Under what circumstances should the director of a commercial organization (health center) be paid compensation upon his dismissal by decision of the owner? Is its size regulated? At what point is compensation calculated and paid? Is it subject to personal income tax and insurance premiums? Can expenses arising in connection with the payment of compensation be included in the expenses taken into account when determining the tax base for income tax? What entries should be made in the accounting records?

upon dismissal of a director by decision of the owner?

When the head of an organization is dismissed by decision of the owner, compensation is paid if the provisions of Art. 181 or 279 of the Labor Code of the Russian Federation.

Article 181 provides guarantees for the head of the organization, his deputies and the chief accountant upon termination of the employment contract due to a change in the owner of the organization’s property. In this case, the new owner is obliged to pay compensation to these employees in an amount not less than three times their average monthly earnings, except in cases provided for by the Labor Code. So, by virtue of Art. 181.1 of the Labor Code of the Russian Federation, a collective agreement, agreements, local regulations, employment contracts or decisions of the employer, authorized bodies of a legal entity, the owner of the organization’s property or bodies authorized by him cannot provide for the payment of severance pay, compensation to employees and (or) assignment to them of any other payments in any form in the following cases:

- dismissals on grounds that relate to disciplinary sanctions (Part 3 of Article 192 of the Labor Code of the Russian Federation);

- termination of employment contracts on the grounds established by the Labor Code of the Russian Federation and other federal laws, if this is related to the commission of guilty actions (inaction) by employees.

It follows from Article 279 of the Labor Code of the Russian Federation that upon termination of an employment contract with the head of an organization, he is paid compensation in the amount determined by the employment contract, but not less than three times the average monthly salary, if the following conditions are met:

- the decision to terminate the employment relationship was made by an authorized body of a legal entity, or the owner of the organization’s property, or a person (body) authorized by the owner (clause 2, part 1, article 278 of the Labor Code of the Russian Federation);

- there are no guilty actions (inaction) of the manager (if the basis for dismissal is related to the employee committing guilty actions (inaction), compensation cannot be paid - see also Article 181.1 of the Labor Code of the Russian Federation);

- the exceptions provided for by the Labor Code do not work.

In addition, when paying compensation in connection with the dismissal of a director by decision of the owner of a commercial organization, it is necessary to comply with the limitations on the amount of payment established by Art. 349.3 of the Labor Code of the Russian Federation, if the organization is a business company, more than 50% of the shares (shares) in the authorized capital of which are in state or municipal ownership, a state or municipal unitary enterprise. To the managers of such companies upon their dismissal by decision of the owner, compensation provided for in Art. 181 and 279 of the Labor Code of the Russian Federation, must be paid in the amount of three times the average monthly salary. Other payments in connection with the dismissal of a manager by decision of the owner of the listed legal entities (in addition to compensation in the amount of three times the average monthly earnings) cannot be made, since the total amount of payments cannot exceed three times the average monthly earnings of such an employee. But you need to remember that when determining this total amount, the size of the following payments is not taken into account:

- salary due to the employee;

- average earnings retained in cases where an employee is sent on a business trip, for vocational training or additional vocational education outside of work, in other cases in which, in accordance with labor legislation and other acts containing labor law norms, the employee retains average earnings ;

- reimbursement of expenses associated with business trips and expenses when moving to work in another area;

- monetary compensation for all unused vacations (Article 127 of the Labor Code of the Russian Federation);

- average monthly earnings saved for the period of employment (Articles 178 and 318 of the Labor Code of the Russian Federation). In the situation under consideration, such a payment is not assigned to the manager. And the compensation payments established by Art. 181 and 279 of the Labor Code of the Russian Federation do not apply to the amounts of severance pay and average monthly earnings for the period of employment (Letter of the Ministry of Finance of the Russian Federation dated October 8, 2018 No. 03-15-06/72219).

