Prerequisites for dividend payments

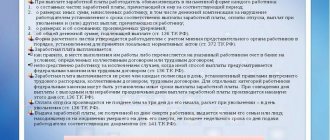

Dividends (part or the entire amount of net profit) are paid to shareholders (in a JSC) or participants (in an LLC) at quarterly, semi-annual or annual intervals according to a decision made by the general meeting of the company. The adoption of such a decision and its subsequent execution are possible subject to the following conditions (letter of the Ministry of Finance of the Russian Federation dated September 20, 2010 No. 03-11-06/2/147, Article 43 of the Law “On Joint-Stock Companies” dated December 26, 1995 No. 208-FZ and Art. 29 of the Law “On LLC” dated 02/08/1998 No. 14-FZ):

- according to the accounting data for the payment period, there is a net profit;

- The management company has been paid in full;

- the amount of net assets exceeds the sum of the charter capital and the reserve fund (and for a joint-stock company also the amount of the excess of the value of preferred shares over the par value), and this ratio will not change after the issuance of dividends;

- there are no signs of bankruptcy, and they will not appear after the payment of dividends;

- the repurchase of shares was completed according to the existing requirements of shareholders - for JSC;

- the withdrawing participant is fully paid his share - for an LLC;

- the necessary sequence is observed in determining payments: first for preferred shares with advantages, then for other preferred shares and finally - for ordinary shares for the joint-stock company.

The meeting, making a decision on payment and documenting it in minutes, establishes the following:

- the amount intended for payment;

- form and timing of funds issuance;

- the amount of payments for each type of shares - in the joint-stock company;

- the date on which the list of shareholders will be compiled - in the joint-stock company.

Based on these data, the amounts allocated to each participant are determined depending on:

- the type and number of shares he has - in the joint-stock company;

- the size of his share (if there is no other distribution formula in the charter) - in an LLC.

If a legal entity has a single participant, the minutes of the meeting replace its sole decision.

The preferred form of issuance is cash, because the permitted property form is equated to sale (letter of the Ministry of Finance of the Russian Federation dated December 17, 2009 No. 03-11-09/405) and is extremely unprofitable from a taxation perspective.

The issuance period should not exceed:

- in JSC - 10 (for nominal holders and trustees) and 25 (for other shareholders) working days from the date on which the list of shareholders was compiled;

- in LLC - 60 days from the date of the decision.

If for some reason a participant has not received his share on time, then he has the opportunity to demand payment within 3 years (or 5 years if specified in the charter) from the date:

- decision-making - in the joint-stock company;

- completion of the 60-day period - in an LLC.

After a 3- or 5-year period, unclaimed amounts are returned to the legal entity’s net profit.

Case Study

Based on the results of 2021, Compass LLC determined the amount of retained net profit: 100 thousand rubles. At the annual meeting of the founders of the company, the following decision was made: to distribute 60 thousand rubles between 3 founders, 20 thousand rubles each, since they have equal shares in the company. Transfer the remaining amount of funds to the reserve fund.

Note! One of the founders is the general director of the company, and an employment contract has been concluded with him.

Accounting entries for transactions:

- Dt99 Kt84.

100 thousand rubles - the undistributed part of net profit is displayed. - Dt84 Kt75.02.

20 thousand rubles - dividends were accrued for payment to 1 founder.20 thousand rubles - dividends were accrued for payment to the 2nd founder.

- Dt75.02 Kt68.

5,200 rubles – personal income tax is charged, which will be withheld. - Dt84 Kt70.

20 thousand rubles. – payment was accrued to the founder - general director of the company. - Dt70 Kt68.

2,600 rubles – personal income tax is charged, which will be withheld. - Dt84 Kt82.

40 thousand rubles – replenishment of the reserve fund from the company’s net profit. - Dt75.02 Kt51.

34,800 rubles - funds were transferred to the founders. - Dt70 Kt51.

