension Fund of the Russian Federation dated December 25, 2019 No. 730p). If an employee refuses to keep a work book on paper, a record of this is made in it (clause 3 of Article 2 of Law No. 439-FZ) and its registration is terminated. The employee will have to keep the book with him.

- The employee has the right to make a choice in favor of maintaining a paper document (Clause 2, Article 2 of Law No. 439-FZ). In this case, it will continue to be processed (in parallel with the accumulation of electronic data) either until the employee completes his labor activity (clause 4 of article 2 of Law No. 439-FZ), or until he makes a decision to switch to the electronic version (clause 5 of art. 2 of Law No. 439-FZ). A work record book that continues to be kept on paper may require an insert.

However, for persons hired for the first time after 2021, an electronic work book is the only possible way to generate information about work activity (Clause 8 of Article 2 of Law No. 439-FZ). This means that over time, the paper work record book will disappear completely, and with it the need to draw up an insert for it.

Features of changing information when filling out the insert

Before filing the insert in the work book, the employee uses it for many years. Not surprisingly, changes may occur in his life. A woman can get married and change her last name, her education can change, her qualifications can improve. These nuances should be reflected in the owner's work report.

Therefore, it is quite advisable to invite the owner of the work to write an application for the issuance of an insert . It is also appropriate to invite him to fill out a questionnaire. This will allow you to determine what changes have occurred and understand how to fill out the insert most competently and adequately.

If the employee graduated from a university, which was not reflected on the title page of the employment contract, in the insert in the line “education” you write “higher”. If the specialty in which a citizen works has changed, then you have the right to indicate the specialty in which you are hiring him when providing the necessary documents.

The most important thing is to pay attention to the last name of the work owner. The entry in the insert must match:

- with passport data;

- with information in TC.

If the passport and TC have different surnames of the owner of the documents, then you need to request a document that reflects the reason for the change of surname, for example, a marriage certificate. After submitting the document that affected the change of surname, you:

- Make a copy of this document or offer the employee to do so.

- File a copy in your personal file.

- Based on your passport, enter your new surname on the title page of your work permit.

When changing your last name:

- On the title page of the work document, you need to carefully cross out the old name.

- Below write down the last name that is relevant at the moment.

- On the inside cover of the employment record, make a note about the change of surname.

The entry is made as follows: “The last name has been changed to (insert new last name) on the basis of (passport, enter passport details). Keep in mind that without providing a document confirming the reason for the change of name, you do not have the right to accept the book of a newly employed person, since he has not confirmed its authenticity.

Let's sum it up

- The source of information about the employee’s work activity is the work book. A special form in the form of a book is provided for its registration. When the sheets of one of the main sections of this document are fully used, an insert is sewn into it, filled out according to the same rules as the work book.

- The costs of purchasing the work book forms and the insert in it are borne by the employer. But the employee must reimburse the employer for the amount of these expenses when he is issued the appropriate form.

- With the introduction of an electronic method of accumulating data on labor activity, there is no need to draw up a paper work book and, accordingly, to use an insert in it. However, these documents serve as confirmation of work experience that occurred before 01/01/2020, and, despite the mandatory accumulation of information in electronic form, which has begun, they will continue to be issued for persons who have decided to continue maintaining a paper document.

- Initial registration for work after 2021 will be carried out without issuing a paper work book. Therefore, over time, its paper version will no longer be used at all. Accordingly, the need for an insert will disappear.

In many situations, when working for a long time or frequently changing places of business, it may be necessary to draw up an insert in the work book, and not all employers or the employees themselves know what this document is for, what form it takes and who should buy it. It should be remembered that this issue is strictly regulated by law and violation of its rules can lead to infringement of the rights of the worker or to holding the employer liable.

Every HR specialist should know what an insert in a work book is, how it is drawn up in the book for recording the movement of documents of an enterprise, and other nuances associated with its maintenance and filling out.

In what cases does the employer pay for the form?

