When and who can count on child care benefits for children up to one and a half years old?

A monthly child care allowance is paid to persons who care for a child during the leave of the same name. Parental leave is provided until the child reaches 3 years of age , and benefits are paid only until the child reaches 1.5 years of age .

Unlike maternity benefits, which are paid only to the mother of the child, the benefit in question can also be received by other adult relatives who actually care for the child and are subject to compulsory social insurance. For example, these include a father, grandmother, etc. If caring for a baby requires the participation of two or more relatives, then only one of them can count on receiving benefits.

Federal Law No. 81-FZ of May 19, 1995 stipulates that the right to receive benefits is given to:

- relatives of the child (when paying contributions to the Social Insurance Fund);

- contract military mothers;

- mothers fired due to the liquidation of the company during pregnancy or maternity leave;

- relatives of a child who were fired due to the liquidation of the company while they were on parental leave;

- mothers, fathers, guardians (including full-time students);

- relatives who are not subject to compulsory social insurance - in the event of the death of the mother and/or father, deprivation of their parental rights, etc.

EDV

In addition to monthly financial assistance for the birth of a child, you can receive several one-time benefits.

They are provided only once and in full.

When registering in early pregnancy

In order to receive this one-time assistance, you must register no later than the 12th week of pregnancy. And then contact your employer, dean’s office or social security authorities with the relevant documents. You will need:

- statement;

- medical certificate confirming pregnancy and registration.

The benefit amount is small, but it is constantly indexed. In 2020, the payment amount is 613 rubles. It is paid along with the BIR benefit, which in turn is provided after the birth of the baby.

For pregnancy and childbirth

Another type of lump sum payment is the BIR benefit. All women going on maternity leave receive it.

But there is one caveat - unemployed expectant mothers can apply for benefits only when they were fired due to the liquidation of an enterprise or are receiving an inpatient education. Also, a woman who is a military personnel can receive these maternity payments.

In what case are gubernatorial benefits paid for the first child? How much is the lump sum benefit for the birth of a child? Find out here.

The BIR benefit is paid by the Social Insurance Fund even when the recipient contacts the employer. For registration you will need the following documents:

- medical certificate indicating the period of leave;

- statement.

You can submit documents along with your application for maternity leave. This occurs no earlier than the day indicated on the sick leave certificate. According to the rules, an employee can leave 70 days before the birth of the baby. But you can submit them after childbirth, since the money will be credited taking into account the date of actual maternity leave.

A woman can take maternity leave and receive financial assistance from her employer within 30 days after her dismissal.

Often, receiving funds from an employer becomes impossible for the following reasons:

- the company is on the verge of bankruptcy;

- the company's accounts were frozen;

- the employer is hiding from creditors;

- the company was closed before the woman applied.

In these cases, you should go to court, and then go with the court decision to the FSS.

Since litigation is impossible for a pregnant woman or a woman who has just given birth, you can file a claim within six months after the end of maternity leave.

At the birth of a child from February 1

From February 1, a special indexation coefficient applies when calculating benefits. Its size is 1.025.

But this increase is only used when calculating benefits for children born after this date.

If the child was born earlier, but the mother makes payments after the specified date, the increasing coefficient does not apply.

Amount of monthly child care benefit

Working citizens receive a monthly allowance for a child up to one and a half years old in the amount of 40% of the average salary calculated for the previous 2 years .

Thus, if a woman decides to go on maternity leave in 2021, then when calculating the benefit, the salary for 2019 and 2021 is taken into account. It is on these amounts of income that the monthly child care allowance will depend.

The minimum benefit depends on the minimum wage , the maximum depends on the maximum base of contributions to the Social Insurance Fund for the previous 2 years.

The minimum monthly benefit amount for working citizens is:

- for the first child – 5,116.80 rubles. (RUB 12,792 x 40%);

- for the second and subsequent children - 6,751.54 rubles, and from February 1, 2021 - 7,082.85 rubles (see “Children's benefits from February 1, 2021”).