17,400 rubles - the CEO's dividends were transferred to his current bank account. - Dt68 Kt51.

7,800 rubles – tax paid to the Federal Tax Service.

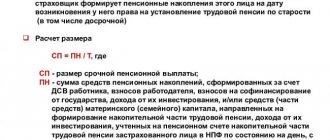

Tax calculation

Based on the minutes of the meeting (or the decision of the participant), the head of the legal entity issues an order for payment. It will already contain the amounts due to each recipient. When calculating them, it is advisable to immediately determine the amounts of withholding taxes, for the payment of which an extremely limited time is allotted (no later than the first business day following the day of payment of dividends):

- for personal income tax (payments to individuals) - according to clause 6 of Art. 226 Tax Code of the Russian Federation;

- for income tax (payments to legal entities) - clause 4 of Art. 287 Tax Code of the Russian Federation.

Taxes on payments made in 2020-2021 are calculated at the following rates:

- Personal income tax - 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation) for individuals with Russian citizenship, and 15% (clause 3 of Article 224 of the Tax Code of the Russian Federation) for foreign citizens;

You can learn how to reflect the payment of dividends in the 6-NDFL and 2-NDFL reports from the Ready-made solution from ConsultantPlus. Get temporary access to the legal reference system. It's free.

- income tax - 13% (subclause 2, clause 3, article 284 of the Tax Code of the Russian Federation) for companies established in the Russian Federation, and 15% (subclause 3, clause 3, article 284 of the Tax Code of the Russian Federation) for legal entities of foreign origin; when calculating tax on a legal entity that has owned more than half the share in the capital of the dividend payer for at least a year, a 0% rate can be applied (subclause 1, clause 3, article 284 of the Tax Code of the Russian Federation).

Everything about the calculation and payment of income tax when paying dividends is described in the analytical material of ConsultantPlus. And filling out the income tax return when paying dividends is discussed in the Ready-made solution from ConsultantPlus. Having received free trial access to the legal reference system, you can study any issue.

When the legal entity paying dividends is also their recipient, the tax paid by residents can be reduced by reducing the total tax base (the total amount of dividends allocated for distribution), which in this case will be calculated as the difference between the amounts intended for payment and received dividends (clause 2 of article 214 and clause 2 of article 275 of the Tax Code of the Russian Federation).

For more information about calculating tax on dividends, read the article “How to correctly calculate tax on dividends?” .

Subtleties of determining the tax base of an enterprise using the simplified tax system after payment of dividends

In connection with the payment of dividends, “simplified” people often have a question: “Is the payment of dividends (entries indicated) and the transfer of personal income tax reflected in the tax base of the simplified tax system?” Enterprises in the “Income minus expenses” mode can reflect a limited list of expenses mentioned in the Tax Code of the Russian Federation. But dividends accrued and paid to participants are not indicated in it. Consequently, expenses on them cannot reduce the tax base. And since the company, following the duties of a tax agent, does not transfer taxes for itself, the amount of personal income tax withheld is also not reflected in the reduction of the tax base.

So, the article presents basic concepts, such as dividends, accounting entries reflecting operations for their accounting.

What does your nose shape say about your personality? Many experts believe that you can tell a lot about a person's personality by looking at their nose.

Therefore, when you first meet, pay attention to the stranger’s nose

Never do this in church! If you are not sure whether you are behaving correctly in church or not, then you are probably not acting as you should. Here's a list of terrible ones.

Top 10 Broke Stars It turns out that sometimes even the biggest fame ends in failure, as is the case with these celebrities.

11 Weird Signs That You're Good in Bed Do you also want to believe that you please your romantic partner in bed? At least you don't want to blush and apologize.

15 Cancer Symptoms Women Most Often Ignore Many signs of cancer are similar to symptoms of other diseases or conditions, which is why they are often ignored.

