04.07.2019

0

119

4 min.

The law guarantees citizens the receipt of all mandatory payments upon termination of relations with an employer. In particular, according to Article 127 of the Labor Code of the Russian Federation (hereinafter also referred to as the Code), the dismissed employee must receive monetary compensation for unused vacations. This amount is paid along with all funds due, in addition to wages for the time actually worked. An important condition for receiving compensation is the availability of non-vacation days of annual paid leave. If an employee did not rest, but was not paid vacation pay upon dismissal, then there is reason to believe that the employer is violating labor laws. In such a situation, a citizen has the right to apply for protection of his rights with a complaint to control and supervisory authorities or with a statement of claim in court.

Payment terms upon dismissal

Based on Art. 140 of the Labor Code of the Russian Federation, enterprise managers are obliged to fully pay resigning employees on the last day of work, regardless of the reason and initiator of termination of the employment contract. If the dismissing employee is absent from the workplace for any reason on that day, full payment must be made no later than the day following the day the relevant demands are presented.

Full payment means payment of all funds due to the employee by law:

- salary for the period worked;

- severance pay if staff is being reduced;

- compensation for all unused vacations.

The resigning person is also given certificates of earnings and the status of his personal account in the Pension Fund, reflecting the amount of money transferred for his length of service in the organization.

Violation of the requirement for timely payment threatens the manager with liability under Part 6 of Article 5.27 of the Criminal Code of the Russian Federation. If this violation is systematic and most of the employees do not receive payments, if there is evidence of a crime, they may be charged under 145.1 of the Criminal Code of the Russian Federation.

Important! In a single case, the maximum penalty that an employer faces is administrative liability. Also, the dismissed person can recover through the court or voluntarily a penalty in the amount of 1/150 of the current refinancing rate of the Central Bank of the Russian Federation for each day of delay (Article 236 of the Labor Code of the Russian Federation).

What is meant by late payment?

If an employee leaves of his own free will, he must notify management of his intentions. By law, management must be notified 14 days before termination of the employment relationship.

In case of voluntary resignation, the employer is obliged to make all payments provided by law:

- payment according to the number of working hours, taking into account two-week work;

- compensation for unused vacation;

- incentive and incentive payments in accordance with the collective agreement;

- disability benefits with sick leave;

- severance payments under the main contract or additional agreements.

Issuance of earned funds later than the above deadlines is considered untimely payment. The forced dismissal of an employee due to disciplinary violations does not exempt the employer from due payments. Delay in payment upon dismissal at will or under an article of the Labor Code of the Russian Federation serves as the basis for holding management accountable.

How is compensation for unused vacation calculated?

If an employee has even 1 day of unused vacation, compensation must be paid upon termination of the employment relationship. To check the correctness of the accruals, citizens can calculate everything themselves using the algorithm:

- We determine earnings for the year. To do this, we add up all salaries by month.

- We divide the average annual salary by 12 months and by 29.3 - the average number of days in a month established by Art. 139 Labor Code of the Russian Federation. This is the average daily earnings.

- We multiply the average earnings per day by the number of days of unused rest.

Let's look at a practical example:

Zinoviev O.N. works at OOO. He has 10 days of unused rest left. When dismissal in July, to calculate compensation for vacation not taken, the average annual salary for the last 12 months is first determined:

| July | 33 091,18 |

| August | 34 059,12 |

| September | 33 987,95 |

| October | 45 694,57 |

| November | 34 586,28 |

| December | 34 687,23 |

| January | 33 586,56 |

| February | 34 687,76 |

| March | 33 987,46 |

| April | 34 865,17 |

| May | 35 968,18 |

| June | 35 264,47 |

All salaries for each month are summed up. The total is 424,465.93. This number is divisible by 12:

42,465.93 / 12 = 35,372.16 rubles. – average monthly wage.

35,372.16 / 29.3 = 1,207.24 rubles. – average daily earnings.

1,207.24 x 10 = 12,072.4 rubles. – final vacation compensation.

Calculation of penalties

At the moment, the amount of the penalty has been increased and is 1/150 of the refinancing rate of the Central Bank of the Russian Federation. Previously, the value was equal to 1/300.

In 2021, the refinancing rate is 7.75% per annum. The money should be paid on February 7, but the employer transferred compensation only on March 5. The amount of debt is 45,000 rubles.

