Starting from 2021, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; “Purpose of payment” – INN and KPP of the payer for whom the payment is made and the one who pays; “Payer status” is the status of the person whose duty is performed. This is 01 for organizations and 09 for individual entrepreneurs.

Payment order or payment order

document to the bank on behalf of the owner (client) of the current account: transfer money to another account (pay for a product or service, pay taxes or insurance premiums, transfer money to the account of an individual entrepreneur or pay a dividend to the founder, transfer wages to employees, etc. everything is below )

A payment order can be generated (and sent via the Internet) in Internet banking (for example, Sberbank-online, Alpha-click, client bank). Internet banking is not needed for small organizations and individual entrepreneurs because... it is complicated, expensive and less safe. It is worth considering for those who make more than 10 transfers per month or if the bank is very remote. Payments can also be generated using online accounting, for example.

Where can I get a payment order for free? How to fill out a payment order? What types of payment orders are there? I will post here samples of filling out payment slips in Excel for 2016-2017, made using the free Business Pack program. This is a fast and simple program. In addition to payment slips, it also contains a bunch of useful documents. I recommend to all! Especially useful for small organizations and individual entrepreneurs who want to save money. Some additional functions in it are paid, but for payment orders it is free.

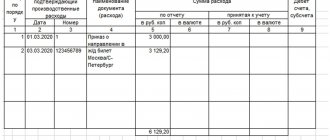

Sample payment slip

From 2021, tax contributions can be clarified if the bank name and the recipient's account are correct. The remaining contributions must be returned and paid again (subclause 4, clause 4, article 45 of the Tax Code of the Russian Federation).

You can calculate all contributions and prepare payment slips. The first month is free.

Any insurance premiums, unlike taxes, are never rounded.

Let us remind you that since 2015, to pay an additional 1%, a different BCC has been used that is different from the fixed insurance premium. And for 2017-2018 they are completely different - see them below.

Fixed Pension Fund

Purpose of payment: Insurance contributions for compulsory pension insurance in a fixed amount from income up to 300 rubles. for the 1st quarter of 2021 Reg. No. 071-058-011111

Payer status: Payer status: 24 - for individual entrepreneurs for themselves (since 2017, you need to indicate 09, because we pay contributions to the Federal Tax Service Order of the Ministry of Finance dated April 5, 2021 No. 58n).

OKTMO must be 8-digit.

Fig. Sample of filling out a payment order (insurance fixed contribution of an individual entrepreneur) in the Business Pack.

Pension Fund over 300 tr.

Purpose of payment: Insurance contributions for compulsory pension insurance in a fixed amount for income over 300 tr. for the 1st quarter of 2021 Reg. No. 071-058-011111

Payer status:

TIN, KPP and OKTMO should not start from scratch.

Attention! Starting from 2021, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. You can find out the details of your Federal Tax Service.

Fig. Sample of filling out a payment order (PFR over 300 tr. Individual entrepreneur) in Business Pack.

How long should payments be kept?

Within 6 years after the end of the year in which the document was last used for calculating contributions and reporting (Clause 6 of Part 2 of Article 28 of the Federal Law dated July 24, 2009 No. 212-FZ) or 5 years (clause 459 Order of the Ministry of Culture of Russia dated August 25 .2010 N 558)

Medical insurance FFOMS

Purpose of payment: Insurance premiums for compulsory medical insurance in a fixed amount for the 1st quarter of 2021 Reg. No. 071-058-011111

Payer status: Payer status: 24 - for individual entrepreneurs for themselves (from 2017 you need to indicate 09, because we pay contributions to the Federal Tax Service).

TIN, KPP and OKTMO should not start from scratch.

In field 109 (date, below the “reserve field”, on the right) enter the date of the declaration on which the tax is paid. But under the simplified tax system and all funds (PFR, FSS, MHIF) they set 0.

It will sound strange, but field 108 (below the “code” on the right and the “reserve field” on the left) indicates “14; SNILS IP number”. This is the requirement of the Pension Fund.

Fig. Sample of filling out a payment order (Medical insurance FFOMS IP) in Business Pack.

Attention! Starting from 2021, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. You can find out the details of your Federal Tax Service.

Payer and recipient information

Any samples of filling out payment orders will include such details as the payer’s INN (with code 60). If for some reason the subject of legal relations does not have it, then it is necessary to enter 0. If the payment form is filled out by an individual who is not registered as an individual entrepreneur, then, provided that the corresponding identifier is indicated in detail 108, the field with code 60 is not necessary to fill out. If an enterprise transfers part of an employee’s salary to the budget, then the TIN of the corresponding employee is indicated.

The checkpoint details with code 102 are filled out by legal entities that have the appropriate certificate. Individuals do not have it, so they put 0 in this field (as do enterprises that transfer funds from employee salaries to the budget).

