UTII is an imputed tax “assigned by the authorities,” which does not depend on the income of the enterprise paying it, and is applied to strictly defined types of commercial activities. The tax rate is calculated based on the regulations of the Russian government, local authorities and the physical indicators of the enterprise itself.

When paying UTII, organizations are exempt from income tax (entrepreneurs from personal income tax), value added tax, excluding import transactions, and property tax required for their commercial activities (with the exception of real estate registered in the cadastral register).

At the end of the year, an additional 1% is paid on profits received in excess of 300,000 rubles. How to calculate UTII for individual entrepreneurs and organizations, we will consider further.

Types of taxable activities

Organizations or individual entrepreneurs (individual entrepreneurs) carrying out commercial activities in the area have the right to pay taxes in accordance with UTII (Unified Tax on Imputed Income).

- retail trade (the area of the outlet should not exceed 150 sq/m);

- catering (total area of the hall should not be more than 150 sq/m);

- veterinary, household services (repair of electrical equipment, plumbing, electronic devices, apartment cleaning, etc.);

- distribution and (or) placement of advertising;

- rental services for retail outlets, land plots (with the exception of petrol and gas filling stations, as well as facilities exceeding 500 sq/m in area);

- hotel business and rental housing (including rental apartments);

- repair, maintenance and washing of vehicles;

- delivery of goods and transportation of passengers by road;

- provision of parking.

The full list of services is specified in Article 346.26 of the Tax Code of the Russian Federation.

UTII does not apply to individual entrepreneurs and organizations whose number of employees exceeds 100 people and commercial enterprises in which the share of participation of other organizations is more than 25%.

Application of UTII in 2021

It should be noted that when paying UTII, both individual entrepreneurs and organizations are exempt from paying the following taxes:

- on property;

- on profit (personal income tax);

- value added (VAT).

In general, the possibility of applying the Unified Tax on imputed income is regulated by regulations of local authorities. At the same time, the procedure for paying UTII may be different due to the fact that the K2 coefficient may differ in different regions.

The use of UTII involves payment of tax based on the amount of income not actual, but imputed by officials of an individual entrepreneur or organization.

The 2021 UTII formula includes basic yield, as well as physical indicators and coefficients K1 (deflator) and K2 (adjustment).

When choosing UTII, individual entrepreneurs and organizations are required to register as payers of this tax within five days after the start of activities on UTII. Conducting activities on UTII without registration entails a fine in the amount of 40,000 rubles or 10% of the potentially received income.

UTII does not have the right to apply to individual entrepreneurs and organizations with more than 100 employees.

Calculation of UTII 2021

The single tax formula for calculating UTII in 2021 for individual entrepreneurs and organizations for the month is as follows:

UTII = BD*K1*K2*FP*0.15

- DB – basic profitability. This is the exact figure determined by the tax code for each type of activity. It is indicated for the unit of measurement, depending on the type of enterprise. For example, for retail trade, if the area of a retail outlet exceeds 5 sq/m, the basic profitability is 1,800 rubles per square meter. For a motor transport company for the delivery of goods – 6,000 rubles for each transport unit. For an organization providing household services – 7,500 rubles for each worker, including the entrepreneur himself. A complete list of basic income amounts is specified in the Tax Code, Article 346.29.

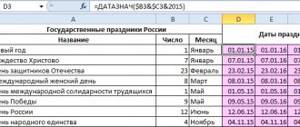

- K1 – deflation coefficient established by the government of the Russian Federation. For 2015, coefficient K2 = 1.798.

- K2 is a correction factor. It is appointed by local government authorities and, at their request, can be from 0.005 to 1, that is, whether or not to reduce the tax burden. When using a correction factor, the resulting value should be rounded (to the third decimal place). To find out the size of K2, you should contact your local tax office.

- FP – physical indicators of the enterprise. This is the total number of units of measurement specified in the “base yield” paragraph. For entrepreneurs in the field of retail trade, it is necessary to calculate the square meters on which the retail outlet(s) are located, for organizations providing personal services - this is the number of employees, for motor transport enterprises for the delivery of goods - the number of vehicles, etc. When calculating the single tax FP rounded to whole numbers.