The maximum monthly child care benefit is, in turn, in 2021 – 29,600.48 rubles .

For officially employed citizens, benefits are accrued simultaneously with the start of parental leave. At the same time, the child’s mother can continue to work full time if one of the closest relatives or a nanny takes care of the child. In this case, she will not receive benefits.

If a woman wants to both work and maintain child care benefits, she needs to go to work part-time or work from home.

Article 256 of the Labor Code provides that an employee, during parental leave, has the right to ask to work from home or to go to his workplace on a part-time basis. The employer has no right to refuse him this. That is, if an employee approaches his superiors with such a request, the employer must find him a job that he can do at home.

The amount of monthly child care benefits for those who do not work under an employment contract, from February 1, 2021, is 7082.85 rubles .

Entrepreneurs, as well as persons engaged in private practice (lawyers, notaries, etc.) who have entered into a voluntary agreement with the Social Insurance Fund are entitled to a minimum benefit .

The minimum monthly child care benefit for individuals is 7082.85 , regardless of the number of children. For a number of persons, the maximum amount of child care benefits for a full calendar month is 13,504 rubles. For example, from January 1, 2021, an employee is on leave to care for two children under the age of 1.5 years. The amount of the summed minimum benefit for two children for January 2021 is 13,504 rubles. (RUB 6,752 x 2) (if the eldest does not turn 1.5 years old this month). (Law dated 06/08/2020 No. 166-FZ).

For some categories of citizens, benefits are calculated taking into account the amount of income not for the previous 2 calendar years, but for 12 calendar months before the start of parental leave or preceding the month of dismissal. These categories include:

- women contract soldiers, as well as employees in law enforcement agencies;

- persons dismissed due to liquidation of the company during pregnancy, or maternity sick leave, or parental leave.

If an employee who wishes to apply for a child care benefit works part-time for two employers over the past 2 years, the benefit is paid for by one of them at the employee’s choice.

If a woman, while on maternity leave, takes sick leave for maternity leave, then she must choose one of these two benefits.

Procedure for assigning assistance

Parents or other relatives caring for the child can apply for payment. An application with application package should be submitted:

- at the place of work;

- in the MFC;

- to the social protection authorities.

For information: grandparents and other relatives can only contact the employer.

The condition for granting the benefit is the actual employment of the mother. It is necessary to notify the body making payments within one month about the occurrence of circumstances affecting:

- on the amount of charges;

- for the right to receive.

The transfer of funds stops (or the amount changes) from the first day of the month following the date of occurrence of the circumstances. Money paid unreasonably is subject to refund.

Advice! The mother who receives assistance has the right to choose one of the types of benefits if:

- is on maternity leave;

- pregnant with her second (subsequent) baby.

Where to go for the unemployed

Unemployed citizens must write an application to social security. These include the following persons:

- Parent or guardian:

- who is unemployed but does not receive appropriate benefits;

- dismissed during maternity leave due to the liquidation of the company;

- full-time student;

- spouse of a contract serviceman (unemployed);

- an entrepreneur who does not pay voluntary contributions to the Social Insurance Fund (SIF);

- Other relatives, if parents:

- cannot care for a newborn due to health reasons;

- died or were declared dead;

- deprived of rights;

- limited parental rights;

- declared missing;

- declared incompetent;

- are serving a sentence for a crime in special institutions;

- avoid raising children;

- officially abandoned the child.

Reference! If unemployment benefits are paid, the applicant can choose one of the types of payments.

Required documents

The following documents must be provided to social security:

- application (form issued on site);

- birth certificates of all children;

- certificate: about living together with the baby;

- from the employment agency about the lack of appropriate payments;

Mothers laid off due to the liquidation of production are additionally required to provide:

- a copy of the leave order;

- certificate of calculation of benefits assigned and paid.

For information! Money is transferred monthly from the date of birth of the child to one and a half years. You should apply within six months from the date of birth of your child.

Destination Features

If parents have been deprived of rights in relation to older children, then they are not taken into account when processing the application. Consequently, the benefit may be reduced in amount. For example, if a woman has two minors, she relies on the youngest - 6554.89 rubles.

