Author of the article: Anastasia Ivanova Last modified: January 2021 46409

Any employee has the right to change his place of work for various reasons. And he has the right to initiate such a process. It is necessary to find out what payments are due upon dismissal of one's own free will. These include not only earnings for time worked, but also other types of accruals. Knowing your rights will allow you to receive the full amount of funds required by law.

What operations are performed during calculation

Employees can quit for various reasons: from their own desire to staff reduction. However, payment of wages upon dismissal is carried out regardless of under which article of the Labor Code of the Russian Federation the employment contract was terminated.

The responsibility for calculating the amounts lies with the accountant, but every employee can check whether everything has been done correctly. To carry out this operation, it is necessary to request a payslip on the day of dismissal and carefully study the accruals reflected in it. After you receive the document in your hands, you can proceed to a detailed analysis of payments.

The final payment upon dismissal usually includes:

- salary for the last month of work;

- monthly bonus (if it is provided for in the employment contract);

- payment for additional work time (overtime, night, holidays, etc.);

- compensation for missed vacation.

Some enterprises have a collective agreement under which a resigning employee may be entitled to various compensation payments, especially if the contract is terminated at the initiative of the administration. This can be a one-time severance pay in a fixed amount or a percentage of the employee’s salary.

Vacation pay calculation

The company from which the employee is resigning must necessarily pay him compensation for vacation that was not used during the entire period of employment. In the case where a person has not been there for several years, the amount of payments is accordingly made for all this time. If a citizen terminates his employment relationship with an organization on his own initiative, and the period of work is not completely completed, then in this case deductions are made from his salary for the vacation used. In this case, the accounting department will have to calculate the exact number of days or months of work of the person.

The amount of vacation pay upon dismissal is calculated as follows:

- The number of days of annual paid leave is taken, for example 28. Then it is divided by the number of months in the year, i.e. 12. Then the resulting number (2.33) is multiplied by the number of months worked in the working period, for example 4.

- If you multiply 2.33 by 4, you get 9.32 unused vacation days. This number is then multiplied by daily earnings, for example 900 rubles. It turns out 8388 rubles. This is the money that a person is entitled to as compensation for unused vacation. Personal income tax will be withheld from the same amount - 13%.

The final payment to the employee should not be delayed by the boss. It must be done on time, regardless of which of the grounds specified in the Labor Code the citizen is dismissed from.

Payment terms

Calculation upon dismissal - payment terms . What is the deadline for terminating an employment contract? Regardless of the reasons for dismissal, the company is obliged to fully pay its obligations to the employee on his last day of work. Such requirements are contained in Article 140 of the Labor Code of the Russian Federation.

If the organization has a salary project, the amount due to the dismissed person is transferred to his bank card. If a company pays wages in cash, the employee receives the money from the cash register. Consequently, the calculation for the dismissal of any employee is made within the time limits specified by law.

Sometimes on the last working day an employee is absent from the workplace, for example, he is on vacation or sick. In this case, the organization is obliged to pay him the final payment upon demand on the last or next business day. If the dismissed person does not show up for the money, the funds due to him are deposited.

Payment upon dismissal of an employee is made simultaneously with the issuance of a work book and familiarization with the order to terminate the contract. This must be done on the last working day of the dismissed person.

This is also important to know:

the day of dismissal is considered a working day or not

Calculation of payments

Let's look at how the amounts payable are calculated in the event of voluntary dismissal.

Wage

The size of the salary directly depends on the payment system adopted in the organization:

- Time-based payment provides for the payment of funds for working days worked. For example, if the salary is 20 thousand rubles, and out of 22 days in a month only 12 were worked, then the amount of earnings will be: 20,000 / 22 * 12 = 10,909 rubles.

- The piecework system is characterized by the results of labor, measured in specific indicators, for example, in the number of products made. Let’s say that during the month when the employment contract is terminated, the worker produced 20 pieces of products, the cost of each of them is 400 rubles. The earnings due to him will be calculated as: 20*400 = 8,000 rubles.

In addition, other payment systems can be used, for example, piecework-bonus, progressive, bonus, etc.

In addition, a person dismissed by decision of the owner of the property of the head of the organization, when the termination of the employment relationship is not related to his activities, on the basis of Art. 279 of the Labor Code of the Russian Federation, a special reward is issued.

