Basic concepts and comments

Unfortunately, situations where an employer refuses to fulfill its obligations to a subordinate, thereby violating his rights, are not uncommon, but this is not at all a reason to put up with it and not defend one’s own interests in the relevant authorities. But before filing a complaint, it would not hurt to familiarize yourself with the basic provisions of Article 236 of the Labor Code of the Russian Federation governing this issue.

In case of delay or refusal to pay benefits due under the Labor Code or contract, the employer is subject to penalties, which are added to the outstanding debt. Typically, the amount of the fine is determined at the rate of the Central Bank currently in effect and corresponding to 1/300 of the amount of the unpaid benefit. In this case, a kind of cumulative system is used, which makes it possible to take into account each subsequent day of downtime until the payment of monetary compensation and the penalty attached to it (this day also applies to settlement days).

The amount of compensation can be regulated upward in accordance with regulatory documents - a collective or labor agreement, as well as local acts adopted by the employer within its competence in full compliance with current labor legislation.

As for the timing, interest begins to automatically accumulate from the moment the employer fails to fulfill its obligations to the employee, that is, from the next day after the official dismissal.

If an employee does not receive severance or any other benefit through no fault of the enterprise, the obligation to repay the resulting debt still falls on the employer. All other provisions are given in Art. 236 of the Labor Code of the Russian Federation in the new edition with comments for 2017-2018. The main ones are:

- The amount, validity period and procedure for paying off financial liability for late payment of benefits are regulated by current labor legislation.

- The terms of payment of wages, vacation pay, compensation for unused vacation, maternity benefits are determined by Art. 136 of the Labor Code of the Russian Federation “Procedure, place and timing of payment of wages.” Payments of severance pay and the procedure for calculating employees are regulated by another prescribed legal norm, which is Art. 140 “Terms of calculation upon dismissal.” To receive all the required payments, the employee does not need to write any statements addressed to management, since all accruals are carried out automatically based on the relevant orders. In this case, the employer undertakes to repay in one day not only the delayed wages or severance pay, but also the interest accrued during this period.

- If a fine has been imposed on an enterprise with corresponding obligations to repay the current debt (such actions are within the competence of the labor inspectorate), but the implementation of this decision is delayed, then the employee retains the right to file a complaint with the judicial authorities. If the claim filed by him is satisfied, the court must issue an appropriate order based on Art. 122, which can be used as an executive document.

- The article does not apply when disputes arise regarding the payment of compensation for overtime work and in some other situations that can be resolved amicably by employees and representatives of management positions of the enterprise.

- The employee always retains the right to demand indexation of the delayed amount due to inflation of the national currency and rising prices for essential goods.

- For some industries, separate rules for calculating benefits and interest for their delay are provided. Thus, when concluding tariff agreements, the recovery percentage can be much higher than the norm prescribed by law. If wages are delayed by 2 weeks or more, management pays compensation in the amount of average monthly earnings. If the delay does not exceed 15 days, then for each day it is necessary to collect at least 1/200 of the Central Bank rate established at the time of the delay.

- All deadlines for filing claims for repayment of the resulting debt are given in Art. 392 “Time limits for applying to court for resolution of an individual labor dispute.”

Starting from December 1, 2008 and to this day, a 13 percent annual refinancing rate is in effect at the rate of the Central Bank of the Russian Federation. It is this value that is used to calculate compensation for delayed wages under Art. Labor Code of the Russian Federation 236. At the same time, in Art. 233 “Conditions for the onset of material liability of a party to an employment contract” provides for certain exceptions, among which it is worth highlighting the imposition of debt obligations on the employer for the employee’s failure to receive benefits and compensation for the delay, regardless of the fault of the former.

An enterprise may have its own rules for calculating penalties for late cash payments, but in any case they should not be less than the norms established by the labor legislation of the Russian Federation. These rules, and the lack of any relief for employers, were designed to ensure that employees could feel as protected as possible.

Appeal to other authorities

It should be remembered that only a court can recover money from an employer. It is quite possible that you will be advised to file a complaint with the Prosecutor's Office or the labor inspectorate, and it is quite possible that these authorities will help you. However, please remember that:

- The prosecutor's office and labor inspectorates are extremely slow structures. The period for considering citizens' applications there is a month, but by the time you receive an answer, it may well take a month and a half.

- The orders of these authorities cannot oblige the employer to pay you.

- Contacting labor inspectorates does not suspend the running of the statute of limitations. If we assume that you waited a month and a half for the employer to pay voluntarily, then waited a month and a half for the inspectorate to wag its finger at the employer, then you have already missed the deadline for going to court.

- The court may recognize the missed deadline as valid due to the fact that you were waiting for a response from the labor inspectorate. Or maybe he won’t admit it. Just remember that the courts are overloaded with work, and every new lawsuit is a tragedy for the judge. Therefore, almost any judge will do everything possible to get rid of both you and your claim.

