The categories of persons who can qualify for unemployment benefits are limited by Law No. 1032-1 of April 19, 1991, including individual entrepreneurs. That is, citizens who are registered as individual entrepreneurs will not be able to receive payment until they close their business.

The payout size is limited by a minimum and maximum value. Former entrepreneurs can only count on a minimum amount, taking into account the increasing coefficient in the region. The coronavirus quarantine announced in 2021 increased the maximum benefit amount, but did not change the lower limit.

Who can register with the CZN?

The main regulations that regulate employment issues are:

- Law of the Russian Federation of April 19, 1991 No. 1032-1.

- Decree of the Government of the Russian Federation of September 7, 2012 No. 891.

They determine the categories of persons who are classified as unemployed and the procedure for registering them with the Employment Center.

According to the rules of Article 3 of Law No. 1032-1, the right to register is given to able-bodied citizens who do not have a job or income. However, not all payments from an employer are considered earnings. In order to support citizens laid off not on their own initiative, the state does not consider the payments they receive upon layoff as earnings (what benefits do they receive at the labor exchange upon dismissal of their own free will?).

The main signs of an unemployed person are the lack of a place of permanent activity, lack of income and ability to work, that is, the state of health must allow the citizen to perform work.

A person registered as an individual entrepreneur is not recognized as unemployed.

Law No. 1032-1 also defines categories of persons who, having been de-registered as individual entrepreneurs, cannot be registered with the Central Prison Center:

- those who have entered into an employment contract on a full-time or part-time basis, seasonal and temporary workers;

- temporarily absent from the workplace due to vacation, sick leave, retraining or advanced training courses, military training, strike;

- members of production cooperatives and artels;

- registered as a notary, lawyer;

- those employed in auxiliary industries and selling products under contracts;

- those who have concluded civil contracts for the performance of work, provision of services and copyright agreements;

- appointed or confirmed to an elected position;

- persons undergoing military, alternative civilian service or service in the internal affairs department, the Ministry of Emergency Situations, the penitentiary system;

- students and other full-time students;

- founders of commercial organizations;

- members of a peasant or farm enterprise;

- those receiving old-age pensions, including early, funded, and long-service pensions;

- refused two suitable vacancies within 10 days;

- failed to appear without good reason within 10 days from the date of their registration to offer a suitable job;

- sentenced by a court decision to correctional labor, as well as to punishment in the form of imprisonment.

Registration will be denied to a person who provided false information or concealed the fact of having a job and income.

How to fill out an application

The data that needs to be entered is obvious and minimal - the main thing is to correctly indicate the bank details. But there is one trick - you need to indicate for what month the individual entrepreneur expects to receive the subsidy:

- for April - code 04;

- for May - 05;

- for both months - 0405.

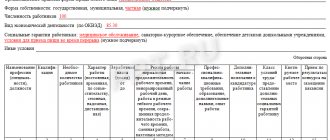

| Appendix No. 2 to the Rules for the provision in 2021 from the federal budget of subsidies to small and medium-sized businesses operating in sectors of the Russian economy that were most affected by the worsening situation as a result of the spread of the new coronavirus infection (form) Individual entrepreneur Petrov Petr Petrovich TIN 7812345678 Statement No. 1 I ask you to provide the Individual Entrepreneur Petrov Petrovich with the subsidy provided for by Decree of the Government of the Russian Federation dated April 24, 2021 No. 576 “On approval of the Rules for the provision in 2021 from the federal budget of subsidies to small and medium-sized businesses operating in sectors of the Russian economy to the greatest extent victims in a worsening situation as a result of the spread of a new coronavirus infection,” for 2021, month code: 0405 Please transfer the specified subsidy to a current account opened with PJSC Sberbank in St. Petersburg, correspondent account: 3010800400000007892, BIC: 0440578797, INN/ (checkpoint) bank 7809490557/78618001 Account number 4070860870805640694651 Recipient Individual entrepreneur Petrov Petr Petrovich With this application I confirm the fulfillment of the obligation to provide information in the form “Information on insured persons”, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated February 1, 2021 No. 83p, in full in the manner and within the time limits established by the legislation of the Russian Federation. Individual entrepreneur ______________________ (signature) __________________________ (date) |

Can an individual entrepreneur receive assistance from the budget?

One of the conditions for receiving unemployment benefits is registration with the Employment Center. Individual entrepreneurs are classified by law as employees. For this reason, they cannot be accepted for registration in the central registration center.

