20.07.2019

0

210

4 min.

The Labor Code obliges employers to make payments to employees in the event of their dismissal. These include salary, compensation for unused vacation and, in some situations, severance pay. Often the requirements prescribed by regulations are not observed by management. Therefore, employees should find out how vacation pay is calculated upon dismissal in order to assert their rights if necessary.

Is compensation for unused vacation calculated upon dismissal in 2021?

In practice, situations often arise when an employee does not have time to take all the paid leave due to him under the Labor Code.

And if such an employee suddenly decides to leave the company, the question will arise: what to do with the unused part of the vacation? Should I take the remaining days off or can I receive monetary compensation for them? In addition, does the reason for which the employment contract was terminated matter? And how will compensation for unused vacation be calculated upon dismissal? The Labor Code of the Russian Federation clearly answers: the employer must pay the former employee compensation for unpaid vacation upon dismissal, i.e. for each unused day.

The period from 03/30/2020 to 05/11/2020 has been declared non-working due to the spread of coronavirus infection. Is it possible to fire an employee on non-working days and what risks are possible for the employer, ConsultantPlus experts explained.

Get trial access to the system and upgrade to the ready-made solution for free.

An employee’s right to calculate compensation for unused vacation and its payment upon dismissal does not depend on the basis on which the employment contract was terminated (letter of Rostrud dated July 2, 2009 No. 1917-6-1).

What payments are due to employees resigning on their own initiative?

It is important to understand what payments are generally due to a person who wants to terminate his employment relationship with the company. Upon termination of employment, the employer is obliged to provide the resigning person with the following compensation payments:

- vacation pay, taking into account the number of days worked in the new period;

- no more than 20% is withheld from earnings if the employee previously took more days off than due from the last payment;

- unused vacation is compensated even if the employee held his position for less than a month, but more than two weeks.

If a citizen has vacation days left, then before dismissal he can use this period to avoid the mandatory 2-week work period.

The main thing is to submit your application for care in a timely manner. An important addition is that if a person is entitled to a longer vacation period than 28 days, calculations are made taking this indicator into account.

More information about payments upon dismissal can be found in the following video:

How to calculate vacation compensation upon dismissal

After the organization is convinced of the need for payment, it faces the question: how to calculate compensation for unused vacation?

In accordance with the general rule, an employee who decides to leave the company has the right to receive monetary compensation for unused vacation in proportion to the total months worked in the company for which these days were accrued (clause 28 of the Vacation Rules, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169, hereinafter referred to as the Rules).

However, if an employee decides to leave his previous place of work not of his own free will, but due to the occurrence of the circumstances listed in clause 28 of the Rules (for example, there was a reduction in staff), then the employer will have to pay him compensation in the amount of the full year worked , but only on condition that such an employee managed to work in the company from 5½ to 11 months (clause 28 of the Rules).

IMPORTANT! The above rule applies only if the employee has not worked for the company for a whole year. Otherwise, upon dismissal, compensation for unused vacation will be calculated according to the general procedure, i.e., in proportion to the time worked.

Other employees (who left the company not due to circumstances specified in clause 28 of the Rules) can also count on full compensation (as for a whole year), but only if on the date of leaving the organization they managed to work for 11 months, but did not complete the full year.

Taxation and special cases

When calculating monetary compensation for unused vacation, you also have to take into account basic tax deductions , since this type of benefit is taxable. Thus, it is customary to collect personal income tax on this amount of compensation if the employee receives payment on the day of official payment or on payday according to the established schedule and this should be handled exclusively by the employer.

However, you should not think that after taxation the amount of compensation will be reduced, because this expense item is assigned to the enterprise itself and the employee receives a net payment. This rule does not apply to situations where an employee decided to leave his position at his own request or wanted to receive monetary compensation for unused vacation days instead of the vacation itself. Income tax, unified social tax, as well as insurance and pension contributions are not withheld from the total compensation.

Employees who are on maternity leave have the right to claim monetary compensation for unpaid leave. In this case, all unused days of vacation service and the average daily earnings, determined by the tariff rate, are taken into account. It is customary to adhere to the same calculation algorithm when determining compensation for additional leave that an employee spent at his workplace. In this case, payment for it must be accrued on the payday.

Calculation of compensation for unused vacation upon dismissal: formula

In general, the formula for calculating compensation for unused vacation upon dismissal is as follows:

Rcompens. = Number of unused days × SRdnZr,

where: Rcompens. - amount of compensation ;

Number of non-users days — number of unused vacation days;

SRdnZr - employee’s earnings on average for 1 working day.

In order to determine the value of the SRdnZr, you need to have information about what salary was accrued to the employee who decided to leave the company during the last 12 months (before the dismissal). In addition, you should know exactly how many days out of these 12 months the employee actually performed work functions (clause 5 of the Decree of the Government of the Russian Federation “On the calculation of average wages” dated December 24, 2007 No. 922).

Taxes

Compensation for unused days off upon dismissal is equal to wages. For this reason, taxes will be withheld from amounts provided to the employee:

- Tax on earnings of individuals (13%);

- To the Pension Fund of the Russian Federation (22%);

- To the Federal Compulsory Medical Insurance Fund (5.1%);

- To the Social Insurance Fund (2.9%);

- Collection for accidents at work (the amount of deduction depends on the type of activity of the organization).

How to calculate compensation for unused vacation: formula for calculating average salary

The formula for calculating the average salary of an employee per working day in order to determine the amount of compensation for non-vacation leave upon dismissal is as follows:

SRdnZr = ZP /12 × 29.3,

where: ZP is the salary that was accrued to the employee for the last 12 months;

29.3 is the average number of days in a month.

Important! For the purpose of calculating the average salary per day, all payments received by the employee and provided for by the labor or collective agreement are taken into account. In this case, payments made outside the framework of labor relations (social benefits, financial assistance, etc.) are not taken into account (paragraphs 2, 3 of Resolution No. 922).

If an employee, according to the Labor Code of the Russian Federation, is entitled to vacation not in calendar days, but in working days, then in order to correctly calculate compensation , the average earnings per day should be calculated differently:

SRdnZr = ZP / K6-day. slave. weeks,

Where:

SRdnZr - employee’s earnings on average for 1 working day;

Salary - the salary that was accrued to the employee for the last 12 months;

K6-days slave. weeks = the number of days an employee has worked based on a 6-day workweek calendar.

If for the 12 months preceding the day of dismissal the employee was not paid a salary, then the average salary for one day will be determined on the basis of data on earnings accrued for the previous period of a similar length (clause 6 of Resolution No. 922).

The calculation method has not changed in recent years, so compensation for leave upon dismissal in 2021 should be calculated according to the above formulas and rules.

In order to correctly determine what amount in monetary terms should be reimbursed to an employee for not having time to take his entire allotted vacation, it is important to find out exactly how many days he has left. However, doing this in practice is not always easy.

Payment of vacation pay for vacation followed by dismissal

The situation parameters and action algorithm are as follows:

| Conditions | Meaning |

| How to apply | The employee has the right to take accrued time before the vacancy actually becomes vacant. To do this, it is necessary to write down such a request separately in the resignation letter. This is required, otherwise it will be compensated in monetary terms by default. |

| Last day | For all final mandatory manipulations - calculations, entries in the personal card, in the work book and its issuance - are carried out on the last day before the start of the vacation. The moment of dismissal is its deadline (Article 127 of the Labor Code). |

| Payments | All payments are made “in advance” as stated above, that is, as if the employee had already taken off the actual time taken. Compensation for days not taken off is calculated only if there are any left, taking into account what was actually taken. The calculation is carried out according to the formulas we described above: they calculate how much a citizen is entitled to for the entire period of work, subtracting the length of the future vacation actually taken, as if it had already been taken off. What remains will be the unused period. Next, determine the average daily earnings and apply one of the formulas. |

How to calculate compensation upon dismissal: counting the days

First of all, you need to find out what the “vacation” length of service of the employee who decided to quit is. That is, for how many full months of performing his duties in the company he is entitled to the corresponding number of vacation days.