Payment types

Not all employees of an enterprise have the right to apply for financial assistance under the Labor Code of the Russian Federation (Article 236), but only those who fall into certain categories. We are talking about the following persons:

- Employees working under any type of employment contract or fulfilling their duties in fact (in the latter case, the right to benefits and compensation is regulated by Article 66 “Form of the employment contract”, in which the key point is the employee’s access to his workplace, which implies further payment).

- Workers forced to perform their duties under any other contract created to disguise the employment relationship. If disputes arise regarding monetary payments, the concluded agreement will be automatically equated to a contract if any traces proving labor activity are identified.

In accordance with the current Art. 236 of the Labor Code of the Russian Federation with comments 2017, the dismissal of employees necessarily involves two types of payments - severance pay and compensation for unused vacation or individual days thereof.

However, the benefit options discussed in this legal regulation do not end there. So, this list also includes the following types of payments:

- wage;

- vacation pay;

- payment for temporary disability, which is carried out according to average earnings or tariff rates;

- children's (child care benefits up to one and a half years old);

- payment for downtime at work and failure to fulfill job duties due to a reason beyond the control of the employee;

- monetary compensation in the amount of the average salary for dismissal carried out illegally;

- payment for work services during a business trip;

- compensation for the exploitation of the employee’s personal belongings;

- other options.

In all of the above situations, the employee has the right to claim monetary compensation, however, the algorithm for calculating its amount may change significantly. In addition, each benefit option has its own deadline for the start of accrual of penalties.

Actions of employees in case of delayed wages

If wages are delayed for a long time, the employee has the legal right to contact the labor inspectorate to receive the payment due to him.

The first thing an employee should do to protect his interests is to contact the labor inspectorate located at the location of the legal address of the employing organization. The inspectorate has the right to order an inspection and issue an order, according to which the employer is obliged to immediately pay the employee wages, including compensation for their delay.

The most effective measure is that the law allows an employee to stop working from the 15th day of non-payment of wages until the wages are paid. The administration should be notified about this in writing and make sure that a mark indicating the receipt of the warning is received (on the delivery receipt or on a copy of the application), otherwise the employer may refuse to receive the notification. In such a situation, the employee’s refusal to work will be regarded as absenteeism, entailing disciplinary action, which may even be dismissal.

It is also important to remember that it is impossible to refuse to work for civil servants and employees of organizations that are engaged in issues of life support for the population. This category includes: ambulance workers, energy workers and communications workers.

Accrual of penalties

Before calculating the interest on the delay of any type of benefit, it is necessary to clarify whether it actually happened, because each payment has its own deadlines. The following important nuances are meant:

- Salaries must be paid on a predetermined day or the weekdays preceding it if it falls on weekends or holidays. The next day is already allowed to be included in the calculation of penalties, as well as all subsequent ones, until the full payment of the benefit itself and the interest calculated for its delay is made.

- Vacation pay must be accrued no later than three working days before the start of the vacation.

- Severance pay is accrued on the employee’s last day of work, but only if he was at his workplace.

- If for some reason the employee does not show up to the company, then the salary is paid two days after his notice of resignation from his position.

The beginning of the delay will not be considered the day on which the payment is due, but only the next business day. If there really is a delay, then you can begin to calculate compensation for it.

Features of the dismissal procedure

The day of dismissal is also considered the last working day. An exception is if the management of the enterprise, for one reason or another, retains a position for a non-working employee. The article under which the contract is terminated is entered into the work book, its part and clause are indicated. The peculiarity of the dismissal procedure is that the employer is obliged to pay the employee in full, pay him all the money due and issue documents. You must not miss the moment when you must pay wages upon dismissal.

The grounds for termination of an employment contract are contained in the Labor Code of the Russian Federation (Article 77). The initiative can come from both the employee and the management of the enterprise. Reasons for dismissal include :

- Agreement of both parties;

- Employee's intention;

- The employer's desire to part with his subordinate;

- Refusal of personnel to transfer to work in another district/region;

- Violation of the terms of the employment contract;

- Other circumstances, including those that do not depend on the will of the parties.

If the initiative comes from an employee, he only needs to submit a letter of resignation. Further, if the management of the enterprise insists, you have to work for two weeks and receive a payment. An exception is an employee’s urgent move to another location or serious illness. Then the dismissal procedure occurs quickly.

If the initiative comes from the employer, he will have to prove that the grounds for forced dismissal are significant . Their full list is given in the legislation (Article 81 of the Labor Code of the Russian Federation), these include:

- Liquidation, bankruptcy, reorganization of an enterprise;

- Professional unsuitability of the employee;

- Repeated violation of labor discipline;

- Failure to comply with the terms of the employment contract, ignoring the duties assigned to the employee;

- Committing unjustified, hasty actions that caused material damage to the enterprise.