An individual entrepreneur will be able to count on receiving benefits only if he officially ceases his activities and is excluded from the Unified State Register of Individual Entrepreneurs.

The fact of termination of activity and exclusion from the Unified State Register of Individual Entrepreneurs must be documented.

Let's sum it up

It must be admitted that there is currently little tangible assistance from the state when opening an individual entrepreneur. Existing programs are mainly aimed at existing businesses, and not at those who are taking their first steps. In reality, an entrepreneur can only count on getting back the money spent on registering an individual entrepreneur.

But in some regions, the authorities still continue the subsidy program through Employment Centers. To count on government money, you need to present a good business plan. We have provided the general rules by which such support is implemented. Details of the programs need to be found in the regional offices of the Center for Significance.

How can a former businessman obtain unemployed status?

The procedure for an individual entrepreneur to obtain unemployed status consists of several stages. First, you must officially cease your activities, which involve exclusion from the Unified State Register of Individual Entrepreneurs. Then you will need to prepare a number of documents. And finally, you need to contact the central control center.

Termination of activities

The procedure for terminating the activities of an individual entrepreneur is regulated by the norms of Federal Law of August 8, 2001 No. 129-FZ.

- The first step will be to fire employees. If the entrepreneur entered into employment contracts with individuals, then it will be necessary to prepare a dismissal order in connection with the liquidation of the employer, issue work books and pay the final payment. It is important to notify employees in advance of the upcoming dismissal, as well as inform the employment service about this.

- The next stage is the termination of existing agreements under contracts with legal entities and individuals. This can be done in two ways - fulfill your obligations in full, as soon as possible, or terminate the relationship unilaterally. The second option may entail claims against the entrepreneur. The individual entrepreneur will bear responsibility even after the termination of its activities.

- Next, you should put the reporting documentation in order and pay off existing debts.

Individual entrepreneurs must submit reports on their former employees to the Federal Tax Service, Pension Fund and Social Insurance Fund. If the entrepreneur does not pay all taxes and fees at the time of closure, this debt will remain with him as an individual. - After this, you need to deregister the cash register, if one is used in your business. To do this, you will need to contact the tax office and submit an application. The appeal is considered within 10 working days. At the end, the entrepreneur will receive a card confirming the deregistration of the cash register.

- Then you need to close your current account. To do this, you will need to submit an application to the bank that services the individual entrepreneur. Before doing this, you need to make sure that all transactions with the current account are completed. Otherwise, funds may simply freeze and become inaccessible.

Preparation of documents after closing

To terminate activities, an individual entrepreneur will need to prepare a number of documents.

These include:

- Receipt for payment of state duty. Its amount, according to sub. 7 clause 1 art. 333.33 of the Tax Code of the Russian Federation will be 160 rubles.

- An extract from the pension fund confirming that there are no debts and all insurance payments up to the specified date were made on time. It is not necessary to bring an extract - the Federal Tax Service can independently request data from the Pension Fund.

You need to collect documents only after visiting the local Social Insurance Fund and deregistering there.

The specified documents will be attached to the application of the interested person, which must be drawn up according to form P26001, approved by Order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ-7-6/ [email protected]

The application must indicate the following:

- OGRNIP;

- last name, first name, patronymic of the entrepreneur;

- TIN;

- contact details – telephone number and email address;

- entrepreneur's signature.

The application must be certified by a notary if the application is submitted by mail or through a legal representative. Also, documents can be submitted in person, sent through the MFC, the Federal Tax Service website or the State Services portal. In these cases, a notary's signature is not required. The application will be reviewed within 5 days. The answer can be received by hand or by mail.

Contacting the Employment Service and acquiring unemployed status

An entrepreneur has the right to contact the Employment Center at any time after the official termination of his activities. The law does not establish clear deadlines for this. You must have with you:

- passport;

- certificate;

- diploma or other educational documents;

- work book;

- an extract from the Unified State Register of Individual Entrepreneurs (it is not necessary to provide it).

Documents are reviewed within 10 days. A specialist from the central control center will inform the initiator about the date and time. On the appointed day you must come to the Center to register.

After this, the person will have the right to:

- receiving a monthly benefit;

- assistance in finding a job;

- assistance in training and retraining.

You must contact the central control center in person. The former individual entrepreneur will be offered vacancies for which he can perform work. The employment center can offer an individual entrepreneur permanent or temporary work or send him to paid public works.

