In what cases is compensation due and what does its amount depend on?

According to the Labor Code of the Russian Federation, paid leave of 28 days is provided for one working year (Article 115 of the Labor Code of the Russian Federation).

You can take vacation after 6 months of continuous work with one employer. As a general rule, the number of vacation days consists of 2.33 calendar days for each month worked in the year: 2.33 * 12 = 27.96.

The value of a month in labor legislation is taken to be 29.3 days (the average monthly number of calendar days). Based on these data, compensation for unused vacation is calculated:

Amount of compensation for unused vacation = Average daily earnings x Number of unused vacation days

However, the amount of compensation also depends on two important factors:

- reasons for dismissal (employee initiative or employer initiative),

- vacation experience (that is, the number of days worked that affects compensation).

How are they calculated?

If the employee resigns voluntarily, this day will occur two weeks after submitting the resignation letter or at another time agreed with the employer.

The employee notifies the employer two weeks before the date of the expected termination of the employment relationship. This can be done even while you are away from the workplace, for example during vacation or sick leave. However, if the employee has extenuating circumstances or the employer has already found a replacement for him, the dismissal date may be postponed to an earlier date.

The basis for starting the calculation of compensation is the dismissal order . This order is drawn up on the basis of an employee’s application to terminate the employment relationship at his own request (how to apply for dismissal with compensation for unused vacation?).

Compensation upon dismissal at will

- If the employee has worked for more than 6 months, but less than a year

Example 1. An employee worked for the company for exactly 7 months with a salary of 20,000 rubles/month. Then he found a new job and quit of his own free will. In 7 months, the employee earned 140,000 rubles. How to calculate monetary compensation for vacation?

First: we determine how many days of vacation the employee is entitled to:

2.33 days * 7 months. = 16.31 days

Second: we determine the amount of compensation. To do this, you must first calculate your average daily earnings:

We divide the total amount of salary received by the number of months worked and by the average monthly number of calendar days: 140,000 rubles. / 7 months / 29.3 days = 682.6 rubles.

Thus, we determine the amount of compensation :

682.6 rub. * 16.31 days = 11,133 rubles. 2 kopecks

- If the employee has worked for 11 months

Example 2. Let’s say that an employee worked under the same conditions not for 7 months, but for 11 months, after which he quit. How to calculate vacation compensation in this case?

11 months is actually a year worked, so in this case the employee is entitled to compensation for all 28 days:

682.6 rub. * 28 days = 19,112 rubles. 8 kopecks

- If the employee has worked for the company for less than six months

Despite the fact that the employee did not receive the right to paid leave, he nevertheless has the right to compensation (Article 122 of the Labor Code of the Russian Federation). In this case, compensation is paid, as in the previous examples, according to the proportional principle: average daily salary * number of unused vacation days . However, if the length of service in a given company does not exceed 15 days, no compensation is due.

general information

All working people have the right to claim twenty-eight days of rest per year. They add up as follows:

Some categories of citizens are also entitled to additional rest. Its duration is determined by employment contracts.

A person does not always take the required rest completely. Therefore, at the time of dismissal, people have unused periods. Their employer includes them in the accruals.

Suppose a person got a job at a company at the beginning of January and by the end of December of the same year decided to quit. During this time he did not rest, although by law he had the right to do so after six months. It turns out that at the time of dismissal, the employer is obliged to pay him for unused vacation for 28 days. If the same employee quit after six months, he would receive 14 days of compensation. After all, for every month of work there are 2.33 days of rest.

Important! Compensation for leave is not paid upon dismissal when a person has worked at the enterprise for less than half a month or when the allotted rest has been fully used earlier. The law does not establish a specific period for using the required rest.

But when the employee pays off, the employer is obliged to pay them at the time of dismissal.

This is important to know: Application for leave before maternity leave: sample 2021

Compensation upon dismissal, if it is not related to the employee’s initiative

- If the employee has worked for more than six months

An employee has the right to receive full compensation for all 28 days of vacationif he worked for the organization for more than six months and was then fired for one of the following reasons:

- liquidation of an organization (its individual parts) or reorganization;

- reduction of staff (work) or temporary suspension of work;

- entry into active military service;

- revealed unsuitability for work.

Let's go back to our example 1 (employee who worked for 7 months). Upon dismissal of his own free will, his compensation for vacation amounted to 11,133 rubles. 2 kopecks However, if he were fired for one of the reasons stated above, his compensation would be:

682.6 rub. * 28 days = 19,112 rubles. 8 kopecks

- If the employee has worked for less than six months, but more than 15 days

In this case, the employee has the right to receive proportional compensation, that is, according to the formula: average daily salary * number of unused vacation days.

