Filling out a payment slip for UTII: problematic details

In practice, other payment details may be no less important for the UTII payer. Despite the fact that their incorrect indication, as in the case of the KBK, cannot be a basis for the Federal Tax Service to refuse to offset the payment, they should be known and applied correctly - in order to avoid any difficulties with the processing of the payment by the bank, as well as to quickly detect the payment Federal Tax Service upon receipt of funds into treasury accounts.

There are details that are quite difficult to make a mistake (for example, in the name of the payer). There are those that in many cases are filled in automatically (for example, the details of the payer’s bank - by a banking program). But there are also those that may be difficult to fill out. Such details include:

- OKTMO code;

- document number and date;

- priority, basis and purpose of payment;

- UIN code;

- taxable period.

Let's consider how to correctly determine the specified details, as well as where to get and how to fill out a receipt for UTII.

Kbk utvd 2019-2020 for individual entrepreneurs, penalties, fines

This article reveals the features of payment for the KBK UTII 2021 for individual entrepreneurs. The deadlines and codes of the budget organization for sending the payment are indicated.

A single imputed tax replaces standard scattered payments and eases the burden on small businesses. To avoid making a mistake when paying, you must use the KBK UTII 2021 for individual entrepreneurs - the digital designation of a budgetary institution.

Where to pay UTII

The Federal Tax Service is the body that is responsible for tax control. The service has divisions in populated areas. The choice of branch for payment is carried out on a territorial basis using UTII KBK. A general rule has been established: tax is paid at the place of activity.

Exceptions to the rule:

- cargo transportation;

- transportation of passengers;

- advertising placed on vehicles;

- delivery trade;

- payment of insurance premiums for employees.

Both categories are paid at the place of registration of the individual entrepreneur. Other types of activities, from household and veterinary services to the lease of a retail outlet, are subject to the main norm.

When to pay UTII to individual entrepreneurs

According to the law, the payer is obliged to timely repay tax debts to the state. UTII is no exception. Specific payment deadlines are set out in the Tax Code of the Russian Federation (Article 346.32). A quarter is recognized as a period. The deadline is the 25th day of the month following the last tax period.

Payment due in 2021

The rules haven't changed. There have been no changes to the timing. There are 4 quarters provided. At the end of each quarter, the merchant is obliged to pay UTII.

The following dates were in effect:

| Fourth quarter 2021 | Until January 25, 2021 |

| First quarter of 2021 | Until April 25, 2021 |

| Second quarter 2021 | Until July 25, 2021 |

| Third quarter 2021 | Until October 25, 2021 |

The last day of payment did not fall on a working day. Entrepreneurs paid according to the standard scheme, without transfer to working days

Pay attention to the time of filing the declaration. The deadline differs from the direct payment of tax - until the 20th of the corresponding month

In other words, the act is submitted earlier than the payment of the obligation.

Payment due in 2021

The norms will remain. Moreover, not a single day will be a holiday - merchants pay according to the standard scheme in accordance with the KBK for paying UTII in 2021. The quarters end in a similar manner - in January, April, July and October, respectively. The deadline for filing the declaration has also not changed.

| Fourth quarter 2021 | Until January 25, 2021 |

| First quarter of 2021 | Until April 25, 2021 |

| Second quarter 2021 | Until July 25, 2021 |

| Third quarter 2021 | Until October 25, 2021 |

CBC for UTII for paying taxes, penalties and fines IP 2019-2020

The budget organization code depends on the purpose of payment. The data is presented in the following table:

| UTII in 2021 for individual entrepreneur KBK (tax code itself) | 182 1 0500 110 |

| Penalty code | 182 1 0500 110 |

| KBK penalty UTII | 182 1 0500 110 |

Penalty is a sanction that is accrued daily for late payment of an obligation. Unlike a penalty, a fine is imposed for a specific violation. Despite the direct relationship of sanctions to “imputation”, the Code of Criminal Code of fines and penalties differs from the code of the tax itself. It is recommended to save the data so as not to confuse the direction of the money.

act:

- date of preparation and type of payment;

- information about the individual entrepreneur, his name and TIN;

- information about the recipient (indicate BIC, TIN and KPP;

- payment amount in numbers and words.