It must also be said that there are exceptions to the general rule, according to which both the work book and the insert for it are paid for at the expense of the employee. The same paragraph 47 of the Rules indicates that the cost of the form is paid by the employer in the following cases:

- If the form is damaged by the employer himself (clause 48 of the Rules). If the entries in the book or insert were made incorrectly from the very beginning or the document form was irreversibly damaged and this damage occurred for any reason other than the direct fault of the employee, the employer issues a new document form, and the employee does not pay these expenses.

- If as a result of an emergency there was a massive loss of work records (clause 34 of the Rules). Since the insert is sewn into the book and is not filled out separately from it (clause 38 of the Rules), if the books are lost, of course, the inserts are also lost. In this situation, the employee is issued a duplicate document, and the costs for such issuance are borne by the employer.

Thus, we can draw the following conclusion: in general, the employee pays for the issuance of both the insert and a duplicate in the event of loss or damage to the work book (together with the insert) through his fault. If the document turns out to be lost while it was in the employer’s custody, or damaged by the employer, the employee does not bear any expenses.

Insert in the work book - what is it, legislative regulation

An insert in a work book is a separate document that duplicates the fields provided in the book itself. Accordingly, it is possible to answer the question of why an insert in a work book is needed even based on its content - it is used when there are no free pages in the work book or its separate part for new entries.

This means that the worker does not need to start a new work book if the old one runs out of pages. The insert is an entirely official document that has a certain level of security against counterfeiting and is provided in accordance with the form established by law.

The direct issues of regulating the use of inserts are enshrined in various regulatory documents of the Russian Federation, which include:

- Government Decree No. 225 of April 16, 2003. This regulatory document is the main one, according to which all other regulations and principles of legal regulation of the use of labor and liners are implemented. It is in it that the rules for storing and maintaining the said documentation, as well as the necessary forms of documents, are enshrined.

- Resolution of the Ministry of Labor No. 69 of October 10, 2003. This resolution establishes general rules, according to which both the work books themselves and the inserts in them are filled out and used.

- Order of the Ministry of Finance No. 117n dated December 22, 2003. This order approves the current procedure, according to which Russian employers are provided with the forms of the work books and inserts themselves, since it is precisely this side of the labor relationship that is responsible for maintaining and processing the said documentation.

The labor period is over, we sew in the liner

A work book is an employee’s document confirming his work experience. All employers, both organizations and entrepreneurs (private notaries, lawyers who have established law offices) must keep work books of their employees if they have worked for them for more than 5 days, and this place of work is the main one (Part 3 of Article 66 of the Labor Code of the Russian Federation ).

As a result, the work book is included in the list of documents required to be presented during employment (Article 65 of the Labor Code of the Russian Federation). Of course, this only applies to workers for whom this is not the first place of work, and therefore they already have a work book.

In practice, it happens that a personnel employee needs to make a new entry in the work record, but there is not enough space for this: the work book has run out. Who should buy the insert? Since employers are responsible for maintaining labor records by law, it is the enterprise’s personnel officers who must take care of purchasing and sewing such an insert into the employee’s work book (clauses 44, 46 of the Rules, approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225).

It would seem, why not use other sections of the labor report? After all, there may be space left in them, which is enough for subsequent entries. But you can’t do that. In case there is no space left for a new entry, inserts are provided in the work book (clause 38 of the Rules, approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225).

How to prepare an insert in a work book

In general, making notes in the insert should be done in the same way as directly filling out the work book. These actions are carried out directly by the employee’s employer - only this person has the right to make any entries or transfer such powers to individual employees, including employees of the personnel department.

So, when filling it out, the following procedure should be taken into account:

- The title page of the insert is filled out taking into account the actual date of execution of the document. In this case, it is the date of filling out the insert that is indicated, and not the date of registration of the work book.

- The insert contains the actual data of the employee at the time of filling it out. This is important for cases where the employee has changed his first and last name, his position or other features of the installation data have changed.

- The title page is affixed with the employer's seal and the signature of the responsible person. If the organization does not use a seal, then its affixing is not necessary.

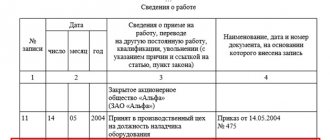

- The insert itself is filled. The procedure for filling it out is identical to making entries in the work book. Thus, the numbering of entries on the insert should continue the numbering existing in the work book. If the entry was started in the work book, but not completed, it continues in the insert from the moment of the break.