0.15 is 15% of the calculated imputed income, which must be paid to the budget.

To pay for a quarter, the resulting value is multiplied by three.

Changes to UTII in 2021

Increase K1

Let us recall that back in 2021, the adjustment coefficient K1 was supposed to be 2.083, but the Ministry of Economic Development of the Russian Federation decided to leave K1 at the 2015 level - 1.798. For 2021, K1 in the amount of 1.798 continued to be valid for the purpose of calculating UTII.

Thus, over the course of three years (2015, 2021, 2021), there have been no significant changes in this tax system. The use of tax deductions and the procedure for making insurance contributions for individual entrepreneurs and organizations remains the same.

But 2021 brought a not very pleasant surprise. A draft law was proposed for consideration by legislators, increasing the K1 from 2018 by 3.9% from the K1 in force in 2021. The bill was passed and signed by the president. With such a percentage increase, K1 in 2018 for calculating UTII amounted to 1.868.

For 2021 , K1 was increased and is 1.915, which entailed an increase in the tax amount.

The size of K1 in 2021 is currently unknown. We will update this page as soon as the relevant regulations are published.

Cancellation of UTII after 2021

As stated above, 2021 will likely be the final year of this tax regime. The Minister of Finance A. Siluanov said the day before that UTII is often used by unscrupulous entrepreneurs who evade paying taxes. He added that on average, UTII payers pay taxes in the amount of only about 1% of their revenue. All this leads to the fact that the state budget does not receive the required amount of taxes.

In this regard, the Ministry of Finance does not support the idea of extending UTII after the end of 2021. The State Duma holds a similar opinion.

At the same time, already in 2021, UTII may be abolished in a number of regions of the Russian Federation by decision of local authorities. In particular, several municipalities of the Perm Territory have already adopted the relevant legislative acts.

Ban on trade in labeled goods from 2021

Some entrepreneurs using UTII will have to switch to a different tax regime starting in 2021. The fact is that from January 1, 2021, changes to the tax code will come into force. According to Art. 346.27 of the Tax Code of the Russian Federation, UTII from 2021 cannot be applied in the field of trade in the following products:

- medicines subject to mandatory labeling;

- shoes and clothing, products made from natural fur and other products subject to mandatory labeling.

As of today, the bill has been adopted by the State Duma in the first reading, but has not been finally approved and is being finalized.

Reducing UTII

Taxation under UTII does not exempt from mandatory payments to the Pension Fund of Russia (PFR) as well as to the Federal Mandatory Medical Insurance Fund (FFOMS).

Contributions to the Social Insurance Fund (FSS) are made voluntarily “for oneself” and are mandatory for employees.

VAT is levied on a company engaged in the sale and production of products or services. Not everyone is aware of the essence of this tax. What is VAT in simple words will be discussed in the next article.

Read about what the concept of “gross margin” includes here.

Businesses open and close, and every entrepreneur should know not only how to open a business, but also how to properly close an enterprise so that the tax and other authorities do not have questions or claims. Here we will look at the nuances of closing an LLC.

Based on the tax code, an individual entrepreneur who does not hire employees can deduct up to 100% of the single tax.

If an enterprise has employees, then no more than half of the single tax is deducted.

Calculation example 1

UTII can be applied both to organizations and individual entrepreneurs. UTII for individual entrepreneurs and its calculation for a specific example is presented below. It should be noted that there are slight differences in the nuances of using the system, but, in general, the methodology does not change.

Here is an example of calculating UTII based on initial data:

- enterprise IP Malinkov A.A.;

- type of activity: veterinary services;

- region: city center;

- basic income: 7500 rubles;

- physical indicator: hired employees together with individual entrepreneurs;

- K1 = 1.868;

- K2 = 1;

- Rate – 15%.

Tax calculation for the quarter:

7500 * 1 * 1.868 * 1 * 0.15 * 3 = 6304 rubles - this is the amount excluding insurance premiums.

Since the individual entrepreneur paid insurance premiums that exceeded the amount of tax, he does not owe anything to the budget.

Calculation of UTII:

6304 -6997 = - 693 = 0 rubles.

Example of UTII calculation

Let's figure out how to calculate imputed income.

