Legal leave

According to the Labor Code, every person who is officially employed has the right to an annual paid calendar vacation.

On average, it lasts twenty-eight days (although employers often prefer that their employees break the vacation into several parts of seven to ten days), and every day of such vacation is paid. Vacation is due every year if the employee has already worked a full eleven months, but by agreement with the boss, you can ask for official vacation even after six months from the first working day. And in some cases, for example, if the employee is a minor, he can ask for leave without waiting for a six-month period - and the employer does not have the right to refuse him and must agree to the conditions of his employee.

How to explain the amount of vacation pay to an employee

- billing period (in general, this is 12 full calendar months preceding the month in which the vacation begins);

- earnings for the billing period.

In this case, to calculate the average daily earnings, you need to take into account:

- whether the billing period has been fully worked out;

- on which days (calendar or working) vacation is granted.

If vacation is granted in working days, then the average daily earnings are calculated by dividing the amount of actually accrued wages by the number of working days according to the calendar of a 6-day working week. This follows from paragraph 11 of the Regulations on the specifics of the procedure for calculating average wages (approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922; hereinafter referred to as the Regulations).

Let's consider options for providing vacation in calendar days.

If your employee was on vacation in May, check whether his vacation pay corresponds to the new minimum wage. The amount of payments for the billing period in monthly terms should not be less than the federal minimum wage if the employee has fully worked the billing period and fulfilled his labor standard (clause 18 of Regulation No. 922). This paragraph instructs to recalculate and pay additional vacation pay to employees.

But during the billing period, the employee could be on vacation, sick, etc. In addition, the employee could work part-time. How exactly to perform a recalculation in these cases is not stated in paragraph 18 of Regulation No. 922. It is also unclear from it what to compare with what and how to use the minimum wage when calculating. We advise you to do this.

Step 1. Calculate the vacation average daily earnings of employees in the usual manner.

Let's look at a numerical example. The employee goes on vacation from May 3 for 14 calendar days. He works full time, five days a week. The billing period is from May 1, 2021 to April 30, 2018. During this time, he was credited with 109,192.55 rubles. Of the 12 months of the billing period, he worked fully for 10, and in two he was sick and on annual leave. The number of calendar days per hour worked was 310.4517 days.

RUB 109,192.55 : 310.4517 days. = 351.72 ₽.

Step 2. Calculate your average monthly earnings based on your actual earnings.

In our example, this amount will be 10,305.40 rubles. (351.72 ₽ × 29.3 days).

If you compare not monthly earnings, but daily earnings, the result will be the same. But paragraph 18 talks about monthly earnings.

Step 3. Compare the result with the minimum wage.

10 305,40 ₽ < 11 163 ₽.

Vacation pay must be calculated based on the minimum wage. And there are two options.

11,163 ₽: 29.3 days. × 14 days = 5333.86 ₽.

11,163 ₽: 31 days. × 14 days = 5041.35 ₽,

https://www.youtube.com/watch{q}v=e7RF6rJuov8

where 31 days. — the number of calendar days in May.

351.72 ₽ × 14 days. = 4924.08 ₽.

If you formally follow paragraph 18 of Regulation No. 922, the employee is entitled to 5041.35 rubles. Let us remind you that it says that the average earnings in terms of a full month cannot be less than the minimum wage. And this condition is met. But do not forget about paragraph 16 of the Regulations, which obliges you to take into account wage indexation when calculating average earnings.

Since the procedure is not clearly stated, claims against you from inspectors are practically excluded. After all, the employee will receive more. The employee himself, of course, will not complain either.

Why is vacation pay less than salary? There may be several reasons for this. Firstly, if during the last year a specific employee’s salary was increased - not for the entire institution or department, but specifically for this employee. Then the current salary will be higher than the vacation pay.

The second reason is that during the billing period the employee worked part-time for some time, but now works full-time. Then the actual accrued amounts will be included in the calculation, but working part-time will not affect the number of calendar days taken into account.

The third reason is that the employee asked not to include “borderline” weekends in his vacation. For example, I wrote a statement from Monday not to Sunday, but to Friday. The Labor Code does not prohibit doing this. Having received less vacation pay because of this, he will have more days of rest.

When vacation pay will be greater than salary. And this is quite possible. The reasons here are the opposite. For example, an employee’s salary was not increased, but reduced. And here it doesn’t matter whether there was a decrease in the company as a whole or only this employee suffered.

Another reason is that the employee received a large bonus during the pay period. It will be included in the average earnings and will affect the amount of vacation pay.

Finally, the amount of vacation pay will increase if the employee asks for vacation not from Monday, but from Saturday. That is, including two extra days off. True, thereby he will reduce the number of days of his future rest.

When is the best time to go on vacation? Summarize. First of all, it is most profitable to go on vacation in those months that have more working days. Indeed, in this case, the employee will receive not only vacation pay, but also wages for the days worked. Let's show the difference with an example.

Can I go on vacation if I have worked for less than 12 months?

The provisions of the Labor Code of the Russian Federation allow an employee to exercise the right to rest before he has worked a full calendar year.