- The insert is filed in the employee’s book.

- On the first sheet of the labor document, a stamp is affixed indicating the issuance of the insert, in which the installation information of the document being entered is entered, and if there is no such stamp, a similar entry is simply made by hand.

- A mark of issue is affixed in the book of registration of the movement of work books.

Rules and instructions for maintaining and filling out the insert in the TC

Maintaining the insert is guided by two documents that are most important in this regard:

- Rules approved by the Government on April 16, 2003 No. 225.

- Resolution of the Ministry of Labor and Social Development dated October 10, 2003 No. 69 – Instructions for filling out and maintaining Labor Codes and inserts for them.

The inserts are filled in accordance with the listed regulatory documents.

The insert in the TC must be filled out carefully, without any marks. It is filled out before the number is entered into the TC and filed. The fact is that when filling out there may be a blot or typo.

In this case, you will have to change the form and correct the labor number entered on the title page. If a blot or mistake is made when filling out the title page of the insert, the form must be replaced and a careful entry must be made on a new form, and the damaged one must be written off as an act.

The filling date is usually not chosen arbitrarily, but is associated with the need to make a new entry:

- about hiring or dismissal;

- on renaming a department or organization;

- about changing the form of ownership, etc.

For example, an employee submitted his resignation 2 weeks in advance. During this period, a dismissal order is prepared and the Labor Code is put in order. If necessary, fill out the insert. Sometimes filling out the insert is associated with the next inspector (or other) check. That is, the date of filling out the insert should not be associated with a specific event reflected in the labor report. However, such a connection can be assumed.

The issuance stamp can legitimately replace an inscription entered manually. Just like the inscription, the stamp is placed in the upper right corner of the title page of the work. This is a small rectangle 10x25 mm, which consists of the wording: “Insert issued.” The insert number is entered by the issuing authority.

The transfer of a record from the TC to the insert is carried out directly. The HR person or person in charge must visually determine that there is enough space on the page for the last entry.

He brings it in, filling the remaining space. The next entry is made in the insert. It is considered normal if the appointment record remains in the labor record. And the information about the dismissal is included in the insert.

The numbering of entries in the insert continues the numbering of entries included in the work record. That is, the first serial number in the insert is one more than the last one in the work book. If one insert already exists, the next one continues the numbering of the previous one.

Step-by-step design

A blank insert form is filled out by analogy with the entries in the work book.

However, the information in the insert may be more current. For example, the surname changed due to marriage. The employee has acquired a higher education, increased his rank, etc. It is necessary to identify the information in the documents. If the title page does not reflect the new name of the employee, it is unacceptable to indicate it in the insert without changing the employment record.

After filling the liner, to avoid marks:

- You need to check all the information entered on the title page and in the insert columns.

- Put a stamp or make a note about the issue of the insert.

- Enter the unique identifier (number) of the insert.

- Hem the liner to the labor one.

A properly hemmed liner must be fastened to the labor one. The fastening must comply with the instructions.

It cannot be glued, secured with paper clips, metal staples or other materials. It is sewn to the inside cover of the work, or more precisely, between the cover and the last page of the book.

It is hemmed with threads. For this, ordinary cotton threads are used, preferably No. 10. They are strong enough and do not tear the paper when using the liner. Sew the liner as follows:

- Approximately 2-3 cm are removed from the upper and lower edges of the liner.

- Holes are made with an awl.

- A needle and thread are threaded through the insert cover and the work cover, extending through its back wall.

- The needle returns, threading through the back of the workbook cover, then through the hole in the insert cover.

- Thus, you need to make several neat stitches, attaching the liner to the TC with threads.

Who should buy the work book insert - the employee or the employer?

Since the documents in question have a certain degree of protection and are carried out in a strict form, their production by current federal regulations is entirely the responsibility of GOZNAK. Employers have the opportunity to unlimitedly purchase both the labor documents themselves and inserts in the form of forms for storing them in the organization.

