It is necessary to check payment orders in 2021

It is necessary to indicate new details of the Federal Treasury. Although I didn't notice any changes in the details.

You need to fill out detail “15” of the payment order - the account number of the recipient’s bank, which is part of the single treasury account (STA).

The details can be checked using the service of the Federal Tax Service website.

A payment order or payment document is a document to the bank on behalf of the owner (client) of the current account: transfer money to another account (pay for a product or service, pay taxes or insurance premiums, transfer money to the account of an individual entrepreneur or pay a dividend to the founder, transfer wages to employees, etc. .everything is below)

A payment order can be generated (and sent via the Internet) in Internet banking (for example, Sberbank-online, Alpha-click, client bank). Internet banking is not needed for small organizations and individual entrepreneurs because... it is complicated, expensive and less safe. It is worth considering for those who make more than 10 transfers per month or if the bank is very remote. Payments can also be generated using online accounting.

Vacation and sick leave can be combined in one payment if they are paid in the same month. Then indicate the period as the first number, for example - 09/01/2018.

Where can I get a payment order for free? How to fill out a payment order? What types of payment orders are there? I will post here samples of filling out payment slips in Excel for 2018-2019, made using the free Business Pack program. This is a fast and simple program. In addition to payment slips, it also contains a bunch of useful documents. I recommend to all! Especially useful for small organizations and individual entrepreneurs who want to save money. Some additional functions in it are paid, but for payment orders it is free.

Payment of personal income tax on compensation

If an employer fires an employee, then on this day he needs to pay compensation for vacation that was never used. The former employee may also be granted leave with further termination of the employment relationship. We are talking about vacation pay here. Tax on compensation payments is withheld directly on the day they are provided.

Therefore, it is recommended to pay personal income tax to the state budget within the following deadlines:

- if the financial institution received funds to pay the tax, it must be paid immediately, no later than that day;

- if the payment was transferred to the employee’s account, then personal income tax should be transferred no later than the date of receipt;

- if compensation payments are issued from the revenue of a specific organization, then the tax must be paid no later than the date that follows the day of the actual payment from the cash register.

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call: +7 Moscow and region.

+7 St. Petersburg and region. 8 Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will take care of all your problems!

Sample payment slip

From 2021, tax contributions can be clarified if the bank name and the recipient's account are correct. The remaining contributions must be returned and paid again (subclause 4, clause 4, article 45 of the Tax Code of the Russian Federation).

Starting from 2021, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; “Purpose of payment” – INN and KPP of the payer for whom the payment is made and the one who pays; “Payer status” is the status of the person whose duty is performed. This is 01 for organizations and 09 for individual entrepreneurs.

From February 6, 2021, in tax payment orders, organizations in Moscow and Moscow Region will have to enter new bank details; in the “Payer’s bank” field, you need to put “GU Bank of Russia for the Central Federal District” and indicate BIC “044525000”.

Taxes, unlike contributions, are calculated and paid rounded to whole rubles.

Purpose of payment: Personal income tax withheld by the tax agent from employee salaries for September 2021

Payer status: Payer status: 02 - for organizations / 02 - for individual entrepreneurs (if personal income tax (from salary or dividend) is paid for employees (founders) as a tax agent).

Basis of payment: – “TP”, if you pay current tax; – “ZD”, if you voluntarily repay the debt; – “TR”, if you are transferring the amount upon request from the tax office.

TIN, KPP and OKTMO should not start from scratch.

In field 109 (date, below the “reserve field”, on the right) enter the date of the declaration on which the tax is paid. But under the simplified tax system and all funds (PFR, FSS, MHIF) they set 0.

In field 107 (period, below “code”, on the left) enter the month in which the employee(s) received taxable income.

If an error is made in field 107, then the payment must be clarified by writing a letter to the Federal Tax Service in any form.

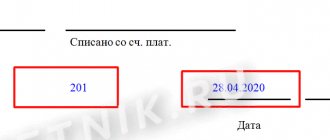

Rice. .