Here is what is stated in Article 122 of the Labor Code:

- Leave must be granted annually;

- The first right to use it appears after six months of work at one enterprise.

However, it is acceptable to write a leave application before the expiration of the due date in the following cases:

- pregnancy and childbirth;

- the employee's age is less than 18 years;

- adoption of a child less than three months old;

- transfer from another organization.

A full list of situations when you can get leave before six months after employment is specified in a number of federal laws.

The influence of the size of the coefficient on vacation pay

The coefficient 29.3 is used when calculating vacation pay and shows the average number of days excluding federal holidays. It is on this and the number of months worked in full that the employee’s earnings are divided.

Taking into account the fact that the coefficient has decreased, the calculation has become more profitable for employees: they have the right to count on larger vacation pay.

Thus, the change in the coefficient was fully justified by the changed realities.

What is the procedure for calculating vacation pay for an incomplete year and month worked?

In the practice of human resources services of Russian enterprises, three scenarios are common for calculating vacation pay for employees who have worked for less than a year:

1. When an employee goes on paid leave, having worked for his employer for less than 1 year. Vacation pay is calculated for less than a full year of work.

2. When a person goes on vacation, having worked for a period that includes at least 1 partial month and 1 full month.

These two scenarios can obviously be combined with each other. Therefore, the scheme for calculating vacation pay is similar in them.

3. When an employee goes on vacation, having worked for the employer for less than 1 month by that time.

Here the scheme for calculating vacation pay will be slightly different.

Let us study in more detail the specifics of calculating vacation payments for each of the above scenarios.

Where does the calculation of vacation pay begin?

First of all, it is necessary to determine which period will be the calculation period.

The calculation period is the 12 months preceding the month in which the employee goes on vacation.

For example, an employee plans to go on vacation from June 4th. The billing period will be from 06/01/2017 to 05/31/2021.

However, if an employee’s length of service with a particular employer is less than a year, then the calculation period is the period from the date of hiring to the last calendar day of the month preceding the month of going on vacation. Let's say an employee was hired on September 11, 2017, and on June 18, 2021 he goes on vacation. The billing period is from 09/11/2017 to 05/31/2021.

Basic parameters for calculation

To calculate vacation pay, you need to set several important parameters. This:

- billing period;

- average earnings for it;

- duration of vacation.

Billing period

This is the period during which income received should be taken into account when calculating average daily earnings. Usually it is 12 months, but in some cases it may be less - if the employee works for a shorter period, or the company provides vacation several times a year.

A separate point that should be noted: if the employee did not work during the billing period and does not have accruals to account for (usually this happens if the employee goes on maternity leave), then for the calculation we take the period preceding the one that was supposed to be originally calculated.

Another option is if the employee does not have any worked periods and accruals at the time of going on vacation. Then the calculation is based on the monthly salary and the standard number of days in a month (29.3).

To summarize, the following periods of time can become the billing period:

- 12 months before going on leave;

- the total time the employee has worked in the company, if he has not yet worked for 12 months;

- when on vacation during the month of employment, the calculation period will be the time that the employee managed to work;

- if wages have not been accrued in the last 12 months, the previous period must be used as the calculation period.

Average earnings

Once the payroll period has been determined, it is necessary to calculate the employee’s average daily earnings. Of course, in an incomplete billing period this figure will be less.

For example, how to calculate vacation pay for six months if an employee receives 8,000 rubles per month. To this amount you need to add - if any - regional coefficients, all bonuses for length of service, scientific titles and works, and the like. That is, any payments that are issued on a regular basis and are included in the wage system. Let’s say it turns out to be 8,423 rubles for five months and 8,200 rubles for the first month, the billing period is exactly six months. Then the calculation of average daily earnings will look like this:

((8,423 x 5)+8,200)/6/29.4 = 285.23 rubles,

where 29.4 is the average number of days in a month, a coefficient established at the state level.

This is the amount the employee will receive for each day of his official vacation.

You should also not forget that if you quit, for example, 11 months or less after employment, you will have to pay back all the funds previously issued for vacation, since they were received, as it were, on credit.

Duration of vacation

Average daily earnings, as mentioned above, are paid for each day of rest. At the same time, public holidays and official non-working days are not taken into account in the duration of vacation and, accordingly, are not paid.

That is, an employee with an average daily earnings of 567 rubles, who will rest from December twenty-eighth to January third, will officially go on vacation for five days and receive 2,835 rubles for this time period.

It must be remembered that rest after the first six months of work is due in full, established at the enterprise. That is, if it is supposed to be twenty-eight days, the employee can go for all of these twenty-eight days, if thirty-five days are due, for all thirty-five, and so on.

If a worker asks for leave before he has worked for six months, he can only claim the days he actually earned. That is, approximately two to three days for each month worked.

Billing period

The duration of the calculation period when calculating vacation pay in 2015 depends on how long the employee works for the employer. The billing period cannot be more than a year.

Option 1

The employee worked for more than a year before the leave.

The billing period will be 12 calendar months prior to the month in which he goes on vacation. A calendar month is taken from the 1st to the last day inclusive. That is, in May from 1 to 31, and in February - up to the 28th inclusive. Option 2

The employee worked for less than a year before the leave.

The billing period will be the entire time during which he is registered in the organization.

When calculating vacation pay in 2015, exclude from the calculation period the days when the employee:

- received an average salary (was on secondment...);

- was ill or received maternity benefits;

- was on leave without pay, etc.

Procedure for granting leave for incomplete periods

Even if an employee has worked for the company for less than twelve months, he has the right to go on vacation. In fact, for every day spent in service, money is awarded for future vacation. They are summed up in a special account.

As noted above, the right to paid rest appears after six months of work. But there are categories of citizens who can take vacation even earlier:

- Pregnant women going on maternity leave.

- Minor employees.

- Adoptive parents of a baby up to three months old.

- Men who have had a child.

- Part-time workers who are scheduled to rest at their main place.

According to the law, the employer can, at its discretion, release a person from the second day of employment. But with this option, calculating vacation for less than a full month does not play a role, since, in fact, the vacation is given in advance.

Key calculation data

If an employee worked continuously for a year and decided to go on vacation after twelve months, then there is no need to calculate the number of days, since it is enough to refer to the employment contract and find out how many days are allotted. It is more difficult when a person decides to exercise his right to early leave, since it is necessary to calculate how many days he managed to work.

The rules for calculating vacation for an incomplete year come down to two principles:

- The average number of vacation days per month is obtained by dividing the total by twelve. For example, 12/28=2.33.

- When calculating, all full months are taken into account, as well as those in which more than fifteen days were worked.

If a person is entitled to more vacation days than twenty-eight, then this number is divided by twelve. That is, all available days of rest are first summed up, and then the monthly average is calculated.

Algorithm for calculating rest duration

The sequence of actions when calculating the number of vacation days can be presented as follows:

- Determining how many days of rest a person is entitled to per calendar year.

- Calculation of the monthly average.

- Calculation of the number of fully worked months and days in non-integer periods.

- Multiplication of certain indicators.

There are two categories of citizens for whom the calculation is made in a different way:

- seasonal workers;

- people employed under a fixed-term contract.

It is important to know! For these population groups, for each month worked, in accordance with Article 291 of the Labor Code of the Russian Federation, two days of vacation are accrued. This rule is also stated in the employment contract.

Billing period

The standard calculation of the number of vacation days uses a twelve-month calculation period, but when the employee has not yet worked for a whole year, his entire service life is taken as a basis.

Moreover, it is important to remember about the rule associated with incomplete months. If more than fifteen days are worked, the period is taken into account in full; if less, it is completely discarded. Note that sick leave and absenteeism, that is, moments when a person was absent, are also deducted from the calculations.

Example of days calculation

In order to summarize all the rules and principles described above, let's look at an example of how to calculate vacation for less than a month and a year. Let’s say that citizen K got a job at the company on February 10, 2021 and plans to go on vacation on November 5, 2021. She is entitled to a standard rest period of twenty-eight days.

First of all, it is necessary to determine the average monthly number of days. Since the rest period is standard, the indicator will be 2.33. Next, we calculate for what periods vacation is granted:

- in February, the citizen worked twenty days - more than half, therefore, it will be taken into account;

- for the next eight months the woman worked entirely;

- in November he will be on duty for only four days - he will be discarded.

It is important to know! It turns out that the employee has the right to 21 days of rest (2.33 * 9 = 2.97). Rounding is always done in favor of the employee, and not according to the rules of arithmetic, when calculating vacation days for an incomplete month.

Number of vacation days to calculate

Most often, vacations are granted in calendar days. Standard paid basic leave is 28 calendar days. Moreover, the employee can take time off not immediately, but in parts. The main thing is that at least 2 weeks of vacation should be taken off continuously.

Some categories of workers are entitled to extended basic leave (Article 115 of the Labor Code of the Russian Federation). For example, workers under 18 years of age must rest 31 calendar days, and disabled people - 30 (Article 267 of the Labor Code of the Russian Federation, Article 23 of the Federal Law of November 24, 1995 No. 181-FZ)

Labor legislation also provides for additional leaves for employees (Article 116 of the Labor Code of the Russian Federation).

For the calculation, it is important to exclude all non-working holidays from vacation days. That is, all all-Russian holidays established by Art. 112 of the Labor Code of the Russian Federation, and holidays established in a specific region by the law of the subject of the Russian Federation (part 1 of article 72 of the Constitution of the Russian Federation, article 22, 120 of the Labor Code of the Russian Federation, article 4 of the Federal Law of September 26, 1997 No. 125-FZ, clause. 2 letters of Rostrud dated September 12, 2013 No. 697-6-1). However, weekends are still included in the calculation.

Important! Non-working days to which holiday weekends are postponed are included in the calculation. If the day off coincides with a holiday, then the Government of the Russian Federation issues a resolution setting the date to which the day off and holiday is transferred. For example, in 2021, February 23 fell on a Saturday, and the day off from that day was moved to May 10. If an employee is on vacation on May 10, this day must also be paid.

Calculation of vacation pay for an incomplete month worked

The need to calculate vacation pay for an incomplete month may arise in the following cases:

- In the case when an employee takes a vacation after working for the employer for less than a year . Vacation pay is calculated for less than a full year of work.