If parental rights are deprived of the first child, she will receive only 3,277.45 rubles. Some categories of citizens are required to provide an expanded package of documents:

- Guardians should prepare:

- death certificates of parents;

- a court decision to deprive them of their rights;

- a certificate stating that the parent is in prison;

- court decision on the unknown absence of mom and dad;

- a document stating that the baby was abandoned;

- act of mother abandoning her newborn;

- birth certificate, in which the columns “mother” and “father” are not filled in;

- Entrepreneurs are required to attach to the application:

- a certificate confirming the absence of voluntary contributions to the Social Insurance Fund;

- document on professional status (lawyers, notaries, etc.).

Clue! Foreign citizens are required to provide a copy of their residence permit.

Conditions for workers

Employed citizens turn to the management of the company. In this case, payments are made:

- at the request of the employee;

- from the end of maternity leave;

- during absence from work due to parental leave for up to three years;

- for part-time employment: part-time;

- at home.

Clue! It is allowed to apply for a benefit for the father:

- at the place of his work/service;

- in social security.

Required documents

Employed persons must write to the manager an application for the appropriate payment. Attached to it:

- a copy of the birth certificate of the newborn child;

- copy of passport;

- a certificate stating that the second parent does not receive benefits of this type at the place of employment.

For information! In practice, it is customary to submit one application:

- to provide parental leave;

- for the calculation of the corresponding allowance.

How much will they pay

The amount of accruals is calculated using a special formula:

Rp = D2 / P x 30.4×40%,

- Where:

- Рп - the required amount;

- D2 - total income for the two previous years, which does not include accruals: for sick leave;

- related to maternity leave;

- illness;

Clue! When calculating benefits for entrepreneurs, the amount of income is not taken into account. These individuals receive minimal amounts.

Restrictions

The accountant is obliged to take into account the boundary indicators when calculating benefits for up to one and a half years:

- minimum is the amount of benefits received on the basis of the minimum wage;

- the maximum income for the year cannot be greater than the established base of contributions to the Social Insurance Fund for the corresponding period.

Clue! If during the calculation the resulting amount does not reach the minimum, then the calculation is made on the basis of the minimum wage.

Registration deadlines

An application for a benefit must be reviewed within ten days. Payments are made on certain days:

- during the payment of salaries to other employees;

- on the date established by the social security authority.

Attention!

Monthly assistance is accrued for up to one and a half years. The last month of transfer of funds is the one when the child reaches the threshold age. Working mothers are given the right to choose financial assistance. If it turns out that the benefit for up to 1.5 years is greater than maternity payments in size, then it is allowed to pay the described type of benefit from the date of birth of the newborn. In this case, maternity benefits already received will be taken into account. This can be done if a woman is on maternity leave and is pregnant/gave birth to a second child.

Deadline for applying for benefits

All documents must be submitted to the destination of payments no later than 6 months from the date the child turns one and a half years old. If a person entitled to benefits applies for it during this period, the money will be paid to him for the entire period from the date of provision of parental leave until he reaches the age of 1.5 years.

The benefit must be assigned within 10 calendar days from the date of provision of the necessary documents. The employer must make the payment on the next payday.

The territorial body of the Social Insurance Fund pays the benefit through a credit institution or sends it by mail.

Who is entitled to

First of all, the mother or father of the child has the right to receive benefits.

If we are talking about a benefit for early registration, then the expectant mother can apply for it. But any relative who provides this care can receive financial assistance to care for a child for one and a half years.

The right to receive funds does not depend on whether the recipient is employed or not.

But in the first case, calculations and payments are made by the employer, and in the second - by the Social Insurance Fund.

And at the same time, the minimum benefit amount is used.

Direct payments

In some regions of Russia there is a “Direct Payments” project. In 2020, 69 regions of the Russian Federation are already participating in this project, and from July 1, another 8 constituent entities of the Russian Federation will join them. The project implies that benefits will be accrued not through the employer, but directly from the Social Insurance Fund. This project is aimed at protecting the employee in the event of bankruptcy or unlawful actions of his employer. Payments in this case are processed, as before, at the place of work.

