The presence of a debt in a citizen entails not only the blocking of bank cards and seizure of wages, but also certain types of property in order. determined by law.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

At the same time, not all debtors know what else the bailiffs can confiscate and in what order, not to mention the measures taken to collect the debt - from suspension of a driver’s license to a ban on traveling abroad. And this is not the limit.

Basic moments

According to the latest statistics, in Russia there are approximately 40 million people who, for one reason or another, are in arrears on loan obligations or current payments for utility services. And what is typical is that the increase in debtors increases by several percent every year due to a decrease in living standards and loss of solvency.

However, the law is the same for everyone, and a citizen who has taken on financial obligations must repay them within the time limit established by the schedule. Otherwise, he will face forced collection of debt with the involvement of bailiffs, whose duties include the strict execution of court decisions and orders based on a previously held court hearing.

Normative base

Even if there is a court decision to repay the debt, not all defendants are ready to repay the existing debt, not only because they do not have the funds, but because they believe that they have a good reason for the arrears, and their debt should be forgiven. But the law also protects the rights of creditors who have the right to expect the return of funds previously provided to the borrower.

Thus, a number of measures are applied to debtors who do not want to execute court decisions voluntarily, the executors of which are the Federal Bailiff Service, operating only within the framework of regulations.

This:

- Federal Law of July 21, 1997 N 118-FZ;

- Federal Law of October 2, 2007 N 229-FZ.

What can the bailiffs take away?

The basis for securing a debt that was not paid on time and was the cause of litigation is always the property of the debtor. It is assumed that every adult citizen has some property that can be sold and thereby repay debts that were incurred as a result of unreasonable actions, malicious intent or a desire to delay execution. At least 1/3 of their number are people playing with fate on the verge of a foul. In the first ranks of those with debt are borrowers from banks and microfinance organizations (MFOs), who draw up a loan agreement, knowing in advance that they will not return the money. They have appropriate legal grounds for this. In addition to omissions in the laws, this is also facilitated by the dual, amorphous state policy in the field of compliance with social guarantees for the population. Until now, despite the extremely anti-social policies, the President and the Government have two taboos:

- a ban on using the full power of law enforcement to collect debts for housing and communal services;

- restrictions on bringing insolvent debtors to criminal liability, even if the fact of fraud is obvious.

Hotline for citizen consultations: 8-804-333-70-30

Being well aware of the consequences of non-payment of debt, most debtors are not particularly worried about their property, because they know: most of the life-sustaining items cannot be sold for debts.

You need to know this: When bailiffs come home - how to prepare for the visit and how to buy back seized property

The list of such assets that bailiffs can seize includes a wide variety of items, from land and real estate to cash. First of all, they seek to recover funds stored in bank accounts, Qiwi wallet and other electronic means of payment.

Rights and obligations of the FSSP

Bailiffs enter the debtor's house not of their own free will, but within the framework of the law, which gives them a number of rights and responsibilities.

Thus, by virtue of Article 12 of Federal Law No. 118, the bailiff has the right to:

- receive any information, including personal data of debtors for the execution of court decisions;

- verify all financial documentation from borrowers' employers;

- freely enter residential or non-residential premises belonging to citizens for inspection and inventory, as well as subsequent seizure of available property;

- put fugitive defendants on the wanted list;

- call citizens to give explanations to the FSSP.

In this case, bailiffs are obliged to:

- execute court decisions in strict accordance;

- provide debtors with information on the existing debt, as well as the opportunity to repay the debt within the framework of the law in stages;

- carry out a search for both the debtor himself and his property in order to properly execute the court decision;

- consider the defendants' applications for the procedure for repaying the debt with a reduction in the recovery percentage in the presence of certain circumstances;

- Be guided in your actions only by the rules of the law.

Who pays off the loan in the event of the borrower's death? Information is in the article. The father does not pay the loan. What should children do? Find out here.

What can bailiffs take away in 2021?

Bailiffs have very broad powers to seize the property of debtors in order to pay off the resulting debt. But in the process of seizure, they are obliged to respect the interests of other citizens, in particular, members of the debtor’s family, which is why so many questions arise.

In case of non-payment of loan

The very fact that credit obligations are overdue does not entail a visit from the bailiffs, given that they must have a court decision or an order on their hands, on the basis of which the seizure is made.

If there is a debt and a judicial act specifically to repay the loan, bailiffs can seize:

- pieces of furniture;

- household appliances;

- residential premises owned by the debtor;

- household items;

- jewelry;

- automobile.