Let's calculate the single tax for an individual entrepreneur who does not have employees and provides household services: BD - 7,500 rubles (data from the tax code), FP will be equal to one, since there is only one employee, K1 - 1.798 (RF government decree for 2015), K2 Let’s also take it equal to one, as in most subjects of the Russian Federation.

UTII will be:

DB (7500)*K1 (1.798)*K2(1)*FP(1)*0.15 = 2022.75 per month, for the quarter 2022.75*3 = 6068.25 rubles.

Contributions for an individual entrepreneur, based on the minimum wage approved by the Government of the Russian Federation for 2015, will be:

- in the Pension Fund of Russia 18,610.80 rubles;

- in the FFOM 3650.58 rubles;

Total for the year 22261.38 rubles, for the quarter 22261.38 / 3 = 7420.46 rubles.

Contributions exceeded the tax, so we fill out a “zero” declaration.

Let's calculate UTII for a store with an area of 40 sq/m and two employees with a salary of 20,000 rubles.

BD(1800rub) * K1(1.798) * K2(1) * FP(40 sq/m) * 0.15 = 19418.4 rubles, for the quarter 19418.4 * 3 = 58255.2 rubles.

Mandatory payments for employees per month:

- in the Pension Fund of the Russian Federation (22%): 20000*2*22% = 8800 rubles.

- in FFOMS (5.1%): 20000*2*5.1% = 2040 rubles.

- in the Social Insurance Fund (2.9%): 20000*2*2.9%= 1160 rubles.

Total for the month is 12,000 rubles, for the quarter 12,000 * 3 = 36,000 rubles.

50% of UTII is: 58255.2 / 2 = 29127.6 rubles. and this is exactly how much should be paid to the tax service, since mandatory contributions (36,000 rubles) exceed this value.

What do you mean by tax?

Let's consider a single tax on imputed income. It means a special fee regime that can be applied by an individual entrepreneur or organization, but only for established types of activities. There are 14 such types of activities. In each municipality, the government independently decides which types of activities (within the federal list) will be subject to UTII and which will not. And each of these decisions is governed by local law.

In UTII, the amount of actual income does not matter. This tax can be determined based on the amount of possible monthly income, which is established by the state. The amount and amount of imputed income for each type of activity under the Tax Code (Article 346.29 of the Labor Code) is clearly defined.

Like any other special regime, UTII with the calculation of one tax replaces several basic ones: income tax (for individual entrepreneurs), income tax (for organizations), VAT (with the exception of the customs territory of the Russian Federation, paid at the intersection of goods) and property duty.

The number of employees using special UTII regimes can be no more than 100 people. Another significant restriction on the use of UTII for an organization is the prohibition on the use of UTII in services for the transfer of temporary possession or use of gas stations.

When using UTII, the declaration is submitted quarterly, and quarterly tax is paid in the amount of 15%.

Tax payment deadlines

Payment of UTII should be made before April 25th for the 1st quarter, before July 25th for the 2nd quarter, before October 25th for the 3rd quarter and before January 25th for the 4th quarter. .

It is possible to make a tax deduction only from contributions already paid, for example, to reduce UTII in the first quarter, you must have time to pay contributions to the Pension Fund, FFOM, Social Insurance Fund for the last quarter of the previous year.

Tax must be paid to the tax office where the company is registered.

Calculation example 2

Initial data for calculating UTII:

- enterprise LLC "Rost";

- type of activity: trade;

- region: city center;

- basic profitability: sales floor area;

- physical indicator: 70 sq.m.;

- basic income - 1800;

- K1 = 1.868;

- K2 = 1;

- Rate – 15%.

Tax calculation for the quarter:

1800 *70 * 1.868 * 1 * 0.15 * 3 = 105916 rubles - this is the amount excluding insurance premiums.

Since the company paid insurance premiums for its employees, the tax amount is reduced by the amount of insurance premiums paid, but not more than 50%.

Example of UTII calculation:

105916 - 52957 = 52959 rubles.

Combination with other taxation systems

With several types of activities of a commercial enterprise, there is the possibility of joint payment of various taxes: for example, under UTII and the simplified taxation system (STS).

The payment method in this case is not defined by law.