- When an employee goes on vacation after working at least 1 half month and one full month . The vacation pay calculation scheme will be similar.

- When an employee goes on vacation after working for less than 1 month for the employer . In this case, the calculation of vacation pay will be different.

In the first two cases, vacation pay is calculated using the following formula: amount of vacation pay = Employee’s income for the billing period (from signing the contract to going on vacation) / conditional number of days that fall on those worked in the billing period taken into account * duration of vacation in days.

Conditional days taken into account when determining the amount of vacation pay are calculated as follows: 29.3 * number of full months worked + number of calendar days that fall within the period worked in partial months * 29.3 * number of partial months.

The number of calendar days that fall within a period worked in partial months is defined as the number of full months worked * the number of vacation days for a full year of work according to the work book / 12 - the number of days used since the conclusion of the employment contract.

The number of full months of work includes only those months in which the employee worked more than 15 days (according to clause 35 of the Vacation Rules approved by the USSR No. 169). If the indicator of days worked is not equal to a whole number, then it is subject to rounding in favor of the employee.

It is worth noting that rounding the number of unused days is not provided for by law, although it is not prohibited. According to the Ministry of Health and Social Development, the company has the right to decide on rounding at its own discretion. But rounding the value down is unacceptable.

If an employee has worked for the company for less than 15 days and quits, he is not entitled to vacation pay. And if he worked for more than half a month, then compensation would have to be paid for him as for a full month.

When determining the amount of vacation pay (or monetary compensation) for an incomplete month, we are not talking about the calendar month, but about the month worked by the employee . For example, he was hired on May 24, the full month worked will expire on June 23.

According to clause 35 of the Vacation Rules, there are specifics for calculating vacation pay for an incomplete month if an employee took a vacation without working a full month at the company (this situation is allowed with the consent of the employer), or goes on vacation with subsequent dismissal (as an option, receives compensation for unused leave upon dismissal).

According to legally established rules, a person who has worked for a company for less than 15 calendar days is not entitled to paid leave. If the employee worked for more than half a month, then the duration of the vacation will be calculated as follows: 28 / 12 = 2.33 days. When rounded in favor of the employee, the value is 3 days of paid leave.

Let's give an example of calculating vacation pay for an incomplete month. For example, an employee worked for the company for 16 days (30 days in a month). His income was 10,000 rubles. Vacation pay will be calculated as follows:

- We determine the number of days in an incomplete month that will be taken into account for accrual of vacation pay: (16 / 30) * 29,3 = 15,63.

- We calculate vacation pay for an incomplete month: (10,000 / 15.63) * 3 = 1919.39 rubles.

Thus, when calculating vacation pay for a period that includes an incomplete month (one or more), the estimated number of working days is calculated separately for full months worked and for incomplete ones. If a person has worked for the company for less than a month, then he can count on vacation pay only if he works for more than 15 days.

How to correctly calculate vacation pay if the year has not been fully worked

If an employee came to work more than six months ago, but did not work 365 days, he has the right to legal paid rest.

An example of how to calculate vacation pay for an incomplete period of time worked in 2021:

Suppose forwarder Dmitry got a job on March 11, 2021 with a salary of 21,000, worked for exactly six months and expressed a desire to rest for 2 weeks.

The following formula will tell you how to calculate vacation pay in 2021: CO = SZR * KDO, where KDO = (2812) * KOM.

The employee’s KOM is equal to 6 months, the KDO will be equal to 14.

SZR = OPP (29.3*6), where the employee’s OPP is 21000 * 6 = 126000.

It follows: 126000*(29.3*6)=716.72 (average daily earnings).

716,72 * 14 = 10034,13.

Dmitry will receive vacation money in the amount of 10034.13 (excluding taxes).

When transferring

An unusual situation arises in practice when an employee has been transferred from another organization. If such an employee decides to take paid leave early, what period should be taken into account?

According to the Labor Code of the Russian Federation, transfer is a legal procedure that is carried out according to the rules provided for in Article 72.1 of the Labor Code of the Russian Federation. In this case, the employment agreement with the previous employer terminates. Therefore, when determining average income, one should not take into account the length of service and profit provided by the former employer.

The employee will be paid compensation upon termination of the employment relationship with him.

To calculate such an employee at a new workplace, you must perform the following steps:

- Calculate the number of days worked.

- Sum up all income that is taken into account when calculating average income.

- Determine the employee's vacation days.

- Determine the amount of average earnings.

- Calculate the amount of vacation pay.

Part-time job

A non-standard situation arises when calculating vacation pay for a part-time employee. We remind you that in accordance with the Labor Code of the Russian Federation, such employees have the right to receive extraordinary leave, taking into account the moment they go on “vacation” at their main place of work. Thus, part-time workers can go on vacation early - before the end of 11 months.

In addition, the duration of such vacations may not be the same. For example, if an employee receives additional paid vacation days at his main place of work.

The employer has no right not to provide these days, but he is not obliged to pay for them.

The most optimal way out of this situation is possible when the employee takes vacation at his own expense for additional days of rest. But the employee is obliged to provide evidence that his application was prepared for objective reasons.