Article 279 of the Labor Code of the Russian Federation - Guarantees to the head of the organization in the event of termination of the employment contract

In the event of termination of an employment contract with the head of an organization in accordance with paragraph 2 of part one of Article 278 of this Code, in the absence of guilty actions (inaction) of the manager, he is paid compensation in the amount determined by the employment contract, but not less than three times the average monthly salary, except for the cases provided for this Code.

Compensation for unused vacation

The amount of compensation depends on many indicators and, as a rule, special software is used to calculate it.

The calculation algorithm is carried out in the following order:

- The length of service is determined to determine the number of vacation days. To do this, you will need to subtract the date of entry to work from the date of dismissal. From the resulting period it is necessary to exclude time of rest at your own expense for more than 14 days. The result obtained must be rounded according to the following principle: count the number of months and round down the remainder of less than 15 days, round up more than 15 days;

- The required number of days is calculated depending on the length of service and the points of the agreement;

- The number of unused vacation days is established by subtracting those actually taken off from the total period;

- Average earnings per day are calculated. The salary for the last year is divided by the actual days worked over a specified period of time.

Example of compensation calculation:

If a citizen started working on August 13, 2015, and quit on September 16, 2016, and he did not take vacation at his own expense, then his length of service at the enterprise will be 13.1 months. To calculate the amount of compensation, we round the figure and get 13. In accordance with the contractual obligations of the employer and employee, he must be provided with 36 vacation days per year. Thus, we divide 36 by 12 and multiply by 13, we get 39 days. In fact, they were given 15 days off work. Therefore, subtracting 15 from 39 will leave 24 unused days.

Salary for the previous 12 months is 460,000 rubles. Except for vacation, all working hours were worked out. In this case, the average daily income is equal to:

460,000 / (29.3*11 + 29.3*15) = 1365.19 rubles, where:

- The average number of working days per month is 29.3;

- Number of days for 06.2016 – 30;

- The actual period worked in June 2021 is 15 days.

24 unused days are subject to reimbursement in the amount of: 1365.19 * 24 = 32,764.56 rubles.

How to calculate an employee upon dismissal: compensation for vacation

The need to calculate and pay the cash equivalent of vacation pay to a resigning employee is set out in Article 115 of the Labor Code of the Russian Federation. It states that each employee who has worked for 11 months is entitled to annual paid leave of at least 28 days.

It is not difficult to determine that for each full month an employee is entitled to 2.33 days of vacation. Based on this number, vacation pay is calculated for employees and compensation for unused vacation for those being dismissed.

Main holiday

The formula for calculating compensation looks like this:

Number of workers days = 28 days / 12 months * Number of complete work. months – Number of uses days otp.

This formula is used to calculate the employee's dismissal.

Example

Bobrov D.S. was hired as a security guard on February 1. His last working day at the company is October 31. The employee was on vacation from August 1 to August 14. 9.33 days of unused vacation are subject to compensation (28 / 12 * 10 – 14).

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Additional leave

Some categories of personnel are entitled to additional days of rest, for example, employees who have irregular working hours. Since additional leave is provided only after the main one has been used, when the employment contract is terminated, these days are usually unused.

This is also important to know:

What certificates must an employer issue when dismissing an employee in 2021?

To understand how additional leave is calculated when an employee is dismissed, you need to carefully study the Labor Code. The categories of personnel listed there are entitled to:

- 3 days – for specialists with irregular working hours, middle and senior managers, if the corresponding norm is in local regulations (Article 117 of the Labor Code of the Russian Federation);

- 7 days – for workers in hazardous industries (Article 119 of the Labor Code of the Russian Federation);

- in accordance with the provisions of Articles 348.10, 339, 350 of the Labor Code of the Russian Federation and industry regulations - for other categories of personnel.

Also, from 1 to 10 days, depending on length of service, is provided to civil servants of government agencies for length of service.

If the employee took a vacation in advance

If an employee took more vacation days than he was entitled to, upon termination of the contract, the accountant will have to recalculate vacation pay and withhold the excess amount paid.