For your information:

Article 279 of the Labor Code of the Russian Federation, applied in cases established by law in systematic connection with Art. 349.3, is aimed at ensuring compliance with the balance of private and public interests when the owner of the organization’s property (a person or body authorized by him) exercises the right to dismiss the head of the organization on the basis provided for in paragraph 2 of part 1 of Art. 278 Labor Code of the Russian Federation. Therefore, this rule cannot be regarded as violating the rights of the manager. Such conclusions were voiced in the Determination of the Constitutional Court of the Russian Federation dated January 26, 2017 No. 35-O.

Reasons for dismissal of a manager

The manager of a company can be dismissed for various reasons described in the Labor Code. Usually the procedure is formalized by agreement of the parties. But there are other reasons for termination of employment relationships:

- at your own request;

- in case of bankruptcy of an enterprise;

- by decision of the owners (Article 81 of the Labor Code of the Russian Federation);

- the end of a fixed-term agreement (Article 79 of the Labor Code of the Russian Federation);

- when the owner of the organization changes.

Expert commentary

Kamensky Yuri

Lawyer

At the initiative of shareholders, the dismissal of a director can also occur if the manager violated his duties. Also, the procedure is initiated if the actions of the top manager harm the interests of the organization (Article 81 of the Labor Code of the Russian Federation).

Calculation and payment of compensation.

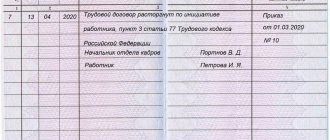

According to Art. 84.1 of the Labor Code of the Russian Federation, on the day of termination of the employment contract, the employer is obliged to issue the employee a work book and make payments to him in accordance with Art. 140 Labor Code of the Russian Federation. The day of termination of the employment contract in all cases is the last day of work of the employee, with the exception of cases when he did not actually work, but according to the Labor Code or other federal law, his place of work (position) was retained.

Article 140 of the Labor Code of the Russian Federation provides: upon termination of an employment relationship, payment of all amounts due from the employer to the employee is made on the day of his dismissal. If he did not work on the day of dismissal, then the corresponding amounts must be paid no later than the next day after the dismissed request for payment is presented.

Thus, compensation in connection with the termination of an employment contract is accrued and paid in full to the head of the organization on the day of his dismissal (the day of termination of the employment relationship). If compensation (part of it) is paid later than the established deadline, the employer (even if the delay is not his fault) must also pay interest in an amount not less than 1/150 of the key rate of the Central Bank of the Russian Federation in force at that time on the amounts not paid on time. Interest is accrued for each day of delay, starting from the next day after the due date for payment until the day of actual settlement, inclusive. The amount of monetary compensation paid can be increased by a collective or labor agreement, local regulations (Article 236 of the Labor Code of the Russian Federation).

Key points about dismissing a manager

A manager is an individual responsible for the activities of a company. Labor relations with the managers of the organization are described in the Labor Code, Art. 43. To dismiss the top manager of a limited liability company, a meeting of its founders is convened, where the issue is discussed. The manager is notified of the termination of the employment contract, and an internal order is created in the organization. Further, the procedure is no different from the dismissal of an ordinary employee. It includes making an entry in the labor record, calculating and issuing documents.

Dismissal of a manager is impossible in situations where:

- he has a certificate of temporary incapacity for work;

- he is on vacation;

- he has a dependent disabled child under 18 years of age;

- the manager is a pregnant woman or a mother on maternity leave.

The only exceptions are situations when the company is liquidated or reorganized.

Personal income tax.

According to paragraph 3 of Art. 217 of the Tax Code of the Russian Federation are not subject to (exempt from taxation) personal income tax all types of compensation payments established by the current legislation of the Russian Federation, legislative acts of constituent entities of the Russian Federation, decisions of representative bodies of local self-government (within the limits established in accordance with the legislation of the Russian Federation) related to the dismissal of employees, for except:

- compensation for unused vacation;

- the amount of payments in the form of severance pay, average monthly earnings for the period of employment, compensation to the manager, deputy managers and chief accountant of the organization in a part exceeding in general three times the average monthly salary (six times the amount for workers dismissed from organizations located in the Far North and similar areas).