Since an individual entrepreneur does not have a checkpoint, “0” is indicated in the field. The document is drawn up in printed form on a tangible medium. It is acceptable to prepare an order in electronic format.

For ease of perception, below is a sample payment order that will help you avoid errors and typos when filling out.

VAT codes

Value added tax on goods (work, services) sold in Russia (KBK VAT code for 2015) 182 103 01000 011000 110

VAT penalties on goods, works, services sold on the territory of the Russian Federation 182 103 01000 012100 110

VAT penalty on goods, works, services sold on the territory of the Russian Federation 182 103 01000 013000 110

Value added tax on goods imported into Russia (from the Republics of Kazakhstan and Belarus) 182 104 01000 011000 110

How to fill out the details in a payment document for the transfer of UMDV in 2021

In the payment form, each field has its own number assigned only to it. In line 104 write down the combination for the imputed tax. It is located at the bottom left corner. The same budget classification code applies to legal entities and businessmen.

Example

An example is considered - Analytics LLC pays UTII for the 2nd quarter of the current year. The accounting employee is obliged to transfer money for the second period no later than July 25, 2021. To avoid penalties for failure to pay taxes on time, LLCs should adhere to this rule.

Filling out the declaration

Filling out a payment order looks like this:

- in field 104 indicate the BCC, which is the same for all imputation payers - 182 1 0500 110;

- in line 101 indicate 01;

- in field 105 you need to write OKTMO;

- TP is entered in line 106;

- in field 107 indicate KV.02.2019;

- line 106 contains the value 0;

- in field 109 they print the date of signing the UTII declaration for the 2nd tax period of 2019;

- in line 21 enter 5;

- field 22 indicates 0.

Businessmen and companies for which a special tax regime has been established are required to pay taxes no later than the 25th day of the month following the end of the tax period. To do this, fill out a sample payment order for UTII in 2021, and indicate the KBK in field 104. If the code is entered incorrectly, the amount will not go to the budget. Therefore, when filling out the document, employees are advised to check the accuracy of the entered combination and other information.

The code is an important detail in the payment, but not the only one. To issue a non-cash order, dozens of information must be indicated in the declaration in full compliance with the provisions approved by the Bank of Russia. The KBK UTII table for 2021 can be found on the Internet.

When to pay taxes

It must be said that in Russia UTII must be paid once a quarter - this is a quarterly payment. According to current legislation, the deadline for payment is limited to the 25th day of the month following the end of the given quarter. This means that the deadline for paying the single tax for the first quarter of the year is April 25th, etc.

It happens that the last possible payment date is a weekend, in which case it is moved to the first upcoming working day after it.

Which BCC is used to pay UTII in 2019-2020

If the KBK is indicated incorrectly in the payment slip, then the UTII (fine, fine for it) will be considered paid, however, most likely it will fall into the category of unknown. Any sanctions by the Federal Tax Service for transferring tax with an incorrect BCC are illegal, and those applied are successfully challenged in arbitration, as practice shows.

If the BCC is indicated incorrectly in the payment slip, then the UTII (fine, fine for it) will nevertheless be considered paid, but will most likely fall into the category of unknown. Any sanctions by the Federal Tax Service for transferring tax with an incorrect BCC are illegal, and those applied are successfully challenged in arbitration, as practice shows.

To learn how to correct errors in the KBK, read the material “An error was made in the KBK in a payment order.”

In turn, the tax payment will most likely not be counted (as a result, sanctions may be lawfully applied to the payer) if the payment reflects incorrect:

- Treasury bank account;

- the name of the financial institution in which the Federal Tax Service account is opened.

Let's study how to determine the relevant details correctly.

