09.06.2019

0

509

6 min.

The responsibilities of every head of a company or commercial enterprise engaged in financial activities include proper organization and maintenance of document flow. Since he often has to purchase material assets from third-party companies, he must take the procedure for receiving the cargo seriously and follow a certain procedure. To avoid any misunderstandings during the next inspection by the competent authorities, it is necessary to follow the current instructions.

Act of shortage: the essence and meaning of the document

In the course of conducting economic or trading activities, heads of organizations or individual entrepreneurs are forced to purchase raw materials or finished products in order to further form a normal production process or resell the goods at a better price. Receipt of the cargo is carried out taking into account the established procedure and regulations by special employees who bear financial responsibility.

The responsibility of the employee receiving the goods is not only to receive it, but also to weigh it, count the quantity and check the quality. After this, he must register the cargo and distribute it to a warehouse or other storage locations.

It is important to know! If deficiencies are identified during the procedure, namely low quality, defects or a discrepancy between the quantity of goods and the quantity indicated in the invoice, the employee is obliged to record the violation and draw up a report.

The official document reflects information about received inventory items (TMV) and identified deficiencies. The receiving party enters information about the quantity of damaged goods and the degree of damage, and also records the discrepancy between the numbers in the invoice and in fact. When drawing up an act, the recipient pursues two goals. First, it indicates the amount of material damage caused, expressed in monetary terms, which the recipient wishes to compensate at the expense of the supplier or transport agency. Secondly, it demonstrates the professionalism of its employees responsible for accepting incoming cargo (material), as well as the level of production and organization of the work process.

Reasons for holding

Inventory can be carried out at the initiative of the company’s management to perform the following current tasks:

- identification of errors in calculations that have already led or may lead in the future to accounting violations;

- check the correspondence of the actual cash flow with what is displayed;

- how in practice the rules of activity of materially responsible persons, such as cashiers, are observed in order to increase order among employees.

In other cases, the organization is obliged by default to conduct an inventory:

- when are annual reports prepared?

- if the persons responsible for handling cash (cashiers) change (done on the same day when cases are transferred between changing employees);

- in case of criminal incidents (theft, theft, etc.) or damage to valuables;

- force majeure (fire, utility accident, etc.);

- a decision is made to close the organization and a liquidation balance sheet is drawn up.

The organization can also establish a planned inventory, for example, once a quarter, or arrange a surprise check.

Depending on the initiator, the inventory can be internal (by decision of management) or external (on-site), in connection with the needs of the founder or for investigative purposes.

The main regulatory document that inspectors must follow is the Methodological Instructions of the Ministry of Finance No. 49 of 1995. It describes the general rules for conducting inventory, as well as specifics for certain types of assets and liabilities.

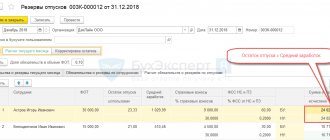

Drawing up a statement of shortage

The deficiency report serves as the basis if the recipient intends to file a claim with the organization or transport company that did not deliver the goods in order to compensate for damage in the form of monetary compensation or additional quality products. If it is drawn up during the audit, and not during the procedure for receiving the cargo, then the information contained in it is taken into account when preparing annual reports. Based on the information provided, the commission can most accurately determine the amount of expenses of a company or organization.

Regulatory documents

To date, there is no single form of report on the identified shortage of goods. Therefore, the law allows you to draw up a document of the type that the company developed on its own specifically for these purposes. The main thing is that it reflects all the necessary details and contains complete information.

When creating your own prototype of a regulatory document, you can rely on existing unified forms. The sample act on the identified shortfall of cargo or goods used in the future must be fixed in the Accounting Policy for the purpose of accounting control. To gain the skills to correctly draw up acts for various purposes, you need to refer to regulatory documents and thoroughly study the rules and procedure for filling out primary documentation. Today, three types of forms are used for different purposes.

- TORG-2. This form is used when accepting products from domestic companies. It must be filled out without errors or blots and have at least three copies.