What formula is used:

SD x DP x 1/150 x 7.75%, where SD is the amount of debt, DP is the number of days of delay (27).

45,000 x 27 x 1/150 x 7.75% = 627.75 rubles. – the amount of the penalty.

What periods are not taken into account when calculating

When calculating the average salary for the year, the following periods are not taken into account:

- the time the employee maintains average earnings;

- sick leave;

- maternity leave;

- suspension of labor activity due to the fault of the employer or circumstances beyond the control of the parties.

Basis for payment of vacation pay

In accordance with the Labor Code of the Russian Federation, each employee must be provided with paid leave annually, that is, time for the employee to rest at his personal discretion while maintaining his job and average earnings. The duration of the main rest period is 28 calendar days, and in certain areas of activity additional leave is provided, the terms of which are regulated at the level of legislative acts and local acts of the organization.

The right to receive leave arises after 6 months from the date of employment. Subsequent vacations are granted for each year of work in accordance with the priority established at the enterprise, approved 1 month before the start of the calendar year (before December 1). The vacation schedule is mandatory for all organizations and all employees without exception. An employee may have several vacations (within the established days), but one of them is at least 14 days. Based on the vacation schedule, the employer informs about the start date of the vacation 2 weeks in advance and the employee must write a vacation application 2 weeks in advance, where he must indicate the duration and terms of the vacation. The employer must transfer vacation pay no later than three days before the vacation.

What to do if the employer does not pay compensation?

When faced with a situation where a manager refuses to compensate for unused vacation, it is recommended to try to get a written explanation from him. From a legal point of view, the law is on the side of the person leaving, and it is likely that the employer will refuse to enter into a dialogue.

In this case, the employee has several options:

| Complain to the labor inspectorate | Go to court |

| The disadvantage of this method is that the inspector will simply issue an order to eliminate violations within a specified time frame. It is likely that the employer will not agree to comply with the requirements of the regulation, and the maximum that he faces is administrative liability | In the claim, you can file a petition for payment of compensation along with a penalty, as well as for holding the director accountable. Claims are determined by the citizen independently |

Important! If the employee was employed unofficially, the situation becomes more complicated. First you will have to prove the fact of employment, and only after that you will have to collect all due payments from the manager.

Labor legislation on vacation

It is impossible to work completely without rest, no matter how much a person loves his job and no matter how irreplaceable he is - burnout, fatigue, and hence health and mental problems are inevitable.

Therefore, according to the Labor Code, twenty-eight calendar days are provided annually on which each employee can take a break from the work process. The duration may vary depending on the employee’s profession, overtime work, working conditions, etc. The head of the organization can also allow employees a longer vacation than established by law, but cannot reduce it. The only thing available to him without violating labor laws is to recall the employee from vacation with the latter’s consent or compensate the employee for unused days with money (which is very similar in principle to calculating vacation pay upon dismissal).

How to contact the labor inspectorate: step-by-step algorithm

If there is a possibility that the director will comply with the requirements of the order and pay the money, it is easier to solve the problem with the help of the labor inspectorate.

The application procedure is as follows:

| Drawing up an application | It is necessary to indicate the start and end dates of employment, information about the employer and the essence of the problem - non-payment of compensation. |

| Submitting an application and documents | To do this, you need to come to the State Inspectorate in person or use the remote inspection service. In the latter case, you will need a digital signature and scanned copies of documentation. |

| Carrying out an inspection | Upon application, the head of the GIT appoints a responsible inspector who visits the enterprise or orders a documentary inspection. During events, the employer is obliged to provide access to all documentation. |

| Obtaining a conclusion | The applicant is notified in writing of the results of the inspection. The manager is given an order indicating the time frame for eliminating the problem. |

Expert commentary

Kamensky Yuri

Lawyer

Failure to comply with the instructions will result in liability under Art. 19.5 Code of Administrative Offenses of the Russian Federation for the employer.

Documentation

When applying to the State Labor Inspectorate, an application, an employment contract, and a passport are provided. Proof of earnings may be required. The GIT inspector has the right to request additional documentation independently after the start of the inspection.

What is the period for payment of vacation pay provided by law?

