Is sick leave included in the calculation of vacation pay?

Whether sick leave is included in the calculation of vacation pay or not, every worker who falls ill must go to the clinic to be examined by a specialist. After the examination, the doctor will write out an official form that will release the patient from work for the entire period of treatment and recovery. Upon returning to work, a person will receive payment for all days missed - temporary disability payments.

In order to determine whether sick leave is included in the calculation of vacation pay, you first need to know that every employee must take a well-deserved rest at least once a year - as stated in the Labor Code. You can divide the required vacation into two periods, for example, fourteen days each, and only take half off, but working without breaks is harmful, and the State is trying to ensure that the requirements for this part are met.

Online magazine for accountants

Some organizations pay their employees temporary disability benefits higher than the amounts accrued by the Social Insurance Fund. What this entails and how to arrange an additional payment up to the average salary on sick leave , you will learn from our publication.

EXAMPLE S. Mikhailov, who works in and is a tax resident of the Russian Federation, took out sick leave on September 26, 2020. He returned to work on October 6, 2020. The average salary of an employee over the past two years per day was 2,250 rubles. Insurance experience – 7 years. The company's collective agreement provides for additional payment for sick leave up to average earnings . What actions need to be taken?

26 Jun 2021 glavurist 580

Share this post

- Related Posts

- Chelyabinsk Tariffs for Water Supply and Sanitation for 2020

- Labor code of the Russian Federation, time off for previously worked time

- Extract from the Unified State Register and Certificate of Ownership are One and the Same

- How to apply for a foreign passport through government services of a new type

Is sick leave included in the calculation of average earnings?

Let's start with non-insurance SZ (including to determine the amount of vacation pay due to the employee and compensation for unused days of annual leave). To calculate it, all income received by an employee of the company is taken into account, with the exception of those that, according to legal requirements, must be excluded from the calculation. In this case, the employee’s total income for a period equal to the previous 12 months during which the employee maintained his earnings is taken as the basis.

In the first case, you need to be guided by the provisions of the law “On OSS from VNiM” dated December 29, 2021 No. 255-FZ and the Decree of the Government of the Russian Federation “On approval of the regulation on the procedure for calculating temporary disability benefits and pregnancy benefits” dated June 15, 2021 No. 375 (hereinafter referred to as - resolution No. 375).

Results

Returning to the question of whether sick leave is included in the average earnings, we summarize: sick leave is not taken into account when determining the average earnings of an employee in accordance with the requirements of regulations governing the procedure for calculating SZ, due to the fact that the period of illness of the employee is compensated from the Social Insurance Fund and insurance premiums are not charged on the amount of sick leave.

Sources:

- Law “On OSS from VNiM” dated December 29, 2006 No. 255-FZ

- labor Code

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Nuances of calculating average earnings for sick leave

There is no need to take into account in the calculation periods when the employee did not work due to downtime due to the fault of the employer and in other cases when the average daily earnings were maintained. Many people are interested in whether sick leave is included in the average salary. No, this period is not taken into account when calculating new sick leave.

Next, based on the data obtained, you need to determine the salary for the entire period of incapacity of the subordinate. You should definitely know if weekends are included in the calculation. If the employee was sick for 14 days, then 246 rubles must be multiplied by 10 days, since 4 days are days off. Therefore, for sick leave he will receive a salary, the amount of which will be 2 thousand 460 rubles.

Calculation of daily earnings

For employees who do not have knowledge of the calculation of cash payments, questions arise if the amount received does not coincide with expectations. Legal legislation regulates the process of receiving vacation compensation.

This is important to know: Documents for calculating sick leave

To process any payments or compensations, the accounting department calculates the average daily income per employee, taking into account the duties performed and the position held. The billing period is an accounting of monthly wages; the calendar month is taken into account from the previous year.

The situation when a woman is on maternity leave cannot be taken into account, because the employee was on vacation, then the previous year that preceded maternity leave is taken into account. The legislation defines periods that may affect vacation pay and those that do not.

