When is an inventory required in the Social Insurance Fund?

Providing an inventory to the Social Insurance Fund is necessary if the company has employees who need social benefits. However, what is more important is the direct responsibility of the employer: it is necessary to regularly submit to the Social Insurance Fund all documents that are in one way or another related to the allocation of funds for the payment of insurance claims.

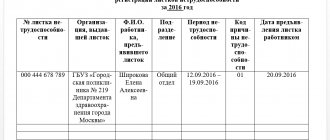

Filling out the sick leave register

In order for the Social Insurance Fund to accept the register, it must be completed in accordance with existing standards. However, the main difficulty is that there is no single sample BC register that could serve as an example when accountants create documents. If we talk about the official website of the FSS, then on its expanses you can find the following option.

Sample register provided by the FSS website

As mentioned earlier, in some cases the employer needs to enter additional information related to the sick leave of an employee. In this regard, it is advisable to study the order of the Social Insurance Fund No. 223, which allows you to understand the different variations of registers that may be needed under different circumstances.

Who makes it up

Responsibility for compiling a complete list of documents for the Social Insurance Fund falls on the management of the company and the immediate head of a specific department. Such a hierarchy allows you to improve the structure between the Social Insurance Fund and the company, as well as make error-free payments. So, the management collects all the documents and draws up an inventory, using the help of the office, signs and sends it to the Social Insurance Fund.

Composition of the document

The document, which was approved on December 29, 2021, includes the following information:

- Full information about the policyholder: registration number, department code, etc.

- Main part: a table with the names of employees and their category according to which payments should be made.

- Attachments: attached documents that are necessary to confirm the need for social insurance.

At the end of the inventory there must be the signature of the manager and the seal of the organization.

Video with the procedure for sending documents to the FSS:

Format for registering insurance cases

To generate the document, any of the available software is used - 1C, accounting programs, special developments of system administrators. 1C configurations provide registers for insurance cases for various purposes - disability, payment of benefits for care and birth of a child.

Enterprises with a small number of employees fill out the register data manually.

- The document is signed by the chief accountant of the enterprise. The signature is certified by the seal of the organization. Certification of the register with the signature of the manager is not mandatory.

- The form is submitted both on paper and in electronic form.

- The need to submit copies of certificates of incapacity for work is eliminated.

The register is compiled for a monthly period. For certificates of incapacity for work carried over to the next month, a separate note about continuation is made indicating the bulletin number (

Rules for filling out an inventory in the Social Insurance Fund

So, now as for the actual filling. First, the register consists of two parts: introductory and tabular. This is important to consider because the first part contains:

- full policyholder number

- subordination code, which is determined in accordance with the registration number and registration with social authorities. insurance

- full information about tax identification number and checkpoint

- name of the organization that sends the inventory

- official name and number of the FSS body to which the shipment is made

After this, the main part begins - the tabular one. It is made of five columns, which contain information regarding:

all employees who are entitled to payment- type of payment

- full names of documents according to which payment is due

- applications

In addition to the fact that all names must be written in full, in the “Types of payments” it is required to indicate a serial number, which relates to the specific basis of the benefit. So, let's look at each code:

- 1 - temporary impossibility of performing labor

- 2 - pregnancy and, as a result, stay in medical care. institutions

- 3 - hospital registration in the early stages of pregnancy

- 4 - birth of a child

- 5 - maternity leave

- 6 - injury due to an accident and temporary disability

This is where the main part ends and all that remains is to attach and list all the documents that serve as the basis for assigning assistance. The complete register must be signed by the head of the organization, indicating all dates and the organization's seal.

Design rules

Since 2021, there are two forms of sick leave in Russia - paper and electronic.

The external differences between these two forms are insignificant - the only difference between them is that the digital form is more convenient to use. Immediately after the doctor completes the paper or digital certificate of incapacity for work, information from these forms is automatically transferred to the general database of the BL registry.

Sometimes registers can combine information about sick leave and social benefits

The register of certificates of incapacity for work, in turn, can also be maintained in two ways - using a paper journal and using electronic accounting, which allows you to quickly access a particular form. The electronic register format currently exists in many programs developed for accountants, such as:

In order to make working with sick leave more convenient, the FSS website has provided an opportunity through which an accountant can activate his personal account. Thus, the specialist will have access to the database of employees who issued certificates of incapacity for work (this rule applies only to forms in electronic format).

You can read below about how to create a personal account on the Social Insurance Fund website and what functions it performs for the insured person.

In addition to familiarizing yourself with sick leave certificates, the presence of a personal account on the Social Insurance Fund website allows the accountant to carry out other useful actions, such as:

- subsequent printing of sick leave certificates;

- transfer of information about the policyholder to the electronic certificate of incapacity for work;

- indication in the BC form of all time periods during which the employee was incapacitated;

- instant transfer of information about the employee who filed a certificate of incapacity for work with the Social Insurance Fund, freeing the accountant from the tedious collection of paper reports and their subsequent sending;

- quick access to all payments for sick leave taken by employees using the Social Insurance Fund database.