The three-day period before the start of the vacation, during which the organization is obliged to pay vacation pay to the citizen, is determined by Article 136 of the Labor Code, and Articles 114 and 115 indicate that if these days fall on weekends or holidays, then the money is accrued in advance.

Important

Labor law prohibits the accrual of vacation pay in installments.

In practice, most employers tend to transfer them much earlier, since delays sometimes arise due to unforeseen circumstances: for example, a bank delay in a transaction.

In this case, the organization will be obliged to additionally pay the employee for each day of delay, regardless of the reason. Since payment of annual leave is the employer’s responsibility, he cannot justify the delay in transferring finances by ignorance of the employee’s retirement, lack of funds, etc.

Solving the problem through court

To recover penalties and unpaid compensation, you can apply to the district court at the place of registration of the employer. If the main office of the company is located in another city, it is allowed to file a claim at the location of the branch (Article 29 of the Code of Civil Procedure of the Russian Federation).

The step-by-step procedure looks like this:

- The plaintiff independently determines the amount of unpaid compensation and penalties - they will be needed when filling out the claims.

- A lawsuit is being filed. It indicates the period of work at the enterprise, full name. director (defendant), position of the plaintiff. The situation is described in detail: under what circumstances compensation is not paid, references to legislative norms, an indication of the manager’s refusal to pay. At the end, claims are made: to pay compensation and a penalty for it. The date of compilation and signature of the initiator is required.

- Filing a claim in court. To do this, you must appear in person at the government agency or send documents with a list of attachments by registered mail.

- Acceptance of materials for production. The judge is given 5 days to do this, after which a decision is made to begin the proceedings. The parties receive notices with the date of the first meeting.

- Consideration of the case in the courtroom. The employer can come in person or entrust the representation of interests to another person. If the petition for consideration in absentia is satisfied by the plaintiff or the defendant, the case is considered without their participation.

- Adjudication. The operative part is announced. After 1 month, the decision comes into force, and the plaintiff is issued a writ of execution. He has the right to keep it with him or present it to the bailiffs for forced retention of the debt if the claims are fully or partially satisfied.

Expert commentary

Platonov Alexander

Lawyer

If the court refuses to satisfy the requirements, the decision can be appealed within a month through a higher authority.

Statement of claim

Along with the claim, a passport, salary certificates, and an employment contract are provided. Copies are made of the documents, and the originals are given to the owner.

State duty

According to Art. 333.36 of the Tax Code of the Russian Federation, plaintiffs in labor disputes are exempt from paying state duty.

Application deadlines

As mentioned earlier, plaintiffs in cases of collection of payments can appeal to the courts within a year from the date when the money should have been transferred by law. If the deadline for filing a claim is missed for valid reasons, a restoration procedure is first carried out, and only after that documents are submitted to the court to consider the case.

If the employer fails to pay compensation for unused vacation upon termination of the employment contract, the employee has the right to contact the labor inspectorate or a judicial authority to resolve the dispute. In addition to the amount of compensation, the employer is charged a penalty for each day of delay at the initiative of the citizen whose rights were violated.

Where to go if you haven't paid your vacation pay

As practice shows, most issues of calculating vacation pay on time are resolved at the stage of notifying the manager of the employee’s intention to appeal to the labor inspectorate or court.

But if this does not bring results, the citizen can submit an application to the specified authorities to bring the company’s management to justice.

The application is drawn up in free form in compliance with the rules for maintaining official documentation and indicating the following information:

- Details: Full name of the person to whom the document is sent, Full name, registration address and contact telephone number of the applicant, full name of the employing organization indicating the form of ownership, contact telephone number, address of the head office and Full name O. manager.

- The essence of the complaint: the date of leaving on vacation according to the schedule, the amount due for payment, the expected date of payment, the number of days of delay.

- Link to the document on the basis of which the applicant cooperates with the organization (employment contract), its details.

- The applicant’s demands: consideration of the complaint, inspection of the enterprise’s activities, collection of debt from the employer along with compensation.

- Date of document preparation and signature.

This is also important to know:

How is the average salary collected during forced absence?

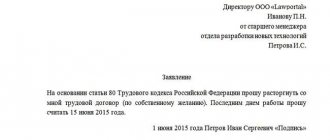

Sample application for late payment of vacation pay to the labor inspectorate: