How to properly return accountable money to the organization’s account?

These days, almost every employee has a salary card. It is to this card that money can be transferred to the account. It is more convenient for an individual to return the balance of unused funds to the organization’s account from the same card through online banking.

How to do this in practice?

Firstly, the possibility of issuing and returning accountable money through a current account to or from employee salary cards or bank cards of persons involved under civil law contracts must be enshrined in a local act of the enterprise - for example, draw up a Regulation on settlements with accountable persons or include it in the Accounting Policy .

Secondly, it is necessary to return accountable funds to the current account by making an entry “return of unused accountable amounts” in the “payment name” field. This entry will allow you to avoid problems with the tax authorities and not include the amounts received in the tax base for profit tax, VAT and income when applying the simplified tax system. If, when making a payment, the accountant did not indicate that the money transferred is a return of the unused amount, it is better to formalize this with an explanatory note to the payment.

Accounting of settlements with accountable persons.

Accounting for settlements with accountable persons is kept on account 71 “Settlements with accountable persons” (A-P). Analytical accounting of the account is maintained for each accountable person. After issuing the money to the employee, the accountant will make the following entry:

Debit 71 – money issued on account

Credit 50 (51)

Write-off of spent accountable amounts is carried out on the basis of the approved advance report and is reflected in the credit of account 71.

WRITTEN OFF BUSINESS EXPENSES

| Type of consumption | Wiring |

| − property acquired | D 10 (08, 41) – materials were capitalized (fixed assets, K 71 goods) purchased by an accountable person When purchasing valuables in retail trade, the employee must submit a sales receipt or invoice and cash register receipt to |

| − expenses related to the needs of the main, auxiliary or service industries | D 20 (23, 29) – the expenses of the accountable person are written off as expenses K 71 main (auxiliary, servicing) production |

| − expenses related to management activities | D 25 (26) – general production expenses K 71 (general business) expenses were paid by accountable persons. |

| − expenses related to the sale of finished products or goods | D 44 – expenses of accountable persons are taken into account in selling expenses K 71 |

| − expenses for non-production activities (for example, expenses for sporting events, recreation, entertainment, etc.): | of the person reporting to K 71 are taken into account as part of other expenses |

WRITTEN OFF TRAVEL EXPENSES

| Purpose of the trip | Wiring |

| − purchase, delivery of fixed assets (equipment, cars, etc.) | D 08 – business trip costs associated with the purchase, K 71 delivery of fixed assets |

| − purchase, delivery of materials | D 10 – business trip costs associated with the purchase, K 71 delivery of materials |

| − purchase, delivery of goods | D 41 – business trip costs associated with the purchase, K 71 delivery of goods |

| − concluding agreements on the sale of products, studying sales markets in other regions, participating in exhibitions | D 44 – expenses for a business trip related to sales of K 71 |

| − participation in training seminars, shareholder meetings, other goals related to production activities | D 26 - written off the costs of a business trip necessary for K 71 management needs of the organization |

| − warranty repairs of previously sold products (if a reserve for warranty repairs has been created) | D 96 – expenses for a business trip associated with the return, K 71, transportation of defective products were written |

| − business trip of a non-production nature (for example, checking a summer camp owned by an enterprise) | D 29 (91) – business trip expenses are written off, not directly To 71 related to production activities pre- acceptance |

| − elimination of consequences of emergency situations | D 91 – the costs of a business trip related to K 71 eliminating the consequences of an emergency situation |

If the employee has an unspent balance of the advance payment , then within 3 days allotted for drawing up the advance report, it must be returned to the cash desk using a cash receipt order. In accounting, such an operation is formalized by posting:

D 50 – the balance of the advance from the accountable person is returned to the cashier

K 71

If an employee has reasonably spent money in an amount greater than the advance payment issued, then the amount of overspending is reimbursed to him from the organization’s cash desk on the basis of an approved advance report. This operation is formalized by posting:

D 71 – the employee is reimbursed for expenses exceeding the amount of the advance payment issued

K 50

If the employee does not return the accountable amount within the prescribed period, then within a month (the statute of limitations) by order of the head of the enterprise, it must be withheld from the employee’s salary. This operation is executed by transactions:

D 94 – the accountable amount not returned on time is reflected

K 71

D 70 – unreturned accountable amount was withheld from the employee’s salary

K 94

As long as the amount not paid on time is registered with the employee, it is regarded as a loan provided to him. In this case, the material benefit from the use of borrowed funds must be calculated. If the debt is written off at the expense of the organization, then this amount must be included in the employee’s total income and personal income tax must be withheld from it.

Accounting for settlements with personnel for other operations.

is maintained on account 73 “Settlements with personnel for other operations” (A - P). Sub-accounts can be opened for the account: 73-1 “Settlements for loans provided”;

73-2 “Calculations for compensation for material damage”;

73-3 “Payments for goods provided on credit”;

73-4 “Insurance calculations”, etc.