Where to get a receipt for UTII and how to fill out problematic details

If the person applying UTII does not have a bank account (for example, this is an individual entrepreneur who does not need an account for his activities), the tax can be paid through a bank branch using a receipt. As a rule, such payments are made through Sberbank, so we will tell you about the nuances of filling out the receipt used in Sberbank.

The same information is entered into it as in the payment order. The OKTMO code is determined according to the same principle as the key payment details that we studied above - that is, based on the place of business or location of the economic entity. Knowing in which municipality the company is registered, you can easily determine the corresponding code using the “Find out OKTMO” service on the Federal Tax Service website.

In paper receipt forms available at bank branches, the corresponding column may be called “OKATO Code”. This is an outdated name, and the OKTMO code should be entered in this column.

UTII is paid quarterly. If the tax is paid for the 3rd quarter of 2021, then in the details of the receipt “Name of payment” it is written in full that this is UTII and for which quarter it is paid - 3rd quarter of 2021. The column “Budget classification code” is also present in the receipt - the corresponding BCC from the list given at the beginning of the article should be entered there.

Another nuance is that the receipt must indicate the personal identification data of the payer - address, TIN. Special columns are provided for this.

The column “L/s No.” does not need to be filled in.

Such sections typical for a tax payment order as “Payment date”, “UIN code” are not found in bank receipts.

When filling out a payment slip for UTII, it is extremely undesirable to make a mistake in indicating the name of the bank in which the payee’s account is opened - the Federal Tax Service, as well as when indicating the account in the treasury. If there are errors here, tax authorities may not credit the payment. Indicating the correct BCC and other details also helps to avoid problems with making a payment through a bank and its processing by the tax service. If the UTII payer does not have a current account, you can pay the tax using a receipt.

More information on the topic is in the “UTII” section.

What actions to take if the KBK is entered incorrectly in the payment

When filling out a payment form, no one can be protected from errors, because even a small typo or one incorrectly written number will be considered an incorrect action. In this case, there is no need to be very upset, since the taxpayer only needs to come to the tax authority with an application to clarify the payment. The application itself is written in any form, since the law does not insist on any specific sample application. Along with the application, documents confirming the error (a copy of the incorrectly filled out payment slip) must be submitted.

It should be noted that all these actions are possible if such an error did not cause the specified amount of the Single Tax to not be transferred. If this happens, then the taxpayer will have to pay not only UTII, but also the corresponding penalty that accrued over a certain period.

What to do if you made a mistake

Let's look at the most common mistakes when making payments for taxes and contributions:

- Erroneous BCC for pension/social insurance contributions.

Essence: The tax payment indicates the BCC of fines or penalties, instead of the BCC of contributions.

In this case, the tax inspectorate often does not recognize the contribution as paid, and the payer, unexpectedly for himself, becomes indebted to the state for taxes (duties) and overpays for penalties.

Legal conflict:

- In this case, the pension fund or social insurance fund cannot offset the erroneous amounts among themselves; they do not have the authority to do so (laws 250 Federal Law, 243 Federal Law);

- payment of fines becomes an overpayment and these same funds have the authority to return the overpaid money to the taxpayer.

Solution:

- the first step is to pay the tax, contribution again, using the correct BCC and details;

- fill out an application for a refund of overpayments on fines to the Pension Fund of Russia or the Social Insurance Fund;

- wait for a decision (10 working days). The decision will be sent to the tax office for execution.

Important! The decision will be made if the taxpayer has no debt for periods that expired before January 1, 2021.

- Instead of tax in the payment to the Federal Tax Service, the budget classification code (BCC) for fines and penalties is indicated.

The bottom line: Despite all the similarities to the case discussed above, the difference is significant. This error concerns TAX. Differences in solution method.

Important nuance: The taxpayer instructed his bank to pay the tax (issued a payment order). There was enough money in the current account to pay this tax. The bank transferred funds from the current account.