Note:

When applying this norm, it is necessary to sum up all payments made to an employee upon dismissal, with the exception of compensation for unused vacation (Letter of the Ministry of Finance of the Russian Federation dated September 30, 2016 No. 03-04-05/57062).

Thus, if compensation payments paid in connection with the dismissal of the head of an organization do not exceed, in general, three times the average monthly salary (in certain cases, six times the amount), then the tax exemption provided for in paragraph 3 of Art. 217 Tax Code of the Russian Federation.

Amounts of corresponding payments upon dismissal exceeding three times the amount (six times the amount) of the average monthly earnings are subject to personal income tax in accordance with the generally established procedure (letters of the Ministry of Finance of the Russian Federation dated October 12, 2018 No. 03-04-06/73550, dated September 14, 2018 No. 03-04-05 /66019, dated July 25, 2018 No. 03‑04‑05/51951). The excess amount is subject to taxation.

Guarantees for some specialists

Russian labor legislation specifies categories of specialists who cannot be dismissed even if the owner changes. These include:

- Single mother with a child under 14 years of age.

- A woman raising children under three years of age or a disabled child.

- Pregnant employee.

- Guardian of a minor left without a mother.

- The only breadwinner in a family with a young child or a disabled child.

In addition, it is prohibited to terminate cooperation with sick employees who have issued a certificate of temporary incapacity for work. It is also impossible to fire citizens who are on annual leave.

Insurance premiums.

By virtue of paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation are not subject to insurance premiums for all types of compensation payments established by the legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation, decisions of representative bodies of local self-government (within the limits established in accordance with the legislation of the Russian Federation) related to the dismissal of employees, with the exception of:

- compensation for unused vacation;

- the amount of payments in the form of severance pay and average monthly earnings for the period of employment in the part exceeding in general three times the average monthly earnings or six times the average monthly earnings for workers dismissed from organizations located in the Far North and equivalent areas;

- compensation to the manager, deputy managers and chief accountant of the organization in a portion exceeding three times the average monthly salary.

A similar exemption applies to the taxation of these payments with contributions for compulsory social insurance against accidents at work and occupational diseases (see paragraph 2, paragraph 1, article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents” cases at work and occupational diseases").

Consequently, compensation paid to the head of an organization upon dismissal is exempt from insurance premiums in an amount not exceeding, in general, three times the average monthly salary. If compensation exceeds this amount, then insurance premiums must be calculated from the excess amount.

Confirmation from the Ministry of Finance can be found in Letter dated 10/08/2018 No. 03‑15‑06/72219. Compensation payments related to the dismissal of the head, deputy head and chief accountant of organizations located in the regions of the Far North and equivalent areas, in the cases specified in Art. 181 and 279 of the Labor Code of the Russian Federation are exempt from insurance contributions in an amount not exceeding in general three times the average monthly earnings of these persons. Amounts of these payments exceeding three times the average monthly earnings are subject to insurance premiums in accordance with the generally established procedure.

Normative base

In Art. 75 of the Labor Code establishes that an employer can terminate employment relationships with specialists in the event of a change in the owner of the enterprise’s property. But it should be noted that only a legal entity is considered such an owner. The founders of the company, regardless of their number, who have invested personal funds in its creation and development, are only bearers of rights and obligations in relation to a specific organization.

If there are several such individuals and one of them sold or donated his share to another citizen, then there is no reason to assert that the owner of the enterprise has changed. This is explained by the norm of Art. 48 of the Civil Code of the Russian Federation, according to which individual members of the company cannot be considered the owners of the organization.

A change of ownership of property occurs in the following cases:

- Enterprises belonging to the Russian Federation become the property of the constituent entities and vice versa.

- State organizations become the property of municipalities and vice versa.

- The property of the organization is transferred to the ownership of the state.

- Privatization of state or municipal property.

Thus, the legislation establishes very specific situations that can be qualified as a change of owner of an enterprise. The founders are not considered owners, and therefore changes in their composition are not grounds for dismissal of the organization’s management.