Specific periods are considered length of service, which also affects the calculation of vacation pay:

- The time period when an employee held a specific position, coped with assigned tasks, and was engaged in work activities.

- Annual leave or pregnancy, caring for a baby, while keeping his job.

- The time when the employee did not work due to the fault of the boss, such a period is included in the employee’s length of service.

- Vacation at the expense of the employee.

When calculating the required amount of vacation pay, the company accountant will independently calculate all those periods that are not taken into account when determining the amount of payments.

The Labor Code contains legal regulations and rules for calculating all compensation that is due to an employee for a working period of one year. To make the calculations, you need to calculate the employee’s daily income.

Calculation of average earnings for sick leave

- “Sick leave” for the first 3 days is paid at the expense of the policyholder. From the 4th day - at the expense of the Social Insurance Fund of the Russian Federation. In other cases of temporary disability (prosthetics, caring for a sick family member, quarantine, after-care in a sanatorium), benefits are paid at the expense of the Social Insurance Fund from the first day of disability.

- The benefit is paid for calendar days (= the period for which the certificate was issued). An exception is suspension from work under clause 1 of Art. 9 of the Federal Law of December 29, 2021 No. 255-FZ).

- The money is paid depending on the employee’s length of insurance coverage. In Part 1 of Art. 7 of Law No. 255-FZ specifies specific numbers. If the insurance period is less than 5 years - 60% of average earnings; 5-8 years – 80% of the minimum wage; 8 and more – 100% of the SZ. In separate materials you will learn how to determine the length of insurance for calculating sick leave. To put it quite simply, this is the entire period for which contributions to the Social Insurance Fund were paid. The length of service is calculated according to information from the work book. If it is not there, then you will have to look at employment contracts and/or certificates from previous places of work. If there are no documents, contact the Pension Fund branch for information about wages.

- SZ = all payments for which insurance premiums were calculated in the 2 previous calendar years. What is included in the calculation of average earnings for sick leave? Salary, vacation pay, bonuses, overtime allowances, some types of financial assistance, amounts of compensation for unused vacation and others.

- Temporary disability benefits are calculated even if in 2 years the employee managed to change 5-7 employers. Average daily earnings = amount of accrued earnings in the billing period / 730.

- The employee had no earnings during the reporting period (in 2021, the reporting years are 2021 and 2021).

- The employee receives average earnings, but the amount is less than the minimum wage (i.e. 9,489 rubles).

- The employee receives an average salary, which is equal to the minimum wage.

- The employee's work experience is less than 6 months.

Interesting read: The VIN code cannot be accessed on the traffic police website

Specifics of calculations

The Labor Code stipulates all monetary remunerations for a company employee. Clauses and amendments to laws contain information on income that is taken into account when calculating vacation payments.

This is important to know: What to do if you have extended sick leave for pregnancy and childbirth

Such payments include:

- material aid;

- compensation provided for in the employment contract for travel, food;

- certificates of temporary disability of the employee.

The days and amounts of sick leave do not affect the employee’s overall length of service. During a forced break, the employer does not have the right to dismiss an employee or change his working conditions without his own department.

If the duration of sick leave exceeds more than 30 days, then the previous month is taken for calculations. Days of leave for temporary disability are not taken into account in the calculation of the total calendar year. Calculations of cash payments consist of a number of specific nuances and clarifications. Each employee has the right to seek advice from a company lawyer.

Vacation is calculated using a pre-determined formula, into which you need to enter values and parameters of the calendar year itself. All payments provided for by the organization’s charter are recorded in the accounting department and are included as part of the vacation calculation, except for sick leave.

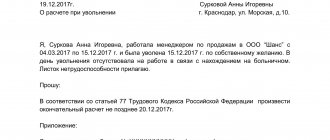

Is sick leave included in the calculation of compensation for vacation upon dismissal?

