Office management is a living, constantly changing area, into which new terms come every now and then. Recently, entrepreneurs, accountants and employees have come across the increasingly common concepts of “gross salary” and “net salary”. These terms indicate completely different amounts of the same salary.

How to organize office work and document flow in an organization?

We will try to explain below how to figure out what the differences between these phenomena are, whether it is possible to calculate one, knowing the other, how to navigate, what exactly is meant when offering this or that form of wages.

Origin of names

Initially, the terms “gross” and “net” go back to Latin, but their economic use is determined by their meanings in English.

Where does "gross" come from?

The word “gross” in English, where it came from in our economic vocabulary, has been used in the context of money since the 16th century. It transferred its meaning of “something general, total, total” to the calculation of finance. There are several meanings of this concept.

- "Gross". In the 16th century, English businessmen used the expression “gross profit,” that is, total profit not cleared of gross expenses and tax components. Today, instead of it, “total profit” is more typical for the English language. Thus, the first meaning of the epithet “gross” in the entrepreneurial sphere is similar to the Russian definition of “gross”.

- "Wholesale". Another meaning of this term, also going back to its “universality”, is transactions related to the trade in large quantities of goods - “gross”. In English, buy “by the gross” means a wholesale deal.

- "No deductions." The total composition of the salary, before the deductions required by law are made from it, is also “gross”. This is the meaning used in modern entrepreneurial vocabulary.

What is gross salary

Salary gross is from the English gross, the amount before all deductions. This is the amount of the employee’s salary before deducting personal income tax of 13%. In Russia, personal income tax is calculated and withheld by the employer, so the employee immediately receives a smaller amount into his account. Gross salary is also called “dirty”.

The amount of salary after taxes is also called “no” - from the English net, that is, “final”.

How do we share income with the state?

The difference between gross and non-gross salary is the 13% of personal income tax that the employer transfers to the tax office for you. It is considered this way - let’s say that the employee’s salary before taxes is 50,000 RUR.

50,000 R × 13% = 6,500 R.

50,000 R − 6,500 R = 43,500 R.

He will receive 43,500 RUR in his hands.

If you are officially employed and pay personal income tax, you can return part of it using tax deductions: for example, for dental treatment, buying an apartment, training in a driving school or charity. Read more about this in our collection “The Country Owes You Something.”

The size of the gross salary is important for benefits: it is the full amount that is taken into account when calculating them. You receive 43,500 RUR in your hands, and the allowance is calculated as if you were receiving 50,000 RUR. This is taken into account when calculating subsidies for housing and communal services and, for example, the monthly payment for a child.

What about "net"

In Russian transcription, the word “no” in relation to salary does not sound very optimistic. But you need to take into account the English meaning of this word, which originates from the Italian “netto”, which means “pure”.

Along with the term “gross profit”, the antonymous “net profit” was also used, which, in turn, meant net profit, from which all consumable components were already excluded.

Today, the term “net” in relation to wages means the amount received by the employee in person.

What is salary net

By analogy, it can be argued that no salary is the salary after income tax in the amount of 13% or 30% has been deducted from it. That is, this is the amount of money that a person receives in his hands.

That is, no salary is gross minus income tax and other mandatory deductions . These include:

- health insurance;

- contributions for voluntary insurance;

- alimony in favor of children, parents, former spouses;

- fines for administrative violations;

- other deductions provided for by law.

In addition to deductions, there are tax benefits. For example, property deductions for children. Therefore, the amount of all deductions and penalties made from wages must be clarified with the accounting employee whose duties include making the calculations.

Is alimony withheld from the advance payment and other nuances in enforcement proceedings?

An employer who is involved in enforcement proceedings related to the assignment of alimony must keep in mind that:

1. Deductions cannot be made, in particular:

- from daily allowances paid to the posted worker;

- from amounts to reimburse the employee’s business expenses;

- from child care benefits.

A complete list of income from which alimony cannot be withheld in court is given in Art. 101 of Law 229-FZ.

See also “Is alimony withheld from financial assistance?”

