What is financial assistance for treatment?

Let's start with the concept of “material assistance”. This may include additional cash payments in addition to wages and bonuses. The payment of financial assistance is not stipulated in the labor legislation of the Russian Federation, but the employer can make it on his own initiative.

All provisions relating to such payments must be spelled out in the internal regulations of the organization or in the collective agreement. Namely, the size and conditions for the provision of financial assistance.

So, in order to pay financial assistance, a reason - that is, a circumstance that would require additional support. For example, financial assistance is provided for the birth of a child, in the event of losses due to force majeure, or in the event of illness of an employee or his relative.

However, if an employee needs financial assistance for one reason or another, know: payment of financial support is right , not an obligation.

Of course, in most cases, management pays its employees additional funds for social support, but there are also opposite situations.

Financial assistance due to employee illness: cases of payment

Cases of payment of financial assistance due to illness may concern not only the employee of the company directly, but also his close relatives, including parents, spouses, natural and adopted children. Such cases include:

- receipt by the employee or other specified persons of paid medical services;

- their acquisition of medications necessary to treat the disease in accordance with the doctor’s prescription;

- other cases involving the need to incur expenses for health improvement and treatment.

Important! Payment of compensation for medicines in accordance with paragraph. 5 paragraph 28 art. 217 of the Tax Code, in order to avoid income tax, requires a prescription from the attending physician confirming the validity of their purchase and use.

See also “Financial assistance for the birth of a child from the employer.”

Terms of payment help for treatment

As we have already said, financial assistance is paid for various reasons. And one of them is the need for employee treatment.

Financial assistance for treatment is issued subject to certain conditions:

- this payment is purely social and is of a targeted nature;

- the payment is in no way related to the main salary;

- is prescribed in the local regulations of the enterprise.

We noted above that not only an ill employee, but also an employee whose close relative .

Turning to Art. 2 of the Family Code of the Russian Federation, we note that close relatives include:

- parents;

- children (including adopted children);

- brothers and sisters (including adopted ones);

- older generations - that is, grandparents in relation to their grandchildren.

Financial assistance for treatment may be eligible if an employee or close relative:

- receives (or has received) paid medical services;

- purchased expensive drugs with a prescription from a doctor;

- bears other expenses that are directly related to treatment.

The employer can:

- Compensate the employee for funds already spent based on submitted supporting documents.

- Participate in concluding an agreement with a medical institution and pay bills on your own.

Sample application and documents required to obtain assistance from the Social Security Administration

Submitting documents and filling out an application takes place at the social security office at the place of registration. Officially employed persons contact management at their place of work. The applicant attaches a package of documents to the form, which is issued by the institution’s employees. Since the range of categories that are subject to financial support is quite extensive, the list of papers required for submission may vary. The following are required to be provided:

- citizen’s passport and copies of identity cards of his family members;

- a certificate of income for each family member issued by employers;

- birth certificate of the child, if the mother is given maternity benefits;

- pensioner's ID;

- employment history;

- medical confirmation of disability indicating the group or certificate of poor health;

Certificate of disability - death certificate of a relative and its copy;

- receipts for purchased expensive medications or rehabilitation products, for which social security can issue monetary compensation.

Application forms vary depending on the situation in which the applicant is requesting funds from the social security office. It is not necessary to fill them out in advance: this can be done at the institution itself, which also provides a writing sample.

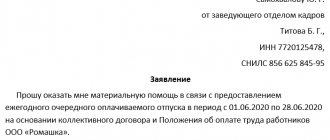

Sample application for social assistance

Application for financial assistance for treatment

The writing of this statement is not regulated . It is written in free form.

If the organization’s local act specifies a unified sample for writing an application, follow it.

In fact, it doesn’t matter at all how exactly the statement is drawn up. The main thing is that the document complies with the internal rules of the company and does not contradict the norms of social and labor law. Moreover, the statement must contain key points, which we will consider below.

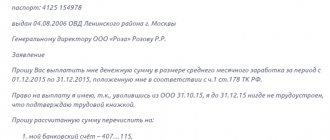

Thus, an application for financial assistance in connection with treatment must contain:

- name of company;

- FULL NAME. and the position of manager;

- FULL NAME. applicant, position;

- a request for financial assistance in case of treatment or expenses incurred in this regard;

- supporting documents (in the attachment);

- date;

- signature and transcript of the signature.

