Account DtKt accountOperation description5157Money “in transit” was credited to the account5158/66.67Repayment of the loan provided/receipt from the loan taken and other loans5186Receipt of funds for targeted financing, from other organizations and persons, budget5191Proceeds from sales8151Repurchase of shares (own shares) from participants8451Payment for events (according to decision of the founders) 9951 Coverage of uncompensated expenses related to emergencies and natural disasters

Example 1. Postings when opening a current account

Let’s say Leto LLC has one main bank account. Soon, in addition, Leto LLC opened a corporate card account, to which funds were credited from the current account. The bank's opening fee was also withheld. The main account has been replenished. All transactions were carried out in Russian currency.

Table – Postings for 51 accounts when opening an account:

| Account Dt | Kt account | Wiring Description | A document base |

| 51 | 50 | Receipt of funds to the main current account from the cash register | Payment order |

| 55.07 | 51 | Transfer of funds to a bank card account from a current account | Bank statement |

| 91.02 | 55.07 | Paid for bank services (commission) | Bank commission invoice |

Example 2. Postings for deposit transactions for 51 accounts

Posting table – Deposit transactions:

Example 3. Postings to 51 accounts when paying by bill of exchange

Table - Postings for payment by bill of exchange:

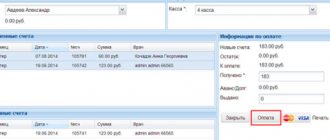

Analysis of 51 accounts and account cards

Analytical accounting for 51 “Current Accounts” accounts in the 1C Accounting program is carried out using standard reports for each:

- Sub-account, that is, for each current account of the organization, using the Turnover Balance Sheet report;

- Receipt and debit of funds using the Account Card report.

For prompt management of finances, the account balance is monitored daily.

Add a comment Cancel reply

You must be logged in to post a comment.

kartochka.png

Like any standard report, a card can be generated for a certain selected period of time, and identification of each operation allows you to determine the occurrence of an error or inaccuracy in an extremely fast time. In addition to the chronological recording of daily transactions on the current account, the card accumulates final data for a given period. This allows you to quickly compare report data with other accounting registers.

Information on the amount of debit and credit turnover for the month, quarter, year, as well as the size of the opening and closing balance for account 51 must coincide with the data in the balance sheet for the corresponding period.

If a company has several current accounts in different banks, then it is more convenient to maintain cards separately for each credit institution. At the end of the reporting month, the final data is summarized and reflects the total balance of funds on all ruble current accounts of the company. This indicator should be equal to the debit balance of account 51, reflected in the balance sheet and journal order.

Filling algorithm

For full functionality, the paper can be issued in a single copy. At the top of the document fill out:

- Basic details. The OKPO code is already entered in the form - 0301010. OKUD is filled out.

- The full name of the company, if any, the structural division of the company within which the form is being filled out.

- The name of the statement, its number, the date of signatures.

- The period for which the calculations were made.

The date for drawing up the document can be chosen arbitrarily, but on the condition that this day will not be earlier than the last day in the current month and no later than the actual day the funds are written off from the organization's cash desk.

In addition, on the second page of the statement there is a table, each column of which must be filled in (otherwise a dash is placed in the table cell).

In total, the document contains 18 columns with the following names:

- serial number of the employee to whom the payment is intended;

- personnel number of the same employee;

- last name, first name and patronymic (the latter are abbreviated to initials);

- position held, profession or specialization in which the employee is engaged;

- salary or tariff rate;

- how many days or hours were worked during the specified period (weekends and weekdays are indicated separately);

- the amount accrued by the organization to this employee for the month (the column is divided into different types of fees, including a “general” column that summarizes the data);

- what amount was withheld and credited earlier (advance payment, income tax, etc.);

- the employee’s debts to the organization or, conversely, the exact amount;

- how much money is supposed to be paid to the employee according to this statement.

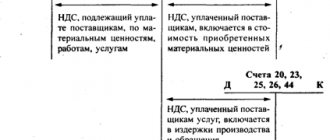

How is account 51 used in accounting?