And, therefore, the last day of work cannot be considered a calculated day, even if it is the only day that a person has left to work at this enterprise. However, everything is not so simple. Under what conditions can you dismiss an employee who is on sick leave? To understand the problem, let's turn to the Labor Code (LC) - the handbook for accountants and personnel officers. The Labor Code says the following about dismissal:

- Removal of the head of the debtor company in connection with the assignment of bankrupt status to it;

- The adoption by the authorized body or the owner of the organization of a decision to terminate the employment contract with this person;

- Additional reasons for terminating the relationship between an employer and a managerial employee are set out in this document.

Issuance and payment of sick leave in accordance with the Labor Code

- The amount of salary for the last two years is determined.

- In the case of a part-time working period, earnings are calculated in proportion to employment.

- To calculate sick leave benefits (temporary disability), average earnings are determined by dividing the total amount earned over two years by 730, and to determine the amount of benefits accrued for pregnancy and childbirth - by the exact number of calendar days for the time period.

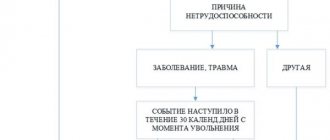

- The benefit amount is calculated by multiplying the average daily earnings by a percentage based on data on the insurance period. A person with more than 8 years of experience is paid 100% of average earnings. If you have 5 to 8 years of experience - 80%, less than 5 years - 60%. If an insured event occurs within 30 days after dismissal - 60%.

- The total amount of the payment is determined by multiplying the amount of the daily benefit by the exact number of calendar days when the employee was disabled.

- diseases;

- injuries, including after abortion;

- illness of a child or adult family member;

- quarantine, including quarantine of a child or incapacitated family member;

- prosthetics;

- treatment in a sanatorium.

Average earnings for calculating sick leave 2021

• in connection with a natural disaster or other emergency in order to compensate for material damage caused to an employee or harm to their health, as well as to individuals who suffered from terrorist acts on the territory of the Russian Federation; • an employee in connection with the death of a member (members) of his family; • to employees (parents, adoptive parents, guardians) at the birth (adoption) of a child, paid during the first year after birth (adoption), but not more than 50,000 rubles for each child; • provided by employers to their employees, not exceeding 4,000 rubles per employee per billing period.

Incorrect calculation

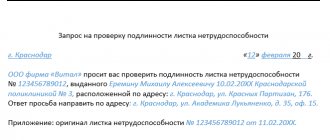

If an employee brought an amendment to a new enterprise with incorrect amounts and the average sick leave salary was paid to him in full, or as required by law 80% or 60%. Once management learns that the numbers are incorrect, the necessary funds will be withheld from the salary.

How to calculate average earnings for all benefit payments

- all payments of a social nature - financial assistance to an employee from the enterprise, partial or full payment for food or travel, and other compensation that an employer can pay to its employees, but which are not related to work;

- payments that an employee receives based on average earnings - “travel allowance”, “sick leave”, “vacation pay”.

Example : Calculate the salary for February if the “sick leave” is from 02/02/2014 to 02/17. 2014. Salary per month - 28,475 rubles. Regional coefficient - 1.3. In the period from 08/25/2013 to 09/17/2013 - vacation. For the entire period, the employee received an income of 589,762 rubles.

Interesting: Find out the queue for a trip to a sanatorium for the disabled in Moscow

Are vacation pay included in the calculation of average earnings?

Interesting read: Answers during a job interview

Average earnings is the average salary of an employee for a particular period of time. This figure is needed in calculations related to vacation payments, cash benefits for disabled employees and when calculating the amount of pension savings.

Features of calculating parental leave

In addition to working days, to calculate the vacation payments received, the average salary must be determined. For the calculation, all amounts are taken except sick leave. If an employee goes on maternity leave, child care benefits are not taken into account.

The following nuances are also not subject to consideration:

- sick leave during maternity leave is not included in vacation;

- days are not considered checkout time;

- Maternity benefits are not included in the employee’s total income.

But it is important to know your rights, which require mandatory leave during pregnancy and childbirth. This period is taken into account in the vacation period and implies mandatory rest for mothers.