Any reason for dismissal at the initiative of the company's management must be documented.

This is an incomplete list of grounds that give an employer the right to forcibly dismiss an employee. Additionally, you can specify absenteeism, theft, disclosure of trade secrets, and others.

Calculation of compensation for delayed payment

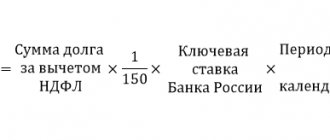

To calculate the amount of a fine for late repayment of debt to an employee, a special formula is provided. According to the current legislation, the C3 x KS / 100 / 150 x KDZ algorithm is used in practice, where:

- SZ - the total amount of debt for the past period, starting from the first day of delay;

- KS - key rate;

- KDZ - the number of days during which the employee does not receive wages or any other benefit due to him by law.

In this case, the total amount of the debt is taken into account, minus all taxes, insurance fees and penalties (damage to property, alimony, etc.), that is, the employee must receive it in his hands in full. This point should also be taken into account when studying it in more detail in Art. 236 of the Labor Code of the Russian Federation with comments. Calculation example for 2021:

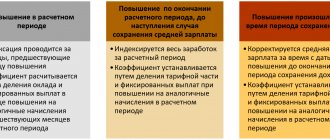

- The employee was supposed to receive his salary on April 17, but in fact the payment arrived in his personal account only on the 30th of the current month. At the same time, on March 30, he received an advance in the amount of 40 thousand rubles, and from April 3 to April 6, he was absent from work without a good reason, for which he received a penalty proportional to the average monthly salary. The salary for March was 110 thousand Russian rubles.

- It is necessary to determine the amount of monetary compensation to the employee for delayed wages.

- The delay begins to be counted from the 18th to the day of payment inclusive. As a result, the CDD was 12 days. In order to calculate the amount of accumulated debt of the SZ, it is necessary to subtract from it not only the advance and collection, but also income tax in the amount of 13 percent. As a result, we get: SZ = 110,000 (salary) - 110,000 x 13% (personal income tax) - 40,000 (advance) - 15,714 (collection) = 39,986 rubles. In this case, the compensation amounted to 39986 x 10 / 100 / 150 x 12 = 319 rubles 88 kopecks.

This means that on the day the salary arrears are repaid, the employer is obliged to pay the employee compensation in full. In the example under consideration, the total amount of the “net” cash payment was 39986 + 319.88 = 40 thousand 305 rubles 88 kopecks.

Last changes

Since October 2021, Federal Law No. 272-FZ of July 3, 2021 came into force, which is aimed at encouraging employers to pay employees wages on time.

The above Law provides, among other things, for the timing of salary payments in 2021 and some other changes. Namely:

- employers must pay wages no later than 15 calendar days from the end of the period for which they were accrued;

- Employees have the right to declare their violated rights in court within a year. This period is calculated from the date of payment of the specified amounts. Previously this period was 3 months;

- an employee may file a claim for restoration of labor rights at his place of residence;

- labor inspectorates have the right, without agreement with the prosecutor's office, to conduct unscheduled inspections of enterprises based on complaints from workers about non-payment of wages;

- the amount of monetary compensation for delayed salaries will be 1/150 of the key rate of the Central Bank of the Russian Federation, instead of 1/300.

- warnings will not be applied to officials who have delayed payment of wages. The fine in case of a one-time delay in payment of wages will range from 10,000 to 20,000 rubles. If wages are not paid again, the fines will be: for individual entrepreneurs from 10,000 to 30,000 rubles; for legal entities from 50,000 to 70,000 rubles; officials who delay the payment of wages more than once are deprived of their positions for a period of one to three years.

How to calculate compensation

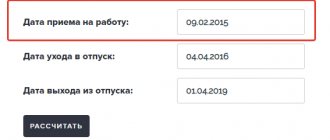

Services with an attached calculator may be used for this. For example, you can go to the website dogovor-urist ru and use the form provided to enter data as follows:

- go to the website and get acquainted with the tariffs of the Central Bank;

- Enter the required data into the form fields. The example indicates only the date following the day of dismissal and the amount that the employee is entitled to upon leaving the company. The manager owes a month's wages, compensation for unused vacation;

- since there was no partial payment, it means that you just need to click the “Calculate” button and get the result;

- As a display of the received data, the user will be familiar with the calculation formulas and current tariffs at the time of certain days of delay.

In this case, the fact is indicated that since March 26, the Central Bank rate was reduced, hence compensation calculations are carried out in two steps. The sums are added up and the final result is given. The resulting value is added to the amount of debt - the employer must pay it on the specified date of the request.

On July 27, 2021, a new Central Bank rate will be approved, which will be higher or lower than the previous one. If the employer does not transfer the debt by the specified deadline, the compensation will be calculated in three steps.