That is, practically everything that belongs to the debtor on the basis of ownership rights by him, and not by members of his family.

The issue of confiscation of things and items that are jointly owned is considered separately, especially if we are talking about indivisible things, such as an apartment or a plot of land.

And of course, the bank has the right to seize, through the bailiffs, the collateral that served as insurance for the repayment of the loan, namely, the same mortgaged apartment or vehicle, without taking into account the restrictions provided for in Article 446 of the Code of Civil Procedure of the Russian Federation.

Which things

By virtue of Article 446 of the Code of Civil Procedure of the Russian Federation, personal use items are not subject to seizure, but with some exceptions.

The bailiffs have every right to take away jewelry, as well as luxury items that are not considered necessary, that is, fur coats, if there are several of them.

The bailiffs do not have the right to confiscate other things, for example, dresses, trousers, shirts, even if the wardrobe is very impressive.

Furniture from the apartment

Furniture is exactly the same property as real estate, which is why bailiffs can seize, despite their size, sofas and wardrobes, as well as furniture walls.

However, they do not have the right to empty the apartment completely, given that the minimum necessary for personal use must be left.

For example, if 4 people are registered in an apartment, at least 4 chairs, a table, and several beds will not be taken away. By the way, they will not be able to seize items that do not belong to the debtor, but, for example, to his grandmother or wife.

car

As a rule, in order to pay off an existing debt, the first thing that is seized is money and a vehicle, given that both the first and the second are quite easy to seize.

However, there are some restrictions regarding the machine.

Thus, within the framework of Article 446 of the Code of Civil Procedure of the Russian Federation, a car cannot be taken away if it is a way of obtaining a livelihood, which is relevant, for example, for taxi drivers or freight forwarders.

Telephones, TV and other equipment

Household appliances can also be subject to seizure to offset existing debt, but only subject to certain rules:

- If each mechanism has a warranty card, as well as information about the purchaser, this will allow you to determine the owner. If the same microwave oven was registered by a family member, and not by the debtor, the bailiffs will no longer be able to take the equipment.

- Also, the penalty may not apply to all items, given that the required minimum must be left. In particular, the same refrigerator will not be touched, since the family needs to store food somewhere, but the TV and computer may be confiscated. But they will leave the stove, given that family members need to cook food, while they will deprive the microwave, because porridge can be heated on the stove.

Gift property

By virtue of the norms of Federal Law No. 229, any property that belongs to the debtor is subject to seizure, regardless of how the ownership right was obtained - as a result of purchase or donation.

That is, the donated property will be confiscated on a general basis.

At the same time, I would like to separately note the transfer of the debtor’s property to his relatives after the court decision on collection. In this situation, the gift agreement can be challenged, given that there is clearly evidence of evasion of debt repayment.

Money

Money is debited from bank cards and accounts of debtors first.

The debt itself is formed in monetary terms and thus it is easier to cover it.

But the seized property must first be seized, assessed and sold, and then the debt must be repaid. This involves time and certain costs.

Moreover, taking into account that it is impossible to completely deprive the debtor of the means of subsistence, the law provides for a percentage of income seizure.

In Article 99 of Federal Law No. 229, the amount of the penalty is initially applied to existing savings in general, and subsequently only to 50% of monthly earnings until the debt is fully repaid.

Moreover, in a number of cases that relate to arrears of alimony and compensation for damage to health, this limitation does not apply and collection can be made at the rate of 70%.

Pension

Pension benefits are considered income within the framework of the law. Therefore, if there is a debt, funds are also collected from the specified payment within the framework of the norms of Article 98 of Federal Law No. 229.

So:

- If the pensioner’s debt is less than 10 thousand on the basis of a collection order sent to the territorial administration of the Pension Fund by bailiffs, Pension Fund employees are required to make a deduction.

- If there are not enough funds in the account, the debt amount is divided into several parts until full repayment.

For debts

By virtue of Federal Law No. 229, practically all the property that belongs to him by right of ownership can be confiscated from the debtor, as well as foreclosure can be imposed on property that partially belongs to him.

That is, in fact, during the seizure, they can take away everything except the necessary minimum belonging to the family, but they will sort it out later, and even then on the basis of an application for the return of part of the funds and items due to the fact that the same sofa belonged to the wife and not the husband.

Pick up a child

A child, like parental rights themselves, is not a subject of property.

A father or mother cannot lose their child, as well as the legal rights to raise him if there is debt.