- TORG-3. If the receipt of cargo that was delivered by foreign companies is carried out, the receiving employee is required to fill out a report in accordance with this form. Later he must submit the document in five copies.

- TORG-12. Missing products or goods to be returned are described in a statement filled out according to the model of this document.

Reception employees are required to know the intricacies of filling out all forms. This will avoid problems with authorities that control document flow.

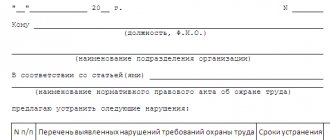

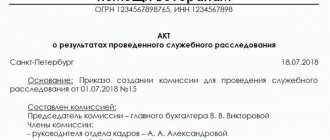

Creation of an inspection commission

Since during the acceptance of commercial cargo, an insufficient quantity of goods is discovered, the law requires the drawing up of an act. To comply with legal standards, management is obliged to create a special commission from among the employees who accept products (or other employees). The main thing is that it must include at least three people.

It is important to know! The exception is individual entrepreneurs who do not have a staff of workers. They can identify the fact of a shortage and draw up the document themselves.

p style="text-align: center;">

The composition of the commission is approved by the relevant order of the management. Based on the concluded agreement, they undergo special training. The report must be drawn up with the participation of a representative of the supplier or shipper. For this purpose, the contract prescribes the procedure for notifying the seller of the need to send an authorized person to accept the goods and record shortfalls, specifying the time frame for its arrival, as well as actions in case of its absence. In practice, if the cargo arrives unaccompanied, the document is endorsed only by the recipient. A copy is sent to the supplier by registered mail or email.

Compilation procedure

In order to avoid various misunderstandings during an inspection by special authorities or during court proceedings, the deficiency report must be drawn up as correctly as possible. To do this, you need to take into account several basic points.

- The legislation allows the use of a unified form or sample developed by a company or organization, but containing all the necessary details.

- If a shortage is discovered, the document must be drawn up in the presence of a representative of the supplier. If you don’t have one, you can invite a driver from a carrier company or forwarder. In a situation where it is not possible to attract the above persons, the recipient has the right to use the services of an independent expert.

- If the recipient simultaneously accepts cargo from several suppliers and in each case a shortage is detected, it is recommended to draw up as many reports as the number of incomplete shipments arrived. In order to provide an evidence base, all violations must be recorded using photos and videos.

- The document drawn up must be signed by members of the commission, a representative of the supplier, or instead an independent expert.

- After registration, a lawyer or accountant is obliged to draw up a claim as soon as possible and submit it to the seller against signature. The timing of this procedure is clearly defined by Federal legislation. If they are violated, the supplier has the right to refuse to fulfill it.

- If there is a shortage of fuel, the commission is obliged to draw up a report on the write-off of fuel and lubricants, indicating the reason for the overconsumption.

During the preparation of the act, you need to enter all the necessary details, and after completion, indicate the date of execution.

Contents of the shortage report

A sample report on identifying a shortage of goods, which can be viewed, is presented at the end of the article. For a document to have legal force, it must be filled out correctly.

A cap. Here you should indicate the details of the company or organization that received the goods. They contain: name, location address, structural unit, telephone numbers. On the other hand, you need to enter the document number and the date of its preparation.

Main part. This section fully displays all important information.

- Details of the sender of the cargo or goods (name of organization, address, telephone number).

- The location where the shipment was received.

- Information about the product manufacturer, supplier, insurance company (if necessary).

- Basic documents (contract, invoice, invoice, act), and their data (number and date of preparation).

- The date the item was shipped and the method of transportation.

- Day, date and time of shipment from the warehouse or departure station

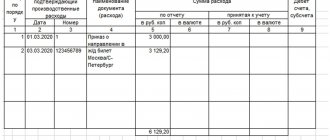

List of goods. Here, for clarity, it makes sense to insert a table in which the fact of the shortage and basic information will be recorded. Units of change are indicated according to OKEI.

- Name, quantity, article, grade, price, amount of goods or cargo specified in the invoice and available in fact.