The applications must include documents confirming the need for treatment or the fact of incurring expenses:

- medical certificate or medical report;

- prescription for the drug;

- doctor's appointments;

- checks or receipts for payment for medical services and/or medications.

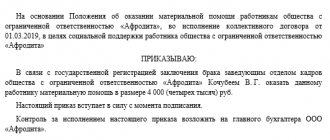

Please note that the employer does not always ask the employee to write an application for additional payment. The manager can take the initiative and pay social assistance independently by issuing an order to pay a certain amount to a specific employee.

How to raise money for treatment on the Internet?

The main assistant for those who do not know how to raise money for treatment is most often the Internet.

There are several options where to go:

- social media;

- appeal to famous bloggers and media personalities;

- websites specializing in collecting money for those in need (for treatment, purchasing medicines).

Use the form below to place an appeal to raise money for treatment for yourself or loved ones. The chance that someone will respond, although not great, is there.

Request title

Your letter has been sent to the site!

Subscribe to our VKontakte group.

When collecting money online, you need to follow the instructions:

- Describe the situation, the symptoms of the disease, and the reasons why it is not possible to cure yourself as fully as possible.

- Create bright headlines that attract attention (“Help raise money for treatment!”, SOS!).

- Indicate all possible contacts (phone, Viber, WhatsApp), including bank details for transferring funds.

- Post a photo or video message from a person who needs help.

- Keep statistics of funds received and the amount still needed for treatment.

Taxation of financial aid for treatment

Issues of taxation of personal income tax and insurance contributions for financial assistance for treatment of an employee are regulated by Art. 217 and art. 422 of the Tax Code.

In accordance with Art. 207 of the Tax Code of the Russian Federation, namely clause 1, an must pay personal income tax on payments received.

Based on Art. 419 and art. 420 of the Tax Code of the Russian Federation, the employer independently pays insurance premiums from funds paid to the employee.

In general , financial assistance for the treatment of an employee is not subject to personal income tax and insurance premiums are not charged on it - according to clause 1 of Art. 422 and art. 217 of the Tax Code of the Russian Federation, if the amount of financial assistance does not exceed 4 thousand rubles during one calendar year.

There is a nuance - if the employer paid for the employee’s treatment directly to the medical institution. And when an employer applies OSNO, he may not be subject to personal income tax on amounts spent on the treatment of an employee. This follows from paragraph 10 of Art. 217 of the Tax Code of the Russian Federation (see letters of the Ministry of Finance dated March 16, 2020 No. 03-04-06/19819, dated January 24, 2019 No. 03-04-05/3804).

At the same time, these payments are subject to insurance premiums in full in accordance with the established procedure.

But employers using special regimes (under which they do not pay income tax) will have to calculate both contributions and personal income tax from medical assistance for treatment according to the general rules - with a usual deduction of no more than 4,000 rubles.

Is an employer required to pay compensation to an employee injured at work?

Labor legislation obliges the employer to provide safe working conditions. Article 212 of the Labor Code provides for certification of workplaces, which is carried out in order to assess working conditions at workplaces and identify harmful and hazardous production factors. The results of certification make it possible to develop and implement measures to bring working conditions into compliance with state regulatory requirements for labor protection. The procedure for certification of workplaces is set out in the Order of the Ministry of Health and Social Development of the Russian Federation dated April 26, 2011 No. 342n “On approval of the Procedure for certification of workplaces based on working conditions.”

But, unfortunately, workplaces do not always comply with legal requirements. In addition, an employee may be injured as a result of subjective reasons. For example, fatigue, dizziness, inattention, unstable emotional background - all these reasons can be the source of a work-related injury.

Naturally, first of all, the injured employee makes a claim to the employer to pay him compensation, since the injury was received during the performance of work duties.

Let's figure out what payments are due to employees in such cases and who is obliged to make them, in which cases the employer is obliged to make compensation payments to employees injured at work. The employer must also know whether these payments are subject to taxes and insurance premiums.

What regulations should an employer follow if an accident occurs at the enterprise?