Let's decipher the comment of the Ministry of Finance: The tax inspectorate cannot assume that the tax has not been paid; in fact, the money has been transferred to the state.

The question is that we hit the wrong item, an element of the budget. In practice, the tax inspectorate, if a mistake is made, declares that the tax has not been paid - this is illegal.

The options for considering the tax unpaid are regulated by the Tax Code in Article 45, paragraph 4.

Solution:

- notify the tax office in writing of your desire to clarify the payment, indicate the error and which details (budget classification code, payer status, tax period, etc.) are correct;

- attach documents to confirm that the tax is transferred to the appropriate treasury management account, that is, to the budget.

In order not to enter into unnecessary correspondence with the tax authorities, to return or offset incorrectly paid taxes, you need to be interested in all changes in tax legislation, fill out payments correctly and you can calmly work for the benefit of yourself, your family and the team of employees.

Federal Tax Service of the Russian Federation

Profit tax of organizations credited to federal budget funds 182 10101011011000 110

Penalties on income tax of organizations transferred to federal budget funds 182 10101011012100 110

Penalty for income tax of organizations transferred to federal budget funds 182 10101011013000 110

Profit tax of organizations credited to the budget funds of constituent entities of Russia 18200 110

Penalties for income tax of organizations credited to the budget funds of constituent entities of the Russian Federation 18200 110

Penalty for income tax of organizations credited to the budget funds of constituent entities of the Russian Federation 18200 110

Budget classification codes TAX ON INCOME RECEIPTS OF INDIVIDUALS for 2015 – Federal Tax Service of the Russian Federation.

Tax on personal income. The source of income is the tax agent (Code KBK INCOME TAX OF INDIVIDUALS 2015 for employees and employees), with the exception of Income under Art. 227, 227.1, 228 Tax Code of the Russian Federation 182 10102010 011000 110

Penalties for INCOME TAX FOR INDIVIDUALS. The source of income is a tax agent, with the exception of Income under Art. 227, 227.1, 228 Tax Code of the Russian Federation 182 10102010 012100 110

Penalty for INCOME TAX FOR INDIVIDUALS. The source of income is a tax agent, with the exception of Income under Art. 227, 227.1, 228 Tax Code of the Russian Federation 182 10102010 013000 110

Tax on income receipts of individuals (individual entrepreneurs, notaries, lawyers, etc., engaged in private practice in accordance with Article 227 of the Tax Code of the Russian Federation) 182 10102020 011000 110

Penalties INCOME TAX FOR INDIVIDUALS (individual entrepreneurs, notaries, lawyers, etc., engaged in private practice in accordance with Article 227 of the Tax Code of the Russian Federation) 182 10102020 012100 110

Fine INCOME TAX FOR INDIVIDUALS (individual entrepreneurs, notaries, lawyers, etc., engaged in private practice in accordance with Article 227 of the Tax Code of the Russian Federation) 182 10102020 013000 110

Tax on Income Receipts of Individuals on income received by individuals in accordance with Article 228 of the Tax Code of the Russian Federation (kbk Tax on Income Receipts of Individuals in 2015) 18210102030 011000 110

Penalties on INCOME TAX FOR INDIVIDUALS received by individuals in accordance with Article 228 of the Tax Code of the Russian Federation 182 10102030 012100 110

Fine on income received by individuals in accordance with Article 228 of the Tax Code of the Russian Federation 18210102030 013000 110

INCOME TAX FOR INDIVIDUALS in the form of fixed advance payments on income received by non-residents employed by citizens on the basis of a patent, respectively. With Article 227.1 of the Tax Code of the Russian Federation 182 10102040 011000 110

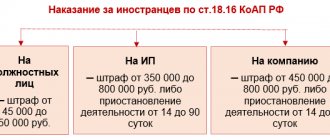

What is the liability for non-payment of tax?

Organizations and individual entrepreneurs that violated the deadline for paying UTII for the 4th quarter of 2019 may be held accountable.