Vacation pay for a part-time employee is calculated in the usual manner. Additional days of vacation are not paid.

If there were no charges

In practice, a situation may arise that in the previous 12 months the employee had no accruals, that is, he did not receive income.

It should be clarified that such an employee did not receive payments that are taken into account when calculating average income. So, if a woman was on maternity leave, she was paid an allowance. But this type of income is not taken into account when determining average earnings.

So, in this situation, accruals are made based on the 12 months that follow before the billing period.

How to calculate vacation pay for an incomplete month: example

When fifteen days are worked, the month is rounded up.

An example of calculating vacation pay for an incomplete month in 2021:

Milkmaid Lyudmila worked for 11 months. She wants to go on vacation from January 1, 2021 for 14 days. Lyudmila's salary is 32,600. She was not awarded any additional bonuses.

Accordingly, the calculation proceeds as follows:

Lyudmila’s CDO is 28/12*11=25 full days, that is, she has the right to 14 days. Next: 32600/29.3=1112.63.

1112.63*14=15576.79 - payments due to Lyudmila minus thirteen percent. From this example, it becomes clear how to calculate vacation for an incomplete month worked.

An example of calculating vacation pay for an incomplete month

The norm enshrined in paragraph 35 of the Rules predetermines the features of calculating leave in the third scenario: when a person takes leave without working a full month at the company (this is theoretically possible with the consent of the employer), or goes on leave with subsequent dismissal (or receives compensation for unused leave) .

In accordance with this norm, a person who has worked for the company for less than half a month is not entitled to paid leave in the scenario under consideration. Half a month should be considered 15 calendar days (clause 4 of the Rules). If an employee has worked for the company for more than 15 days, then he has the right to leave, the duration (D) of which is calculated as follows:

OD = 1 × 28 / 12 = 2.33 days.

We round up in favor of the employee, it turns out to be 3 days.

Example:

For all days of work before vacation, the employee was paid 30,000 rubles. The period worked is 20 calendar days - from June 1 to June 20, 2021.

The estimated duration of work (RD) will be:

RD = (20 / 30) × 29.3 = 19.5 days.

We calculate vacation pay for an incomplete month (VO):

VO = (30,000 / 19.5) × 3 = 4615 rub. 38 kop.

Procedure for part-time calculations

If the company has part-time employees, a rate coefficient is added to the calculation system. This clause affects only the amount of payments; the formula for calculating days worked by an employee remains unchanged. The employee is entitled to proper rest, despite working part-time. How to calculate the amount of vacation pay for an employee for an incomplete month, taking into account the rate coefficient, is clearly shown by the following formula: CO = SZR * KDO, where in calculating the SZR the salary is multiplied by the rate coefficient. For example, with a salary of 10,000 and work at 0.5 rate, real monthly payments are 0.5 * 10,000 = 5,000.

In any case, it is necessary to keep records of insurance payments. In order to avoid questions from the tax inspectorate or the social insurance fund, payments must be made within the time limits established by law.

If summarized working time tracking is not installed

To determine the amount of vacation pay, it is necessary to multiply the employee’s average daily earnings by 28 (the number of days of annual paid leave). An employee’s average daily earnings for vacation pay are determined by dividing the entire amount of the employee’s salary for a period of 12 calendar months (preceding the month of calculation and payment of vacation pay) by 12 and by 29.4. In this case, all types of payments provided for by the remuneration system and used in the organization are taken into account. A complete list of such payments is given in clause 2 of the Regulations.

Let's look at the procedure for calculating vacation pay using a specific example.

Example 1 . In accordance with the employment contract, storekeeper of Maximum LLC Ivanova E.P. works two days a week (Monday and Thursday) for 6 hours.

As of November 1, 2006, she goes on vacation.

For the billing period, which was fully worked out, she was credited with 124,900 rubles.

Let's calculate the amount of vacation pay:

RUB 124,900 : 12 months : 29.4 k.d. x 28 k. days. = 9912.70 rub.

And if the employee has not fully worked the pay period, the average salary for accrual of vacation pay will be calculated differently. Let's give an example.

Example 2 . Manager of Sprint LLC Utkin K.L. works two days a week (Tuesday and Thursday) for 6 hours.

Deadlines for payment of vacation pay

According to Article 136 of the Labor Code of the Russian Federation, payment for vacation is made no later than three days before its start. The countdown is carried out in calendar days (Article 14 of the Labor Code of the Russian Federation). So, if the start of the vacation falls on Monday, the money must be paid no later than Thursday of the previous week (letter of the Ministry of Labor dated 09/05/18 No. 14-1/OOG-7157; see “Vacation starts on Monday: when should vacation pay be paid?”).

ATTENTION. The law does not establish the earliest date when an employer is required to pay vacation pay. This means that a company or individual entrepreneur can issue money four, five or more days before the start of the vacation, and this will not be a violation.

Compensation for unused vacation must be issued on the day of dismissal, or no later than the next day after the request for payment is submitted (Article 140 of the Labor Code of the Russian Federation).

Required data

The greatest difficulty is calculating the amount of average earnings.

To calculate the average salary, you need to determine which period is considered the calculation period. It is the income received during this time that will be taken into account when identifying the indicator.