2. The question of whether alimony is withheld from the advance payment is within the full competence of the employer.

The main thing is that upon payment of the second (main) part of the salary, alimony is deducted in the established amount and subject to the restrictions determined by law. If alimony amounts to the maximum 70% of the salary, then when the salary is divided into 2 equal parts, one of them will go towards alimony in full, and another 20% will have to be taken from the other part of the salary.

2. Any alimony collected by the court must be the first in line among all payments by the employer - along with writs of execution to satisfy claims related to compensation for harm (clause 2 of Article 855 of the Civil Code of the Russian Federation). Only after making such payments are other deductions made from wages, for example, for unpaid advances.

3. If the alimony payer quits, then the company must report this (and the new place of work of the debtor, if it has such information) to the bailiff within 3 days after the occurrence of this event (clause 1 of Article 111 of the RF IC).

If this order is not followed, the bailiff has the right to apply sanctions to the company under Art. 17.14 of the Code of Administrative Offenses of the Russian Federation, or impose a fine under Art. 19.7 of the Code of Administrative Offenses of the Russian Federation in the amount of 300–500 rubles. (per official), 3000–5000 rubles. (for a legal entity).

What is gross salary and salary net

Gross salary is the amount of salary that will be regularly accrued to the employee for the performance of his labor functions. From the specified amount of earnings, personal income tax will be withheld in the amount of 13%, so the employee will not receive the specified amount in hand. Gross salary is also sometimes called “dirty”.

Often, future employees believe that by indicating the gross salary, the employer wants to deceive them: after all, this value is greater than what the employee will actually receive. In fact, by indicating a gross salary, the employer does not violate the law, and under certain conditions, an employee can receive a gross salary without having it reduced by tax.

In order to understand the size of his future income, an employee should take into account some nuances. So, in the indicated gross salary value, not only the monthly salary can be indicated, but also bonuses and allowances . Moreover, in fact, the amount of employee income may change taking into account annual and quarterly bonuses.

Before applying for a job, an employee should become familiar with the company's current remuneration system. It may be specified in a collective agreement or other local legal act. Particular attention should be paid to the procedure for calculating and paying bonuses: what criteria does the employer follow when calculating the bonus, what is its size (is there a minimum value).

You also need to take into account that employees are paid not only on a time-based basis, but also on a piece-rate basis, as a certain percentage for the amount of work completed.

Why does it make sense for an employee to know the gross salary? After all, the tax rate on income from the performance of labor functions is the same for all employees and is 13% (according to paragraph 1 of Article 224 of the Tax Code). The employer, as a tax agent, is obliged to withhold and transfer the amount of personal income tax to the budget. But still, the gross salary indicator is more informative than the net salary indicator.

The fact is that many employees can count on receiving tax deductions, which reduce the tax base and allow them to receive a larger salary. Thus, employees are entitled to social deductions provided for minor children. To receive them, the employee must contact the employer with an application under Art. 218 Tax Code.

Employees are also entitled to property deductions when purchasing an apartment. They can receive their full salary until the amount of unwithheld taxes reaches 260 thousand rubles. (according to Article 220 of the Tax Code).

Often, employers pay part of the salary “in an envelope” in order to reduce the tax burden. After all, in addition to personal income tax, the employer is obliged to pay pension and insurance contributions from the employee’s earnings, pay sick leave and maternity leave, pay for downtime and forced absenteeism according to average earnings. In this case, the salary value in the advertisement is completely uninformative.

The amount of salary after taxes is also called "net" .

This definition comes from the English net, or "ultimate". The difference between gross and net wages is personal income tax of 13%.

Employers don't follow the rules

After we found out the opinion of the applicants, we came to representatives of the employing companies with the same question. They were not so clear: opinions were divided almost equally. This means that it will not be easy for applicants to determine what salary they have in mind for a specific vacancy.

You not only have to guess whether personal income tax is included in the salary, but also carefully read the text of the advertisement: sometimes the amount in the vacancy includes salary and various bonuses. First of all, we are talking about positions in sales, where remuneration often depends on the implementation of the plan - this is every third vacancy on the site.

Another feature of salaries in vacancies is that the higher the position, the less often employers indicate the amount of remuneration: 61% of companies publish offers for top managers without a stated salary. Compare this with specialist vacancies, where only 8% of employers do not write the exact amount.

