The company's advance reports are always of great interest to the inspection inspector. During their visit, tax officials will check the availability of supporting documentation confirming the legality of expenses, as well as the compliance of checks, receipts, and bank card slips with the procedure for their execution approved by law. And if the inspector discovers violations when documenting the organization’s expenses, the company faces fines.

Therefore, it is recommended to be careful when preparing a document such as an advance report. How to fill out the report form depends on whether the enterprise has approved a standard form or has implemented an internal document with an adapted report structure.

The law allows the use of any form of advance report at an enterprise; the main thing is compliance with the rules for recording information on the expenditure of accountable funds.

Only accountable amounts issued to an employee to pay for goods or services that are performed in the interests of the organization can be accepted as expenses classified as expenses of the enterprise.

Expenses are recognized as goods or services, payment for which will allow the enterprise to increase income or avoid additional expenses. In this case, expenses are allowed to be taken into account as economically justified.

Payments made without economic justification are not subject to accounting as expenses of the organization. Such expenses are recognized as expenses for the personal needs of the accountable person, and the amounts of such purchases are withheld from the employee’s income with the subsequent accrual of personal income tax.

Deadline for submitting a business trip report

The employee must fill out an advance report for travel expenses and submit it to the chief accountant or the person replacing him within 3 working days from the date of return from the business trip. Moreover, in this case it does not matter what business trip the employee was on: foreign or on the territory of the Russian Federation. This period is specified in the Bank of Russia instruction dated March 11, 2014 No. 3210-U. You can violate the 3-day deadline only for a good reason - for example, illness or when sent on another business trip. , the employee must submit an advance report within 3 days

There are cases when an employee actually lives on business trips. This is especially true for truck drivers. They bring cargo, unload and leave again. Sometimes a new business trip can begin on the same day as the previous one ended, or within a couple of days after its end. In this case, we recommend that the employee not delay in submitting the reporting documents for the business trip, so as not to lose or damage the supporting documents.

Normative base

According to Bank of Russia Directive No. 3210-U dated March 11, 2014, an accountable person may be:

- any employee of the organization, including a manager, a foreigner who is not a currency resident of the Russian Federation, a person who has an outstanding debt on previously received amounts;

- a subject performing duties under a civil contract.

The law does not provide for the transfer of cash to another employee. If necessary, you will have to return the funds to the cashier and carry out the procedure again.

If a decision is made to limit the list of subordinates who are entitled to receive accountable amounts, an order drawn up in any form will be required.

By order of the Bank of Russia, it is allowed to issue financial resources in any amount on account. At the same time, the employee should be explained that when carrying out cash transactions on behalf of the company, he must comply with the limit established by the regulatory act - 100 thousand rubles.

Violation is punishable by administrative sanctions:

| Face | Amount of recovery (thousand rubles) |

| Job title | 4–5 |

| Legal | 40–50 |

For individuals without individual entrepreneur status working under a civil contract, the limit on cash payments does not apply.

The Ministry of Finance, in letter dated July 21, 2017 N 09-01-07_46781, allows the transfer of accountable amounts to employees’ bank cards. To do this, indicate in the purpose of payment: “Under report for payment of travel expenses.”

According to Letter of the Ministry of Finance of the Russian Federation dated August 25, 2014 N 03-11-11_42288, the method of settlement with accountable persons does not relate to the accounting procedure and does not need to be fixed in the accounting policy of the enterprise.

Regardless of the duration of the interval for using funds specified in the manager’s order or the employee’s application, the period for returning the unspent amount is three days from the end of the trip.

The period was approved by Decree of the Government of the Russian Federation of October 13, 2008 N 749. The procedure for issuing money in this case does not matter.

How to fill out an advance report for a business trip

The travel report form is not legally approved. Therefore, the employer has the right to approve its report form (advance report) or use the AO-1 form. Let's look at filling out an advance report on a business trip using the AO-1 form as an example.

In such a report, after a business trip, the employee must fill out columns 1 – 6 of the reverse side of the advance report based on the documents that he brought with him.

The remaining columns of the report are filled out by the accountant.

There is no deadline for approval of the travel expense report . This procedure is prescribed by the employer. But it is better to approve the advance report within the next few days in order to post expenses in accounting and tax accounting on time.

You can find out how to fill out a business trip report form (sample) here:

SAMPLE OF ADVANCE REPORT FOR A BUSINESS TRAVEL

If the tickets and hotel were ordered and paid for by the company, then in the advance report the employee indicates only the amount of daily allowance for the business trip. The amount of daily allowance is calculated based on the standard established in the company’s act and the number of days of business travel.