Thus, the direct purchase of work books and inserts in them is provided by the employer. His responsibilities include filling out the order itself with the necessary documentation, payment and delivery of the goods. At the same time, purchasing these documents from third parties is unacceptable, and such documentation may be considered invalid - there are quite a large number of counterfeits on the market, the use of which can subsequently result in problems for both employees and employers themselves.

However, the employer is not obliged to spend his own funds on the purchase of insert forms - the law directly allows employers to reimburse the specified costs for processing work and inserts at the expense of employees. Such compensation can be made either in monetary form by directly requiring the employee to provide funds to pay for the registration of the employment slip, or by simply deducting the amounts spent from wages.

But it should be borne in mind that in this matter there are a number of restrictions used to protect the rights of workers. These include the following features:

- The employer has the right to demand payment for the insert from the employee in an amount no higher than the actual cost of one purchased form. That is, the employer cannot oblige the employee to pay for the purchase of a batch of insert forms, even if one has been made.

- If damage to documentation occurs due to the fault of the employer, he replaces these documents only at his own expense and cannot demand repeated reimbursement of the spent funds from the employee.

- If the insert form was damaged by the employee himself, then the employer has the right to demand new compensation for the cost of the forms from the employee.

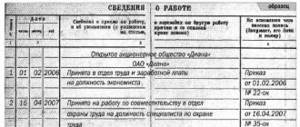

Making an entry

Sample:

The fact of registration of the insert must be recorded . To do this, a stamp “insert issued” is placed directly on the work book itself, indicating its series and number . If there is no stamp, the information is written manually. It should be very clear and readable , without blocking other entries.

The number of inserts is not regulated by the instructions. If necessary, one employee can have countless numbers . You just need to remember that without the main document it is invalid.

Features and nuances associated with inserts in the work book

When preparing an insert, it is prohibited:

- Instead of drawing up an insert, create a new labor document. The employer cannot oblige employees to create a second work book - he must use only inserts if there is no free space in the document.

- Use sections not intended for making entries. Thus, some employers practice continuing to keep records in the section intended for marks of awards, independently correcting its name. These actions are completely illegal, and such records may subsequently not be accepted by regulatory authorities. Instead of such actions, an insert should be made.

- Instead of an insert, you cannot use blank, plain sheets of paper or those torn from other books. They cannot be pasted or filed into the document - only inserts on the corresponding forms produced by GOZNAK are allowed to be used.

An important fact is that if it is necessary to enter information into the insert, such information must be entered exclusively by the employer who issued the insert.

Also, the employer should draw the attention of the fact that the current regulations do not specifically indicate where the liner should be sewn. Therefore, to resolve this issue, one can turn to judicial practice.

Most often, courts and regulatory authorities do not pay attention to where exactly the insert was filed, however, there are some decisions that invalidate cases where inserts were filed in the corresponding sections of books or in the center (place of stitching) of the book itself.

If the insert is filed at the end of the document, before the cover, then this will be a legal action and in judicial practice there are no cases of challenging this method of filing the insert in the labor document.

The question of who should buy the work record and the work book insert is of interest to both the personnel department employees and the workers themselves. Although the costs for this are small, many companies are very principled in this regard.

Expert opinion

Volkov Georgy Tarasovich

Legal consultant with 10 years of experience. Specializes in the field of civil law. Member of the Bar Association.

You can find different opinions on specialized forums. According to the law, it is the employer who is responsible for maintaining this enhanced reporting form, but whether he is obliged to buy this document for employees is worth figuring out.

How to embed an addition into a work document

To sew the form in according to the rules, you need to make holes on it in the same places where they are located in the work sheet. The insert should be sewn to the spread on which the last page of the document is located.

Sewing additional sheets into the worksheet

In order to make holes, you can use a regular awl. Then take dark threads and a needle and carefully sew the form in the selected places.

What to do if there is no stamp

If for some reason the organization does not have a stamp, then there are two ways out of this situation:

- Place your stamp order as a matter of urgency and receive it within the next few days.

- There is a mark with a regular pen indicating that the liner has been sewn in. It should be in the place where the stamp was supposed to be. You must use a blue or black pen and write “insert issued” in neat handwriting, then indicate the date and sign.

Errors occurred during the sewing process

If the HR employee sewed the insert in the wrong place or filled it out with errors, this can be corrected.