Allowance for the third and subsequent children

Since 2013, the Russian Federation has been implementing a program to assist large families.

It was initiated by the President of the Russian Federation V.V. Putin, having signed decree No. 606 of 05/07/2012. 69 regions joined the events. The methodology for assigning additional support to families raising children is developed and approved by the local government. Reference! You should find out about specific conditions on the official websites of regional authorities. In general, the programs are designed to support mothers with children up to the age of three in families with more than 2 minor children. Assistance is provided to low-income families:

- having an average income per person that does not exceed the minimum in the region;

- those who applied for payments on their own initiative.

The application should be submitted to the social security office at your place of residence. In addition to the above documents, the following should be attached:

- certificates of income of parents and other relatives living with the family;

- information about family composition;

- others (depending on the region).

Additional support is provided until the youngest child’s third birthday. You can apply for regional benefits when you have a third or subsequent children.

For information! Under federal law, an applicant who has multiple grounds for receiving assistance must choose only one. This does not apply to regional support measures.

You are allowed to receive help at the same time:

- federal;

- local.

Download for viewing and printing:

Decree of the President of the Russian Federation No. 606 of 05/07/2012 “On measures to implement the demographic policy of the Russian Federation”

Monthly compensation payments in the amount of 50 rubles

Previously, during the period of parental leave for a child up to 3 years old, in addition to the allowance for caring for a child up to 1.5 years old, another payment was provided - compensation for loss of earnings. This is 50 rubles plus the regional coefficient in those territories where it is provided. This payment came from the wage fund at the request of the employee.

This compensation was established in 1994. At that time, wages were about 200–300 rubles. And the amount of 50 rubles at that time, one might say, was approximately a week’s earnings. But since 1994, this payment has never been indexed.

From January 1, 2021, in accordance with the decree of the President of the Russian Federation dated November 25, 2019 No. 570-FZ, the monthly child benefit in the amount of 50 rubles was canceled for all children born from this date. For children born before 01/01/2020, this compensation continues to be paid until they turn 3 years old.

Instead of a benefit of 50 rubles, from January 1, 2021, V. Putin proposed and implemented the payment of a new benefit in the amount of the subsistence minimum for a child in the region (on average 10,000 - 14,000 rubles). It is no longer the employer who pays it. Only families with a low level of income have the right to it (the average per capita income should be no more than 2 times the subsistence level of the working-age population of the region for the 2nd quarter of the previous year).

Thus, the abolition of the compensation payment in the amount of 50 rubles made it possible to receive much more significant financial assistance to those families who really need it.

How to calculate the amount of payments in 2021

All existing benefits are calculated taking into account the minimum wage or salary.

If the recipient is employed, then his salary for the last two years (income in 2021 and in 2021) should be used to calculate payments. Average monthly earnings are calculated. And then the required percentage is subtracted from this amount.

The amount of the benefit depends on it (for example, financial assistance under the BIR).

Monthly allowance for caring for a disabled child

Special mention should be made of the monthly allowance for disabled children. Families who are raising a disabled child under the age of 18 or a disabled person of group 1 since childhood have the right to it.

The payment is assigned to one parent (guardian, trustee, adoptive parent) who cares for such a child - exclusively for the period of care. In this case, the parent should not work , but take care of the child.

If there are 2 children in a family who are entitled to receive this benefit, the payment will be assigned to each of them.

From July 1, 2021, the amount of this payment for parents (adoptive parents, guardians) is 10,000 rubles.

Payment for other non-working persons caring for a disabled child - 1200 rubles.

Step-by-step instructions for applying for a “children’s” allowance

Officially working relatives of the child, as a rule, arrange for the payment of benefits at their enterprise. The law allows you to apply for an accrual directly to social insurance (to your regional branch) - this project is valid for certain regions of the Russian Federation, namely the Karachay-Cherkess Republic, Nizhny Novgorod, Astrakhan, Kurgan, Novgorod, Novosibirsk, Tambov regions and Khabarovsk Territory.

