An individual will have to file a bankruptcy petition with the court if it is impossible to pay off all existing debts.

On October 1, 2015, the procedure for declaring citizens bankrupt came into force in Russia by considering a court application for bankruptcy of an individual. Consideration of bankruptcy cases of legal entities is quite common, and now individuals also have this opportunity. The bankruptcy procedure for individuals is regulated by Art. 25 of the Civil Code of the Russian Federation and paragraph 1.1. Chapter X of the Federal Law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy)”.

Going through bankruptcy proceedings for individuals means, first of all, getting rid of loan payments in the absence of financial capabilities. At the same time, bankruptcy for an individual means a temporary ban on traveling abroad, selling existing property, and the inability to obtain a new loan or work as an entrepreneur.

How to file a bankruptcy petition for an individual

When and who should prepare such a statement? Applicants in a bankruptcy case of an individual may be the citizen himself, his creditors, or authorized bodies for the collection of mandatory payments (for example, the tax service). The law establishes the obligation of an individual to file a bankruptcy petition within 30 working days from the date of discovery of the relevant circumstance if the amount of his obligations to creditors is more than 500,000 rubles, and satisfying the creditor’s demands will make it impossible to fulfill his monetary obligation to other creditors.

A citizen can file an application with the court to declare him bankrupt when he meets the criteria of insolvency and is unable to fulfill monetary obligations within the established time frame, i.e. he foresees himself going bankrupt.

In this case, the application will be accepted by the court if payments are overdue for more than 3 months.

In other words: a citizen’s available funds, property, and assets do not cover the amount of his debts to other individuals and organizations.

The grounds on which creditors and authorized bodies apply to the court for bankruptcy of an individual are established by Art. 213.5.

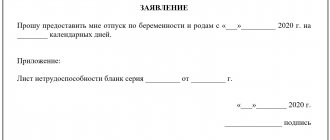

The list of information that is indicated in the application and its annexes are strictly regulated by law. The sample posted on the website will help you prepare such an application yourself.

How to prepare applications for your application yourself

When talking about how to start bankruptcy proceedings for an individual on your own, you cannot ignore the list of documents that the legislator requires to be attached to the application. After all, to successfully apply to the arbitration court, just filing for bankruptcy of an individual in 2021 is not enough - the debtor will need to collect a package of documents confirming the fact of his inability to pay his existing obligations and allowing him to determine the period of time during which he did not pay his bills.

This is also important to know:

Who are the participants in the bankruptcy case?

The list of documents that must be attached to the application (if any) is established by the provisions of paragraph 3 of Art. 213.4 Federal Law No. 127. These include, in particular:

- an inventory of the applicant's assets and copies of certificates confirming the fact that he has ownership rights to such assets;

- list of creditors;

- documents confirming the existence of debt;

- extracts confirming the presence/absence of the applicant’s entrepreneur status;

- other documents, the list of which varies depending on the circumstances of a particular situation.

Debts to each creditor or lender

List what you owe and to whom. Debts can be of any kind; the main thing is to have a document supporting the information. Moreover, you also need to indicate such debts that will not be written off from you, but the court must know about their existence.

For example, if you pay alimony, indicate this fact and the amount of alimony. If you have caused damage to the health of a citizen and are paying him money for treatment, also indicate this fact, etc.

To simplify your task, you can find a sample bankruptcy petition for an individual online and look at examples of creditors in it.

Justification for bankruptcy

Declaring bankruptcy of individuals always has good grounds.

Therefore, you need to briefly but specifically outline the circumstances that led you to make this decision.

The court must be convinced that you have not been able to pay your debts for three months. Another condition is that you yourself tried to establish contact with the banks and convince them to reconsider your payment schedule.

If the banks did not cooperate, and your income fell so much that it became impossible to pay, you must explain why this happened and provide evidence.

For example, you received an injury that caused you to lose your ability to work. In this case, attach documents from the doctor and tell about this episode in the application.

If you had a high salary level, but there were layoffs at work that you fell under, explain that you were unable to find a new job with such a salary, although you joined the labor exchange, trying to somehow improve your situation. There may be other reasons, the main thing is to be able to prove them.

Current litigation and decisions

If there are any legal proceedings against you, or you are complying with any court decisions, list them. After the bankruptcy decision is made and during the restructuring, all of them will be suspended. The exception is alimony payments, compensation for harm to life and health, etc.

Bank accounts and deposits

If you have money in banks, provide a list of the accounts in which they are stored and add copies of agreements to the appendices.

This is also important to know:

If the company goes bankrupt, what will happen to the employees: dismissal rules, required payments

An application for bankruptcy of individuals must necessarily contain this information, since concealing it may end disastrously for you, because the financial manager will still discover this fact.

Of course, one of the disadvantages of bankruptcy is that if you have these financial “excesses,” the court will oblige you to cover your debts or part of them with them, but hiding the existence of accounts is jeopardizing the possibility of filing bankruptcy and getting rid of debts that you will not be able to do anyway pay.