Rarely does anyone have an exact number of months worked at the time of dismissal. Much more often in practice, a different situation is common: on the day of dismissal, a month has not been fully worked. How to calculate compensation upon dismissal in this situation is described in paragraph 35 of the Rules:

- if more than half a month has been worked, you need to count such a month as a full month;

- if less than half a month is worked, such period is not taken into account.

For calculation purposes, a month is understood not as a separate calendar month, but as the month of actual performance of labor functions by an employee in a specific company from the moment he was hired by the company (for example, from June 16 to July 16).

A practical example prepared by ConsultantPlus experts will help you correctly calculate your length of service. You can watch it right now with free access to the system.

After determining the “vacation” period, the accountant must calculate the number of days of unused vacation. How to calculate compensation upon dismissal depends on which days the employee’s vacation was accrued—calendar or working days.

If leave was granted in calendar days, then you need to proceed as follows.

For each month of work, the employee is accrued 2.33 days of vacation (letter of Rostrud dated October 31, 2008 No. 5921-TZ). Next, by multiplying the value of 2.33 and the “vacation” experience, the total number of vacation days is calculated. After this, those days that the employee has already taken off work before are subtracted from the total value.

This is discussed in more detail in the article “How to calculate the number of vacation days upon dismissal.”

Important! The exception is those persons who managed to work in the company for more than 11 months, but decided to leave it without working for the company for a year. In such cases, the organization pays compensation in full annual amount, i.e., as if the entire year had been worked.

The formula for calculating unused vacation days looks like this:

Number of non-users days = Number of months slave. × 2.33 – Disp.,

Where:

Number of non-users days _ — number of unused vacation days;

Number of months slave. — the number of months during which the employee was registered with the company;

Disp. — the number of vacation days used by the employee.

Important! When calculating compensation, the days remaining from vacation must be rounded in favor of the employee (up), and not according to arithmetic rules. For example, an employee was hired by the organization on March 27, 2020, and left on June 4, 2020. In this case, the number of days of unused vacation is 4.66 calendar days (2.33 calendar days for the period from March 27, 2020 to April 26, 2020 and 2.33 calendar days for the period from April 27, 2020 to May 26, 2020. Period from May 27 to 04.06 is not taken into account since it is less than half a month).

Let's look at how to calculate vacation compensation upon dismissal if an employment contract was concluded with the employee for the period of seasonal work. In this case, vacation is accrued according to the Labor Code of the Russian Federation in working days (Article 295). For 1 month of work, in this case, not 2.33 calendar days are required, but 2 working days of vacation (Article 139 of the Labor Code of the Russian Federation).

Therefore, the formula for calculating the remaining vacation days will be slightly different:

Number of non-users days = Number of months slave. × 2 – Disp.

What to do if you didn’t transfer your vacation pay upon dismissal?

In case of complete or partial non-payment of wages, and the delay in vacation pay is fully consistent with this concept, the citizen has the right to demand elimination of the violation. The following list of ways to protect his interests is available to him:

- A written application to the company with a demand to repay the vacation pay debt;

- Writing an application to the labor inspectorate outlining a list of violations committed by the employer;

- Submitting a claim against the employer to the prosecutor's office;

- Going to court.

The least effective in practice are attempts to collect compensation through communication with the employer. If he deliberately failed to pay vacation pay upon dismissal, it is unlikely that he will correct the violation.

How to complain about violations during dismissal to the State Labor Inspectorate?

Rostrud bodies are responsible for monitoring compliance with labor legislation. If an employee’s rights are violated, he has the right to contact the labor inspectorate located in the territory where his employer operates. To do this, you need to write a statement in free form, in which you need to indicate (Article 7 of the Law of 02.05.2006 No. 59-FZ):

- The name of the Rostrud department to which the applicant is applying;

- Identification information of the applicant: full name, address, telephone, email;

- Information about the employer who committed the violations, including the name of the company, its address;

- Describe the violations committed in the employee’s opinion, as well as your requirements regarding their elimination.