Average earnings

So how do you calculate your average income? First of all, it is necessary to determine which payments are taken into account when calculating vacation pay. As a general rule, this is all income received by the employee.

However there are some exceptions:

- benefits that are not subject to personal income tax;

- amounts of compensation for the period of company downtime;

- payments for certificates of incapacity for work;

- funds issued to compensate for travel, food, travel expenses, etc.

In this case, when calculating average income, the following are taken into account:

- remuneration, including in non-monetary form;

- material incentives;

- regional coefficients;

- allowances that are paid within this enterprise.

To identify average earnings, it is necessary to carry out calculations using the formula: income for the billing period/number of months/29.3.

So, you can get the value of the salary per day.

Billing period

The employee has the right to a full vacation (28 days) after he has worked 11 months from the date of employment or previous vacation.

According to the Labor Code of the Russian Federation, an employee can go on paid “vacations” earlier - 6 months after being hired. In this situation, the billing period will be six months.

It should also be taken into account that certain categories of employees can take advantage of the right to leave after 6 months:

- minor employees;

- female workers before or after maternity leave.

In such a situation, the billing period will be even shorter.

Accrual of vacation pay

When sending an employee on annual vacation, the employer is obliged to transfer him the due payment. The transfer amount, as well as the calculation of vacation days for an incomplete month worked, depends on two indicators:

- average daily income of an employee;

- number of days of rest.

The general formula is as follows: payment = average daily earnings * vacation days - VAT. This type of income is subject to taxation as it is part of the basic salary.

When determining the average daily income, a twelve-month period is taken, but if the employee worked less than this period, then the calculation is based on the following:

- There were payments - the earnings for the time actually worked are summed up and divided by the number of days spent in service.

- There were no transfers - vacation pay is calculated on the basis of salary.

When determining income, only basic payments are taken into account - salary. It may include, in particular, bonuses, additional payments for length of service, fees and allowances. But all this must be recorded in the company’s internal documents. But financial assistance, travel allowances, and social compensation do not increase the amount of vacation pay.

Personal income tax and insurance contributions from vacation pay

Vacation pay is subject to contributions: pension, medical, social insurance in case of temporary disability and in connection with maternity, as well as contributions to the Social Insurance Fund “for injuries”.

ATTENTION. It often happens that the start of vacation and the accrual of vacation pay occur in different months. For example, the vacation begins on December 1, 2021, and vacation pay is calculated and issued on November 26, 2021. When should contributions be calculated? In the month of accrual of vacation pay. In our example - in November.

Earnings for the billing period

When calculating your earnings, include all payments that are provided for by the organization’s remuneration system. This:

- salary accrued for time worked;

- bonuses and additional payments (for class, length of service, combination of professions, etc.);

- compensation payments related to working hours and working conditions - regional coefficients and percentage increases in wages, additional payments for work in hazardous and difficult working conditions, at night, in multi-shift work, on weekends and holidays and overtime;

- other bonuses and rewards.

Is compensation possible?

According to the provisions of labor legislation, in some cases monetary compensation for vacation is acceptable. For example, if a person terminates an agreement with an employer, but has unused days, then he does not have to take them off, funds are simply transferred for them.

Attention! In some cases, employees have the right to replace part of their vacation with money if their standard rest period is above the norm for their profession. Let's say the owner of an enterprise decided that his employees deserve a vacation of forty days a year, but some preferred to replace the additional twelve days with money. This is their legal right.

Even if the year has not been fully worked, employees have the right to take legal paid rest. True, the number of days will be directly related to the period spent in service. When calculating the period for which a person can go on vacation, the average monthly indicator is used, with a standard vacation equal to 2.33. This is exactly how many days are accrued for each month of continuous work.

We take into account the increase in tariff rates

Sometimes a salary increase (tariff rate, official salary or monetary reward) occurs during the pay period or during vacation. How then to calculate the amount of vacation pay?

If the tariff increase occurred within the billing period, then the salary that was accrued to the employee before the increase must be multiplied by the increase factor.

We calculate the salary increase coefficient as follows:

salary increase factor = new salary / previous salary.

Let's explain the situation with an example.

Example 4 . The company's employee was granted regular leave from October 7, 2006, lasting 28 calendar days. The employee's salary is 10,000 rubles. The billing period has been fully worked out. No bonuses or other additional payments were accrued during the period under review. By order of the manager in September 2006, the salaries of all employees were increased by 2000 rubles. The increase coefficient for the entire organization is 1.2 ((RUB 10,000 + RUB 2,000) : RUB 10,000). It is by this coefficient that the salary accrued to the employee for the period from October 2005 to August 2006 (11 months) should be increased.

Let's determine the average daily earnings of an employee:

(10,000 rub. x 1.2 x 11 months + 12,000 rub.) : 12 months. : 29.4 = 408.16 rubles/day.

His vacation pay will be:

408.16 rub/day. x 28 days = 11,428.48 rub.

If the tariff increase occurred after the billing period, but before the vacation, the average earnings determined for calculating vacation pay are recalculated taking into account the coefficient of increase in salaries and tariffs. Let's look at an example.