However, if the dad is a malicious evader from providing for the children and has a significant alimony arrears, the mother can initiate a lawsuit to deprive the dad of parental rights, of course, in conjunction with other negative circumstances in the form of abuse and evasion of upbringing. But the bailiffs have no right to lay claim to the children.

Parents' property

By virtue of Federal Law No. 229, a debtor can be liable for his debts only with the property that belongs to him by right of ownership.

Items and things provided to him for rent or temporary use by other persons, including close relatives, cannot be confiscated.

That is, if the debtor’s dad gave him his computer for a while, the bailiff does not have the right to seize the specified item.

Real estate (including the only residence)

Residential premises, along with other property, are also subject to seizure to pay off existing debt, but only under certain circumstances.

Thus, Article 446 of the Code of Civil Procedure of the Russian Federation states that an apartment, which is the only home of a family, cannot be confiscated to pay off a debt, regardless of its size, as well as the presence of other property.

However, if the specified housing is collateral in a mortgage loan, the condition established by Article 446 of the Code of Civil Procedure of the Russian Federation does not apply.

Driver license

Permits themselves for carrying out any type of activity do not have material value for third parties.

That is why a driver’s license cannot be confiscated, but its action can be suspended by order of the bailiffs.

Article 67.1 of Federal Law No. 229 states that the right to drive a vehicle can be temporarily limited, but not if the debtor’s main type of employment is related to the same driving activity.

What are the consequences of declaring an individual bankrupt? Collectors threaten violence. What to do? Find out here.

I'm on maternity leave. There is nothing to pay the loan with. What to do? Information is here.

Maternal capital

By virtue of Federal Law No. 256 dated December 29, 2006, maternity capital can be used not only to cover the immediate needs of children, but also to buy an apartment or form a mother’s funded pension.

However, the capital is still not the property of the parents, but a measure of state support, spent under the strict control of the Pension Fund.

And since money can be allocated only on the grounds approved by Article 7 of Federal Law No. 256, the bailiffs cannot seize these funds to cover the debt.

At IP

By virtue of Article 23 of the Civil Code of the Russian Federation, an individual entrepreneur is not a legal entity, although he receives the right to conduct commercial activities.

And since a separate business entity is not created for all of its debts, the individual entrepreneur is liable with his personal property - from an apartment and a microwave oven to a tractor and a lawn mower.

In children

Debts can accumulate not only among adult citizens, but also among persons who have not reached the age of majority. Indeed, by virtue of Article 26 of the Civil Code of the Russian Federation, children from 14 to 18 years of age have the right to independently manage their funds, as well as make small household transactions, which in some cases can lead to the formation of debt.

And, nevertheless, due to their minority status, bailiffs cannot open enforcement proceedings against children, and therefore parents are held accountable as legal representatives.

At the guarantor's

Under Part 2 of Article 363 of the Civil Code of the Russian Federation, the guarantor is jointly and severally liable for the debts of the borrower to the bank, which predetermines the possibility of seizure of property from the specified person by bailiffs.

However, before the property to repay the debt is described, you need to carefully study the agreement for the same loan, taking into account that subsidiary liability may not always be present.

In a large family

The very status of debtors and their belonging to a certain less protected social group is not a basis for refusing to seize property.

However, given that parents with many children are obliged to worry not only about repaying the debt, but also about the needs of their children, the bailiff can set them a minimum percentage of debt repayment, of course, after confiscating things and items that the family can do without.

If there is no property

Cases where the debtor does not have his own property are quite common. After all, some people specifically register everything in advance for their wife or mother-in-law, while others do not yet have time to acquire their own things.

However, debts still need to be repaid, which is why the penalty is applied to the debtor’s monthly salary in the percentage ratio established by the norms of Article 99 of Federal Law No. 229.

Other

Depending on the amount of the debt, bailiffs do not always foreclose on existing property and in some cases may instead take other measures to repay the debt.

Thus, by virtue of Article 67 of Federal Law No. 229, the debtor may be subject to a temporary restriction on traveling abroad, and on the basis of Art. 67.1 of Federal Law No. 229, a special right is suspended, that is, a license to perform certain types of work has been canceled or a driver’s license has been blocked.

What do they not have the right to take?

Within the framework of Article 68 of Federal Law No. 229, bailiffs have fairly broad powers and can deprive the debtor of almost everything, with the exception of the minimum necessary for living. But, nevertheless, bailiffs do not have the right to seize certain types of property.

