How to get money accountable?

The costs of travel to the business trip destination, renting housing for the duration of your stay away from the place of permanent work, as well as daily expenses in accordance with Article 168 of the Labor Code are covered by the employer.

In addition, if a business trip involves the expenditure of additional funds (for example, the purchase by a seconded mechanic of spare parts for repairing equipment), the advance must include the corresponding additional amounts of money.

An advance for a business trip is issued in the accounting department of the enterprise that sends the employee on a business trip and can be made either in cash or in non-cash form (to the employee’s bank salary card).

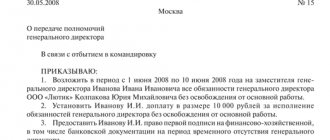

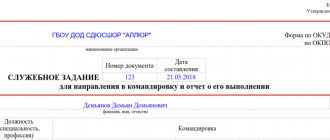

In order for an employee to be given an advance for expenses associated with a business trip, one of the two documents presented below must be available:

- Form T-9 duly filled out (or an order from the boss on the company’s letterhead);

- An application for the issuance of travel funds, drawn up by the employee and endorsed by the manager.

In the case when cash payments are made, it is necessary to fill out a cash settlement order, which was approved by Resolution No. 88 of the State Statistics Committee of the Russian Federation on August 18, 1998.

The advance payment is issued to the posted employee himself with an identity card (passport) or to his representative upon presentation of a notarized power of attorney.

The cashier of the enterprise (organization) writes down the amount issued in words in the cash settlement order.

After receiving the advance, the employee must, in the presence of the cashier, recalculate the entire amount and sign the order if it corresponds.

Non-cash payment of travel advances is permitted in accordance with letter of the Ministry of Finance of the Russian Federation No. 02-03-10/37209, letter of the Treasury No. 42-7.4-05/5.2-554 dated September 10, 2013 and is regulated by the local act of the enterprise (organization) (collective labor agreement).

In case of non-cash payment, the management's order to pay an advance for a business trip is transferred to the accounting department of the enterprise (organization) and is the basis for transferring the calculated amount to the employee's salary card.

In cases where the funds issued were not enough to cover the expenses foreseen in the business trip expense estimate, the employee uses personal funds, and upon returning from a business trip, indicates additional expenses in the report.

The company is obliged to reimburse the employee for all confirmed expenses for which the advance payment was not sufficient.

If the business trip has been extended, the employer must finance the employee’s expenses for all days of the extension by transferring additional funds to a bank card.

Important! Issuing an advance for a business trip is a mandatory condition for sending an employee on a business trip.

Even if the employee has written consent to reimburse expenses incurred in connection with a business trip after returning to his permanent place of work, the employer may be brought to administrative or criminal liability.

How to submit an application?

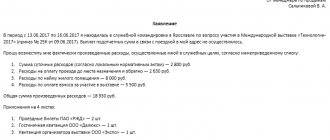

To receive a travel advance, the employee draws up an application for the issuance of funds in connection with a business trip.

The document must comply with the general rules for the design of working documentation - consist of a header, main part and conclusion.

An application for an advance for a business trip is drawn up by the employee addressed to the boss.

The main part contains the details of the order for sending on a business trip (number, date), the period of the business trip, the amount of the advance payment with the main items of expenses listed (accommodation, travel, daily expenses).

Also, the employee on whose behalf the application is being drawn up must indicate that he is familiar with the obligation to report on the waste of the advance payment within three working days after returning from the trip.

At the end of the document, the date of preparation, signature and visa of the authorities are indicated.

Without the last paragraph, the application is considered invalid for accounting transactions.

applications for an advance for a business trip – word.

When should I report travel expenses?

A report on the waste of a travel advance is a mandatory document, the submission of which is regulated by Articles 313-314 of the Tax Code of the Russian Federation.

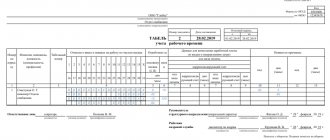

The submitted report must be drawn up on a special form No. AO-1 and provided by the employee within three working days after the end of the business trip (paragraph 2, clause 6.3 of Bank of Russia Directive No. 3210-U dated March 11, 2014).

Documents confirming expenses are attached to the specified document: checks, receipts, travel tickets, etc.