Don’t know how to solve or complete a coursework or dissertation? Order a solution

What to do with the transfer fee?

If a transfer fee was charged for a refund transaction, whether to reimburse it or not and accept it as expenses or not will depend on the wording in the organization’s local act on the procedure for reimbursement of travel expenses and in the local act on non-cash payments.

If the local regulations of the enterprise do not provide for a way to return an unspent advance through an online bank, as well as reimbursement of the bank’s commission for such a transaction, then the employer is not obliged to return to the employee the amount paid to the bank for the transaction.

Thus, a collective agreement or a local act of an organization may establish the types and amounts of reimbursable travel expenses, the procedure for their reimbursement, the procedure and method (cash and/or non-cash, including through online banking) of returning an unused advance, a list of documents accepted in confirmation of expenses (including in the form of a bank commission charged when returning an unspent advance through online banking).

An example of including in a local act a provision on the method of returning unused amounts to the organization’s current account:

The employer's local act may contain a provision on reimbursement to the employee for any expenses incurred with the permission or knowledge of the employer. In this case, the decision to reimburse the bank’s commission for returning money through online banking can also be made.

Return period

The employee must report on the amounts received for reporting no later than three working days after the expiration of the period for which these amounts were issued. To do this, he needs to present to the chief accountant or accountant, and in their absence, to the manager, an advance report with attached supporting documents (clause 6.3 of the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U). From what date this period is to be counted depends on the purpose for which the employee was given accountable money.

If an employee received money on account for business needs, then he must report for it within three days from the end of the period for which it was issued to him (clause 6.3 of the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U).

If the money is issued on account of travel expenses, then the employee must report for them within three working days after returning from a business trip (clause 26 of the regulation approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

Checking the advance report, its approval by the manager and the final settlement on it are carried out within the time period established by the manager (clause 6.3 of the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U). That is, the employee must return the unspent amounts within the period set by the manager.

Situation: when must an employee report on amounts received on account for business needs if the deadline for their return has not been established?

On the day you receive them.

The employee must report on the amounts received for reporting no later than three working days after the expiration of the period for which these amounts were issued (clause 6.3 of the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U). The question of how to report on accountable amounts if the return period has not been established is not stated in the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U. According to the tax department, in such a situation the employee must report on accountable money on the same day on which he received it (letter of the Federal Tax Service of Russia dated January 24, 2005 No. 04-1-02/704).

Advice: due to the ambiguity of the issue, it is better for the organization to establish a period for which accountable amounts are issued for business needs. This will help avoid possible disagreements with regulatory agencies.

An example of calculating the period during which an employee must report on amounts received for reporting for business needs

On April 8, secretary E.V. Ivanova received money to purchase stationery (paper, staplers, pens, etc.) for the organization. She completed the task without spending the entire amount received for the report.

The organization does not set a period for which employees receive accountable amounts for business needs. Therefore, no later than April 8, Ivanova must submit an advance report.

Situation: from what date should I calculate the reporting period for amounts issued for travel expenses - from the end date of the business trip specified in the order, or from the day when the employee actually returned to his place of permanent work?

From the day when the employee actually returned to his place of permanent work.

The deadline for an employee’s report on travel expenses is three working days from the date of his return from a business trip (clause 26 of the regulation approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749). Therefore, regardless of what date is indicated in the manager’s order to send an employee on a business trip, the countdown must be carried out from the moment when the employee actually returned to the place of work (paragraph 2, paragraph 4 of the regulation, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749). When traveling within the country, this day is determined on the basis of travel documents (clause 7 of the regulations approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749). When traveling abroad - according to the mark in the international passport (paragraph 2, clause 18 of the regulation approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

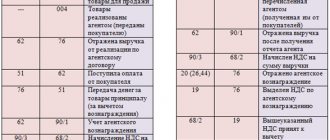

Return of accountable amounts to the current account, postings

Receipt of funds to the organization's current accounts in accounting is documented by the following transactions:

Dt 51 Kt 71 - unused accountable funds were received into the organization’s bank account.

Dt 52 Kt 71 - unused accountable funds were received in the foreign currency account of the organization’s company.

Dt 73 Kt 51, 52 - the amount of the bank commission for the transfer was returned to the employee.

Dt 91 Kt 73 - bank commission is recognized as an expense.

The last two entries are recorded in accounting if the local act of the enterprise stipulates the possibility of compensating the bank’s commission.

Issuing money to an accountable person: general rules

Return of the accountable amount to the cashier

According to Directive of the Central Bank No. 3210-U dated March 11, 2014, an organization can issue funds to an employee for reporting:

- in the form of an advance on expenses for an upcoming business trip;

- for use for household needs (purchase of materials, goods, payment for services in the interests of the company).

Accountable funds can be issued either in the form of cash from the company’s cash desk, or in non-cash form by transferring to the employee’s bank account.

Current legislation allows individual entrepreneurs and other self-employed persons to withdraw funds from the cash register for personal use. This right is not provided for by law for legal entities.