Thus, by virtue of Article 446 of the Code of Civil Procedure, it is not subject to seizure for any amount of debt:

- an apartment or house that is the only home for the debtor and his family, especially if there are small children;

- the land plot on which the house is located, which is the only dwelling;

- personal items, namely clothing and shoes;

- home furnishings, but only to the required minimum;

- things or items that are necessary for professional activities;

- domestic animals, namely cows, sheep, goats and items necessary for their maintenance;

- Food;

- fuel, that is, coal, which the family needs for heating;

- prizes and medals.

Rights and powers of a bailiff

At the very beginning of communication with bailiffs, it is important to pay attention to their appearance and distinctive features.

They must wear a special civil servant uniform, present the appropriate document - a court order, as well as a document indicating the exact amount of the bank client's debt. The debtor must understand that the bailiffs represent the law, so it makes no sense to resist or not open the door to them. On the contrary, those who enter into dialogue with representatives of the law and try to constructively solve this problem have a greater chance of saving their property or getting by with minimal losses.

Bailiffs have the right to seize the debtor's property and valuables in payment of debt, with the exception of certain categories. These include:

- the only housing owned by the debtor;

- items necessary for professional activities (computer, musical instruments for a musician or an easel for an artist);

- things that belong to other family members (this must be confirmed by purchase receipts);

- clothing, utensils and other things necessary for life.

You can find out more precisely what bailiffs can take away by studying the relevant chapters of Article 446 of the Civil Code.

What to do and how to behave?

After the court decision to repay the debt comes into force, the issue of execution of the specified act is entrusted to the bailiffs, which does not at all mean an inventory of all property the next day.

To begin with, the bailiff must take some steps to eliminate the debt by blocking the same bank accounts and cards, and only if there is not enough money, resolve the issue of forced seizure of property.

However, even after this, a resolution to initiate enforcement proceedings is first drawn up and the debtor is notified of the need to repay the debt voluntarily.

And at this stage, a visit from the bailiffs to your home can be avoided if you personally appear at the service and draw up a schedule for repaying the debt in stages.

If there was no visit, the bailiffs are in any case obliged to notify of their appearance and purpose and only then visit the debtor.

At the same time, even if the bailiff appears on the doorstep, you should not panic, since only the personal property of the debtor has the right to describe.

By the way, it should be remembered that the actions of the bailiffs can be challenged and some things can be returned if they are joint property, but only on the basis of an application and supporting data, that is, checks and receipts.

Payment order

The federal legislation on enforcement proceedings establishes that creditors' claims are satisfied in a certain order. There are several queues:

- Debts for alimony for minor children, disabled relatives, compensation for harm caused to health.

- Settlements under employment agreements, payment of wages, bonuses to employees, remuneration for intellectual activity.

- Payment of taxes and other obligations to the state budget.

- Transfer of money under other writs of execution, satisfaction of claims of other creditors.

What will happen next?

By virtue of Article 84 of Federal Law No. 229, to begin with, the bailiffs, in the presence of witnesses, draw up an inventory of the property, and then they confiscate it and place it in storage or leave it to the debtor, but with the delivery of a decree on the seizure of individual items.

However, as a rule, this procedure applies to large items that are very difficult to transport.

Other things are placed in specially equipped storage facilities, for which authorized persons are responsible based on the resolution.

Who will evaluate the confiscated property and how?

Naturally, the next step is to evaluate the property by the bailiff himself, based on current market prices and the degree of wear and tear.

However, if the seized items are classified as specialized, an appraiser is engaged on the basis of a resolution, and a copy of the information about the obtained value of the items is sent to the debtor.

If he does not agree with the amount, he can protest it and attract another appraiser at his own expense.

Sale of property

As a rule, if the total amount of the described things by virtue of Article 87 of Federal Law No. 229 does not exceed 30 thousand, the debtor can sell them independently.

However, if there is property for a larger amount, specialized institutions are involved in the manner prescribed by Article 87 of Federal Law No. 229.

Then, within 30 days, items from the inventory are offered for sale.

If no one wants to purchase them, based on the bailiff's decision, the price is reduced by 15%.

However, if the property still has not found its buyers after the next month, everything is transferred to the claimant at a price 25% lower than the previous value.

At the same time, the collector is not obliged to accept the debtor’s things in kind, and may refuse to accept them, which is why, in the absence of the opportunity to sell anything or transfer it to pay off the debt, everything is returned to the debtor and the issue of repaying the debt is resolved accordingly using other measures.