KBK insurance premium for individual entrepreneurs

| Payment type | For 2021 in 2021 | For 2021,2015 and earlier | For 2021, 2021 |

| Insurance contributions for pension insurance of individual entrepreneurs for themselves in the Pension Fund of the Russian Federation in a fixed amount (based on the minimum wage) | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Insurance contributions for pension insurance of individual entrepreneurs for themselves in the Pension Fund of the Russian Federation with income exceeding 300,000 rubles. | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Insurance premiums for medical insurance for individual entrepreneurs for themselves in the Federal Compulsory Compulsory Medical Insurance Fund in a fixed amount (based on the minimum wage) | 392 1 0211 160 | 182 1 0211 160 | 182 1 0213 160 |

All payments

See the full list of payment orders.

In connection with the transfer of administration of insurance premiums to the Federal Tax Service in 2017, the rules for filling out payment orders have changed. Among other things, the details of the payee have changed, the status of the payer, which must be indicated in field 101, and the KBK has been updated.

In this publication, we will find out how to fill out payment orders in 2021 and offer readers a sample payment order for insurance premiums in 2021.

Many entrepreneurs in Russia, in order not to waste time tracking changes in legislation, use a convenient online service. This saves time, minimizes risks and ensures the accuracy of payments and reports.

What has changed in the document

The payment order in 2021 is filled out in accordance with the new rules. In particular, the Tax Code includes relevant amendments, and a new chapter is planned to be introduced in the near future to ensure control over insurance premiums. Reporting and transfer of contributions is carried out to the nearest branch of the Tax Service located at the place of registration of the payer.

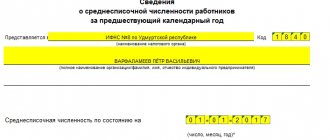

In 2021, the period for preparing and submitting the report was extended by 5 days. That is, the SZV-M for December 2020 can be submitted until January 15, 2021 inclusive. Find out details about mandatory medical insurance contributions to the Federal Compulsory Compulsory Medical Insurance Fund in 2021 from our article.

The Ministry of Finance has approved new reporting, which will completely replace the existing and previously used calculations in form 4-FSS and RSV-1. New budget classification codes are also beginning to be used, with the help of which payers are given the opportunity to charge contributions to the FFOMS.

Recipient details in the payment order for insurance premiums 2021

Starting from 2021, most of the contributions must be transferred not to the funds, as in previous years, but to the Federal Tax Service. Only one type of contribution needs to be paid to the Social Insurance Fund: contributions from employees’ salaries for compulsory insurance against industrial accidents and occupational diseases, as before. The remaining contributions are now payable to the Federal Tax Service. Namely:

- contributions in a fixed amount for compulsory pension insurance of individual entrepreneurs “for themselves”;

- contributions in a fixed amount for compulsory medical insurance of individual entrepreneurs “for themselves”;

- contributions from employees' salaries for compulsory health insurance;

- contributions from employees' salaries for compulsory pension insurance;

- contributions from employees' salaries for compulsory insurance for temporary disability and maternity.

Accordingly, for insurance premiums paid to the Federal Tax Service, it is necessary to indicate the details of the Federal Tax Service Inspectorate with which the individual entrepreneur (organization) is registered.

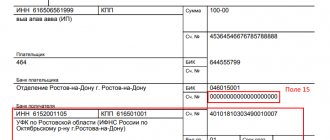

Field 16 - “Recipient” in the payment order for insurance premiums 2021

Thus, according to the letter of the Federal Tax Service dated December 1, 2016 No. ZN-4-1 /, in field 16 “Recipient” the abbreviated name of the Federal Treasury body must be indicated, and in brackets the abbreviated name of the tax inspectorate to which the payment is transferred. For example: “UFK for Moscow (Inspectorate of the Federal Tax Service of Russia No. 7 for Moscow).

Field 61, 103 - “TIN”, “KPP” in the payment order for insurance premiums 2021

In fields 61 “TIN” and 103 “KPP” the TIN and the reason code for registration with the tax office must be indicated, as when paying taxes.

Field 101 - payer status in the payment order for insurance premiums 2021

Perhaps the most unclear issue in connection with the innovations was the status of the payer in the payment order, which must be indicated in field 101. Previously, field 101 in the payment order for the payment of insurance premiums was filled out on the basis of Appendix No. 5 to Order No. 107n of the Ministry of Finance of the Russian Federation. However, the transfer of administration of contributions to the Federal Tax Service changed the status of the payer in relation to the recipient, which called into question the previously applied rules.

There are no official clarifications on this topic at the time of publication of this material. On thematic forums on the Internet, accountants express three points of view, and which of them is absolutely correct is still unclear. There is only one thing that saves the situation: even if the incorrect payer status is indicated in field 101, this will not lead to loss of payment and subsequent arrears from the policyholder. Federal Tax Service inspectors count payments, even if the payer status is incorrectly indicated.

So, we offer three points of view on the issue of filling out field 101 in the payment order for insurance premiums in 2021.

Status "14"

According to one opinion, the value of field 101 should be “14”, meaning taxpayers making payments to individuals. And although this status has nothing to do with the policyholder, a number of Federal Tax Service Inspectors managed to give official answers that the value of field 101 should be exactly “14”.

Status "08"

According to another point of view, field 101 should contain the value “08”, which was in force in previous years and means individual entrepreneurs and organizations transferring funds to pay insurance premiums and other payments to the budget system of the Russian Federation. It is noteworthy that payment orders for the payment of insurance premiums with this particular payer status are accepted by Sberbank-Online, rejecting payments with other payer statuses.