Clarifying points

- In Russian labor legislation there is the concept of “extended vacation” of 42 or 56 calendar days. It is assigned to such categories of employees as teachers.

- Payment of compensation to an employee must be made at the time of dismissal or no later than the day after the dismissed person submits a request for payment.

- Continuous work experience includes both the time of actual work and the time of maintaining a job - time spent on sick leave, non-working holidays and weekends.

- Absenteeism without a valid reason and time off for vacation are not included in continuous work experience; therefore, these days are not included in the calculation when compensating for vacation.

Pavel Timokhin , head of the accounting service "Finguru"

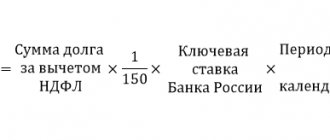

What to do if they don't pay?

If the compensation due to the employee is not paid by the employer on time, then the employee may resort to such types of protection of his own rights as:

- Send a written request to the employer to reimburse vacation pay. As a rule, this method rarely works. If the employer is dishonest and has not paid the required compensation on time, then it is unlikely that such treatment will affect him.

- Contact the labor inspectorate with a statement outlining the violation committed by the employer. Having received the application, the inspector will conduct an inspection, on the basis of which an order will be drawn up to pay compensation to the employee. The Labor Inspectorate will ensure that this order is followed.

- Contact the prosecutor's office with a statement also containing the essence of the employer's violation.

- Apply to the court with a statement of claim, which will set out the employer’s violations and the requirements against him.

This is important to know: Order for additional leave: sample 2021

When contacting any of the above-mentioned authorities, you will need to present your passport and an employment contract concluded with an employer who is violating the terms of payment of compensation. It will also be necessary to draw up a corresponding statement describing the violations of the employer and the requirements for him.

If an employer does not pay compensation for vacation, the labor inspectorate may hold him accountable and impose a fine on him.

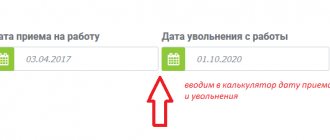

Thus, upon dismissal, the employee is required to pay compensation for unused vacation on the day of termination of the employment relationship. Currently, there are many calculators on the Internet that allow you to quickly and correctly calculate the amount of compensation, taking into account all the rules. If the employer does not fulfill his obligation to make this payment, then the employee must contact human rights authorities.

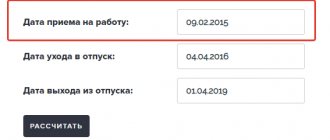

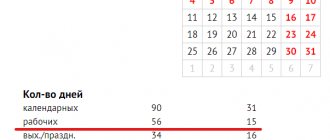

How to calculate vacation time

In order to determine how unused vacation is paid upon dismissal, it is necessary to add up all the days/months of work that provide vacation experience, and then highlight the full number of months worked since employment.

Moreover, if the dismissal is made before the end of the 1st working year, then Art. 28 Rules on ... vacations, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169.

Thus, employees who have had an employment relationship with the employer for 11 months receive the right to compensation for a whole year of work. Moreover, if the employee worked even 10.5 months, then according to Art. 35 of the Rules, you need to round this value to 11, that is, having worked only 10.5 months, you can already count on full compensation for annual leave. Also, the right to receive full compensation for a year of work is granted to employees who worked for more than 5.5 months, but were dismissed due to the liquidation of the employer, enlistment in military service, being sent to study at a university, or being declared unfit for work.

Features of compensation calculation

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

When calculating compensation payments for previously unused vacation days in a situation where, before dismissal, an employee decided to take vacation for the current year, it is necessary to take into account some details.

So, the date of dismissal in this case coincides with the last day of vacation. In this case, actual relations with the employer cease from the moment of going on such leave (decision of the Constitutional Court of Russia dated January 25, 2007 No. 131-О-О).

Thus, payment of compensation for vacations not taken, along with other types of earnings, is made before going on vacation. This follows from Art. 140 of the Labor Code, according to which all payments due to a resigning employee must be provided on the last working day. This, in turn, in the case of going on vacation before dismissal, will be the day preceding the start of the vacation.

Therefore, when calculating the amount to be paid, even though it will be paid in advance, vacation days should also be taken into account.

Allotted vacation days

The minimum duration of annual leave is 28 days (Article 115 of the Labor Code). The duration of additional leave (Articles 116–119) is established individually depending on the position held (giving the right to extended leave, such as for teachers) and working conditions (for example, working in harmful or hazardous conditions to health gives the right to additional rest days).