Where to go if you lose your passport as a citizen of the Russian Federation? Details are in our article. Is it possible to complain about bailiffs over the phone? Find out here.

What property is not subject to seizure by bailiffs

The task of the bailiffs is to collect the required amount according to the writ of execution. Guided by these goals, FSPP employees strive to take away expensive property that is easy to sell. The debtor has the right to participate in the selection of values for the final repayment of the debt. Under objective conditions, not all property is subject to seizure. Its alienation is considered illegal, and the defaulter can protest the actions of the bailiffs. This rule also applies to material assets that provide the basic needs of the debtor. This list contains the following assets:

- Bailiffs do not have the right to describe the furniture and home furnishings in the apartment that satisfy the minimum household needs of the defendant.

- Assets necessary for the debtor’s professional activities, if their value does not exceed 100 minimum wages.

- Agricultural objects (breeding livestock, outbuildings), if they are used for personal consumption and are not related to business activities.

- Cash and food in the amount of the subsistence minimum per debtor and his dependents.

- Bailiffs cannot take away transport and equipment for disabled people from the debtor.

- Fuel for heating homes and cooking.

- Bailiffs do not have the right to take prize awards from the apartment, even those that are of material value.

Site Expert

Beloborodova Yulia

From 2004 to 2012 she worked as a bailiff. Specializes in the field of procedural, civil, financial, family and labor law.

Ask a Question

Also, the penalty does not apply to social payments, benefits related to harm to health, and alimony for minors. If the amount of debt does not exceed 3,000 rubles, the property will not be seized. The exception is cases where material assets are pledged.

Property that the bailiffs can seize, but they will not be able to sell it:

- The only housing intended for the debtor and his family. And also, the bailiffs do not have the right to take away the debtor’s housing if its value significantly exceeds the amount of the claims.

- Land on which the only dwelling is located.

- Not the only housing with a mortgage is not alienated, if the claims are not related to the bank’s demands for non-payment of the mortgage loan.

Tips and tricks

What documents must the employee present?

Seizure of property to pay off existing debt is carried out only on the basis of documents, the list of which is approved by Article 80 of Federal Law No. 229.

During a personal visit, the bailiff must present:

- FSSP employee ID;

- resolution to seize property.

What to do if you don't live alone? Can a wife be taken away from her husband?

The law strictly protects the property rights of every citizen. That is why it is legally impossible to collect the debt from the debtor’s wife.

However, if a couple owns real estate acquired during marriage, part of the apartment may be arrested, but only after being allocated shares in kind.

Is it possible to avoid the arrival of employees?

Forced seizure of property is used only if the debtor independently does not want to comply with the court decision.

However, if, after drawing up the resolution on enforcement proceedings and receiving it in person, he personally appears at the FSSP and draws up a statement with the procedure for repaying the debt, the bailiffs will have no reason to visit the house.

Is it possible to return what was taken?

The law allocates at least 30 days for the sale of property, but in anticipation of this, an appraiser is also involved, who can also make calculations throughout the month. As a result, the debtor has time to repay the debt and return the seized property or challenge the actions of the bailiffs, for example, if his wife’s things were seized.

How to protect yourself?

The best option to avoid a visit from the bailiffs is a negotiated debt repayment regime both with the debt collector himself at the pre-trial stage of the proceedings, and with the bailiffs who are not interested in tinkering with old microwaves and sofas.

How to remove blocking from bank cards?

As a rule, the first action of the bailiffs is to block the debtor's bank accounts, which automatically implies the seizure of cards, including salary cards.

And since the bailiff does not have information about which card the debtor has - salary or deposit - everything is blocked.

However, by virtue of Article 99 of Federal Law No. 229, bailiffs can remove the debt monthly from the salary in the amount of no more than 50%, of course, if the debt does not relate to alimony. Therefore, the debtor, after receiving information from the bank about the seizure of his account, must contact the bailiff with a statement and a certificate from the company that the account is a salary account.

Can bailiffs arrest a debtor?

If you stop paying your loan, expect a subpoena and then bailiffs at your doorstep.

Bailiffs use many methods to collect debt. But do they have the right to arrest the debtor? We will talk about this in our article.

How does collection work?

As soon as the court decision to collect the credit debt comes into force, the bank sends a writ of execution to the bailiff service.

Having received the document, the FSSP employee opens enforcement proceedings, notifies the debtor about this, and invites him to voluntarily pay the debt within 5 days.

You have exactly 5 days to repay the debt voluntarily.