Status "09" and "01"

Finally, it has been suggested that individual entrepreneurs should indicate “09” in this field, and organizations should indicate “01”. This applies to the status of taxpayers-individual entrepreneurs and taxpayers-legal entities. This point of view is explained by the fact that the transfer of administration of insurance premiums to the Federal Tax Service turns policyholders into taxpayers. That is, statuses “09” and “01” can now be applied to the payment of both taxes and insurance premiums. The correctness of this approach raises no less doubts than in previous cases, because the current edition of the Tax Code of the Russian Federation itself separates the concepts of “payer of insurance premiums” and “taxpayer”.

In all likelihood, an official clarification on this issue should appear in the near future. Therefore, we can advise you not to rush into transferring insurance premiums.

Update 02/08/2017 - clarification of the Federal Tax Service on the issue of payer status

Some regional Federal Tax Service Inspectors have sent out clarifications to policyholders regarding filling out payment orders for the payment of insurance premiums in 2021. They, along with samples of filling out payment slips, are contained in the following document:

According to the document, the payer status is indicated as follows:

- Status 01 - indicated when paying insurance premiums by a legal entity;

- Status 09 - indicated when paying insurance premiums by an individual entrepreneur;

- Status 10 - indicated when paying insurance premiums by a notary engaged in private practice;

- Status 11 - indicated when paying insurance premiums by the lawyer who established the law office;

- Status 12 - indicated when paying insurance premiums by the head of a peasant (farm) enterprise;

- Status 13 - indicated when paying insurance premiums for employees by an individual (who is not an individual entrepreneur).

How to fill out a payment order

So, now let’s look at how to fill out this payment order point by point, what’s new in it and what remains the same.

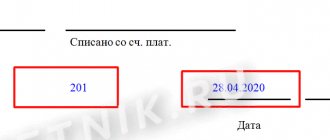

As already mentioned, each line in the payment slip is numbered. Let's move on to line 3, where we fill in the payment order number. In line 4 we put the date the notification was filled out. In this case, the following must be taken into account:

— if the document is submitted on paper, then the full date is written;

— if the document is submitted electronically, then the date is recorded in the format of the credit institution. DD.MM.YYYY.

In line 5, type of payment, we note the following: “urgent”, or “by telegraph”, or “by mail”, or another indicator determined by the bank. You can also leave this item blank if the bank allows it.

In line 6, enter the amount of the required payment. Rubles are written in words, and kopecks are written in numbers. Moreover, both rubles and kopecks are not reduced or rounded. If the amount to be paid is a whole amount and there are no kopecks, then these same kopecks need not be recorded.

In line 7, enter the same amount to be paid, but in numbers. Rubles are separated from kopecks with a dash sign “–”. If the number is an integer, then an equal sign “=” is placed after it.

On line 8, enter the name of the payer. If the payer is a legal entity, then the name is written in full, without abbreviations and various abbreviations.

Line 9. The account of the payer registered with a banking institution is written here.

Line 10 contains the name of the bank and its address.

Line 11 contains the bank code, which identifies the institution where the payer of taxes and contributions is serviced.

In line 12, enter the correspondent account number of the taxpayer's bank.

The following lines are intended for entering the bank details where the funds are transferred.

Line 13, details of the bank where the funds are transferred are entered.

Line 14 contains the identification code of the institution receiving the money.

Line 15 records the bank correspondent account number where contributions are transferred.

Line 16 contains the full or abbreviated name of the enterprise receiving the funds. If the recipient is an individual entrepreneur, then the full name is written and the legal status is indicated. If this person is an individual, then it is enough to indicate the full name of the citizen.

Line 17 contains the account number of the financial institution receiving the money.

In line 18 the constant value is “01”, i.e., it does not change.

Line 19 is the due date. If the bank has not made a different decision, then nothing is filled in here.

Line 20 also remains empty.

In line 21 (order of payment) a figure is entered that determines the order of the amount to be paid, corresponding to the legislative documents.

Line 22. Here you enter the classifier code for the amount to be paid, whether it is contributions or tax deductions. This code consists of both 20 and 25 digits. This detail is available if it is assigned by the recipient of the money and is known to the taxpayer.

If the entrepreneur independently calculates how much money he should transfer, then it is not necessary to use a unique identifier. The institution that receives the money determines payments based on the numbering of TIN, KPP, KBK, OKATO. Therefore, in this line we indicate the code “0”.

And remember, if, when registering the TIN, a credit institution requires additional information about the code, this is considered illegal.

On line 23 the field is left blank. There is no need to fill it out.

Line 24. The purpose for which the payment is made, as well as its purpose, is filled in here. In addition, the name of goods, works, services, etc., numbering and numbers used in the documents, according to which this payment is assigned, must be indicated. These are usually agreements, acts, invoices for goods, etc.

Line 43 is for printing IP.

In line 44 it is necessary to affix the signature of an authorized employee of the organization, manager or corresponding authorized representative.

Line 45 is stamped.