Upon returning from a business trip abroad, the employee must fill out special column 6 “in currency” of the advance report if he received foreign currency for the business trip.

Nuances

In different situations, the preparation of an expense report has its own characteristics. Below are some of such cases.

When traveling abroad

A line-by-line translation of supporting documents written in a foreign language is required. It can be carried out by an invited professional or a company employee.

Decree of the Government of the Russian Federation 749 of October 3, 2008 regulates the reimbursement of expenses for travel registration, mandatory fees and medical insurance.

As a basis, you can submit documents containing the following data:

- about the amount of actual costs;

- names of paid services.

From business trip to vacation

In this case, the procedure for submitting the report differs only in that the employee must fill out and submit the paperwork to the accounting department within three days after the end of the next rest period.

For how long is sick leave paid? Read our article.

You will find information about the main accounting registers.

How to write an application for financial assistance? Find out .

In a budget institution

The advance report is drawn up in the form approved by Order of the Ministry of Finance of the Russian Federation 52N.

By personal car

If the trip is made in your own car, then the following documents must be presented as proof of expenses:

- waybill;

- cash receipt for fuel payment.

If you were fired during the trip. When to close a report?

In this situation, you will need to recall the employee to the place of work. Thus, all paperwork must be completed upon return, but no later than the date of termination of the employment contract.

Is one reporting document allowed for several work trips?

If we are talking about a business trip, then the following norm should be adhered to: the report must be submitted within the time limits specified by regulations, after the end of the trip.

In cases where permanent work is carried out on the road, you must report the expenditure of funds in the period for which they were issued.

Is it possible to issue one document for two employees?

This procedure is acceptable when money for a trip is given to one of the traveling employees.

Otherwise, each accountable person is obliged to draw up papers in relation to the amount received by him.

An advance report for a business trip is confirmation of the expenditure of funds that are provided to the employee to cover business expenses during the trip. It must be issued upon return within the prescribed interval and supported by supporting papers.

Supporting documents for a business trip

The list of supporting documents for a business trip is not established .

The advance report must be accompanied by documents confirming the expenses incurred during the business trip. These can be reporting documents for staying in a hotel or renting housing:

- hotel invoice and online receipt or certificate of services rendered;

- reporting documents for living in an apartment - a lease agreement or a lease deed and a document for payment (receipt, card extract, other payment document).

Travel costs to and from your destination can be supported by the following documents:

- passenger ticket and baggage receipt, boarding pass;

- Railway tickets;

- documents for other types of transport (for intercity bus, ferry, etc.);

- documents for renting a vehicle (lease agreement, certificate of services rendered and document for payment).

We take into account travel expenses

how the main business trip expenses are recognized for tax purposes .

| Type of expenses | Income tax | Personal income tax | Insurance contributions to the Pension Fund, Social Insurance Fund, Compulsory Compulsory Medical Insurance and Compulsory Compulsory Compulsory Medical Insurance | |

| Daily allowance in the amounts provided for by local regulations or collective agreement | Fully included in expenses | Not withheld from amounts not exceeding: (or) 700 rubles. per day - for business trips around Russia; (or) 2500 rub. per day - for business trips abroad. If the daily allowance was paid in a larger amount, then the excess amounts are subject to personal income tax | Not credited | |

| Daily allowances for the day of arrival from a business trip abroad must be paid according to the norm established for business trips in Russia (in rubles). And even if the regulations on business trips adopted by your company state that daily allowances for the last day of a business trip are paid in the same amount as for all days of a business trip abroad (for example, 2,500 rubles), only 700 rubles will not be subject to personal income tax. If daily allowances were paid in foreign currency, then in order to compare the amount of daily allowances with the established ruble standard for the purpose of calculating personal income tax, you need to convert them into rubles at the official exchange rate in effect on the date of payment of daily allowances (and not on the date of approval of the advance report) | ||||

| Travel expenses: — to the place of business trip and back (including business class or in SV carriages); — to the airport, train station, pier (including by taxi) and back | Counted into expenses without restrictions | Doesn't hold | Not credited | |

| Expenses for renting residential premises - subject to availability of supporting documents | Counted into expenses without restrictions | The entire hotel payment amount is not deducted. If there are no supporting documents, then personal income tax is imposed on amounts in excess of: (or) 700 rubles. per day - for business trips around Russia; (or) 2500 rub. per day - for foreign business trips | Not credited. If there are no supporting documents, then the amount reimbursed to the employee is not subject to contributions within the limits established in the local regulations. If you have not established such standards, then urgently supplement your business travel regulations with a procedure for reimbursing employees for unconfirmed expenses in order to avoid paying contributions | |

