What is the KM-3 act and who fills it out

In cases where the buyer returns goods purchased for cash on the same day, the cashier must refer to the KM-3 act. This document is unified and approved by a resolution of the State Statistics Committee in 1998. In addition to the return of goods by the buyer, the KM-3 act must certainly be filled out in a situation where the cashier made a mistake during the sale, as a result of which he was forced to carry out the “Return” operation.

Summarize

If the buyer purchased the goods for cash, then he has the right to return it to the seller, based on the Law on Consumer Rights. To do this, an act is filled out in the km-3 form in the presence of a commission of four members of the organization from which the goods were purchased. Other forms can be viewed “Album of unified forms of primary accounting documentation for accounting for cash payments...” in Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132. After this, the act is transferred to the company’s accounting department so that the amount of cash proceeds can be adjusted.

Instructions for filling out the KM-3 act

This document must be drawn up in one copy by an established commission consisting of:

- The head of a company or structural unit (for example, a store);

- Head of department (manager);

- Senior shift cashier;

- Cashier.

We present the completion of the act in the form of a table:

| p/p | Intelligence | A comment |

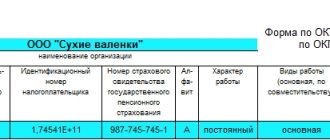

| 1 | Company or division registration details | Indicated in the header of the act and consist of the name in accordance with the registration documents, TIN, contact information |

| 2 | Information about CCP used in the organization | Make, model, numbers (registration and factory) |

| 3 | Filling period | Indicate the date of drawing up the act |

| 4 | Serial number | Indicated depending on the number of check grounds |

| 5 | Check number and amount | The cashier learns this information from the cash receipt |

| 6 | Person who authorized the return | You must indicate your position and full name |

Sample and example of act 2021 - 2018

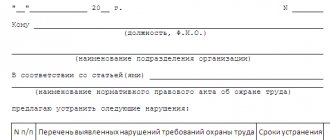

The document has a single approved form and is used in all stores, service points and other organizations involved in retail trade. It must contain the following information:

- Official full name of the organization and contact details, type of activity and TIN.

- Name of the cash register and application program.

- Act number (in accordance with the numbering adopted by the company) and the date of its preparation.

- “I approve” visa for the manager (store director).

- The tabular part, which lists in chronological order the numbers of checks punched incorrectly (or checks for which funds must be returned), the amount is written down to the nearest penny and the full name and position of the person who authorized the return of money is indicated (for example, a senior cashier or administrator ).

- Next, the total amount of all returned funds and/or the amount of all erroneously punched checks is indicated in words. It is prescribed that all cash receipts on a given day should be reduced by this amount.

- Next, all members of the commission who participated in drawing up the act sign – usually this is the department manager, the senior cashier and the cashier himself who made the mistake (or returned the funds to the buyer). The official title of the position is written down, a signature is placed and a transcript (last name, initials).

In the same act, it is allowed to record both returned and erroneously punched checks. But they all must have the same date. Therefore, if such operations are performed on different days, a separate form is drawn up for each day.

The form is presented below:

Completed form that can be used as a sample:

Errors when filling out the KM-3 form

Due to the fact that this act is an extremely important document for the Federal Tax Service inspection, allowing the company to prove that no revenue was posted to the company, special attention should be paid to errors that occur when preparing this document.

The most common errors that occur when filling out are:

- The act does not contain the signatures of the responsible persons. Due to the fact that this document confirms the issuance of funds, this is unacceptable.

- The “document number” field remains blank. The cashier prints the document from the accounting program. In this case, the date in most cases is entered automatically, and the act number must be entered manually.

- One person signs for all members of the commission. The law established that the issuance of funds under the KM-3 act must be confirmed by a commission consisting of heads of structural divisions, as well as a cashier. As a result, the document must contain the signatures of the above persons.

Filling out KM-3 when using an online cash register

From July 2021, most sellers are required to use online cash registers.

For information about the “simplified” option not to use online cash registers when providing services to the population (except for public catering services) until July 1, 2019, read the publication “A deferment for online cash registers has been introduced.”

Read about the use of online cash registers by UTII payers in the article “Use of online cash registers for UTII (nuances).”

When using an online cash register, it is not necessary to use KM-3 when returning money to the buyer. Fiscal data that comes to the tax office from online cash desks completely replaces information from forms KM-1, KM-2, KM-3, KM-4, KM-5, KM-6, KM-7, KM-8, KM-9 (see letter of the Ministry of Finance dated September 16, 2016 No. 03-01-15/54413 (notified to the tax inspectorates by letter of the Federal Tax Service dated September 26, 2016 No. ED-4-20/18059).

When the buyer returns the goods, the seller using the online cash register, based on the buyer’s application, must issue a check with the “return of receipt” sign (see letter of the Ministry of Finance of the Russian Federation dated July 4, 2017 No. 03-01-15/42312, 03-01-15/42315 ). In addition to the check with the sign “return of receipt”, it is also necessary to issue a cash receipt order for the amount of the refund (Article 1.1, Clause 1, Article 1.2, Clause 1, Article 4.7 of the Law of May 22, 2003 No. 54-FZ, Clause 6.2 of the Bank’s instructions Russia dated March 11, 2014 No. 3210-U).

In what programs can the KM-3 act be formed?

The following programs can be used:

| Software for generating the KM-3 act | |||

| p/p | Program | Maybe | Impossible |

| Paid programs | |||

| 1 | 1c accounting | Yes | |

| 2 | Circuit | Yes | |

| 3 | Class365 | Yes | |

| 4 | SAP | Yes | |

| Free programs | |||

| 5 | Taxpayer legal entity | No | |

| 6 | Business Pack | No | |

Certificate of return of funds

The act is drawn up in two copies and signed by the commission:

- filled out and submitted to the accountant along with the check

- stored in cash documents for this date for 5 years.

For the amount for which the refund was issued, the cash register is reduced and a cashier-operator report is filled out and signed by the senior cashier and the manager. However, with the advent of online cash registers in our lives, the need to fill out these documents has disappeared, since processing a refund has become much easier.

When is an act in form No. KM-3 needed?

When tax authorities check the work of organizations and entrepreneurs with cash and their conduct of cash transactions, then when they discover an act on the return of money to buyers (clients) for unused cash receipts in the unified form N KM-3 <1> (hereinafter referred to as the KM-3 act) They study it and the documents attached to it especially carefully. After all, they must make sure that cash proceeds are recorded correctly. Therefore, we will consider when it is necessary to draw up this primary document and how to draw up the papers attached to it.

When to draw up an act

Act KM-3 must be drawn up if:

<or> the cashier made a mistake and entered an incorrect cash receipt (for example, a check for a larger amount that was not cleared during the shift);

<or> the buyer returns the goods on the day of purchase and the money is returned to him from the operating cash desk;