Account 51 is active. An increase in an account is shown as a debit, and a decrease as a credit. For example: if sales revenue is credited to the company’s account, then debit entries on account 51 will be used, and if services, raw materials or debt to counterparties are paid from the current account, then account 51 entries will be made on credit.

The account balance is debit. It shows the cash balance that belongs to the company at the reporting date. Since monetary resources are the assets of the enterprise, the final account balance is reflected in the balance sheet asset, in particular, in line 1250.

The main document confirming the status of the account is a bank statement.

The balance of account 51 cannot be negative. If the company has no money, then the balance is zero; if it does, then the balance is greater than zero. If the bank has provided an overdraft, then it should be reflected as accounts payable, but not as a positive balance.

Statement 2 on the debit of account 51 “Current accounts” for September 2014

Balance at the end of the month______________ rub.

Journal - order 2 for the credit of account 51 “Current accounts” for September 2014.

Journal order No. 4 for the credit of account 66 “Settlements for short-term loans and borrowings”

ANALYTICAL DATA FOR ACCOUNT 66 “Calculations for short-term loans and borrowings” for September 2014

Bibliography

1. Law of the Russian Federation dated December 6, 2011. No. 402-FZ “On Accounting” (as amended on September 28, 2010).

2. Chart of accounts for financial and economic activities, approved. by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

3. Regulations on non-cash payments in the Russian Federation, approved. Central Bank of the Russian Federation 03.10.2002 No. 2-P

4. Regulations on accounting and financial reporting in the Russian Federation, approved. by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n (as amended on March 26, 2007).

5. Accounting Regulations “Accounting Policy of the Organization” PBU 1/2008, approved. by order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n.

6. Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” PBU 3/2006, approved. by order of the Ministry of Finance of the Russian Federation dated November 27. 2006 No. 154 n.

7. Accounting regulations “Accounting statements of an organization” PBU 4/99, approved. by order of the Ministry of Finance of the Russian Federation dated 07/06/99 No. 43n.

8. Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved. by order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n.

9. Accounting Regulations “Income of the Organization” PBU 9/99, approved. by order of the Ministry of Finance of the Russian Federation dated 05/06/99 No. 32n.

10. Accounting Regulations “Expenses of the Organization” PBU 10/99, approved. by order of the Ministry of Finance of the Russian Federation dated 05/06/99 No. ЗЗн.

11. Accounting Regulations “Accounting for Intangible Assets” PBU 14/2007. approved by order of the Ministry of Finance of the Russian Federation dated December 27, 2007 No. 153n.

12. Accounting Regulations “Correcting Errors in Accounting and Reporting” PBU 22/2010, approved. by order of the Ministry of Finance of the Russian Federation dated June 26, 2010 No. 63n (as amended on November 8, 2010).

13. Bogataya, I.N. Accounting: textbook. – 2nd ed., revised. and additional /I.N. Bogataya, E.G. Bogrov, E.M. Efstafiev, ed. Khakhonova N.N. – M.: Phoenix, 2008. – 380 p.

14. Bogachenko, V.M. Accounting: textbook. – 13th ed., revised and supplemented. / V.M. Bogachenko, N.A. Kirillova – M.: Phoenix, 2010. – 479 p.

15. Gomola, A.I. Accounting: textbook. – 6th ed., rev. and additional / A.I. Gomola, V.E. Kirillov, S.V. Kirillov – M.: Academy, 2010. – 416 p.

16. Melnik, M.V. Accounting: textbook. – 8th ed., rev. and additional / M.V. Melnik – M.: Economist, 2008. – 383 p.

17. Brykova, N.V. Fundamentals of accounting: textbook. – 9th ed., rev. and additional – M.: Academy, 2013. – 139 p.

18. Lebedeva, E.M.. Accounting: workshop. – 6th ed., stereot. – M.: Academy, 2014. – 173 p.

20. Lebedeva, E.M.. Accounting: textbook. – 4th ed., stereot. – M.: Academy, 2013. – 297 p.

1. Bogachenko, V.M. Accounting: textbook. – 10th ed., revised and supplemented. / V.M. Bogachenko, N.A. Kirillova - M.: Phoenix, 2009. - 256 p.

