Many accountants are not aware of whether it is possible to transfer salaries to another person’s card upon application from an employee. Such a right does exist, but requires certain documentary evidence. Is it possible to transfer salary to another person’s card upon application?

Dividing the family budget often requires careful attention, but making the same type of transfers every month can become a very tedious task. Therefore, an employee has the right to request the transfer of wages to another person’s account. Usually the reason is to pay off a mortgage, loan or child support. Accountants, on the other hand, evaluate these requests from a professional point of view, for example, they consider the possibility of tax risks. Are there really any restrictions, and what are the risks of this method of dividing funds?

The department’s primary task is to credit money to the employee’s account in the amount established by the employment contract. Changing this order is possible only by direct order of management, with documentary evidence.

Salary cards for all company employees are usually ordered from one bank. The money is transferred in a single payment within the framework of ongoing projects. Typically, such a process does not have a commission on the part of the bank; the money is transferred directly to the employees’ accounts.

Legal justification

The main task of the accounting department at each enterprise is to accrue to the employee the salary he received and other monetary preferences. We are talking about payments that are established by the employment agreement. Changing such an order is permissible, but only on the basis of an official order from management and strictly with documentary evidence.

Today, salary transfers are carried out to bank cards. Moreover, quite often these are cards pre-ordered from one institution and bearing the name - salary cards. This approach allows you to transfer funds to all employees at once in a single payment. In this case, the company is not charged any commission.

The general rules for calculating and transferring salaries to employees are prescribed in Art. 136 Labor Code of the Russian Federation. It says here that an employee can receive the required wages into a bank account or in cash. But there are certain exceptions to this rule. They may be subject to the following provisions:

- Laws adopted at the federal level;

- Official employment contracts and agreements;

- The court's decision.

Here is one common example of such an exception to the rule. In paragraph 1 of Art. 30 of the Civil Code of the Russian Federation states that the trustee has the full legal right to receive wages for a certain citizen. Such a “monetary manager” is assigned to someone who has lost the ability to work for one reason or another or has become incapacitated.

As for the standard employment contract, according to Art. 421 of the Civil Code of the Russian Federation, each such transaction is carried out on fairly free terms. In other words, the parties to the transaction independently establish the terms of the agreement and enter into it without any coercion. Accordingly, both employees and employers can resolve the issue regarding the procedure for remuneration for work activities.

The management may not include in the contract the conditions for the possibility of transferring salary to another person’s card. If the corresponding clause is not in the agreement, a court decision will be considered a mandatory justification for transferring funds to another person. A current example here is the payment of a certain part of earnings as alimony.

Regulatory framework

In order to confidently and, most importantly, correctly answer the question of whether it is possible to receive a salary on another person’s card, it is necessary to study the regulatory documents that determine the procedure for paying salaries and equivalent payments.

The legal framework in this case is:

- Labor Code of the Russian Federation, Article No. 136,

- ILO Convention No. 95 “Concerning the Protection of Wages” (adopted on July 1, 1949 in Geneva and ratified on January 31, 1961 by the Decree of the Presidium of the Supreme Soviet of the USSR), article No. 5,

- Civil Code of the Russian Federation, Article No. 421.

In accordance with paragraph 9 of Article 136 of the Labor Code, wages must be transferred directly to the employee himself, either to his bank (in our case, card) account, or in cash. However, there may be exceptions in at least three cases.

Enumeration Features

Transferring the received salary to another person’s account quite often creates some difficulties:

- A commission is required, since another account is usually not registered with a particular company.

- Every day this factor must be taken into account in the process of issuing salaries.

Despite such difficulties, there is a way out of this situation. An employee who cannot, for one reason or another, receive money on his card must write a corresponding statement.

If it becomes clear that it is impossible to do without paying the commission, it is transferred from the employee’s salary.

Transfer amount

Transferring salary to another person's account is a legal action. The reason is that every person has every right to manage his salary. Accordingly, there is no fixed amount that can be transferred. There are also no restrictions on whether to transfer the entire amount or part of it.