The complaint can be submitted in person or by registered mail with acknowledgment of receipt. It is allowed to send a message through the appropriate section of the regional labor inspectorate website. After receiving the request, the State Tax Inspectorate must respond to it within 30 days. In some cases, it is possible to extend this period by another 30 days (clause 116 of the Administrative Regulations, approved by Order of the Ministry of Labor of Russia dated October 30, 2012 N 354 n).

During this period, the inspectorate must conduct an inspection of the employer on all the facts stated in the application. If the violations indicated in the appeal are confirmed, she issues an order against the employer with a requirement to eliminate them and pay the due compensation along with interest for the delay.

By issuing an order, the State Tax Inspectorate does not resolve the dispute, but only requires the company to fulfill its obligations within a certain period of time. If the employer does not comply with the requirements, the State Tax Inspectorate has the right to impose an administrative fine on him and transfer the inspection materials to the court.

How to file a complaint with the prosecutor's office about the delay in compensation for vacation?

If the deadline for paying vacation pay for unused rest days upon termination of an employment contract is violated, the employee may contact the prosecutor's office. To do this, you also need to write an appeal indicating the details of the prosecutor, the applicant, the company and a list of violations committed and requirements for their elimination. The procedure will be similar to that used for GIT:

- Submitting an application;

- Initiation of an investigation by the prosecutor;

- Issuance of an order to eliminate violations if they are actually confirmed;

- Receiving a written response from the prosecutor's office based on the results of the inspection within 30 days from the date of registration of the application.

Important! The proposal made by the prosecutor is mandatory for execution by the employer (24 Laws of January 17, 1992 N 2202-1).

A citizen’s appeal to the State Tax Inspectorate or the prosecutor’s office does not prevent the simultaneous filing of a claim in court. The actual expediency of such actions is questionable, since when applying to all these authorities, the final decision will be made by the court. Therefore, it is better to either file a claim immediately or first contact one of the indicated supervisory authorities, and then, if the conflict is not resolved, go to court. The prosecutor's office, upon discovering evidence of a crime, can also transfer the collected materials to the investigative authorities or initiate legal proceedings against the employer.

How to file a lawsuit if vacation pay is delayed?

When filing a claim in connection with non-payment of compensation for vacation, a citizen has the right not to take into account the time that has passed since the end of the working year for which it was provided. The general period for going to court is one year from the date of dismissal (Resolution of the Constitutional Court of the Russian Federation of October 25, 2018 N 38-P). If the established period for filing a claim was missed for valid reasons, it can be restored by a judge (Part 2, 4 of Article 392 of the Labor Code of the Russian Federation).

Resolving a dispute over non-payment of compensation for vacation can occur in two ways:

- In the order of writ proceedings, if the amount of debt does not exceed 500,000 rubles. and is not disputed by the parties;

- In the procedure of claim proceedings, if the value of the claim is more than 500,000 rubles. or the company objects to its payment.

Applications for the issuance of a court order are considered by a magistrate. If the case must be resolved by law in the course of litigation, then you should contact the district court. Writing a statement of claim may require certain legal knowledge, as well as an understanding of the intricacies of procedural proceedings. Therefore, it is advisable to seek help in representing your interests from qualified and experienced lawyers.

Judicial procedures should take no more than 2 months from the moment the claim is accepted for consideration. They require great effort on the part of the plaintiff in collecting evidence and clearly justifying his position. In addition, hearings are often postponed for formal reasons and the total period for consideration of a claim can be up to 3-4 months.

Calculation in non-standard situations

An important nuance in calculating average earnings occurs if an employee quits on the last day of the month. In this case, the billing period is determined in a special way. A ready-made solution from ConsultantPlus and the practical example included in it will help you learn these special rules and avoid making mistakes in your calculations. Get trial access to the system and proceed to the material.

Also, when calculating payment for unused vacation, the following situations may arise:

- The person resigning has worked for less than half a month - no compensation is awarded to him (clause 35 of the Rules on regular and additional leaves, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169).