Fig. Sample of filling out a payment order (personal income tax for employees) in Business Pack.

How to fill out a personal income tax payment order

All details of the payment order must be specified correctly - only this will exclude claims from the tax authorities.

If you are a tax agent for personal income tax, then a ready-made solution from ConsultantPlus will help you when filling out a payment form. If you are an individual entrepreneur and you need to issue a personal income tax payment from your income, this is a ready-made solution for you. Follow the links and get trial access to K+ for free.

For more information about what errors in payment orders lead to, read the material “Errors in payment orders for taxes.”

Any payment order indicates its number, date and amount of debit in numbers and in words.

In the “Taxpayer status” field, code 09 can be entered if an individual (individual entrepreneur) independently transfers personal income tax from his income to the budget, or 02 if the payment is made by a tax agent.

See also: “Main payer statuses in a payment order.”

The name of the payer of the payment, his tax identification number, checkpoint, current account, payer’s bank with all details (BIC and correspondent account) must also be indicated.

In the “Recipient” column, enter the name of the tax office to which the personal income tax payment must be made. Other fields indicate her TIN, KPP, and current account in the corresponding bank branch.

Note! From 01.05.2021, when paying taxes, it is necessary to fill out field No. 15 “Account number of the recipient's bank.” From January to April 2021 is a transition period. This means that until 05/01/2021 payment orders can be filled out both according to the old rules and the new ones. See here for details.

In a payment order for the transfer of personal income tax, like any other tax, it is required to indicate the KBK , OKTMO, the basis for payment (current payment or repayment of debt for expired periods, etc.), data of the tax period for which payment is made, number and date document on the basis of which the tax is transferred. If there is no information about the basis document, then the value 0 is entered in the corresponding fields of the payment order.

Read about filling out field 106 here.

The “Payment Type” field starting from January 1, 2015 in tax bills does not need to be filled in due to the changes made by Order of the Ministry of Finance of Russia dated October 30, 2014 No. 126n “On Amendments to Appendices No. 1, 2, 3 and 4 to the Order of the Ministry of Finance Russian Federation dated November 12, 2013 No. 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation.”

In the “Payment priority” field, put 5. Currently, the third priority is intended for the transfer of wages and taxes or tax payments collected by force.

Read more about the order of payment here.

In the “Purpose of payment” field, information about the transfer of personal income tax is disclosed.

The payment order on paper is signed by the manager and chief accountant or authorized persons. It must also be stamped by the payer. If personal income tax is transferred via the Electronic Bank system, the order is signed with an electronic signature of authorized persons.

If you, as a tax agent for personal income tax, still made a mistake when transferring personal income tax, the payment can be clarified if three conditions are met. Read more about them in ConsultantPlus. Get trial access to the system for free.

KBK NDFL

Current for 2016-2017. For 2021, the BCC has not been changed.

| Payment | BCC for tax | KBK for penalties | BCC for fine |

| Personal income tax on income the source of which is a tax agent, with the exception of income in respect of which tax is calculated and paid in accordance with Articles 227, 227.1 and 228 of the Tax Code of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Personal income tax on income received by citizens registered as: – entrepreneurs; – private notaries; – other persons engaged in private practice in accordance with Article 227 of the Tax Code of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Personal income tax on income received by citizens in accordance with Article 228 of the Tax Code of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Personal income tax on income received by citizens in accordance with Article 228 of the Tax Code of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

Personal income tax upon dismissal after using vacation

If there is an order to grant leave followed by dismissal, payments are made:

- vacation pay 3 days before the start of the vacation;

- the rest of the due payments are due on the last day of work before the vacation.

At the same time, it is necessary to transfer personal income tax on the due salary and compensation provided for by the company’s local documents the next day after issuance (i.e., on the first day of vacation of the resigning employee), and the tax on vacation pay can be transferred until the end of the month of their receipt.

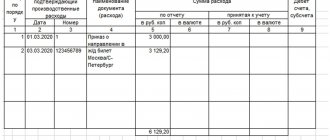

All payments

See the full list of payment orders:

- For a description of the fields and rules for payment orders, see here.

- Sample of filling out a payment order for payment of the simplified tax system in Excel and in Business Pack

- Sample of filling out a payment order (personal income tax for employees) in Excel and in Business Pack

- Sample of filling out a payment order for VAT payment in Excel and Business Pack

- Sample of filling out a payment order for payment of Property Tax in Excel and in Business Pack

- A sample of filling out a payment order for the payment of Income Tax in Excel and in Business Pack

- A sample of filling out a payment order for payment of the Fixed Contribution of Individual Entrepreneurs (PFR and FFOMS) in Excel and in Business Pack

- Sample of filling out a payment order (PFR, Social Insurance Fund contributions for employees) in Excel and in Business Pack

See also: Calculator (free) Salary and deductions.

Payment of personal income tax upon dismissal: terms of transfer if sick leave is paid

It happens that a resigning employee falls ill during the working period or even on the last day of work. The employer is obliged to accept and pay for the presented certificate of incapacity for work and to dismiss the employee upon his return from sick leave. In this case, the withheld tax on sick leave must be paid before the end of the month of payment of the sick leave certificate.

Based on current regulations, we will consider options for transferring income taxes in various situations related to dismissal.

Example 1

An employee of the company is granted leave from June 5 to June 15, 2018, followed by dismissal. The last working day is June 4. Payments for May have been made in full, and payments have been accrued:

- vacation pay in the amount of 17,000 rubles;

- salary for 2 days of June - 4100 rubles,

- compensation payments in the amount of 20,000 rubles.

Personal income tax accrued and withheld:

- from vacation pay - 2210 rubles. (17,000 x 13%);

- from salary and taxable compensation – 3133 rubles. ((4100 + 20,000) x 13%).

Payments made by date:

- vacation pay in the amount of 14,790 rubles. – June 1st;

- salary and compensation RUB 20,967. – June 4th.

The accountant is obliged to transfer personal income tax withheld from wages and compensation in the amount of 3,133 rubles. no later than June 5, and for vacation pay in the amount of 2210 rubles. – no later than June 30.

How to calculate, withhold and transfer personal income tax in 2021

In 2018, it is important for tax agents to determine three dates: receipt of income, withholding and transfer of tax (see table below). Tax must be calculated on the date of receipt of income. The employer withholds the calculated amount upon actual payment (clause 4 of Article 226 of the Tax Code of the Russian Federation). And the timing of the transfer depends on the amounts from which the company calculated personal income tax.

In 2018, when paying personal income tax, a general rule applies - tax agents are required to transfer the withheld tax no later than the day following the day of payment (clause 6 of Article 226 of the Tax Code of the Russian Federation). There are two exceptions to this rule: employee income in the form of vacation pay and temporary disability benefits, including benefits for caring for a sick child.

Tax on these payments must be remitted no later than the last day of the month in which the employee received the money. For late payment, a fine of 20% of the tax amount is possible (Article 123 of the Tax Code of the Russian Federation). You can pay personal income tax on the day the company withheld it, but not earlier. Otherwise, inspectors will consider that the amount paid is not tax.

Dates of receipt, withholding and transfer of personal income tax

Have a question? Our experts will help you within 24 hours! Get answer New

When transferring contributions to the budget, it is important to correctly enter data into the personal income tax payment order (sample

in our article). After all, a mistake made can lead to undesirable consequences, leading to the payment of penalties or lengthy proceedings with the tax authorities. Our consultation will help you avoid them.