- The condition of the seals of the container, wagon, boxes (to detect unauthorized opening and internal shortages).

- List of defective and broken products (quantity, amount).

- Deviation from the data specified in the accompanying document, that is, a shortage or surplus.

The next section should show how the quantity or weight of the goods was counted and measured, describe the nature of the damage and an opinion about the reasons for its occurrence. At the end, the actions of the recipient are indicated, namely, that the goods were unloaded and sent to the warehouse for further storage. In this case, you must enter its name. What follows is the opinion of the commission members and their conclusion.

Attention! The fully completed document is endorsed by members of the commission. It indicates the place of work and position of each of them, as well as the decryption of the signature. Similar information about the supplier’s representative, transport company, or independent expert is also entered here.

Who takes inventory of the cash register?

To carry out the inventory, a permanent inventory commission is created. When there is a large volume of work, working inventory commissions are created to simultaneously carry out an inventory of property and financial obligations (based on clause 2.2 of Methodological Instructions No. 49).

The composition of permanent and working inventory commissions is approved by the head. Documents on the composition of the commission can be an order, resolution, order, etc. (based on clause 2.3 of Methodological Instructions No. 49).

The inventory commission includes:

- representatives of the organization's administration;

- accounting employees;

- representatives of the internal audit service or employees of independent audit companies;

- security officers or other company specialists (economists, managers, etc.).

It should be borne in mind that the absence of even one approved member of the commission during the inventory serves as a basis for declaring its results invalid (the basis is clause 2.3 of Methodological Instructions No. 49).

Regulatory documents do not oblige the annual reissue of the order on the composition of the inventory commission if there have been no personnel changes in the organization.

Design features

In practice, the act of shortage of goods is very often confused with a similar document identifying a shortage of funds at the cash register. In fact, legal norms provide for the use of various forms to formalize such violations. p style="text-align: center;">

Product shortage

Identification of a shortage of goods upon receipt is formalized by a special act in the form TORG-2 or TORG-3, which has a certain structure:

- The header of the document, which indicates the details of the supplier: name of the company (organization) or full name of the seller, address of the location where the act should be sent.

- Document's name

- The factual part, which describes in detail: the place of the “incident”, the invoice number of the arrived cargo, a description of the means and method of delivery.

- The composition of the commission, place of work and position of each of them are indicated at the bottom. Their signatures will also be located here.

Lack of cash in the cash register

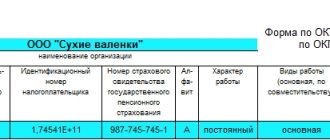

The cash register check is completed using the INV-15 form. Its sample is not approved by the State Statistics Committee of the Russian Federation, and therefore requires extremely careful, almost perfect, filling. The act on the amount of the identified shortage of funds or inventory items has a certain structure and must contain the following data:

- Name of the organization (enterprise, company) or its division.

- Act number, registration date and inventory time.

- Reason for inspection.

- The actual presence of material assets (money).

- Receipt from the financially responsible employee for valuables at the cash desk.

- Explanation of the reason for the lack of banknotes in the cash register at the time of inspection.

This information allows you to get an idea and draw preliminary conclusions regarding the lack of funds in the cash register and the reasons for this misunderstanding.

Introduction

Russian legislation strictly regulates the activities of the cash register and the procedure for action in the event of a shortage. Usually it is detected at the end of the working day, when the cashier recalculates the cash and takes out the Z-report. This procedure should be carried out under the guidance of the head of the company or the chief accountant, but not everyone adheres to this requirement. The normal development of the situation is when the amount of cash available in the cash register coincides with the Z-reporting. If the report shows one amount, but in fact it is less, this means that there is a shortage.

The cash register must be checked regularly

The problem is not always found at the end of the day: it all depends on cash discipline, the cashier and the rules in force in the company. It can be detected during the working day if the cashier suspects an error. To do this, he can take a Z-report at any time of the day and double-check the funds, both for one cash register and for the entire department.