The amount of vacation payments depends on the monthly salary, bonus and other monetary incentives provided for in the contract. If an employee took sick leave, then these payments are not taken into account to calculate the amount of vacation pay. The rest period for temporary disability is taken into account in the vacation period, therefore an employee on maternity leave has the right to vacation, which is calculated in accordance with labor legislation.

Are vacation pay included in the calculation of sick leave?

Regarding additional leave provided at the discretion of the employer, the following can be noted. The possibility of providing such periods of rest is provided for in Art. 116 of the Labor Code of the Russian Federation: in the manner established by a collective agreement or other local regulatory act (LNA), adopted taking into account the opinion of the trade union.

From sub. “a” clause 17 of Regulation No. 375 implies that the calculation of sick leave includes vacation days if they include a period of incapacity due to injury or illness of the employee. Regarding the entire vacation period and payments to it, a conclusion about whether vacation days are included in the calculation of sick leave can be made from the general rules of Regulation No. 375.

How is sick leave paid?

Exceptional situations when payment for days of incapacity to work is not made to an employee include:

- being on leave without pay;

- detention;

- idle time;

- suicide attempt;

- receiving a domestic injury within the first five days.

Period of sick leave for care

The legislative basis for registration and payment of temporary disability benefits is Federal Law No. 55 of 12/29/2021 . Payments are accrued to all employees of the enterprise ( Article 183 of the Labor Code of the Russian Federation ), including part-time workers. Article 183. Guarantees for an employee in case of temporary disability

Is sick leave included in the calculation of vacation pay?

Sick leave periods should be counted in calendar days, and to calculate vacation pay they need to be “translated” into working days. To do this, you need to use the formula: 29.3 / K *(K - Claim D), where K is the number of calendar days in a month, Claim. D – number of days excluded from the billing period. For example, an employee was sick for 12 calendar days in April. Do sick days count? Yes! The calculation should be taken as 29.3 / 30 * (30 – 12) = 17.58 working days.

- Actual work;

- Periods when the employee did not actually work, but his place of work was retained. For example, annual leave or maternity leave;

- Periods of forced absence due to the fault of the employer;

- Vacation periods at your own expense, but not more than 14 calendar days per year.

How is the number of days missed due to illness calculated?

To make the above information more understandable, we will give an example of such a calculation.

So, an employee worked in an organization under an employment contract and decided to quit. During his work, he accumulated 14 days of vacation. Over the previous 12 months, his salary amounted to 354,000 rubles. During this time, the employee was on sick leave for 7 days, for which he received benefits in the amount of 4,655 rubles. There were no other amounts that were subject to exclusion from wages when calculating compensation.

Thus, the amount of disability benefits must be subtracted from the amount of wages: 354,000 rubles - 4,655 rubles = 349,345 rubles.

Next you need to calculate the number of days taken into account. So, the employee worked for a full 11 months, and in the twelfth month he was sick for 7 days. This month according to the calendar had 30 days. Therefore, the number of days will be: 11 * 29.3 + (29.3/30 × (30 - 7)) = 344.76 calendar days.

Now you can calculate the average salary of an employee: 349,345 rubles / 344.76 days = 1,013.29 rubles.

Then the amount of compensation for vacation will be 1,013.29 * 14 = 14,186.06 rubles.

Is sick leave included in the calculation of average earnings for vacation amounts?

The employee did not work at full capacity throughout the year, but he had vacation from November 2 to November 15, 2021. The state employee's income amounted to 42,021 rubles for each month. He took office on April 2, 2021. In August, the employee received a payment due to absence on sick leave for a week in the amount of 12,021 rubles.

According to current legislation, sick leave cannot be included in the calculation of vacation pay. In addition, the presence of documents on incapacity for work cannot in any way affect the average earnings in terms of one working day, because when calculating administrative leave, the amounts due for payment, as well as the number of missed days off, will not be taken into account. This innovation was included to protect workers' rights.

Is payment of sick leave at the expense of the employer considered wages?