- First you need to try to detach the incorrectly attached form without damaging the work itself. If this is not possible, then a duplicate is created.

- Spelling and punctuation errors can be corrected by carefully crossing them out. If there are a large number of errors, you should replace the form with a new one and check what you have written more carefully next time.

- It is recommended to first fill out the title page of the form and only then file it in the book. This will prevent the insert from being removed if errors are detected.

Stamps about the insert in the labor document

Knowledge of the nuances of filling out the insert will be needed both by the personnel department and by persons applying for any position to check the process of drawing up this document.

Classifying the insert as a strict reporting document indicates the need to comply with special rules when filling it out and using it, as well as the responsible behavior of both parties to the labor relationship.

The need to purchase an insert

A work book is an employee’s document, which confirms his work experience. Inside it there are sections (certain pages) for entering data about the job: date of acceptance, position, reasons for hiring. Separately, there are columns for entering notes regarding awards and incentives.

Important! The responsibility for maintaining the employee’s work book, namely making entries regarding acceptance, transfer, dismissal, falls on the employer.

You need to enter data regarding the cold if it exceeds 5 days. Taking this into account, the place in the labor document for providing the necessary information may run out.

You cannot use other sections (award, encouragement) to indicate “accepted,” “transferred,” or “dismissed.” As a result, there is a need to purchase an insert, which is needed to record data regarding the length of service.

This is a form with the same lines and columns as in the employee’s work book. It is pasted into the workbook.

An insert that is not filed with the labor document has no legal force, even if entries are made in it and there are seals. When it is sewn into the labor force, it becomes an integral part of it.

The numbering of entries in the insert continues, rather than starting from the beginning.

In order to confirm the presence of the insert, its number and series are written on the title page of the work in the upper right corner. Such a mark can be entered by hand by an authorized person of the company.

It is allowed to put a standard 10 x 25 mm stamp with the insert data. Sewing the insert is necessary not only when there is no space for notes regarding length of service, but also when there is no space to indicate new awards.

Making an insert: step-by-step instructions for making an entry

The question of whether it is necessary to file an insert in a book may arise:

- from an employee during employment;

- from the personnel officer;

- at the employer.

To understand where to get the insert and who should buy it, i.e. pay, know that having a record in the employment record is the responsibility of the employer. Therefore, the employed person does not need to show anxiety, fussiness regarding the need for an insert, or worry about this.

It is the employer who is obliged to make an entry in the Labor Code, and also decide how it is convenient to do this. He can offer options on how to order the insert:

- Pay the cost of the insert form against the invoice in cash.

- Write an application for an insert in the book.

Both actions will be legal, in addition, he can accept the work book without explanation and file the insert, without demanding payment and without introducing the employee to the nuances of personnel operations.

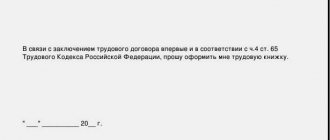

Are applications required?

If an employee is asked to write an application for the provision of an insert, then the employer will deduct the cost of the form from his salary. The fact is that the employer or accounting department do not have the right to make deductions from wages without an application or other written request from the employee.

It is also possible that at an enterprise, applications for the issuance of inserts and technical documentation are an additional form of accounting and control of these forms, which also makes sense.

The application is written in any form addressed to the manager, but can be submitted to the chief accountant, accountant or HR department employee. The statement requests:

- On the issuance of an insert form for filling out information about the work.

- About deducting the amount of payment for the form from earnings.

If an offer to write an application has not been received from the employer or an authorized person, the employee should not take the initiative to write an application. But provided that he insists on this, the refusal on the part of the employer will be unlawful. In this case, the insert must be issued upon application, and the application must be filed in a personal file.

It is quite possible that at his previous place of work he wrote a statement regarding some documents , and the employer convinced him that this should be so in accordance with the regulations.

If you provide work to citizens or maintain labor records, keep in mind that employees may impose their opinions, as they consider themselves knowledgeable and informed on many issues.

In unprincipled situations, it is better not to enter into an argument with them, otherwise they will demand lengthy explanations about the structure of your personnel records.