The main document regulating the actions of the employer in the event of an accident at work is the Labor Code of the Russian Federation. The procedure is defined in Article 228 of the Labor Code of the Russian Federation.

Firstly, the employer is obliged to organize the provision of first aid to the victim and his delivery to a medical facility.

Secondly, report the incident to the appropriate authorities.

Thirdly, take the necessary measures to organize and ensure a proper and timely investigation of the accident and registration of investigation materials.

These are the main duties that an employer must perform when an accident occurs.

The next group of documents defines the procedure for assigning and paying compensation to injured workers. Such documents include Federal Law No. 125-FZ of July 24, 1998 “On compulsory social insurance against accidents at work and occupational diseases” (hereinafter referred to as Law 125-FZ).

In some industries, industry agreements provide for the payment of one-time compensation in connection with loss of productivity. For example, an industry agreement on the mechanical engineering complex of the Russian Federation for 2011–2013 (approved by the Association of Mechanical Engineering Trade Unions of Russia, the Trade Union of Automotive and Agricultural Engineering Workers of the Russian Federation, the Trade Union of Mechanical Engineers of the Russian Federation, the Public Association "All-Russian Electric Trade Union", the All-Russian Industrial Association of Employers "Union of Russian Mechanical Engineers" 01.03 .2011) compensation for loss of ability to work has been established. Its size depends on the degree of disability and is established by local regulations. Consequently, if the employing organization belongs to those industries in which industrial agreements have been adopted, it is obliged to pay the employee the compensation due to him. Payments are made in addition to those enshrined in Law 125-FZ.

What event is considered an industrial accident?

Insurance payments in accordance with Law 125-FZ are provided only to those employees who were injured as a result of an accident. Therefore, you need to have a clear understanding of what an industrial accident is.

An event is recognized as an industrial accident if it entailed the need to transfer the employee to another job, led to temporary or permanent disability or death of the employee (paragraph 10, article 3 of Law 125-FZ).

The need to transfer an employee to another job must be confirmed by a medical certificate issued in accordance with the law. Such a conclusion is a Certificate of the final diagnosis of a victim of an industrial accident (Appendix No. 2 to Order of the Ministry of Health and Social Development of Russia dated April 15, 2005 No. 275).

In this case, the duration of the sick leave must be at least one day (Part 1 of Article 230 of the Labor Code of the Russian Federation). For example, an employee got into an accident during a work trip and only suffered abrasions. He did not go to a medical facility and went to work the next day.

This case cannot be classified as an industrial accident, since it did not cause serious damage. The injured employee has no right to claim social benefits.

Industrial accidents also do not include those cases when an employee was injured due to alcohol intoxication or committing criminal acts (Part 6 of Article 229.2 of the Labor Code of the Russian Federation). Such situations are classified as accidents not related to production. It is clear that in such situations, workers lose the right to receive social benefits.

Therefore, the employer’s task is to document the incident in a timely and correct manner, since the presence of industrial accidents inevitably leads to an increase in the rates of insurance premiums for compulsory insurance against industrial accidents and occupational diseases (Article 22 of Law 125-FZ).

Which employees are entitled to receive compensation if they are injured while performing their work duties?

Compensation payments are assigned only to an employee who has lost his professional ability to work. A medical and social examination has the right to make a conclusion about loss of ability to work (Clause 1, Article 10 of the Law).

If the examination recognizes the employee as not having lost his professional ability to work, he has no right to apply for compensation.

What types of benefits are provided in case of injury at work?

Workers who have lost their ability to work as a result of an injury at work have the right to receive two types of compensation payments - one-time and monthly.

One-time payments are determined in accordance with the degree of loss of professional ability of the insured based on the maximum amount established by the federal law on the budget of the Social Insurance Fund of the Russian Federation for the next financial year. For 2013, the amount set is 76,699.8 rubles.

Let me remind you that the degree of disability is determined by a medical and social examination in its conclusion. The procedure for conducting the examination is determined by Decree of the Government of the Russian Federation dated October 16, 2000 No. 789 “On approval of the Rules for determining the degree of loss of professional ability to work as a result of industrial accidents and occupational diseases.”