Work that does not require special education or preliminary training will be considered suitable for a former individual entrepreneur.

Read about where and how you can apply for unemployment benefits and what documents are needed here, and how to join the labor exchange after dismissal is described here.

How to write a business plan

Many people are intimidated by the need to write a business plan for an employment center. There is absolutely nothing to be afraid of, a business plan can and even should be written in your own words, in a clear and accessible language (the easier it is to understand it, the greater your chances of receiving a subsidy).

Back to contents

Required items

There are no standard forms of business plans, but some points must be present in it.

- Title page and contents.

- Brief description of the project.

The section should contain a description of the project in a fairly concise form: literally a few sentences about what it will actually be, what funds are needed to start (see example) and a forecast for payback and profit. After reading this section, it should be clear what will be discussed and what results this activity will lead to.

- Information about the product (service).

Here it is necessary to reflect the description of the product (service) and its application, note the uniqueness of the product (service) offered, it is also necessary to emphasize why you think that your business will be successful, what is its value.

- Market analysis and description of the promotion of your business.

The section should talk about buyers/clients, the segment and market share you plan to occupy, possible competitors (highlighting strengths and weaknesses), market size and an assessment of its growth prospects.

- Production plan.

This chapter should provide a description of the production process, including what kind of premises you plan to occupy (location, area, requirements for the premises), the necessary equipment, issues of supply of raw materials and materials.

- Staff.

Reflect here the composition of employees, requirements for their qualifications, work schedule and planned personnel costs, including what salary you will set for yourself. Here you can reflect your experience and knowledge in the field of business that you want to develop: your qualifications will be a definite plus when agreeing on a business plan.

This section is of considerable importance for the employment center, since it addresses the issue of organizing additional jobs. In this regard, if you plan to hire workers, place special emphasis on this, including information on the number of employed people can be included in the “Brief characteristics of the project” section as one of the positive results of the activity. If there are no additional personnel in your project, you can skip this section and reflect your personal income in a financial plan.

- Financial plan.

Financial planning should contain information about sources of funds (savings, loans, subsidies, etc.), the cost of goods (services), and also include a plan for income and expenses, profitability, a plan for cash receipts and payments, and payback forecasts. When making plans, do not forget that the subsidy received is taxed in accordance with the regime that you chose when registering an individual entrepreneur.

The planning period should be at least a year, because it is during this period that you want to receive unemployment benefits in the form of a one-time subsidy, but it is better to provide a plan for a period of one and a half to three years, so that it is possible to assess the prospects of the project.

- Risk assessment.

The section should contain not only a list of what may interfere with your business, but also options for solving possible problems.

- Applications.

You can include tables with calculations and graphs in the appendices: as a rule, this design is more visual and easier to understand.

The entire volume of the business plan should occupy 30–40 sheets.

Back to contents

Tips for writing

Here are some tips for more successful writing of a business plan for a job center.

- To get started, read a few other ready-made business plans.

- Try to write in an accessible and understandable manner, as if you were explaining the essence to your friend (of course, avoiding colloquial expressions and illiterate constructions).

- When planning your budget, take into account taxation and force majeure situations; especially note, as stated above, that you will provide new jobs (it is also highly advisable to mention this at the defense - this is a big plus).

- Try to write strictly to the point, concisely, without unnecessary words; at the same time, describe your idea in as much detail as possible (the fewer questions left after reading the business plan, the better); use graphs and tables, they are more visual than dry text.

- It’s good if you have already done some preliminary work: launched your website, held preliminary negotiations with suppliers, found out purchase prices, etc. Don’t forget to mention this in the business plan for the employment center and in your defense before the expert commission.

Back to contents

What's next

After you have defended your project before the commission, the employment center will sign an agreement with you “On receiving funds for the development of small businesses and self-employment of unemployed citizens.” The funds will be transferred to your personal account - and you can safely begin implementing your business idea.

It should be remembered that for at least a year after receiving the subsidy, you must adhere to your plans as much as possible. In addition, after a certain period established by the employment center (usually from one to three months), you will need to report on the intended use of the funds allocated to you.

You cannot receive a subsidy and spend it on your personal needs - the allocated funds are subject to return in cases of violation by the individual entrepreneur of the agreement concluded with the employment center, including:

- if the funds are not spent for the allocated purposes;

- if the subsidy is not spent within three months from the date of transfer to your personal account;

- if during the term of the contract the individual entrepreneur ceased his activities.