Line 60 contains the taxpayer’s TIN, and line 61 contains the recipient’s TIN.

The next line 62 is filled out by the bank employee, where he puts the date of submission of the notification to the financial institution related to the payer.

Line 71 contains the date when money is debited from the taxpayer’s account.

Line 101 is intended to enter the payer status.

Below is an updated list of payer statuses for 2021.

01 — Taxpayer (payer of fees) – legal entity

02 — Tax agent

06 — Participant in foreign economic activity – legal entity

08 — Organization (individual entrepreneur) that transfers other obligatory payments to the budget

09 – Taxpayer (payer of fees) – individual entrepreneur

10 – Taxpayer (payer of fees) – notary engaged in private practice

11 – Taxpayer (payer of fees) – lawyer who established a law office

12 – Taxpayer (payer of fees) – head of a peasant (farm) enterprise

13 – Taxpayer (payer of fees) – another individual – bank client (account holder)

14 — Taxpayer making payments to individuals

16 — Participant in foreign economic activity – individual

17 — Participant in foreign economic activity – individual entrepreneur

18 - Payer of customs duties, who is not a declarant, who is obligated by Russian legislation to pay customs duties

19 - Organizations and their branches that withheld funds from the salary (income) of the debtor - an individual to repay debts on payments to the budget on the basis of an executive document

21 — Responsible participant of the consolidated group of taxpayers

22 — Member of a consolidated group of taxpayers

24 - Payer - an individual who transfers other obligatory payments to the budget

26 - Founders (participants) of the debtor, owners of the property of the debtor - a unitary enterprise or third parties who have drawn up an order for the transfer of funds to repay claims against the debtor for the payment of mandatory payments included in the register of creditors' claims, during the procedures applied in a bankruptcy case

27 - Credit organizations (branches of credit organizations) that have drawn up an order for the transfer of funds transferred from the budget system, not credited to the recipient and subject to return to the budget system

28 – Legal or authorized representative of the taxpayer

29 — Other organizations

30 — Other individuals

Next line 102. The checkpoint of the payer of contributions and taxes is written here. The checkpoint consists of 9 digits, the first of which are zeros. And in line 103 the checkpoint is also written, but this time for the recipient of the funds.

Line 104 indicates the KBK indicator, consisting of 20 consecutive digits.

Line 105 indicates the OKTMO code - 8 or 11 digits; they can be recorded in the tax return.

In line 106 the basis for the payment is written. It is expressed by a two-digit indicator and has the following meanings:

TP – payment of the current year, when there is no violation of the deadline;

ZD - filled in when voluntarily repaying the debt of the expired tax period;

TR – requirement of the tax authority;

RS – repayment of overdue debt, carried out in accordance with the schedule;

RT – filled in when repaying restructured debt;

VU - filled in when paying off deferred debt when external management is introduced;

OT – repayment of deferred debt;

AP – debt repayment according to the inspection report;

PR - filled in when paying to repay debts suspended for collection;

AR – debt subject to payment under a writ of execution.

How to calculate TP:

1 in the first quarter of the current TP period is equal to the amount of the monthly advance payment payable for the last three months of the previous tax period:

2 in the second quarter, one third of the advance payment amount calculated for the first reporting period is accepted for payment;

3 in the third quarter in field 106, the TP indicator is equal to one third of the difference between the amounts of the advance payment calculated based on the results of the half-year and calculated based on the results of the first quarter;

4 in the fourth quarter - one third of the difference between the amounts of the advance payment calculated based on the results of nine months and based on the results of the six months.

Moreover, if the payable indicator is negative or equal to zero, then no payments are made in the corresponding quarter in field 106.

Line 107 is intended for payment of insurance premiums on a monthly basis. In this case, the filling scheme is as follows: “MS.XX.2017”, where XX is the month for which insurance premiums are paid. The first letters determine the frequency of payment. There are four such indicators:

MS - monthly regularity;

KV - quarterly;

PL - six months;

GP - annual.

Line 107 is filled in in accordance with the purpose of the payment:

if taxes are paid, the tax period is fixed, for example, MS 02.2014;

if customs payments are made, the identification code of the customs unit is indicated;

if you need to deposit money in relation to other contributions, write “0”.

Line 108 “Document number” is intended for payment of insurance premiums on a monthly basis; the number “0” is entered here.

Line 109 “Document date” is also intended for payment of insurance premiums on a monthly basis and the number “0” is also placed here.

Line 110 “Payment type” - set to “0”.

Field 104 - KBK in the payment order for insurance premiums 2019

By Order of the Ministry of Finance No. 230n for 2021, new KBK codes were approved. Complete list of budget classification codes.

Please note that for insurance premiums (except for “injury” contributions), the first three digits of the BCC, meaning the chief administrator of budget revenues, have changed. In connection with the transfer of administration of insurance premiums to the Federal Tax Service, the first three digits of the BCC are now 182. In past years, the first three digits of the BCC were 392.