You can maintain separate accounting records for income and expenses, property, and wages of employees employed in various enterprises.

The easiest way is to divide income separately by activity taxed by UTII and separately taxed by the simplified tax system.

Expenses should be calculated according to UTII, according to the simplified tax system and according to joint expenses, in proportion to the income received from different enterprises.

Many enterprises distribute various types of activities across different organizations so as not to combine tax payments and not to increase the number of accounting calculations.

Calculation method

Current regulatory legal acts of representative bodies establish a single tax rate of 15%. The question of how to correctly calculate the UTII amounts yourself can be solved by using the formula. The following formula applies:

UTII = BD * Federal Law * K1 * K2 * 15%,

where BD is the basic profitability established by the state per unit of physical indicator - it depends on the type of business activity being carried out;

FZ - physical indicator by type of activity (individual);

K1 – deflator coefficient (its cost for each calendar year is established by law);

K2 is an adjustment factor that takes into account the specifics of doing business in a particular municipality (municipal authorities set the amount of UTII tax for established types of activities).

The amount of the duty determined in this way must be reduced by the amount of insurance premiums actually paid from the wage fund of employees of the business entity, but not more than 50%.

The values of the basic UTII yield in the declaration are indicated in rubles.

Tax accounting and reporting

Individual entrepreneurs operating under UTII are exempt from maintaining accounting books and to pay the tax it is enough to fill out a tax return once a quarter.

If an individual entrepreneur has hired personnel, then additionally, no later than the 15th day of January, April, July and October, it is necessary to submit a report to the Pension Fund and the Federal Compulsory Medical Insurance Fund on the amount of mandatory contributions made to these funds, as well as once a year to report on the amount employees at the tax office until January 20.

Organizations are required, in addition to the tax return, to submit to the tax service accounting reports (quarterly) and once a year data on the physical indicators of the enterprise and the average number of employees. A report on contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund is made once a quarter.

Definition of indicators

Let's look at each of the indicators in more detail:

- The basic yield of UTII can be established according to the rules of the Tax Code. It is determined per unit of physical indicator by type of activity. The table below presents a list by type of activity of enterprises and the rate of basic profitability.

| Code of type of entrepreneurial activity UTII | Physical indicator | Profit per month, rubles |

| Domestic services | Number of employees (together with the individual entrepreneur himself) | 7500 |

| Veterinary | Number of employees (together with the individual entrepreneur himself) | 7500 |

| Car maintenance and repair | Number of employees (together with the individual entrepreneur himself) | 12000 |

| Parking services | Parking area | 50 |

| Cargo transportation | Number of vehicles | 6000 |

| Transportation of passengers | Number of seats | 1500 |

| Retail trade through stationary facilities | Trade hall area | 1800 |

| Retail trade without a sales area with a sales area of no more than 5 sq.m. | Number of retail outlets | 9000 |

| Retail trade without a sales area with a sales area exceeding 5 sq.m. | Trade hall area | 1800 |

| Catering services with service hall | Visitor service hall area | 1000 |

| Food services without a service hall | Number of employees (together with the individual entrepreneur himself) | 4500 |

This list is also legislatively approved in Article 346.26 of the Tax Code of the Russian Federation.

- Physical indicator. As its unit, you can take the number of trade objects and working employees of the company, the area of the trading floor, the number of vehicles, etc.

- The value of the deflator coefficient is established by law by the Ministry of Economic Development. In 2021 it was equal to 1.798, and in 2021 it was 1.868, and in 2021 it was set at 2.063.

- The value of the UTII correction factor can be set by local authorities in each region in its own way. It depends on the type of activity of the company and the place of business. In order to find out the value of this coefficient, you need to go to the tax service website, finding the desired region and the desired value.

- The UTII rate may be reduced in some regions at the local government level.

The value of the adjustment coefficient of basic profitability K2 is formed under the influence of the following factors:

- the amount of income of the entrepreneur, which depends on the type of activity (B);

- the amount of income depending on the level of average wages per company employee (Z);

- The place of business of the entrepreneur (F) is taken into account.

The formula for the K2 coefficient for calculating UTII is as follows:

K2 = V*Z*F.