If you decide to create a truly working, beneficial business, receiving government financial assistance is certainly not the most difficult and, most importantly, economical option (after all, the subsidy is given free of charge).

When the project is implemented by you, you do not need to throw away the business plan that has fulfilled its function, since this is only the initial stage of the development of your business: constantly returning to previously outlined plans and indicators, analyzing deviations and adjusting the planned course and refining the strategy - this is the only way to create a business for many years. And the business planning process in this case should be continuous.

Back to contents

Amount of payment for an entrepreneur who has ceased operations

Unemployment benefits to former individual entrepreneurs are paid according to the rules of Article 34 of Law No. 1032-1, in a minimum amount (what are the maximum and minimum amounts of unemployment benefits?). For 2021, according to Decree of the Government of the Russian Federation dated March 27, 2021 No. 346, this is 1,500 rubles. The final amount is determined by increasing by the regional coefficient, which is established for each region of the country separately. It ranges from 1.2 to 2.0.

Read about how the amount of unemployment benefits is determined and what it depends on here.

Unemployment benefit for individual entrepreneurs: now at the maximum amount

All Russian citizens have the opportunity to register for unemployment on the labor exchange, but the size of the benefit is different for everyone. It depends on length of service, earnings at the last place of work, and social status.

Until mid-June 2021, individual entrepreneurs who closed their business received the bare minimum (1,500 rubles), but today the situation has changed. From June 13, for individual entrepreneurs who ceased their activities after March 1 of the current year, the benefit is set at a maximum amount equal to the minimum wage - 12,130 rubles . The budget plans to pay it within 3 months, but no later than October 1, 2020. In other words, this is a temporary measure to support entrepreneurs.

Categories of persons entitled to receive subsidies

Opening an individual entrepreneur through the Employment Center is available to all adult citizens who do not have a job and are officially registered as unemployed. Remember, having lost your job and officially registered your new status, you get the opportunity not only to purchase funds to launch a business project. You will also be offered various trainings and courses that will help you master a new area of activity and help you draw up a development strategy for your future enterprise.

Receiving a subsidy from the Employment Center is only possible for officially unemployed people registered there

True, there are also some limits on the issuance of subsidies for starting a business. First of all, the following people lose the right to receive money:

- minors;

- women on maternity leave;

- university students;

- persons who have reached retirement age and receive such support;

- people carrying out activities on the basis of employment agreements.

In addition to these categories of citizens, the subsidy is not available to existing individual entrepreneurs and joint-stock companies, prisoners and systematic violators of the rules of the center.

general information

If we are not talking about capital construction, you do not plan to launch a powerful production with a couple of dozen or hundreds of jobs, but you plan to open a private enterprise that will employ up to ten hired workers, or just you and members of your family, then there will be support from the state quite enough.

In this case, you will have to sign an agreement with a government agency . This can be done by a person who is registered as a private entrepreneur. By this agreement, he assumes certain responsibilities, among which are the following basic ones:

- the entrepreneur must have Russian citizenship;

- the enterprise must have a registration that does not exceed a calendar year;

- allocated financial resources can only be spent for the purposes specified in the submitted business plan;

- all funds received as a subsidy must be spent within a calendar year;

- If during the inspection it is determined that the allocated subsidies were spent for other purposes, the recipient is obliged to return them in full.

Funds allocated by the state are not given just like that. At a minimum, they will need to be accounted for. This must be done in writing, in the form of a report, which will outline where all allocated funds were spent. This report must be submitted no later than one year after receiving the subsidy.

If during the calendar year, after receiving financial assistance from the state, it is not spent in full, then the recipient is obliged to return the remaining funds regardless of the reasons why he could not spend them. After three months from the date of receipt of the subsidy, the deadline for submitting a report on the money spent begins.

But the state allocates subsidies not for any purpose, but for certain costs.

Thus, you can receive subsidies for the purchase of equipment and materials with the help of which the entrepreneur’s activities will be carried out. This includes raw materials necessary for production, acquisition of patents, technologies, etc.

If the report is not provided within the specified time frame, then sanctions will follow from the regulatory authorities . An entrepreneur may be punished for an administrative offense, and in some cases his actions may be regarded as fraud, for which he will be subject to criminal punishment in the form of a large fine and even imprisonment.