Tax accounting.

For profit tax purposes, any accruals to employees in cash or in kind, incentive accruals and allowances, compensation accruals related to work hours or working conditions, bonuses and one-time incentive accruals, expenses associated with the maintenance of these employees, provided for by the norms of the legislation of the Russian Federation, labor and collective agreements are included in labor costs. Article 255 of the Tax Code of the Russian Federation establishes that these expenses also include accruals for dismissed employees. Therefore, the payment made upon dismissal of the head of the organization, provided for by labor legislation, labor or collective agreement, can be taken into account when determining the tax base for income tax. But, as financiers add, for this to happen the criteria established by Art. 252 of the Tax Code of the Russian Federation (see letters dated April 25, 2017 No. 03-04-06/24848, No. 03-04-06/24850, No. 03-04-06/24853, dated July 24, 2017 No. 03-03-06/1 /46887, dated 03/09/2017 No. 03‑04‑06/13116). In particular, the payment must be economically justified (based on clause 1 of Article 252 of the Tax Code of the Russian Federation, expenses are recognized as justified expenses - economically justified expenses, the assessment of which is expressed in monetary form). And as the chief arbitrator explained, with a significant amount of money paid to the employee in connection with the termination of the employment contract, and its obvious inconsistency with the circumstances characterizing the employee’s work activity, the taxpayer bears the burden of disclosing evidence justifying the nature of the payment made and its economic justification (see. Review of judicial practice of the Supreme Court of the Russian Federation No. 4 (2016), approved by the Presidium of the Supreme Court of the Russian Federation on December 20, 2016 (position 14)).

The clarifications of the Plenum of the RF Armed Forces regarding the specifics of establishing the amount of compensation may help with this (clause 12 of Resolution No. 21 dated June 2, 2015). The supreme arbitrator indicated that the amount of compensation provided for in Art. 279 of the Labor Code of the Russian Federation upon termination of an employment contract under clause 2, part 1, art. 278 of the Labor Code of the Russian Federation, is determined by the employment contract, that is, by agreement of the parties, and if a dispute arises, by the court. If there is no provision in the employment contract for the payment of the specified compensation, as well as if a dispute arises regarding its amount, the amount of compensation is determined based on its intended purpose - providing protection from the negative consequences that may occur for the dismissed head of the organization as a result of job loss. It is important to remember that the amount of compensation cannot be less than three times the manager’s average monthly salary.

In turn, when deciding on the amount of compensation, the court should take into account the factual circumstances of the case, for example:

- the duration of the dismissed person’s work as the head of the organization;

- time remaining until the expiration of the employment contract;

- transformation of a fixed-term employment contract into an employment contract concluded for an indefinite period (part 4 of article 58 of the Labor Code of the Russian Federation);

- the amount of amounts (wages) that the dismissed person could receive while continuing to work as the head of the organization;

- additional expenses that he may incur as a result of the termination of his employment relationship.

The amounts of insurance premiums (when accrued if the amount of compensation exceeds three times the average monthly earnings) are taken into account for profit tax purposes on the basis of paragraphs. 1, 45 p. 1 art. 264 of the Tax Code of the Russian Federation as part of other expenses associated with production and sales.

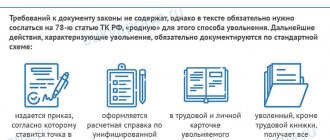

Commentary on Article 279 of the Labor Code of the Russian Federation

Unlike the previous version of Art. 279, which spoke about the termination of an employment contract before its expiration and provided for compensation for early termination of an employment contract with him, the current version of Art. 279 speaks of termination of the employment contract in accordance with paragraph 2 of Art. 278 in the absence of guilty actions (inaction) of the manager. The commented article provides for the payment of compensation to the head of an organization only in connection with the absence of guilty actions upon termination of an employment contract with him.