And entering into a debate about this with subordinates is ineffective . All your actions in the eyes of the employee should look like the actions of a competent person. But in fact, they should be.

Application for an insert in the work book - sample.

How to fill it out correctly?

Filling out the insert is carried out in the context of continuing to enter information into the Labor Code. Keep in mind that these are the same document. An insert without labor is invalid. Therefore, the main rule and purpose of filling out the insert is to transfer information from the labor report into it. To do this, the entries on the title page of the insert must fully correspond to the information on the title page of the book.

All information must be entered correctly, in accordance with the Rules, Instructions and nomenclature documents that define the general rules for maintaining TC. It is necessary to be guided by the fact that all the requirements established for maintaining books are fully applicable to maintaining inserts. Below you can see an example.

Blank form.

Numbering or serial number

Numbering plays an important role. Please note that the serial number of the first entry in the insert is one greater than the last serial number in the book. That is, the order of serial numbers continues to be observed , and the information entered continues with that included in the work record.

The complex should create a semantic unity of all data entered into the document. Situations often arise in which the last entry in the Labor Code is the employment entry, and the dismissal entry is already included in the insert.

This is a normal situation and quite common.

Decor

In addition, the associative and legal unity of the document is created in a special way, when preparing an insert in the work book. Without a registration record, a sewn-in insert (see here how to sew in an insert) is invalid. Registration is done in two ways:

- By placing a stamp: “Insert issued.”

- By making a note that the insert has been issued.

Both methods are identical. The employer, if it is not possible to put a stamp, makes the entry manually. Both the stamp and the entry are placed in the same place: in the upper right corner on the title page of the work. In general, the design looks like this:

- A stamp is placed or a note is made “the insert has been issued.”

- Below is the series and number of the insert.

- At the end of the work, an insert is sewn between the last page and the cover.

The number of the insert is its identifier, that is, it must certainly match the one written on the title page of the TC. So you need to transfer it very carefully, carefully checking every letter and number. The number of inserts that can be issued to an employee is not limited. Accordingly, if there is already a mark on the issue of the insert in the designated place, make a new mark a little lower.

Prohibitions

There are a number of prohibited actions if an employee’s employment has ended, including:

- You cannot enter data that does not correspond to the section. Previously, personnel officers practiced crossing out the entry “information about awards” and simply entering data about the length of service in this section. But such actions contradict the rules for maintaining the Labor Code, because any crossings out or corrections are unacceptable.

- The establishment of a new labor record is prohibited only for the reasons that the old one is covered with writing. There are inserts for this.

- Paste in a blank sheet of paper lined by hand. This is a violation of the law, since in this case it will not be possible to indicate the insert number, because it simply does not exist. Even for a single recording you need to sew in an insert.

Cost of the form

The price of the form is stated upon purchase, not upon issuance. If suddenly the cost turns out to be high, the employee pays the costs only for the purchase.

Some organizations take payment in cash; in other cases, the cost is deducted from the salary. The employee's consent to the retention must be required. The employee is required to write an application to the chief accountant or manager to deduct from the salary the amount for the cost of the insert. The application is written in any form.

The price depends on the sample, if the old one is 120 rubles, the new one is 180 rubles. There is no charge for the form only if it is damaged by an employee of the HR department.

If a citizen has lost his work book, there is no need to be upset. He should go through the organizations where he previously worked and ask him to make notes again in a new document. In this way, work experience is restored.

In case of lack of time and a large number of records, hire a specialist. For each organization where he will have to go to restore his employment record, he will have to pay from 500 to 1,500 rubles. The year of manufacture also affects the cost.

Purchase

According to the law, the employer is responsible for entering data and maintaining labor records while the employee is on the company’s staff. In this case, the question arises: who should buy the insert and work book? The regulations clearly state that the employer purchases the forms in question for the employee.

Including if the employment has not yet been established, that is, the employee gets a first job after completing his studies.

Since purchasing something is an expense, it is quite logical for employees to be indignant if they try to charge them the cost of forms. After all, the law clearly states who should buy an additional insert for the work book.