FSS. Grounds for incapacity Sources of payment Illness of an employee or injury to an employee received at home The first 3 days of the period of incapacity for work are paid from the enterprise’s sources of income, starting from the fourth day of illness, the source of covering the employer’s costs is the Social Insurance Fund Maternity benefit The first 3 days of the period are paid from the income of the enterprise starting from the fourth day of illness - at the expense of the Social Insurance Fund Industrial injury caused by an accident At the expense of the Social Insurance Fund Care for a child or relative At the expense of the Social Insurance Fund Quarantine of an employee or relative At the expense of the Social Insurance Fund After-care in sanatorium-resort-type institutions At the expense of the Social Insurance Fund Prosthetics specialized institution At the expense of the Social Insurance Fund Persons who voluntarily entered the insurance system are paid from the funds of the fund, starting from the first day. Who pays for sick leave - the state or the employer - depends on the number of days of incapacity for work. The standard order is as follows:

An employee who has received an injury or an occupational disease Those employees who have received an illness or injury during their work activities, that is, their damage to their health is associated with the costs of the profession, benefits are considered to be paid according to a specific limit. What should an employer know about sick pay in 2021? If an employee cannot bring a document on the amount of earnings from his previous place of work, upon his written application, it is necessary to send a letter to the territorial body of the Russian Pension Fund with a request for the necessary information. Sick leave at the expense of the employer is subject to personal income tax at the time of payment. If the employee showed a certificate of the amount of earnings after the benefit was calculated, then the operation should be performed again, but no more than 3 years in advance. Temporary disability benefits are paid along with your salary or advance payment.

Is vacation pay included in the new vacation calculation?

In addition, at enterprises there are additional permanent bonuses and purely internal additional payments, fixed by the collective agreement and individual employment contract. All wages and additional payments and remunerations included in the collective agreement according to the collective agreement are accepted for calculating vacation pay. The specifics of including bonuses in wages based on the results of a quarter or year are explained in detail in the regulation “On the specifics of the procedure for calculating average earnings.”

If the calendar year has been worked in full, the calculation of the average daily earnings for calculating vacation pay is carried out according to the standard formula. The total amount of wages and income included in it for the previous 12 months is divided by 12 and 29.4. The last figure is calculated annually and is included in the Labor Code of the Russian Federation as an amendment.

How to calculate the amount of compensation for vacation?

To correctly calculate the amount of compensation, you first need to correctly calculate the employee’s labor income. It includes:

- wage;

- bonuses provided for in the employment contract (is the bonus paid after the employee’s dismissal?);

- other payments, except for sick leave, maternity leave, and business trips.

To calculate payment for unused vacation upon dismissal, you must perform the following steps:

- Calculate the amount of income earned for the twelve calendar months preceding dismissal.

- Specify the amount of disability benefits paid during the same twelve months.

- Subtract the amount of benefits paid from the salary amount.

- Divide the resulting amount by 12 - according to the number of months, and 29.3 - the average number of months in a calendar month. At the same time, if in some month the employee was on sick leave, sick leave days must be excluded.

- Multiply the resulting result by the number of vacation days that remain unused. The resulting value will be the amount of compensation.

To calculate the vacation days to which an employee is entitled, the Rules on regular and additional vacations approved by the People's Commissariat of Labor of the USSR on April 30, 1930 are applied.

What to do if vacation pay is calculated incorrectly

If you find that the amount of vacation pay is incorrect due to inclusion in the sick leave period, then you should contact the accountants in the organization to request a recalculation. Here you will need to submit a written application, a template of which must be provided to you. If an accountant refuses to carry out your next calculation, then you should also seek a written justification for the refusal. When you receive such a document, you will be able to seek help from the relevant authorities or file a claim.

Important! In addition to reviewing vacation pay, the court process may also include moral compensation. It is worth remembering that if you want to get a profitable result, you need to be guided only by the content of the exact requirements for the company, and also at the same time stock up on your own calculation of the amount of vacation pay.