Step 1 – preparing a package of documents. Along with the application for payment of benefits, you will need to provide a number of supporting documentation to the personnel department of your enterprise or the Social Insurance Fund:

- baby’s birth certificate (copy and original);

- if the applicant has other children, their birth (adoption) certificates are needed;

- a certificate from the official place of work of the second parent stating that he was not given the required leave to care for his child;

- if necessary - a certificate from the previous place of employment about the amount of average earnings (if the applicant changed jobs during the two years preceding the birth of the child);

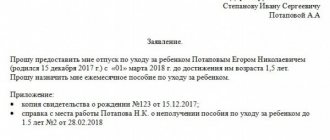

- if necessary, an application requesting the replacement of years to calculate the payment base to earlier ones;

- for part-time workers - a certificate from the employer who does not provide benefits stating that the employee was not actually provided with benefits for this place of work.

Step 2 – writing an application. The text of the application is drawn up in a relatively free form (without contradicting the general rules of office work). It is addressed to the management of the organization. You can combine a request to provide benefits for up to 1.5 years of age for a child and to pay a monthly “employer” compensation of 50 rubles. up to 3 years.

Sample application for payment of benefits for child care up to 1.5 years

To the General Director of Metafora LLC, Anton Aleksandrovich Skaznitsky, Sales Manager Irina Petrovna Talanovskaya

statement.

I ask you to grant me leave from February 15, 2021 to care for my child Platon Igorevich Talanovsky, born on December 28, 2016, until he reaches the age of three. My son is my first child.

I ask you to assign me a monthly allowance for caring for a child up to 1.5 years old and a monthly compensation payment.

I am attaching to the application:

- a copy of P.I. Talanovsky’s birth certificate;

- a copy of the passport of I.P. Talanovskaya’s mother;

- a certificate from the place of work of his father, Igor Mikhailovich Talanovsky, stating that he was not provided with parental leave and that no benefits were assigned.

February 10, 2021 / Talanovskaya / I.P. Talanovskaya

Another sample application with detailed preparation can be found on this page.

Sample certificate for the second parent

It is issued on the organization’s letterhead or its basic details must be indicated. This certificate is issued as outgoing documentation.

Limited Liability Company "Inspiration" LLC "Inspiration" 127546, Moscow, st. Zabelina, 36, office 2 Tel./fax +, e-mail OKPO xxxxxxxxxx, OGRN xxxxxxxxxxxxxxxx, INN/KPP xxxxxxxxxxxx/xxxxxxxxxx

REFERENCE

Data given to Igor Mikhailovich Talanovsky is that he actually works at Inspiration LLC, holding the position of economist from July 18, 2014 to the present (hiring order No. 117-k dated June 18, 2014). During this period, child care leave for Platon Igorevich Talanovsky, born on December 28, 2016, was not provided until he reached the age of three, and no monthly child care allowance was assigned.

The certificate was issued for presentation at the place of request.

General Director of LLC "Inspiration" /Sedykh/ R.L. Sedykh Chief Accountant /Antiokhina/ S.P. Antiokhina

Step 3 – submit an application. The application, along with copies of the attached documents, must be submitted to the personnel department (or directly to the Social Insurance Fund).

Step 4 – receive a copy of the order. Based on the documentation received, the HR department initiates the execution of the corresponding order from the manager to grant the requested leave and assign legally required benefits. The order is signed by the general director; it must be familiarized with the signature of the chief accountant and the applicant himself. The period for drawing up an order and assigning payment to the employer is a maximum of 10 days.

Initial values of minimum benefits and their indexation coefficients

In accordance with paragraph.

2, 3 hours 1 tbsp. 15 of the Law “On State Benefits for Citizens with Children” dated May 19, 1995 No. 81-FZ, the basic minimum benefit amount is 1,500 rubles. for caring for the first child and 3,000 rubles. for caring for the second and subsequent children. These values have been established since 01/01/2007 and are indexed annually (in 2008 – twice a year) based on the forecast level of inflation. According to Part 1 of Art. 4.2 of Law No. 81-FZ, the size and timing of indexation, as well as the forecast level of inflation, are established by the federal law on the federal budget for the corresponding financial year and for the planning period. The current minimum amount of child care benefits can be calculated by sequentially multiplying the minimum amount of benefits by the coefficients that were applied in previous years, as well as by the current year coefficient:

- From 02/01/2019, the coefficient was approved at 1.043 (Resolution of the Government of the Russian Federation dated 01/24/2019 No. 32).

- From 02/01/2018, the coefficient was set at 1.025 (Resolution of the Government of the Russian Federation dated 01/26/2018 No. 74).

- From 02/01/2017, the coefficient was set at 1.054 (Part 1, Article 4.2 of Law No. 81-FZ, Part 1, Article 4.2 of the Law “On the suspension of the provisions of certain legislative acts...” dated 04/06/2015 No. 68-FZ, Decree of the Government of the Russian Federation dated 01/26/2017 No. 88).

- From February 1, 2016, the coefficient was 1.07 (Part 1, Article 4.2 of Law No. 81-FZ, Decree of the Government of the Russian Federation dated January 28, 2016 No. 42).

- In 2015, the coefficient was 1.055 (Part 1, Article 4.2 of Law No. 81-FZ, Part 2, Article 8 of the Law “On the Federal Budget for 2015 and for the Planning Period of 2021 and 2021” dated December 1, 2014 No. 384-FZ ). In 2014, the coefficient was 1.05 (Part 1, Article 4.2 of Law No. 81-FZ, Part 2, Article 9 of the Law “On the Federal Budget for 2014 and for the Planning Period of 2015 and 2021” dated December 2, 2013 No. 349 -FZ).

- In 2013, a coefficient of 1.055 was applied (Part 1, Article 4.2 of Law No. 81-FZ, Part 2, Article 10 of the Law “On the Federal Budget for 2013 and for the Planning Period of 2014 and 2015” dated December 3, 2012 No. 216-FZ ).

- In 2012, a coefficient of 1.06 was established (Part 1, Article 4.2 of Law No. 81-FZ, Part 2, Article 10 of the Law “On the Federal Budget for 2012 and for the Planning Period of 2013 and 2014” dated November 30, 2011 No. 371-FZ).

- In 2011, a coefficient of 1.065 was applied (Part 1, Article 4.2 of Law No. 81-FZ, Part 2, Article 10 of the Law “On the Federal Budget for 2011 and for the Planning Period of 2012 and 2013” dated December 13, 2010 No. 357-FZ ).

- In 2010, a coefficient of 1.10 was established (Part 1, Article 4.2 of Law No. 81-FZ, Part 2, Article 10 of the Law “On the Federal Budget for 2010 and for the Planning Period of 2011 and 2012” dated December 2, 2009 No. 308-FZ).

- In 2009, the coefficient was 1.13 (Part 1, Article 4.2 of Law No. 81-FZ, Part 2, Article 11 of the Law “On the Federal Budget for 2009 and for the Planning Period of 2010 and 2011” dated November 24, 2008 No. 204 -FZ).

- From July 1, 2008, a coefficient of 1.0185 was applied (Part 1, Article 4.2 of Law No. 81-FZ, Part 2.1 of the Law “On the Federal Budget for 2008 and for the Planning Period of 2009 and 2010” dated July 24, 2007 No. 198-FZ ).

- From 01/01/2008, a coefficient of 1.085 was established (Part 1, Article 4.2 of Law No. 81-FZ, Part 2.1 of the Law “On the Federal Budget for 2008 and for the Planning Period of 2009 and 2010” dated July 24, 2007 No. 198-FZ) .

Read about the types of existing parental leave and the procedure for paying them in the article “Art. 256 of the Labor Code of the Russian Federation: questions and answers" .