- Income is present only in the month of dismissal. Then the average earnings are determined for this month by dividing the accrued salary by the calculated value of the average number of calendar days in it (clause 7 of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922), which is calculated from the number 29.3 in proportion to the share of calendar days of work in the total number of days in the month of dismissal (clause 10 of the Decree of the Government of the Russian Federation dated December 24, 2007 No. 922).

- There was no income in the billing period. Then, to calculate average earnings, they take the same period preceding it (clause 6 of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922). If there is no income in it, then the average earnings are calculated from the salary or tariff rate (clause 8 of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

- In the calendar year considered for calculating the number of days of vacation pay, there were vacations at one’s own expense, and their total duration for the year exceeded 14 calendar days. The difference between the actual length of vacation at your own expense and 14 calendar days should reduce the period for which the vacation will be paid.

- The employee took vacation in advance and then quits without working the entire calendar year related to him. Overpaid vacation pay must be withheld from him (clause 2 of the Rules on regular and additional vacations, approved by the People's Commissar of the USSR on April 30, 1930 No. 169), if there are no grounds for paying them in full.

To learn how to calculate the amount of overpaid vacation pay, read the material “Deduction for unworked vacation days upon dismissal.”

Compensation

The calculation of compensation funds is carried out according to the established procedure, which is regulated by Article 139 of the Labor Code of the Russian Federation. There are two options for receiving vacation pay. If the vacation was not taken off completely, then vacation pay is paid in full. If there are days off, including those in certain additional categories, the calculation is based on the total number of days. Compensation can be either full or partial.

Important! The availability of additional days for rest, including those due to complexity and intensity, must be paid for in full settlement with the resigning employee.

How compensation is paid:

- calculations are made based on earned rest days;

- this includes days for previous years, if they have not been burned;

- the calculation is made on the last day in conjunction with other due payments.

If the vacation has already been paid off, there will be no compensation.

Important! If an employee has not worked until the end of the year, but has already received vacation pay, then, based on the calculation, the amount received is withheld in favor of the employer.

Compensation for unpaid leave upon dismissal: payment procedure

As a general rule, the company must calculate compensation for unused vacation upon dismissal and pay it to the resigning employee on his last day of work (Article 140 of the Labor Code of the Russian Federation).

Important! If the resigning employee for any reason was not at work on his last working day, the company is obliged to pay all amounts due no later than the next day after the dismissed employee submitted a request for payment.

Therefore, on the last working day, an employee who decides to leave his place of work must receive compensation from the company for unpaid vacation.

Compensation for unpaid leave can be documented using a form developed by the employer independently, or unified form No. T-61.

For more information about form No. T-61, see the article “Unified form No. T-61 - form and sample.”

When should the payment be made?

Vacation pay upon dismissal is paid on the last working day. It is understood here that this circumstance does not depend directly on the date of termination of the employment relationship.

Simply put, if a person quits working until the last day, then directly on the day of termination of the employment relationship he is given documents, estimated payments, and this date is recorded as the official date of dismissal. All this happens on the last working day.

Formally, a delay of even one day is considered a gross violation of current legislation, but it is important not to confuse this fact with the processing period of a bank payment.

Banks often stipulate in their regulations that funds will be transferred within 3 business days. In this case, the date on which the employer sent funds to the employee’s account will be taken into account. But in fact, he can receive them in 3 days (through a bank transfer of money). The bank will also not be considered the guilty party, so the employee cannot appeal to the regulatory authorities (more precisely, his complaint will be rejected).

How to calculate compensation for unused vacation upon dismissal, if the vacation is additional

There are often situations where an employee who has decided to leave the company did not have time to take not only his annual leave, but also did not take advantage of the days of additional leave.

Such leave is provided to the employee under a collective agreement. For example, a collective agreement may stipulate that upon reaching a certain length of service in the company, an additional few days of vacation are granted.

In such a situation, it is important to remember that days of additional leave must be compensated in accordance with the general procedure (described above), i.e., as if these were days of regular annual leave. This conclusion follows from Art. 127 of the Labor Code of the Russian Federation, which states that when an employee is dismissed, the employer must compensate him (in monetary terms) for all unused vacations.