Example 5 . Let's say an employee of a trading company was granted regular leave from November 5, 2006, lasting 28 calendar days. The organization's accountant calculated the average daily earnings saved during vacation; it amounted to 11,428.57 rubles. However, from November 1, 2006, the salary of all employees of the company was increased by a factor of 1.2. Therefore, the amount of vacation pay that must be accrued to the employee will be:

RUB 11,428.57 x 1.2 = 13,714.28 rub.

If a tariff increase occurs during a vacation, then only that part of the average earnings increases that falls on the period from the moment of the increase until the end of the vacation.

Please note: the average salary for the period an employee is on vacation should be increased only if the increase in tariffs (salaries) occurred throughout the company as a whole, and not just in the case of payment for his work.

I.S. Egorova

Lawyer

ACG "Interekspertiza"

| Home » Accountant » Example of calculating vacation pay in 2018 |

Results

If vacation pay is calculated for a period that includes an incomplete month (one or more), then the estimated number of working days when calculating the payment is calculated separately for full months and incomplete (one or more). If a person has worked for the company for less than 1 month since the conclusion of the employment contract and goes on vacation, then he is entitled to vacation pay only if he has worked for more than 15 days.

Sources

- https://hr-portal.ru/article/kak-rasschitat-otpusknye-za-nepolnyy-god

- https://prozakon.guru/trudovoe/raschet-otpusknyh-pri-nepolnom-otrabotannom-gode.html

- https://nalog-nalog.ru/otpusk_i_vremya_otdyha/raschet_otpusknyh_pri_nepolnom_otrabotannom_mesyace/

- https://TrudGid.ru/otpusk/raschet-otpuska-za-nepolnyj-mesjac.html

- https://ZnatokTruda.ru/otpusk/otpusknye-nepolnyj-god/

- https://ipinform.ru/kadry/otpusknye/kak-rasschitat-otpusknye-za-nepolnyj-god.html

- https://pravo.team/trudovoe/otpusk/nepolnui-mesac.html

- https://BusinessXXL.ru/kak-pravilno-rasschitat-otpusknye/

- https://TrudGid.ru/otpusk/raschet-otpuska-za-nepolnyj-otrabotannyj-god.html

- https://zakonosfera.ru/cat-num-6/kak-rasschitat-otpusknie-esli-otrabotan-nepolniy-god.php

- https://trudopravo.ru/otdyh/vyplaty/raschet-otpuska-za-nepolnyj-otrabotannyj-god.html

Why is the monthly average number of calendar days always equal to 29.3

This figure represents the number of calendar days in a year, reduced by the number of non-working holidays and divided by 12 months.

According to Article 112 of the Labor Code of the Russian Federation, Russia has officially established 14 non-working holidays: January 1, 2, 3, 4, 5, 6 and 8 (New Year holidays), January 7 (Christmas Day), February 23 (Defender of the Fatherland Day), 8 March (International Women's Day), May 1 (Spring and Labor Day), May 9 (Victory Day), June 12 (Russia Day) and November 4 (National Unity Day).

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

Thus, to find the average monthly number of calendar days, you need to subtract 14 days from 365 (or 366) days, and divide the resulting result by 12 months. After rounding, the final value is 29.3.

Calculation order

The period for calculating vacation payments is the 12 months preceding the vacation.

There are situations when an employee of an organization does not have accruals for wages for this period of time or he did not actually work at this time. In this case, the calculation time must take those 12 months that precede the calculation year. If there are no accruals and days worked and 2 years before the vacation, the average daily salary is calculated based on the data of the month in which the employee goes on vacation.

With full time worked

The ideal case is when the employee did not go on vacation or sick leave for the entire billing period. Then he will have his working hours fully met.

In such a situation, vacation pay is calculated according to a specific formula

:

3g = 3g / (12 * 29.3)

- Zd – average daily earnings,

- Zg – annual salary,

- 29.3 – average monthly number of calendar days.

The annual amount of accrued remuneration for labor is obtained by summing the accrued salary for the 12 months preceding the vacation.

With incomplete hours worked

The formula discussed above is not suitable for calculating vacation in situations where the employee has not fully worked 12 billing months.

Here you need to use another, more complex formula

:

Zd = Zg / (M * 29.3 + D * 29.3 / Dn)

- M – number of months worked in full,

- D – number of calendar days worked in unworked months,

- Day – the norm of calendar days in unworked months.

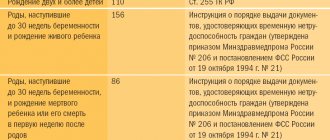

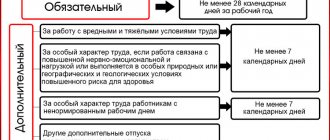

Types of leave and conditions for its provision

The Labor Code of the Russian Federation guarantees employees of organizations the following types of rest:

:

- leave without pay.

The first two types of vacations are paid. Main holiday

is given for 28 calendar days. An employee of an organization can go on vacation after six months of continuous work.

The employer has the right to send specialists of certain categories on leave with their consent, without waiting for 6 months of work experience.

In the organisation.

