Annual paid leave for an employee working part-time

It is established according to the rules in force for all workers (Part 4 of Article 93 of the Labor Code of the Russian Federation): at least 28 days in calendar terms per year of work. For the first time it is granted after six months of performance of labor duties.

Time is excluded (list in parts 1, 2 of Article 121 of the Labor Code of the Russian Federation):

- absence of a worker without good reason;

- absence from child care until the age of 1, 5, or 3;

- absence without pay for more than two weeks in a working year.

Time is counted:

- performance of duties;

- travel for work;

- sick leave;

- weekends, holidays;

- vacations, except for child care;

- temporary downtime due to the fault of the employer;

- when a worker who was unable to undergo a medical examination due to someone else’s fault was suspended from performing work duties;

- absenteeism of an illegally dismissed employee who was subsequently reinstated;

- absence without pay, less than two weeks per year of work.

The working year begins on the date the worker is hired. Excluded periods shift the end of the year by the corresponding number of days.

The principles by which short-term vacations are granted are the same for everyone. According to Art. 125 of the Labor Code of the Russian Federation, a worker, by agreement with the administration of the enterprise, uses paid vacation, provided annually, in parts, if one part is at least 14 days.

Example

Let’s say, according to a written application to the bricklayer, E.N. Sterkhov, the administration of Stroitelny Mir LLC reduced the duration of the shift from 8 to 4 hours. The shift will be counted as a full shift if Sterkhov E.A. will work the time assigned to him by the administration.

How is the number of vacation days calculated?

Vacation involves the absence of an employee from the workplace, but maintaining all the conditions provided for in the employment agreement, including his position. In some cases, vacations are paid based on average earnings. The duration of the rest period is determined by the type of break from work. The following options are available:

- Basic annual;

- For expectant mothers;

- Additional;

- For child care;

- Unpaid, due to personal circumstances;

- Designed for learning.

The number of vacation days is calculated depending on the specific type of vacation and the characteristics of its provision in accordance with the Labor Code of the Russian Federation.

Annual leave

The main leave must be issued to each employee of the organization annually (Article 114 of the Labor Code). Anyone who has worked in a company for more than 6 months has the right to it (Article 122 of the Labor Code). In some cases specified in this paragraph, vacations may be granted before the expiration of the allotted period.

Vacation for subsequent years is given in accordance with the approved schedule, which is formed by the employer, based on the production conditions in the company. The order of priority is mandatory for both the administration and the worker.

This is paid leave, the amount of payment is determined based on average earnings. The duration of rest, in accordance with Article 115 of the Labor Code of the Russian Federation, must be at least 28 days . They are calculated in calendar form, the period includes weekends, but does not add up to holidays. Some categories of citizens are granted extended basic rest (for example, teachers).

This is important to know: Is vacation available to an external part-time worker?

Article 126 of the Labor Code provides that if the duration of rest fixed in the contract exceeds 28 days , the employee has the right to receive compensation for an increased number of days or only part of them. To do this, the citizen needs to write an application addressed to the manager. The rule does not apply to the following employees:

- Women expecting a baby and employees under 18 years of age (all types of leave);

- Working in conditions recognized as harmful to the body (only for additional rest).

The full number of days is recorded for a period called the working year. It differs from the calendar calendar in that it starts not from January 1, but from the date and month of admission to the company. If a person entered into an agreement on 02/02/2018, then from this date the first working year will begin, which will end on 02/01/2019. Some periods, according to Article 121 of the Labor Law, are not included in this length of service, these include:

- Unpaid holidays exceeding 14 days per working year.

- A break from work to raise a child up to 3 years old .

- All periods of absence if the reason for the event is considered unexcusable.

The end date of the working year is shifted by the number of days of the specified periods. The total number of days, according to Article 125 of the Labor Code, may be divided into parts if there is consent of both parties to the employment contract and one of the fragments exceeds 14 days. The same clause provides for the possibility of interrupting rest if necessary.

The main rest, in accordance with Article 124 of the Labor Code, must be extended if there are grounds (for example, if it coincides with sick leave).

It is also possible to postpone the holidays to another date if production circumstances require it, or the employee agrees with the administration.

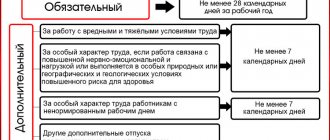

Additional

In some cases, a worker may be granted additional days of vacation. They can be provided as an annual holiday, or as a one-time event for medical rehabilitation. Based on Article 116 of the Labor Code, in order to receive an additional number of vacation days, it is necessary that the work be related to the following circumstances:

- Factors of the place of performance of duties that are recognized as harmful or dangerous to the body. The minimum number of vacation days is 7 (Article 117 of the Labor Code).

- The territorial location of the company is in the Far North or similar territories. The duration is 24 and 16 days, respectively (Article 321 of the Labor Code).

- Incorporation in the employment contract of conditions regarding non-standard working hours. Vacation cannot be less than 3 calendar days (Article 119 of the Labor Code).