At the same time, employers are ready to accommodate candidates halfway: 67% of respondents said that they can indicate the amount after taxes in vacancies, since this is what applicants expect from them. We hope this will help companies and future employees find each other.

Salary gross and net: what is the difference?

From the concepts considered, we can conclude that they are significantly different. The difference lies in the amount of earnings established for the employee before and after the deduction of personal income tax. The gross amount is the initial salary amount calculated by the accounting department. Then it is reduced by the amount of the tax and issued to the employee in the form of a net salary.

For reference. Personal income tax rates (NDFL) are established by Russian legislation and are as follows:

- 13% for residents of the Russian Federation;

- 33% for non-residents of the Russian Federation,

Accordingly, depending on the tax status of the employee, the gross salary will be reduced by the tax rate.

Which type of salary is more profitable?

At their core, these are two identical salaries. That is, a person cannot receive a gross salary in person. All deductions and deductions must be made from it. That is, he will receive “no” income in his hands.

But when applying for a job, it is necessary to clarify what type of income the employer offers in his advertisement for the search for new employees. It may be that he has “gross” written down in his ad (this is what most often happens). Therefore, a person who has the right to tax deductions, pays alimony, etc., can make the calculation himself.

If the salary is indicated as “no”, then it is worth thinking about the benefits. For example, an applicant has 2 children. He has the right to receive a tax deduction for each of them. It’s worth thinking about whether it’s profitable to work under such conditions, or whether it’s worth looking for a job that offers “gross”.

Definitions of salary types

Salaries for hired personnel in Russia consist of the following components:

- salary;

- various allowances, if provided for by law and the employment contract;

- bonus or other incentive (if provided and/or deserved).

Wages constitute the main form of income for individuals, therefore they are subject to income tax - personal income tax. This factor is the determining factor in the difference between “gross” and “net” wages.

Gross salary in accounting refers to the amount of remuneration for an employee’s work, which includes all components of the salary, including personal income tax. Colloquial synonyms – “Salary according to documents”, “dirty salary”, “black salary”, “gross”.

Net-salary is a monetary amount from which all mandatory tax payments (NDFL) are excluded, that is, the amount of money received by an employee as payment for labor (at the cash register or on a bank card). Colloquial synonyms: “salary in hand”, “clean”, “white salary”.

How to avoid getting confused as an employee

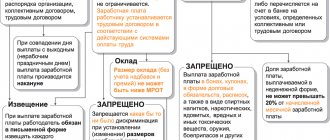

The documents formalizing the relationship with the employer indicate the gross salary, that is, the official salary. This happens because it is the employer who is obliged to be a tax agent for his subordinate - to calculate and deduct the required amount of taxes from all wages even before they are paid to the employee himself, and also to report this to the tax authorities.

Sometimes the “gross” amount is indicated in hiring advertisements - after all, a more impressive amount is more attractive to applicants, and not everyone knows the meaning of the term. Thus, formally the advertisement does not contain false information, while the employee will receive a significantly smaller amount than he read.

IMPORTANT! If you are attracted by the number in the advertisement indicating the size of your future salary, do not rush to rejoice at the generous offer; check whether the employer means “gross” or “net”.

"Black" and "white"

It is no secret that black and white salaries are also popularly referred to as the amount “in the envelope” and the legal salary, respectively. An entrepreneur can pay “gross” to staff, and reflect a smaller amount in documents in order to reduce insurance payments and taxes for themselves. At first glance, it is more profitable for an employee to receive an amount from which personal income tax is not collected monthly. However, in fact, by not transferring the necessary funds to the Pension Fund, the employer “robs” the employee’s future pension. In addition, “black wages” is an economic crime, and if detected by tax authorities, it is seriously punishable.

How to calculate them

Every employee can do this. “Gross” is prescribed in the employment contract during employment. Knowing the amount of income tax and the amount of other deductions or benefits (if they exist), you can make fairly simple calculations. The final result must coincide with what is written on the payslip.