The calculation procedure for dismissing an employee who has used vacation early is as follows:

1. Exclude periods from working days:

- temporary disability;

- maternity and child care leave;

- business trip days;

- being on paid or administrative leave;

- downtime due to the fault of the administration;

- days of a strike in which the quitter did not participate;

- additional days of rest (for parents of a disabled child).

2. Subtract periods not included in the vacation period - days of absenteeism, suspension from work due to alcohol intoxication (drug use), inadmissibility to work due to lack of permission from a medical worker, failure to complete safety training, expiration of a weapons license (driver's license). right).

Responsibility for late payments to a dismissed person

For violation of the deadlines for issuing payments due upon dismissal to an employee, various responsibilities are provided:

| Administrative | Criminal |

| In accordance with the provisions of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, the conditions for attraction to it are considered to be complete or partial non-payment of payments accrued to the worker under the employment contract. Its goal is to protect and respect workers' rights, and its main function is punitive measures. Therefore, in addition to financial compensation to the employee, a warning to the company or penalties to the state are issued. Officials may be disqualified. It will only be possible to hold you accountable if the employer is proven to be at fault for the delay. | Article 145.1 of the Criminal Code of the Russian Federation defines non-payment of wages as a punishable act. In this case, the organization’s guilt in the delay and a sole or selfish goal, provoked by an impulse to hide incompetence, a desire to achieve a return service or support on a specific issue, must be proven. As a rule, it is defined as the desire to achieve property gain by committing an illegal act. Only an individual - employer, head of the enterprise, chief accountant - can be involved in it |

It should be noted that the resigning citizen must have information about the payments due by law. The ability to calculate the amounts established by law and handle them before the administration of the organization will allow you to protect your interests in any case.

Average daily earnings

Any calculation of an employee upon dismissal begins with determining the amount of average daily earnings. To do this, all payments related to the wage fund are summed up. The calculation does not include:

- material aid;

- payment for study leave;

- travel compensation when sent on a business trip;

- money allocated for employee health improvement;

- funds to pay for kindergarten.

To understand how to calculate an employee’s salary upon dismissal, you can use the following rule: “The calculation of average daily earnings does not include payments already calculated based on average earnings (travel allowances, vacation pay, etc.).”

Fact

Formula for calculating average daily earnings:

Wed days charge = Salary amount. in 12 months / 12 / 29.3

The coefficient of 29.3 was introduced by Government Decree No. 642 dated July 10, 2014.

Let's give an example of how to pay an employee upon his dismissal. To do this, we will use the formula for average daily earnings.

Example

The monthly income of the seller Mikhailov E.A. for November 2021 - March was 30,000 rubles, and from April to October - 32,000 rubles each. The billing period has been fully worked out. Then the average daily earnings will be 1063.71 rubles. ((30000 * 5 + 32000 * 7) / 12).

Average daily earnings for severance pay are calculated differently. To understand how to calculate the salary for the dismissal of an employee who is entitled to severance pay, you need to divide the amount of income he received by the number of days worked according to the production calendar.

Example

Using the data from the above example, we will find the average daily earnings of E. A. Mikhailov to pay him severance pay. It will be equal to 1514.17 rubles. ((30000 * 5 + 32000 * 7) / (21 + 21 + 17 + 19 + 20 + 21 + 20 + 20 + 22 + 23 + 20 + 23)).

If you need to figure out how to correctly calculate an employee upon dismissal, you need to take into account that the days when the employee was absent from the workplace are deducted from the total amount.

Let’s assume that in January E. A. Mikhailov was sick for 10 days and earned not 30,000 rubles, but 14,000 rubles. Then his average daily earnings will be 1,510.55 rubles. (30000 * 4 + 14000 + 32000 * 7) / (247 – 10)).

Payments upon dismissal: step-by-step instructions

How to pay an employee upon dismissal? The accountant should remember that he must be extremely careful in determining the amount of payments due to the employee upon termination of the contract. After all, underpayment of the calculation is fraught with claims from the employee and inspections by the Labor Inspectorate, and overpayment threatens with an unreasonable understatement of income tax with all the ensuing consequences.

This is also important to know:

Dismissal of a pregnant woman under a fixed-term employment contract

Calculation upon dismissal must be made according to the following algorithm:

- Determine your earnings for the last month, taking into account all due payments.