Property

As with bank accounts, do not try to hide assets.

Concealing property can be regarded as an attempt to carry out a fictitious bankruptcy, and this is already a criminal liability.

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Make a detailed inventory and enter there not only the property that you have in Russia, but also that which is located outside its borders (if any).

Property can be movable and immovable. As a rule, the fact of the existence of property is confirmed by certificates of state registration of property.

Total debt

A bankruptcy claim for an individual must contain information about the total amount of debt as a justification for your bankruptcy.

SRO of arbitration managers

According to the Law on Bankruptcy of Individuals (2015), the application must contain the name of one of the organizations of arbitration managers. The court will select from it a financial manager for your trial.

Applications

The list of applications that must be present in the general package of documents is reflected in the law on bankruptcy of individuals. The sample statement of claim presented on our website will help you understand the variety of applications.

The main sections of the applications include the following:

- Documents of the borrower about his personality, marital status, children and status as an individual entrepreneur;

- Information about the borrower’s debts and about the creditors who provided funds: private individuals can also be indicated here, and not just credit organizations;

- Information about the borrower’s income and finances for three years;

- Inventory of property with the attachment of relevant papers;

- Medical certificates, documents recognizing the borrower as unemployed or disabled, documents on guardianship, documents on transactions in amounts exceeding 300 thousand over the last three years;

- Receipts for payment of state fees and labor of the financial manager.

Date, signature

Place a date and signature at the end of the application.

After completing the collection of papers and writing the application, you need to file a bankruptcy petition for an individual in court.

Since the process of writing an application and collecting papers is quite labor-intensive and requires attention, we offer you applications to the court.

Bankruptcy of individuals is not just a formal procedure, therefore the absence of certain applications or positions in the application may lead to the fact that the case simply will not be considered.

Filing a bankruptcy petition for an individual

The application is submitted to the arbitration court at the debtor’s place of residence. The state duty will be 6,000 rubles. Along with the prepared application, the documents established by Art. 213.4 of the Law. Unlike the rules for filing a claim in civil proceedings, where the court itself sends copies of the claim to the defendant, the debtor in bankruptcy cases must send its creditors a copy of the statement and materials thereto by registered mail with a notice better than the declared value. A notice of referral is attached to the application.

Methods for filing bankruptcy for individuals

An application to declare a citizen bankrupt can be submitted to the Arbitration Court in one of three ways:

- via Russian Post;

- personally through the office of the Arbitration Court;

- electronically through the “My Arbitrator” service; for this you must be registered on the State Services website.

If you are filing for bankruptcy in person through the court office, print out a second copy of the application to stamp receipt.

Time limits for consideration of an individual's bankruptcy application

Within 5 working days, the Arbitration Court must “determine the fate” of the bankruptcy application (sometimes, due to the workload of the courts, this period is not observed):

- Accept the application for proceedings, set a date for the first court hearing

After accepting a bankruptcy petition for proceedings, the court must consider it within 15 days to 3 months. If a citizen’s bankruptcy application is recognized as justified, a debt restructuring procedure is introduced by default. If, at the time of consideration of the question of the validity of the application, the citizen has no income or it is minimal, the Arbitration Court, on the basis of the corresponding petition of the citizen, has the right not to begin the debt restructuring procedure, but to immediately declare the citizen bankrupt and begin the procedure for the sale of property.

- Leave the bankruptcy application without progress until the deficiencies are eliminated

This is also important to know:

Who are the participants in the bankruptcy case?

Most often, courts leave an individual’s bankruptcy petition without progress if:

- An incomplete set of documents required by the bankruptcy law was provided;

- The state duty in the amount of 300 rubles has not been paid;

- No funds have been deposited with the Court in the amount of 25,000 rubles.

Unfortunately, often, bankruptcy applications for individuals are left without legal action. According to Resolution of the Plenum of the Supreme Court No. 45 dated October 13, 2015, if the amount of debt exceeds 500 thousand rubles, the court does not have the right to leave an individual’s bankruptcy application without progress, citing the lack of a number of necessary documents. In this case, the court must accept the application for proceedings and request the missing documents by the date of the court hearing.

- Refuse to accept an individual's bankruptcy petition for processing

- Due to the lack of jurisdiction of the case in this court. Jurisdiction is determined according to the place of your permanent registration (registration). Bankruptcy at a temporary registered address can cause difficulties. For example, in the Moscow Arbitration Court, some judges categorically refuse to accept a bankruptcy petition if a person does not have permanent registration in Moscow. At the same time, among our clients there are many people who are going bankrupt in the Moscow Arbitration Court due to temporary registration.

- If the amount of debt is less than 500 thousand rubles. Unfortunately, the myth about the impossibility of bankruptcy with a debt amount of less than 500 thousand rubles also exists among some judges who refuse to accept applications with a debt amount of less than 500 thousand rubles and a delay of less than 3 months. In this case, you will have to prove your case in higher courts.