| Expenses for service in bars, restaurants, in the room, as well as fees for the use of recreational and health facilities (for example, a fitness room, sauna, etc.) are not taken into account for profit tax purposes. | ||||

| Costs for processing and issuing visas, international passports, vouchers, invitations, etc. | Counted into expenses without restrictions | Doesn't hold | Not credited | |

| Payment for communication services | ||||

| Payment for services of VIP lounges (superior lounges) at airports | ||||

| You can justify the cost of paying for VIP rooms, for example, like this: service in the VIP room provides access to telephone and other types of communications, as well as access to the Internet, which allows a business trip employee to quickly solve production problems that require his participation | ||||

Why do you need a boarding pass?

If my boarding pass is lost, how do I report it to the accounting department? A boarding pass or coupon (more and more often it is electronic and the employee prints it out independently or at the airport when checking in/boarding for a flight) confirms the fact of using the air ticket, i.e. the fact of the flight.

There are times when a boarding pass is not issued. This is possible on a charter flight or when renting an aircraft. In this case, the fact of the flight is confirmed by the flight sheet , which must be on each board.

If your boarding pass is lost, how can you report it? must the boarding pass or coupon along with the air ticket to his advance report - since it is the boarding pass with the security check mark that confirms the trip. There are many explanatory letters from the Ministry of Finance on this matter (dated 01/28/2020 No. 03-03-06/1/4908, dated 02/28/2019 No. 03-03-05/12957, dated 12/18/2017 No. 03-03-RZ/84409, dated 01/09/2017 No. 03-03-06/1/80056).

However, you can justify the fact of traveling on a business trip or back with any documents that confirm the use of purchased tickets. This position is reflected in the following letters from the Ministry of Finance: dated 03/10/2020 No. 03-03-07/17700, dated 01/28/2020 No. 03-03-06/1/4908, dated 12/09/2019 No. 03-03-05/95878, dated 02/28/2019 No. 03-03-05/12957, dated 06/18/2018 No. 03-03-07/41457.

a certificate from the airline about the flight that took place on a specific flight. Any airline has this information. However, some carriers issue such certificates for an additional fee. Therefore, if the employee is to blame for the loss of the boarding pass, he must pay the cost of the certificate.

In what form?

The advance report is documentation of a mandatory nature. Each employee who goes on a business trip is required to provide the company management or accounting department specialists with an advance report upon return.

For documents that are subject to mandatory registration, labor legislation provides unified forms for filling them out. The advance report is no exception.

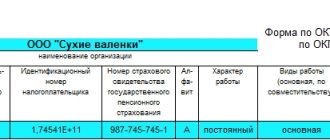

A unified form AO-1 has been developed for this form. It was approved by Resolution of the State Statistics Committee of the Russian Federation No. 55.

It is important to note that in 2013 it was decided to assign the AO-1 form a recommended character.

Therefore, it is not necessary to adhere to it at present. An organization can develop its own form.

When developing it, it is important to adhere to the requirements established for mandatory details. The latter are specified in Federal Law No. 402 - “On Accounting”.

The AO-1 advance report form has not lost its popularity even after it became optional. Most employers continue to use it in their work.

Who does it?

The advance report includes several parts. One of them is intended for entering information by an employee, the other - by an accountant.

Directive of the Central Bank of the Russian Federation No. 3210-U states that the document must be filled out by the person who received the accountable funds. These could be:

- employees of the enterprise;

- individuals who are freelance workers who have entered into a civil contract with the organization. For example, a contractor.

When filling out an advance report, the latter are treated as employees of the organization. The issuance of funds and the delivery of the remaining amount in this case should be carried out in the standard manner.

It should also be taken into account that the list of persons entitled to fill out the report, if desired by the head of the company, can be approved. information regarding this topic is prescribed in a local regulatory act - Regulations on business trips or others.

Reporting documents on business trips abroad

Upon returning from a trip abroad, the employee must attach documents confirming his expenses to the report. a copy of the passport with customs control marks on border crossing must be attached to the report a customs broker . An employee may also have consumable documents for currency exchange, obtaining a visa, translation services, compulsory medical insurance, fees for the right to enter vehicles, consular fees, etc.

All reporting documents, including those for accommodation, must be translated into Russian line by line. The translation can be done in a specialized company or performed by a full-time employee who is responsible for translating documents.