- Calculate the amounts of main and additional leave.

- Calculate severance pay.

- Add up the received amounts.

- Withhold overpayment of vacation pay and other amounts that the employee must reimburse (if necessary).

The final amount will be the company's debt to the resigning employee.

The answer to the question of when severance pay should be paid is obvious: on the employee’s last working day. Moreover, if the resigning employee does not have a salary card, and he did not show up at the cash desk on the last working day, the amount due to him is deposited in a special account.

Compensation for unused vacation

If the employee did not rest, he is given compensation. The Labor Code of the Russian Federation regulates the calculation for dismissal as follows: first, calculate the average earnings for 1 working day; when calculating, take into account bonuses and allowances. Then multiply the resulting amount by the number of days of rest required. When calculating vacation pay, consider the following points:

- If an employee has used all the allotted days this year, he is not entitled to compensation.

- If an employee has accumulated unclaimed days of rest over several years or over the last period, then all unused days are paid (including for previous years).

- If the employee took vacation in advance, a recalculation is made and previously paid amounts are withheld from the wages due.

An online calculator will help you correctly calculate an employee’s resignation at his own request.

Use the average daily earnings calculator upon dismissal

Use the compensation calculator for unused vacation upon dismissal

Calculation of severance pay upon dismissal

A one-time payment (sometimes also called compensation) is issued to an employee on the following grounds:

- if the employment contract contains a clause obliging the employer to pay severance pay in a fixed amount or based on average monthly earnings;

- upon liquidation of a company (closure of an individual entrepreneur) due to bankruptcy, revocation of a license, etc. - on the basis of the norms of clause 1 of Article 81 of the Labor Code of the Russian Federation;

- when reducing the number of personnel - according to the requirements of clause 2 of Article 81 of the Labor Code of the Russian Federation;

- when the owner of the organization changes - in relation to top management, whose dismissal occurs in accordance with the provisions of clause 4 of article 81 of the Labor Code of the Russian Federation.

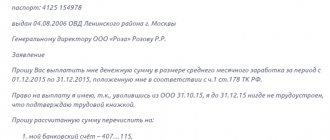

The amount of payments to personnel dismissed on the grounds provided for in clauses 1-2 of Article 81 of the Labor Code of the Russian Federation is regulated by the norms of Article 178 of the Labor Code of the Russian Federation. It says that the calculation of amounts due after the dismissal of an employee must include severance pay in the amount of at least 1 month’s average earnings. If a citizen registers with the employment service within 2 weeks after termination of the contract and is unable to find a job in the next 2 months, during this period he will be paid a benefit calculated in the manner described above.

Managers and chief accountants who terminate contracts on the grounds of clause 4 of Article 81 of the Labor Code of the Russian Federation are entitled to a payment in the amount of at least 3 average earnings. They have no obligation to register with the employment service.

How severance pay is calculated: example of calculation upon dismissal

To determine the amount of severance pay, you can use the following formula:

Amount of settlement = (Amount of earnings in the calculation period / Number of days worked) * Number of days in the next months

To draw up a certificate of average daily earnings, which a dismissed employee submits to the employment service, the billing period is 3 months.

Mechanic Demidov A.S. resigns on October 31, 2019. The billing period for drawing up a certificate of average daily earnings is 08/01/2019-10/31/2019. It contains 66 working days, which are fully worked out. The employee’s income for three months amounted to 81,000 rubles. Using a calculator, we calculate severance pay upon dismissal according to clause 2 of Article 81 of the Labor Code of the Russian Federation.

For November, A.S. Demidov is owed 25,772.73 rubles. (81000 / (23 + 20 + 23) * 21). If he contacts the employment service on time and does not find a job during December 2021, the company will pay him another 25,772.73 rubles. (since in November and December 2021 the number of working days is the same - 21).

After presenting a work record book without a mark on employment, the accounting department will make a calculation upon dismissal, while the timing of payment of benefits due to A.S. Demidov will be 3 working days after the application.