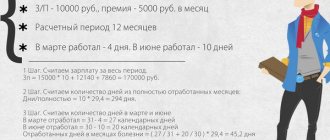

Calculation example

Above we answered the question: net and gross salary - what is it. Gross is the amount of wages before tax deductions established by current legislation. Now we’ll tell you how to calculate the net amount that the boss will hand over to the employee at the end of the working month.

The difference between these types of payroll is directly related to the income tax that is withheld from gross payments. Therefore, the tax rate is decisive:

- for residents of the Russian Federation the rate is 13%;

- for non-residents the rate is 33%.

To understand how much an employee resident of the Russian Federation will receive, you need to subtract 13% from the gross salary. For example, if the contract specifies the amount of 40,000 rubles, then the employee will receive 34,800. The calculation is as follows: 40,000 rubles. – 13% = 34,800 rub. The worker will be deducted 5,200 rubles.

The difference is significant, so if, when considering vacancies, you were attracted by the salary indicated in the advertisement, you should not rejoice ahead of time. Specify whether the employer means gross or net.

By whom and how is alimony withheld from wages?

Based on the above regulatory documents, the accounting department at the place of employment of the payer is obliged to make monthly deductions in favor of the recipient of funds, subject to the mandatory presence of:

- writ of execution on collection (issued on the basis of a court decision or order);

- a notarized voluntary alimony agreement (equal in legal force to a writ of execution);

- bank account details of the claimant.

The procedure for the accounting department to work with the executive document:

- The employee’s monthly income is determined after personal income tax is withheld (in accordance with paragraph 1 of Article 99 of Law No. 229-FZ);

- deduction is made in the manner specified in the writ of execution (in shares of income or in a fixed amount of money);

- funds must be brought to the claimant no later than three days from the date of accrual of wages (Article 109 of the Family Code of the Russian Federation);

- the frequency of deductions for judicial collection is monthly, for an alimony agreement - established by this document (varies from monthly to quarterly or once a year);

- When collecting alimony in a fixed amount, alimony payments must be indexed by accounting in proportion to the increase in the cost of living (Article 117 of the RF IC).

When working with a writ of execution, the immediate manager of the enterprise and its accounting department are personally responsible for the accuracy and timeliness of alimony calculations, and can also be subject to inspection by bailiffs within the powers established by Art. 12 Federal Law of July 21, 1997 No. 118-FZ “On Bailiffs”.

Which salary option is more profitable?

This and similar questions are often asked on job seeker forums.

This formulation of the question is not entirely correct, since both terms represent two sides of the same salary.

If we consider two vacancies, where one indicates the gross salary level and the second net, the option in which the Net indicator is higher is more economically profitable for the applicant. First, you need to calculate the amount of the “net” salary for the vacancy where the gross salary is indicated and then compare. So, a net salary of 45 thousand will be more profitable than a gross salary of 50. This is exactly the case when more does not mean better.

What to do if you pay small alimony?

If in this situation you turn to the bailiffs or directly to the court with your arguments, they will not be able to assist in resolving it, because work only with official documents confirming the payer’s income , namely:

- salary certificate in form 2-NDFL;

- information from the Pension Fund on deductions from official wages (contributions to compulsory pension insurance).

However, there are organizations where a caring recipient of alimony can try to contact in order to “restore justice” in the form of identifying the real income of the payer:

- Territorial body of state statistics is an organization that determines the level of average wages in certain industries and types of activities (professions) in the region of residence;

- Department of the Federal Tax Service (hereinafter referred to as the Federal Tax Service) - because this service itself is also interested in receiving income (only in this case not personal, but state).

It is also necessary to determine the presence of a number of objective factors indicating an underestimation of the amount of alimony payments:

- the payer works full-time (and not short-time) at a full-time rate;

- Previously, at the same enterprise, he received decent income;

- the person obligated for alimony has a higher or special education (or has a working rank) and is employed in his specialty;

- the payer occupies a significant position (director, boss, specialist, including a narrow profile, etc.);

- the enterprise's activities are widely developed;

- advertising of vacancies for a given enterprise (organization) offers a higher amount than is presented in the official income certificate, etc.