Nuances

When paying wages to an employee using this method, you need to remember important nuances:

- Payment to the account of a third party does not fall under the concept of deductions from wages (Articles 137, 138 of the Labor Code of the Russian Federation), therefore the amount of payments cannot be limited within the limits of wages.

- If the application specifies a certain transfer amount, but in fact, after paying personal income tax, the employee has less money to pay, the actual amount is transferred. The company is not required to make additional payments.

- In the text of the purpose of payment “payments” it is advisable to focus on the fact that the salary is being transferred, and not other, additional, income of the employee.

Briefly

- Transferring salary to another person's card is permitted by law. Such an agreement between the administration and the employee must be enshrined in the employment agreement, in the additional agreement to the document. A statement is also required indicating: to whom, how much, for what period, from what payments the transfer should be made; and detailed details for transfer.

- The payment order also indicates to whom the money was sent, from whose salary, for what period, and details of the basis document.

- The accountant keeps track of payments using account 76 and opening sub-accounts corresponding to the analytical data.

Rules for drawing up an application

In most cases, the salary is transferred without any delays. The financial department and the director cannot have reasons on which to delay the transfer operation.

The only reason for delay may be the absence of an application for the transfer of funds.

Until the employee completes this application, the transfer operation will not be carried out. The request must contain the following important information:

- The percentage of the salary amount that needs to be deducted is 100% or 50%;

- From what part of the amount should funds be deducted - bonus, sick leave, as well as a percentage of transactions;

- In what situations is it necessary to transfer funds - advance payment, final salary amount, all transfers without exception;

- Exact payment period;

- Official details of a third party;

- The basis for transferring funds is alimony or loan repayment.

In order for the application to be accepted, the information written in it must be as complete as possible.

As soon as the accounting department begins to transfer the required amounts, a payment slip must be drawn up for each payment. Employees must include complete information in their reports regarding the transfers made. The request is sent to the head of the organization and the head of the financial department.

The employee, in turn, must write down information that he fully agrees to make the required transfer and to withhold the commission established by the bank.

Example of entries for salary transfers in favor of other persons

Employee Antonov P.P. wrote an application for the transfer of salary funds in favor of his wife A.A. Antonova. The employer signed this application and the application was submitted to the accounting department.

In accounting, the accountant, based on the employee’s application and bank statement, reflected the following transactions:

| Operation | Debit | Credit |

| Antonov P.P.'s wages were accrued. | 20 | 70 |

| Salary based on the application (instruction) of Antonov P.P. transferred to his wife Antonov A.A. | 70 | 76 |

| The amount was transferred to Antonova A.A. | 76 | 51 |

Important points for accounting

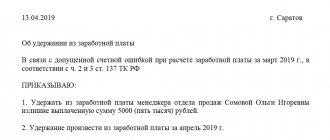

Partial or full transfer of salary to another person’s card may be interrupted in some situations. No enterprise can be insured against the occurrence of various difficult situations. Accounting employees quite often encounter the following situations:

- The salary amount in a certain month was much less than the specified transfer amount. In such a situation, the organization transfers the available amount. No payments are made against future debt. If such a situation occurs, the employee is notified through a special pay slip.

- Funds may be directed to the wrong account. In this situation, you need to contact the bank to cancel the payment. After this, the funds are transferred to the correct account.

When filling out documents, accounting staff must exercise maximum care.

If the required amount does not arrive in the specified account due to the fault of the accounting department, the employee can submit a memo about the violation of deadlines for salary payment.

In general, there are quite a lot of situations when funds do not arrive in the account. The reasons may be different, ranging from an accounting error to the carelessness of the employee himself who provides false data. In any case, the problems can be corrected, and the due earnings are transferred to the account specified in the application.