Pay attention to your body. If you notice

Why are some babies born with an "angel's kiss"? Angels, as we all know, are kind to people and their health. If your child has the so-called angel's kiss, then you are out of luck.

Calculation of dividends to founders: postings from the payer

The accrual of dividends by entries in the accounting of the person paying the dividends must be made on the date when the meeting of shareholders (participants) decided to pay them. Accounting for settlements with founders is kept on account 75, if the founder is not an employee of the enterprise, or on account 70, if the founder and director are the same person.

The entries associated with the accrual of dividends will be as follows:

- Dividends were accrued to the founders (posting as of the date of the decision with a breakdown in the analytics of accounts 70 and 75 by participants): Dt 84 Kt 75 - for participants-legal entities and individuals who do not work for the dividend payer;

- Dt 84 Kt 70 - for individual participants who are employees of the dividend payer.

- Dt 75 Kt 68 - for participants-legal entities (income tax) and individuals who do not work for the dividend payer (personal income tax);

- Dt 75 Kt 51 (50) - to participants-legal entities and individuals who do not work for the dividend payer;

- Dt 68 Kt 51 - broken down by type of tax (profit or personal income tax).

- Dt 75 Kt 84 - listed on account 75.

To learn how account 84 is reflected in the balance sheet, read the article “Procedure for compiling a balance sheet (example).”

Instructions 70 count

Instructions for using the chart of accounts for accounting the financial and economic activities of organizations in accordance with Order No. 94n dated October 31, 2000

Account 70 “Settlements with personnel for wages” is intended to summarize information on settlements with employees of the organization for wages (for all types of wages, bonuses, benefits, pensions for working pensioners and other payments), as well as for the payment of income on shares and other securities of this organization.

In the credit of account 70 “Settlements with personnel for wages” the following amounts are reflected:

- wages due to employees - in correspondence with accounts of production costs (selling expenses) and other sources;

- wages accrued from the reserve formed in accordance with the established procedure for the payment of vacations to employees and the reserve of benefits for length of service, paid once a year - in correspondence with account 96 “Reserves for future expenses”;

- accrued social insurance benefits, pensions and other similar amounts - in correspondence with account 69 “Calculations for social insurance and security”;

- accrued income from participation in the capital of the organization, etc. — in correspondence with account 84 “Retained earnings (uncovered loss).”

The debit of account 70 “Settlements with personnel for wages” reflects the paid amounts of wages, bonuses, benefits, pensions, etc., income from participation in the capital of the organization, as well as the amount of accrued taxes, payments under executive documents and other deductions.

Amounts accrued but not paid on time (due to the failure of recipients to appear) are reflected in the debit of account 70 “Settlements with personnel for wages” and the credit of account 76 “Settlements with various debtors and creditors” (sub-account “Settlements for deposited amounts”). .

Analytical accounting for account 70 “Settlements with personnel for wages” is maintained for each employee of the organization.

Chart of accounts

By debit of the account

| Contents of a business transaction | Debit | Credit |

| Salaries were paid from the organization's cash register | 70 | 50 |

| Salary was transferred from the current account | 70 | 51 |

| Salary transferred from foreign currency account | 70 | 52 |

| Salary was transferred from a special bank account | 70 | 55 |

| Personal income tax is withheld from salary | 70 | 68 |

| The debt of employees for vouchers at the expense of social insurance funds is reflected | 70 | 69-1 |

| Accountable amounts issued to the employee are offset against wages | 70 | 71 |

| The amount of material damage was withheld from wages | 70 | 73-2 |

| Personal insurance payments withheld from salary | 70 | 76-1 |

| Salary not received on time deposited | 70 | 76-4 |

| The accrued salary of an employee transferred to a branch allocated to a separate balance sheet was written off (posting in the accounting of the head office) | 70 | 79-2 |

| The accrued salary of an employee transferred to the head office is written off (posting in the branch accounting) | 70 | 79-2 |

| The amount of the shortfall in excess of the norms of natural loss was withheld from the salary | 70 | 94 |

| Amounts issued on account and not returned within the prescribed period are withheld from wages | 70 | 94 |