KBC for insurance premiums for periods up to 2021

If insurance premiums accrued for earlier periods are transferred in 2021, the transitional BCC must be indicated in the payment order. Their only difference is in the numbers from 14 to 17 inclusive (income subtype code). For example, in the KBK of contributions for compulsory health insurance, the code for the subtype of income takes the value 1011. For contributions paid in 2021 for 2017, the income subtype code in the KBK data has the value 1013.

For the convenience of readers, transitional BCCs of insurance premiums are collected in the table below:

| Type of insurance premiums | "Transitional" KBK |

| Contributions to compulsory pension insurance for individual entrepreneurs “for oneself” | 182 1 02 02140 061100 160 |

| Contributions to compulsory pension insurance for individual entrepreneurs “for themselves” (from income over 300,000 rubles) | 182 1 02 02140 061200 160 |

| Contributions for compulsory health insurance for individual entrepreneurs “for themselves” | 182 1 02 02103 081011 160 |

| Contributions to compulsory pension insurance of employees at the basic rate | 182 1 02 02010 061000 160 |

| Contributions to compulsory health insurance for employees | 182 1 02 02101 081011 160 |

| Contributions to compulsory social insurance in case of temporary disability and in connection with maternity | 182 1 02 02090 071000 160 |

KBK of pension contributions of individual entrepreneurs “for themselves” in 2021

Separately, it is worth mentioning the issue of KBK paying pension contributions to individual entrepreneurs “for themselves” in 2021. The final amount of these contributions is determined by the income of the individual entrepreneur. If it does not exceed 300,000 rubles, then contributions are paid in a fixed amount, depending on the minimum wage established as of January 1 of the year for which contributions are paid. If the income of an individual entrepreneur exceeds 300,000 rubles, then one percent of the amount exceeding 300,000 rubles is added to the above contribution in a fixed amount.

To pay these contributions in 2021 for periods up to December 31, 2016, two separate BCCs are provided. To pay these two contributions for periods after 01/01/2017, one BCC is applied. See the table below for details.

More information on calculating insurance premiums for individual entrepreneurs “for themselves”.

Changes to the BCC for pension contributions at the additional tariff in 2019

According to the general rule (clauses 1, 2 of Article 428 of the Tax Code of the Russian Federation), the additional tariff for pension contributions for employees working in hazardous work ranges from 6% to 9%, depending on the type of work. But, according to paragraph 3 of Art. 428 of the Tax Code of the Russian Federation, if a special assessment carried out by the employer established other classes of working conditions, other additional tariffs are applied - from 0% to 8%.

In past years, payment of contributions at additional tariffs was made to one of two KBK, the choice of which did not depend on whether a special assessment was carried out. One BCC was used to pay insurance premiums for workers engaged in work, the types of which are specified in clause 1, part 1, art. 30 Federal Law No. 400-FZ, the other - for payment for workers engaged in work, the types of which are listed in paragraphs. 2-18 hours 1 tbsp. 30 Federal Law No. 400-FZ.

To pay contributions for additional tariffs, starting from 2017, four BCCs are used. Now the BSC must be selected not only depending on the type of work, but also on the fact of a special assessment. The BCCs for such contributions are shown in the table below:

Will there be changes in 2021?

Despite periodic discussions regarding changes in the amounts and interest rates of some insurance premiums or the introduction of new types of payments, there are no finally approved changes for 2021. Possible options included:

- Single insurance premium. It was supposed to combine three main fees (for pension, health and social insurance), which are now paid separately, and thus simplify reporting. But in 2021 its introduction remains at the level of rumors.

- Increase in pension tax. Previously, it was planned to increase the rate in 2021 from the current 22% to 26%. In order to reduce the fiscal burden on payers, the tariff increase was canceled by Law No. 306-FZ, which the President signed back in 2021. But the period for its “freezing” has not been established, so it may end if another regulatory act is signed.

This might also be useful:

Is the information useful? Tell your friends and colleagues

Dear readers! The site's materials are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to know how to solve your specific issue, please contact us. It's fast and free! You can also consult by phone: MSK - 74999385226. St. Petersburg - 78124673429. Regions - 78003502369 ext. 257

Field 101 “Payer status”. In field 101 of payment slips for payment of insurance premiums, companies must indicate payer status 01, and entrepreneurs - 09. Status 01 is now called “Taxpayer (payer of fees, insurance premiums).” Officials ruled out code 14 completely. In payments for contributions for injuries, in field 101, continue to indicate 08.

Field 105 “OKTMO Code”. In this field, provide the OKTMO of the municipality of eight characters (clause 6 of Appendix 2 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n). Previously, it was possible to indicate OKTMO with both 8 characters and 11 characters.

Fields 106-109. Fill out these fields in the same way as in tax payments. For example, if you are transferring contributions for May, enter “MS.05.2017” in field 107. In the payment form for contributions in case of injury, do not fill in fields 106-109, put 0. They are filled out only when making payments to the tax office.

Field 110 “Payment type”. In payments for taxes and contributions, still do not fill in this field.