If this approximate list of factors is available, the recipient of alimony has sufficient grounds to contact the Federal Tax Service.

How to prove that alimony is not enough?

Underestimated monthly alimony amounts most often become possible when the most common method of collecting alimony is assigned to payment - a percentage in relation to all types of income of the payer. And since it is he who has priority when assigning alimony, in accordance with Art. 81 of the RF IC, alimony is withheld from wages in the amount of:

- 25% - for the maintenance of one child;

- 33% - for two children;

- 50% - for three or more children.

Concealment of real income by the payer occurs if the recipient of alimony has the following typical situation:

- the monthly amounts paid by the ex-husband (child's father) are “symbolic” - i.e. very low;

- the recipient of alimony is aware that the payer’s income in reality is much higher than on paper;

- the payer has a good education, before alimony was assigned, he received a stable, decent salary at the same enterprise;

- the person obligated for alimony periodically goes on vacation, makes repairs, acquires property, etc.;

- the payer works full time for a low official salary.

Example

Oksana T. lived with her husband in marriage, her husband’s salary was 40,000 rubles monthly. After the divorce and the assignment of alimony in favor of one joint child in the amount of 25% (or 1/4 of the part) of the salary of the ex-husband Oksana T. instead of the expected 10,000 rubles. began to receive alimony in the amount of 3,750 rubles. During a conversation with the bailiff conducting the proceedings, the recipient found out that the available certificate of the husband’s official salary differs from his real income at the enterprise known to his ex-wife - officially the child’s father receives only 15,000 rubles, from which There is 25% monthly in the form of alimony payments.

Contacting the territorial body of state statistics

Before contacting the tax office, the first thing you need to do is find out what the average salary in the region is paid to workers in the field of activity in which the alimony payer is employed. This is done so that subsequent appeals to the tax office do not become completely unfounded.

Example

The alimony payer Nikolay O. provided the bailiff with a certificate of salary of 10,900 rubles, holding the position of head of the installation department of the Krasnodar rehabilitation center for elevator equipment.

However, according to the Rosstat department of the Krasnodar Territory, the average monthly salary of employees of organizations by type of economic activity “construction and installation work” amounted to 26,673 rubles/month in 2021. This means that at the enterprise where Nikolai O. is employed, wages are paid below the industry average for the region .

To contact the territorial body of state statistics (hereinafter referred to as the Rosstat branch), you must:

- Find out the correct name and address of this body in the region of employment of the alimony payer;

- Write a letter of appeal (preferably in writing and not electronically) containing:

- name of the employer organization of the payer of funds;

- presentation of your problem.

- Send a letter by registered mail and wait for a response.

A sample application to the State Statistics Authority can be found below or.

Territorial body of state statistics for the Krasnodar region Krasnodar, st. Ordzhonikidze, 29, 350000

Eminova Tatiana Leonovna Krasnodar, st. Polyarnaya, no. 8.

I am contacting you regarding the payment of alimony obligations, Mr. Eminov Eldar Viktorovich. If we refer to the amount of alimony payments, equal to 25% of the salary according to the decision of the bailiffs, the salary of Eminova E.V. per month is 9,200 rubles, because Currently, child support is 2,300 rubles.

The official salary of Eminova E.V. does not correspond to the position he holds, his higher education in the relevant specialty and work experience (more than 8 years).

Place of work Eminova E.V. - LLC "Montazh-Oborudovanie", position - specialist in the lifting and transport department.

In accordance with the above and within the framework of your competence, I ask for clarification on the average level of income of workers in the specialty of installation and construction work in the Krasnodar Territory for the period 2013 - 2021.

"____" ___________ 2021 ____________ T.L. Eminova

Contacting the tax office (IFNS)

Contacting the tax service is not a difficult task, but here the recipient of underestimated alimony payments first of all needs to clearly decide for himself whether it is worth dealing with this issue, because the consequences may be different:

- positive (if official wages are nevertheless increased);

- negative (an employee who has caused the company problems with the tax inspection may simply be laid off altogether, or such violations will be revealed at the company that it will not be able to continue working in the foreseeable future).

Before contacting the tax office, the recipient of low alimony payments should remember that this is not always a winning case.