- The special nature of work activity.

Separate regulations at the federal level may provide for the provision of additional holidays to other groups of employees, as well as different durations of breaks. The company also has the right to establish in its local regulations additional conditions for the provision of such leaves.

When a worker has several reasons for taking added vacation days, they must be summed up.

Such vacation is provided in conjunction with the main vacation.

Under hazardous working conditions

The presence of certain dangers in the workplace that could harm an employee gives the right to receive at least 7 days of rest in addition to the main one.

Specialists who conduct research on labor factors have special accreditation and perform such assessments at least every 5 years.

The conditions under study can be classified into one of several groups described in Law No. 426-FZ of December 28, 2013:

- Dangerous (4) . Factors found in the work environment pose a threat to life or contribute to the formation of an acute illness under professional influence.

- Harmful (3) , where there are several subclasses. Conditions that significantly affect the body of an employed person, causing health changes of varying severity - from mild harm to health to complete loss of ability to work. The rest period established by the Labor Code does not allow returning to the previous level of functioning.

- Acceptable (2) . Factors surrounding the place of activity affect the body, but do not create any particular harm, do not violate hygienic standards, or a person can fully restore strength during periods of rest guaranteed by law.

- Optimal (1) . Excellent conditions have been created that either do not affect the employee, or their impact is minimal and does not violate the requirements. Conditions contribute to the fruitful activity of the worker.

If, based on the results of the assessment, the factors at a particular place of work are assigned to 3 or 4 , the worker will have the opportunity to secure additional rest. An employee's part-time working regime does not impose restrictions on the provision of rest.

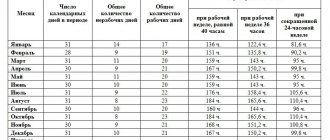

Billing period

Used to calculate vacation pay. This is 12 calendar months preceding the one in which the worker will rest. Or 12 preceding the calculation interval, if there was no earnings in it.

If the employee has not worked for a year, the time taken from the day of reception until the last day of the month preceding the one in which the employee intends to rest.

Example

Milling operator, Zimin E.A., got hired on 02/14/2017. From May 21, 2018, he goes on vacation for 28 days. For the calculation, the period from 02/14/2017 to 04/30/2018 is taken.

The intervals when the worker actually performed labor duties are taken into account. Weekends and holidays within such periods are also taken into account.

Defined by:

Drasch. = Mtotal*29.3 + 29.3: Dcalend*Drab.

Where:

Mfull. – number of full months;

Dcalend. – number of calendar days of the month;

Dpris. – the number of calendar days during the period of performance of labor duties, including weekends and holidays.

Silantiev I.V., rested for 28 days from 06/04/2018. From June 2021 to May 2018, 610,704 rubles were accrued. In the absence of gaps requiring exclusion, the average daily earnings will be: 610704:12:29.3 = 1736.93 rubles. The payment amount will be: 1736.93*12 = 20843.14 rubles.

Example

Dementyeva A.Yu., hired several years ago, works 4 hours a day. From March 19, 2018, she is going to rest for 28 days. From March 2017 to February 2021, she was accrued 365,150.4 rubles, of which 31,256 were vacation pay.

- Determine full months.

There are 10 of them. Billing period: from 03/01/2017 to 02/28/2018.

August, September Dementyeva A.Yu. worked part-time: from August 7, 2017 to September 3, 2021, the employee took rest at the employer’s expense.

- We determine the estimated number of calendar days in August and September.

In August:

29.3:31*6 = 5.7 days.

In September:

29.3:30*27 = 26.4 days.

- Determine the total number of days.

10*29.3+5.7+26.4 = 325.1 days.

- We calculate vacation pay.

(365150.4-31256):325.1*28 = 28757.44 rub.

We accrue “incomplete” vacation pay

Egorov V.V. , consultant on issues of salary calculation, social benefits and their taxation

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

The construction company was forced to introduce part-time working hours. We will talk about how this will affect the calculation of vacation pay in the article.

Part-time work

Working time is considered part-time if the duration is less than the normal working time. Let us remind you: in accordance with Article 91 of the Labor Code of the Russian Federation, the normal working hours cannot exceed 40 hours per week.

A part-time working regime in the form of a part-time working day (shift) or a part-time working week can be established both upon hiring and subsequently by agreement between the employee and the employer (Article 93 of the Labor Code of the Russian Federation).

In the event that reasons associated with changes in organizational or technological working conditions (changes in equipment and production technology, structural reorganization of production, other reasons) may lead to mass dismissal of workers, the employer, in order to preserve jobs, has the right, taking into account the opinion of the elected body the primary trade union organization to introduce a part-time working regime for up to six months.

Calculation of vacation pay for part-time work

Article 93 of the Labor Code of the Russian Federation states that part-time work does not entail for employees any restrictions on the duration of the annual basic paid leave, calculation of length of service and other labor rights. However, the legislator kept silent about the fact that the amount of vacation pay would become smaller.