Monthly insurance payments are paid to the insured employee throughout the entire period of permanent loss of professional ability from the day on which the fact of loss was established by the medical and social examination institution, excluding the period for which temporary disability benefits were assigned.

By virtue of paragraph 1 of Art. 12 of Law No. 125-FZ, the amount of the monthly insurance payment is determined as the share of the employee’s average monthly earnings, calculated in accordance with the degree of disability. Thus, if the employee never recovers and is unable to return to full-time work, he will receive insurance benefits for the rest of his life. The maximum amount of insurance payment is established by the federal law on the budget of the Social Insurance Fund of the Russian Federation for the next financial year (Clause 12, Article 12 of Law No. 125-FZ). For 2013, the specified limit is RUB 58,970.00. (Clause 2, Part 1, Article 6 of the Federal Law of December 3, 2012 No. 219-FZ).

In addition, monthly insurance payments are subject to indexation in the manner and amount established by the Government of the Russian Federation (paragraph 2, paragraph 11, article 12 of Law No. 125-FZ).

Which body pays one-time and monthly compensation for loss of ability to work?

If an employee has a medical and social examination report on loss of ability to work, then in this case he has the right to receive a one-time compensation. But the obligation to pay it lies not with the employer, but with the territorial body of the Social Insurance Fund at the place of registration of the employer, since it is the insurer. According to paragraph 7 of Art. 15 of the Law, it is the insurer, and not the employer, who is obliged to pay insurance payments.

The employer, being the insurer, is only obliged to pay the employee temporary disability benefits on the basis of the sick leave provided (clause 1, clause 1, article 8, clause 7, article 15 of Law No. 125-FZ).

Amount of temporary disability benefit due to an industrial accident

Temporary disability benefits due to an industrial accident and occupational disease are paid in the amount of 100% of the employee’s average earnings and do not depend on the employee’s insurance length (Article 9 of Law No. 125-FZ, Clause 2 of Article 1, Article 14 of Law No. 255-FZ).

At the same time, Federal Law No. 36-FZ dated 04/05/2013 establishes the maximum amount of insurance payment, which cannot exceed four times the maximum monthly insurance payment.

The maximum amount of insurance payment is established by the federal law on the budget of the Social Insurance Fund of the Russian Federation for the next financial year (Clause 12, Article 12 of Law No. 125-FZ).

In 2013, this limit is RUB 58,970.00. (Clause 2, Part 1, Article 6 of the Federal Law of December 3, 2012 No. 219-FZ). Consequently, the maximum amount of disability benefits due to an occupational injury or illness per full calendar month will be RUB 235,880.00. (Article 1 of Law No. 36-FZ, paragraph 12 of Article 12 of Law No. 125-FZ, paragraph 2 of Part 1 of Article 6 of Law No. 219-FZ).

What documents must be submitted to receive a lump sum payment?

If the conclusion of a medical and social examination indicates that the employee has lost his ability to work as a result of an accident, then he has the right to apply to the Social Insurance Fund to receive a one-time benefit. The benefit is assigned based on the application of the insured person. Since the insured person is the employee, the application must be submitted on his behalf.

Moreover, the application must be submitted to the territorial body of the Social Insurance Fund at the place of registration of the policyholder, that is, the employer.

The application is accompanied by documents in accordance with the list established by the FSS for each specific case (Clause 4 of Article 15 of the Law).

Such documents include:

- act on an industrial accident or act on an occupational disease;

- a certificate of the average monthly earnings of the insured for the period chosen by him to calculate monthly insurance payments in accordance with this Law;

- conclusion of a medical and social examination institution on the degree of loss of professional ability of the insured;

- conclusion of a medical and social examination institution on the necessary types of social, medical and professional rehabilitation of the insured;

- a copy of the work record book or other document confirming that the victim is in an employment relationship with the insured;

- notification of a medical institution about the establishment of a final diagnosis of an acute or chronic occupational disease;

- conclusion of the center of occupational pathology on the presence of an occupational disease;

- documents confirming the costs of carrying out, according to the conclusion of the medical and social examination institution, the social, medical and professional rehabilitation of the insured person, provided for in subsection. 3 p. 1 art. 8 of this Federal Law;

- rehabilitation program for the victim.

The list of documents may differ, since the FSS authorities request the relevant documents for each specific case.