1. Administrative liability for failure to pay the Unified Tax on Imputed Income:

- collection of tax arrears (clause 2, article 45 of the Tax Code of the Russian Federation);

- collection of a fine - 20% of the amount of UTII that was not paid if the non-payment was unintentional (clause 1 of Article 122 of the Tax Code of the Russian Federation);

- collection of a fine - 40% of the amount of UTII that was not paid if the non-payment was intentional (clause 3 of Article 122 of the Tax Code of the Russian Federation).

If UTII was paid, but not on time, the organization or individual entrepreneur will face penalties for each day of delay.

KBC for transferring penalties on UTII in 2021:

182 1 0500 110

KBC for paying off fines on UTII in 2021:

182 1 0500 110

2. Criminal liability for non-payment of UTII is provided for businessmen who have not paid tax in a particularly large (or large) amount.

In this case, the management of the organization, the chief accountant, as well as persons who are accomplices (instigators) of the crime may be found guilty. Such persons may be tax consultants or an accountant who deliberately distorted the primary documentation.

The material has been updated in accordance with changes in the legislation of the Russian Federation. Last modified date: 09/05/2019

How to transfer UTII tax to the budget

Organizations pay taxes only by bank transfer, and individual entrepreneurs can pay the budget either in cash or through a current account.

But in any case, when drawing up a payment document, you need to know a special code for transferring tax - KBK (budget classification code). If you enter the code value incorrectly, the payment will go unaccounted for and you will be left with arrears.

Budget classification codes are established by the Ministry of Finance.

KBK UTII 2021 for organizations and individual entrepreneurs was approved by Order of the Ministry of Finance dated September 17, 2019 N 149n. Budget classification codes.

| KBK UTII 2021 for tax payment | 182 1 0500 110 |

| KBC penalties for UTII in 2021 | 182 1 0500 110 |

| KBC fines for UTII in 2021 | 182 1 0500 110 |

Tax burden on UTII in 2020

For 2021, the Ministry of Economic Development plans to set the deflator coefficient K1 equal to 2.009. The order has not yet been approved, but there is a draft order with a new coefficient. In 2019, the deflator coefficient K1 is 1.915.

Let us remind you that UTII does not depend on actual income and expenses; the tax is calculated based on physical indicators, basic profitability, as well as coefficients K1 and K2. K2 is set by local authorities depending on the type of activity and working conditions. And K1 is the same for all imputed people. Accordingly, as K1 increases, the amount of UTII will also increase. We’ll show you exactly how with an example.

Example. How will the amount of UTII increase from 2021?

The organization is engaged in retail trade and applies UTII. The area of the store's sales area is 100 square meters. m. Coefficient K2 is equal to 1. The UTII rate is 15%. We will show how much the UTII amount will increase in 2020 compared to 2019.

KBK for tax payment

In order to correctly pay tax or insurance payments, it is necessary to indicate the correct BCC when making transfers to the budget. For each tax or fee, the KBK provides for the tax itself, a penalty or a fine. Differences within codes. Let's consider several typical situations.

Without employees

When paying UTII, it does not matter whether there are employees or not, the tax is paid on the area of the premises. BCC for tax payment - 182 1 05 02010 02 1000 110.

BCC for tax payment - 182 1 0500 110.

Insurance contributions to the Pension Fund for yourself

An entrepreneur pays insurance contributions for himself to the pension fund using the following codes:

| 182 1 0200 160 | income for the period until 2021 is less than or equal to 300,000 rubles - in a fixed amount from the minimum wage |

| 182 1 0210 160 | income from the beginning of 2021 is less than or equal to 300,000 rubles - 26,545 rubles by December 31, 2018 (fixed amount) |

| 182 1 0200 160 | income for the period until 2021 is more than 300,000 rubles - the amount exceeding 300,000 is multiplied by 1%. What happened must be paid to the state |

| 182 1 0210 160 | income from the beginning of 2021 is more than 300,000 rubles - We also multiply the excess amount by 1%. Payment until July 01, 2021 |

How to fill out a payment order

An important issue is to correctly fill out the payment order for taxes, and the correct work of accountants keeping records of activities.