To calculate the required vacation days (VA), we use the formula:

OPE - duration of full annual leave, including basic and additional, in days;

12 - number of months in the working year;

Мр - number of months actually worked.

Unused vacation days

In order to calculate those vacation days that were not used before dismissal and for which payments are due, you will need to subtract from the allotted days for annual rest those that were actually used. In formula form it will look like this:

ODn - unused vacation days;

ODFI - actually used vacation days.

Average daily earnings

The procedure for calculating average daily earnings for calculating compensation upon dismissal for vacations not taken is similar to that used to determine regular vacation pay. So, according to Part 4 of Art. 139 of the Labor Code of the Russian Federation, to calculate the average daily earnings (ADZ), you must add up all the salaries received over the last 12 months (Zar12) and divide by 12 (the number of months in a year). Then the resulting value should be divided by 29.3 (the average monthly number of days calculated by the legislator):

SDz = Zar12 / 12 / 29.3.

Moreover, depending on whether the employee quits on the last day of the month or not, the following options are possible:

- if the dismissal occurs on the last day of the month (exactly 30/31, and in February - 28/29), then this month of work is included in the calculation of SDZ;

When determining Zar12 from the billing period, in accordance with clause 5 of the Regulations, approved. Government Decree No. 922 dated December 24, 2007, it is necessary to deduct periods, as well as amounts accrued during this time, when the employee:

- was on sick leave;

- had the right to maintain average earnings (for example, he was on vacation or was seconded for official reasons), with the exception of the periods allocated for feeding an infant;

- did not work due to downtime caused by the employer;

- could not work due to a strike in which he did not take part;

- used the right to additional days of rest to care for children with disabilities;

- was released from work by the employer, regardless of whether this period was paid or not.

How to calculate the amount of payment for vacation time taken

To calculate what the payment for unused vacation will be (It), it is necessary to multiply the number of days of unused vacation calculated using the formulas presented above by the amount of average daily earnings:

How is compensation for unused vacation upon dismissal calculated and accrued?

To calculate the amount of compensation due to an employee upon dismissal, you need to know two indicators:

- the average salary of an employee for 1 day (the income of the past 12 months before termination of the employment contract is taken as a basis);

- the number of days of unrealized vacation for previous years or days of rest that the employee “earned” in the current year at the time of dismissal.

The average daily salary of an employee is calculated using the formula:

D/12/29.3,

D - the total income of the worker for the last 12 months;

12 - number of months in a year;

29.3 is an indicator established by Decree of the Government of the Russian Federation No. 922 dated December 24, 2007, meaning the average number of days in each month of the year.

If in the reporting year an employee did not work all days in some months, then the following formula is proposed for calculating the average daily salary:

D / (29.3 × Mn + Mn),

Where:

D - total earnings for the past year;

29.3 is the average number of days in each month of the year;

MP - the number of months worked by the employee in full;

Mn - the number of days worked in partial months.

Calculation order

To receive the required amount, the employee does not need to write any statements. The accountant makes calculations on the basis of Art. 127 TK.

The general scheme for calculating and paying compensation consists of several stages:

Determination of average earnings for the year. Here you need to clearly understand which amounts are taken when calculating average earnings and which are not. Government Decree No. 922 and Art. 139 of the Labor Code determine the list of payments included in the calculation. These include, for example:

The same resolution also establishes payments that are not taken when calculating average earnings for calculating vacation amounts. According to this regulatory act, amounts that are not related to the remuneration system are not taken into account. For example, financial assistance.

Calculation of the required rest period for the entire period of work in the company. Days are accumulated from the moment of hiring for full months of work. The following periods are also included in the calculation of work experience:

- sick leave;

- paid vacation;

- for pregnancy and childbirth;

- business trips;

- rest at your own expense for less than fourteen days;

- just me.

The following periods cannot be included in the work experience:

- for child care;

- rest at your own expense for more than 14 days;

- absenteeism;

- suspension from work without pay.

For example, if a woman is on maternity leave, she is not entitled to regular or additional leave during this period.

- Identification of the number of unused periods.

- Calculation.

- Personal income tax deduction.

- Payment of compensation together with other due amounts.

All payments due to a resigning person are made at the time of immediate dismissal.

If the employee cannot appear to receive the money, payment must be made to him the next day after the request is made. When there is a dispute over payments, the employer must pay the undisputed amount on the due date.

How compensation for unused period is paid depends on the method of permanent transfer of monthly salary. If an employee received a salary on a card, this means that this payment will be transferred to him using the same method.