It should be noted that an insured employee who has the right to receive insurance payments has the right to contact the insurer, that is, the Social Insurance Fund, with an application to receive insurance coverage, regardless of the statute of limitations of the insured event.

When applying for an appointment to pay monthly insurance coverage, after three years from the moment the right to receive it arises, payments are made for the past time for no more than three years preceding the application.

Time limit for consideration of an application by an injured employee at the territorial body of the Social Insurance Fund

The decision to assign a payment or refuse is made by the Federal Social Insurance Fund of the Russian Federation within 10 days from the date of submission of the application and relevant documents. Payments to the insured employee are made by the Federal Social Insurance Fund of the Russian Federation within one month from the moment a positive decision is made (clauses 4, 7, Article 15 of the Law).

Can an employer file documents for its employee?

Getting injured is always stressful for anyone. And even after treatment, he is not always able to independently collect all the documents and submit them to the territorial body of the Social Insurance Fund. Typically, employees have a very superficial understanding of the social insurance system and the rights they have, since these issues are usually decided for them by the employer.

And in this situation, first of all, the employer must explain to the employee what payments he is entitled to receive from the Social Insurance Fund and provide him with all the necessary documents in a timely manner.

In addition, the organization can help the employee by independently completing the documents specified in the list and submitting them to the Federal Social Insurance Fund of the Russian Federation. Law 125-FZ allows for the possibility of filing an application through a proxy, therefore, the organization has the right to submit documents for the employee (paragraph 1, clause 4, article 15 of Law 125-FZ).

Can an employer provide financial assistance to an injured employee?

From the analysis of the Law, it is clear that the employing organization is obliged to pay only temporary disability benefits to an employee who has received an industrial injury. One-time and monthly social payments are made by the Social Insurance Fund.

But the employer can, on its own initiative or on the basis of an employee’s application, pay the employee financial assistance in order to compensate for the costs of treatment and rehabilitation, and the amount of this assistance is not limited by the legislation of the Russian Federation.

It must be remembered that financial assistance in the amount of 4 thousand rubles is not subject to insurance contributions (clause 11, part 1, article 9, part 1, article 10, part 2, article 12, part 2, article 62 of the Law No. 212-FZ, paragraph 12, clause 1, article 20.2 of Law No. 125-FZ, Letters of the Ministry of Health and Social Development dated May 17, 2010 No. 1212-19, dated March 1, 2010 No. 426-19). Personal income tax is also not withheld from this amount (Article 216, paragraph 4, paragraph 28, Article 217 of the Tax Code of the Russian Federation).

In addition, the employer has the right to pay his employee the cost of treatment and medical care from the funds remaining after paying income tax. In this case, the income received by the employee is not subject to personal income tax (Clause 10, Article 217 of the Tax Code of the Russian Federation).

Thus, if an accident occurs in your organization and the injured employee turns to you to receive compensation payments, you must remember that the employer is obliged to pay his employee only temporary disability benefits. It must be remembered that an accident not related to production (for example, due to alcohol intoxication), but occurring at the workplace, is paid based on the minimum wage (clause 2, article 8 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity").

One-time and monthly insurance payments are assigned and paid to the employee by the territorial bodies of the Social Insurance Fund based on the employee’s application, so the employer can only help his employee prepare a package of documents for submission to the Social Insurance Fund.

In addition, the employer can provide the injured employee with financial assistance or pay for his treatment and purchase of medicines.

Results

In conclusion, let's summarize some results:

- There is no legislative concept of financial assistance for the treatment of an employee;

- Based on the norms of tax law and the positions of domestic judicial authorities, such payment should not be made within the framework of labor relations (but follow from the collective agreement);

- regardless of whether there is proof of medical expenses, assistance in the amount of up to 4,000 rubles per year is not taxed and insurance premiums are not charged;

- the payment initiative can come both from the employee (this requires his application) and from the employer himself (in this case, one order is sufficient);

- the form of application and order is free, but they must contain a justification for the reason for payment and a description of the needs for treatment, in addition, they must be carried out in accordance with the internal rules of office work and have the necessary details;

- Payment can be made not only for medical treatment, but also for medications necessary for the employee in accordance with doctor’s prescriptions.