- representatives of the fairer sex before and immediately after him;

- employees who are adoptive parents of children under 3 months of age;

- employees under 18 years of age.

In subsequent years of work at the enterprise, the employee can take vacation at any time.

Extended annual leave has been established for certain specialists

. It is provided on the basis of the Labor Code and other federal laws.

In particular, they are:

Additional holidays

while maintaining the average salary, the following are established for the organization’s employees:

- for deviating from normal;

- for the special nature of the work;

- for irregular working hours;

- for work in the Far North and equivalent areas;

- in other legally established cases.

In addition to the above, the collective agreement may provide for special additional holidays for employees to rest.

How is the enhancement factor applied?

Using an example, we can consider how the increase factor affects the accrual of vacation pay. Let's assume that an employee works at the enterprise during the entire billing period from May 2015 to April 2021. During this time, for six months his salary remained unchanged and amounted to 30,000 rubles. After this, the amount was increased to 32,000 rubles, and in February - to 34,000. No allowances or bonuses were awarded to the employee. He is going on vacation for 14 days.

- Finding the increase factor. The last salary increase was in February. This means that you need to find the ratio of this value to the amount of payments last month. From May to October the indicator is 34,000 / 30,000 = 1.13. From November to January the value will be 34,000 / 32,000 = 1.06.

- We index employee payments. For the period from May to October: 30,000 * 1.13 * 6 = 203,400; from November to January: 32,000 * 1.06 * 3 = 101,760.

- We find the total earnings: 203,400 + 101,760 + 34,000 * 3 = 407,160.

- We calculate the average daily earnings: 407,160 / 12 / 29.3 = 1,158.02.

- Now we calculate the amount of vacation pay: 1,158.02 * 14 = 16,212.28.

To calculate vacation pay, a coefficient is used that reflects the average number of days in a month. Previously, it was considered equal to 29.4, but in 2014, due to the increase in the number of days off, a new value was set - 29.3. Also, coefficients are required after salary increases. Indexation of average earnings is important for calculating vacation pay. It is worth considering that it is required when increasing wages throughout the enterprise or in its branch. The specific procedure for indexing is not established by law.

Post Views: 511

An accountant specializing in payroll is often faced with the accrual of vacation pay.

Moreover, there are such cases as granting leave to a part-time worker, a new employee who has not worked for six months since joining, and other interesting points.

After reading this article, you will learn how to calculate vacation in 2019 and get acquainted with examples of calculating vacation payments.

Indexation for salary increases

You will also need to use the appropriate coefficient in the case where there has been an increase in wages. However, the following conditions must be met:

- the increase occurs during the billing period, right before going on vacation or during vacation;

- salaries are increased for all employees of the enterprise, its branch or structural unit.

This increase rate has no set value. It is calculated from the ratio of the new salary to the previous one. Along with tariff rates, the amount of allowances may change. In this case, to determine the increase coefficient, divide the amount of the new salary and bonuses by the amount of the same payments according to the old values.

The salary increase procedure does not affect all payments at the enterprise. Only those values that are calculated depending on the amount of earnings are indexed. Indexation does not apply to premiums with a fixed amount or multiples of the tariff rate.

Legislative regulation

The most important regulatory document in terms of organization and remuneration of labor is the Labor Code of the Russian Federation. To account for vacation, it has a whole chapter numbered 19.

In addition, to regulate certain issues regarding the provision of leave to employees, Federal laws and Decrees of the Government of the Russian Federation were adopted.

In particular, Resolution No. 922

“On the peculiarities of the procedure for calculating average wages” dated December 24, 2007, solves possible problems in calculating average wages.

The basic local act at the enterprise is the collective agreement

, which is concluded between the employees of the organization and the employer. It spells out all the main nuances of providing annual leave. In addition, the key points in granting leave to a specific employee are established in the employment contract.

What is taken into account when calculating

Russian Government Decree No. 922 dated December 24, 2007 addresses issues related to the calculation of average daily earnings. It states that the calculation of the average salary per day must be carried out taking into account all payments that relate to remuneration for labor.

These include

:

- Wage. This is an official salary, tariff rate, payment at piece rates, payment as a percentage of revenue and others, including non-monetary wages.

- Various allowances and surcharges. These are all kinds of incentive and compensation payments, northern coefficients and regional allowances.

- Performance bonuses and other rewards.

- Other types of payments related to labor remuneration.

To calculate the average salary, you need to take only those accruals that were made for the actual work time and for the work that was actually performed. It follows from this that when calculating the average daily salary there is no need to take into account

the following charges:

- benefits and other payments financed by the Social Insurance Fund;

- payments made on the basis of average earnings (these include vacation payments, payment during a business trip);

- one-time bonuses not related to wages (bonuses for certain holidays);

- gifts and financial assistance;

- other accruals not related to remuneration for labor.

Regarding work periods

included in the vacation calculation, the same principle applies. The 12-month calculation period includes only the time that was actually worked by the employee.

the following periods are excluded from the total annual experience

:

- the time when the employee retains the right to receive the average salary;

- the time the employee was on or at;

- days off with pay, which are allocated for caring for the disabled;

- the period of release of the employee from work (absenteeism, downtime, etc.).