Other travel expenses

In addition to those established in Art. 168 of the Labor Code of the Russian Federation for expenses that the employer is obliged to make, other expenses that have been agreed upon can also be reimbursed.

For example, the cost of packing luggage can be reimbursed as travel expenses. But in this case, it must be taken into account that it is better to indicate the possibility of compensation for such expenses in the local act of the organization, and in addition, confirm that this was done for production purposes - to ensure the safety of documents and property of the organization. If it is confirmed that we are talking about packaging the employee’s personal property, these expenses will need to be included in the employee’s income with subsequent withholding of personal income tax.

Another pressing and frequent question is paying for food on a business trip. The issuance of daily allowances is aimed at covering additional expenses of an employee on a business trip, including food. In this regard, the organization is not obliged to pay additionally for food. For example, even with regard to one-day business trips, the Ministry of Finance of the Russian Federation in Letter dated October 09, 2015 No. 03-03-06/57885 indicates that reimbursement of the cost of food is not an expense associated with a business trip.

But the organization has the right to provide for payment for food in a local act and pay it to employees in addition to the daily allowance. But these will be payments under the employment contract, which are subject to insurance premiums and included in income for the purpose of withholding personal income tax.

However, in some cases, the cost of food is considered differently. For example, if in a hotel the price of a room includes the cost of breakfast, when flying or traveling the cost of food is included in the ticket price, then this is not subject to insurance premiums (Appendix to the Letter of the Federal Insurance Service of the Russian Federation dated November 17, 2011 No. 14-03-11/08 -13985).

But the Ministry of Finance takes a different position, believing that if the cost of food in the ticket is highlighted as a separate line, then these costs are not taken into account when calculating income tax (Letter of the Ministry of Finance of the Russian Federation dated May 20, 2015 No. 03-03-06/2/28976).

Payment of daily travel expenses in 2018

In order for an accountant to correctly calculate the amount of payments, the number of days spent on a business trip should be multiplied by the approved daily expenses. When calculating the number of days, consider:

- all days of the trip, including holidays and weekends;

- days spent en route, including days of departure and arrival;

- days of forced downtime or delay.

Typically, a business trip order contains an order for the payment of an advance. It can be transferred to the employee’s card or issued in cash through the institution’s cash desk. Upon return, the employee is required to provide an advance report to the accounting department.

When an employee is sent on a one-day business trip, daily subsistence allowances are not paid, in accordance with paragraph 11 of Government Decree No. 749. But transportation costs are reimbursed.

The period for payment of daily allowance before the trip is at the discretion of the employer

*** Personal income tax is withheld from amounts paid for days spent by an employee on a business trip, and insurance premiums are also calculated in the same manner as from wages. Daily allowance When sending an employee on a business trip, the employer is obliged to reimburse him for additional expenses associated with living outside his place of permanent residence - daily allowance (Article 168

Attention TC RF). Daily allowances are paid for each calendar day of being on a business trip, including weekends and non-working holidays, as well as days spent on the road (clause 11 of the Regulations on the specifics of sending employees on business trips).

How the actual duration of a business trip is determined, and what documents confirm it, is discussed in the article “Business trips of employees: we process them correctly.”

Daily allowance rates for a business trip in 2018

Labor legislation does not provide for the employer to oblige the employee to bear any expenses at his own expense. The procedure and amount of reimbursement of expenses related to business trips can be determined by a collective agreement, as well as by local regulations. However, both a collective agreement and a local regulatory act can be applied only if otherwise is not established directly by the Labor Code of the Russian Federation, as well as other regulatory legal acts of the Russian Federation (hereinafter - NLA). Thus, according to Article 168 of the Labor Code of the Russian Federation for state (municipal) employees, the procedure and amounts for reimbursement of travel expenses are determined by the legal acts of state authorities of the constituent entities of the Russian Federation and local self-government. The procedure and conditions for the secondment of federal government civil servants (hereinafter referred to as employees) were approved by Decree of the President of the Russian Federation of July 18, 2005 No. 813

(hereinafter referred to as Order No. 813).

For other points, employers are required to apply the Regulation on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749

(hereinafter referred to as Regulation No. 749). Accordingly, collective agreements and local regulations in relation to employees should not contradict the procedures and amounts for reimbursement of travel expenses established by regional (municipal) regulatory legal acts, as well as Procedure No. 813 and Regulation No. 749. However, they may contain cases not covered in these acts.