Reduced severance pay

In some cases, the severance payment may be reduced to two weeks' average earnings. The reasons for this are listed in the Labor Code of the Russian Federation:

- a significant deterioration in working conditions, resulting in the impossibility of further work;

- the employee’s refusal to transfer to another job for medical reasons or the employer’s lack of a suitable vacancy;

- reinstatement of a previously dismissed employee;

- the employee’s disagreement with the employer about being transferred to another location;

- joining the army, conscription for alternative service;

- recognition of incapacity for work based on the conclusion of a medical commission.

This is also important to know:

Dismissal of a financially responsible person at his own request

Payments after dismissal for these reasons are made on the last working day.

Increase in severance pay

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

In some cases, a dismissed employee may agree with the employer on more substantial compensation than he is entitled to by law. Typically, top managers manage to achieve such preferences when the company’s owners change. The amount of the agreed severance pay is usually fixed in an additional agreement to the employment contract. The terms of payment upon dismissal are also specified there.

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

It should be noted that additional agreements of this type usually contain a phrase about the absence of claims against the employer. Consequently, if the employee changes his mind, it will be almost impossible for him to challenge the amount of payments in court.

An example of calculating severance pay and other payments

Manager Shishkin A.A. is called up for military service. In this regard, he resigns from the company on November 16, 2019. The employee's salary is 26,000 rubles, monthly bonus is 3,000 rubles. The employee has been working for the company since January 2015, the pay period (November 2021 - October 2021) has been worked out in full, Shishkin A.A. has not been on vacation for the last year, so he is due 28 days of rest.

It is most convenient to calculate the employee upon dismissal, but if this is not possible, the accountant will act according to the following scheme:

- Will determine the salary for November - 13,619.05 rubles. (26000 / 21 * 11).

- Calculate the monthly premium - 1571.43 rubles. (3000 / 21 * 11).

- Find the average daily earnings - 989.76 rubles. ((26000 + 3000) * 12 / 12 / 29.3).

- Calculate compensation for unused vacation - 27,313.28 rubles. (989.76 * 28).

- Determines the amount of severance pay - 9897.60 rubles. (989.76 * 10).

- Calculate the total settlement amount - 52,401.36 rubles. (13619.05 + 1571.43 + 27313.28 + 9897.60).

The employee will receive the money after his dismissal. The answer to the question: “When should I be paid?” will be standard - no later than the last working day in the company.

Dismissal after completing a probationary period

The period during which the head of the company must evaluate the professionalism of an employee in a specific position, and the employee evaluates his expectations about job responsibilities with reality.

The main feature of the end of the working relationship during this period is the short period for consideration of the application. The application must be signed within three days and the employer does not have the right to increase it. The duration of the probationary period is established by the employment contract or an amendment to it. It cannot exceed three months. For management employees, it can increase to six months. For fixed-term contracts valid for up to 2 months, such verification is not provided in principle, and for 6-month agreements - no more than 2 weeks.

In any of the situations, the employee upon dismissal is not obliged to provide the reasons for the decision and has the right to terminate the employment relationship at any time. While undergoing a probationary period, employees have the same rights to benefits as regular company employees.

Required documents

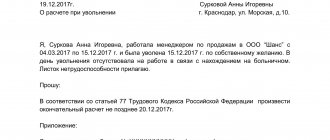

The following documents serve as grounds for dismissal:

- an employee’s application for dismissal (if he terminates the contract voluntarily) or notice of termination of the employment contract;

- severance agreement.

To understand how to correctly pay settlements upon dismissal of an employee, let’s look at the list of documents that an accountant will need for this. It includes:

- dismissal order form T-8 or T-8a;

- note-calculation - form T-51;

- work record book of the dismissed person;

- personal card in form T-2.

What documents does the employer issue?

When leaving, an employee takes a number of documents with him. It must be borne in mind that the employer provides copies of documents with the exception of work and medical books.

A standard set of documents that an employer issues to a resigning employee:

- Order that the employee is hired;

- Employment contract;

- Employment history;

- Dismissal order.

Calculation deadlines that apply when dismissing an employee in different situations

Sometimes staff quit while on vacation, sick leave, etc. Such situations often lead to an incorrect interpretation of labor legislation. Let's look at several typical cases that arise in the practice of accounting services.

How to calculate an employee if dismissal occurs after going on vacation

If an employee has written an application for leave with subsequent termination of the contract, the accounting department is obliged to calculate and pay him the salary on the last day of work (i.e. before the leave). On the same day, the personnel officer introduces the employee to the dismissal order. makes an appropriate entry in the work book and gives it to the employee.