New standards for filling out a payment form for the payment of mandatory contributions

Each payment is assigned its own serial number. It is written at the top, in the header of the payment document. Numbering is carried out from the beginning of the year and is determined by accounting. When preparing a document, the responsible person should take into account a number of key requirements:

- dating is done in numbers, for example, 11/11/2017;

- the words “ruble” and “kopeck” are not abbreviated when written;

- the total indicator is indicated in words, and the penny amount is recorded in numbers;

- the “type of payment” position is not filled in if we are talking about internal deductions;

- if there is no handprint, “b/p” is indicated;

- the signatures of the head of the organization and the chief accountant are affixed simultaneously if both signatures were certified on the bank card;

- corrections are not allowed.

The policyholder needs to fill out all positions of the form taking into account the updated Rules for Indicating Information, approved by Order of the Ministry of Finance No. 107n dated November 12, 2013 (hereinafter referred to as the Rules).

| Item number in the payment form | Explanations for filling out form 0401060 |

| 18 | Type of operation performed: for a payment card this value is “01” |

| 101 | Policyholder status |

| 60 | TIN |

| 102 | Checkpoint of an organization (or its division) |

| 8 | Name of the policyholder (its division) |

| 61 | INN of the addressee: Federal Tax Service, Social Insurance Fund when paying contributions in case of injury |

| 103 | Checkpoint of the recipient of the Federal Tax Service, Social Insurance Fund when paying contributions for injuries |

| 16 | Name of the Federal Treasury body (abbreviated) |

| 21 | Payment queue, enter the number “5” (in accordance with the Civil Code of the Russian Federation, Article 855, clause 2 and Letter of the Ministry of Finance of the Russian Federation No. 02‑03‑11/1603 dated 01/20/2014) |

| 22 | Coding (20-25 digits): “0” is entered when making current payments |

| 104 | BCC of general mandatory contributions from 2021 |

| 105 | OKTMO (8 digits for municipality): code at the location of the policyholder (its division) (the actual code can be found using the search service on the official website of the Federal Tax Service) |

| 106 | Reason for making payment: from 01/01/2017, when paying contributions, the value “TP” is entered in this position |

| 107 | Reporting period for payment: From 2021, for the above-mentioned values “TP and ZD”, the month for which contributions are transferred is indicated, for example, “MS.01.2017” |

| 108 | Document number: for the above-mentioned “TP” and “ZD”, “0” is placed in this position |

| 109 | Dating: for the above “TP” value for the payment of mandatory contributions, “0” is written |

| 110 | Type of payment made: “0” or nothing |

| 24 | Purpose of insurance payment, paid period |

When paying contributions for injuries, “0” is entered in positions 106–109. For other types of contributions, these positions are filled out in the same way as in tax payments. Positions numbered 19, 20, 22, 23 are filled in accordance with bank instructions.

When filling out form 0401060, it is recommended to also be guided by the regulated standards of attachments (hereinafter referred to as attachments):

- attachment 4 to ministerial order No. 107n regarding the identification of the insurance payment when transferring it;

- attachment 1 to the same Order, indicating the TIN, KPP of the addressee and the policyholder;

- attachment 2 to this Order when entering information on items 104—

It is not allowed to leave mandatory positions blank. If there are no specific values for positions 20, 106-109, “0” is written in the corresponding lines.

The Federal Tax Service website has a program that allows you to create payment orders. It is expected that it will soon be set up for generally compulsory insurance payments (

Samples of payment slips

In field 104 you indicate the BCC. See the table with the KBK for 2021 below. Check if the recipient's bank details have changed. For example, from May 5, 2021, new details must be entered in the , which the company transfers to inspections near Moscow. Check them out on your tax office website and in samples 3 and 4 below. Payments with old details will be listed as unknown.

Table. KBC for payment of insurance premiums for periods from January 1, 2017

Sample 1. Payment for pension insurance contributions for 2021

Sample 2. Payment for payment of health insurance premiums for May 2021

Sample 3. Payment for payment of contributions for insurance in case of temporary disability and in connection with maternity for May 2017

2019 is a year of surprises for individual entrepreneurs. Another innovation concerns insurance premiums. Now they are accepted by the Federal Tax Service

, and not the Pension Fund of Russia, which entailed a change in the payments themselves. The form remains the same, but some fields can be filled out according to improved rules. Thus, the status of an individual entrepreneur payer in a payment order to the Pension Fund of Russia in 2021 is outdated, and the BCC has also changed. Fields in which zeros were written are now filled in. Read on for all this and much more.

Common mistakes when preparing a payment order

Often, inaccuracies and errors are made in settlement documents. If, in this case, the deducted amounts of general mandatory contributions still arrive at the required accounts, then the obligated person has the right to make adjustments through the Federal Tax Service. For this purpose, the policyholder at the place of registration can submit an application. In it, he must describe the error and ask for clarification of the payment made. A copy of the payment slip containing the error must be attached to the application.

Some errors do not require clarification of the insurance payment. For example, when indicating the value “14” in the policyholder status. The value will be recoded here by the tax authority. The situation with an erroneous OKTMO in the settlement document is similar. Because of this, the payment will not acquire the status of unknown. And no clarification is needed here either.