In accordance with the Resolution of the Constitutional Court of the Russian Federation dated March 15, 2005 N 3-P (see commentary to Article 278) in Art. 279, an amendment has been made that establishes the minimum amount of compensation to the head of an organization in the event of termination of an employment contract with him in accordance with clause 2 of Art. 278 in the absence of guilty actions (inaction) of the manager (three times the average monthly salary).

Within the meaning of the above-mentioned Resolution of the Constitutional Court of the Russian Federation, the compensation paid to the manager is a legal guarantee of the protection of the rights and legitimate interests of the manager in connection with the loss of his job. The amount of compensation in the event of dismissal of a manager in the absence of guilty actions on his part must be provided for by the terms of the employment contract. It should be emphasized that the specified amount is the minimum limit of compensation paid upon dismissal of the head of an organization in the absence of guilty actions (inaction) on his part. Such compensation is paid, for example, to the head of an organization upon dismissal due to a change in the owner of the organization. This payment is made by the new owner in accordance with Art. 181 TK.

Accounting.

The compensation paid to the head of the organization in connection with his dismissal, as well as the insurance premiums accrued on it (if three times the average monthly earnings are exceeded) in accounting are classified as expenses for ordinary activities (clause 5 of PBU 10/99 “Expenses of the organization” ). These expenses are recognized on the date of their accrual (clause 16 of PBU 10/99) by being reflected in account 26 “General business expenses” (Instructions for using the Chart of Accounts).

Example

The health center, in connection with the dismissal by decision of the owner of the head of the organization, paid him compensation in the amount established by the employment contract - 450,000 rubles. This amount exceeds three times the average monthly salary by 30,000 rubles. The organization charges insurance premiums at generally established rates. There is no exceeding the maximum base values for calculating contributions to compulsory pension insurance and compulsory social insurance in case of temporary disability and in connection with maternity. The contribution rate for compulsory social insurance against accidents at work and occupational diseases is 0.2%.

When paying compensation to the manager in connection with his dismissal, the health center must withhold personal income tax in the amount of 3,900 rubles from his income. (RUB 30,000 x 13%). Insurance premiums in the amount of RUB 9,060 must also be charged on the amount of compensation exceeding three times the average monthly salary. (RUB 30,000 x 30.2%).

In the accounting of the health center in the described situation, the following entries should be made:

| Contents of operation | Debit | Credit | Amount, rub. |

| Compensation accrued in connection with the dismissal of the manager is included in general business expenses | 26 | 70 | 450 000 |

| The amount of compensation (minus accrued personal income tax on the excess amount) was paid to the manager (450,000 - 3,900) rub. | 70 | 50 (51) | 446 100 |

| The amount of personal income tax accrued and withheld from income paid in the form of compensation upon dismissal of a manager is reflected. | 70 | 68‑NDFL | 3 900 |

| The personal income tax amount was transferred to the budget | 68‑NDFL | 51 | 3 900 |

| Insurance premiums are calculated on the amount exceeding three times the average monthly earnings by compensation | 26 | 69 | 9 060 |

Table: when and how much severance pay to pay

Grounds for dismissal

This is important to know: Social payments in the DPR today

How much severance pay should I pay?

Average monthly earnings.

- seasonal workers. They are compensated in the amount of two weeks' average monthly earnings (Article 296 of the Labor Code of the Russian Federation);

- employees who are hired for a period of up to 2 months. They are compensated in the amount determined by a local act or a collective or labor agreement (Article 292 of the Labor Code of the Russian Federation).

Reduction in headcount or staff

Refusal to transfer to another job for medical reasons

Average earnings for two weeks (Article 178 of the Labor Code of the Russian Federation)

Conscription

Reinstatement at work by decision of the court or labor inspectorate

Refusal to transfer to another location due to employer relocation

Recognition of an employee as completely incapable of work

Refusal to continue work due to changes in the terms of the employment contract that occurred due to organizational or technological changes in working conditions

Violation through no fault of the employee of the rules established by law for concluding an employment contract, if this excludes the possibility of him continuing to work and there is no possibility of transferring him to another job

Average monthly earnings (Article 84 of the Labor Code of the Russian Federation)