When working part-time, the average daily earnings to pay for vacations and pay compensation for unused vacations are calculated in the general manner (clauses 10, 12 of the Regulations on the specifics of the procedure for calculating average wages).

The regulation was approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

That is, the average daily earnings for payment of vacations provided in calendar days and payment of compensation for unused vacations are calculated by dividing the amount of wages actually accrued for the billing period by 12 and by the average monthly number of calendar days - 29.4.

Since paragraph 5 of the Regulations does not require excluding from the calculation period the time not worked during part-time work, it follows that the month is considered fully worked (despite the fact that the time sheet indicates, for example, only three days worked out of five possible according to the regular schedule, as well as weekends and holidays). And the calculation takes into account the accrued earnings for this month and the average monthly number of calendar days (29.4).

According to the norms of labor legislation (Articles 114, 115 of the Labor Code of the Russian Federation), employees are granted annual leave of 28 calendar days with preservation of their place of work (position) and average earnings. Consequently, a part-time employee is entitled to leave of exactly this duration.

This is important to know: self-employed people on maternity leave

EXAMPLE 1

Will not affect the duration of vacation and working hours during a part-time work week. However, the amount of vacation pay will be less than the amount that the employee would receive if he worked normal hours.

EXAMPLE 2

From February 1, 2009, Podryad LLC, due to a decrease in the volume of work, established a part-time working schedule for all employees (three days a week) with a work schedule of “Monday, Wednesday, Friday - 8 hours a day.”

From June 1, 2009, he goes on another vacation of 28 calendar days. The billing period from June 1, 2008 to May 31, 2009 (12 months) has been fully worked out.

Let's calculate the amount of vacation pay:

Thus, the establishment of a part-time working schedule does not affect the duration of annual paid leave. But the amount of vacation pay will decrease, because it depends on actual earnings.

However, there is one way to ensure that the amount of vacation pay is not affected by part-time work (if the organization has the necessary funds).

To do this, you can use the employer’s right to establish in a local regulation or in a collective agreement a different billing period for calculating average earnings (Article 139 of the Labor Code of the Russian Federation).

This article does not specify such a period, stipulating only one condition: a different procedure should not worsen the employee’s situation. Therefore, nothing prevents in this case from leaving a 12-month billing period, while stipulating that part-time work time is not included in the billing period.

Does an organization have the right to establish a 12-month billing period for calculating vacation pay for employees temporarily transferred to part-time work due to the crisis, stipulating that “time spent working part-time is not included in the billing period”? In order to prevent a decrease in the amount of vacation pay.

Indeed, Article 139 of the Labor Code of the Russian Federation allows the collective agreement or local regulatory act of the organization to provide for a different period for calculating the average salary, different from the usual one.

At the same time, the legislator sets one condition: the adopted billing period should not worsen the situation of workers.

It is clear that the organization’s establishment of a procedure in which time not fully worked will be excluded from the billing period will increase the average earnings (all other things being equal) and the condition set by law will be met. However, the following must be taken into account here. If a part-time regime is established at the request of employees, the reduction in wages is associated with the will of the employee and, accordingly, lower average earnings for calculating vacation pay are a normal phenomenon. This implemented the principle: less work on your own initiative - less wages - less average earnings.

If the part-time regime is established in order to avoid mass layoffs (Article 74 of the Labor Code of the Russian Federation), then the situation will be different. The employee could and would like to work normally, but is deprived of such an opportunity. In this case, making a decision to change the calculation period for determining the average earnings by excluding from it the period of part-time work is completely justified.

B.A. Chizhov , State Councilor of the Russian Federation, 2nd class

Accounting and taxation

Expenses for paying annual leave are for the organization expenses for ordinary activities, taken into account in the cost of work performed (clauses 5, 8, 9 PBU 10/99, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n).

In accounting, the amount of vacation pay due to an employee of a construction company is reflected in the credit of account 70 “Settlements with personnel for wages” in correspondence with the debit of the account in which the organization accounts for the costs of construction or construction and installation work (08 “Investments in non-current assets ", 20 "Main production", etc.).

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

Accordingly, in tax accounting, such expenses are also recognized as labor costs on the basis of paragraph 7 of Article 255 of the Tax Code of the Russian Federation and are taken into account when calculating profit (directly or through depreciation, depending on the purpose of the work performed).

The employee's income in the form of vacation pay is included in the personal income tax tax base in accordance with paragraph 1 of Article 210 of the Tax Code of the Russian Federation, and is also recognized as subject to taxation by the unified social tax in accordance with paragraph 1 of Article 236 of the Tax Code of the Russian Federation. In addition, pension contributions and contributions for insurance against industrial accidents must be calculated on “incomplete” vacation pay on a general basis (clause 2, article 10 of the Federal Law of December 15, 2001 No. 167-FZ, clause 3 of the Rules approved Decree of the Government of the Russian Federation of March 2, 2000 No. 184).