Example 1. Sample of drawing up a payment slip in form 0401060 for payment of mandatory pension contributions

LLC “Project” pays mandatory pension contributions for September 2021. The payment amount is “Three hundred seventy-seven thousand rubles 50 kopecks.” The standard form prescribes the new BCC from 2017 - “18210202110061010160”, the status of the policyholder is “01” (for an organization), the basis of payment is “TP”, the tax period is “MS.09.2017”.

Sample of filling out a payment slip for payment of OSN contributions - 2021

Example 2. Sample of filling out payment form 0401060 for payment of compulsory medical contributions

The same organization as in example 1, Project LLC, must pay mandatory medical contributions for September 2021. To make the payment, payment document form 0401060 is separately filled out. The same data is recorded there as in the previous example. The exception is the payment amount and BCC. For these positions, values typical for compulsory medical insurance contributions are prescribed.

So, the payment amount will be different - “Six thousand rubles 30 kopecks.” BCC from 2021 in medicine is the following -18210202101081013160. In position “24” (purpose and payment period), the text part will also change and will read: “Insurance premiums for compulsory health insurance for September 2021.”

Sample of filling out a payment slip for payment of compulsory medical insurance contributions – 2021

New recipient of fixed insurance contributions - Federal Tax Service

The transfer of administration of fees to the federal tax office is not surprising. Even before the introduction of insurance premiums, it was this body that accepted payments for the unified social tax, which individual entrepreneurs and organizations paid for their own insurance and the insurance of their employees.

When insurance premiums began to be used instead of the unified social tax, it was decided to form extra-budgetary funds, which began collecting them. These are the familiar Pension Fund of Russia, FFOMS, and FSS. They failed to cope with their task, which is confirmed by statistics - since 2011, the debt on pension contributions has exceeded 200 billion. So, the idea of returning the collection of contributions under the control of the tax authorities suggested itself.

Now, according to the decree of the Government of the Russian Federation, a payment order for insurance contributions to the Pension Fund in 2021 for individual entrepreneurs does not need to be drawn up for themselves. Now the collection of fixed payments is the responsibility of the tax service.

The Federal Tax Service will accept the following fixed insurance premiums:

- Pension;

- Medical;

- Social (optional for the entrepreneur).

Chapter number 34 has been added to the Tax Code of the Russian Federation, which sets out both the amount of contributions and the procedure for their payment. Therefore, apart from filling out the clause taking into account the changes, individual entrepreneurs will not encounter any unpleasant innovations.

As for the payment, now in the “Recipient” field you should write the short name of the federal treasury and the short name of your tax office. The second is in parentheses. For example, the Federal Tax Service for Moscow (Inspectorate of the Federal Tax Service of Russia No. 56 for Moscow)

.

You need to choose an inspectorate at your place of residence or registration

, and not the one that works somewhere nearby.

Filling out a payment order

Filling out the payment order must be carried out in full compliance with the requirements of Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for transferring funds” and Appendices 1, 2 and 3 to this regulation. Along with this, filling out a payment order for transferring payments to the budget and extra-budgetary funds must also take into account the Orders of the Ministry of Finance. Thus, from January 2014, Order of the Ministry of Finance of the Russian Federation of November 12, 2013 No. 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation” comes into force.

Please note that empty details fields are not allowed. If a specific field cannot be filled in or is not necessary, then a zero is entered in it.

How to find out the details of your Federal Tax Service

You can find out the payment details of your treasury on the Federal Tax Service website at https://service.nalog.ru/addrno.do. To find it yourself, click on the orange button labeled “Services” and select “Address, inspection payment details” from the drop-down list.

Check the box for individual entrepreneur and enter the registration address of your business. If you know your inspection number, please indicate it. Then click “Next” and the window will display all the details of your Federal Tax Service that are currently relevant.

Through the same service you can find out OKTMO.

Filling out a payment order to the Pension Fund online on the Federal Tax Service website

For some, filling out a payment document online will seem like the easiest option due to the fact that you won’t have to look for forms and spend a lot of time dealing with new filling out rules.

Step 1 : Follow the link https://service.nalog.ru/

Step 2 : Enter your tax code, click “next”.

Step 3 : Find out the name of the municipality where your company is located (or where you are registered if you are engaged in entrepreneurial activity) and select it from the list provided, click “next”.

Step 4 : Select “payment order” in the “type of payment document” line, click “next”.

Step 5 : In the “Payment Type” column, select “payment of tax, fee, contribution”, click “next”.

Step 6 : Enter BCC, click “next”.

Step 7 : The status of the person who issued the payment document is “01”, “next”.

Step 8 : Basis of payment – “TP”, “next”.

Step 9 : Select the billing period, “next”.

Step 10 : Report the date on which the dues settlement was signed. If the day is unknown, simply click “next”.

Step 11 : Payment order – “5”, “next”.

Step 12 : Fill in the fields TIN, KPP, name, payment details, contribution amount.

Step 13 : Click “next”, “generate payment order”. Done, the completed document has been downloaded to your computer.

New BCCs for additional insurance fees

When the income of an individual entrepreneur exceeds the fixed 300 thousand, he must pay additional funds to the Federal Tax Service in the amount of one percent of the excess. Not from the entire amount, but from the resulting difference between actual income and 300,000

. This has always been the case, only previously this tax was paid to the Pension Fund.