The payer fields in the payment order are filled in in accordance with the details from the statutory and bank documents:

- payer TIN field;

- Payer checkpoint (value “zero” if individual entrepreneur);

- 1 – name of the payer, the full name of the individual entrepreneur and his address are indicated;

- 2 – if individual entrepreneur, code 09 is indicated. Field “Account. No. – bank account;

- The payer's bank is, respectively, the name of the bank in which the individual entrepreneur (legal entity) account is opened, the bank's BIC and the bank's correspondent account.

Filling in the fields of the recipient of the tax payment:

- field Recipient's bank – Name of Bank of Russia branch;

- BIC – Bank of Russia branch code;

- Recipient – Name of the tax authority. Usually it looks like this: “UFK for the city (name) (INFS No. city (name));

- Tax INN, tax checkpoint field;

- 3 – Type of payment (tax – 01);

- 4,5,6 – the date of the document is indicated. This field is optional. You can put “zero” in all three fields;

- 7 – the period is indicated, for example KV.01.2018 – for the 1st quarter of 2020;

- 8 – payment indicator, for example “current payment” (TP);

- 9 – OKTMO, code of place of business activity;

- 10 – The BCC of tax and insurance premium is indicated;

- Payment purpose field - indicates what tax and for what period. Example - “Payment of UTII for the 1st quarter of 2021.”

The most important fields are the recipient’s TIN and KPP; it is necessary to indicate the correct data from the tax office at the place of business of the UTII. Be sure to correctly indicate the BCC, OKTMO and the period for which the payment is made.

If there are errors in any of these fields, the payment will go to the wrong details, will go to the account of the wrong tax office, or will go to unidentified payments, and the tax will be considered unpaid.

This entails penalties (fines and penalties) from the tax authorities. However, some errors can be challenged.

Sample filling:

KBK UTII for individual entrepreneurs and legal entities

The budget classification code is a special digital code indicated when transferring amounts to the budget in order to correctly distribute them among items in the budget.

The KBK UTII 2021 for legal entities is the same as the KBK UTII in 2019 for individual entrepreneurs; the indicator in this case does not depend on the legal form of the taxpayer.

The value of the code must be set up-to-date in payment documents, in accordance with current legislation, otherwise the financial obligation will not be considered fulfilled. It is possible to correct the identified error, but it will require interaction with tax officials.

Who pays the tax

The UTII taxation system is a preferential tax payment regime provided for by law for certain categories of taxpayers subject to certain conditions and requirements. This system, also called “imputation,” allows you to pay only one instead of a whole series of taxes. Accordingly, not only costs are reduced, but also reporting. “Imputement” replaces four taxes:

- Personal income tax (but only for individual entrepreneurs);

- VAT;

- property tax;

- income tax.

There are restrictions on exemption from fees, they are specified in Art. 346.26 Tax Code of the Russian Federation.

To switch to this mode, you need to register for special registration. In addition, it is necessary that the type of activity of the subject be included in the list from Art. 346.26 of the Tax Code of the Russian Federation, the number of staff did not exceed 100 people and the requirements for the participation of other organizations in them were met.

Where is the KBK indicated?

The code values are indicated in the payment order for the transfer of the fee in field 104. This field must be filled in when making settlements with budgets. It is located at the bottom of the form on the left, below the “Recipient” column and above the purpose of the payment.

Table of values

BCC for payment of UTII in 2021 are established by Order of the Ministry of Finance No. 132n. It must be filled out when making payments to the budget. The value is the same for all categories of payers: commercial and non-commercial legal entities and individual entrepreneurs.

However, when assigning a payment, the code changes: the KBK “UTII Penalty 2019” for legal entities is set differently than when making the main tax payment (the value also does not depend on the legal form of the entity, that is, the same indicator is set for individual entrepreneurs).