This coefficient has specific features for different places of business, as reflected in the table below.

| Kind of activity | Urban district | Territories remote from the center |

| Domestic services | K2 = V*Z*F | K2= Z*F |

| Veterinary services | K2 = V*Z*F | K2= V*F |

| Car maintenance and repair | K2 = B | K2 = B |

| Parking services | ||

| Cargo transportation | ||

| Transportation of passengers | ||

| Retail trade through stationary facilities | ||

| Retail trade without a sales area with a sales area of no more than 5 sq.m. | ||

| Retail trade without a sales area with a sales area exceeding 5 sq.m. | ||

| Catering services with service hall | ||

| Food services without a service hall |

For individual entrepreneurs that operate without the use of hired labor, the value of indicator Z is 0.75. If the individual entrepreneur is a disabled person, but without the participation of hired labor, then Z is equal to 0.2.

If an individual entrepreneur has at least 50% disabled employees, then the value of Z is 0.25.

The value of indicator B depending on the type of activity is presented in the table below.

| Kind of activity | Value B |

| Household services, except shoe and clothing repair | 0,5 |

| Household shoe and clothing repair services | 0,25 |

| Veterinary services | 1 |

| Parking services | 0,8 |

| Cargo transportation | 1 |

| Transportation of passengers | 1 |

| Retail trade through stationary facilities up to 150 sq.m. | 1 |

| Retail trade without a sales area with a sales area of no more than 5 sq.m. | 1 |

| Retail trade without a sales area with a sales area exceeding 5 sq.m. | 1 |

| Catering services with service hall | 1 |

| Food services without a service hall | 1 |

The value of indicator 3 for some types of activities is reflected in the table below.

| Terms of use | Value Z |

| The average wage per 1 employee is less than the subsistence minimum | 1 |

| The average wage per 1 employee is more than the subsistence minimum | 0,75 |

The minimum subsistence level for the population is established by the Government. The average salary is determined based on the following data:

- certificate 2-NDFL;

- work time sheet;

- pay slips.

If there is no data on wages, then indicator 3 is equal to 1.

If a company has unified tax debts to the budget, then Z is also taken equal to 1.

The value of the F indicator is set:

- urban district - 1;

- territories remote from the center – 0.2.

What taxes are best to pay?

Advantages of paying UTII for individual entrepreneurs: no accounting is required. Disadvantage: quarterly tax payment.

The amount of the single tax changes depending on the decision of local authorities, so it is difficult to say which form of taxation will be more profitable, and each entrepreneur decides for himself.

If you want to organize your own business, but you don’t even have the minimum amount to invest, you need to look for options on how to get this money. You can find out the most affordable ways to get money for a business from scratch on our website.

You will find an overview of options for making money on the Internet for schoolchildren in this topic.

What are the payment terms?

The deadlines for paying UTII for the quarter are clearly established in the legislation.

There is no need to pay UTII tax in the following cases:

- loss of physical indicator;

- deregistration and termination of activities under UTII.

The tax period is a quarter.

The payment date is the 25th of each month following the quarter.

What is area reference?

In the case where the retail outlet is stationary (renting premises in a shopping and entertainment complex), the tax amount is calculated based on the area of the premises. According to the current law, the standard rate is one thousand eight hundred rubles per square meter. Since all available square meters are taken into account, the entrepreneur should correctly delimit the rental premises.

A feature of UTII, like any other special regime, is the replacement of the main taxes of the general taxation system with one - a single

It is quite easy to calculate the tax base; to do this, you need to multiply the correlating coefficients by each other. The resulting amount should be multiplied by the area of the premises and the current tax rate. The result of these calculations should be divided by 0.15 in order to find out the amount of taxation. Let's see how to calculate UTII - an example of a store with an area of twenty-five square meters:

- 0.437*1.798*1800*25=35,357.67 rubles;

- 35 357,67*0,15=5 303, 66.

It is important to pay attention to the fact that in this case the amount of tax deductions is practically unchanged. An increase or decrease in the payment amount is observed only if the correlation coefficients change.