By account credit

| Contents of a business transaction | Debit | Credit |

| Wages accrued to employees involved in construction or acquisition of non-current assets | 08 | 70 |

| Wages accrued to employees engaged in primary production | 20 | 70 |

| Salaries accrued to employees engaged in auxiliary production | 23 | 70 |

| Salaries accrued to employees engaged in production maintenance | 25 | 70 |

| Salaries accrued to employees involved in the management of the organization | 26 | 70 |

| Salaries paid to employees involved in repairing defects | 28 | 70 |

| Wages accrued to employees engaged in service production | 29 | 70 |

| Salaries paid to sales employees | 44 | 70 |

| Social benefits accrued at the expense of the Social Insurance Fund (sick leave, etc.) | 69 | 70 |

| Accrued payments due from other organizations | 76 | 70 |

| The salary of an employee transferred from a branch allocated to a separate balance sheet is taken into account (posting in the accounting of the head office) | 79-2 | 70 |

| The salary of an employee transferred from the head office is taken into account (posting in the branch accounting) | 79-2 | 70 |

| Dividends accrued to founders who are employees of the organization | 84 | 70 |

| Wages accrued to employees engaged in obtaining other income or working in non-production departments of the organization (kindergartens, holiday homes) | 91-2 | 70 |

| Salaries were accrued to employees who eliminated the consequences of emergency situations (earthquake, flood, fire, etc.) | 91-2 | 70 |

| Salary accrued from a previously created reserve | 96 | 70 |

| Wages have been accrued to employees engaged in performing work, the costs of which are taken into account in future expenses | 97 | 70 |

Business and Accounting

> Postings for accrual of personal income tax from dividends

Accrual of dividends: postings to recipients

Accrual of dividends - entries from recipients (founders, participants) are reflected in the accounting records on the date when the meeting of shareholders (participants) decided to pay them (clause 7, subclause a-c, clause 12, clause 16 PBU 9/99 , approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 32n):

Dt 76 Kt 91.

Please note that if dividends are to be received from a Russian organization in cash, then income in the form of dividends is reflected minus income tax subject to withholding by the tax agent (letter of the Ministry of Finance of Russia dated December 19, 2006 No. 07-05-06/302).

When dividends are actually received, the founders (participants) reflect them by posting:

Dt 51 CT 76.

However, in tax accounting, the founders (participants) reflect dividends not on the date of the decision to pay them, but on the date of actual receipt (subclause 2, clause 4, article 271 of the Tax Code of the Russian Federation).

Options for accounting entries

To reflect dividend payments in accounting, account 84 Retained earnings is used.

By debit of account 84

| Dt | CT | Explanations |

| D84 | K75 | Net profit is accrued as the financial result of the organization after accrual of dividends and taxation for the reporting period. |

By debit of account 84

| Dt | CT | Explanations |

| D84 | K84-2 | The authorized capital has been increased as a result of the presence of retained earnings. |

| Share capital has been increased as a result of the appearance of retained earnings. | ||

| K84 | The amount of loss exceeds the share premium due to the placement of shares of the enterprise. | |

| K82 | Reserves were formed from retained earnings. | |

| K84 | Covers losses from previous years. | |

| Profit and expenditure accounts are closed after the funds have been exhausted and are credited to the reserve capital. Dividends are accrued on preferred shares. | ||

| K75 | Dividends were accrued to the owners and shareholders of the enterprise. |

On account credit 84

| Dt | CT | Explanations |

| D91 | K84 | A loss was incurred from the gratuitous transfer of assets. |

| D84 | The amount of loss exceeds the share premium due to the placement of shares of the enterprise. | |

| D45 | The withdrawn capital is written off as a loss if it is not authorized capital. | |

| D99 | Losses were incurred as a result of activities during the reporting period. |