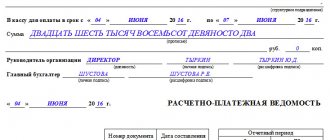

An example of a completed sick leave register

There is a strong assumption that in the future, public clinics will increasingly begin to abandon paper BCs in favor of electronic ones. This step will allow accountants to work not with scattered papers, but with a single database connected to the Social Insurance Fund.

Thanks to this measure, it will significantly simplify not only the preparation of sick leave certificates, but also the calculation of payments to each employee.

Features of the accident inventory

In the event of an accident, the Social Insurance Fund can pay all insurance premiums, but the key stage is the recognition by the Social Insurance Fund of such an event as an insured event and, as a result, a production one.

Federal Law No. 125, which has jurisdiction over everything related to insurance, defines an industrial accident as harm to the health of an employee during the performance of work duties. And it is the part “at the time of performance of work duties” that is key, since it frees a person from being directly on the employer’s premises.

Therefore, in order to receive payments from the Social Insurance Fund and draw up an inventory, official registration of all damage is required. Thus, Art. 250 of the Labor Code of the Russian Federation, a complete list of necessary documents is contained in Resolution of the Ministry of Labor of the Russian Federation No. 73.

If we do not take into account all the documents that the employer must prepare, then the investigation and further inventory of the Social Insurance Fund must be supported by materials from specialists monitoring the case. Moreover, the legislator has every right to conduct additional examinations. Thus, if the opposite is proven - the damage to health was caused in such a way that it does not fall under the insured event - the company management will personally pay compensation. In this case, the Social Insurance Fund will be exempt from payments to such an employee.

About failure to submit reports

Now regarding missing the reporting deadline. It is regulated by Art. 26.30 Federal Law No. 125, which provides mandatory social services. insurance. Thus, the amount of the fine will be about 5% of the total number of contributions for every 3 months of the previous period. This rule applies regardless of whether the past months were complete or not. However, there is a small limitation in the form of maximum percentages of this amount - no more than 30%.

In addition, if the order is violated, a fine of 200 rubles is paid. However, the presence of financial sanctions that relate directly to the organization is not the only thing that can overtake the employer.

A fine can also be imposed on the head of the company and be interpreted as an administrative violation - this will be ensured by Art. 15.33 Code of Administrative Offences. The amount of such a penalty will be up to 500 rubles.

These sanctions are imposed on the company regardless of the reason for the delay in delivery: intentionally or through negligence - is not taken into account. However, the legislation defines a number of cases that take into account the impossibility of sending a report in a timely manner (Table 1).

| Article number | Description |

| 26.25 | relieves responsibility if the deadline is missed due to: a natural disaster, lack of control over actions as a result of illness, carrying out clarifications for the fund, etc. |

| 26.26 | provides mitigating circumstances that will help reduce the fine: difficult financial situation, family problems, etc. |

Thus, these are only the main features of the inventory that must be taken into account in the event of an accident and further compensation of all funds.

Video about reporting deadlines:

For reimbursement

Reimbursement of benefits from the Social Insurance Fund is possible, but it requires first of all determining where the funds were spent. Thus, compensation is allowed exclusively for: sick leave, benefits for pregnant women and child care, as well as for the funeral of an employee.

However, the Social Insurance Fund compensates these benefits only partially and only some fully. And if we consider the reimbursement procedure, it is quite standard; it is necessary:

- Write an application: it contains all the information about the person.

- Prepare a statement of calculation and other documents that are required - determined personally.

- Wait for a full check by the FSS.

- Receive funds.

Despite the simple algorithm of actions, problems often occur when: collecting and completing the required package of documents, correctly drawing up the form, and meeting the deadlines for sending and receiving funds. All this is the direct responsibility of the employer and must be regulated by him throughout the entire procedure until the employee receives the funds.

Shipping methods

There are two main methods for sending a list of documents to the Social Insurance Fund (Table 2).

| Shipping method | Description |

| Electronic | The use of this method implies the presence of special communication channels and the use of an electronic digital signature. Otherwise, sending is not possible. |

| Physical | Sent either by mail or courier. It is mandatory to have a sealed envelope with an inventory of the contents and other means of protecting physical documents. It is also recommended to use registered mail, which is much more reliable, since the sender will be immediately notified that the addressee has received the letter. |

Compliance with all established conditions is also mandatory and does not constitute a benefit if the report does not reach the fund on time.

Who, how and when fills out the register of certificates of incapacity for work?

The register is prepared by the accounting department. Manual preparation is labor-intensive. The program from the FSS is free, but requires manual data entry. Special software generates RBL automatically, but is not always justified for small businesses and is not always finalized. When creating a RBL, it is worth considering that there is a sick leave register. It contains almost the same columns; perhaps it is worth combining the two lists.

In regions that are not participating in the pilot project, you can fill out the register of sick leave for FSS reimbursement in any way you like; a sample is available on the Internet. In this case, RBL must be provided only at the request of the Fund. However, some departments are introducing their own initiatives to identify fake sick leave certificates. When participating in a pilot project, RBL is required. Only the technical side of data presentation is regulated; everything else is at the discretion of those filling it out.