It should also be said that for small stalls and trade pavilions a different computing system is used. In the case where their area does not exceed five square meters, the base rate is nine thousand rubles. The number of sellers in the pavilion is used as a physical indicator. For example, let's look at a small stall, the area of which is only four squares. If there is one employee working in this store, the amount of tax deductions will be equal to:

9,000*1*0.437*1.798*0.15=1,060.7 rubles.

It should be noted that the amount of quarterly payments may be reduced in the following situations:

- with additional payments for sick leave;

- making an insurance premium;

- payment of compulsory insurance tax.

It is important to note that the maximum UTII benefit is fifty percent.

Since 2013, UTII is a voluntary tax regime

UTII - example of tax calculation for an incomplete period

Let's change the conditions of the previous example a little. Let’s say that individual entrepreneur Tarasov was registered with the tax inspectorate for imputed activities on 02/12/18. Let’s change the type of entrepreneurship. Let the businessman be engaged in the provision of cargo transportation services, and not in retail trade. For these purposes he has 5 cars. The coefficients are taken the same. How to calculate the amount of UTII tax for 1 sq. 2021? The accountant will perform the following calculations:

- There is no tax charged for January.

- Tax for February is calculated according to part-time rates.

- DB for February, March = 6000.00 rub.

- Number of physical indicators for February, March = 5 TC.

- VD value for February, March = 30,000.00 rub.

- Amount of tax payable for February = ((RUB 30,000.00 x 1.868 x 0.8 x 17 days) / 28 days) x 15% = RUB 4,083.00

- Amount of tax payable for March = 30,000.00 x 1.868 x 0.8 x 15% = 6,725.00 rubles.

- Amount of tax to be paid for 1 sq. 2021 total = 4083.00 + 6725.00 = 10808.00 rub.

Rules for making calculations

Let's move on to talking about how to calculate UTII for individual entrepreneurs. First of all, it should be said that this taxation is calculated for one quarter . To do this, the entrepreneur must fill out the appropriate document. The declaration must be submitted by the twentieth day, the first month from the beginning of the new quarter.

It is important to note that a specific feature of this system is the absence of the need to take into account the real profit of the entrepreneur. The rate is determined on the basis of conditional results characteristic of a particular type of activity. This point is quite controversial, however, according to the tax authorities, such a regime makes it possible to make the most accurate calculations of the real revenue of enterprises operating in a certain direction.

For UTII, the actual income received does not matter

Before filling out the declaration, it is recommended that you read article number three hundred forty-six of the Tax Code of the Russian Federation, which records information on the basic profit of various industries . In order to correctly calculate the amount of tax deductions, you will need to carefully study the various terms used in this document . Next, we propose to consider the meaning of the most important terms:

- Physical presence . This term characterizes the volume of business activity and is used to compare several organizations specializing in the same field. Similarity is determined based on established standards. For organizations involved in the sale of motor vehicles, indicators of the number of vehicles are used, and for companies engaged in trade, calculations are made based on the size of the “working” area of the premises.

- Correlation/deflator coefficients (K1). The compilation of these calculations is carried out by the Ministry of Economy. These coefficients are used to increase the basic tax rate. In two thousand and fifteen this figure was 1.799 percent. This means that the tax rate must be multiplied by this indicator. In addition, there is a second coefficient, the value of which is determined by local authorities. Its calculations are made based on the volume of a particular settlement, the degree of profitability of business activities and other parameters.

The formula for calculating UTII is quite simple, taking into account knowledge of all the above parameters. When making calculations, the following formula is used: “DB*(P1+P2+P3)*K1*K2=NB”. Let's take a closer look at this formula. “BD” is an abbreviation of the term “basic income”, the amount of which is regulated by the Tax Code. The terms “P1”, “P2” and “P3” represent physical indicators of the enterprise’s income for each month in the quarter. We discussed above what the abbreviations “K1” and “K2” mean. “NB” stands for taxable base.

Next, we propose to consider a real example of calculating UTII. As an example, we will consider the activities of a veterinary clinic registered as a limited liability company. This organization operates in Voronezh. In the first two months of the quarter, the company had fifteen employees, and in the third month the company hired two additional people. The basic profitability of this enterprise is seven thousand five hundred rubles. The correlation coefficient in the city of Voronezh is set at 0.50 percent. The overall correlation coefficient for two thousand and eighteen is 1.868 percent.