If you decide to apply, you need to carefully study the guidelines for action . The basis for the appeal will be:

- letter of the Federal Tax Service of the Russian Federation dated July 28, 2006 No. BE-6-04/ “On the direction for analysis and use of documents in work”, illustrating the text of the decision of the arbitration court on the claim of tax service employees about the evasion of taxes by one enterprise, which became the starting point in initiating similar inspections of enterprises;

- a copy of the salary certificate of the person liable for alimony (it can be obtained from the bailiff conducting your enforcement proceedings);

- a copy of the response from the government agency. statistics with information on average wages in the labor sector of interest to us in the region;

- a thesis statement of the situation in connection with which this appeal was needed: when alimony was collected;

- what amounts are paid monthly?

A sample application to the tax office can be viewed below or.

Inspectorate of the Federal Tax Service of Russia for Bryansk Bryansk, st. Krakhmaleva, 53, 241037

Laponova Natalia Vladimirovna Bryansk, st. Frunze, 9-26, 241000

I am writing to you regarding the alimony obligations of Maxim Igorevich Laponov in relation to his son, Oleg Maksimovich Laponov, born in 2005. According to the decision of the bailiffs of Bryansk, the amount of monthly alimony payment from Laponov M.I. must be 1/4 of (or 25%) of all types of income of the debtor. Since Laponov M.I. has no other income other than wages. not available, the amount of alimony as a percentage of wages is 2,340 rubles. - therefore, the monthly earnings of Laponov M.I. (a certified specialist with 10 years of experience) at the Stroyplus LLC enterprise is 9,360 rubles/month.

According to data provided by the Territorial Office of the Federal State Statistics Service, the average monthly salary of employees of organizations by type of economic activity (namely, the production of machinery and equipment) is 25,000 rubles/month.

Based on the above, guided by the letter of the Federal Tax Service of the Russian Federation dated July 28, 2006 No. VE-6-04/[email protected] “On the direction of documents for analysis and use in work,” I ask you, within the framework of your authority, to conduct an inspection of Stroyplus LLC, which pays wages to its employees below the industry average, take the necessary measures and notify me of its results.

I am enclosing the following:

- A copy of the resolution to initiate enforcement proceedings;

- A copy of the certificate from the place of work of Laponov M.I. about the amount of salary;

- A copy of Bryanskstat's response.

“___” __________ 2021 ____________ N.V. Laponova

Based on such a request, the tax inspectorate is authorized to conduct an audit of the enterprise and notify the applicant of its results.

What does the employer deduct from the employee's gross amount?

In simple terms, gross is the amount an employee costs the employer. Thus, the employer deducts from it:

- contribution to the Pension Fund;

- insurance contribution in case of illness or disability of an employee;

- medical fee;

- income tax (collected from each employee, without exceptions).

It is worth noting that all these contributions are not fully deducted from the employee’s salary, since a portion is paid by the employer himself.

Employee's resume and employer's announcement: salary amount

Employers and people seeking to get a job have different views on wages, and therefore calculate them differently. For the former, it is more important to attract as many applicants as possible, so they strive to indicate the maximum amount without tax deductions. The latter are also looking for vacancies with a high salary, but they are interested in the money that they will receive in their hands after all the deductions.

When compiling a resume, candidates act logically: they indicate the amount that they would like to have on hand regularly after personal income tax, pension and insurance contributions are withheld. In 80% of cases, counting on the expected income, they prescribe the amount of payment Net, that is, “net”.

At the same time, persons familiar with the basics of accounting indicate Gross wages in their questionnaires, that is, “dirty” wages without deductions. This category of applicants mainly includes specialists in human resources management, financiers and bank employees.

Attention! Employers, on the contrary, often try to indicate cash payment in the total amount from which pension, tax, and insurance contributions will be deducted. According to surveys, only 42% of managers indicate the Net salary in advertisements, 32% always indicate Gross, and the remaining 36% of employers periodically use one or another type of payment to post vacancies.

Thus, in order to justify their hopes and get the desired job with a salary that will actually coincide with that specified in the vacancy, applicants need to carefully read the lines of the advertisement text.