Table. KBK UTII 2021 for LLC, JSC, individual entrepreneur and other legal forms of taxpayer.

| Payment type | Core Obligation | KBK "Peny on UTII" in 2021 | Penalties |

| A single tax on imputed income | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

Example of a payment order

Look at a sample UTII payment slip for the 1st quarter of 2019; BCC is indicated in field 104.

When filling out the form, it is necessary to take into account that the values of the BCC for UTII are set uniformly for all subjects of the Russian Federation, while other details depend on the location of the payer and payment must be transferred to the tax office that controls the territory in which the subject is officially registered as a tax payer under the simplified regime. Only taxpayers engaged in cargo transportation transfer funds to pay the fee at their place of registration.

You can find out the address and details of the Federal Tax Service on the official website of the Federal Tax Service.

Payment period

The payment terms are established in Art. 346.32 Tax Code of the Russian Federation. It is the same for all reporting periods (which are quarters) - until the 25th day of the month following the reporting quarter. Thus, in 2019 the deadlines are:

- for the first quarter - until April 25;

- for the second quarter - until July 25;

- for the third quarter - until October 25;

- for the fourth quarter - until January 25, 2021.

In 2021, none of the dates fall on a weekend, therefore, there will be no postponements. But in 2021, January 25 falls on a Saturday, which means the payment deadline is postponed to Monday, January 27.

Kbk yvd-2019 for individual entrepreneurs

Individual entrepreneurs who conduct business activities subject to a single tax on imputed income (UTII), and who voluntarily switched to this special regime, must pay UTII in the manner and within the time limits provided for in Art. 346.42 Tax Code of the Russian Federation. We will tell you about the deadlines for paying taxes in 2019 and the BCC for transferring UTII by entrepreneurs in our consultation.

Deadlines for paying UTII for 2021

UTII is paid by entrepreneurs (as well as organizations) quarterly. Tax for the past quarter must be paid no later than the 25th day of the first month of the next quarter (Clause 1, Article 346.32 of the Tax Code of the Russian Federation). The above means that for the tax periods of 2021, UTII must be transferred within the following periods:

1st quarter 04/25/2019

2nd quarter

Calendar of reporting and payment of tax on UTII

The UTII declaration is submitted within the deadlines specified in Article 346.32 of the Tax Code of the Russian Federation - no later than the 20th day of the first month following the reporting quarter.

The rule applies: if the deadline for submitting a declaration falls on a weekend or holiday, it is postponed to the next business day. However, in 2021, all these days will be working days, so there will be no postponement of the deadline. Deadlines for submitting UTII declarations in 2021 for individual entrepreneurs and organizations

| Reporting period | Deadline for submitting the declaration |

| 4th quarter 2021 | 20.01.2020 |

| 1st quarter 2021 | 20.04.2020 |

| 2nd quarter 2021 | 20.07.2020 |

| 3rd quarter 2021 | 20.10.2020 |

| 4th quarter 2021 | 20.01.2021 |

We recommend using our online service to prepare your UTII declaration. Spend just a few minutes and you will receive a print-ready and correctly completed report.

Create a UTII declaration

The UTII declaration contains information about the amount of tax to be transferred to the budget, so the Federal Tax Service will immediately be able to control their timely and full payment.

Only 5 days are allotted for this, i.e. The deadline for transfer is no later than the 25th day of the first month following the reporting quarter. Deadlines for paying UTII in 2021 (taking into account the postponement of weekends)

| Reporting period | Tax payment deadline |

| 4th quarter 2021 | 27.01.2020 |

| 1st quarter 2021 | 27.04.2020 |

| 2nd quarter 2021 | 27.07.2020 |

| 3rd quarter 2021 | 26.10.2020 |

| 4th quarter 2021 | 25.01.2021 |

Not sure if you calculated the tax on imputed income correctly? Check the amount on our UTII calculator. And if necessary, you can contact 1C:BO specialists for a free consultation.