Here we need clarification, although the purchase of forms and additions to them is the responsibility of the employer, according to the law, he has the right to deduct the cost of such a purchase from his salary - this is legal. The employee is required to pay the cost of the forms, despite the fact that the employer purchased them.

The financial issue regarding the purchase of labor and liners is especially relevant for beginning entrepreneurs, because any costs can be critical for their profit.

Should I embed the document or not?

The insert into the work book is always only sewn into place . No staples, staples, or tape.

It is preferable to sew on completely finished liner. Otherwise, erroneous registration will entail an unpleasant procedure for retrieving , drawing up a damage report, and destroying the damaged form.

It is better to use #10 cotton thread . It is thick enough and does not cut paper. The sewing procedure itself is extremely simple:

- Using an awl, make holes along the fold line in the amount of three or four pieces. It is most convenient and reliable to file a document using four punctures. The distances between the holes are the same.

- The same punctures with the same distance are made on the work book itself.

- Sew so that the ends of the thread come out of one hole .

- Secure the thread with a strong knot .

- to seal with wax .

The instructions do not say where exactly the insert should be sewn: at the beginning, maybe in the middle or even at the end of the work book.

Each personnel officer chooses at his own discretion .

Technically, it is more convenient to sew in the middle.

This makes it easier to make punctures, and the liner itself holds tighter. But this option is bad because the recording is split into parts. This is clearly visible when photocopying.

Therefore, it is more advisable to place the insert at the end, between the very last page of the work book and its cover.

You can learn how to properly sew an insert into a work book by watching the video :

Cases when the employer pays

But the answer to the question of who should buy an additional insert for the work book is not as clear-cut as it seems. There are cases when it is the employer who needs to spend money on this, without the right to recover from the employee. There are only 2 such situations:

- If the form that the employee bought (paid for) is damaged by the employer, including a HR specialist. In this case, this means not only damage to the form itself, but also clerical errors/errors when filling out the title page. This also applies to the situation of incorrectly maintaining the form.

- If an emergency occurred that led to a massive loss of forms. In this case, both books and inserts will be lost, since they are an integral part of the document. Then a duplicate is issued with the official registration of all records. It is the employer who bears the costs of its production.

There are no other options when the employer needs to pay for the purchase of a book or insert on his own, and his actions regarding deducting the money spent from his salary are completely legal.

At whose expense is the form purchased?

Any purchase or sale involves payment for the goods - and here another question arises: at whose expense should the insert in the work book be purchased? In practice, disputes often arise about this: the employer collects money from the employee, but the employee objects...

The answer to this question can be found in paragraph 47 of the Rules, which states that the employer, when issuing a work slip to an employee, collects from him an amount equal to the cost of purchasing the form. This requirement of the law is unambiguous; there simply cannot be any disagreement in interpretation.

Thus, if an insert is required to continue entries in the work book, then the employer purchases it, and all expenses are fully reimbursed by the employee. However, the amount of compensation cannot exceed the cost of the form that was used for a particular employee. This needs to be clarified, since quite often forms of work books and inserts are purchased at GOZNAK or from distributors in bulk, in large quantities. In this case, Clause 47 of the Rules does not allow demanding reimbursement from the employee for all expenses incurred by the employer under the contract for the purchase of forms.

How to glue it correctly?

Despite the fact that the Instructions for filling out work books are a fairly detailed document that regulates various aspects of working with work books, it nevertheless does not contain instructions on how to insert the insert into the document.

For this reason, the employer, represented by its personnel department employees, can paste the insert into any part of the work book in such a way that the use of the insert is as convenient as possible for all persons responsible for filling it out.

Due to the structure of the work book, the most convenient option for inserting an insert into it should be considered to be gluing the insert into the middle of the document. This is due to the fact that in the middle of the work book form there is a seam that can be used for further insertion of the insert itself.

Since the conditions for using the liner is the need to be able to freely fill all of its sections, this location - in the middle, where there is a seam, is the most convenient.

The number of inserts that can be pasted into a work book is in no way limited by law . This is due to the fact that cases of replacing a work book and issuing a duplicate are extremely limited today.

Sample design of an insert in a work book

The only condition is that the use of the inserts after gluing them must remain convenient, and all information entered into them must be readable and not allow for other interpretations.