On account credit 84

| Dt | CT | Explanations |

| D80 | K84 | The authorized capital is reduced in order to achieve the amount of net income, which occurs during the reorganization of an enterprise. |

| D80 | Part of the authorized capital is used to cover losses. | |

| D83 | Additional capital is used to cover losses. | |

| D75 | An amount proportional to the value of non-current assets obtained through gratuitous transactions is allocated to cover losses. | |

| D82 | Reserve capital funds are used to cover losses. | |

| D84 | Losses incurred before the reporting period are covered. |

| Dt | CT | Explanations |

| D84-1 | K84-2 | Share capital has been increased as a result of the appearance of retained earnings. |

| The organization's working capital was replenished from retained earnings. | ||

| Reserves were formed from retained earnings. | ||

| The profit received replenishes the previously withdrawn part of the capital. | ||

| K75 | Dividends were accrued to the owners and shareholders of the enterprise. | |

| D91 | K78 | Part of the profit is allocated to the subsidiary. |

On the credit of accounts K84 and K443

| Dt | CT | Explanations |

| D82 | K84 | Dividends are accrued from reserve capital if the profit received during the reporting period was not enough. |

| D99 | Profit and expenditure accounts are closed after the funds have been exhausted and are credited to the reserve capital. Dividends are accrued on preferred shares. | |

| D91 | Withdrawal from income, which can be carried out when large sums are withdrawn from circulation for a long period. |

After reviewing the information presented, we can conclude that the calculation of dividends and their reflection in accounting is a complex procedure that requires the involvement of specialists.

Knowledge of this for an organization’s accountant will allow you to avoid violations of tax laws and the rights of owners.

We invite you to watch two interesting videos on the topic of the article: Accrual and payment of dividends to founders in 1C

Calculation of dividends to employees in 1C

Results

Dividends (income from participation in the authorized capital of a legal entity) can be accrued to both JSC and LLC.

The decision on their payment is made by the meeting of shareholders (participants). Accrual entries for both the payer and the recipient of dividends are made on the date of this decision. But the amounts will be accrued differently, since the payer will withhold and pay tax (on profit or personal income tax) on dividends to the budget. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Covering losses on account 84 at the expense of the founders

At the end of 2015, JSC Fiesta received losses in the amount of 841,800 rubles. The founders of JSC “Fiesta” are Savelyev R.N. (58% share in the authorized capital) and Markov K.L. (42% share in the authorized capital). By decision of the board it was established that the losses of 2015 would be covered at the expense of the founders:

- at the expense of Savelyev - 488,244 rubles. (RUB 841,800 * 58%);

- at Markov’s expense - 353,556 rubles. (RUB 841,800 * 42%).

The protocol of the board’s decision was signed in February 2021. In the same month, funds were received from Savelyev and Markov into the current account of JSC Fiesta.

To reflect operations to cover losses at the expense of the founders’ own funds, the following sub-accounts were opened in the balance sheet of JSC Fiesta:

- 75.1 - Savelyev’s funds aimed at repaying the loss;

- 75.2 — Markov’s funds used to repay the loss.

The following entries were made in the accounting of JSC Fiesta:

| Dt | CT | Description | Sum | Document |

| 75.1 | 84 | Savelyev's debt to repay the loss with his own funds is reflected | RUR 488,244 | Minutes of the board's decision |

| 75.2 | 84 | Markov's debt to repay the loss with his own funds is reflected | RUR 353,556 | Minutes of the board's decision |

| 51 | 75.1 | Funds from Savelyev were credited to repay the 2015 loss | RUR 488,244 | Bank statement |

| 51 | 75.2 | Funds from Savelyev were credited to repay the 2015 loss | RUR 353,556 | Bank statement |

| 99 PNO | 68 Income tax | The amount of permanent tax liability is taken into account (RUB 488,244 * 20%) | RUR 97,649 | Minutes of the board's decision |