Registration and accounting

IMPORTANT! A sample application for transfer of salary to a third party from ConsultantPlus is available here

In the employment contract, the possibility of transferring to a third party’s card is formulated as a possibility, in general phrases, for example, like this: “An employee’s salary can be transferred to a third party to his bank account, at the request of the employee. The payment is determined by the moment the funds are debited from the organization’s account.”

In addition to the contract, an application itself is required from the employee. It is issued in the name of the head of the company 5 days before the payment of salaries in the organization. The text must contain a request for a transfer to the account of a third party. In this case, be sure to indicate:

- Full name of the card owner;

- full bank details of the card, indicating the account, bank and its details.

The employee’s application must indicate how much needs to be transferred: as a percentage of the salary or in total. It is also necessary to clarify in writing which payments will be transferred, and whether bonuses, vacation pay, and sick leave are included in the calculation. The moment of transfer must be indicated. For example, if an employee wants to send someone his advance, the second part of his salary, or both parts, he must write this down in the application. The document may contain a request to transfer funds in a certain period or continuously.

The payment order indicates whose salary is transferred to the account of a stranger, for what period (month, year), on the basis of what document (employee application). If an employee wishes that his salary be used to repay certain payments to a third party, for example, to repay a loan, this fact is also indicated in the purpose of the payment. Typically the information contains details of the loan agreement. This way, the organization can protect itself from claims and prove the legality of the transfer of funds.

If an employee often applies to transfer his salary to someone else or there are several such employees, it is advisable to keep a journal in which these documents are recorded.

In accounting, account 76 is used for such operations, with the opening of a separate subaccount (subaccounts).

Postings:

- D70 K76/transfers to third parties;

- Dt 76/transfers to third parties K51.

It is necessary to provide a line on the payslip reflecting such a transfer. If the commission is paid by the employee, it is taken into account in account 73, as settlements with personnel: D70 K73.

Important points for the employee

Although it is important to transfer funds to an employee's or other person's account, the finance department is not required to track these transfers. The organization's accountants are not considered responsible for crediting the amount to another account. Also, they do not have to monitor the timely receipt of the required amount.

These processes must be handled by the employee who submits the application. It is he who is responsible for monitoring the payment process. If the money does not reach the recipient, he must immediately report this to the accounting department.

Implementation procedure

In 2014, significant changes were adopted in labor legislation, which secured the right of an employee to independently choose the banking institution with which it is more convenient and familiar to work. Previously, the employer alone determined which bank to cooperate with.

Important! There may be exceptions to this rule when payments to all employees occur in one bank, regardless of the wishes of the employees, but this is expressly provided for in the contract, and with his signature the employee agrees with this procedure for making payments.

If the employer plans to transfer funds to cards of a single institution, then it is necessary to organize mass and centralized receipt of accounts from the bank. As a rule, if it is necessary to simultaneously transfer many employees to the services of a particular bank, bank clerks are invited to the enterprise to collect copies of documents, as well as applications for opening accounts. Later, when the cards are ready, they are also centrally distributed to all employees. A copy of the account numbers is transferred by the bank itself to the accounting department of the enterprise.

When each employee's salary is transferred to the account of the desired financial institution, the preparation of payment details falls entirely on the shoulders of the employee. In this case, in order to receive your earned funds on time, you need to submit the details of your financial account to the accounting department no later than five days before the expected payday . To officially secure your account for calculating salaries, you need to submit a corresponding application to your employer.

Filling out basic documents

Transfers of earnings to third parties must be reflected in special accounting reports.

Payment papers and certificates are filled out with the utmost care. It is imperative to indicate the general purpose of the payment, as well as the fact that a certain amount is withheld from the accrued salary. If you make a mistake, tax officials may regard this as the employee’s illegal income.

If employees of the accounting department understand that such transfers will be made on an ongoing basis, they open a sub-account for transferring the required amounts according to a previously written application. This is not only convenient, but necessary. The reason is that personal income tax must be withheld in the usual manner, even if an application has been received to transfer salary to third parties.