budget classification codes (tables) for paying taxes, state duties, fines

Name of income of KBK

| Property tax for individuals, levied at the rates applied to taxable objects located within the boundaries of intra-city municipalities of federal cities: | |

| — payment amount (recalculations, arrears and debt for the corresponding payment, including canceled ones) | 182 1 0600 110 |

| — penalties on the corresponding payment | 182 1 0600 110 |

| — interest on the corresponding payment | 182 1 0600 110 |

| — amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation | 182 1 0600 110 |

| Property tax for individuals, levied at the rates applicable to taxable objects located within the boundaries of urban districts: | |

| — payment amount (recalculations, arrears and debt for the corresponding payment, including canceled ones) | 182 1 0600 110 |

| — penalties on the corresponding payment | 182 1 0600 110 |

| — interest on the corresponding payment | 182 1 0600 110 |

| — amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation | 182 1 0600 110 |

| Property tax for individuals, levied at the rates applied to taxable objects located within the boundaries of urban districts with intra-city division: | |

| — payment amount (recalculations, arrears and debt for the corresponding payment, including canceled ones) | 182 1 0600 110 |

| — penalties on the corresponding payment | 182 1 0600 110 |

| — interest on the corresponding payment | 182 1 0600 110 |

| — amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation | 182 1 0600 110 |

| Property tax for individuals, levied at the rates applicable to taxable objects located within the boundaries of intracity districts: | |

| — payment amount (recalculations, arrears and debt for the corresponding payment, including canceled ones) | 182 1 0600 110 |

| — penalties on the corresponding payment | 182 1 0600 110 |

| — interest on the corresponding payment | 182 1 0600 110 |

| — amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation | 182 1 0600 110 |

| Property tax for individuals, levied at the rates applied to taxable objects located within the boundaries of inter-settlement territories: | |

| — payment amount (recalculations, arrears and debt for the corresponding payment, including canceled ones) | 182 1 0600 110 |

| — penalties on the corresponding payment | 182 1 0600 110 |

| — interest on the corresponding payment | 182 1 0600 110 |

| — amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation | 182 1 0600 110 |

| Property tax for individuals, levied at the rates applied to taxable objects located within the boundaries of rural settlements: | |

| — payment amount (recalculations, arrears and debt for the corresponding payment, including canceled ones) | 182 1 0600 110 |

| — penalties on the corresponding payment | 182 1 0600 110 |

| — interest on the corresponding payment | 182 1 0600 110 |

| — amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation | 182 1 0600 110 |

| Property tax for individuals, levied at the rates applicable to taxable objects located within the boundaries of urban settlements: | |

| — payment amount (recalculations, arrears and debt for the corresponding payment, including canceled ones) | 182 1 0600 110 |

| — penalties on the corresponding payment | 182 1 0600 110 |

| — interest on the corresponding payment | 182 1 0600 110 |

| — amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation | 182 1 0600 110 |

Document for payment

A payment order is an order from the account owner sent to the bank and containing a request to transfer funds to the account of another recipient, including one opened at another financial institution. Personal income tax payment

– this is an order to transfer funds to the tax system to pay income tax.

This document can be used in cash and non-cash payments. It contains information about the company, bank and funds being transferred. Blank sample payment order for 2016

year looks like this:

The following fields are required (see table).

| Field | Explanation |

| Payment order form | Located in the upper right corner. When using a standard template, it has code 0401060 |

| Payment number | Marked with numbers. Resets every year |

| Date of preparation | Indicate in the format DD.MM.YYYY or DD month YYYY |

| Write-off amount | Write in numbers and in words (with capital letters) |

| Payment type | By mail, telegraph or electronically. In most cases, this field is left blank. |

| Transaction reason code | When paying personal income tax for the current year, put the letter designation “TP” |

| Current and correspondent account | Accurate and complete account numbers that appear in the payment transaction |

| Payer information | Status, TIN, checkpoint |

Let us remember that income tax is paid on most types of income in favor of individuals. Keep in mind: in 2021, personal income tax

is paid, among other things, on income received when concluding civil agreements with separate divisions on behalf of the parent company. Similar requirements apply to businessmen using a patent or imputation.

When drawing up a document, you must comply with all the requirements established by Order of the Ministry of Finance No. 107n of 2013 and correctly indicate the details. It may be difficult to fill out some lines. Let's look at the design features of some of them.

Sample payment order when transferring vacation pay

Here you can write a specific date. The word “frequency” means the period for which the tax is transferred. She may be:

- Menstruation - MS,

- Quarterly - KV,

- Semi-annual - PL.

- Annual - GD.

For example, if money is transferred from vacation pay assigned in March 2021, then “MS.03.2018” is written on the payment form. In gr. 108 of the payment order form, as a rule, is always entered “0”.

The figure needs to be changed when the debt is repaid due to the requirement of the regulatory authority. In field 109 of the order, write the date of certification of the declaration for tax payment. The number “0” is entered when the tax is transferred earlier than the declaration is submitted. If the debt is repaid at the request of the tax office, then the repayment date is filled in this field.

Payment of vacation pay in 2021: new rules

Billing period The time for which payments to an employee are taken into account is called the billing period.

- special, which the employer chooses at his discretion.

- standard, for the 12 months preceding the month in which the employee goes on vacation. Depends on what month the employee’s vacation begins.

A billing period of more than 12 months is established in cases where an employee’s salary changes during the year, or extra days need to be excluded from the period. When a special pay period is used for calculation, vacation pay is calculated in two ways: standard and special. When to pay personal income tax on vacation pay in 2020?

Before you pay tax, it must first be withheld from the employee’s income. According to Article 226 of the Tax Code of the Russian Federation, tax must be withheld on the day the employee is paid.

Clause 6 of Article 226 of the Tax Code of the Russian Federation specifies the deadline for transferring personal income tax from vacation pay.

Sorry, this page was not found.

It's fast and free! CONTENT:

- Deadlines for filing income tax How is it filled out?

- What purpose of payment should I indicate when transferring? Sample payment slip

Deadlines for processing income tax Holidays are always subject to income tax. The employee receives the amount minus personal income tax. Tax withholding is made on the day of issuance of vacation pay, and its transfer is due no later than the last day of the current month. This rule also applies to rolling vacation pay, when the start of the vacation falls on one month and the end on another.

Thanks to such payment deadlines, the accountant can transfer income tax at the end of the month for several employees who went on vacation. To pay, it is enough to fill out one payment order form.

This is important to know: Compensation for unused additional leave upon dismissal

From June 1, 2021 new codes

The Central Bank of the Russian Federation has approved codes for the type of income that will need to be indicated in payment documents for the payment of salaries and benefits to employees. The Bank of Russia has approved the following codes for various types of income:

- “1” - when transferring wages and other income for which restrictions on the amount of deduction are established;

- “2” - when transferring funds that cannot be levied;

- “3” - when transferring funds to which restrictions do not apply.

The type of income code is not indicated when transferring funds that are not income, for which restrictions are established and (or) for which collection cannot be taken.

The code is indicated in detail 20 “Name. pl.” payment order.

Note:

According to the new rules, the bank cannot ask the client to clarify the contents of the payment. This means that from June 1, 2021, the bank formally has the right to refuse due to any error in the payment order (). The error can be corrected only if there is an internal instruction of the bank that allows you to request clarification from the client. For late payment due to inaccuracies in the payment, counterparties will have to pay a penalty or legal interest, and the Federal Tax Service will have to pay a penalty.

The procedure for filling out a payment order for the transfer of personal income tax from vacation and sick pay

The Federal Tax Service of the Russian Federation, in a letter dated September 1, 2016 No. BS-3-11/ [email protected] , explained how to fill out a payment form when transferring personal income tax from vacation and sick pay. If the company transfers tax on these payments, then you can issue one payment. In detail “107” you should indicate “MS”, since the frequency of tax payment is a month (for example, if the payment was made in March - “MS. 03.2019”).

At the same time, the Federal Tax Service of the Russian Federation noted that if a tax agent makes payments with different deadlines for paying personal income tax, then different payments must be made for the transfer of personal income tax.

Thus, when transferring personal income tax from wages, vacation pay and sick leave, separate payments are drawn up, since the deadlines for paying tax on these payments are different.