The BCC for excess contributions has changed. Also, as in the case described above, if the fee is paid for the previous year, the old ones are written to the KBK in the payment form, and the changed ones are written for the new one. You can see them in the table:

There is one more nuance regarding the BCC for insurance premiums:

- If fees are paid for 2021, then the BCC for simple contributions and those with excess are written differently.

- If for 2021 - the same.

Current BCCs for payment of insurance premiums, penalties and fines to the Pension Fund of Russia

When specifying the BCC, you need to be extremely careful, because if they are indicated incorrectly, the contribution will not be considered paid. Here you need to consider the following points:

- The first three digits of the code are 182 (due to the fact that the tax service now administers payments to the Pension Fund);

- For contributions for December 2021 a special BCC applies (and it doesn’t matter if the payment is made later than January 1, 2017);

- For the payment of penalties and fines for late payments, the Pension Fund also provides separate codes for the period 2021 and 2021;

- Fixed payments (for individual entrepreneurs without employees) for the time before and after 01/01/2017. are listed under various BCCs.

This table outlines the costs for different payment purposes.

| Purpose of payment | 2016 | 2017 |

| Payment of insurance premium to the Pension Fund of Russia | 18210202110061000160 | 18210202110061010160 |

| Payment of the fine | 18210202110063000160 | 18210202110063010160 |

| Payment of penalties | 18210202110062100160 | 18210202110062110160 |

| Payment of a fixed payment | Within the income limit: 18210202140061100160 When exceeding the income limit: 18210202140061200160 | 18210202140061110160 |

New status of individual entrepreneurs in the payment slip for insurance premiums in 2021

It doesn’t matter what contribution you pay, mandatory insurance or additional from excess income, indicate the payer status 09

. In the order of the Ministry of Finance of November 2013, he is listed as the status of a payer of contributions on the income of an entrepreneur.

The fields entitled “Base of payment” and “Tax period” are now filled in. Instead of the usual zeros in the first, indicate “TP” for contributions for 2021 or “ZD” for fees for the previous year. And in the second - “GD.00.2019” if you make payments for the period of this year or “GD.00.2018” if you pay the fee for the period of the past.

Sample payment order in the Pension Fund in 2021 for individual entrepreneurs without employees

To clearly see that practically nothing has changed in the sub-section, let’s look at a sample of filling out a payment slip to the Pension Fund for a fixed payment for an individual entrepreneur for himself in 2021. Or rather, not to the pension fund, but to the Federal Tax Service.

Instructions for filling out the clause for payment of insurance fees:

- The fields “Received” and “Written off” are marked here by the bank itself; payers do not fill them out.

- “Payment order No.” – enter the number that you assigned to your payment order.

- “Date” – the day, month and year when you finished creating the payment order. Strictly in that order.

- “Type of payment” – here indicate the payment method: “Electronically”, “Urgent”, “By mail” or do not write anything if you decide to visit the bank in person.

- In the square in the right corner we indicate the status 09.

- “Amount” and “amount in words” – indicate the payment amount in both words and figures.

- “TIN” – for entrepreneurs this is 12 digits.

- “Checkpoint” – entrepreneurs do not fill in this field.

- “Payer” – indicate the same name as in the individual entrepreneur registration.

- “Sch. No. – here write your account number from which you will pay the insurance premium.

- “Payer's bank” is the name of the bank where your account is registered.

- “BIC” – BIC of this bank.

- “Sch. No. is his correspondent account.

- “Recipient's bank” - enter the name of the bank there in the account opened for your inspection.

- BIC of this bank.

- “Sch. No. – do not fill in.

- “Recipient” is the name of your tax authority.

- “Sch. №” – his account number.

- “Type of transaction” – enter 01. This number means a tax order.

- “Payment order” – always put the number 5.

- "Code" - 0.

Below there are 7 more fields. Enter the information in the following order:

- OKTMO;

- Basis for payment: TP - if it is a current payment, 3D - additional payment for past periods according to verified calculations, AP - according to a tax audit report, TR - at the request of the federal tax service.

- Payment period: MS.01.2019 – monthly payment of insurance premiums, KV.01.2019 – supplement according to updated figures, GD.01.2019 – duty according to the decision of the tax audit.

- Item number – 0. Or another one, which is indicated on the inspection decision.

- Date – 0. And again, if the insurance premium is paid as an additional payment or by decision of the Federal Tax Service, indicate the date when this decision was made.

- Skip the next field.

- And at the end, in a large cell, we write the purpose of the payment.

- At the end, the IP seal is affixed, if any.

Code 110 - simplified

Code 110 corresponds to such details as payment type. A sample of filling out a payment order (personal income tax, penalties, interest) drawn up for almost any enterprise will include it. Here, as we noted above, 3 options are possible - PE (for penalties), PC (for interest) or 0 (for taxes, fines, advance transactions). Similarly, 0 is set if the document compiler finds it difficult to indicate the correct type of payment.

Code 21 corresponds to such details as the order of payment. It is recommended to set the number 5 - in accordance with the provisions of Article 855 of the Civil Code of the Russian Federation.