When receiving an advance payment for a foreign business trip in rubles, an employee may need to exchange currency. A document that will confirm these expenses can be a certificate from the bank about the movement on the account (if paying with a ruble card) or a certificate of purchase of currency issued by an exchange office.

Advance report for a business trip: rules for registration, nuances of filling out, accounting entries

In this case, the form must bear the signature (resolution) of the person who accepted the document. The latter's autograph will indicate that the report has been accepted for consideration.

To ensure that there are no difficulties when compiling a report, before going on a business trip, you should carefully familiarize yourself with the tasks set by management.

It is necessary that the tasks of the business trip be formalized in writing - in the form of a job assignment (if any incomprehensible issues are identified, they need to be resolved on the spot).

Thus, the responsibilities of the traveler are limited solely to the performance of those functions that will be specified in this document. It is the results of resolving these issues that should be reflected in the report first of all. If possible, they should be supported by additional supporting documents.

If during the trip the employer suddenly considers it necessary to assign some additional tasks to a subordinate, he will definitely have to agree with him on the possibility of completing them. At the same time, the employee has every right to refuse them.

The deadline for submitting a business trip report is determined individually and depends on the characteristics of the enterprise. On average, this is three working days, but in any case, this period should not exceed one month from the moment the employee returns from a business trip.

In addition to the report, the traveler must submit to the accounting department:

• advance report (on expenses incurred on a business trip);

• receipts, checks, travel tickets, etc. confirming payment papers;

• travel certificate (if issued).

Before moving on to a detailed description of the document, let's give some general information. Let's start with the fact that this report can be written either in any form, or in a unified form, or, if the organization has its own document template approved in the accounting policy, according to its type. The method for generating the report must be specified in the company’s local regulations.

The report can be written on a regular sheet of paper of any suitable format (preferably A4) or on letterhead - if this requirement is in the internal regulatory documents of the enterprise. You can write it either by hand or type it on a computer (with mandatory subsequent printing).

Only one rule must be unconditionally followed - the report must contain the autograph of the traveler, the person who accepted the report (usually the head of a structural unit), as well as the director of the enterprise (in addition to the signature, he must put his resolution on the report).

It is best to write the report in two identical copies (if by hand, then you can use a carbon copy), one of which should be given to management, the second, just in case, should be kept with you (after making a note to accept the copy from the employer’s representative).

First, a short explanation of the structure. If you are writing a report in any form (and this practice is now widespread), then mentally divide the form into three parts: the beginning, the main section and the ending.

Beginning – information about the document itself (number, place, date of preparation).

The main block is the report itself, which includes:

• its period (start and end date);

• basis (here you must indicate the document on the basis of which you were sent on a business trip - this could be an invitation from another organization, an order from the director, etc.);

• purpose of the trip (indicate the actual tasks that management has assigned to you);

• trip results: the more detailed, the better. If, as a result of the business trip, any agreements were concluded, certificates were received, etc. documents, you need to indicate their number and date.

If necessary, you can attach additional papers to the form, documenting their presence in the report as a separate item. At the end, the document must be signed and dated to the current date.

Business trip report

The preparation of a business trip report for management can be prescribed in the company’s local regulations. Such a report should not be confused with an advance report.

The business trip report contains information on the fulfillment of official assignment , which was issued for the period of the business trip.

EXAMPLE OF COMPLETING A REPORT ON A BUSINESS TRIP:

Took part in working meetings with ..... (for example, representatives of a partner company).

Resolved issues regarding the further implementation of work on project 11-A/2019 (to ensure reliable power supply during the preparation and holding of the EEF in 2021):

…. (disclose the list of issues worked out and the result of the solution).

The company may approve travel report forms. Or it is written as a free-form memo.

"Travel" VAT

And finally, a few words about VAT on travel expenses. Some companies purchase tickets through specialized agencies that issue a VAT invoice. At the same time, VAT is not allocated on the tickets themselves (Clause 7, Article 171 of the Tax Code of the Russian Federation). The Ministry of Finance says that in such a situation, if there is an invoice, there are no obstacles to deduction. However, it happens that tax authorities refuse to deduct tax. In their opinion, deduction of VAT on travel expenses to the place of business trip and back is possible only on the basis of a travel document (ticket), in which VAT is highlighted as a separate line , since this is required by Resolution N 914. And organizations have to seek the truth in the courts, which stand on their side.

In order not to run into a conflict with the tax authorities in the described situation, you can simply not “shine” the invoice issued to you, and write off the cost of purchased tickets entirely as expenses.

Organization of tax accounting, Expenses

| Home » HR » Business trip report |