After we have received all the numbers needed to prepare the calculations, we should move on to the calculations themselves. First you need to add up the number of employees. The resulting amount should be multiplied by the basic profitability of the enterprise. The result obtained is multiplied by correlation coefficients established by local authorities and the tax service of the Russian Federation. The calculation formula in this example is as follows:

7500*(15+15+17) *0.50*1.868=329,235 rubles.

Having calculated the amount of the tax base, you will need to calculate the tax rate, the value of which is fifteen percent of this amount. This will require 329,235 rubles, multiplied by 0.15. The result of this multiplication is an amount equal to 49,385.25 rubles, which is the amount of the UTII payment.

The tax is calculated based on the amount of estimated income, which is established (imputed) by the state

There will be no extension of the regime

The decision to cancel UTII is final; there will be no extension of the period for its application. Although various bills on this topic were considered, they were not adopted. According to the letter of the Federal Tax Service of Russia No. SD-4-3 / [email protected] dated August 21, 2020, from January 1, 2021, organizations and individual entrepreneurs that are UTII taxpayers will be deregistered. Taxpayers themselves do not have to submit any applications to the Federal Tax Service - deregistration will take place automatically.

At the same time, the UTII tax return for the 4th quarter of 2021 is submitted to the Federal Tax Service before January 20, 2021, and the tax itself must be paid no later than January 25.

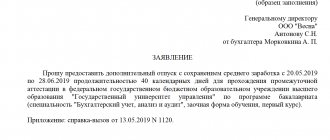

The procedure for switching to UTII

You can make the transition to imputation in several ways:

- Submit the necessary application when registering an individual entrepreneur, or when opening an LLC, along with the necessary documents for registration.

- Within five days from the date of commencement of application of the imputation.

There are special forms for tax registration:

- Form UTII-1 for companies;

- Form UTII-2 for entrepreneurs.

Registration of an LLC on UTII must be carried out at the location, and as an individual entrepreneur - at registration or residence. But if the same type is planned to be carried out on the territory of several regions or municipalities at once, it is not necessary to register it immediately in all tax authorities that relate to them.

It is allowed to switch to imputation from another regime if the new conditions turn out to be more beneficial for the subject.

Important! If the registration deadlines are not met, a fine of 10 thousand rubles may be imposed.

How to calculate tax for UTII, using what formula

The calculation of UTII has its own nuances: the formula for calculating UTII includes both real business indicators (number of employees, number of vehicles, store area) and expected ones - monthly profitability of activities. This is a fixed amount that officials calculate; it changes quite rarely. And to take into account inflationary processes and local characteristics of activity, deflator coefficients are used: K1, which is established by the Ministry of Economic Development, and K2, which is determined by municipal officials.

To calculate UTII you need to know the tax base. How to calculate the tax base for UTII - read here .

It's rare that a company starts its work on the first day of a new quarter. In this regard, the question arises: how should the imputed tax be calculated if the company began its work in the middle of the month? A detailed answer with links to explanations from the Ministry of Finance is given in the article “If a new business is started in the middle of the month, UTII is calculated only for days worked .

IMPORTANT! A company can change the amount of imputed tax payable depending on the days actually worked only at the beginning of its activities as an “imputed tax” or when closing a business on UTII. Read more about this in the material “Imputed income does not depend on the number of days actually worked .

So, you have switched to UTII and want to know how to calculate the tax base for UTII without errors and protect yourself from the nagging of tax inspectors? Then you need to read this publication .

Imputation has one undoubted advantage, thanks to which this special regime is in some cases more profitable than PSN, which can also be used for many types of activities falling under UTII. The UTII payer can reduce the tax payable by the amount of insurance premiums. “The procedure for reducing UTII by the amount of mandatory insurance contributions” will tell you how to do this .

If you are the head of a company and want to check the work of your accountants, then our article will be useful to you.

This publication contains a formula for calculating imputed tax, links to legislative acts regulating the calculation, the sizes of deflator coefficients and the calculator itself for calculating UTII. Knowing the size of the physical indicator, you can calculate the tax payable. The calculator will be useful not only for managers, but also for accountants - use it to check your calculations.