Highlights of Order No. 813

In accordance with Procedure No. 813, when an employee is sent on a business trip, he is guaranteed retention of his position and salary, as well as reimbursement of expenses.

Travel to and from your business trip

Travel expenses to the place of assignment and back to the permanent place of service include payment for:

| — | services for issuing travel documents and providing bedding on trains; |

Features of accounting for expenses on a foreign business trip

When sending an employee on a business trip abroad, several features must be taken into account.

A significant difference is the determination of the amount of daily allowance. The amount of daily allowance changes for the period of a business trip (clause 17 of the Regulations): when traveling within Russia, daily allowance is paid in the amount established for domestic business trips, and on the territory of foreign countries - in the amount established for business trips to this state. In a local act, daily allowances can be set either in the same amount for all foreign business trips, regardless of the country, or depending on the state.

Daily allowance and other expenses can be issued in foreign currency. Accounting for travel expenses in foreign currency is carried out in rubles.

For the day of departure from Russia, daily allowance must be paid according to the norms for travel through foreign territory, and upon return - according to the norms for domestic Russian business trips (clause 18 of the Regulations). The date of border crossing is determined by the stamps in the passport. If an employee leaves and returns on the same day, then the daily allowance is paid in the amount of 50% of the norm established for a business trip to this state.

From an accounting point of view and to determine to which account the costs of a business trip are attributed, it does not matter whether a business trip is within the territory of the Russian Federation or abroad.

In addition, when traveling abroad, the costs of obtaining a foreign passport, visa, other documents necessary for the business trip, payments and fees are additionally reimbursed (clause 23 of the Regulations).

Reflection of the results of a foreign business trip in accounting will be similar to a business trip in the Russian Federation, and travel expenses will also be written off depending on the purpose of the trip. But due to the fact that expenses are incurred in foreign currency, there will be specifics regarding the recognition and conversion of currency into rubles.

If travel allowances are issued in rubles, then expenses incurred in foreign currency by bank transfer (with an employee’s ruble card) must be converted into rubles at the rate that was in effect on the date of payment. If travel allowances were issued in cash, then the ruble conversion rate based on the certificate of currency purchase is accepted. In the absence of such a certificate, the rate is accepted on the date of issuance of an advance payment in rubles to the employee (Letter of the Ministry of Finance of Russia dated January 21, 2021 No. 03-03-06/1/2059).

For the purpose of tax accounting of travel expenses, the date of expenses will be the date of approval of the advance report (clause 5, clause 7, article 272 of the Tax Code of the Russian Federation).

If the advance is issued in foreign currency, then the debt is recalculated into rubles at the exchange rate on the date the advance was issued and the funds are not recalculated (clause 10 of PBU 3/2006).

How to apply for daily allowance for a business trip

3 tbsp. 14 of the Law of December 10, 2003 No. 173-FZ). This conclusion was made in relation to a foreign representative office, but it can also be extended to Russian organizations. This is due to the fact that the provisions of Part 3 of Article 14 of the Law of December 10, 2003 No. 173-FZ apply both to payments made by non-resident organizations and resident organizations.

The Supreme Arbitration Court of the Russian Federation took the position of organizations on this issue (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 18, 2008 No. 10840/07). The court indicated that issuing cash currency to an employee as an advance for a business trip abroad cannot be qualified as a violation of currency legislation. This is due to the fact that the procedure for carrying out foreign exchange transactions for issuing cash currency to pay for travel expenses is not established by law. This means that such operations can be carried out without restrictions (paragraph 2, part 2, article 5 of the Law of December 10, 2003 No. 173-FZ).

The possibility of issuing a foreign currency advance for a business trip is not denied by the Government of the Russian Federation (clause 16 of the Regulations approved by Resolution No. 749 of October 13, 2008).

Advice: since the issue of issuing a foreign currency advance from the cash register is not clearly regulated by law, if possible, it is better to choose issuing an advance in rubles or issuing currency by bank transfer - by transferring to a plastic bank card.

Upon returning from a business trip, the employee draws up an advance report. If an employee traveled abroad and was given an advance in foreign currency, then the documents must be prepared in a special way.

Is this a violation? Yes, this is a violation of Article 168 of the Labor Code, since it is mandatory to issue an advance for travel expenses before the trip.