If the bailiff's demand is ignored, he has the right to visit you in order to seize your property. It should be noted that the bailiff’s visit will be legal only from 6 a.m. to 10 p.m.

Bailiffs have no right to show up at your place in the middle of the night.

Powers of bailiffs

In their work, FSSP employees are guided by the provisions of the Federal Law “On Enforcement Proceedings”. They are provided with a large list of rights and ways of influencing an unscrupulous debtor.

Bailiffs have the right:

- request information about the defaulter from various authorities (at the place of work, at the bank, etc.);

- call the debtor for a conversation;

- enter a citizen’s home without his consent, and even open the locks on the entrance doors;

- seize the debtor's property and sell it at auction;

- seize bank accounts;

- put the defaulter on the wanted list.

Thus, the FSSP officer cannot arrest you - he simply does not have such powers. If you are hiding, you will be wanted.

Bailiffs can take your property, but do not have the right to arrest it.

What can't bailiffs take away?

Usually the court makes a decision to withhold a certain amount from the defaulter’s bank account (up to 50% of official income), and only in rare cases does it come to the seizure of property.

Remember that not all property can be taken away. Not subject to collection:

- Household items

Things you can't live without in everyday life. For example, the bailiffs will not take away a gas stove, but they can take away a microwave oven. This category also includes the concept of “luxury goods”. For example, if you only have one TV, then they will leave it. If there are two of them, one will definitely be taken away.

- Property from which you earn your living

If you are a taxi driver and use your car to make a living, they will leave the car for you. You don’t have to worry about the computer either, if you need it for work.

- Livestock, poultry or bees

They also cannot be removed. The exception is that you are breeding them for the purpose of earning money, that is, you are an entrepreneur.

Your apartment or house where you live with your family will also be left behind. Conditions are your only home. If your spouse has another apartment, then your property will be seized.

- The property of a disabled person, which he needs due to his physical condition.

This could be a wheelchair, a special car or other items necessary for movement and normal existence in society (prostheses, hearing aids, etc.).

Bailiffs can take away jewelry and jewelry—luxuries that are not needed for survival.

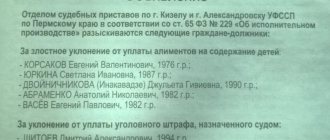

When does the bailiff start looking for the debtor?

The search begins if the FSSP officer was unable to establish the real location of the debtor himself or his property.

Search activities are prescribed in the following situations:

- alimony debt;

- compensation for damage to health caused by the debtor;

- if the amount of debt is more than 10 thousand rubles;

- compensation for damage caused as a result of a crime;

- execution of a court decision on serving compulsory labor.

The law clearly regulates the procedure for putting a defaulter on the wanted list. Activities are carried out both on the territory of the Russian Federation and in other countries (subject to agreement).

The bailiff has the right to use information received from private detectives or use the capabilities of the media. The search for the debtor is carried out by a special FSSP employee - a search officer.

While they are looking for you, the enforcement proceedings in the case are suspended, but not closed.

How to delay the bailiff's visit?

After the court decision to collect the debt comes into legal force, you will be sent an account number and a requirement to deposit the entire amount of the debt into it. Exactly 5 days are given for payment.

If you have not taken any measures to pay the debt, then the seizure of accounts and property cannot be avoided.

But there is a way out - go to court with a request to defer the payment of the debt. In the text of the application please write:

- the name of the court that made the decision in the case;

- personal data;

- the reasons why you need a deferment of payments - the planned sale of real estate, returning to work from maternity leave, etc.;

- evidence that your financial situation will soon improve and you will be able to pay off your debt.

It is important to submit your application on the exact day the court renders its verdict in your case. If the judge finds your arguments convincing, he will meet you halfway.

An application for deferment of payments is submitted to the court that made the decision to collect the debt.

While the court is considering your application, you have the right to demand that the bailiffs postpone actions to collect the debt.

If you managed to achieve a deferment, FSSP employees do not have the right to come to your home. If they nevertheless decide to drop by to see you, you can, with a clear conscience, not let them into the house.

It is better not to bring the matter to court and pay off your debts on time. Otherwise, you can lose not only money in bank accounts, but also honestly acquired property.

To check whether enforcement proceedings are being carried out against you, you need to go to the official website of the FSSP and enter your personal data in a special window. The system will show all your unpaid debts, if any.

Source: https://protivdolgov.ru/dolg-sudebnym-pristavam/mozhno-li-platit-dolg-sudebnym-pristavam-chastyami-2