Calculation upon dismissal on a day off: terms

If the date of dismissal falls on a weekend, payouts must be paid on the first working day following the non-working day. This follows from the provisions of Article 14 of the Labor Code of the Russian Federation.

Payment of settlement pay on a day off from the administration upon dismissal of a shift worker: deadlines

If the dismissed person works on a shift schedule and his last working day falls on the administrative staff’s day off, it is convenient for the cashier (accountant) to pay him his paycheck on a working day. Otherwise, they need to be called to work on days off, which is fraught with additional costs for paying the cashier and accountant.

This is also important to know:

How to write a resignation letter of your own free will

In addition, the called employees must obtain written consent to work on days off.

Taxes upon dismissal of personnel: terms and procedure

When calculating a resigning employee, you need to keep in mind that all payments included in the payroll (salary, bonus, compensation for unspent vacation, etc.) are subject to personal income tax. However, personal income tax is not withheld from an employee’s severance pay calculated in accordance with the requirements of the Labor Code of the Russian Federation. Tax must be collected only on amounts exceeding mandatory payments.

If the payment of an employee’s salary upon dismissal occurred on a weekday, the deadline for transferring personal income tax is no later than the next working day. If the payment is made on a weekend, personal income tax is transferred on the next working day.

What is included in the calculation when leaving at your own request?

In accordance with current legislation, upon dismissal on his initiative, the following payments are made to an employee:

- wages for the period worked before termination of work;

- bonuses, allowances and other amounts provided by the organization, accrued to wages;

- compensation in cash equivalent for the days of regular annual paid leave and additional paid days that were not taken off by the employee before the dismissal;

- other payments provided for by the collective labor agreement and industry agreement (Articles 57, 178 of the Labor Code).

A situation may arise when the next vacation was spent by the employee in advance, i.e. for the period before the end of the working year. Then, in accordance with paragraph. 5 hours 2 tbsp. 137 of the Labor Code of the Russian Federation, the employer has the right to deduct from the amount paid before dismissal for unworked vacation days. But this is only possible when the amount of deductions is no more than the charges themselves. Otherwise, they have no right to recover the overpayment for vacation time taken.

Calculation note upon dismissal: goals and design

The calculation note reflects the procedure for calculating the average daily earnings used to calculate severance pay. It does not have a regulated form; in most organizations, accountants use the T-61 form because of its clarity and convenience. The document is internal; the employee can receive it only upon a written request outlining the reasons for the request.

Purposes of receiving a note-calculation:

- control over the procedure for calculating payment amounts;

- confirmation of income at a new job (for negotiations with a potential employer);

- confirmation of the fact of illegal settlement in litigation.

Appearance and content

The T-61 calculation note contains the front and back sides.

On the front side there is information about the employee:

- Full name, position, personnel number;

- article of the Labor Code of the Russian Federation, according to the norms of which the order was issued;

- information about the date and number of the order on the basis of which the calculation is made;

- number of vacation days to be paid (or used in advance).

On the reverse side, in fact, is the calculation itself:

- monthly earnings are shown;

- the number of days of the billing period is indicated;

- average daily earnings calculated;

- the amount of vacation pay (compensation upon dismissal), the personal income tax withheld from it and the amount to be paid were calculated.

The document is endorsed by the accountant who made the calculations for the dismissed person.

Counting order

The calculation is made by the accounting department on the basis of an order to terminate the contract (unified form T-8) issued by the employer.

The following procedure for calculating voluntary dismissal is currently in effect:

- Salary is calculated for days worked.

- Compensation for unclaimed leave is calculated.

- The amounts received are added up and transferred to the resigning employee.

What to do if payments are delayed upon dismissal, employer's responsibility

If the employer does not pay the employee in a timely manner, the dismissed person must seek help from the competent authorities. The complaint can be addressed to:

- to the labor inspectorate;

- to the prosecutor's office;

- to the district (city) court at the place of legal address of the offending organization.

The application must indicate a violation of the employee’s rights, formulate a demand for the former employer, consisting of full payment of obligations and payment of penalties for all days of delay in settlement amounts.