2. Kirillova, N.A. Fundamentals of accounting: Collection of tasks: educational and practical guide. /ON THE. Kirillova, V.M. Bogachenko – M.: Phoenix, 2008. – 454 p.

3. Comments on accounting provisions: / V. D. Glinisty et al.; resp. ed. A. S. Bakaev. – 2nd ed., add. – M.: Yurayt, 2006. – 419 p.

4. Periodicals: “Glavbukh”, “General Ledger”, “Accounting”, “Acts and Comments for an Accountant”, “Current Accounting”, “Current Issues of Accounting”.

5. Reference information and legal system “Garant”.

6. Reference information and legal system “ConsultantPlus”.

7. Reference information and legal system “Code”.

8. Information and analytical electronic publication in the field of accounting and taxation – Access mode: https://www.buhgalteria.ru/.

9. Portal “Accounting Online” – Access mode: https://www.buhonline.ru/.

10. Information support portal for accounting in small businesses – Access mode: https://www.businessuchet.ru/.

Main entries for account 51

The majority of transactions carried out on the account are settlements with suppliers and customers, which are carried out by the company in accordance with concluded agreements. Let's look at typical transactions for these operations:

| Dt | CT | Description | Document |

| 62 | Receipt of funds from the buyer for goods (both in the form of an advance payment and as final payment for shipped products) | Bank statement | |

| Return by the supplier of goods (works, services) of previously paid funds | Bank statement | ||

| Receipt of funds for services transportation of finished products | Bank statement | ||

| 76 | Crediting funds under agreements with other counterparties | Bank statement | |

| Payment to suppliers (contractors) for goods (work, services) in the form of an advance payment, as well as as final payment for shipped products (work performed) | Payment order | ||

| 62 | Refund to buyers (customers) of funds that were previously credited erroneously | Payment order | |

| 76 | Transfer of funds to third party organizations and persons for other types of transactions | Payment order | |

| 90 | Crediting revenue received from the sale of goods (works, services) | Bank statement | |

| 91 | Receipt of funds as income from sales and other disposals. Reflection of non-operating income. | Bank statement |

The account is also actively used to reflect non-cash payments to personnel, namely:

- monthly payment of remuneration (salary, allowance, bonuses, etc.) and related transfers to social funds;

- transfer of funds to employees for business needs (both in the form of an advance and upon completion of a business transaction);

- travel expenses (issuance of an advance and reimbursement of funds for a business trip).

Correspondence 51 accounts with personnel

Here are the main transactions for settlements with personnel in which the account is used:

| Dt | CT | Description | Document |

| Paying salaries to employees' bank accounts | Payment order | ||

| Issuing funds to an employee for household needs | Payment order | ||

| 69 | Receipt of funds excessively transferred to insurance funds | Bank statement | |

| 73 | Receipt of funds from employees (covering shortfalls, compensation for damage, etc.) | Bank statement |

Other operations carried out on the account include loan settlements, crediting funds for targeted financing, and payments to shareholders.

| Dt | CT | Description | Document |

| Receipt of targeted financing | Payment order | ||

| 67 | Repayment of long-term loans | Payment order | |

| 81 | Shares were purchased from shareholders | Bank statement |

Option 1. Opening an account

The movement of funds when opening an account is reflected in accounting. The report indicates a number of transactions. A prerequisite is the indication of the basis document, which confirms the actual implementation of the operation.

Table 4. Opening operations.

| Accounts | Contents of operation | A document base | |

| Dt | CT | ||

| 51 | 50 | Receiving funds from the cash register to the organization's account | Payment order |

| 55.07 | 51 | Transfer of funds from a bank account to a card account | Statement from a financial institution |

| 91.02 | 55.07 | Payment of commissions accrued when performing banking transactions | An invoice reflecting the bank's commission for services provided |