Therefore, when calculating compensation for unused vacation upon dismissal in 2021, it is important to strictly follow the general procedure described above.

We described in detail about compensation for unused vacation without dismissal here.

In addition to compensation for missed vacation, the employer is obliged to pay the employee wages. Find out how to calculate it correctly here.

Basic Concepts

The question of whether vacation pay should be paid upon dismissal affects many citizens. Often they do not even know that upon termination of an employment contract such payments are due.

First of all, you should refer to Article 114 of the Labor Code of the Russian Federation. It guarantees the right to annual leave, which is paid for by the employer. The procedure for providing such rest is described in Art. 122 of the specified document. In accordance with it, temporary termination of work is permitted after 6 months of work with payment based on the average salary.

Attention! This right is also exercised in cases where an employee resigns. Article 127 of the Labor Code says that if he was not on vacation last year, he is entitled to monetary compensation. It is provided for all unused vacation days during the previous billing period.

Conditions for receiving compensation

Compensation for material damage for missed rest days is possible only if certain requirements are met. Therefore, not everyone can count on the bonus. First of all, you should familiarize yourself with the current conditions for payment of leave upon dismissal.

It is important to remember that there are a large number of holidays. If any of them is not used, this is not a basis for demanding funds from management. The following types of time off are not subject to compensation:

- Sick leave;

- Decree;

- Additional for special working conditions.

By law, only annual paid vacations that the employee did not take while continuing to work are required to be compensated. In other cases, the employer does not have to pay any funds.

Delivery deadlines

The payment procedure is provided for in Article 140 of the Labor Code. In accordance with it, compensation must be issued along with other accruals on the day the dismissal occurs. At the same time, an entry is made in the work book, which is later returned to the employee.

Results

Calculating compensation for unused vacation upon dismissal of an employee is a task that requires the accountant to have a clear knowledge of the relevant labor legislation, as well as an understanding of the features of calculating the employee’s average earnings per day and, accordingly, the vacation days due to him.

It is important to remember that the answer to the question of how to calculate vacation compensation upon dismissal depends on how the employee is supposed to accrue vacation days according to the Labor Code of the Russian Federation: in calendar days or in working days. The organization must compensate unused vacation to a resigning employee on the last day the employee works. In this case, the calculation of compensation for unused leave upon dismissal must be made for all unused days of both annual and additional leave.

If an employee takes vacation in advance and decides to quit, the employer has the right to withhold funds for unworked vacation days. Find out how to correctly calculate the amount to be withheld here.

Sources:

- Labor Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 24, 2007 No. 922

- Rules on regular and additional holidays approved by the People's Commissar of the USSR on April 30, 1930 No. 169

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When is no deduction made for unworked vacation?

There are some situations in which the employer does not have the right to withhold vacation pay upon dismissal at his own request:

- Bankruptcy of an organization followed by liquidation;

- Dismissal due to reduction;

- Termination of work due to illness and inability to perform one’s job;

- Conscription into the army;

- Assignment of a non-working disability group;

- Restoring an employee’s rights after a trial.

In all of the above circumstances, the employer will be obliged to transfer compensation in full and within the period of time required by law. If the employee’s rights have been violated, he can appeal to the judicial authorities and the prosecutor’s office to hold the employer accountable.

Documentation

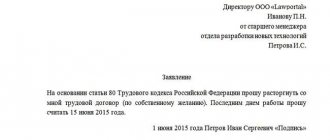

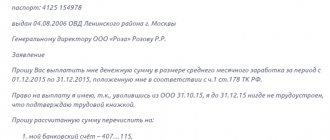

For final payment upon termination of the employment relationship, the following package of documents is required:

- Application for resignation of one's own free will;

- Order to dismiss an employee.

In controversial situations about the amount and timing of payment of vacation pay when an employee resigns at his own request, it is important to have on hand an evidence base, which may be amendment 2 of the personal income tax, which lists the amount of deductions by month and the payment code, thanks to which the received amount of payment can be made.