The following must be attached to the application:

- a copy of the work book;

- a copy of the dismissal order;

- pay slips, certificates 2-NDFL and 182-for the last 2 years;

- copies of cash receipts or payment orders for salary payments.

The labor inspectorate and the court, as a rule, side with the employee, obliging the employer to fully pay off the obligations and pay off any accrued penalties.

Dismissal during vacations without pay: nuances

It is possible that during the period of work the employee took leave without pay - dismissal in this case can be compensated under special conditions.

The fact is that days of vacation at your own expense, starting from the 15th day of such vacation in the working year, are not included in the length of service used in determining the duration of vacation (Article 121 of the Labor Code of the Russian Federation). This means that with a sufficiently long vacation at your own expense, the indicators in the formulas we discussed above can change significantly.

For example, the YEARS indicator in the first formula for calculating the duration of compensated leave will be applied only if the person has worked for at least 1 working year (at least 11 months from the date of signing the employment contract). If a person worked exactly that much, but at the same time took 15 days of vacation at his own expense, then 1 month will not be taken into account. This will reduce the number of unused vacation days paid upon termination.

For example, an employee worked for 10 months, but took 16 days of unpaid leave. The number of days of unused vacation for calculating compensation upon dismissal will be 21 days (28 / 12 × 9).

What benefits is the employee entitled to?

- Wages for the number of days worked in the current working month;

- Compensation for unused vacation days (Article 127 of the Labor Code of the Russian Federation);

- 13th salary, if this is required under the collective agreement or bonus regulations;

- Compensation for liquidation of a company or reduction of its staff in accordance with Article 178 of the Labor Code of the Russian Federation.

In case of delay in payment of wages, the employer is subject to an administrative fine in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation for each day of delay. When no agreement has been reached between the employee and the organization on the amount of payments, the employee can file a corresponding application with the labor inspectorate or with a statement of claim in court.

How are bonuses taken into account when calculating average earnings for vacation compensation?

Bonuses can be accrued based on the results of various time periods - monthly, quarterly, semi-annual, annual.

The rules for accounting for this type of additional payments when calculating compensation upon dismissal are established in clause 15 of the Regulations on Average Earnings

Monthly bonus

One bonus for each indicator for each month of the billing period is included in the general base. In this case, the bonus must be accrued in the billing period.

Example:

The employee is a specialist in the sales department, he is awarded two monthly bonuses for sales indicators and one for the return of receivables, that is, 24 bonuses were given for sales for the year, 12 bonuses for debt collection.

When calculating average earnings upon dismissal over the last 12 months, only 12 bonuses for sales performance and 12 bonuses for debt repayment can be taken into account.

Quarterly bonus

A bonus for any period longer than a month but less than a year is taken into account according to the same rules: one for each indicator for each period (for example, a quarter), and it must be accrued in the accounting year.

Example:

The employee will retire in December 2021. For the billing period, he was awarded a bonus for the 1st, 3rd quarter and half a year. All three bonuses must be included in full in the calculation.

Annual bonus

This premium is taken into account in a special way.

This is also important to know:

Article 77 of the Labor Code upon dismissal: grounds for terminating an employment contract

It does not matter in what period it was accrued. It must be taken into account both in the case when it is accrued in the billing period, and in the case when it is accrued in the period after the billing period. Of course, this is true if the period for which the annual bonus is assigned is included in the calculation period for average earnings.

Example:

The employee will resign on January 18, 2021. In January 2021, he was assigned an annual bonus for 2021, in January 2021 - a bonus for 2021. You only need to take into account the annual bonus that was assigned for the year that was included in the calculation period for average earnings.

This period is from January to December 2021 inclusive. This means that we include in the database only the bonus assigned for 2021 and accrued in January 2021.

It is possible that the period for calculating average earnings has not been fully worked out. In this case, you need to look at the period for which the annual premium is calculated. If this period is fully included in the calculation period, then it is taken into account in full, otherwise you need to use a formula that will allow you to calculate the part of the annual bonus that needs to be taken into account in calculating average earnings for compensation.

Part of the bonus to be included in the base = Amount of accrued annual bonus / Working days according to the production calendar in the billing period * Actual days worked in the billing period.

Also read about accounting for annual bonuses in this article.